7 Processing the 347 Tax Declaration in Spain

This chapter contains the following topics:

7.1 Understanding the 347 Tax Declaration

Businesses in Spain must submit the 347 tax declaration to the Spanish tax authority for transactions exceeding 3,005,06 euros. The 347 tax declaration includes information about all accounts payable and accounts receivable transactions. The tax declaration also includes information about insurance and leasing transactions, as well as leasing information for buildings that are owned or maintained by the company. The system considers the amounts included in the report both quarterly and annually.

If a large company is subdivided into subcompanies within the system, the parent company should report the consolidated information for all subcompanies.

The first step in processing the Model 347 declaration is to run the Model 347 - Generate Acquisition Records (R74S100) and Model 347 - Generate Sales Records (R74S110) programs to generate the Model 347 workfiles.

The Model 347 workfiles consist of these tables:

-

F74S75 - Model 347 - Link Between Rec. Type 0 and Rec. Type 1 - Spain.

-

F74S76 - Model 347 - Record Type 0 Tag File - Spain.

-

F74S78 - Additional Information for 347 & 349 Models - Tag file - Spain.

-

F74S79 - Model 347 - Record Type 2 Tag File - Spain.

This table explains the record types:

| Record Type | Description |

|---|---|

| Record Type 0 | Contains information about the number of records being submitted. Record type 0 is necessary only if you are using a single file to present tax information about two or more companies with different tax identification numbers.

When you process the report based on the specified country, the report informs in this record type the company information according to the country address book. (Release 9.1 Update) |

| Record Type 1 | Contains information about company address, as well as the amount and number of records that are associated with the company for the country specified in the processing options for the report. (Release 9.1 Update) |

| Record Type 2 | Contains a summary of the amounts of selected transactions from AR and AP records that are distinguished by the tax identification number of the customer or supplier, and by the type of operation (acquisitions or sales). Insurance operations and leasing operations are also identified.

The system displays the summary of amounts for those transactions that apply to the country and tax rate/area specified in the processing options. (Release 9.1 Update) (Release 9.1 Update) This record also contains the following new fields:

|

| Record Type 3 | Contains the total amount of leasing operations and the address of the leased commercial site. Record Type 3 is necessary only if the company leases a commercial site to a customer.

The system displays the total amount for records that apply to the country and tax rate/area specified in the processing options. (Release 9.1 Update) |

The system uses the information in the Model 347 workfiles to produce the Model 347 - Dec. Companies Report and the 347 - Operations Report. You use the Model 347 - Print Records Type 1 - Spain program (R74S71) and the Model 347 - Print Records Types 2 & 3 - Spain program (R74S72) to print these reports that you use to review the data in the workfiles. The system reads the data in the workfiles when you generate the data for the file that you submit to the Spanish tax authority.

7.1.1 Cash Payments

For each declaration year, you must report the year in which cash payments were received, including transactions that were invoiced in a previous year and paid in cash in the declaration year. This requirement applies when the cumulative total of the cash payments from a customer is equal to or exceeds 6000 euros. For example, if you prepared an invoice for 10,000 euros in 2009, and received a cash payment of 10,000 in 2010 to apply to the invoice, you must report that the transaction was invoiced in the year previous to the receipt of the cash payment. Likewise, if you prepared an invoice of 10,000 euros in 2009 and received 2 separate cash payments of 5000 euros in 2010, you must report that you received 10,000 euros in cash payments in 2010 for a transaction that was invoiced in 2009.

For the cash payments for a declaration year, the program writes the year that the cash payment was received. The program includes the cash payments that were received in the declaration year, whether invoiced in the declaration year or the previous year. The program also writes the year of the invoice to the new Invoice Declaration Year field in the F74S72 table.

|

Note: The Generate Acquisitions program (R74S100) also inserts type 2 records into the F74S72 table. However, the Generate Acquisitions program does not retrieve data for cash amounts. The Generate Acquisitions program writes the value 0 to the Invoice Declaration Year field in the F74S72 table. |

7.1.2 Transactions Selected for Processing

The dates that you specify affect how the system selects transactions to process. You specify dates in:

-

Declaration Year processing option

The system uses the year that you specify in the Declaration Year processing option in conjunction with the values in the date range processing option to select the cash and non-cash accounts receivable transactions to process.

-

A processing option in the Generate Tape/File program.

