5 Working with e-GUI for Invoices and Vouchers in Taiwan (Release 9.1 Update)

This chapter contains the following topics:

-

Section 5.1, "Understanding e-GUI for Sales Order and Accounts Receivable in Taiwan"

-

Section 5.3, "Updating e-GUI Details in the Extracted Invoice"

-

Section 5.5, "Activating e-GUI Additional Information for Vouchers"

-

Section 5.6, "Understanding the Extract AP GUI Tax Filing Data Program"

5.1 Understanding e-GUI for Sales Order and Accounts Receivable in Taiwan

The Taiwan Tax Authority stipulates that all goods and services sold by wholesalers, retailers, or manufacturers must be issued with an electronic government uniform invoice (e-GUI) as an accounting receipt to buyers of goods and services and as an official accounting document for tax reporting.

The Taiwan Tax Authority uses a numbering scheme to ensure all sales and accounts receivable transactions are uniquely numbered. The sellers can process and submit their e-GUI Invoices or Credit Memo information to the Taiwan Tax Authority for tax filing once the transactions are processed to generate an e-GUI number.

The e-GUI number is generated by the Taiwan Tax Authority and it is mandatory for all newly registered Taiwan enterprises to use the e-GUI number in their invoice.

When you work with e-GUI in Taiwan, you can:

-

Extract the pre GUI information from the sales order and accounts receivable invoice.

-

Update the e-GUI number for the invoice or credit memo.

