43 Working With Reverse Charge for GST Transactions (Release 9.1 Update)

This chapter discusses these topics:

-

Section 43.2, "Generating the Tax Liability Reverse Charge Report"

-

Section 43.3, "Reviewing Reverse Charge Information for Goods"

-

Section 43.4, "Calculating Reverse Charges for Advance Payments"

43.1 Calculating Reverse Charge for GST

If reverse charge applies to the transactions, the system distributes the tax amounts that the goods or service receiver must pay to the supplier and to the tax authority based on the provider and receiver percentages set up in the F75I802 table.

For example, consider a transaction that is for INR 1,000, the GST applicable is 10%, and the percentage of tax payable to the supplier is 40% and the percentage payable to the tax authority is 60%. Then, the receiver must pay INR 1,040 to the supplier and INR 60 must be paid directly to the tax authority.

|

Note: If you have chosen to calculate reverse charge amounts for transactions that are specified as GST-recoverable, the system records the reverse charge information in the F75I807 table, but does not create journal entries nor updates tables and ledgers for these transactions. |

43.1.1 Reverse Charge for Purchased Goods

When you enter receipts for purchase orders, the Landed Cost Selection program (P43291) retrieves the landed cost rules from the Item/Supplier Cost Components table (F75I791) and calculates GST if GST is applicable to the transactions based on the GST rule set up in the GST Rule Setup table (F75I802). During this process, the system also checks whether reverse charge is applicable to the transactions in the F75I802 table.

If reverse charge applies to the purchase goods, the Landed Cost Selection program calculates the GST amounts that the purchaser must pay to the supplier using the provider's percentage in the F75I802 table. The system enters the calculated reverse charge GST information in the GST Reverse Charge Information table (F75I808). You can review the calculated reverse charge stored in the F75I808 table.

See Section 43.3, "Reviewing Reverse Charge Information for Goods".

When you match the receipts with the vouchers, the system creates journal entries for the transactions, debiting this GST amount (that you pay to the supplier) in the intermediate accounts that you have set up in the GST Account Master Setup program (P75I805). The system credits the amount in the credit accounts for the AAI item 4385 (Cost/Expense Adjustments) for inventory items, and in the AAI item 4315 (Non-Inventory) for non-inventory transactions.

43.1.2 Reverse Charge for Services Received

You run the Calculate GST for A/P Vouchers program (R75I804) to calculate GST for services received from service providers. The system calculates GST (IGST, CGST, SGST, and Cess) for the transactions based on the GST rule set up in the GST Rule Setup table (F75I802) and the GST rate set up in the GST Tax Rate Setup table (F75I809).

If reverse charge applies to the accounts payable transactions, the R75I804 program calculates the GST amounts that the receiver must pay to the service provider. This is the amount that the system calculates using the provider's percentage set up in the GST Rules Setup program (P75I802). The system creates journal entries for the transactions, debiting the GST amounts in the intermediate accounts that you have set up in the GST Account Master Setup program (P75I805) and crediting the amounts in the (PC) AAI credit account that the system retrieves using the G/L offset from the GST GL Offset Setup table (F75I835). If the G/L offset is not specified, the system uses the default trade account associated with the AAI item PC for general ledger credit entries.

43.2 Generating the Tax Liability Reverse Charge Report

You run the Tax Liability Reverse Charge program (R75I801) to adjust the cash ledger with the GST amounts that the goods or service provider must pay to the fiscal authority. For the GST unit and the date range specified in the processing options of the R75I801 program, the system processes the records from the GST Tax File table (F75I807) and the Accounts Payable Ledger table (F0411) that are posted, not voided, and are applicable for reverse charge. The system offsets tax liability from the GST cash ledger and updates GST ITC ledger for all the processed transactions with CGST, SGST, IGST, and GST Cess, and:

-

Updates the tax liability reverse charge batch number in the F75I807 table.

-

Updates the closing balance for the GST cash ledger and GST ITC ledger in the GST Ledgers Setup table (F75I804) and GST cash ledger entries in the GST Ledger table (F75I823).

