8 Working With VAT in Mexico

This chapter contains the following topics:

-

Section 8.1, "Understanding VAT and the General Ledger for Mexico"

-

Section 8.2, "Understanding the Mexico VAT Recognition Process"

-

Section 8.3, "Working with Reports to Reclassify VAT for AP Transactions"

-

Section 8.4, "Working with Reports to Reclassify VAT for AR Transactions"

-

Section 8.5, "Understanding the Setup for Processing VAT on Payments and Receipts for Mexico"

-

Section 8.6, "Setting Processing Options for POs Redistribute AP VAT - Mexico (R76M1630)"

8.1 Understanding VAT and the General Ledger for Mexico

Before you process transactions with VAT, you should understand how the transaction affect the general ledger.

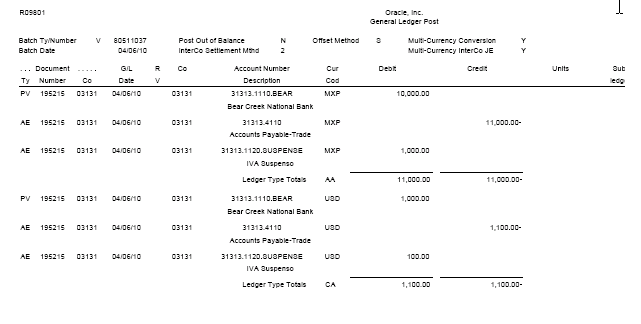

This diagram illustrates the effect on the general ledger of the Mexican VAT process for vouchers:

This diagram illustrates the effect on the general ledger of the Mexican VAT process for prepayments:

This diagram illustrates the effect on the general ledger of the Mexican VAT process for invoices.

8.2 Understanding the Mexico VAT Recognition Process

The VAT process for Mexico calculates VAT on the gain or loss amounts based on the tax explanation code and the tax area of the associated document. The JD Edwards system has three reports that calculate the VAT amount for gain or loss amounts on the AP and AR transactions. The system includes in the reports only those tax explanation codes that start with V or A. When you run these reports, the system reclassifies the VAT on gain and loss amounts that is generated on payments or receipts to VAT accounts.

These examples depict the payment and receipts process with the inclusion of the VAT process for Mexico during the accounts payable and accounts receivable transaction processing respectively:

Accounts Payable

You post a voucher for 1100 units when the exchange rate is 10.

This illustration shows how the system generates the journal entries:

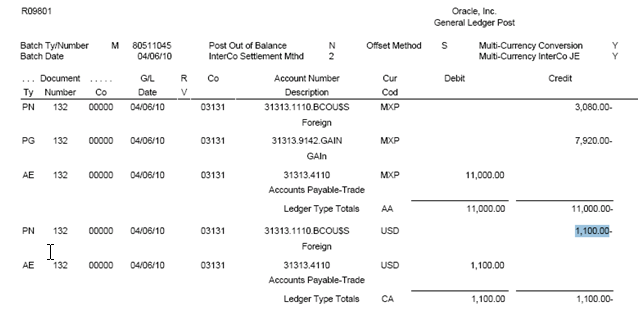

During the time of payment, the exchange rate is 2.8. This diagram illustrates an example of journal entries that the system creates when you make a payment:

Figure 8-5 Example Journal Entries for Payments

Description of ''Figure 8-5 Example Journal Entries for Payments''

In this case, the gain amount is (1100*2.8 - 1100*10 = -7920).

However, the Mexican Localization software generates only certain entries and does not reclassify VAT on the gain or loss amounts. This diagram illustrates an example of journal entries that the system creates without reclassifying VAT:

Figure 8-6 Example of Journal Entries With No Reclassification of VAT

Description of ''Figure 8-6 Example of Journal Entries With No Reclassification of VAT''

When you post a payment, the system classifies the VAT amount separately, but does not process gain or loss amounts. If there is any setup error on the Mexican solution, the system posts the payment batch, but reflects error in the journal entry associated with reclassification.

