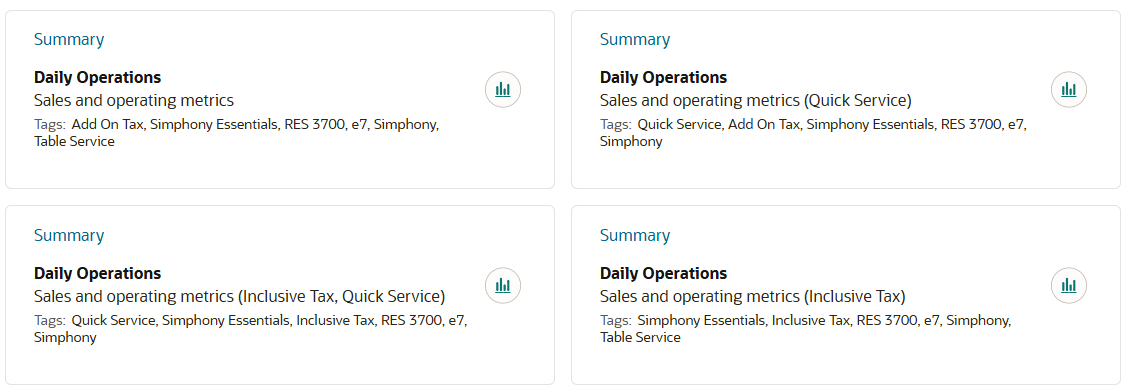

Report Variations

Most reports are available in four variations, depending on tax configuration and operational style. Tax types are noted as either an add-on tax (add-on) or an inclusive tax, also known as a value-added tax (VAT, GST). Operational styles include table service restaurants (TSR) or quick service restaurants (QSR). Keep your restaurant type and tax type in mind when using this guide to find the correct report.

Note:

Report labels can be changed to fit the needs of an enterprise using the VAT or Australian GST tax type. Different labels are applied to report names, descriptions, report component titles, and dashboard tile details. See VAT and GST Tax Labels in the Oracle Restaurants Reporting and Analytics User Guide for more information and for a list of reports that support this feature.All variations of a single report serve the same purpose, the only differences are sales and tax metrics and calculations, and the display of operational metrics.

In most cases, an enterprise is configured to use one tax type and one operational style. Global enterprises may use different tax types, or different operational styles at the same time.

Most reports exist in multiple variations which cover different tax types and operational styles. You can choose which report variations to run for your enterprise so that all your use cases are covered. Typically, an enterprise uses one variation, but a global enterprise can freely choose to use multiple variations of the same reports where applicable.

-

Add-on taxes and table service: default, no description suffix.

-

Add-on taxes and quick service: (Quick Service) description suffix.

-

Inclusive taxes (VAT, GST) and table service: (Inclusive Tax) description suffix.

-

Inclusive taxes (VAT, GST) and quick service: (Inclusive tax, Quick Service) description suffix

Metrics Specific to Tax Type

Some metrics are specific to the tax type that is configured for the location or enterprise.

The following table shows which sales metrics are applicable for either VAT and GST taxes or for add-on taxes.

| Metric | VAT, GST (Inclusive Tax) | Add-on Tax |

|---|---|---|

|

Gross Sales |

No |

Yes |

|

Gross Sales before Discounts |

Yes |

No |

|

Gross Sales after Discounts |

Yes |

No |

|

Net Sales |

No |

Yes |

|

Sales Net VAT |

Yes |

No |

|

Total Revenue |

No |

Yes |

Metrics Specific to Market Type

Some metrics are applicable to just one of the two market types, TSR or QSR. For example, a typical QSR does not count the number of guests or table turns, so those metrics are not available in the QSR-specific reports.

| Metric | Table Service Restaurant (TSR) | Quick Service Restaurant (QSR) |

|---|---|---|

|

Average Dining Time |

Yes |

No |

|

Average Spend per Check |

Yes |

Yes |

|

Average Spend per Guest |

Yes |

No |

|

Average Spend per Table |

Yes |

No |

|

Check Count |

Yes |

Yes |

|

Checks Begun |

Yes |

No |

|

Checks Carried Over |

Yes |

No |

|

Checks Paid |

Yes |

No |

|

Checks Transferred In |

Yes |

No |

|

Checks Transferred Out |

Yes |

No |

|

Drive Thru Average Minutes |

No |

Yes |

|

Guest Count |

Yes |

No |

|

Outstanding Checks |

Yes |

No |

|

Parked Cars Count |

No |

Yes |

|

Sales per Labor Hour |

No |

Yes |

|

Table Count |

Yes |

No |