9 Working with Direct Debits for SEPA

This chapter contains the following topics:

-

Section 9.2, "Setting Up the Direct Debit Mandate Program (P743002) for SEPA Direct Debits"

-

Section 9.3, "Generating the XML File for Direct Debits for SEPA"

-

Section 9.4, "Extracting the SEPA Direct Debit Statement (Release 9.1 Update)"

9.1 Understanding SEPA Direct Debits

For SEPA direct debits, both the debtor and the creditor must hold an account with a participant bank located within SEPA. The debtor must authorize the creditor to initiate collection of payment from the debtor bank and also instruct the debtor bank to transfer the funds directly to the creditor bank. This authorization is based on an agreement between the debtor and the creditor and is referred to as a mandate. The mandate can be in paper or in electronic form and expires 36 months after the last initiated direct debit.

Complying with the mandate, the creditor will initiate the transaction process via the creditor's SEPA account. The scheme gives full discretion to debtors to accept or refuse a mandate.

The debtor can give authorization for recurrent direct debits or onetime single direct debit:

-

Recurrent direct debits are those for which the authorization by the debtor is used for regular direct debits initiated by the creditor.

-

Single direct debits are one-off direct debits for which the authorization is given once by the debtor to collect only one single direct debit. This authorization cannot be used for any subsequent transaction.

The JD Edwards EnterpriseOne system supports the format of collecting funds in euro from accounts designated to accept collections. The debtor and the creditor must set up their bank accounts with the BIC (Bank Identifier Code) and IBAN (International Bank Account Number) and specify that the account is for use for SEPA payments. All transactions will be in euro and if the accounts of the debtor and the creditor operate in any other currency, the fund for the SEPA direct debits has to be converted to euro.

You use the SEPA Direct Debit Mandate program (P743002) to enter and store the data related to the mandate in the system. You must then use the Debit Standard application (P03B571) to generate the SEPA Direct Debit report (R743002) to create the XML file for collecting the SEPA direct debits.

|

Note: (Release 9.1 Update) If you have a previous version of the JD Edwards EnterpriseOne software installed and if you are using the enhanced SEPA direct debit functionality, you must run the table conversion programs to move the data in the existing tables to the updated tables. |

9.2 Setting Up the Direct Debit Mandate Program (P743002) for SEPA Direct Debits

This section gives an overview of the SEPA Direct Debit Mandate program and lists the forms used to set up the mandate in the Direct Debit Mandate program.

9.2.1 Understanding the Direct Debit Mandate Program (P743002) for SEPA Direct Debits

You use the EnterpriseOne Direct Debit Mandate program to add a new mandate and enter the mandate information into the system. Enter mandatory information that the creditor must store in the system for use during the running of the SEPA Direct Debit processes, such as preparing for collections.

You must store information of every mandate signed with debtors, and this information must be date-effective and must include mandate details, any references, account details of the creditor and debtor, and so on.

You also use the Direct Debit Mandate program to modify an existing mandate in the system. The system saves the modified data and a record of the changes made to the mandate in the History Amendment form. The system saves changes of only that data that is mandatory to be informed during the time of collection.

|

Note: The Direct Debit Mandate program uses the term Amendment to mean a change or modification made to a mandate. |

The header of the History Amendment form contains the basic mandate information, and the detail contains the information related to the changes made to the mandate. In the History Amendment form, you can also view the following original mandate data entered at the time the mandate was created:

-

Original Mandate Identification

-

Original Creditor Scheme Identification

-

Original Creditor Name

-

Original Debtor Account Number (IBAN)

-

Original Debtor Agent (BIC Debtor Bank Account)

You cannot change data from the History Amendment form. You can make the changes only in the Revision Mandate form, which you access from Working with Mandates.

You can access and update the debtor, creditor, or ultimate debtor address book record from the Form menu on the SEPA Direct Debit form. The system automatically updates the History Amendment table if you change address book information that has a record in the mandate table and the information should be included in the XML at the time of collection.

9.2.2 Renewing an Expired Mandate Using the Direct Debit Mandate Program (P743002) (Release 9.1 Update)

You can renew an existing mandate which has expired because the Last Collection Date was more than 36 months ago. To renew an existing mandate using the P743002 program:

From the Row exit of the P743002 program, select Renew Mandate. A confirmation window will pop up with a text message: This action will reset the below field values. Press Ok to continue.

The following fields of the mandate are reset:

-

Last Collection Date

-

Mandate Active Date

-

Mandate Cancellation Date

-

Mandate Status

-

Mandate Identification

When the mandate fields are reset, the mandate creation form is displayed. The user can either enter the field values when the form is generated and click OK to save the form or close the form and enter the field values at a later instance.

9.2.3 Forms Used to Set Up the Mandate in the SEPA Direct Debit Mandate Program (P743002)

| Form Name | FormID | Navigation | Usage |

|---|---|---|---|

| Working with SEPA Mandates | W743002A | General SEPA XML (G74SEPA), SEPA Direct Debit Mandate | View and select existing mandates. |

| Mandate - SEPA Direct Debit | W743002B | On the Working with SEPA Mandates form, click Add. | Enter mandate details and access the debtor, creditor, and ultimate debtor tabs to enter respective details. |

| History Amendment | W743002C | Use one of these navigations:

|

View all the amendments to the mandate. |

9.2.4 Entering Mandate Data

Access the SEPA Direct Debit Mandate form.

