1 Feature Summary

This chapter describes the feature enhancements in this release.

Noteworthy Enhancements

This guide outlines the information you need to know about new or improved functionality in the Oracle Retail Merchandising Cloud Services update and describes any tasks you might need to perform for the update. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

Column Definitions

-

Feature: Provides a description of the feature being delivered.

-

Module Impacted: Identifies the module associated with the feature, if any.

-

Scale: Identifies the size of the feature. Options are:

-

Small: These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

-

Large: These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

-

-

Delivered: Is the new feature available for use immediately after upgrade or must the feature be enabled or configured? If no, the feature is non-disruptive to end users and action is required (detailed steps below) to make the feature ready to use.

- Customer Action Required: You must take action before these features can be used. These features are delivered disabled and you choose if and when to enable them.

Table 1-1 Noteworthy Enhancements

| Feature | Module Impacted | Scale | Delivered | Customer Action Required? |

|---|---|---|---|---|

| Retail Fiscal Management Cloud Service |

Retail Fiscal Management Cloud Service |

Large |

Enabled |

Yes |

| Exchange Rate Based on Invoice Date |

Merchandising, Invoice Matching |

Small |

Disabled |

No |

| Manage Variance Between invoice and Order Exchange Rate |

Merchandising, Invoice Matching |

Small |

Enabled |

Yes |

| Ability to Update Promotions/Offers through ReST Service |

Pricing |

Small |

Enabled |

No |

| Removed Same Ownership Type Restriction for SKUs under same Style |

Merchandising |

Large |

Enabled |

No |

| Retail Data Store Audit for Item Location Table |

Merchandising, RDS |

Small |

Enabled |

No |

| Store Order and Replenishment API |

Merchandising |

Large |

Enabled |

No |

| Return to Vendor (RTV) Creation in Approved Status |

Merchandising |

Small |

Enabled |

No |

| Appointment Dates Integration from Warehouses |

Merchandising |

Small |

Enabled |

No |

| Data Conversion Enhancements |

Merchandising |

Small |

Enabled |

No |

| e-invoicing Enhancements |

Invoice Matching |

Small |

Enabled |

No |

Retail Fiscal Management Cloud Service

This is the initial release of Retail Fiscal Management Cloud Service (RFMCS).

Functional Overview

Retail Fiscal Management Cloud Service is designed to enable compliance for retailers by providing a flexible tool to manage fiscal attributes for items and entities. Fiscal attributes are required to support a variety of legal requirements from taxation to fiscal document generation and fiscal reporting. In its initial scope, Retail Fiscal Management has the following capabilities:

-

Fiscal attribute setup via REST services

-

Fiscal attribute list of values setup via REST services

-

Fiscal classification and reclassification for items and entities via user interface and via REST services

-

Extensions for Merchandising Foundation Cloud Service (RMFCS) foundation data integrations

-

Item subscription API

-

Item/Location subscription API

-

Store subscription API

-

Vendor subscription API

-

Fiscal Attributes and List of Values Setup

Fiscal attributes can be created by leveraging webservices. The creation of attributes and the possible list of values for each attribute are associated with data provided by legal authorities. The use of webservices for the setup of these attributes and the lists allows customers to keep legally mandatory attributes up to date.

Note:

For Brazil customers, a set of legally mandatory attributes is available without the need to be configured. However, it is the customers’ responsibility to keep them updated.Fiscal Classification and Reclassification

Fiscal classification and reclassification is the process of associating fiscal attributes to items and entities (locations, suppliers, and partners). This process is supported via RFMCS screens, via foundation integration subscription APIs or via RESTful webservices.

Extensions for RMFCS Foundation Data Integrations

The integration responsible for foundation data creation such as items, suppliers and locations has been extended to support the creation of the required fiscal attributes. These APIs have been extended to have the flexible structure used in RFMCS for fiscal classification and reclassification.

-

Item subscription API: This API subscribes to items from external systems to create, update or delete items in Merchandising. This API includes an extension to have item level attributes associated.

-

Item Location subscription API: This API subscribes to item location from external systems to create or modify item location combinations in Merchandising. This API includes an extension to have item-location level attributes associated.

-

Store Subscription API: The Store Subscription API provides the ability to keep store data in Merchandising in sync with an external system if Merchandising is not being used as the system of record for organizational hierarchy information. This API includes an extension to have entity level attributes associated for stores.

-

Vendor subscription API (suppliers and partners): Merchandising subscribes to vendor information that is published from an external financial application; however, this API is not used by Oracle Retail Financial Integration (RFI). Vendor can refer to either a partner or a supplier. This API includes an extension to have entity-level attributes associated for supplier sites.

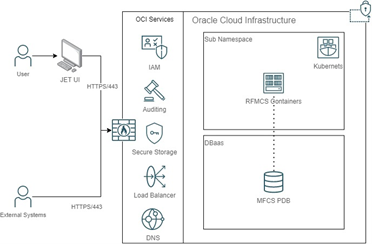

RFMCS is a cloud-native solution that leverages the most recent and advanced technologies used in Oracle Cloud applications and Merchandising Cloud Services architecture.

Fiscal Management Cloud Service is a JET, Java-based application deployed on Oracle Cloud Infrastructure along with the Oracle Retail Merchandising Foundation Cloud Service. The applications are deployed in a highly available, high performance, horizontally scalable architecture.