The date range that you specify in the processing options affects the cash transactions selected for processing. Generally, you will set this processing option to encompass the declaration reporting year. You can accept the default values for the processing option to use the date range of January 1 through December 31 of the year that you specify in the Declaration Year processing option.

-

Data selection.

The date range that you specify in data selection affects the invoices that the system selects to process. If you specify a date range in data selection, the system selects for processing only those invoices in the date range. If an invoice was issued prior to the dates in the date range, the system will not include it in the report. For example, if you specify a date range of January 1, 2011 through December 31, 2011, the system will not locate and process invoices that were generated in December 2010. To assure that you process all invoices for the prior reporting year for which cash payments were received in the current declaration year, Oracle recommends that you either:

-

Carefully consider the date range that you need to specify so that it includes all of the invoices that you need to process.

-

Do not set a date range in data selection so that the system is not restricted from selecting invoices outside of the date range specified.

-

7.1.3 Examples of Cash Payments Amounts and Invoice Dates Included in the Modelo 347 Report

Several situations might exist that will cause the system to include cash payment amounts and invoice dates in the Modelo 347 report. All of these examples assume that the processing options in the Generate Sales program are set to process cash transactions of 6000 or more euros and for a date range that will include the correct cash payments and invoices.

7.1.3.1 Example 1

Suppose that you sent invoices totaling 10,000 euros to Customer 1 in 2009 and that the customer paid 8000 in cash against the invoices in 2009. Suppose further that you sent invoices totaling 15000 to the customer in 2010, and received cash payments against the 2009 and 2010 invoices in the amount of 2000, 7000, and 8000. This table shows the data set for Example 1:

| 2010 Invoices | 2010 Payments | 2011 Invoices | 2011 Cash Payments |

|---|---|---|---|

| 10000 | 8000 | 15000 | 2000 for 2010 invoices

7000 for 2011 invoices 8000 for 2011 invoices |

When you generate the 347 tax declaration in 2011 for the customer situation described in the Example 1 data set, the report is populated with two lines for the customer. One line is for the invoice year of 2010, and shows the cash payment made in 2011 for the transactions that were invoiced in 2010. The second line shows the invoice total from 2011 transactions, and the cash payments made for the 2011 invoices.

This table shows the data that would appear in the 347 tax declaration for the 2011 declaration year for Example 1:

| Declaration Year | Invoice Declaration Year | Operations Total Amount | Amount Received in Cash |

|---|---|---|---|

| 2011 | 2010 | (blank) | 2000 |

| 2011 | 2011 | 15000 | 15000 |

7.1.3.2 Example 2

Suppose that you sent invoices totaling 8000 euros to a Customer 2 in 2010 and that the customer paid 6500 in cash against the invoices in 2010. Suppose further that you sent invoices totaling 5000 to the customer in 2011, and received cash payments against the 2010 and 2011 invoices in the amount of 3500 and 5000. This table shows the data set for Example 2:

| 2010 Invoices | 2010 Payments | 2011 Invoices | 2011 Cash Payments |

|---|---|---|---|

| 10000 | 6500 | 5000 | 3500 for 2010 invoices

5000 for 2011 invoices |

When you generate the 347 tax declaration for this customer for 2010, the report includes two lines for this customer. The first line shows the total invoices for 2009 and the cash payments made in 2010 for the 2009 invoices. The second line shows the invoice total for 2010, and the cash payments received for the 2010 invoices. Even though each of the payments is less than 6000, the total of the cash payments received in 2010 exceeds 6000 and so must be reported with the years of the invoices. This table shows the date that would appear in the 347 tax declaration for the 2010 declaration year for Example 2:

| Declaration Year | Invoice Declaration Year | Operations Total Amount | Amount Received in Cash |

|---|---|---|---|

| 2011 | 2010 | (blank) | 3500 |

| 2011 | 2011 | 5000 | 5000 |

7.1.3.3 Example 3

Suppose that you:

-

Received no cash payments from Customer 3 in 2011 for transactions invoiced in 2010.

-

Sent invoices totaling 7000 euros to Customer 3 in 2011.

-

Received 3500 in cash payments from Customer 3 in 2011.