9.2.4.1 Header

- Mandate Identification

-

Enter the number that identifies the mandate signed by a debtor for that creditor. This number, in combination with the value in the Creditor Identification Code field, must be unique for each mandate.

- Mandate Date

-

Enter the date on which the mandate was signed.

- Mandate Sequence Type

-

Specify the collection type. The value that you enter must exist in the Mandate Sequence Type (74/SQ) UDC. Values are:

OOFF: One-off collection.

RCUR: Recurring collections.

FRST: First recurrent collection.

FNAL: Last recurrent collection.

- Mandate Cancellation Date

-

Enter the date on which the debtor signs the cancellation of the mandate. If the mandate is not canceled, this field is blank.

- Mandate Local Instrument Type (Release 9.1 Update)

-

Enter the local instrument as published in an external local instrument code list. Examples are CORE, which is used to indicate a core direct debit, and B2B, which is used to indicate a B2B direct debit.

Note:

For existing mandates, you must enter a value in this field. If you leave this field blank, the system uses CORE as the default value. - Mandate Status

-

Enter the status of the mandate. This field identifies the status of the mandate. The system selects mandates that are active and occur before the cancellation date. Values are:

Y: Active

N: Inactive

- Mandate Active Date

-

Enter the date on which the mandate becomes active. You use this field to activate an inactive mandate, and you must enter the activation date in this field if the mandate is inactive.

- Mandate Version

-

Enter the version number of the mandate. A mandate with version number 1 indicates that the mandate has no changes. The default value at the time of the mandate creation is 1 and this value increases with the number of changes made to the mandate.

- Last Collection Date

-

This is an output field and if this field is not populated, the system completes this field with the date on which the last collection was processed for this mandate.

- Collection Counter

-

The system completes this field depending on the number of collections made to the mandate.

9.2.4.2 Debtor

Access the Debtor tab in the SEPA Direct Debit Mandate form.

- Address Number - Name

-

Enter the number that the system uses to search the debtor information from the address book. The mailing name of the debtor appears as an output field. The system uses this number to fetch the IBAN and BIC number from the address book.

- Debtor Identification Code

-

The system completes this field with the value taken from the address book according to the address book number that you have entered. This value is the tax ID of the address number, and in case this field in the address book is blank, the system takes the additional tax ID.

- Bank Account - IBAN

-

The system completes this field with the IBAN of the debtor's bank account. The system fetches this number from the record that you entered in the Bank Account Cross Reference program (P0030A) after you enter the debtor address number.

- Bank Account - BIC

-

The system completes this field with the BIC of the debtor's bank account. The system fetches this number from the record that exists in the Bank Transit Master table (F0030) for the debtor's bank account.

9.2.4.3 Creditor

Access the Creditor tab in the SEPA Direct Debit Mandate form.

- Address Number - Name

-

Enter the number that the system uses to search the creditor information from the address book. The mailing name of the creditor appears as an output field.

You can enter or change the address number only when a mandate has no transaction in process. This field is not editable for a mandate that has transaction in progress.

- G/L Bank Account (Release 9.1 Update)

-

Enter a value that identifies an account in the general ledger.

This is a mandatory field.

Note:

If you are already using the SEPA direct debit functionality and have a previous version of the software installed, you must complete the G/L Bank Account field for all existing mandates.Use one of the following formats to enter account numbers:

-

Standard account number (business unit.object.subsidiary or flex format).

-

Third G/L number (maximum of 25 digits).

-

Account ID number. The number comprises 8 digits.

-

Speed code. A two-character code that you concatenate to the AAI item SP. You can then enter the code instead of an account number.

The first character of the account number indicates its format. You define the account format in the General Accounting constants.

-

- Scheme Identification

-

This is the format for creating the creditor identification code that will be used to identify the creditor.

The creditor identification code in combination with the mandate identification code uniquely identifies the mandate for that creditor. A creditor can use the creditor business code extension to identify different business activities, but it is not required to identify the creditor.

- Creditor Identification Code

-

The system completes this field when you enter the country code, verification digit, business code, and National ID in their respective fields.

The creditor identifier code contains the following elements in the order listed:

-

Positions 1 and 2 contain the country code of the country where the National Identification of the creditor has been issued.

-

Positions 3 and 4 contain the two verification digits resulting from the National Identification code of the creditor. When the creditor business code is not used, then the value is set to ZZZ.

-

Positions 8 to 35 contain the code defined by the national community; the system does not validate this value.

A creditor can use more than one identifier. The creditor identification can change due to the merger, acquisition, spin-off, or organizational changes.

-

- Creditor Country Code

-

Specify the value that identifies the country of the creditor. The value that you enter must exist in the BIC Country Code UDC table (74/SA). The system saves this value in the first two positions of the Creditor Identification Code field. You must complete this field.

- Creditor Digit

-

Enter the two verification digits that result from the National Identifier code of the creditor. The system validates the digits that you enter and saves them in positions 3 and 4 of the Creditor Identification Code field. You must complete this field.

