Scenario C

The calculations in this scenario are for a policy with a group account.

Policy 2342

Policy Code |

POL2342 |

Group Account |

ORCL with start date January 1, 2019 |

Contract Period |

- |

Collection Frequency |

12 [1] |

Member 1 |

L. Jones |

Enrollment Product |

BASIC PLAN with start date January 1, 2019 and end date December 15, 2019 |

Member 2 |

S. Jones |

Enrollment Product |

SILVER PLAN with start date January 1, 2019 |

The policy enrollment details are similar between Scenario B and Scenario C. In both the scenarios B and C there are two policy enrollments and they are for the basic and silver plan respectively. However, the calculations for the policy in this scenario are different from scenario B because:

-

The default and enrollment product time periods are driven by the group account time period

-

The override values for adjustment rules on the group account level are selected if available and applied.

-

The persons data (age, region code) are different.

Select and Verify Calculation Periods

Here the advance collection setting is 12 Months, therefore, all the calculation periods from the calculation period to which the look back date belongs to up to the last calculation period in the collection cycle are selected.

Since the policy enrollment started on January 1, 2019 (so January 2019 is in fact the first calculation for this policy), there are no past periods that require recalculation. Therefore calculation periods from January 2019 to December 2019 are only considered for the calculations.

Calculation BASIC PLAN

The configuration that gets applied for BASIC PLAN for L.Jones for the calculation period of January 2019 is as shown in the image below:

Calculation Period January 2019

The calculation period reference date is considered as the reference date for the calculations, that is January 1, 2019. Once the reference date for the calculation period is selected the next step is to select the time periods. In this case, the reference date belongs to ORCL 2019, therefore, the group account time period ORCL 2019 is selected. The group account time period drives the selection of the default time period and enrollment product time periods. The start date of the group account time period June 1, 2018 belongs to Calendar Year 2018 and BASIC PLAN 17-18. Thus Calendar Year 2018 and BASIC PLAN 17-18 are selected as default time period and enrollment product time period respectively.

Enrollment Product Premium

The premium calculation for the enrollment product BASIC PLAN for L. Jones is based on the method 'Calculation Period Based' as the premium amount Interpretation setting is 'Calculation Period'.

The premium schedule lines are based on the dimension Age. L. Jones’s age as of January 1, 2019 is 19 years and, therefore, the premium value of 100.00 applies.

The base premium is 100.00 as no policy add-ons are configured

Surcharges

A Regional Tax surcharge of 3.25% is applicable for this policy enrollment product on the base premium, that is 3.25% on 100.00 = 3.25

Adjustments

The Office Visit Co-payment Discount adjustment is configured for group account ORCL. This adjustment is based on OV Co-pay parameter. Now, a parameter value of 30 is defined on the policy enrollment product and thus the applicable adjustment rule is.

| OV Co-Pay | Discount | Type |

|---|---|---|

30 |

-7 |

Percentage |

The system checks for the group account specific value for this adjustment rule within ORCL 2019 time period. However, no override value for the rule is specified at the group account level and thus the adjustment value of -7% applies.

Adjustment = -7% on 100.00 = -7.00

Surcharges - After Adjustment

The post adjustment Administrative Surcharge of 1.5% applies on the base premium plus adjustments, that is, 1.5% on (100.00 - 7.00) = 1.40

Calculation Result Lines for Basic Plan January 2019

| Start Date | End Date | Input Amount | % | Prorate Factor | Result Amount | Schedule Definition | Premium Schedule |

|---|---|---|---|---|---|---|---|

Jan 1, 2019 |

Jan 31, 2019 |

- |

- |

- |

100.00 |

Age Gender Premium |

Basic Plan |

Jan 1, 2019 |

Jan 31, 2019 |

100.00 |

3.25 |

- |

3.25 |

Regional Tax |

|

Jan 1, 2019 |

Jan 31, 2019 |

100.00 |

-7 |

- |

-7.00 |

Office Visit Co-payment Discount |

|

Jan 1, 2019 |

Jan 31, 2019 |

93.00 |

1.5 |

- |

1.40 |

Admin. Surcharge |

The above calculation applies from February 2019 to May 2019. But from the calculation period June'16 onward the calculation changes as the applicable group account time period changed from ORCL-2019 to ORCL-2020.