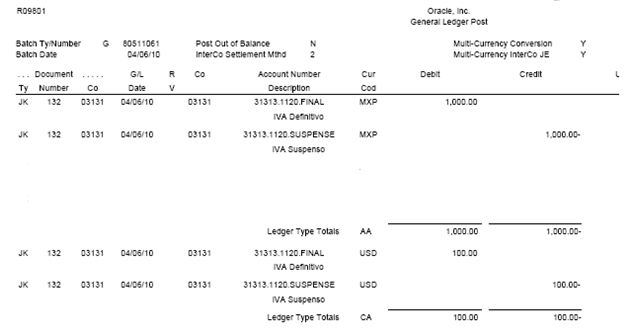

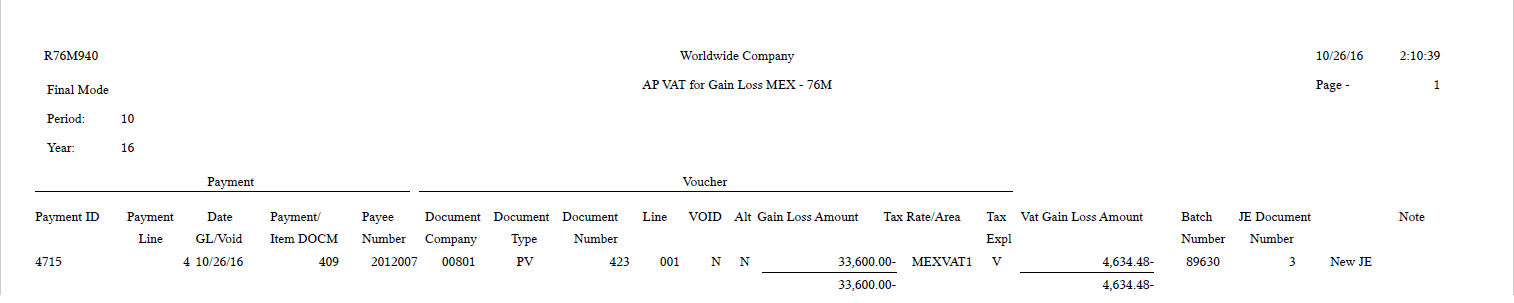

Now, with the new VAT process for Mexico, you run the AP Vat for Gain Loss (R76M940) or the Closed AP Draft Vat on Gain Loss (R76M990) report to reclassify the VAT applicable on the gain or loss amounts. When you run one of these reports, the system generates this new journal entry for the discussed example:

Figure 8-8 Example of AP Vat for Gain Loss Report (R76M940)

Description of ''Figure 8-8 Example of AP Vat for Gain Loss Report (R76M940)''

Accounts Receivable

You post an invoice with an exchange rate of 3. The system generates journal entries as shown in this image:

Figure 8-9 Example of Journal Entries for Accounts Receivable

Description of ''Figure 8-9 Example of Journal Entries for Accounts Receivable''

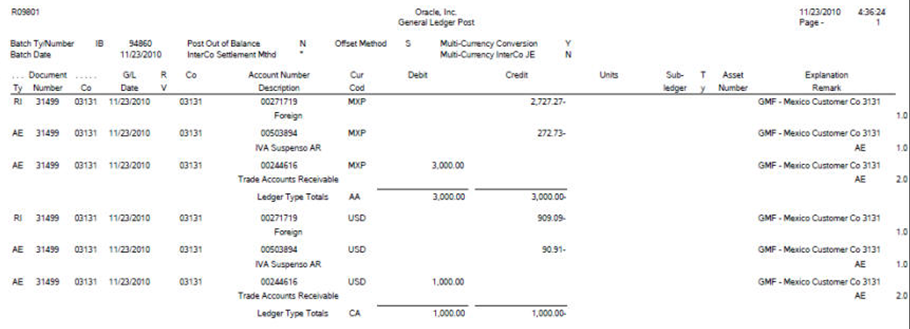

During the time of receiving payment, the exchange rate is 2. Now, the standard posting General Ledger Post report generates these journal entries:

Figure 8-10 Example of Journal Entries for Payment Receipt

Description of ''Figure 8-10 Example of Journal Entries for Payment Receipt''

In this case, the loss amount is (1100*2 - 1100*3 = -1000).

