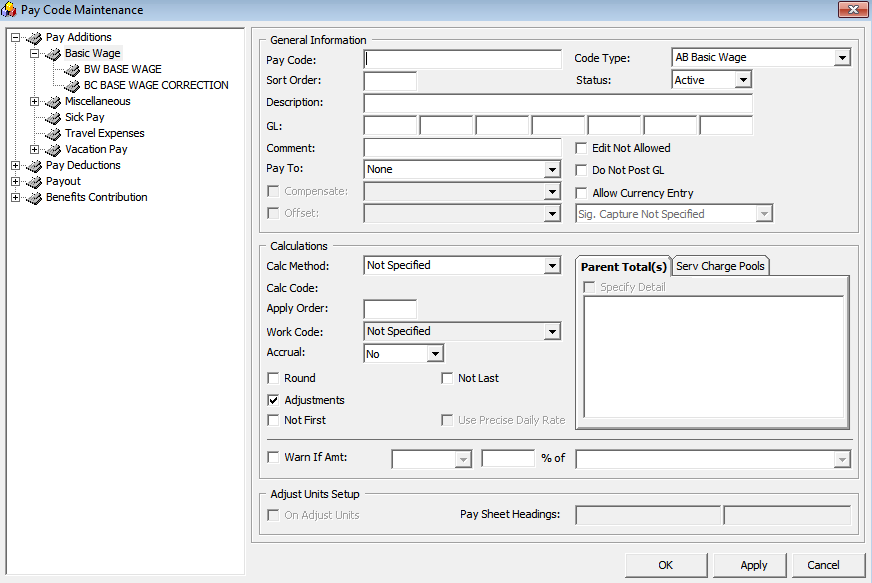

Pay Code Maintenance

The Pay Codes have four (4) categories:

-

Pay Additions: This pay code is used to calculate the Gross Pay for an individual.

-

Pay Deductions: This pay code is used to deduct taxes, allocations, penalties, garnishments, and/or other onboard or shore side obligations. Pay Deductions are the sum of the (Pay Additions)minus (Pay Deductions) which equals the Net Pay of an individual.

-

Payout This pay code is used in the final payments of the net pay to an individual. A normal payout would include cash, ship’s bank, and a financial institution or accrued to the next period.

-

Benefits Contribution This pay code is used to pay benefit contributions such as Social Security or Medicaid or any other employer contribution information added to the contract that has to be accounted for onboard. (used for pension plan or medical plan).

Below are the sub-groups within the major pay groups maintained in SPMS. They are named as the Code Type.

-

Basic Wage

-

Sick Pay

-

Travel Expenses

-

Vacation Pay

-

Allotment

-

Miscellaneous

-

Travel Deductions

-

Tax

-

Payout

Creating a Code Type

-

Log in to the Payroll module.

-

Navigate to the Maintenance menu and select Pay Codes from the context menu.

-

On the Pay Code Maintenance window, right-click and select Add Pay Code Type.

-

Enter a short code and description in the Description field.

Note:

The first character of the Code Type determines the type of pay calculation to use. A Pay Additions Code Type MUST begin with an A, Deductions with a D, Pay Outs with a P and Benefit Contribution with a B. Otherwise the system will not calculate the pay correctly. -

Enter additional information in the Comment field, if any.

-

Check the Enabled checkbox to enable/disable the display of pay code types in other setup forms such as crew assignment, contract template and others.

-

To delete a selected pay code, right-click and select Delete Pay Code Type.

Figure 26-1 Pay Code Maintenance

Table 26-1 Pay Code Maintenance Field Definition

| Field | Description |

|---|---|

|

Pay Code |

A unique identifier for the pay code. Usually a number, but can be alphanumeric. |

|

Code Type |

The type and group of this pay code. |

|

Sort Order |

User definable sort order. If no additional sort is required, enter a zero (0) in this field. |

|

Status |

The current status of the pay code (Active or Inactive). |

|

Description |

The name of the pay code. |

|

GL |

The general ledger account number of the pay code. |

|

Comment |

Any additional information for this pay code. |

|

Pay To |

Determines if the pay code requires information on where to send the deduction or payment.

