Payroll for North America Overview

Payroll for North America Overview

This chapter discusses:

Payroll for North America overview.

Payroll for North America business processes.

Payroll for North America integrations.

Payroll for North America implementation.

Payroll for North America Overview

Payroll for North America Overview

Payroll for North America provides the tools to calculate earnings, taxes, and deductions efficiently; maintain balances; and report payroll data while minimizing the burden on IT managers and payroll staff.

With Payroll for North America, you can design the payroll system to meet your organization's specific requirements. Provide the system with some basic information about the types of balances that you want to maintain, how you want to group the workforce, and when you want to pay them. You can define and establish earnings, deductions, taxes, and processes that fit your unique business needs. The payroll system enables you to calculate gross-to-net or net-to-gross pay, leave accruals, and retroactive pay. You can automatically calculate imputed income for group-term life insurance and process unlimited direct deposits.

With this application you can:

Define various earnings types including regular earnings and additional pays.

Process compensation with multiple compensation rates.

Designate shift schedules and shift premium calculation rules.

Define deduction types for benefit premiums, tax withholdings, garnishments, and other deductions.

Determine the types of payroll accumulator balances that you want to maintain and use.

Define employee pay groups, which are groups of employees that share common payroll characteristics, such as working for the same organization or sharing the same pay frequency or pay date.

Establish pay calendars that reflect the various payroll periods, pay dates, and Fair Labor Standards Act (FLSA) periods throughout the year.

Designate employee holidays for payroll processing.

Create pay run IDs to process payrolls more efficiently.

Establish general rules for processing and paying garnishments.

Set up direct deposits for the workforce.

Set up U.S. Savings Bond information.

Set up Canada Savings Bonds and Canada Payroll Savings (CPS) program information.

Support contract pay for employees in education-related organizations, such as faculty employees who work a nine-month contract that is paid over 12 months.

Define control data for creating paysheets and running other batch processes.

Specify the various companies within your organization and maintain separate payroll data for each—everything from general ledger accounts, to tax information, and unique payroll processing and payment rules.

Payroll for North America Business Processes

Payroll for North America Business Processes

Payroll for North America supports the following business processes:

Set Up and Maintain Core Payroll Tables

Core payroll tables are the tables that are required to implement the Payroll for North America application, including organization tables, compensation and earnings tables, deduction tables, pay calendar tables, garnishment tables, vendor tables, general ledger interface, tax tables, retroactive processing, and tip allocation.

Set Up and Maintain Employee Pay Data

Employee pay data includes personal data, job data, benefits data, federal, state/provincial, and local tax information, general and benefit deductions, additional pay, garnishments, savings bonds (Canada), and direct deposits.

Process the Payroll

The basic steps of payroll processing are: create paysheets, pay calculation, pay confirmation, and generate checks and direct deposits. You can employ audit reports and data review pages to verify and correct the results of each step before moving on. You can also review and adjust employee balances.

Post to General Ledger

Use the integration with PeopleSoft Enterprise General Ledger and Enterprise One General Ledger to transfer the expenses and liabilities incurred from a pay run to the General Ledger application.

Pay Taxes

Use the integration with PeopleSoft Enterprise Payables to transmit tax data to the Payables application for automatic payment to tax authorities.

Pay Third Parties

Use the integration with Payables to transmit employee and employer deductions such as garnishments and benefit deductions to the Payables application for automatic payment to third parties.

Produce Reports

Payroll for North America provides dozens of reports to help you monitor payroll processing and comply with regulatory and tax reporting requirements. You can view reports online or print hard copies. You can also tailor the reports to fit the special needs of your organization.

Optional Features

Within the framework of payroll processing already outlined, Payroll for North America supports the following additional business processes:

(CAN) Savings bonds.

Group-term life insurance imputed income (U.S. and Canada).

(USA) Tip allocation.

(USA) FLSA and Alternative Overtime processing.

(CAN) Canada Payroll Savings programs.

(CAN) Canadian low-interest loans.

(CAN) Business Payrolls Survey reporting.

(CAN) Record of Employment reporting.

(USF) Credit military service to civilian retirement.

(USF) Pay caps and limits processing.

(USF) Within grade increase/tenure nonpay hours processing.

(USF) Agency interface processing.

(USF) Individual Retirement Record and Register of Separations and Transfers reporting.

(E&G) Contract pay administration.

(E&G) Tax treaty processing for nonresident aliens.

We discuss these business processes in the business process chapters in this PeopleBook.

Payroll for North America Integrations

Payroll for North America Integrations

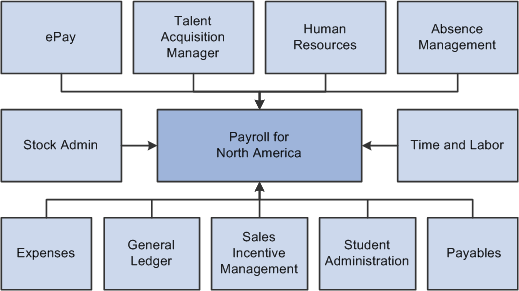

Payroll for North America integrates with these PeopleSoft applications, including HRMS, Time and Labor, and Student Administration:

Illustration showing the main PeopleSoft applications that integrate with Payroll for North America

We discuss integration considerations in the implementation chapters in this PeopleBook.