The GST ITC ledger is updated for the next period available in the GST Ledgers Setup program (P75I804). For example, if the GST cash ledger is updated for the January 2018 period, the GST ITC ledger is updated for the February 2018 period.

The R75I801 report includes primary transaction details and the basis on which the reverse charge was calculated, such as the service category code, provider and receiver percentages, tax amount, and the applicable tax rate. The R75I801 report also includes the recoverable flag to indicate whether the transaction is of recoverable or nonrecoverable type.

For suppliers on which the advanced payment is applied, the R75I801 report includes the advance payment offset details for those transactions. The report offsets the GST paid on advance payment from the voucher or purchase order. The report matches the advance payments with the voucher or purchase order based on the supplier, business unit, GST rate type, recoverable flag, and receiver percentage. The system saves this information in the GST Reverse Charge Offset Advance Payment - P2P table (F75I849).

The R75I801 report offsets GST on advance payment only for those transactions for which the advance payment date is the same or earlier than the transaction date.

If the processing option for R75I801 is set to display an error if the GST cash ledger does not have sufficient balance, then an error is displayed if sufficient balance is not available in the GST cash ledger.

You can run the program in proof or final mode. In final mode, the system updates the Processed Reverse Charge File program (P75I813) with the batch information for the records that were generated successfully using the R75I801 program. You can use the P75I813 program only to review batches processed within a specific duration for a GST unit. The system stores this information in the Processed Reverse Charge File table (F75I813).

When you run the R75I801 program in the final mode, the system:

-

Updates the GST Cash Ledger

-

Credits the permanent GST cash ledger account with the recoverable and nonrecoverable receiver amount for the processed transactions.

-

Debits the intermediate ITC account with the GST recoverable receiver amount for the processed transactions.

-

Debits the nonrecoverable account with the nonrecoverable receiver amount for the processed transactions.

-

-

Updates the ITC Claim Accounts

-

Credits the intermediate ITC account with the total GST recoverable amount for the processed transactions.

-

Debits the permanent ITC account with the total GST amount for the processed transactions.

-

When the cash ledger accounts are updated, the G/L date is the date specified in the processing options of the R75I801 program. If a date is not provided in the processing options of R75I801, the system date is used as the G/L date. When the ITC claim accounts are updated, the G/L date is the first day of the next period setup in the GST Ledgers Setup program (P75I804).

43.2.1 Prerequisites

Before you complete the task in this section:

-

Ensure that the next period setup is available in the GST Ledgers Setup program (P75I804).

-

Set up the processing options for the R75I801 program.

On the General tab of the processing options form, you specify:

-

The records to process (based on the company, date range, and GST unit)

-

Whether to run the program in proof or final mode

-

Whether to summarize the records

-

Whether to process all transactions, or only purchase or accounts payable transactions

-

Whether to use the current date or the date specified in the entries for GST ledger.

-

Whether to display the error if GST cash ledger does not have sufficient balance for all tax types.

-

Document type for the G/L entries to be assigned to the records that are processed for G/L entries.

-

Explanation for the G/L entry.

-

43.3 Reviewing Reverse Charge Information for Goods

You use the GST Reverse Charge Information program (P75I808) to review the calculated reverse charge for goods transactions stored in the F75I808 table. The system updates this program when you perform the purchase order receipt process.

To review the GST reverse charge information:

-

From the Purchase Order Processing (G43A11) menu, select Enter Receipts by PO. On the Work With Purchase Orders to Receive form, enter search criteria to locate the purchase order, then select the record, and click Select.

On the Purchase Order Receipts form, select a record and click OK. Review the landed costs and click OK again.

On the Landed Cost Selection form, select a tax line that has reverse charge information. Then, click Regional Info on the Form menu.

-

On the GST Reverse Charge Information form, review the calculated GST reverse charge information in the following fields:

-

Level Cost

This is the level cost that is linked to the GST rule applied to the transactions.

-

GST Amount Provider

This is the tax amount that the goods provider must pay to the tax authorities. This amount is calculated based on the provider percentage set up in the GST Rules Setup program (P75I802).