This table shows the data set for Example 3:

| 2010 Invoices | 2010 Payments | 2011 Invoices | 2011 Cash Payments |

|---|---|---|---|

| NA

No 2010 invoices were paid in cash in 2011. |

NA

No 2010 invoices were paid in cash in 2011. |

7000 | 3500 for 2010 invoices |

Because no 2010 invoices were paid in cash in 2011, information about the 2010 invoices does not appear in the 347 tax declaration for 2011. Additionally, because the cash payments received from the customer in 2011 are less than 6000 euros, the system does not print the cash payment amount in the declaration. This table shows how the system would populate the fields in the 347 tax declaration for the data set described for Example 3:

| Declaration Year | Invoice Declaration Year | Operations Total Amount | Amount Received in Cash |

|---|---|---|---|

| 2011 | 2011 | 7000 | (blank) |

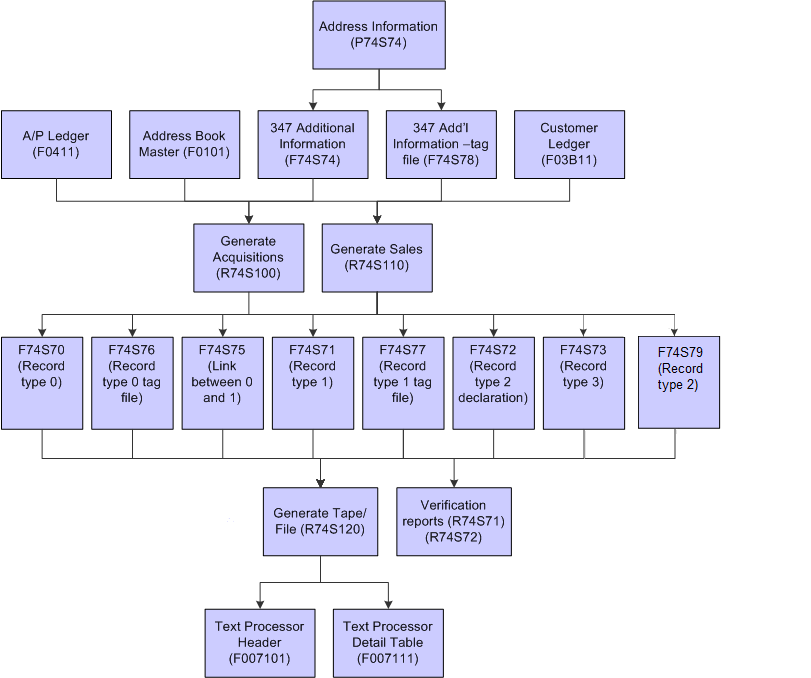

7.1.4 Process Flow

This graphic illustrates the Model 347 process:

Figure 7-1 Process flow for the Model 347 tax declaration

Description of ''Figure 7-1 Process flow for the Model 347 tax declaration''

The steps to generate the declaration are:

-

Add commercial site information to your company records.

You use the Address Information program (P74S74) to add leased commercial site information.

See Adding Commercial Site Address Information to Company Records.

-

Generate the workfiles for the model 347 declaration.

You run the Model 347 - Generate Acquisition Records (R74S100) and Model 347 - Generate Sales Records (R74S110) programs to generate the Model 347 workfiles.

-

Review and revise data in the workfiles if necessary.

You run the Model 347 - Print Records Type 1 - Spain (R74S71) and the Model 347 - Print Records Types 2 & 3 - Spain (R74S72) program to print reports that you use to view the data.

-

Generate the tax declaration file and write the file to the Text Processor Header table (F007101) and Text Processor Detail Table (F007111).

You run the 347 - Generate Tape File program (R74S120) to write the file to the F007101 and F007111 tables.

-

Use the Text File Processor program (P007101) to copy the files in the F007101 and F007111 tables to the media that you submit to the government.

7.1.5 Prerequisites

Before you complete the tasks in this section:

-

In the JD Edwards EnterpriseOne Address Book system, enter a tax identification number for each company, customer, and supplier.

-

If the business leases a commercial site to someone or from someone, set up additional information for the site.

-

Set up additional information for the company that is submitting the tax declaration to the tax authority.

7.2 Generating the Model 347 Workfiles

This section provides an overview of the Model 347 workfiles and discusses how to:

-

Run the 347 - Generate Acquisitions (R74S100) program.

-

Set processing options for 347 - Generate Acquisitions (R74S100).

-

Run the 347 - Generate Sales (R74S110) program.

-

Setting processing options for 347 - Generate Sales (R74S110).