5.2 Extracting Information from Sales Orders and Accounts Receivable Transactions for e-GUI

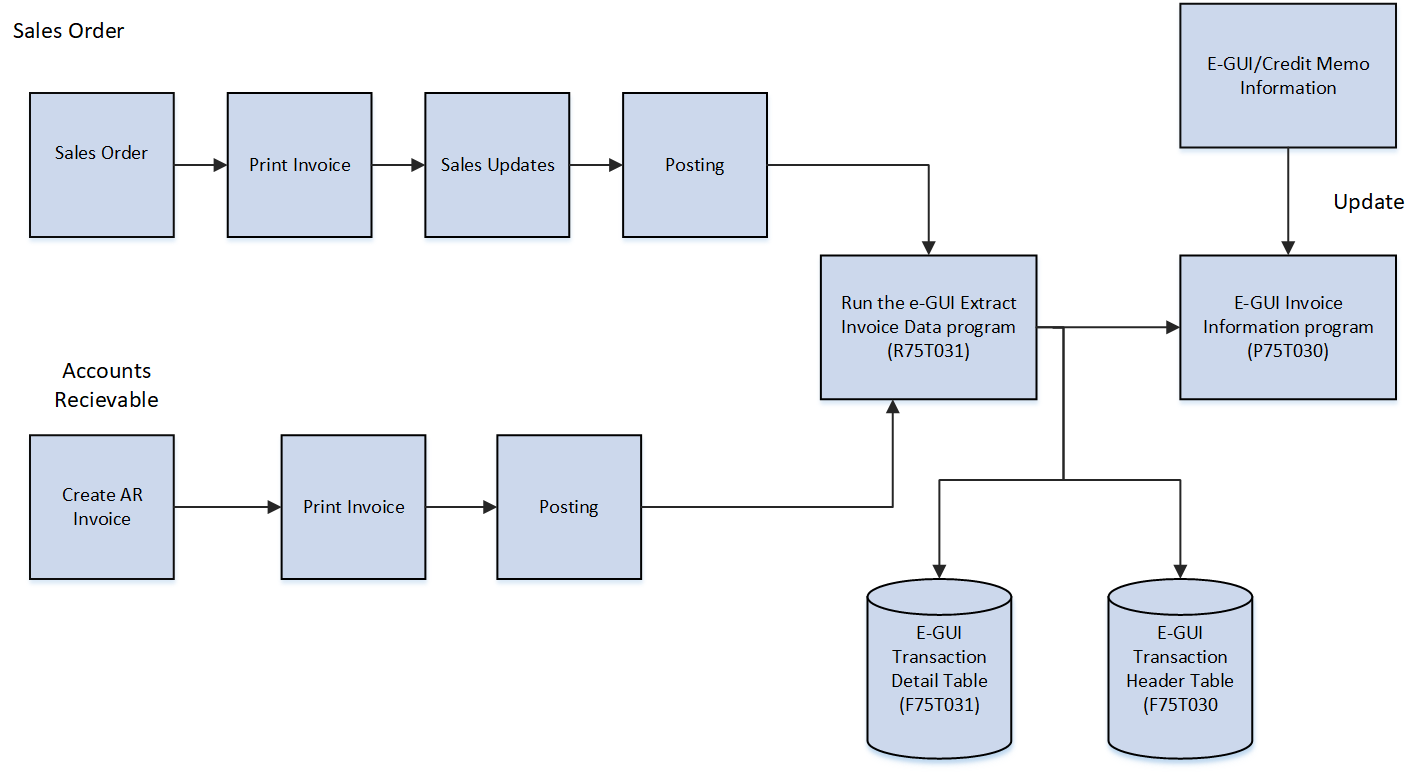

You run the e-GUI Extract Invoice Data program (R75T031) to extract the sales order and accounts receivable invoice information to submit to the Taiwan Tax Authority in order to generate e-GUI. This program retrieves information from the Customer Ledger table (F03B11), GUI/VAT Tax Type Mapping table (F75T008) and the Document Type Additional Information Setup table (F75T033) and stores the information in the e-GUI Transaction Detail Table(F75T031) and the e-GUI Transaction Header table (F75T030).

When you run the program the system updates the information for processed transaction records and updates the e-GUI Transaction table. The system updates only those records for which the e-GUI number does not exist in the e-GUI Transaction table.

The system does not allow you to void an invoice if you have already generated the e-GUI number for the invoice and the invoice transaction details exist in the e-GUI Transaction Detail Table (F75T031).

The system also validates that all the prerequisites are fulfilled to run the e-GUI Extract Invoice Data program (R75T031). If the prerequisites are not met, the system displays an error message.

5.2.1 Prerequisites

Before you complete the tasks in this section:

-

You must set up the e-GUI Transaction Type and format code processing options for the document types for which you are entering the transactions in the Document Type Additional Information Setup program (P75T033).

See, Section 3.18.2, "Adding a Document Type Additional Information for e-GUI".

-

You must set up the customer constants including the e-GUI mode in the GUI/VAT Customer Constants program (P75T009) for the customer for whom you are entering sales order or accounts receivable invoice.

See, Section 3.16.3, "Forms Used to Set Up Customer Constants for Taiwan".

-

You must specify the declaration site and business unit mapping for which you will enter the transactions in the GUI/VAT Declaration Site program (P75T001) and e-GUI Extract Invoice data program (R75T031).

-

You must associate a tax type to a tax area and tax explanation code combination in the GUI/VAT Tax Type Mapping program (P75T008).

-

You must set up the values for the e-GUI mode (75T/EM) and the e-GUI transaction type (75T/ET) in the UDC tables.

See, Section 3.2.33, "e-GUI Mode (75T/EM) (Release 9.1 Update)" and Section 3.2.34, "e-GUI Transaction Type (75T/ET)".

-

While generating print invoice for sales order you must select the disable processing option for the GUI/VAT Creation From Multi-SO (R75T004O) program.

-

You must run the Customer Sales Update program (R42800) for sales orders. The accounts receivable transactions generated after the R42800 program is run must be posted. The e-GUI Extract Invoice Data program (R75T031) processes only posted transactions.

-

You must use data selection to select only those invoices that have an e-GUI number before you run the e-GUI Extract Invoice Data program (R75T031).

-

You must map only an original invoice with a credit note. The Work with Related Invoices for CN/DN program (P7430016) is applicable only for credit notes.

|

Note: It is mandatory for each invoice to have a single tax rate. Each e-GUI number can have only one tax rate.If an invoice has multiple tax rates then the invoice has to be split into multiple invoices else the system will display an error message and will not process the invoice. A valid e-GUI number for invoices must be of ten characters of which the first two must be alphabetic and the remaining must be numeric. A valid credit memo number can be of maximum 16 characters. |

5.2.2 Setting Processing Options for e-GUI Extract Invoice Data Program (R75T031)

Processing options enable you to specify the default values for programs and reports.