Calculation Period June 2019

The image below depicts the configuration that applies for L. Jones of June 2019

Enrollment Product Premium

Since the default time period changes, the applicable premium amount now changes from 100.00 to 105.00

Surcharges

The region code value 'AH' is applicable to the person and thus the surcharge value of 3.5% gets selected.

Regional Tax surcharge = 3.5% on 105.00 = 3.68

Adjustment

The adjustment rule with OV Co-pay value of 20 applies. An override adjustment value of 6% is specified at the group account level for this rule, therefore, the system applies an adjustment value of 6% on base premium.

Office Visit Co-payment Discount adjustment = -6% on 105.00 = -6.30

- Surcharges - After Adjustment

-

The post adjustment Administrative Surcharge of 1% applies on the value given by base premium plus adjustments.

Administrative Surcharge = 1% on (105.00-6.30) = 0.99

Calculation Result Lines for Basic Plan June 2019

| Start Date | End Date | Input Amount | % | Prorate Factor | Result Amount | Schedule Definition | Premium Schedule |

|---|---|---|---|---|---|---|---|

Jan 1, 2019 |

Jan 31, 2019 |

- |

- |

- |

105.00 |

Age Gender Premium |

Basic Plan |

Jan 1, 2019 |

Jan 31, 2019 |

105.00 |

3.5 |

- |

3.68 |

Regional Tax |

|

Jan 1, 2019 |

Jan 31, 2019 |

105.00 |

-6 |

- |

-6.30 |

Office Visit Co-payment Discount |

|

Jan 1, 2019 |

Jan 31, 2019 |

98.70 |

1 |

- |

0.99 |

Admin. Surcharge |

The above calculation applies from June 2019 to November 2019.

Calculation for partial enrollment applies for December 2019 as L. Jones terminates the enrollment halfway through during this period. The partial period resolution for BASIC PLAN is 'Per Day'; this implies that the person is charged only for the days that the person is enrolled during the calculation period.

Calculation Period December 2019

Enrollment Product Premium

The premium amount that gets applied for the calculation period is reduced by the prorate factor. The premium is charged only for the number of days the person is enrolled.

Premium amount = 105.00 * 15/31 = 50.81

Surcharges - After Adjustment

The post adjustment Administrative Surcharge of 1% applies on the value given by base premium plus adjustments.

Administrative Surcharge = 1% (50.81-3.05) = 0.48

Calculation Result Lines for Basic Plan December 2019

| Start Date | End Date | Input Amount | % | Prorate Factor | Result Amount | Schedule Definition | Premium Schedule |

|---|---|---|---|---|---|---|---|

December 1, 2019 |

December 15, 2019 |

105.00 |

- |

15/31 |

50.81 |

Age Gender Premium |

Basic Plan |

December 1, 2019 |

December 15, 2019 |

50.81 |

3.5 |

- |

1.78 |

Regional Tax |

|

December 1, 2019 |

December 15, 2019 |

50.81 |

-7 |

- |

-3.05 |

Office Visit Co-payment Discount |

|

December 1, 2019 |

December 15, 2019 |

47.76 |

1.5 |

- |

0.48 |

Admin. Surcharge |

Calculations for SILVER PLAN

In scenario B, the selected default time period for the SILVER PLAN is different from the BASIC PLAN. Also, the SILVER PLAN has different adjustment types configured within the selected enrollment product time period and different parameter values on the policy enrollment product. This results in the applicable adjustment types, adjustment rules and surcharge rules being different for the SILVER PLAN in comparison to the BASIC PLAN.

In this case, for a given calculation period the selected default time period remains the same for both the enrollment products. This is because it is derived based on the group account time period and not the enrollment product time period. Also, the adjustment types configured on the group account level apply to both the enrollment products. Therefore, for a calculation period the adjustment types, adjustment rules and surcharge rules that apply for both the enrollment product are the same.

