2 Create a Letter of Credit

To create a letter of credit, follow the steps listed below.

-

From the Tasks menu, select Trade Management > Create Letter of Credit. The Letter of Credit window appears.

Note:

An open letter of credit does not require the existence of a purchase order. It can be opened to a beneficiary for a monetary amount.

-

The Letter of Credit ID is populated automatically. The status of the letter of credit is displayed in the top right corner of the window. The default status is Worksheet.

-

Enter, select or search for LC data in the individual sections. For more information about the individual sections, see the Letter of Credit Window section.

-

After you have entered all necessary LC data, choose one of the following options.

-

Select Save to save the LC.

-

Select Save and Close to save the LC and close the Letter of Credit window.

-

Select Cancel to reject all entries and close the Letter of Credit window.

-

Letter of Credit Window

The Letter of Credit window allows you to view, create and edit a letter of credit. The window contains the following sections:

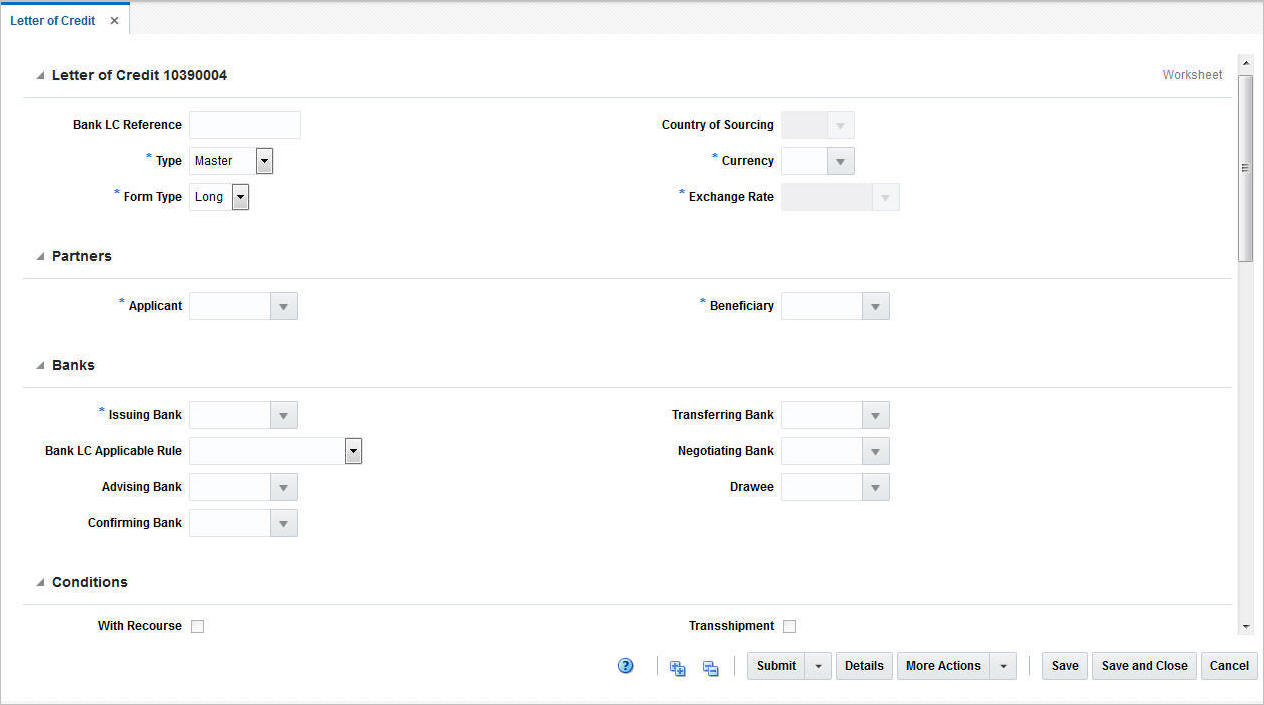

Figure 2-1 Letter of Credit Window

Letter of Credit

The Letter of Credit ID is populated automatically. The status of the letter of credit is displayed in the top right corner of the window, for example, Worksheet.

In the Letter of Credit section enter the following data.

Table 2-1 Letter of Credit - Fields and Description

| Field | Description |

|---|---|

|

Bank LC Reference |

Enter the Bank LC Reference. |

|

Type |

Select the Letter of Credit type from the list. Possible types are:

For more detailed information about possible letter of credit types, see the Letter of Credit Types section. This field is a required field. |

|

Form Type |

Choose between the following two letter of credit formats.