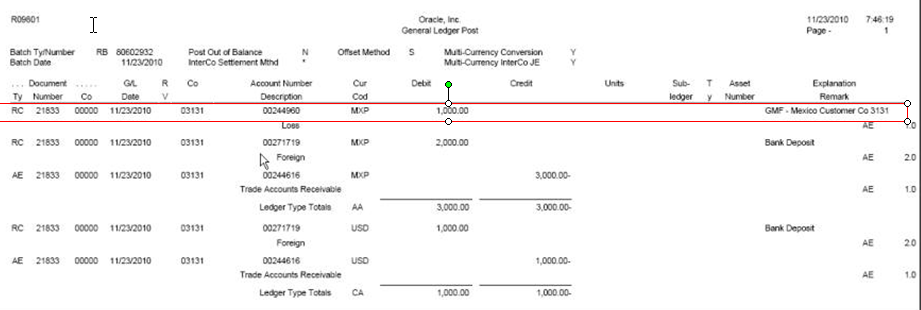

However, the Mexican Localization software generates only these entries without reclassifying VAT on the gain or loss amounts:

Figure 8-11 Example of Journal Entries Without Reclassifying VAT

Description of ''Figure 8-11 Example of Journal Entries Without Reclassifying VAT''

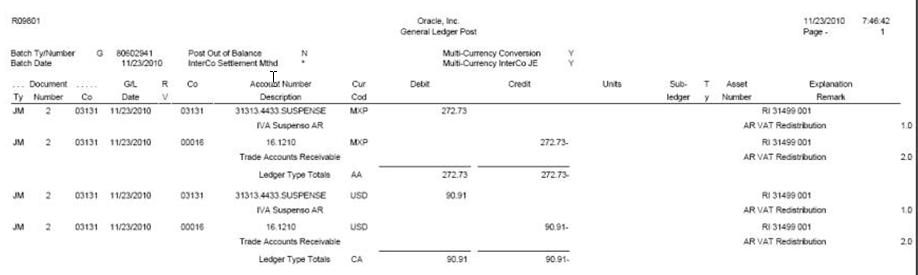

With the VAT process for Mexico, you run the AR Vat on Gain Loss report (R76M930) to reclassify the VAT applicable on the gain or loss amounts.

8.3 Working with Reports to Reclassify VAT for AP Transactions

This section provides an overview of reports to reclassify VAT for AP transactions and discusses how to:

-

Run the AP Vat for Gain Loss report.

-

Set processing options for the AP Vat for Gain Loss report (R76M940).

-

Run the Closed AP Draft Vat on Gain Loss report.

-

Set processing options for the Closed AP Draft Vat on Gain Loss report (R76M990).

8.3.1 Understanding Reports to Reclassify VAT for AP Transactions

You use these reports to reclassify VAT for AP transactions:

-

AP Vat for Gain Loss report

-

Closed AP Draft Vat on Gain Loss report

After you post a payment, depending on the type of transactions, you run one of these reports to reclassify VAT on the gain or loss amount. When you run either of these reports, the system performs these steps to generate journal entries:

-

Selects the journal entry records for gain or loss transactions with document type PG when you run the AP Vat for Gain Loss report and PI when you run the Closed AP Draft Vat on Gain Loss report.

-

Selects tax area and tax explanation code of all selected voucher records and calculates VAT using tax area percentage and the gain or loss amount. If there are multiple tax areas associated to a voucher, the new report processes those vouchers considering all those tax areas.

-

Calculates VAT on gain or loss amount.

-

Searches the automatic accounting instructions (AAIs) or the processing options to find out the final VAT account for generating the journal entry for reclassified VAT.

-

Generates the journal entry.

When you run one of these reports, the system displays the payment and the associated journal entry on the report output, but if there is any error in the processing, the system does not generate journal entries. If there are no errors, the report classifies the payment as processed.

When you rerun the AP Vat for Gain Loss or the Closed AP Draft Vat on Gain Loss report, the report displays the transactions, but does not recalculate VAT on gain or loss amounts. It calculates VAT on gain or loss amounts only when you run the report for the first time.

The system stores the reclassification status in the AP VAT on Gain/loss (F76M940) or GL VAT on Gain/loss MEX (F76M990) table.

The accounts payable system considers these cases to reclassify VAT for AP transactions:

-

VAT recognition on AP gain or loss amount.

-

VAT recognition on voided AP gain or loss amounts.

-

VAT recognition on gain or loss amounts for closed draft.