- Creditor Business Code

-

Specify the value to identify business lines or services. The value that you enter must exist in the Business Code UDC table (74/BC). This value is informational and is not needed to identify the mandate in a unique way. Creditors can change it over time for business reasons. If the creditor business code is not used, then the value is set to ZZZ.

- Creditor National Identification

-

Enter the value defined by the national community that identifies the creditor's country as the national identifier of the creditor. The system saves this value in positions 8 to 35 of the Creditor Identification Code field. The system does not validate the value that you enter.

- Bank Account - IBAN

-

The system completes this field with the IBAN of the creditor's bank account. The system retrieves this value from the Bank Transit Master table (F0030) for the creditor's bank account based on the value that you enter in the G/L Bank Account field (Release 9.1 Update).

- Bank Account - BIC

-

The system completes this field with the BIC of the creditor's bank account. The system retrieves this value from the Bank Transit Master table (F0030) for the creditor's bank account based on the value that you enter in the G/L Bank Account field (Release 9.1 Update).

9.2.4.4 Ultimate Debtor

Access the Ultimate Debtor tab in the SEPA Direct Debit Mandate form.

- Ultimate Debtor Address Number

-

Enter the number that the system uses to search the ultimate debtor information from the address book. The name of the address number appears as an output field. You must complete this field.

- Identification Code

-

The system completes this field with the value taken from the address book according to the ultimate debtor address number that you enter. This value is the tax ID of the address number and in case this field in the address book is blank, the system takes the additional tax ID.

9.2.5 Reviewing Modifications Made to a Mandate

Access the History Amendment form.

9.2.5.1 Original Values

Access the Original Values tab in the History Amendment form. These values will not change if the mandate has collections in progress.

- Original Mandate Identification

-

The system completes this field with the first mandate identification code entered by the creditor when the mandate was created. This data is constant and the system informs this data during collection if it is modified.

- Original Creditor ID Code

-

The system completes this field with the first creditor identification code entered by the creditor (without the business code) when the mandate was created. This data is constant and the system informs this data during collection if it is modified.

- Original Creditor Name

-

The system completes this field with the mailing name of the creditor that was entered when the mandate was created. This is the alpha description of the address book for the creditor. The system informs this data during collection if it is modified.

- Original Debtor - IBAN

-

The system completes this field with the IBAN of the debtor's account number that was entered when the mandate was created. The system informs this data during collection if it is modified.

- Original Debtor Agent - BIC

-

The system completes this field with the BIC of the debtor's bank that was entered when the mandate was created. The system informs this data during collection if it is modified.

9.2.5.2 Grid Data

- Mandate Identification

-

The system completes this field with the new mandate identification code entered for the mandate.

- Amendment Date

-

The system completes this field with the date on which changes were made to the mandate.

- Creditor Identification Code

-

The system completes this field with the new creditor identification code that is generated when you change any of the values in the following fields: Country Code, Verification digit, Business Code, and National ID.

- Creditor Name

-

The system completes this field with the address number of the new creditor that the system uses to search creditor information from the address book.

- Debtor Identification (IBAN)

-

The system completes this field with the IBAN of the new debtor's bank account.

- Debtor Bank Identification (BIC)

-

The system completes this field with the BIC of the new debtor's bank.

9.3 Generating the XML File for Direct Debits for SEPA

This section provides an overview of the XML file for SEPA direct debits and discusses how to:

-

Generate the XML file for SEPA direct debits.

-

View report output generated by BI Publisher for JD Edwards EnterpriseOne.

9.3.1 Understanding the XML File for SEPA Direct Debits

To process SEPA direct debits for JD Edwards EnterpriseOne, you use the JD Edwards EnterpriseOne Automatic Debit program (P03B571). The Automatic Debit program generates the SEPA Direct Debit Extractor report (R743005) or the SEPA Direct Debit Multiple XML Extractor report (R743005A) from the standard Auto Debit table (F03B575). These reports generate the required XML file or files and saves them in the Business Intelligence Publisher (BI Publisher) folders.

You can either generate a single XML file for all of the mandate sequence types or multiple XML files, each corresponding to a mandate sequence type. You use the SEPA Direct Debit Extractor report (R743005) to generate a single XML file and the SEPA Direct Debit Multiple XML Extractor report (R743005A) to generate multiple XML files.

|

Note: To generate multiple XML files, the system uses the R743005A program, which in turn uses the R743005 program to generate individual XML files for each mandate sequence type. Therefore, you must set the Bank Format Version (R743005) processing option for the R743005A program to specify the version of the R743005 program that the system will use. |

From the F03B575 table and the SEPA Direct Debit Mandate table (F743002), the SEPA Direct Debit Extractor report and the SEPA Direct Debit Multiple XML Extractor report extract the receipts of the debtors who have active mandates associated within the period that you process the collection. For each debtor, the report creates a record in the XML file with the mandate data and the receipt information.

To generate the XML file for SEPA direct debits, the system selects the active mandates based on the following criteria:

-

Local Instrument Type

-

G/L Bank Account

-

Creditor Address Number

-

Debtor Address Number

-

Ultimate Debtor Address Number

To generate the XML in the format that is required by the banks for direct debits, the system uses Oracle's BI Publisher, which is integrated with the JD Edwards EnterpriseOne software.