|

|

Compensate |

Works with code type, Benefit Contribution – BCC & BUP to populate pay deduction as the deduction of payroll for crew contributions to pension plan or medical plan. |

|

Offset |

Work with code type, Benefit Contribution to populate the benefit contribution pay code as the benefit posting to the balance automatically when payroll is paid out at the end of the pay period. |

|

Edit Not Allowed |

An option that disables the user from being able to modify the pay amount of the pay code while editing the contract or assignment. |

|

Do Not Post GL |

The option to not write the pay code into the GL file when generating a GL file. |

|

Allow Currency Entry |

A function to allow entry of currency conversion when adding posting or payroll adjustments. Note: Applicable to Quick Posting, New Pay Item, Cash Advance, and Payout. |

|

Signature Capture |

A signature capture is required during payout. Only applicable when selecting Payout. |

|

Calc Method |

This code determines the calculation method used to calculate the amount of the pay code. |

|

Calc Code |

Works with Calculation Method ‘A-SPEC’,’D-SPEC’ or ‘P-SPEC’. It represents a special calculation method that was added to the program to handle a calculation outside the normal methods. |

|

Apply Order |

The posting order of the pay codes when calculating the pay. The order is within the Additions, Deductions and Pay Out pay groups. Note: If a pay code is to be based on a previously calculated amount, then that amount must have a lower apply order of the pay code set up so that its value will be available for the calculation. |

|

Work Code |

Works with the Time Attendance calculation method A-TAOT, A-TAHO, A-TANO, A-PPPH. |

|

Accrual |

Amount accrued for the next month.

Note: Only Pay Additions and Pay Outs can be accrued. |

|

Parent Total |

For certain Calculation Methods (Percent of another amount for example), you can specify the percentage to include on previously calculated pay codes For example: The new Pay Code “10% Percent Bonus” is a percentage of the person’s Basic Wage and Leave Pay. Note: The apply order field for the new pay code must be greater than the apply order field for any of the amount to be used in the calculation. When this button is selected, a list box appears, allowing you to pick the pay codes. |

|

Service Charges Pool |

Works with the Service Charge calculation method A-HBSC to populate the service charge pool type. |

|

Use Precise Daily Rate |

Uses a more precise formula to calculate monthly pay. Example: 10% of Monthly Wage $2100 Used with Precise Daily Rate: 10% x (2100 *12/365) * 29 (contract day) = $200.22 Without Use Precise Daily Rate: 10% x (2100/30) * 29 (contract day) = $203 Note: This option is enabled when the pay code is selected at Specify Detail. It is used more on the A-PERC calculation method. |

|

Round |

Round the final amount calculated for this pay code to the nearest denomination unit of currency. |

|

Adjustments |

Option to allow the pay code for manual adjustments. Note: Applicable to Add New Pay Item, Quick Posting, and Cash Advanced. |

|

Not First |

Do not use this pay code for the first pay period of the contract. |

|

Not Last |

Do not use this pay code for the last pay period of the contract. |

|

Warn if Amt |

This restricts the amount entered on one (1) pay code based on the amounts entered for another pay code. For example: If an allocation must be at least 80% of a crew member’s base pay, you would check the Warn If checkbox, select “is less than” from the drop-down list, enter 80 in the percent text field and select “Base Pay”. |

|

Adjust Unit Setup |

Determines whether this pay code appears on a person’s pay sheet so that unit information can be entered. Pay Sheet Headings: The descriptions to display at the top of the Pay Sheets for Multiple People form. Note: Apply to calculation methods assigned to ‘PPER, HOUR, PDAY, SPEC, PDTD, PDTI, PPMW, PPTE, PWEK, PYER, VACP, TAHO, TANO and TAOT’. |

Adding a Pay Code to Code Type

-

On the Maintenance, Pay Code Maintenance window, expand the tree view and right-click the Code Type you wish to add to the pay code.

-

Select Add Pay Code and complete the pay code setup form.

-

Click Apply to save or click OK to save and exit the form.

-

To edit, select the Pay code, edit and then click Apply to save the changes.