VAT Recognition on AP Gain or Loss Amount

You follow these steps in the VAT recognition on AP gain or loss amount process:

-

Enter a foreign voucher and pay it using the foreign or alternative currency.

-

Post the payment. The system reclassifies the payment VAT amount from the temporary VAT account to the final VAT account.

-

Run the AP Vat for Gain Loss report to reclassify the VAT applicable on the gain or loss amounts from the gain/loss account to the final VAT account.

When you run the AP Vat for Gain Loss report, the system performs these steps:

-

Selects the gain or loss amounts of posted vouchers.

The standard payment process generates a PG record on the Payment Detail table (F0414) associated with the gain or loss amounts respectively. The AP Vat for Gain Loss report selects all posted payments with PG records for processing.

-

Selects tax rate area and tax explanation code of the associated voucher.

If a voucher has multiple tax areas, the new report considers those. If you enter a tax amount manually through the standard voucher entry applications, the system continues to use the standard calculation process to calculate VAT on gain or loss amounts. The system uses the tax rate area and tax explanation code from the F0411 table.

-

If you use an alternative currency to make a payment, the payment process generates two gain or loss amounts that comprise accounts associated with foreign and alternative currencies.

-

Calculates VAT on the gain or loss amount.

For each gain or loss amount selected, the report calculates the VAT associated with the gain or loss amount. The system searches the percentage on the first transaction of the tax rate area that is different from zero. This process does not consider the discount amounts. It calculates VAT using tax rate area percentage and the gain or loss amount. It considers all explanation codes that begin with V or A.

-

Searches AAI for journal entry.

The report retrieves the gain or loss account and the final VAT account to generate the journal entry for each gain or loss amount. You can specify the final VAT account in the processing option. If you do not specify an account in the processing option, the system determines this account based on the AAI values.

-

Generates the journal entry.

The journal entries use the VAT gain or loss amount, gain or loss account, and the final VAT account and update only the AA ledger. The system generates a different batch by payment to reclassify the VAT of the gain or loss amounts.

-

Updates the journal entry in the F76M940 table.

When you run the AP Vat for Gain Loss report, the system generates a journal entry for each gain or loss VAT amount for each payment line. The system saves these journal entries in the F76M940 and F0911 tables. Then, you post the transaction batch.

VAT Recognition on Voided AP Gain/Loss Amount

You follow these steps in the VAT recognition on voided AP gain or loss amount process:

-

Void a foreign payment.

When you post a void payment, the system reclassifies the payment VAT amount from the final VAT account to the temporary VAT account.

-

Run the AP Vat for Gain Loss report to reclassify the VAT of the voided gain or loss amounts from the VAT account to the gain or loss account.

When you run the AP Vat for Gain Loss report, the system performs these steps:

-

Selects gain or loss amounts for voided payments.

The standard payment process generates PG or PL records in the Payment Detail table (F0414) for voided payment lines. The AP Vat for Gain Loss report selects all posted payments with PG or PL records to process the gain or loss amounts so that it includes voided payments for processing. The report searches the PG or PL documents associated with a voided payment and verifies whether the previous document is a PO document in the F0414 table.

-

Calculates VAT for the gain or loss amount for each voided voucher.

The report obtains the voucher gain or loss amount and the associated tax rate area and tax explanation code. If a voucher has multiple tax rate areas, the new report considers those. If you enter a tax amount manually through the standard voucher entry applications, the system continues to use the standard calculation process to calculate VAT on gain or loss amounts. The system uses the tax rate area and tax explanation code from the F0411 table.

-

Reverses the AAI account when you void a payment.

-

Updates the journal entry in the F76M940 table for voided payments.

The system generates new lines in the F0414 table for voided payments. The AP Vat for Gain Loss report generates a journal entry for the gain or loss VAT amount of the voided payment. The system saves this journal entry in the F76M940 table.

VAT Recognition for Gain or Loss Amounts for Closed Draft

You follow these steps in the VAT recognition on AP gain or loss amounts for closed draft process:

-

Enter a foreign voucher and make a draft payment for that voucher.

When you post a payment, the system reclassifies the payment VAT amount from the temporary VAT account to the actual VAT account. Additionally, the AP VAT for Gain Loss report reclassifies the VAT of the gain or loss amounts from the gain or loss account to the VAT account.