You run the XML in the automatic debit process to generate the Automatic Debit Statement report, Errors report, and Structured and Unstructured Remittance reports for both single and multiple invoices. You select a version to print the specific report. When you run the XML, the embedded BI Publisher for JD Edwards EnterpriseOne invokes a report definition. This definition relates the report-specific templates to the report and presents the output in the specified format.

This table lists the reports that are generated, the report definitions and versions associated with the reports, and the output format of the reports:

| Report | Report Definition | Source Version | Output Format |

|---|---|---|---|

| SEPA Direct Debit Errors Detail | None | None | |

| SEPA Direct Debit Auto-Debit Statement | None | None | |

| SEPA Direct Debit - Strc - Mult Remittance XML | RD743005A | XJDE0001 | XML |

| SEPA Direct Debit - Error and Detailed Collection | RD743005B | XJDE0001 | |

| SEPA Direct Debit - Unstr - Mult Remittance XML | RD743005C | XJDE0002 | XML |

| SEPA Direct Debit - Error and Detailed Collection | RD743005G | XJDE0002 | |

| SEPA Direct Debit - Struct - Singl Remittance | RD743005D | XJDE0003 | XML |

| SEPA Direct Debit - Error and Detailed Collection | RD743005H | XJDE0003 | |

| SEPA Direct Debit - Unstru - Singl Remittance | RD743005F | XJDE0004 | XML |

| SEPA Direct Debit - Error and Detailed Collection | RD743005I | XJDE0004 |

The reports are described as follows:

SEPA Direct Debit Errors Detail: The R03B571 program generates the SEPA Direct Debit Errors Detail report to inform the errors generated by the Auto Debit (R03B571) process. If the R03B571 program finds errors, the XML file will not be generated. Instead, the program generates this report in the PDF format.

SEPA Direct Debit Auto-Debit Statement: The R743005 program generates the SEPA Direct Debit Auto-Debit Statement report to inform the receipts included in the XML that is generated by the SEPA Direct Debit Extractor process. If no errors occur when you run the R03B571 program, the R03B575 program displays the processed invoices in the PDF and the R743005 program exports the processed invoices into the XML.

SEPA Direct Debit - Strc - Mult Remittance XML: You must run the XJDE0001 version of the report to generate the SEPA Direct Debit Structured Multiple Remittance XML output that you send to the bank for processing the direct debits.

SEPA Direct Debit - Error and Detailed Collection: You can run the XJDE0001 version of the report to generate the PDF output with error and detailed collection information for structured transaction involving multiple invoices.

SEPA Direct Debit - Unstr - Mult Remittance XML: You must run the XJDE0002 version of the report to generate the SEPA Direct Debit Unstructured Multiple Remittance XML output that you send to the bank for processing the direct debits.

SEPA Direct Debit - Error and Detailed Collection: You can run the XJDE0002 version of the report to generate the PDF output with error and detailed collection information for an unstructured transaction involving multiple invoices.

SEPA Direct Debit - Struct - Singl Remittance XML: You must run the XJDE0003 version of the report to generate the SEPA Direct Debit Structured Single Remittance XML output that you send to the bank for processing the direct debits.

SEPA Direct Debit - Error and Detailed Collection: You can run the XJDE0003 version of the report to generate the PDF output with error and detailed collection information for a structured transaction involving a single invoice.

SEPA Direct Debit - Unstru - Singl Remittance XML: You must run the XJDE0004 version of the report to generate the SEPA Direct Debit Unstructured Single Remittance XML output that you send to the bank for processing the direct debits.

SEPA Direct Debit - Error and Detailed Collection: You can run the XJDE0004 version of the report to generate the PDF output with error and detailed collection information for an unstructured transaction involving a single invoice.

|

Note: BI Publisher for JD Edwards EnterpriseOne does not enable the use of proof and final modes. |

The JD Edwards EnterpriseOne system supports the creditor transmitting the XML file to the creditor bank. You can instruct your bank to initiate transactions once both parties sign the mandate and you prenotify the debtor. The system supports both recurrent and one-off collections.

(Release 9.1 Update) When you run the R03B571 program, the system validates the data sent to the XML file. If any of the mandatory information is missing, the R03B571 program does not generate any XML file and reports the error in the PDF file.

|

Note: (Release 9.1 Update) When you run the R03B571 program, the system performs the SEPA validations only if you set the value of the Bank Format Program processing option as R743005 or R743005A. |

|

Note: (Release 9.1 Update) If there are multiple invoices for multiple payors, Payor A, Payor B, and Payor C, and there is an error during the validation process for one of the invoices for Payor A when you run the R03B571 program, then the system will process the invoices for the other payors that passed the validation but not for Payor A. |