WARNING:

Please use extreme caution when updating pay codes since many of the codes are dependent on other codes.

-

Changing the Apply Order or the calculation method of the code may have an adverse impact on another code.

-

Changing the Calculation Method of an existing pay code from “Flat Rate” to “Percent of Another Amount” will not affect the pay code that is already added to an assignment.

-

Deleting a Pay Code

To delete a pay code, right-click the code and select Remove. You can only delete an unused pay code.

Salary Group

A Salary Group is similar to SPMS Operational Department. This is used to group people by their salary range and responsibility.

-

On the Payroll Maintenance, select Salary Group from the context menu.

-

On the Salary Group window, right-click on the group listed and select Add New.

-

Enter the short code and description for the group in the Description field.

-

Enter an additional comment in the Comment field, if any.

-

In the Mapped ID field, enter the GL ID code. This code is one of the fields used for GL Output file.

-

The Enable field is checked by default. Uncheck to disable the display in other setup forms such as crew assignment, contract template and others.

-

Click Apply to save or OK to save and close the form.

-

To delete a Salary Group, right-click on the code and select Remove. You can only delete a code that is unused.

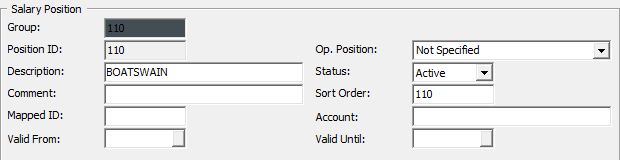

Salary Position

Salary Position groups people by its job responsibilities within a Salary Group. These groups of people typically have a similar, if not identical contract.

A set of salary positions is maintained for the entire Payroll system and is used by all companies set up in the system.

-

Select the Salary Position from the Payroll Maintenance menu option.

-

A list of Salary Groups is shown in the Salary Position Maintenance window. Click the plus (+) key to expand the view of existing Salary Positions.

-

Right-click the Salary Group and select Add New to create a new position.

-

Enter all the require information and click Apply to save. Refer to the following table for field descriptions.

Figure 26-2 Salary Position

Table 26-2 Salary Position Field Definition

| Field | Description |

|---|---|

|

Group ID |

Field represents the Group ID of the Salary Group. This is generated automatically based on the selected Salary Group. |

|

Position ID |

Unique ID for Salary Position. |

|

Description |

Position name. |

|

Comment |

Additional comments. |

|

Mapped ID |

GL mapping field used in the GL Output field. |

|

Valid From/Until |

Validity Period for the position. If the field is blank, this means the position does not have a Validity date. The program checks the valid date against the current system date. An expired or invalid position is not shown when creating a crew contract/assignment. |

|

Op. Position |

Links the Salary Position to Operational Department. Once the position is linked, the crew member that belongs to the operational position is populated on the crew assignment screen. |

|

Status |

Active/Inactive. If the status is set to Inactive, the salary position is not displayed when creating a crew contract. |

|

Sort Order |

Sort Position by the order entered. Used as an alternative sort. If alternative sort order is not required, you may enter any number in this field. |

|

Account |

Department name used for the GL output field. |

Calculation Method Overview

The Calculation Method defines the computation of a particular pay code during pay generation. Although the Calculation Method maintenance form exists, you are not allowed to perform insertion and deletion actions, due to the values in this table as it would require code changes. However, you are allowed to set the status to enable or disable.

Below are the pay calculation methods currently available in the system for general use.

Table 26-3 Calculation Method Overview

| Pay code Type | Code | Description | Calculate based on |

|---|---|---|---|

|

Not Specified |

- |

Not Specified |

The Pay code will not populate when:

|

|

Pay Addition Calculation |

A-CEND |

Contract End |

A flat amount added to the last pay period of a contract. |

|

A-CSTR |

Contract Start |

A flat amount added on the first pay period of a contract. |

|

|

A-FLAT |

Flat Amount |

A flat amount added to each pay period. |

|

|

A-HMTH |

Half Month |

A flat amount added when the person worked for at least 15 days during a period. Half the amount will be added for 1 to 14 days. |