-

Run the Post Outstanding Drafts program (R04803) to close the draft.

When you run this report, the system generates a gain or loss amount by payment entry in the F0911 table.

-

Run the Closed AP Draft Vat on Gain Loss report to distribute the gain or loss amounts amongst all vouchers in payment and to update the F76M990 table.

When you run the Closed AP Draft Vat on Gain Loss report, the system performs these steps:

-

Selects the gain or loss amounts for closed drafts.

-

Calculates gain or loss amount for each voucher.

-

Calculates VAT from the gain or loss amount for each voucher.

-

Searches the accounts for the journal entry and after it obtains the VAT of the gain or loss amount, the gain or loss account, and the VAT account, the Closed AP Draft Vat on Gain Loss report generates the journal entry and updates the F76M990 table.

8.3.2 Running the AP Vat for Gain Loss Report

Select Mexico VAT TAX (G76MVAT), AP Vat for Gain Loss.

8.3.3 Setting Processing Options for the AP Vat for Gain Loss Report (R76M940)

Processing options enable you to specify the default processing for programs and reports.

8.3.3.1 A/B Validation

- Period

-

Specify the period for which you want to run the report.

- Fiscal Year

-

Specify the fiscal year for which you want to run the report.

- Print Documents

-

Specify whether to print all documents or only unprocessed documents on the report. Valid values are:

1: Print all the documents for the period.

Blank: Print only unprocessed documents.

- Proof/Final Mode

-

Specify whether the system runs the report in proof or final mode. Valid values are:

1: Final Mode. When you run the report in final mode, the system generates journal entries.

Blank: Proof mode. When you run the report in proof mode, the system does not generate journal entries.

8.3.3.2 Journal Entry

- Journal Entry Document Type

-

Specify a value from the UDC table 00/DT that identifies purpose of the transaction. If you leave this processing option blank, the system assigns the default value of JK that indicates the purpose of the transaction to redistribute payments.

- Enter an Account to redistribute the VAT difference

-

Specify the account to which to redistribute the VAT difference. If you leave this processing option blank, the system searches for the account in AAIs based on the value given in the Enter the prefix that defines the Automatic Accounting Instruction processing option.

- Enter the prefix that defines the Automatic Accounting Instruction.

-

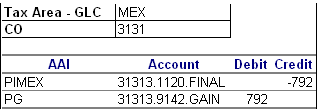

Specify the prefix for the AAI from which to retrieve the VAT account to redistribute the VAT amount. The system concludes the VAT account by prefixing this value to GLC tax area for the specific company. If you leave it blank, the system uses the default value of PI. For a blank value in this processing option, the system considers the final VAT account to be PI+GLC Tax Area. For GLC Tax Area MEX, the system considers the account to be PIMEX.

8.3.4 Running the Closed AP Draft Vat on Gain Loss Report

Select Mexico VAT TAX (G76MVAT), Closed AP Draft Vat on Gain Loss.

8.3.5 Setting Processing Options for the Closed AP Draft Vat on Gain Loss Report (R76M990)

Processing options enable you to specify the default processing for programs and reports.

8.3.5.1 Process

- Enter the range of dates data selection:Date From:

-

Specify the beginning date for which the transaction or code is applicable.

- Date To:

-

Specify the ending date through which the transaction or code is applicable.

- Print Documents

-

Specify whether to print all documents on the report or not. Valid values are:

1: Print all the documents for the period.

Blank: Print only unprocessed documents.

- Proof/Final Mode

-

Specify whether the system runs the report in proof or final mode. Valid values are:

1: Final Mode. When you run the report in final mode, the system generates journal entries.

Blank: Proof mode. When you run the report in proof mode, the system does not generate journal entries.

8.3.5.2 Journal Entry

- Journal Entry Document Type

-

Specify a value from the UDC table 00/DT that identifies purpose of the transaction. If you leave this processing option blank, the system assigns the default value of JK that indicates the purpose of the transaction to redistribute payments.

- Enter an Account to redistribute the VAT difference

-

Specify the account to which to redistribute the VAT difference. If you leave this processing option blank, the system searches for the account in AAIs based on the value given in the Enter the prefix that defines the Automatic Accounting Instruction processing option.

- Enter the prefix that defines the Automatic Accounting Instruction.