5.2.2.1 Default

- Declaration Company of GUI/VAT

-

Specify the default company for which the GUI/VAT declaration is filed.

- Transaction Date

-

Specify the date used to select invoices. Values are:

Blank: Invoice date (Default)

1: G/L date

2: Service date

- Date Range From

-

Specify the beginning date in the date range for which you want to display invoices

- Date Range To

-

Specify the last date in the date range for which you want to display invoices.

- Period Offset

-

This option is applicable only when the Date Range From and Date Range To fields are blank and the Declaration Company of GUI/VAT field is not blank. Keeping this processing option blank will take zero as the offset value and print the transactions from the current period.Value is:

Blank: 0 (Current period)

- Refresh Data (Y/N)

-

Specify whether the system updates the information for the processed transactions.

N: Does not update the records that are already processed and exist in the e-GUI Transaction Header table (F75T030).

Y: Updates all the records for which the e-GUI number does not exist in the e-GUI Transaction Header table (F75T030).

|

Note: For the Transaction Date processing option, if you give any value other than 1 or 2 the system selects the invoice date as the default date.If the Declaration Company of GUI/VAT field is blank, then the system will process multiple companies for extracting the invoice data for e-GUI. The system processes only those invoices that are posted. |

5.3 Updating e-GUI Details in the Extracted Invoice

The e-GUI Invoice Information program (P75T030) enables you to view the invoice information such as the invoice amount and the buyer and seller details which have been extracted by the e-GUI Extract Invoice Data program (R75T031).

The e-GUI Extract Invoice Data program(R75T031) is used to extract pre GUI invoice information. You can submit this information to the Taiwan Tax Authority.The Taiwan Tax Authority uses this information to generate the e-GUI details such as e-GUI number and date for the sales order and accounts receivable invoices. The e-GUI Invoice Information program (P75T030) is used to update the e-GUI details for the invoice.

A credit note, also called a credit memo, is a credit that you send to your customer. You can update the credit memo number received from the Taiwan Tax Authorities for the credit note.

Before you enter a credit memo for a transaction you must associate the original transaction and e-GUI number to the credit note. You can use the Work With Related Invoices for CN/DN program (P7430016) to provide the original document details for a credit note and associate the original document(s) with a debit or credit note.

See, ”Associating Invoices with Debit Note or Credit Note” in the JD Edwards EnterpriseOne Applications Common Features for Localizations Implementation Guide.

The system retrieves the invoice information for the e-GUI Invoice Information program (P75T030) from the e-GUI Transaction Detail table (F75T031) and the e-GUI Transaction Header table (F75T030). You can associate the e-GUI number and e-GUI date with the sales order or accounts receivable invoices after you receive this information from the Taiwan Tax Authority.

5.3.1 Forms Used for the e-GUI Invoice Information program (P75T030)

| Form Name | FormID | Navigation | Usage |

|---|---|---|---|

| Work With e-GUI Invoice Header | W75T030A | e-GUI Periodic Processing (G75T230), e-GUI Invoice Information. | Review header details of the invoice. |

| e-GUI Invoice Details | W75T030B | Select a record for which you want to review the detailed invoice information.

Click on the Work With e-GUI Invoice form. |

Review the e-GUI details of the selected invoice.

Use the invoice details to prepare the pre GUI information. |

| Update e-GUI Details | W75T030D | Select the record for which you want to update the e-GUI details.

Select Update e-GUI Details from the Form menu of the Work With e-GUI Invoice form. |

Update the e-GUI details of the invoice. |

| Update Credit Memo Details | W75T030C | Select the record for which you want to update the credit memo details.

Select Update Credit Memo Details from the Form menu of the Work With e-GUI Invoice form. |

Update the credit memo number for the credit Memo. |

5.4 Updating Additional Information in Vouchers

The Work With e-GUI Voucher Additional Information program (P75T034) enables you to update the e-GUI details such as the e-GUI number, the e-GUI date, Format Code and AP Transaction Type for Taiwan vouchers and debit memos. Using this program you can view all the records in the system including those records which do not contain e-GUI details. This information is saved in the e-GUI Voucher Additional Information table (F75T034). You can view all vouchers which have not been voided in the e-GUI Voucher Additional Information table (F75T034) using the P75T034 program. Adding additional information to vouchers will classify them as transactions with e-GUI information.

