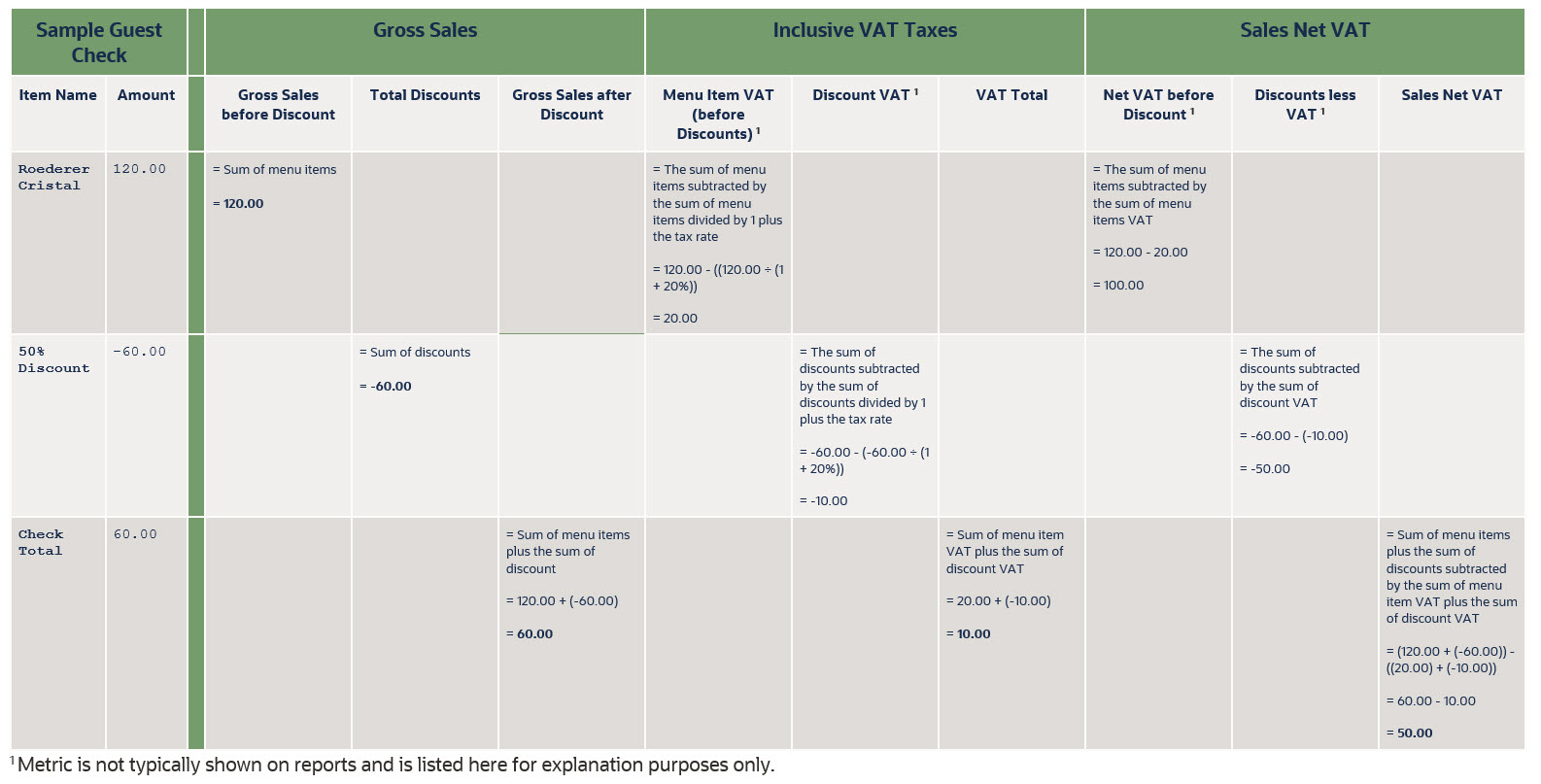

Example for VAT Metrics and Calculations

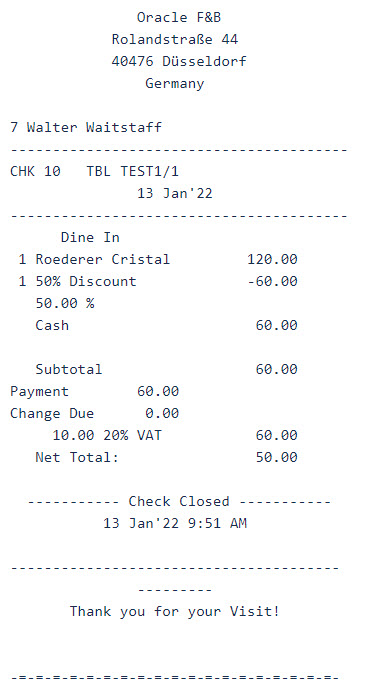

The following sample check illustrates several VAT metrics.

The three tables below provide details for each line item in the sample check. Each table notes a different line item with sales and operational metrics and their calculations. The image below the tables displays this information in a different format.

Table 1-1 Menu Item: Roederer Cristal for 120.00

| Metric | Amount or Calculation |

|---|---|

|

Gross Sales before Discount |

Sum of menu items. 120.00 |

|

Menu Item VAT (before Discounts)* |

The sum of menu items subtracted by the sum of menu items divided by 1 plus the tax rate. 120.00 - ((120.00 ÷ (1 + 20%)) = 20.00 |

|

Net VAT before Discount* |

The sum of menu items subtracted by the sum of menu items VAT. 120.00 - 20.00 = 100.00 |

Table 1-2 Discount: 50% Discount for -60.00

| Metric | Amount or Calculation |

|---|---|

|

Total Discounts |

Sum of discounts. -60.00 |

|

Discount VAT* |

The sum of discounts subtracted by the sum of discounts divided by 1 plus the tax rate. -60.00 - (-60.00 ÷ (1 + 20%)) = -10.00 |

|

Discounts less VAT* |

The sum of discounts subtracted by the sum of discount VAT. -60.00 - (-10.00) = -50.00 |

Table 1-3 Tax and Sales Total: Total for 60.00

| Metric | Amount or Calculation |

|---|---|

|

Gross Sales after Discount |

Sum of menu items plus the sum of discount. 120.00 + (-60.00) = 60.00 |

|

VAT Total |

Sum of menu item VAT plus the sum of discount VAT. 20.00 + (-10.00) = 10.00 |

|

Sales Net VAT |

Sum of menu items plus the sum of discounts subtracted by the sum of menu item VAT plus the sum of discount VAT. (120.00 + (-60.00)) - ((20.00) + (-10.00)) = 50.00 |