-

Specify the prefix for the AAI from which to retrieve the VAT account to redistribute the VAT amount. The system concludes the VAT account by prefixing this value to GLC tax area for the specific company. If you leave it blank, the system uses the default value of PI. For a blank value in this processing option, the system considers the final VAT account to be PI+GLC Tax Area. For GLC Tax Area MEX, the system considers the account to be PIMEX.

8.4 Working with Reports to Reclassify VAT for AR Transactions

This section provides an overview of reports to reclassify VAT for AR transactions and discusses how to:

-

Run the AR Vat on Gain Loss report.

-

Set processing options for the AR Vat on Gain Loss report (R76M930).

8.4.1 Understanding Reports to Reclassify VAT for AR Transactions

You use the AR Vat on Gain Loss report to reclassify VAT for AR transactions.

The accounts payable system considers these cases to reclassify VAT for AR transactions:

-

VAT recognition on AR gain or loss amount.

-

VAT recognition on voided AR gain or loss amounts.

-

VAT recognition on gain or loss amounts for closed collection draft.

VAT Recognition on AR Gain or Loss Amount

You follow these steps in the VAT recognition on AR gain or loss amount process:

-

Enter a foreign invoice and a receipt.

When you post a receipt, the system reclassifies the invoice VAT amount from the temporary VAT account to the final VAT account.

-

Run the AR Vat on Gain Loss report to reclassify the VAT applicable on the gain or loss amounts from the gain or loss account to the final VAT account.

When you run the AR Vat for Gain Loss report, the system performs these steps:

-

Selects the gain or loss amounts for the invoice.When you enter standard receipts or customer drafts, the system saves the gain or loss amount in the F03B14 table. The AR Vat on Gain Loss report selects all receipts that have a gain or loss amount not amounting to zero.

-

Calculates VAT for each invoice gain or loss amount.

If you enter a tax amount manually and this amount is not the result of applying the standard tax calculation process, the system uses the standard calculation process to calculate the VAT on gain or loss amounts. The system uses the tax rate area and tax explanation codes from the F03B11 table.

Generates two gain or loss amounts that comprise accounts associated with foreign and alternative currencies if you use an alternative currency to receive a payment. The report obtains the invoice gain or loss amount and the tax rate area and tax explanation codes associated with the gain or loss. If an invoice has multiple tax rate areas, the new report considers those. If you enter a tax amount manually through the standard invoice entry applications and the amount you enter is not the result of applying the standard tax calculation process, the system uses the standard calculation process to calculate the VAT on gain or loss amounts. The system uses the tax area and tax explanation codes from the F03B11 table.

-

Searches AAI for journal entries.

The report retrieves the gain or loss amount and the final VAT account to generate the journal entry for each gain or loss amount. You can specify a value in the processing options for the final VAT account. If you do not specify a value in the processing options, the system determines these accounts based on the AAI values.

-

Generates the journal entry.

The system writes the journal entries based on the VAT gain or loss amount, gain or loss account, and the final VAT account and update only the AA ledger.

-

Updates the journal entry in the F76M930 table.

When you run the AR Vat on Gain Loss report, the system generates a journal entry for each gain or loss VAT amount of each payment line. The system saves these journal entries in the F76M930 and F0911 tables. Then, you post the new batch.

VAT Recognition on Voided AR Gain/Loss Amount

You follow these steps in the VAT recognition on voided AR gain or loss amount process:

-

Void a foreign invoice.

-

Post the voided receipt.The system reclassifies the payment VAT amount from the final VAT account to the temporary VAT account.

-

Run the AR Vat on Gain Loss report to reclassify the VAT of the voided gain or loss amounts from the VAT account to the gain or loss account.

When you run the AR Vat for Gain Loss report, the system performs these steps:

-

Selects gain or loss amounts for voided invoices.

The standard receipt process uses the document type RO to save the voided invoices on the Receipt Detail table (F03B14). The AR Vat on Gain Loss report includes these RO records when selecting the receipts to process for all gain or loss amounts different from zero.

-

Calculates VAT for the gain or loss amount for each voided invoice.