These are the validations and the associated errors if the validations fail:

| Validations | Error Codes | Error Description |

|---|---|---|

| Mandate exists. | K74E053 | There is no mandate associated with the debtor who's being processed. |

| Mandate is active and the mandate active date is equal to or before the date used to process the debit transfer. | K74E054 | Associated mandate is not active or the mandate active date is in the future. |

| Mandate is not canceled. | K74E055 | Mandate being processed has been canceled. |

| Currency code is valid. | K74E060 | The currency code specified for EURO in processing options of R743002 does not match the transaction currency code of one of the records being processed from Auto Debit Invoice Select and Build table (F03B575). |

| There is no blank value in the processing options fields. | K74E061 | The processing option fields cannot be left blank. |

| Creditor mailing name is set up in the Address Book system. | K74E062 | Creditor mailing name is not set up in the Address Book system. You must set up the mailing name using Address Book Revisions program. (P01012). |

| Creditor tax Id is set up in the Address Book system. | K74E063 | Creditor tax Id or additional tax Id is not set up in the Address Book system. You must set up the tax Id or additional tax ID using Address Book Revisions program (P01012). |

| Creditor mailing address is set up in the Address Book system. | K74E064 | Creditor mailing address is not set up in the Address Book system. You must set up the mailing address using Address Book Revisions program (P01012). |

| Creditor country is set up in the Address Book system. | K74E065 | Creditor country is not set up in the Address Book system. You must set up the creditor country using Address Book Revisions program (P01012). |

| Creditor IBAN is set up in the system. | K74E066 | Creditor IBAN is not set up in the system.You must set up IBAN using IBAN By G/L Bank Account program (P700030). |

| Creditor BIC is set up in the system. | K74E067 | Creditor BIC (SWIFT Code) is not set up.

You must set up the BIC (SWIFT Code) using Revise Bank Information program (P0030G). |

| Creditor bank account is SEPA. | K74E068 | Creditor bank account is not set up as a SEPA bank account. You must set up the bank account as a SEPA bank account using SEPA Account Setup program (P0030G). |

| Ultimate creditor mailing name is set up in the Address Book system. | K74E069 | Ultimate creditor mailing name is not set up. You must set up the mailing name using Address Book Revisions program (P01012). |

| Ultimate creditor tax Id is set up. | K74E070 | Ultimate creditor tax Id is not set up. You must set up the tax Id using Address Book Revisions program (P01012). |

| Debtor mailing name is not set up. | K74E071 | Debtor mailing name is not set up. You must set up the debtor mailing name using Address Book Revisions program (P01012). |

| Debtor tax Id is set up. | K74E072 | Debtor tax Id is not set up.

You must set up the tax Id or additional tax Id using Address Book Revisions program (P01012). |

| Debtor mailing address is set up. | K74E073 | Debtor mailing address is not set up. You must set up the mailing address using Address Book Revisions program (P01012). |

| Debtor country is set up. | K74E074 | Debtor country is not set up.

You must set up the country using Address Book Revisions program (P01012). |

| Debtor IBAN is set up. | K74E075 | Debtor IBAN is not set up. You must set up the IBAN using IBAN By Address Number Bank Account program (P700030). |

| Debtor BIC is set up. | K74E076 | Debtor BIC (SWIFT Code) is not set up. You must set up the BIC (SWIFT Code) using Bank Account by Address program (P0030A). |

| Debtor bank account is SEPA. | K74E077 | Debtor bank account is not set up as a SEPA bank account. You must set up the SEPA bank account using SEPA Account Setup program (P0030A). |

| Ultimate debtor mailing name is set up. | K74E078 | Ultimate debtor mailing name is not set up.

You must set up the mailing name using Address Book Revisions program (P01012). |

| Ultimate debtor tax Id is set up. | K74E079 | Ultimate debtor tax Id is not set up.

You must set up the tax Id using Address book Revisions program (P01012). |

|

Note: The R03B571 program validates that all the receipts selected are in euro. The code that represents euro currency is the one that you entered in the processing option. If the receipt is not in euro, the report shows an error and the information for that receipt is not included in the XML file. You must set up the Auto Debit report (R03B571) to process the receipt in euro. |

The R743005 and R743005A reports update the following fields on the SEPA Direct Debit Mandate table when an XML file is successfully generated for a mandate:

-

Last collection date (this is the last transaction date of the mandate).

-

Transactions counter (this is the number of direct debits under the mandate).

-

Active field with N if the type of mandate is one-off or last so that the report does not process recurrent direct debit transactions in the future.

9.3.1.1 Changing the Status of Payments Using the Copy to Diskette program (P0457D) (Release 9.1 Update)

When you run the Automatic Debit program (P03B571) in final mode, the system generates the XML and updates the status field in the F03B571 table to 2. When you format the bank file, the status changes to 3 (bank file formatted). The XML file is then transmitted to the bank.

To indicate that the XML file has been sent to the bank, you can change the status of the file to 4 (Copy to Medium) by selecting Copy to Diskette in the Row menu. In the SEPA Auto Debit Batch Status Change Confirmation form, select the button to confirm the status change. This form displays only when the country is a European Union country, the bank format is R743005, and the last status is 3.

9.3.1.2 Replaced Characters in the Direct Debit XML File (Release 9.1 Update)

The SEPA Direct Debit Extractor program (R743005) and the SEPA Direct Debit Multiple XML Extractor program (R743005A) generate an XML file that you submit to the banking system. The program generates some information, such as addresses, using the language that is set up in your system. The banking system cannot process all of the special characters that exist in all languages. If your JD Edwards EnterpriseOne system generates the SEPA Direct Debit XML file with unacceptable characters, you can set up your system to substitute acceptable, alternative characters for the unacceptable characters.

You set up the Replace Character In String (74/RS) UDC table with the acceptable characters to use in place of the unacceptable characters. You then specify in a processing option in the SEPA Direct Debit Extractor program that you want to use the 74/RS UDC table to substitute characters in the XML output file.