This field is a required field. |

|

Country of Sourcing |

Only available, if you select the LC Type Open. Enter, select or search for the appropriate country. |

|

Currency |

Enter, select or search for the currency of the LC. This field is a required field. |

|

Exchange Rate |

The exchange rate is populated automatically, based on the selected currency. By default the effective LC/bank rate is displayed in this field. If no LC/bank rate is found, the rate is either defaulted to the consolidation or operational exchange rate. If necessary, edit the displayed exchange rate with the Edit Exchange Rate icon. For more information about how to edit an exchange rate, see the Edit the Exchange Rate section. This field is a required field. |

Partners

In the Partners section enter the following data.

Table 2-2 Partners - Fields and Description

| Field | Description |

|---|---|

|

Applicant |

Enter, select or search for the applicant. This field is a required field. |

|

Beneficiary |

Enter, select or search for the beneficiary. This field is a required field. |

Banks

In the Banks section select, enter or search for the banks that are involved with the letter of credit transaction.

Table 2-3 Banks - Fields and Description

| Field | Description |

|---|---|

|

Issuing Bank |

The issuing bank opens the letter of credit when contacted by the retailer who intends to import goods. Enter, select or search for the corresponding bank. This field is a required field. |

|

Bank LC Applicable Rule |

The set of rules on the issuance and use of letters of credit. Select the set of rules from the list. If you select OTHER from the list, an entry field is displayed next to the Bank LC Applicable Rule field. Enter the used rule set. |

|

Advising Bank |

The foreign bank that advises the seller (vendor) that a letter of credit has been opened in their favor. Collects the documents required for compliance to the terms and conditions of the letter of credit so that payment can be made. Enter, select or search for the advising bank. |

|

Confirming Bank |

The bank that guarantees that funds are necessary to pay claims against a letter of credit. Enter, select or search for the confirming bank. |

|

Transferring Bank |

The bank which is asked by the beneficiary (first beneficiary) to transfer, in part or in full, its rights under the letter of credit to the second beneficiary. Enter, select or search for the transferring bank. |

|

Negotiating Bank |

The bank that is responsible for negotiating the letter of credit between the seller and the advising bank. Enter, select or search for the negotiating bank. |

|

Drawee |

The bank that is responsible for paying claims against a letter of credit. Enter, select or search for the drawee. |

Conditions

In the Conditions section, select the conditions that apply to the letter of credit.

Table 2-4 Conditions - Fields and Description

| Field | Description |

|---|---|

|

With Recourse |

The With recourse term defines the situation in which the paying bank will be able to claim refunds from the beneficiary in case the letter of credit documents are not paid by the issuing bank. Check the With Recourse checkbox. |

|

Transferable |

A letter of credit can be transferred to the second beneficiary at the request of the first beneficiary, only if it expressly states that the letter of credit is “transferable". Check the Transferable checkbox. |

|

Transshipment |

Transshipment means unloading from one means of conveyance and reloading to another means of conveyance (whether or not in different modes of transport) during the carriage from the place of dispatch, taking in charge or shipment to the place of final destination stated in the credit. Check the Transshipment checkbox. |

|

Partial Shipment |

Partial shipment means shipping a lesser amount than what is stated in the letter of credit when only one set of transport documents presented; or making less amount of shipment than what is stated in the letter of credit or using multiple means of conveyance when more than one set of transport documents presented. Check the Partial Shipment checkbox. |

Dates

In the Dates section, enter or select the relevant dates for the letter of credit as shown in the following table.

Table 2-5 Dates - Fields and Description

| Field | Description |

|---|---|

|

Application Date |

Enter the application date or click the Calendar icon to select the date. This field is a required field. |

|

Confirmation Date |

Enter the confirmation date or click the Calendar icon to select a date. |

|

Expiration Date |

Enter the expiration date or click the Calendar icon to select a date. This field is a required field. |

|

Earliest Ship Date |

Enter the earliest ship date or click the Calendar icon to select a date. This field is only available, if you select the LC Type Open in the Letter of Credit header. This field is a required field for an open letter of credit. |

|

Latest Ship Date |

Enter the latest ship date or click the Calendar icon to select a date. This field is only available, if you select the LC Type Open in the Letter of Credit header. This field is a required field for an open letter of credit. |

LC Value

The LC Value section contains the following fields. Enter the variance percent or specification value, depending on your selection in the Amount Type field.