The report obtains the invoice gain or loss amount and the associated tax rate area and tax explanation codes. If an invoice has multiple tax rate areas, the new report considers those. If you enter a tax amount manually through the standard invoice entry applications and the amount that you enter is not the result of applying the standard tax calculation process, the system uses the standard calculation process to calculate VAT on gain or loss amounts. The system uses the tax area and tax explanation codes from the F03B11 table.

-

Generates the journal entry for voided receipts by reversing the AAI accounts.

For each gain or loss amount, this report retrieves the gain or loss account and the final VAT account to generate the journal entry. In some cases, the gain or loss account is defined in F03B14.AIDT for receipts and in F03B14.AIDA for receipts in an alternative currency. If these fields are blank, the system uses AAIs to define the accounts.

-

Updates the journal entry in the F76M930 table for voided receipts.

The system generates new lines in the F03B14 table for the voided receipts. The AR Vat on Gain Loss report generates a journal entry for the gain or loss VAT amount of the voided receipt. The system saves this journal entry in the F76M930 table.

VAT Recognition for Gain or Loss Amounts for Closed Collection Draft

You follow these steps in the VAT recognition on AR gain or loss amounts for closed collection draft process:

-

Enter a foreign invoice and receive payment via draft.

When you post a collection draft, the system reclassifies the draft VAT amount from the temporary VAT account to the final VAT account. The AR VAT on Gain Loss report reclassifies the VAT of the gain or loss amounts from the gain or loss account to the VAT account.

-

Remit the draft and then process the draft collection.

The collection process generates the gain or loss amount by draft. This process selects the original documents associated with a collection by searching for records with document number and distributes the gain or loss amount between the draft invoices.

-

Void the draft collection record.

When you void the draft collection record, the system generates gain or loss.

-

Run the AR Vat on Gain Loss report to select the gain or loss amounts from the F0911 table.

The report searches for the tax rate area and tax explanation codes of each invoice and calculates the VAT on the gain or loss amount of the invoice.

When you run the AR Vat on Gain Loss report, the system performs these steps:

-

Selects the gain or loss amounts for closed drafts.

-

Assigns the gain or loss amount to each invoice in a prorated ratio.

-

Calculates VAT from the gain or loss amount for each receipt.

-

Searches the accounts for the journal entry and after it obtains the VAT of the gain or loss amount, the gain or loss account, and the VAT account, the AR Vat on Gain Loss report generates the journal entry and updates the F76M930 table.

8.4.3 Setting Processing Options for the AR VAT on Gain Loss Report (R76M930)

Processing options enable you to specify the default processing for programs and reports.

8.4.3.1 Process

- Enter the range of dates data selection:

- Date From:

-

Specify the beginning date for which the transaction or code is applicable.

- Date To:

-

Specify the ending date through which the transaction or code is applicable.

- Print Documents

-

Specify whether to print all documents on the report or not. Valid values are:

1: Print all the documents for the period.

Blank: Print only unprocessed documents.

- Proof/Final Mode

-

Specify whether the system runs the report in proof or final mode. Valid values are:

1: Final Mode. When you run the report in final mode, the system generates journal entries.

Blank: Proof mode. When you run the report in proof mode, the system does not generate journal entries.

8.4.3.2 Journal Entry

- Journal Entry Document Type

-

Specify a value from the UDC table 00/DT that identifies purpose of the transaction. If you leave this processing option blank, the system assigns the default value of JM that indicates the purpose of the transaction to redistribute VAT.

- Enter an Account to redistribute the VAT difference

-

Specify the account to which to redistribute the VAT difference. If you leave this processing option blank, the system searches for the account in AAIs based on the value given in the Enter the prefix that defines the Automatic Accounting Instruction processing option.

- Enter the prefix that defines the Automatic Accounting Instruction.

-

Specify the prefix for the AAI from which to retrieve the VAT account to redistribute the VAT amount. If you leave it blank, the system uses the default value of RIxxx that indicates the AAI that is been used to reclassify VAT during the posting of receipts.

8.5 Understanding the Setup for Processing VAT on Payments and Receipts for Mexico

You must complete this setup before processing Mexican VAT transactions.

8.5.1 Discounts and Write-Offs

Discounts (AP and AR) and Write-offs (AR) proportionally decrease the amount of the suspense VAT during the post of the receipt or payment.