|

|

A-HOUR |

Per Hour |

Rate multiplied by pay sheet entered units to arrive at amount.(Rate x Units) |

|

|

A-PDAY |

Per Day |

Rate multiplied by pay sheet entered Units to arrive at amount. (Rate x Units) |

|

|

A-PDAC |

Per Day Automatic Calculation |

Amount entered as a flat amount on the contract, but computation is based on days in period during pay calculations. (Rate / Number of Day of the pay period) |

|

|

Pay Addition Calculation |

A-PERC |

Percent of another Amount |

Percentage taken from previously calculated amount. If detail pay codes are not specified, the percent is taken from the currently calculated gross pay. (Rate (%) x Base (Specified pay code)) |

|

A-PPER |

Per Pay Period |

Amount is entered as a flat amount on the contract, but computation is based on days worked and days in period during pay calculations. (Rate / Number of Days in the pay period) |

|

|

A-SPEC |

Half Month |

A special pay calculation must be written. The code for this calculation must be entered in the Calc Code field. Calc Code: STHMTH = Get full pay if worked more than 16 days. NCHMTH = Get full pay if worked more than 15 days. |

|

|

A-PWEK |

Per Week |

Weekly calculation amount of the pay period. (Rate / 7) |

|

|

A-PYER |

Per Year |

Yearly calculation amount of the pay period.(Rate / 365 or 366) |

|

|

A-SPCO |

SPA Commission Earning |

Pay code to post total amount of crew commission from SPA module (refer to table SPR) into crew member assignment. (Sum of SPR_COMMISSION) |

|

|

Pay Addition Calculation |

A-OFFS |

Negative Percentage Offset of Another Amount |

Negative amount use to offset a specified pay code. (Rate(%) x base (specified pay code)) |

|

Pay Deduction Calculation |

D-CEND |

Contract End |

Flat amount deducted on the last pay period of a contract |

|

D-CSTR |

Contract Start |

Flat amount deducted on the first pay period of a contract. |

|

|

D-FLAT |

Flat Amount |

Flat amount deducted at each pay period. |

|

|

D-PERC |

Percent of Gross (or another amount) |

Percentage of Gross Pay (or another amount) deducted on each pay period. (Rate (%) x Base (Specified pay code)) |

|

|

D-PPER |

Per Pay Period |

Amount deducted on each pay period depending on the number of days worked in the pay period. (Rate / Number of Day of the Month) |

|

|

D-PRMD |

Percent of Remainder |

A percent of current net pay is deducted each pay period. (Rate (%) x Base (specified pay code)) |

|

|

Pay Deduction Calculation |

D-SPEC |

Special |

A special pay calculation must be written. The code for this calculation must be entered in the Calc Code field. Calc Code: STHMTH = Deduct full pay if worked more than 16 days. NCHMTH = Deduct full pay if worked more than 15 days. |

|

D-OFFS |

Negative Percentage Offset of Another Amount |

Negative amount used to offset the specified pay code. Rate(%) x base (specified pay code) |

|

|

D-TAX |

Tax Rates Per Tax Table |

Amount paid out based on tax type defined in TAX table. |

|

|

D-UNTL |

Flat Amount With Maximum |

Same functionality as D-FLAT. |

|

|

D-HMTH |

Half Month |

Flat amount deducted if the person worked at least 15 days during a period. Half the amount will be deducted for 1 to 14 days. |

|

|

Payout Calculation |

P-FLAT |

Flat Amount |

Flat Amount paid out each pay period. |

|

P-PERC |

Percent of Gross |

Percent of Gross paid out each pay period. |

|

|

P-PPER |

Per Pay Period |

Amount paid out based on the number of days worked in the pay period. |

|

|

Payout Calculation |

P-PRMD |

Percent of Remainder |

Amount paid out based on the percentage of whatever has yet to be paid out. |

|

P-OFFS |

Negative Percentage Offset of another Amount |

Percentage to balance the specified pay code. |

|

|

P-SPEC |

Special |

A special pay calculation must be written. The code for this calculation must be entered in the Calc Code field. |