Supplemental information about third–party application integrations is located on the My Oracle Support website.

With PeopleSoft's product integration technology, the system can:

Retrieve an employee's social security number (or social insurance number) and address from the PeopleSoft Human Resources application.

Retrieve the benefit plans for which an employee is eligible from the PeopleSoft Human Resources Base Benefits business process for processing.

Load computed absence results from PeopleSoft Absence Management to paysheets for processing.

Retrieve funding source information for earnings and fringe costs from the PeopleSoft Human Resources Manage Commitment Accounting business process.

Transmit employee pay data to PeopleSoft Enterprise ePay for online access by employees.

Retrieve online employee changes to direct deposit information, voluntary deductions, W-2 reissue requests, and federal W-4 tax information from ePay.

Load data from monetary awards and non-monetary/non-stock awards from the variable compensation business process within PeopleSoft Human Resources to paysheets for processing.

Load approved employee referral award amounts from the Talent Acquisition Manager application to paysheets for processing.

Load time and labor data, such as payable time, from the PeopleSoft Enterprise Time and Labor application to paysheets for processing.

Load refund information and tax data from the PeopleSoft Enterprise Stock Administration application to paysheets for processing.

Load approved employee advance and expense reimbursement amounts from the PeopleSoft Enterprise Expenses application to paysheets for processing.

Load refund credit balances to students, customers, or external organizations onto paysheets for processing.

These refund credit balances are transmitted to Payroll for North America by PeopleSoft Student Administration.

Transmit employee and employer deductions, such as taxes, garnishments, and benefit deductions, to the PeopleSoft Enterprise Payables application for automatic payment to third parties.

Transmit the expenses and liabilities incurred from a pay run to the General Ledger application.

Validate payment requests from PeopleSoft Enterprise Sales Incentive Management (SIM), transmit a message identifying invalid transactions, load valid transactions to paysheets, and publish a payment notification message to the SIM application after payroll is processed and confirmed.

Note. The Load Paysheet Transactions process loads transactions from sources other than PeopleSoft applications to paysheets for processing. Such transactions require a paysheet update source of Other Sources.

See Data Input Requirements for Third-Party Paysheet Data.

See Also

Integrating with PeopleSoft Enterprise Time and Labor

Integrating with PeopleSoft HRMS and Enterprise Expenses

Integrating with Enterprise General Ledger

Integrating with PeopleSoft Payables

PeopleSoft Enterprise Human Resources 9.1 PeopleBook: Manage Commitment Accounting

Payroll for North America Implementation

Payroll for North America Implementation

PeopleSoft Setup Manager enables you to generate a list of setup tasks for your organization based on the features that you are implementing. The setup tasks include the components that you must set up, listed in the order in which you must enter data into the component tables, and links to the corresponding PeopleBook documentation.

Payroll for North America also provides component interfaces to help you load data from your existing system into Payroll for North America tables. Use the Excel to Component Interface utility with the component interfaces to populate the tables.

This table lists all of the components that have component interfaces:

|

Component |

Component Interface |

References |

|

PAY_RUN_TABLE |

PAY_RUN_TABLE |

See Creating Pay Run IDs. |

|

GENL_DEDUCTION_TBL |

GENL_DEDUCTION_TBL |

|

|

GDED_COM_TBL |

GDED_COM_TABLE |

|

|

TAX_LOCATION_TBL |

TAX_LOCATION_TBL |

|

|

COMP_LOCAL_TAX_TBL |

COMP_LOCAL_TAX_TBL |

|

|

SPCL_EARNS_TABLE |

SPCL_EARNS_TABLE |

|

|

TERM_ACTN_RSN |

TERM_ACTN_REASON |

|

|

TERM_PGM_TBL |

TERM_PGM_TABLE |

|

|

FLSA_CALENDAR |

FLSA_CALENDAR |

|

|

TAX_TYPE_TBL |

TAX_TYPE_TABLE |

See Setting Up Tax Types for PeopleSoft Enterprise Payables Integration. |

|

CO_UI_RPTCD_TBL |

CO_UI_RPTCD_TABLE |

|

|

TREATY_NR_ALIEN_TA |

TREATY_NR_ALIEN_TA |

|

|

US_SOC_TBL |

US_SOC_TABLE |

See (USA) Establishing Standard Occupational Classifications. |

|

CAN_WCB_CU_RATES |

CAN_WCB_CU_RATES |

|

|

RETROPAY_PGM_TBL |

RETROPAY_PGM_TBL |

|

|

TIPS_ESTAB_TBL |

TIPS_ESTAB_TABLE |

Other Sources of Information

In the planning phase of your implementation, take advantage of all PeopleSoft sources of information, including the installation guides, table-loading sequences, data models, and business process maps.

See Also

PeopleSoft Enterprise HRMS Application Fundamentals Preface

Enterprise PeopleTools PeopleBook: PeopleSoft Setup Manager

Enterprise PeopleTools PeopleBook: PeopleSoft Component Interfaces