Table 2-6 LC Value - Fields and Description

| Fields | Description |

|---|---|

|

Amount Type |

Select the amount type from the list. Possible types are:

This field is a required field. |

|

Variance % |

Enter the variance value in percent. If you select the Amount Type Exact, this field is disabled. |

|

Specification |

Select a specification, from the list. For example, select Maximum. If you select the Amount Type Approximately, this field is disabled. |

|

Amount |

Enter the amount. If you select the Amount Type Approximately, this field is disabled. This field is a required field |

|

Amount Word |

If you select the Amount Type Exact, this field is disabled. |

|

Net Amount |

This field displays the net value of the letter of credit, calculated as the total amount of the letter of credit plus or minus any amendments. You cannot edit this value. |

|

Open Amount |

This field displays the open amount of the letter of credit; calculated as the net amount minus any drawdowns issued against the letter of credit. You cannot edit this value. |

|

Amendments |

This field displays the total of all accepted amendments attached to the letter of credit. You cannot edit this value. |

|

Drawdown |

This field displays the total of all drawdowns executed against the letter of credit. You cannot edit this value. |

|

Charges |

This field displays the total of all charges incurred against the letter of credit. You cannot edit this value. |

Terms

The Terms section contains the following fields.

Table 2-7 Terms - Fields and Description

| Fields | Description |

|---|---|

|

Title Pass Location Type |

Select the location type from the list. |

|

Title Pass Location |

Enter the location. |

|

Transport To |

Enter, select or search for the transport to location. |

|

Lading Port |

Enter, select or search for the lading port. |

|

Discharge Port |

Enter, select or search for the discharge port. |

|

Place of Expiry |

Enter, select or search for the place of expiry. This field is a required field. |

|

Credit Available With |

Enter, select or search for the bank at which credit is available. |

|

Purchase Type |

Select the purchase type from the list. For example, select Backhaul or Pick-up. This field is a required field. |

|

Issuance |

Select the issuance from the list. |

|

Advice Method |

Select the advice method from the list. |

|

Drafts At |

Select the draft at entry from the list. For example, select 60 Days. |

|

Presentation Terms |

Select the presentation terms from the list. For example, select By Payment. This field is a required field. |

|

Negotiation Days |

Enter the negotiation days. |

Comments

The Comments section holds the comments field. You can enter any comments for the letter of credit.

Letter of Credit Toolbar

The Toolbar displays the icons and buttons for actions that can be performed for the letter of credit such as changing the status of the letter of credit or navigating to the LC Details window to view details of the letter of credit and the PO attached to it. The Toolbar contains the following icons and buttons.

Table 2-8 Letter of Credit Toolbar - Icons/Buttons and Description

| Action Icons/Buttons | Description |

|---|---|

|

Help icon |

You can access the online help for a particular page by clicking the Help icon. |

|

Expand and Collapse icons |

You can expand all the sections and collapse all the sections in the Letter of credit window by clicking the Expand or Collapse icons. |

|

Status |

If you click the Status button, the status of the letter of credit changes to the status specified on the button. When there is more than one status to which the LC can be changed, click the arrow on the right side of the button to display the additional status options. Possible letter of credit status are:

Letters of credit move to the Extracted status when you send them to banks from the Send Letters of Credit window. Therefore, the status Extracted does not appear in the status option list. |

|

Details |

Click Details to view the details of the letter of credit. The LC Details window appears. For more information about LC details, see the Details section. |

|

More Actions |

Click More Actions to see a list of additional actions that can be performed in the Letter of Credit window. For more information about the More Action Menu for LCs, see the Letter of Credit - More Actions Menu section. |

|

Save |

Click Save to save changes to the letter of credit. |

|

Save and Close |

Click Save and Close to save changes to the letter of credit and close the window. |

|

Cancel |

Click Cancel to reject all entries and close the window. |

|

Done |

Only available in view mode. Click Done to close the window. |

Letter of Credit - More Actions Menu

Use the More Actions menu to navigate to the following windows. The More Actions menu contains the following options.

Table 2-9 More Actions Menu - Buttons and Description

| Action Buttons | Description |

|---|---|

|

Activities |

Opens the LC Activities window. This window displays a list of all activities created against the LC, for example, purchase orders, amendments, bank charges and drawdowns. For more information about this function, see the Activity section. |

|

Amendments |

Opens the LC Amendments window. This window allows you to manage amendments to the LC. For more information about this function, see the Amendments section. |

|

Required Documents |

Opens the Required Documents window. This window displays all required documents for the LC. For more information, see “Required Documents" in the Oracle Retail Merchandising Purchase Orders and Contracts User Guide. |

|

Letter of Credit Report |

Opens the Letter of Credit Report. You can print the report, in case a hard copy is needed. |

|

Currency |

You can toggle between the letter of credit and the primary currency, to view the LC amounts in either the LC or the system's primary currency. The currency is set to LC by default. |