Calculation Period January 2019

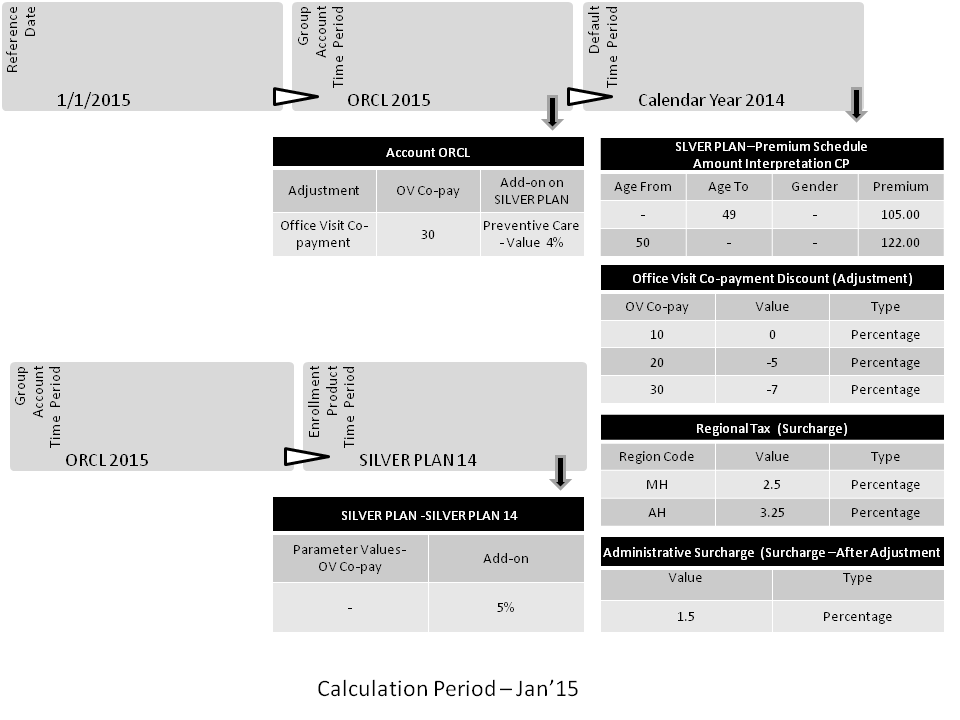

The image below shows the configuration that applies for the enrollment product 'SILVER PLAN' for S. Jones during the premium calculation for the calculation period January 2019.

Enrollment Product Premium

The premium calculation for the enrollment product SILVER PLAN for S. Jones is based on the method 'Calculation Period Based' as the premium amount Interpretation setting is 'Calculation Period'. The premium schedule lines are based on the dimension Age. S. Jones age as of January 1, 2019 is 21 years and, therefore, the premium value of 105.00 applies.

Lets suppose system applies an add-on of 4.20

Base Premium = 105.00 + 4.20 (add-on premium ) = 109.20

Surcharges

Regional Tax = 3.25% on 109.20 = 3.55 (this tax is distributed across the product premium and add-on premium, so two separate calculation result lines are created).

Adjustments

The adjustment scope is set to Total Premium so the adjustment is applied to the product premium and the add-on premium.

Office Visit Co-payment Discount adjustment = -7% on 109.20 = -7.64

Surcharges - After Adjustment

The post adjustment Administrative Surcharge of 1.5% applies on the value given by base premium plus adjustments.The post adjustment Administrative Surcharge = 1.5% on (109.20-7.64) =1.52

Calculation Result Lines for January 2019

| Start Date | End Date | Input Amount | % | Prorate Factor | Result Amount | Add-on | Schedule Definition | Premium Schedule |

|---|---|---|---|---|---|---|---|---|

Jan 1, 2019 |

Jan 31, 2019 |

- |

- |

- |

105.00 |

Age Gender Premium |

Silver Plan |

|

Jan 1, 2019 |

Jan 31, 2019 |

105.00 |

3.25 |

- |

3.41 |

Regional Tax |

||

Jan 1, 2019 |

Jan 31, 2019 |

4.20 |

- |

- |

4.20 |

Preventive Care |

||

Jan 1, 2019 |

Jan 31, 2019 |

4.20 |

3.25 |

- |

0.14 |

Regional Tax |

||

Jan 1, 2019 |

Jan 31, 2019 |

109.20 |

-7 |

- |

-7.64 |

Office Visit Co-payment |

||

Jan 1, 2019 |

Jan 31, 2019 |

101.56 |

1.5 |

- |

1.52 |

Admin. Surcharge |

The above calculation applies from February 2019 to December 2019.