When you set up the 74/RS UDC table, you can specify one or more alternative characters. When you specify multiple alternative characters, the length of the string that is altered does not change; if the original string is three characters, the modified string is three characters. The system drops certain characters from the string if inserting all of the alternate characters will result in the modified string exceeding the allowed length of the string.

These examples illustrate how the system replaces a single character with multiple characters:

9.3.1.2.1 Example 1: Replacing A with FG

Original string is ABC.

Modified string is FGB.

To retain field length of three, the system drops the C from the string.

9.3.1.3 XML File

The XML includes two blocks of records. Block A is the Group Header block and includes description of the XML file and the initiating party or the creditor. Block B is the Payment Information block. This block will group the records from the standard Auto Debit table (F03B575) and includes the following amendment records that you must inform during debit transfer process:

-

Mandate Identification

-

Creditor Scheme ID

-

Creditor Name

-

Debtor IBAN number

-

Debtor BIC number

|

Note: The R743005 and R743005A reports include the preceding amendment records in the XML only if a change in data occurs during the period from the last transaction date to the new transaction date for a mandate based on a logic. |

9.3.2 Understanding the Output Modes of Payments in the XML

You can choose from four versions to specify the mode of payment to inform in the XML:

-

XJDE0001 - Multiple Structured

-

XJDE0002 - Multiple Unstructured

-

XJDE0003 - Single Structured

-

XJDE0004 - Single Unstructured

The structured output uses XML tags to separate each piece of data for a transaction. The unstructured output puts all the data for a transaction into just one XML tag <ustrd> without using separate tags for each specific piece of data.

Section B.3, "Examples of Structured and Unstructured Modes of Payment in the XML"

9.3.3 Setting Processing Options for SEPA Direct Debit Extractor (R743005)

Processing options enable you to set default processing values for programs and reports.

|

Note: You can access the processing options by selecting SEPA XML Direct Debit Extractor (R743005) from the General SEPA XML menu (G74SEPA). |

9.3.3.1 General

- 1. Ultimate Creditor

-

Specify the number that the system uses to fetch the associated additional address book number of the creditor from the F0101 table. The value that you specify must exist in the Ultimate Creditor UDC table (74/UC).

- 2. Currency Code

-

Specify the currency code that you use for the euro. The value that you specify must exist in the Currency Codes table (F0013).

- 3. Purpose Code

-

The system completes this field with a hard-coded value of SUPP.

- 4. Category Purpose

-

The system completes this field with a hard-coded value of SUPP.

- 5. Initiating Party Identification Issuer

-

Enter the value that the system uses to define issuer in the initiating party information.

The system hides the tag </Issr> in the XML output if this field is blank.

- 6. Local Instrument

-

Specify a value from the Local Instrument (74/LI) UDC table to indicate the instrument type. Values are:

CODE or blank: The file is a core file type. This is the default value.

B2B: The file is for a business to business file.

COR1: The file is for a core direct debit file.

- 7. Financial Institution Identification of Debtor Agent

-

Specify whether to include the BIC of the debtor's bank account or to include a tag with the value of Not Provided in the output XML file. Values are:

Blank: BIC of the debtor bank

1: Not Provided

- 8. Financial Institution Identification of Creditor Agent

-

Specify whether to include the BIC of the creditor bank account or include a tag with the value of Not Provided in the XML output file. Values are:

Blank: BIC of the creditor bank

1: Not Provided

- 9. Remittance Identification Issuer

-

Specify the field to retrieve the remittance identification issuer when the remittance information is structured. Values are:

Blank: Document business unit.

1: User-defined value. If you select this value, you must set the Remittance Identification Issuer Value processing option.

- 10. Remittance Identification Issuer Value

-

Specify the value that the system populates as the remittance identification issuer in the XML file, when the remittance information mode is structured, and the Remittance Identification Issuer processing option is set to a user-defined value. If you leave this processing option blank, the system does not populate the <Issr> tag in the XML.

- 11. Creditor Scheme Identification <CdtrSchmeId> Level

-

Specify the level at which the system populates the <CrdtrSchmeld)> element in the XML file. Values are:

Blank: At the payment information level.

1: At the debit transaction level.

2: At the payment information and debit transaction level.

- 12. Batch Booking Upper/Lower Case Flag

-

Specify whether the output XML file should display the Batch Booking Flag value in uppercase or lowercase. Values are:

Blank: Lowercase

1: Uppercase

- 13. Batch Booking Flag (TRUE/FALSE) (Release 9.1 Update)

-

This flag determines the number of SEPA direct debit entries to be created in the XML file.

Specify whether the batch booking element in the XML is TRUE or FALSE. Values are:

TRUE: Single batch entry for the sum of all the amounts.

FALSE: Individual entry for each transaction. This is the default value.

9.3.3.2 Process

- 1. Report Formatted Legal Document Number

-

Specify whether to use the formatted legal number from F03B11.VR01 or the invoice number from F03B11.DOC. Values are:

Blank: Use the invoice number (F03B11.DOC).

1: Use the formatted legal number (F03B11.VR01).