|

|

P-NBCP |

Negative Balance Closing |

Negative amount to be paid out. |

|

|

Benefit Contribution Calculation |

B-FLAT |

Flat Amount |

Flat amount deducted for benefit contribution. |

|

B-OFFS |

Negative Percent Offset of Another Amount |

Percentage to balance the specified benefit contribution pay. (Rate(%) x base (specified pay code)) |

|

|

B-PERC |

Percent of Another Amount |

Percentage taken from specified pay code amount. (Rate(%) x base (specified pay code)) |

|

|

B-TIER |

Tiered percent of Another Amount |

Percentage taken from two (2) sub-entries for pension plan contribution calculation. |

|

|

Pay |

A-BACL |

Being Addition to Crew's Longevity |

Rate = Vacation Pay Entitlement OR No. of Day. |

|

Additions |

A-HBSC |

Hotel & Bar Service Charge |

Sum of HBT_POOLTOTAL |

|

A-HEGA |

HBSC In Excess of Guaranteed Amount |

Used to compare service charge amounts and minimum guaranteed amount. (Amount = A-HBSC – A-MUMG (Daily)) |

|

|

A-HOLP |

Holiday Pay |

Holiday Pay based on the number of holiday X defined rate and base wages on current pay period. System is auto calculated at the daily rate. (Rate x Base (specified pay code) x 12/365 x number of days in HOL) |

|

|

A-MUMG |

Make Up for Minimum Guarantee |

A calculation method that allows the user to specify the amount guaranteed they will get if the pay code does not reach the amount during the payout process at the end of the month

|

|

|

A-PDTD |

Per Diem Travel Domestic |

Domestic Travel pay amount for each pay period. The rate is defined in Contract Level set up (Base Wage x 12/365 x pay unit x Domestic Rate (if defined in contract level)). |

|

|

A-PDTI |

Per Diem Travel International |

International Travel pay amount for each pay period. The rate is defined in Contract Level set up. (Base Wage x 12/365 x pay unit x International Rate (if defined in contract level)) |

|

|

A-PPMW |

Per Previous Contract Monthly Wage |

Total monthly pay from previous contract. (Units x Base (Specified pay code)) |

|

|

A-PPPH |

Premium Points Per HSC |

Time Attendance pay code = A-PPPH and work code matches the set up in Time Attendance module. |

|

|

A-PPTE |

Per Previous Contract Total Earning |

Percentage of total contract pay from previous contract. (Rate (%) x Base (Specified pay code) ) |

|

|

A-SLBE |

Seniority Loyalty Bonus Entitlement |

Amount to be paid based on number of days specified in Seniority Loyalty Bonus set up and Bonus Longevity Setup in Contract Level. |

|

|

A-TAHO |

Per Time & Attendance Holiday Hour |

Holiday Overtime linked to Time Attendance Roster Daily, Work Code. (Rate x Number of Day of HOL records) Note: Crew's Daily Roster in Time Attendance must be in APPROVED status. |

|

|

A-TANO |

Per Time & Attendance Normal Hour |

Overtime linked to Time Attendance Roster Daily, Work Code. Additional pay for each pay period. (Rate x Number of Hours of Work Code) Note: Crew's Daily Roster in OHC. Time Attendance must be in APPROVED status. The daily roster date (TADR_DATE) must be within the pay period. |

|

|

A-TAOT |

Per Time & Attendance Over-Time Hour |

Overtime linked to Time Attendance Roster Daily, Work Code. The total Overtime hours will be deducted by Weekly Work Hour multiplied by the Rate. (Rate x (Number of hours per day – (Weekly Work Hour / 7)) Note: Crew's Daily Roster in Time Attendance must be in the APPROVED status and flagged to “Included Work Hours” |

|

|

A-VACP |

Vacation Pay Entitlement |

Vacation pay amount with Early Repatriation entitlement. The system auto calculates the daily rate. (Rate x Base (specified pay code) x 12/365 x Vacation Pay Entitlement Days x Number of Day of current pay period) / Number of Day of Contract Length) |

|

|

A-VPCT |

Vacation Pay Percentage |

Specify Details = Base Wage or (+) Daily Minimum Guarantee. |

|

|

Deductions |

D-PDTD |

Per Diem Travel Domestic |

Domestic travel pay amount deducted from each pay period. The rate is defined in contract Level setup. (Domestic Rate x Units) |

|

D-PDTI |

Per Diem Travel International |

International travel pay amount deducted from each pay period. The rate is defined in Contract Level setup. (International Rate x Units) |