7.2.1 Understanding the Model 347 Workfiles

Use the 347 - Generate Acquisitions (R74S100) program to add information from the JD Edwards EnterpriseOne Accounts Payable system to the Model 347 workfiles. Use the 347 - Generate Sales (R74S110) program to add information from the JD Edwards EnterpriseOne Accounts Receivable system to the Model 347 workfiles.

The 347 - Generate Acquisition and 347 - Generate Sales programs summarize transactions by the customer's or supplier's tax identification number.

The 347 - Generate Acquisitions and the 347 - Generate Sales programs retrieve information from these tables to build the Model 347 workfiles:

-

Address Book Master (F0101)

-

Accounts Payable Ledger (F0411)

-

Customer Ledger (F03B11)

-

Additional Information for 347 & 349 Models - Tag file - Spain (F74S78)

-

Additional Information for Model 347 - Record Type 2 Tag File - Spain (F74S79).

The system populates the Zip Code field in the Model 347 workfiles based on information in the address book. For domestic customers and suppliers, the system appends three zeros to the first two digits of the customer's or supplier's zip code from the address book. For international customers and suppliers, the system uses 99 plus the customer's or supplier's three-digit country code from user-defined code (UDC) (00/CN).

You use the processing options on the 347 - Generate Acquisitions and the 347 - Generate Sales programs to specify whether to run the report for a country and also to specify the general information that must be included on the declaration. (Release 9.1 Update)

7.2.2 Running the 347 - Generate Acquisitions (R74S100) Program

Select Process 347 - Spain (G74S8011), 347 - Generate Acquisitions.

7.2.3 Setting Processing Options for 347 - Generate Acquisitions (R74S100)

Processing options enable you to specify the default processing for programs and reports.

7.2.3.1 Process

- 1. Report By Country

- Country for Company Information

-

Enter a value from UDC table 00/EC to specify the country for which you want to run the report. The system retrieves company information with address number defined in the Company Address Number for Tax Reports program (P00101) for the country that you specify in this processing option. If you leave this field blank, the system retrieves the company information from address book related to company in the Companies program (P0010) and the system does not enable the country processing.

7.2.3.2 Presentation

- 1. Company

-

Enter the company number of the reporting company. (Required)

7.2.3.3 Common Data

- 1. Declaration Year

-

Enter the 4–digit declaration year.

- 2. Tax Office Number

-

Specify the tax office number to which you send the tax file.

- 3. Code

-

Enter the 2–character country code for the company.

- 4. Line Number

-

Enter the line number from the company's who's who record (F0111) from which to obtain the contact name for the tax report. If you leave this processing option blank, the system uses the value on line 1 of the who's who record.

- 5. Declaration Type

-

Specify the type of declaration. Values are:

Blank: Current declaration.

1: Complementary. The report is an additional to the original report.

2: Substitute. The report replaces the original report.

- 6. Previous Declaration Number

-

Enter the previous declaration number if you are generating a complementary or substitute report.

7.2.3.4 Regeneration

- 1. Regenerate Files: Selection

-

Specify whether to add to the existing records or replace existing records in the workfiles. Values are:

Blanks: Add information into the files.

1: Regenerate files (replace existing records).

7.2.3.5 Amount

- 1. Minimum Amount

-

Enter the minimum amount per supplier or customer that must be declared. If you leave this processing option blank, the system uses 3,005.06 EUR.

- Threshold Amount

-

Use this processing option to specify the minimum amount for the cash transactions to include in the report. This amount is the cumulative amount for cash transactions that occur during the date range that you specify in the date range processing option. For example, if you specify 6000 in this processing option, the system sums all of the cash transactions for the specified date range and includes the transactions in the report if the sum is greater than 6000.

If you leave this processing option blank, the system uses 6000 as the threshold amount.

- Date Range

-

Use this processing option to specify the date range that the system uses to select the cash transaction records to process. If you set the date range to include only transactions for the reporting year, the system does not include cash transactions that were invoiced in a previous year. For example, if you set the date range for January 1 through December 31, 2010, the system does not include transactions for which you received cash payments in December 2009, but does include transactions that were invoiced in December 2009 and paid in cash during 2010.

Similarly, you can set the date range to include cash payments received in the next declaration year for invoices generated in declaration year. For example, if you generate an invoice in December 2010 and received the cash payment in January 2011, you can set the date range for the 2010 declaration year to include January 2011 to include the cash payment in the 2010 declaration year.

7.2.3.6 Currency

- 1. Currency Code

-

Enter the company currency code.