-

GST Amount Receiver

This is the tax amount that the goods receiver must pay to the tax authorities. This amount is calculated based on the receiver percentage set up in the GST Rules Setup program (P75I802).

-

Quantity Ordered

This is the purchased quantity of the item associated with each level cost.

-

Unit tax Amount

-

Extended Tax Amount

Extended tax amount is the total GST amount calculated for each level cost.

-

Line Number

-

Service Provider Percentage

This is the percentage of the tax that should be assessed or paid to the corresponding tax authority by the service provider. The system retrieves this percentage from the GST Rules Setup table (F75I802).

-

Service Receiver Percentage

This is the percentage of the tax that should be assessed or paid to the corresponding tax authority by the service receiver. The system retrieves this percentage from the GST Rules Setup table (F75I802).

-

43.4 Calculating Reverse Charges for Advance Payments

Reverse charge on advance payment is the tax amount you are liable to pay to the tax authority on the advance payment you make for goods or services. The tax amount is calculated based on the provider and receiver percentages set up in the GST Rule Setup program (P75I802). You use the Work With Reverse Charge on Advance Payment P2P program (P75I838) to calculate reverse charge amounts for advance payments that you must make to the supplier and to the tax authority. The system saves this information in the Reverse Charge Advance Payment Header File table (F75I838) and Reverse Charge Advance Payment Details File table (F75I839).

You cannot void a GST prepayment voucher after GST has been calculated. To void such vouchers, you must cancel the payment transaction from the P75I838 program.

You must print the self-invoice for advance payment transactions on which reverse charge is applicable. See Section 41.8, "Printing a Self-Invoice for Reverse Charges" for more information.

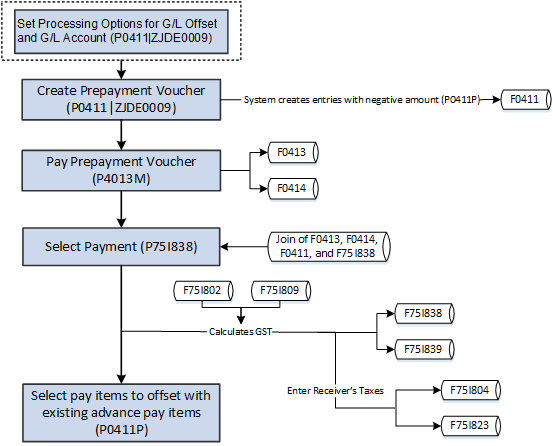

Figure 43-1 GST Process Flow for Reverse Charge on Advance Payments

Description of ''Figure 43-1 GST Process Flow for Reverse Charge on Advance Payments''

43.4.1 Prerequisites

Before you complete the tasks in this section:

-

Ensure that the next period setup is available in the GST Ledgers Setup program (P75I804).

-

Set up the G/L Offset Account and G/L Distribution Account processing options for the version of the Standard Voucher Entry program (P0411) that is used for prepayment vouchers.

See Processing Prepayments in the JD Edwards EnterpriseOne Applications Accounts Payable Implementation Guide.

-

Create prepayment vouchers for GST advance payments using the version of the P0411 program that is used for prepayment vouchers.

-

Issue the payment for the prepayment voucher using the Work with Payments program (P0413M). After you issue the payment, you must post the vouchers.

Note:

For GST prepayments, you must use only the manual payment process. -

Set the following processing options for the P75I838 program:

-

GST category type

-

Default GST Rule

-

GST Ledger Entry Date

-

Ignore or display an error due to insufficient funds in the GST cash ledger

-

Document type for the G/L entries to be assigned to the records that are processed for G/L entries

-

Explanation for the G/L entry

-

-

Set up the legal next number for the self-invoice using the Work With GST Self Invoice Legal Next Numbers program (P75I847).

-

Set up place of supply in the Work with GST State Code program (P75I845).

-

Set up state and country for the supplier number and business unit in the Address Book Revisions program (01012).

The system uses this information to identify whether the transaction is an interstate or intrastate transaction.