- 2. Replace pre-defined characters using UDC 74/RS

-

Specify whether to substitute characters from UDC 74/RS for characters in the XML file. If you specify to use the replaced characters, you must set up the appropriate values in the 74/RS UDC table. Values are:

Blank: Do not substitute characters.

1: Use substitute characters from 74/RS.

9.3.4 Setting Processing Options for the SEPA Direct Debit Multiple XML Extractor Report (R743005A) (Release 9.1 Update)

Processing options enable you to set default processing values for programs and reports.

9.3.5 Generating the XML File for SEPA Direct Debits for SEPA

To generate the XML file for SEPA direct debits using the JD Edwards EnterpriseOne Automatic Debit process:

-

Create invoices using the Standard Invoice Entry program (P03B11)

-

Set up the processing options of the Automatic Debit program (P03B571).

Note:

You must enter the bank account in the processing options for the Automatic Debit program. This account identifies the creditor. You must complete this processing option to avoid the option of selecting more than one company. The SEPA Direct Debit process allows only one creditor company per collection. Also, you must set up the P03B571 processing option to process the receipt in euros. -

Run the Automatic Debit program in final mode. This process generates the R743005 or R743005A report along with the standard receipts header and receipts detail reports. The R743005 report automatically generates an XML file and the R743005A report generates multiple XML files in the process (Release 9.1 Update).

Note:

(Release 9.1 Update) The system generates the R743005 or R743005A report automatically when you run the R03B571 program only if you specify the applicable report (R743005 or R743005A) in the Bank Format Program processing option and a valid version in the Bank Format Version processing option of the R03B571 program. You can also select the record in the P03B571 application and define the format if you have not specified the format in the processing option. Then you generate the report from the P03B571 Row/Format Bank File. -

Download and extract the Debit Statement report.

See "Extracting the SEPA Direct Debit Statement (Release 9.1 Update)"

9.4 Extracting the SEPA Direct Debit Statement (Release 9.1 Update)

The SEPA Direct Debit Extractor program (R743005) and the SEPA Direct Debit Multiple XML Extractor program (R743005A) use the JD Edwards EnterpriseOne BI Publisher from Oracle to generate reports (Release 9.1 Update). After you generate and download the SEPA direct debit files using the R743005 or the R743005A program, you can access the report definitions used by the BI Publisher to extract the Direct Debit Statement (Release 9.1 Update). You can access the XML file from the Submitted Jobs form. To generate the PDF, you republish the XML.

To extract the Debit Statement:

-

Access the Batch Versions program (P98305W).

-

On the Available Version form, select Submitted Jobs from the Form menu.

Figure 9-2 Available Versions form: Submitted Jobs

Description of ''Figure 9-2 Available Versions form: Submitted Jobs''

-

On the Submitted Jobs Search form, select the report that you want to view and then select Republish RD from the Row menu.

-

On the Publish Report Definition Prompt from, select Prompt for Report Definition, and then click OK.

Figure 9-3 Publish Report Definition Prompt form

Description of ''Figure 9-3 Publish Report Definition Prompt form''

-

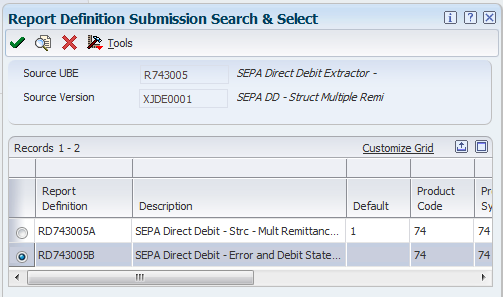

On the Report Definition Submission Search & Select form, select the RD743005B report and click Select.

Figure 9-4 Report Definition Submission Search & Select form

Description of ''Figure 9-4 Report Definition Submission Search & Select form''

-

On the Submitted Jobs Search form, select View RD Output from the Row menu.

-

On the Report Definition Output Repository form, select the row for the Error and Debit Statement PDF.

-

Click the icon in the View Output column to open the PDF.

9.5 Generating the XML File for Draft Remittance for SEPA Direct Debits (Release 9.1 Update)

This section provides an overview of the XML file for draft remittance for SEPA direct debits and discusses how to:

-

Set processing options for SEPA Direct Debit for Draft Remittance Extractor (R743007).

-

Set processing options for SEPA Direct Debit Multiple XML Extractor for Draft (R743007A).

-

Generate the XML file for draft remittance for SEPA direct debits.

9.5.1 Understanding the XML File for Draft Remittance for SEPA Direct Debits

You remit or deposit drafts to the bank so that the bank can collect the funds from the customer's bank. You use the Draft Remittance program (R03B672) to generate the XML file for collecting the SEPA direct debits during the draft remittance process.

You use the R03B672 program to generate the R743007 and R743007A extractor reports from the F03B672 table. You can either generate a single XML file for all of the mandate sequence types or multiple XML files for each mandate sequence type to report SEPA direct debits during the draft remittance process. You specify the XML file format in the Paper/Tape tab of the processing options for the R03B672 program.