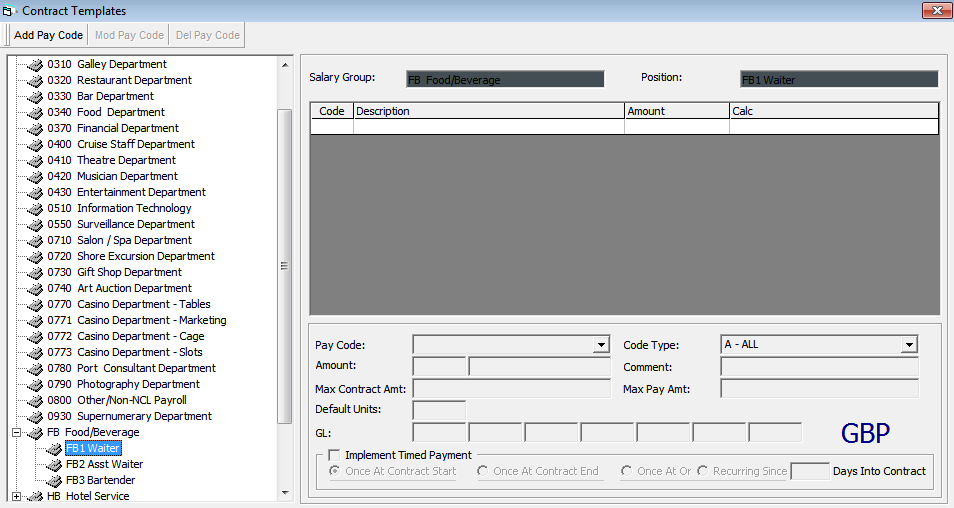

Contract Template

The Contract Template allows you to define a basic contract template for each Salary Position, by person or company specific. This can be used as initial contract pay codes when adding a contract.

Figure 26-3 Contract Templates Form

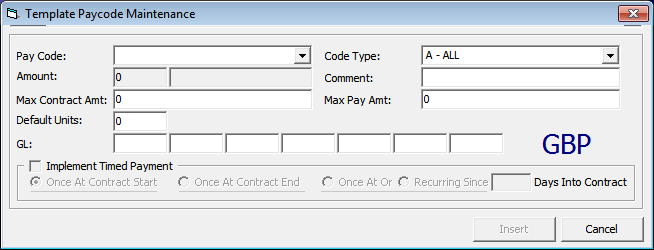

Adding Pay code to Contract Template

-

Select a Position on the Contract Template form.

-

Click Add Pay Code.

-

Navigate to the Template Pay code Maintenance form and fill in the details accordingly.

-

Click Insert to save.

Figure 26-4 Template Pay code Maintenance

Table 26-4 Template Pay code Maintenance Field Definition

| Field | Description |

|---|---|

|

Pay Code |

Pay code Selection |

|

Code Type |

Filter for the pay code by Code Type. |

|

Amount / Rate |

Amount of pay code. Note: Shows ‘Flat Amount’ when calculation method defined is amount calculation. Shows ‘Rate / Percentage’ when calculation method defined is percentage calculation. |

|

Comment |

Pay code comments in template. |

|

Max Contract Amount |

This field holds the total amount (in payroll currency units) that this pay code can accumulate to for the entire length of the contract. Once this amount is reached, no additional amounts are computed for this pay code. |

|

GL |

The shore side general ledger account which this pay code will be accounted for. Note: Will be auto populated if GL codes have been defined in Pay code setup. |

|

Implement Time Payment |

Pay code used for payable upon return. There are four (4) categories:

Note: This option only applies to Pay Additions and Pay Deductions. |

Creating Contract Template

-

Go to the Maintenance, Contract Templates menu. A list of all salary groups is displayed.

-

Expand the group by clicking the plus (+) key.

-

Click Add Pay Code.