- 2. Currency Code

-

Enter the third currency code.

7.2.3.7 Operation Type

- 1. Operation Type

-

Enter the operation type. Values are:

Blank or A: Acquisitions

C: Payments

D: Acquisitions if the company belongs to the Government and it is not related with the regular company activity.

- 2. Operation Class

-

Enter the operation class. Values are:

Blank or 0: Regular operations.

1: Insurance operations.

2: Leasing operations.

7.2.4 Running the 347 - Generate Sales (R74S110) Program

Select Process 347 - Spain (G74S8011), 347 - Generate Sales.

7.2.5 Setting Processing Options for 347 - Generate Sales (R74S110)

Processing options enable you to specify the default processing for programs and reports.

|

Note: (Release 9.1 Update) When you run the Model 347 - Generate Sales (R74S110) report, the system populates the Community Operator Tax ID Number field.For an inter EU transaction, the system populates the Community Operator Tax ID Number field with the value that is set up previously in the field Additional Tax Information from the Address Book. The values are valid for customers and suppliers. If the transaction is not an inter EU transaction or a valid record is not found for Community Operator Tax ID Number, the system leaves the field blank. |

7.2.5.1 Process (Release 9.1 Update)

- 1. Report By Country

- Country for Company Information

-

Enter a value from UDC table 00/EC to specify the country for which you want to run the report. The system retrieves company information with address number defined in the Company Address Number for Tax Reports program (P00101) for the country that you specify in this processing option. If you leave this field blank, the system retrieves the company information from address book related to company in the Companies program (P0010) and the system does not enable the country processing.

- Tax Rate/Area Processing

-

Specify whether to process tax rate/areas for the country specified in the Report By Country processing option. Values are:

Blank: Prevent tax rate/areas additional filtering.

1: To enable an additional filter excluding the tax rate/areas that were not identified for that country in the Alternate Tax Rate/Area by Country program (P40082).

7.2.5.2 Presentation

- 1. Company

-

Enter the company number of the reporting company. (Required)

7.2.5.3 Common Data

- 1. Declaration Year

-

Enter the 4–digit declaration year.

- 2. Tax Office Number

-

Specify the tax office number to which you send the tax file.

- 3. Code

-

Enter the 2–character country code for the company.

- 4. Line Number

-

Enter the line number from the company's who's who record (F0111) from which to obtain the contact name for the tax report. If you leave this processing option blank, the system uses the value on line 1 of the who's who record.

- 5. Declaration Type

-

Specify the type of declaration. Values are:

Blank: Current declaration.

1: Complementary. The report is an additional to the original report.

2: Substitute. The report replaces the original report.

- 6. Previous Declaration Number

-

Enter the previous declaration number if you are generating a complementary or substitute report.

7.2.5.4 Regeneration

- 1. Regenerate Files: Selection

-

Specify whether to add to the existing records or replace existing records in the workfiles. Values are:

Blanks: Add information into the files.

1: Regenerate files (replace existing records).

7.2.5.5 Amount

- 1. Minimum Amount

-

Enter the minimum amount per supplier or customer that must be declared. If you leave this processing option blank, the system uses 3,005.06 EUR.

7.2.5.6 Currency

- 1. Currency Code

-

Enter the company currency code.

- 2. Currency Code

-

Enter the third currency code.

7.2.5.7 Operation Type

- 1. Operation Type

-

Enter the operation type. Values are:

Blank or B: Sales

E: Sales with subsidy

- 2. Operation Class

-

Enter the operation class. Values are:

Blank or 0: Regular operations.

1: Insurance operations.

2: Leasing operations.

- 3. Manual Cash Receipt Processing

-

Specify whether to show cash amounts received for all transactions or for only transactions for which the payment instrument is set to cash. Values are:

Blank: Write the sum of the cash receipts from the F03B11 table to the CASH AMOUNT RECEIVED field in record type 2 for only transactions for which the payment instrument is set to cash.

1: Write the sum of the cash receipts from the F03B11 table to the CASH AMOUNT RECEIVED field in record type 2 for all transactions included in the data selection.

Note:

The system writes to the CASH AMOUNT RECEIVED field in record type 2 only when the sum is 6000 euros or more.

7.3 Generating the 347 Tax Declaration Reports

This chapter provides an overview of the 347 tax declaration reports and discusses how to:

-

Print the 347 - Dec. Companies Report (R74S71).