5.4.1 Forms Used to Update Additional Information in Vouchers

| Form Name | FormID | Navigation | Usage |

|---|---|---|---|

| Work With e-GUI Voucher Additional Information | W75T034A | e-GUI Daily Processing (G75T240), e-GUI Voucher Additional Information. | Review the voucher. |

| e-GUI Voucher Additional Information Revisions | W75T034C | Select the record for which you want to update the e-GUI details.

Select e-GUI Voucher Additional Information Revisions from the Form menu of the Work With e-GUI Voucher Additional Information form. |

Edit or update the e-GUI details for a non-posted voucher. |

5.4.2 Updating e-GUI Details for a Voucher

To update the e-GUI details of a voucher:

-

Access the Work With e-GUI Voucher Additional Information form for the selected voucher.

-

Enter the values in the mandatory fields, e-GUI number, e-GUI date, Format Code, and AP Transaction Type for the voucher. The e-GUI number must be of minimum ten characters and maximum fourteen characters.

The e-GUI Voucher Additional Information Revisions form is used to edit or update the e-GUI details only for non-posted vouchers.

-

Click Save.

5.5 Activating e-GUI Additional Information for Vouchers

You use the e-GUI A/P Voucher Entry program (P75T035) to set the processing option to activate e-GUI additional information for vouchers in the A/P Standard Voucher Entry program (P0411).You can add or update the e-GUI additional information for vouchers when the processing option is set to activate the e-GUI information in the P75T035 program.

5.5.1 Setting Up a Processing Option for the e-GUI A/P Voucher Entry Program (P75T035)

Processing options enable you to specify the default processing for programs and reports.

5.5.2 Updating Additional Information for Vouchers using the A/P Standard Voucher Entry Program (P0411)

To update or add the additional information for vouchers using the A/P Standard Voucher Entry program (P0411):

-

Select Regional Info on the Form Menu of the P0411 program to access the e-GUI Voucher Additional Information Revisions form for the selected voucher.

-

Enter the values in the mandatory fields, e-GUI number, e-GUI date, Format Code, and AP Transaction Type for the voucher.

-

Click Save.

You can update the additional information for vouchers using the P0411 program only if the processing option for the P75T035 program is set to activate e-GUI information.