-

On the Add Pay code form, enter the pay amount and necessary details.

-

Click Insert to insert a pay code into the template.

-

To modify a pay code of a template, select the pay code and click Mod Pay Code.

-

Update the details and then click Update to save the changes.

-

To remove a pay code from the template, select the pay code and click Delete Pay Code.

-

On the confirmation prompt, click OK to proceed.

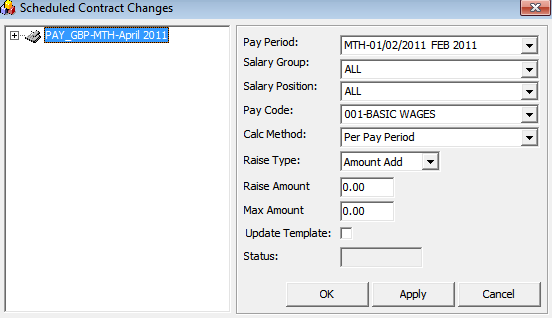

Schedule Contract Changes

Schedule Contract Changes is a scheduler that changes the pay code rates and amount for the following pay period, and can only set up a schedule for future pay periods. For instance, you would set up a schedule in March for a change to take effect in April. The changed pay rate is applied when a new pay period is activated and maintained by the company.

Figure 26-5 Schedule Contract Changes

Table 26-5 Schedule Contract Changes Field Definition

| Field | Description |

|---|---|

|

Pay Period |

Effective Pay Period for the raise. |

|

Salary Group |

Department to which the raise applies. |

|

Salary Position |

Position entitled to the raise. |

|

Pay Code |

Pay code for which the raise applies. |

|

Raise Type |

Defines the type of raise.

|

|

Raise Amount |

Value of raise |

|

Max Amount |

Maximum raise amount |

|

Update Template |

If the Update Template field is selected, the contract template updates with the raise upon opening the specified month. For example: Selected when the raise applies to the existing contract template(s) for the selected salary group, position and pay code. |

|

Status |

Status of schedule changes. Show ‘Closed’ when changes are being processed. |

-

On the Maintenance menu, select Schedule Contract Changes.

-

On the Schedule Contract Changes form, right-click and select Add.

-

Complete the setup form and click Apply to keep the form or click OK to save and close the form.

-

To remove the schedule, right-click the selected schedule and click Remove. You are not allowed to remove a processed schedule.

Tax Types

The Tax Type set up defines the different tax deductions for different pay periods. A No Tax definition is needed if the company does not process the tax deductions for its employees or if all its employees are independent contractors.

The tax type can only be set up when the tax pay code exists, and this is done at the Pay code Maintenance, Tax under Pay Deductions menu option. You must select the Calculation Method “D-TAX – Tax rates per TAX table” and specify the applicable tax pay code.

Figure 26-6 Tax Types

Table 26-6 Tax Types Field Definition

| Field | Description |

|---|---|

|

Tax Name |

Tax name and description. |

|

Marital Status |

Marital status of the crew. The tax amount updates according to the tax calculation formula. |

|

Payroll Period |

Calculation method of the tax in the particular pay period. |

|

Deduction |

Amount of deduction. |

|

Amount From |

The starting salary range that taxes start processing from. |

|

Amount To |

The ending salary range that taxes stop processing to. |

|

Base Deduct |

Minimum deduction (for flat rates). |

|

Percent Deduct |

Percentage of tax to deduct. |

|

Valid From |

Date the tax needs to be applied from. |

|

Valid To |

Date the tax needs to be applied to. |

|

Enabled |

Enabled or disabled for tax deductions. |

-

On the Pay code Maintenance menu, select Tax Pay code.

-

Assign the calculation method to D-TAX and specify a pay code as a taxable amount.

-

Navigate to Maintenance menu, Tax Types. The tax pay code is available on the form.

-

Select the Tax Pay code and then click New.

-

Enter the tax type details and click Apply to save.

-

You can associate multiple tax record to a pay code.

The section below describes the formula used when the program calculates the tax.

