25 Understanding TDS and WCT

This chapter contains the following topics:

25.1 Overview of TDS

Tax deducted at source (TDS) is a tax that is deducted from income that a company in India pays to a recipient or supplier if the income amount exceeds a specific statutory limit in a financial year.

The types of income that are subject to TDS include:

-

Salary

-

Interest and dividends

-

Winnings from the lottery

-

Insurance commission

-

Rent

-

Fees from professional and technical services

-

Payments to contractors and subcontractors

The withholding amounts for TDS can be deducted from an invoice submitted by a supplier or from the payment that is issued to the recipient or supplier. Examples of recipients and suppliers include contractors, providers of professional services, employees, and real estate landlords. Companies submit a TDS certificate to each supplier on a monthly or yearly basis. The certificate includes the payments, as well as information about the company and supplier. Companies must also submit an annual return to the Government for each recipient or supplier for the financial year. TDS certificate can be either Form 16 (R75I10A) or Form 26Q-P2P-IND (R75I122EQ). Form 16 is the TDS certificate which an individual submits and Form 26Q is the TDS certificate which a company submits to the tax authorities.

TDS must also be deducted from payments issued to third parties by both corporate and noncorporate entities. The entity must deposit the amount owed for withholding at any of the designated branches of banks that are authorized to collect taxes on behalf of the Government of India. The entity must also submit the TDS returns, which contain details about the payments and the challan for the tax deposited to the Income Tax Department (ITD).

For electronic TDS, companies must generate the Form 26Q for each financial quarter. This is a statutory requirement for the ITD.

25.2 Overview of WCT

Works contract tax (WCT) is a tax imposed on a contract for work, such as assembling, construction, building, altering, manufacturing, processing, fabricating, installation, improvement, repair, or commissioning of any movable or immovable property.

WCT is based on the contracts for labor, work, or service, and not for the sale of goods; although goods are used to fulfill the contract. For example, when a contractor constructs a building, the buyer pays for the cost of the building, which includes the building material, labor, and other services. No contract exists for the supply of the building material. The WCT tax applies only to the building and not for the materials used for construction. A WCT certificate is the Certificate of Tax (R75I119) which you submit to the dealer or contractor.

|

Note: A transaction is considered a works contract only if the finished product is supplied to a customer and is not sold in the market to any other person. |

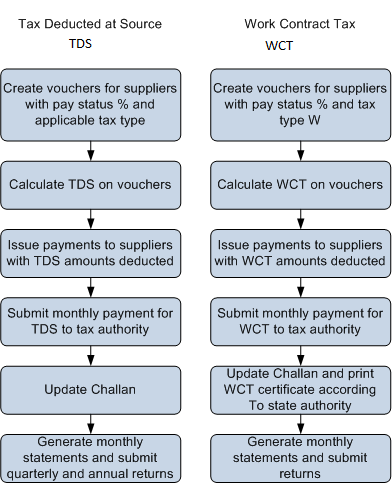

25.3 Process Flow for TDS and WCT

This process flow shows the steps to charge and remit TDS and WCT:

Figure 25-1 Process Flow for TDS and WCT

Description of ''Figure 25-1 Process Flow for TDS and WCT''

25.4 Software Solution for TDS and WCT

To meet the TDS and WCT requirements specified by the tax authorities, the JD Edwards EnterpriseOne programs enable you to:

-

Control the ceiling limit for both TDS and WCT by invoice or by yearly limit according to the statutory requirement.

-

Calculate the TDS at concession rates for each supplier.

-

Track deletions, reversals, and voids in localized tables for both TDS and WCT.

-

Update challan information, such as challan number and BSR code.

-

Update the TDS and WCT certificates.

Note:

To complete the TDS process, visit the official Government Web site for the Tax Information Network of the Income Tax Department. -

Update the quarterly returns electronically (eTDS) for Form 26Q, as well as the annual returns.

25.5 Setup Requirements for TDS and WCT

This table lists the TDS and WCT setup requirements for India:

| Setup Requirement | Comments | Cross-Reference |

|---|---|---|

| Assign tax types for TDS and WCT to suppliers. | You use the TDS Setup Default Values program (P75I010) to assign tax types for TDS and WCT to supplier records. You specify a tax type from UDC table 75I/TY. For WCT, specify W (work contract). For TDS, specify contractor (C), dividend (D), professional (P), and so on. You must also assign the tax account number (TAN) and personal account number (PAN) to a supplier record. | See Assigning TDS and WCT Tax Types to Suppliers. |

| Enter tax rates for TDS and WCT. | You set up TDS rates and WCT rates based on beginning and ending dates and tax type. The tax types for TDS and WCT are set up in UDC table 75I/TY. Use the TDS Rate Master Maintenance program (P75I10A) to set up rates, rate percentages, ceiling limit amounts, and other attributes for both TDS and WCT withholding. When you set up a rate, you specify whether it is for TDS or WCT in the TDS Type and G/L Offset fields on the TDS Rate Revision form. | See Entering TDS and WCT Rates. |

| Enter concession rates for TDS and WCT. | Use the TDS Concessional Rate Maintenance program (P75I15A) to track the concessional limit amount for transports. When you set up a concessional rate, you must specify whether it is for TDS or WCT in the TDS Type and G/L Class fields on the TDS Supplier Specific Concessional Supplier Rate Master Revisions form. | See Entering TDS and WCT Concessional Rates for Suppliers. |

| Set up suppliers for TDS and WCT. | You must complete the Person/Corporation Code field and the Withholding Percent field in the Supplier Master Information program (P04012) when you set up suppliers for whom you withhold TDS and WCT. | See "Entering Supplier Information" in the JD Edwards EnterpriseOne Applications Accounts Payable Implementation Guide. |

| Enter the TDS document company information. | Use the TDS Document Company Maintenance program (P75I20A) to enter the company's address, document company name, fiscal period, as well as other information. | See Entering the TDS Document Company Information |

| Entering vouchers for TDS and WCT. | You use the Standard Voucher Entry program (P0411) to enter vouchers and the Voucher Entry Tag File program to enter India-specific information for the voucher. You enter codes to identify a tax deducted at source (TDS) and works contract tax (WCT). | See Entering Vouchers for TDS and WCT |

| Calculate tax amounts for TDS and WCT. | Run the Calculate TDS (R75I515) and the Calculate Withholding- WCTDS (R75I514) reports to calculate the tax for vouchers that are defined to calculate withholding by invoice. Select Daily Processing (G75ITDS1), Calculate TDS. Select Daily Processing (G75IWCTDS1), Calculate Withholding-WCTDS. | See Calculating TDS and WCT |

| Revise TDS and WCT certificates. | Use the TDS Certificate Master Maintenance program (P75I100) to revise or update the TDS certificate information before you generate the actual TDS certificate number. | See Revising TDS and WCT Certificates |

| Update bank challan. | Run the Bank Challan Update report (R75I104A) to update the Certificate Master Maintenance table (F75I100) with challan details by TDS group and the corporate and noncorporate combination. | See Updating Bank Challan for TDS and WCT |

| Update the TDS receipt number. | Run the TDS Receipt Number Update report to update the receipt number for TDS transactions. | See Entering TDS Receipt Numbers |