To calculate discounts and write-offs correctly, you must complete this setup:

-

Select these options in the Tax Rules program (P0022) for both the JD Edwards EnterpriseOne Accounts Payable and JD Edwards EnterpriseOne Accounts Receivable systems:

-

Tax on Gross including Discount.

-

Discount on Gross Including Tax.

-

-

Set the processing options on the Taxes tab for the General Ledger Post Report program (R09801) as:

-

Update Tax File = 3 (for all Tax Explanation Codes).

-

Adjust V.A.T. Account for Discount Taken = 2 (Update VAT, Ext. Price and Taxable).

-

-

Adjust V.A.T. Account for Receipt Adjustments and Write Offs = 2 (Update VAT, Ext. Price and Taxable).

8.5.2 GL Date for Vouchers and Invoices

For Mexican VAT calculations, you must set the Service/Tax Date processing option on these master business functions to use the GL date:

-

Voucher Entry MBF Processing Options (P0400047).

-

Invoice Entry MBF Processing Options (P03B0011).

8.5.3 Automatic Accounting Instructions

To post the tax amount that is calculated when posting vouchers and invoices to a Suspense VAT account, you must set up these AAIs to reference the Suspense VAT account:

-

PTxxxx

-

RTxxxx

The Suspense VAT account holds the tax amount until a payment or receipt is applied to the voucher or invoice, and the payment or receipt is posted.

You must set up these AAIs with the VAT account to reclassify the tax amount from the Suspense VAT account to the VAT account when the payments or receipts are posted:

-

PIxxxx

-

RIxxxx

The suffix xxxx indicates the GL offset code that is defined on the corresponding tax rate/areas. Blank is a valid GL offset code.

|

Note: You can specify a unique VAT account in the processing options for the POs Redistribute AP VAT - Mexico program (R76M1630) and the POs to Redistribute AR VAT Accounts - Mexico program (R76M1010). |

8.5.4 Set Processing Options to Redistribute AP and AR VAT for Mexico

When you run the version of the post program to post AP payments and AR receipts, the system automatically submits the program to redistribute the VAT amounts. You must set the processing options for these programs so that VAT amounts are posted to the proper account and the correct version of the GL post report is submitted to post the new batch of VAT transactions.

|

Note: The system does not generate a report for the redistributed VAT batches. |

8.5.5 Reviewing Mexican VAT Transactions

You can inquire on the reclassification journal entries in the Account Ledger Inquiry program (P09200).

For Accounts Payable transactions, you can inquire using the supplier invoice number or purchase order number in addition to the payment or prepayment number.

For Accounts Receivable transactions, you can inquire using the invoice number within wildcard characters (for example, *12345*) in the Explanation field of the QBE line.

8.5.5.1 Error Handling

In some cases, the Mexican VAT process might be unable to reclassify the tax information successfully. If this situation happens, you can view the error in the Work Center.

If a fatal error occurs during VAT reclassification and no journal entries are generated, you must calculate the VAT amount to reclassify and enter the journal entry manually.

When the AAI does not exist or when an invalid account has been set up for the Mexican VAT process, the reclassification journal entry is generated with a blank account number. In this case, you must correct the account number on the journal entry and post the journal entry.

8.6 Setting Processing Options for POs Redistribute AP VAT - Mexico (R76M1630)

Processing options enable you to specify the default processing for programs and reports.

8.6.1 Default

- Enter an Account to Redistribute the VAT

-

Specify the VAT account to which VAT amounts should be posted. If you leave this processing option blank, the system uses the account that is specified in the PI AAI.

8.6.2 Versions

- Enter the version to post General Journal.

-

Specify the version of the General Ledger Post Report program (R09801) to use to post the new VAT batch. If you leave this processing option blank, the system uses version ZJDE0001.

8.7 Setting Processing Options for POs to Redistribute AR VAT Accounts - Mexico (R76M1010)

Processing options enable you to specify the default processing for programs and reports.

8.7.1 Default

- 1. VAT Account Number

-

Specify the VAT account to which VAT amounts should be posted. If you leave this processing option blank, the system uses the account specified in the RI AAI.

8.7.2 Versions

- 1. Post General Journal (R09801)

-

Specify the version of the General Ledger Post Report program (R09801) to use to post the new VAT batch. If you leave this processing option blank, the system uses version ZJDE0001.