43.4.2 Calculating GST Reverse Charge Amounts for Advance Payments

To calculate reverse charges for advance payments:

-

From the India Localization module (G75I), click GST Module, GST Daily Processing, and then Reverse Charge on Advance Payment for Purchase (P75I838)

-

On the Work with Reverse Charge on Advance Payment P2P form, complete the header fields, and then click Search.

-

Review the payment information of the prepayment vouchers that are subject to GST.

-

Select the payment record for which you want to apply the reverse charge, and click OK.

-

In the header of the Reverse Charge on Advance Payment P2P form (P75I838|W75I383B), complete the Business Unit field.

You can override the Place of Supply field value that is used by the system to update the Transaction Category value.

The system populates other fields with the details you provided in the P0413M program.

-

In the grid, complete the following fields and click OK:

-

HSN or SAC value

Note:

Use the visual assist to search for the HSN or SAC value based on the item or the category. -

Gross Amount

-

GST Rule

The system calculates the receiver and provider GST amounts for each item based on the HSN or SAC value and the provider and receiver percentages set up in the GST Rule Setup program (P75I802).

The system stores this information in the Reverse Charge Advance Payment Header File table (F75I838) and Reverse Charge Advance Payment Details File table (F75I839).

The system updates the GST cash ledger with receiver's reverse charge amount on the advance payment and stores the information in the GST Ledgers Setup table (F75I804) and GST Ledgers table (F75I823).

If the processing option for R75I801 is set to display an error if the GST cash ledger does not have sufficient balance, then an error is displayed if sufficient balance is not available in the GST cash ledger.

The system stores the self-invoice number in the Reverse Charge Advance Payment Header File table (F75I838) and GST Self Invoice Header File table (F75I848).

-

The system updates the following accounts:

-

GST Cash Ledger

-

Credits the permanent GST cash ledger account with the recoverable and nonrecoverable receiver amount in the current period.

-

Debits the intermediate ITC account with the GST recoverable receiver amount in the current period.

-

Debits the nonrecoverable account with the nonrecoverable receiver amount in the current period.

-

-

ITC Claim Accounts

-

Credits the intermediate ITC account with the recoverable reverse charge receiver amount in the next period.

-

Debits the permanent ITC account with the recoverable reverse charge receiver amount in the next period.

-

When the cash ledger accounts are updated, the G/L date is the date specified in the processing options of the R75I801. If a date is not provided in the processing options of R75I801, the system date is used as the G/L date. When the ITC claim accounts are updated, the G/L date is the first day of the next period setup in the GST Ledgers Setup program (P75I804).

|

Note: To claim ITC for the transaction for which the recoverable flag is empty, you must cancel those transactions and apply GST again. |

43.4.3 Canceling a Payment

To cancel a payment:

-

From the India Localization module (G75I), click GST Module, GST Daily Processing, and then Reverse Charge on Advance Payment for Purchase

-

On the Work with Reverse Charge on Advance Payment P2P form, complete the header fields, and then click Search.

-

From the search results, select the payment that you want to cancel.

-

Select Cancel Transaction from the Row menu.

The system cancels the transaction after confirmation and deletes the entries from the Reverse Charge Advance Payment Header File table (F75I838) and the Reverse Charge Advance Payment Details File table (F75I839).

You cannot cancel transactions for which you have offset advance payment from a voucher or purchase order using the Tax Liability Reverse Charge program (R75i801).

43.4.4 Reviewing the Advance Payment Offset Details

You use the Advance Payment Offset Details program (P75I838|W75I838E) to view information about the GST on advance payment that is offset from a voucher or purchase order.

To review the advance payment offset details:

-

From the India Localization module (G75I), click GST Module, GST Daily Processing, and then Reverse Charge on Advance Payment for Purchase

-

On the Work with Reverse Charge on Advance Payment P2P form, select the record for which you want to review the advance payment offset details.

-

Select Offset Details from the Row menu.

-

On the Advance Payment Offset Details form, review the offset details.

The system displays information about the offset amounts and the vouchers and purchase orders from which the GST on advance payment is offset.