Key technical features include:

-

JET Redwood-themed application

-

REST Services to integrate with external systems

-

OAuth2.0 based authentication via Oracle Cloud Infrastructure Identity and Access Management (OCI IAM)

-

Batch programs that reside inside MFCS batch scheduler

-

Data Access Schema (DAS) and Retail Data Store (RDS) data replication via Golden Gate

-

Workflow-based development, with an ability to change database process flow based on setup

-

Language and Notification customization through the Retail Home application

See the Merchandising Cloud Services documentation for additional details.

Exchange Rate Based on Invoice Date

This cloud service update will allow the exchange rate assigned to the invoices to be based on the document date rather than one on the purchase order. Invoice Matching Cloud Service (ReIMCS) has historically used the exchange rate on the purchase order as the exchange rate of the invoice. With this enhancement, ReIMCS will optionally use the exchange rate as of the date of the document rather than using the exchange rate on the Purchase Order. The exchange rate based on the document date is determined based on the country of the location on the document and a method to identify countries is included as part of this service update.

Manage Variance Between invoice and Order Exchange Rate

This cloud service update allows the option to calculate the exchange rate variance of the receipt value. When this option is selected, the difference between the invoice and receipt exchange rates along with the matched receipt value is used to calculate inventory gain (or loss) due to exchange rate fluctuations and is posted to the general ledger in the local currency.

Ability to Update Promotions/Offers through ReST Service

This cloud service update includes the enhanced Promotions/Offers ReST based APIs, that can be used to update or delete existing promotions/offers, subject to applicable validations. Previosuly, these APIs could only be used to create promotions/offers.

Removed Same Ownership Type Restriction for SKUs under same Style

This cloud service update removes the restriction in Merchandising that prevents SKU (transaction or child) level items with different ownership types (owned, consignment or concession) under a Style (or parent) item at the same location. Users are able to create items that have different ownership types at the same location across transaction level items under the same Style. They’re also able to have different suppliers attached to these SKUs and raise purchase orders based on that setup.

Retail Data Store Audit for Item Location Table

This cloud service update includes the updated RDS replications to enable audits for the Item Location table. The audit data is written in the RDS_ITEM_LOC_AUDIT table.

Store Order and Replenishment API

This cloud service update introduces functionality intended to give the store user flexibility to look at orders/transfers that have been pre-generated by the Merchandising replenishment process prior to their finalization/approval. This enables the store user to look at the external order quantities, validate them with their localized knowledge and make quantity updates subject to pre-specified tolerance constraints.

The set of orders that can optionally be made available to store users for review is composed of single location semi-automatic orders and semi-automatic transfers to the store. The Replenishment attribute setup allows for the definition of the level of access (Restrict, Review, Approve) provided to the store user to review replenishment orders and define tolerances within which the store user can update the replenishment generated quantities. When the replenishment batches run, the orders and transfers generated are additionally grouped by store user access level and made available to SIOCS based on the level of access defined in the replenishment setup.

Once the store user reviews and updates the quantities, the same is updated back into merchandising and the orders and transfers are optionally be approved if the store user has access to approve. Replenishment orders and transfers pending for store review are non-editable in Merchandising and are identified based on a store review status value of pending displayed on the order and transfer screens.

As an exception flow, the Merchandising user can retrieve the orders and transfers that are staged for review by a store user for update and approval in Merchandising. Retrieving these records removes them from the Review list in SIOCS.

Return to Vendor (RTV) Creation in Approved Status

This cloud service update allows for the creation of RTVs in the approved status (along with in progress/shipped ones) based out of a warehouse location via the Manage RTV ReST service. The status of such an RTV is displayed as Approved when accessed via the UI and the user is able to perform the same set of actions on such an RTV compared to the ones created via the online screens. Such RTVs are also be passed on to the downstream applications, similar to the ones approved via online.

Appointment Dates Integration from Warehouses

This cloud service update includes enhancements to the appointments data integration from warehouses. Merchandising subscribes to an appointment when goods are expected to be shipped from one location to another at a specified time and place. Typically, appointments are created in a warehouse management system and sent to Merchandising using the standard integration mechanism.

With this enhancement, the Expected or Scheduled Appointment Date/Time and the Actual Appointment Receipt Date/Time fields have been added to the existing APIs.

Data Conversion Enhancements

This cloud service update includes a new API in the data conversion tool to convert non-sellable inventory for item location combinations into a production environment. This new conversion option follows the same patterns used by the conversion tool and leverage files (.dat) that are loaded via the on-line conversion screens. This conversion results in the creation of non-sellable merchandise inventory at a location by inventory status.

e-invoicing Enhancements

This cloud service enhancement extends the ReIMCS e-invoicing capability to receive a Fiscal ID as an acknowledgement of receipt of a document from a government agency. Documents are passed from ReIMCS to the Fiscal Document Generation service in RMFCS which is integrated with government agencies (through a third-party application) sending them documents and receiving back the Fiscal ID acknowledgement.

The Fiscal ID acknowledgment can be configured to be informational only, or it can control the issueance of Invoices/fiscal documents to the financial system until approval from fiscal authorities have been received.