Specify one of these formats for electronic accounts receivable draft remittance for SEPA direct debits:

-

R743007: SEPA Direct Debit Single XML Draft Remittance Format

-

R743007A: SEPA Direct Debit Multiple XML Draft Remittance Format

When you run the R03B672 program, the system validates the data sent to the XML file. If any of the mandatory information is missing, the R03B672 program terminates in error and reports the error in the PDF file. If there is a validation error, the system generates a blank XML file or files.

|

Note: When you run the R03B672 program, the system performs the validations only if you set the value of the Paper/Tape Remittance Program processing option as R743007 or R743007A. |

|

Note: If there are multiple drafts and the system runs into a validation error with one of the drafts when you run the R03B672 program, the system processes only the drafts that have passed the validation process. For example, if there are 10 drafts, and the R03B672 program runs into a validation error while processing the sixth draft, the system processes the draft remittance for the first five drafts only and generates blank XML files for the remaining five drafts. |

|

Note: The validations for draft remittance for SEPA direct debits are the same as the validations for the standard direct debit process. |

9.5.2 Setting Processing Options for SEPA Direct Debit for Draft Remittance Extractor (R743007)

Processing options enable you to set default processing values for programs and reports.

9.5.2.1 General

- 1. Ultimate Creditor

-

Specify the number that the system uses to fetch the associated additional address book number of the creditor from the F0101 table. The value that you specify must exist in the Ultimate Creditor UDC table (74/UC).

- 2. Currency Code

-

Specify the currency code that you use for the euro. The value that you specify must exist in the Currency Codes table (F0013).

- 3. Purpose Code

-

The system completes this field with a hard-coded value of SUPP.

- 4. Category Purpose

-

The system completes this field with a hard-coded value of SUPP.

- 5. Initiating Party Identification Issuer

-

Enter the value that the system uses to define issuer in the initiating party information.

The system hides the tag </Issr> in the XML output if this field is blank.

- 6. Local Instrument

-

Specify the local instrument as published in an external local instrument code list. Examples are CORE, which is used to indicate a core direct debit, and B2B, which is used to indicate a B2B direct debit.

- 7. Financial Institution Identification of Debtor Agent

-

Specify whether to include the BIC of the debtor's bank account or to include a tag with the value of Not Provided in the output XML file. Values are:

Blank: BIC of the debtor bank

1: Not Provided

- 8. Financial Institution Identification of Creditor Agent

-

Specify whether to include the BIC of the creditor bank account or include a tag with the value of Not Provided in the XML output file. Values are:

Blank: BIC of the creditor bank

1: Not Provided

- 9. Remittance Identification Issuer

-

Specify the field to retrieve the remittance identification issuer when the remittance information is structured. Values are:

Blank: Document business unit.

1: User-defined value. If you select this value, you must set the Remittance Identification Issuer Value processing option.

- 10. Remittance Identification Issuer Value

-

Specify the value that the system populates as the remittance identification issuer in the XML file, when the remittance information mode is structured, and the Remittance Identification Issuer processing option is set to a user-defined value. If you leave this processing option blank, the system does not populate the <Issr> tag in the XML.

- 11. Creditor Scheme Identification <CdtrSchmeId> Level

-

Specify the level at which the system populates the <CrdtrSchmeld)> element in the XML file. Values are:

Blank: At the payment information level.

1: At the debit transaction level.

2: At the payment information and debit transaction level.

- 12. Format Type

-

Specify whether to purge the records from the Draft Remittance Workfile table (F03B672). Values are:

Blank or 0: Purge the data from the Draft Remittance Workfile table.

1: Do not purge the data from the Draft Remittance Workfile table.

- 13. Batch Booking Upper/Lower Case Flag

-

Specify whether the output XML file should display the Batch Booking Flag value in uppercase or lowercase. Values are:

Blank: Lower case

1: Upper case

9.5.2.2 Process

- 1. Report Formatted Legal Document Number

-

Specify whether to use the formatted legal number from F03B11.VR01 or the invoice number from F03B11.DOC. Values are:

Blank: Use the invoice number (F03B11.DOC).

1: Use the formatted legal number (F03B11.VR01).

- 2. Replace pre-defined characters using UDC 74/RS

-

Specify whether to substitute characters from UDC 74/RS for characters in the XML file. If you specify to use the replaced characters, you must set up the appropriate values in the 74/RS UDC table. Values are:

Blank: Do not substitute characters.

1: Use substitute characters from 74/RS.

9.5.3 Setting Processing Options for SEPA Direct Debit Multiple XML Extractor for Draft (R743007A)

Processing options enable you to set default processing values for programs and reports.

9.5.4 Generating the XML File for Draft Remittance for SEPA Direct Debits

To generate the XML file for draft remittance for SEPA direct debits:

-

Create a draft by using the Draft Entry program (P03B602) or by running the Pre-Authorized Drafts program (R03B671).

-

Set the processing options for the Draft Remittance program (R03B672).

Note:

You must specify the draft remittance format (single or multiple XMLs) in the Paper/Tape tab of the processing options for the Draft Remittance program. Set the Paper/Tape Remittance Program processing option value as R743007 to generate the draft remittance information in a single XML file and R743007A to generate multiple XML files. -

Set the processing options for the SEPA Direct Debit for Draft Remittance Extractor program (R743007) and SEPA Direct Debit Multiple XML Extractor for Draft program (R743007A).

-

Run the Draft Remittance program (R03B672) in final mode.

The system generates the R743007 or R743007A report, which generates an XML file or multiple XML files with the direct debit draft remittance information.

-

Download and extract the direct debit draft remittance report.