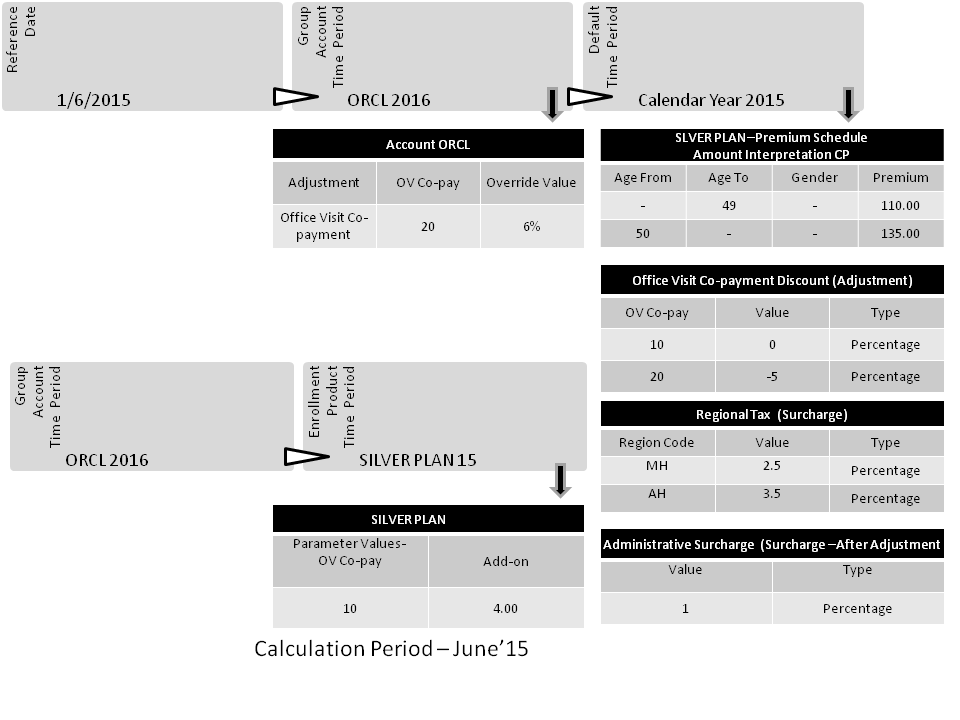

Calculation Period June 2019

The image below shows the configuration that gets applied for the calculation period June 2019

From the calculation period June'16 onward the applicable group account time period changed from ORCL-2019 to ORCL-2020. This results in the selection of different default time period and therefore applicable premiums, adjustments and surcharges also change.

| Start Date | End Date | Input Amount | % | Prorate Factor | Result Amount | Add-on | Schedule Definition | Premium Schedule |

|---|---|---|---|---|---|---|---|---|

June 1, 2019 |

June 30, 2019 |

- |

- |

- |

110.00 |

Age Gender Premium |

Silver Plan |

|

June 1, 2019 |

June 30, 2019 |

110.00 |

3.5 |

- |

3.85 |

Regional Tax |

||

June 1, 2019 |

June 30, 2019 |

- |

- |

- |

4.00 |

Preventive Care |

||

June 1, 2019 |

June 30, 2019 |

4.00 |

3.5 |

- |

0.14 |

Regional Tax |

||

June 1, 2019 |

June 30, 2019 |

114.00 |

-6 |

- |

-6.84 |

Office Visit Co-payment |

||

June 1, 2019 |

June 30, 2019 |

107.16 |

1 |

- |

1.07 |

Admin. Surcharge |

The above calculation applies from June 2019 to December 2019.