The taxable amount will deduct the withholding amount, where the withholding amount equates to number of dependents, multiplied by TAX_DEDUCTIONS of the corresponding TAX_PAYROLL_PERIOD, TAX_MARITAL STATUS, TAX_VALID_FROM and TAX_VALID_TO. Both the TAX_VALID_FROM and TAX_VALID_TO are compared against ASYS.SYS_DATE.

The results are then compared against the same tax table to see if there is a record that the result falls between in the TAX_AMOUNT_FROM and TAX_AMOUNT_TO for the corresponding TAX_TYPE, TAX_PAYROLL_PERIOD, TAX_MARITAL_STATUS, TAX_VALID_FROM and TAX_VALID_TO.

If yes, then the tax amount is the percentage (of percent value TAX__PERCENT) of the difference between the taxable amount and TAX_AMOUNT_FROM. Then adding TAX_BASE to that amount gives you the final tax amount. If no, the final tax amount equates to zero.

Below is an example illustrating the tax deduction process.

-

In Tax Type setup:

-

Marital Status = Marital Status in crew assignment setup

-

Payroll Period = Payroll Companies Pay Cycle

-

Valid From = Between system date

-

-

In crew assignment, define the Marital Status and No. of Dependents. Add the taxable amount (Base Wage pay code) into Pay Addition and the Tax pay code into Pay Deduction. Enter the Base Wage amount $2500 and No. of Dependents equals to 2

-

Based on above Tax Type setup, the tax calculation formula are:

-

No. of Dependents x Deductions $170 (2 x 85 = 170)

-

Taxable amount after subtracting the dependents is $2330 (2500 – 170 = 2330)

-

Compare if the result is within the Amount From and Amount To

-

If yes, the amount in subtracted Amount From is $2280 (2330 – 50 = 2280)

-

Use that amount and multiply the Percent Deducted = 2280 x 12% = 273.6

-

The final tax amount is $283.6 (Result + Base Deduct amount) = 273.6 + 10 = $283.6

-

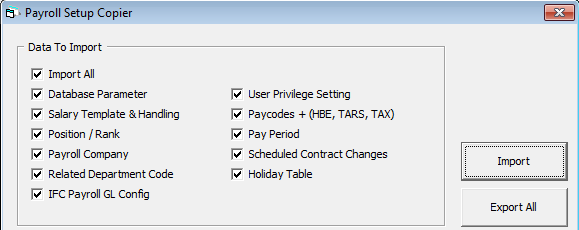

Payroll Setup Copier

-

The Payroll Setup Copier is a tool that copies the entire payroll setup from one database to another, excluding these set ups:

-

Cost Center

-

Daily Currency Setup Detail

-

Operation Position (SPO_AID_ID will be null)

-

Unique record in Pay Raise table, or else the following message appears.

Figure 26-7 Payroll Setup Copier Unique Record Prompt

-

Tax name must be unique, or else the following message appears.

Figure 26-8 Payroll Setup Copier Unique Tax Name Prompt

-

When importing from a selected Payroll Company, all related loyalty bonuses and the vacation pay matrix are copied over, as well as inserting new records but will not delete the existing setup.

-

When importing a Salary Template & Handling and both the source ship and target ship have a loyalty bonus and vacation pay matrix set up, the existing setup of the target ship is deleted before the import continues.

-

If the target ship has a parent total linking or an operation position is unlinked on a source ship that has linking, the Import re-inserts the link.

Figure 26-9 Payroll Setup Copier Options

-

On the Maintenance menu, select Payroll Setup Copier.

-

The application disregards all checked items for the export function. Click Export All when ready.

-

On the Browse for Folder window, select the location to save the file, and then click OK.

-

When the export completes successfully, the system automatically saves the Extensible Markup Language (XML) file (PYRL_SETUP_v[version_number]) at the selected location and displays a confirmation box. Click OK to close the prompt.

-

To import the data, login to the Payroll module of the destination database.

-

On the Maintenance menu, select Payroll Setup Copier.

-

On the Payroll Setup Copier window, select the respective checkboxes for the data to be imported and click Import.

-

Select the file to import from the saved location.

-

Once the import process starts, a progress bar is shown.

-

At the end of the process, the system displays a confirmation prompt. Click OK to close the prompt.