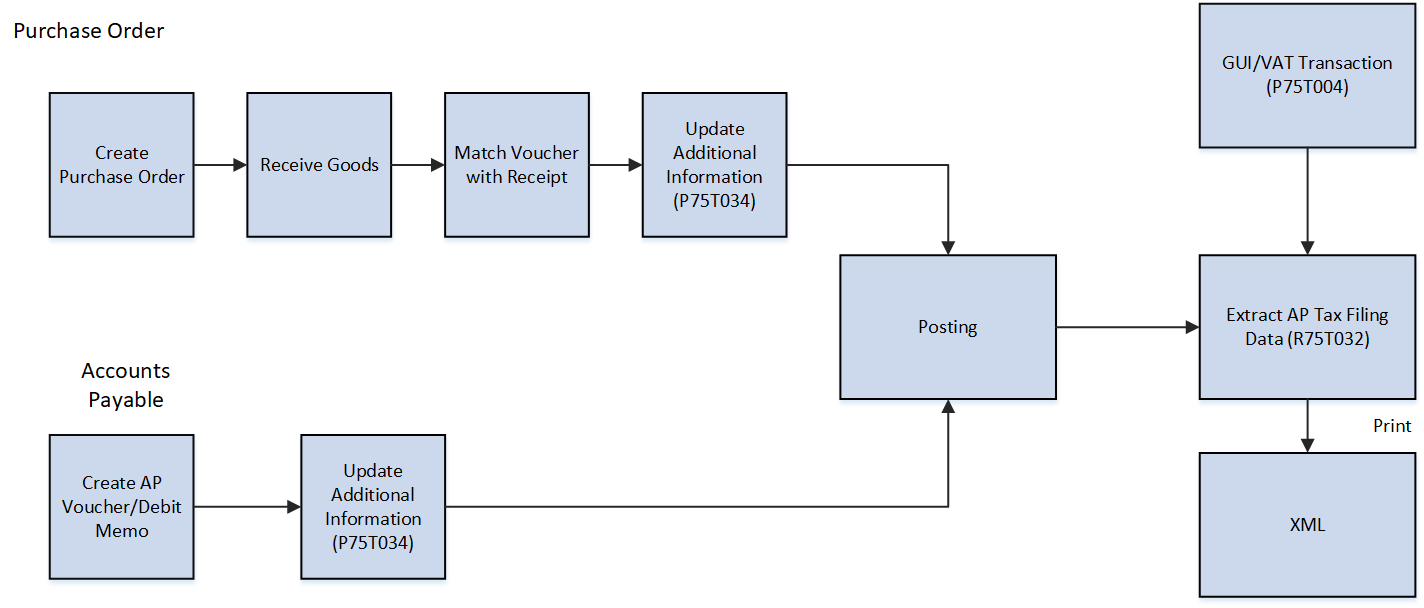

5.6 Understanding the Extract AP GUI Tax Filing Data Program

You run the Extract AP GUI Tax Filing Data program (R75T032) to extract information from the P75T034, P75T004, P4310 and P0411 programs and print the extracted data in an XML format that is specified by the regulatory authority. The program prints the data extracted from both GUI/VAT and e-GUI transaction vouchers.

The R75T032 program uses the P75T032 program to validate if the processed voucher has an e-GUI number. If an e-GUI number does not exist for the voucher, the R75T032 checks the P75T004 program for the GUI/VAT number of the voucher. The R75T032 program then prints the data in an XML format that is specified by the regulatory authority. The voucher details of transactions must exist in the P75T004 program for the system to identify the transactions as GUI/VAT transactions. Transactions that are neither GUI/VAT or e-GUI transactions are skipped by the R75T032 program.

5.6.1 Prerequisites

Before you complete the tasks in this section:

-

You must set up the e-GUI Transaction Type and Format Code for the document types in the Document Type Additional Information Setup program (P75T033) for the voucher with e-GUI to be processed.

See, Section 3.18.2, "Adding a Document Type Additional Information for e-GUI"

-

You must set up additional information for vouchers in the Work with e-GUI Vouchers Additional Information program (P75T034). You can also set up the additional information for a voucher using the A/P Standard Voucher Entry program (P0411). To use this program, you must set up the processing option in the P75T035 program for the voucher with e-GUI to be processed.

See, Section 5.5, "Activating e-GUI Additional Information for Vouchers"

-

The R75T032 program selects only posted and non- voided vouchers.

-

The R75T032 program selects transactions based on the processing option and the run time data that are selected.

-

It is mandatory for each voucher to have detail lines with a single tax rate. Each e-GUI number can have only one tax rate.

5.6.2 Setting Processing Options for the Extract AP GUI Tax Filing Data Program (R75T032)

Processing options enable you to specify the default values for programs and reports.

5.6.2.1 Default

- Declaration Company of GUI/VAT

-

Specify the company for which the GUI/VAT declaration is filed.

- Transaction Date

-

Specify the date to be used for selecting AP vouchers. Values are:

Blank or 1: Select this option if you want the program to select AP transactions by G/L date.

2: Select this option if you want the program to select AP transactions by voucher date.

- Date Range From

-

Specify the beginning date in the date range to select the AP vouchers for processing.

The system checks the GL date or the voucher date of the AP voucher and selects the voucher only if the date is greater than or same as the date entered in this processing option.

- Date Range To

-

Specify the beginning date in the date range to select the AP vouchers for processing.

The system checks the GL date or the voucher date of the AP voucher and selects the voucher only if the date is lesser than or same as the date entered in this processing option.

- Period Offset

-

This option is applicable only when the Date Range From and Date Range To fields are blank and the Declaration Company of GUI/VAT field is not blank. Keeping this processing option blank will take zero as the offset value and print the transactions from the current period.

- Export Date

-

Specify the date on which the export file is submitted to the tax authority.

If you leave this processing option blank, the R75T032 program prints the system date as the default date.

- Export Time

-

Specify the time at which the export file is submitted to the tax authority.

If you leave this processing option blank, the R75T032 program prints the system time as the default time.