-

Print the 347 - Operations Report.

-

Set processing options for 347 - Operations Report (R74S72).

7.3.1 Understanding the 347 Tax Declaration Reports

After you generate the workfiles, you can run these reports to help you identify records that you need to modify. These reports include all of the data that reside in the workfiles.

7.3.1.1 347 - Dec. Companies Report

The 347 - Declaring Companies report lists each company with a unique tax identification number that is included in the tax declaration. Information for companies that share a tax identification number is combined.

The report is for review only. You do not submit this report to the tax authority.

For each reporting company, the report lists the number of records of each type and the total amount of transactions for each record type. The report lists these record types:

| Record Type | Transaction Total |

|---|---|

| Record Type A | Acquisitions over 3.005,06 euros |

| Record Type B | Sales over 3.005,06 euros |

| Record Type C | Payments over 300,51 euros to a third-party payee |

| Record Type D | Acquisitions over 3.005,06 euros by government companies that are not related to regular company activity |

| Record Type E | Government subsidies over 3.005,06 euros |

7.3.1.2 347 - Operations Report

The 347 - Operations report lists the total operations amount by operation type for each customer or supplier. Customer and supplier records are grouped by the declaring company. The report also lists the tax identification number for each customer and supplier.

The 347 - Operations report is for review only. You do not submit this report to the tax authority.

7.3.2 Printing the 347 - Dec. Companies Report

Select Process 347 - Spain (G74S8011), 347 - Dec. Companies Report.

7.3.3 Printing the 347 - Operations Report

Select Process 347 - Spain (G74S8011), 347 - Operations Report.

|

Note: (Release 9.1 Update) When you run the 347- Operations Report, the system displays numerous fields, including the following: Community Operator Tax ID Number (NIF), Def. VAT (Deferred VAT Regime Transactions Indicator), Yearly Amount of Deferred VAT Trans., Reverse Charge, and Deposit Regime. |

7.4 Generating the 347 Tax Declaration Tape File

This section provides an overview of the 347 tax declaration tape file and discusses how to:

-

Run the 347 - Generate Tape File program (R74S120).

-

Set processing options for 347 - Generate Tape File (R74S120).

7.4.1 Understanding the 347 Tax Declaration Tape File

Use the 347 - Generate Tape File program to generate the tax declaration file and write the file to the Text Processor Header table (F007101) and Text Processor Detail Table (F007111). You then use the Text File Processor program (P007101) to copy the files in the F007101 and F007111 tables to the media that you submit to the government.

The tape file contains information from these Model 347 workfiles:

-

Model 347 - Record Type 0 - Spain (F74S70).

-

Model 347 - Record Type 1 - Spain (F74S71).

-

Model 347 - Record Type 2 - Spain (F74S72)

-

Model 347 - Record Type 3 - Spain (F74S73)

-

Model 347 - Link Between Rec. Type 0 and Rec. Type 1 - Spain (F74S75)

-

Model 347 - Record Type 0 Tag File - Spain (F74S76)

-

Model 347 - Record Type 1 Tag File - Spain (F74S77)

-

Additional Information for 347 & 349 Models - – Tag File (F74S78).

-

Model 347 - Record Type 2 Tag File - Spain (F74S79).

7.4.2 Running the 347 - Generate Tape File Program

Select Process 347 - Spain (G74S8011), 347 - Generate Tape File.

7.4.3 Setting Processing Options for 347 - Generate Tape File (R74S120)

Processing options enable you to specify the default processing for programs and reports.

7.4.3.1 Process (Release 9.1 Update)

- 1. Report By Country

- Country for Company Information

-

Enter a value from UDC table 00/EC to specify the country for which you want to run the report. The system retrieves company information with address number defined in the Company Address Number for Tax Reports program (P00101) for the country that you specify in this processing option. If you leave this field blank, the system retrieves the company information from address book related to company in the Companies program (P0010) and the system does not enable the country processing.

7.4.3.2 Company

- 1. Company

-

Enter the company number of the reporting company. (Required)

7.4.3.3 Default

- Declaration Year

-

Enter the 4–digit declaration year.

- Declaration Number

-

Enter the declaration number.

- Media Type

-

Specify the type of media that you use to submit the tax declaration. Values are:

Blank: Tape

1: Disk

- Create Record

-

Specify whether the system creates records for record type 0. Values are:

Blank: Yes

1: No