Overview of Payroll Integration

Overview of Payroll IntegrationTime and Labor transmits the payable time created by the Time Administration process to a payroll application, such as Payroll for North America or Global Payroll. The payroll application compensates time reporters for their payable time and—at the end of the pay run—sends labor-related costs back to Time and Labor, where they are distributed across payable time and made available to Project Costing and other applications.

This chapter provides an overview of payroll integration and discusses how to:

Integrate Time and Labor and Payroll for North America.

Integrate Time and Labor and Global Payroll.

Integrate absence event data.

See Also

Overview of Payroll Integration

Overview of Payroll IntegrationBefore using your payroll system to pay employees for time reported in Time and Labor, you must integrate your systems. This entails:

Mapping time reporting codes (TRCs) to your payroll system's earnings codes.

Selecting settings on various pages within Time and Labor, your payroll system, and PeopleSoft Human Resources.

Configuration requirements vary by payroll system and are described later in this section.

After the setup is complete, payroll personnel can include payable time, created by the Time Administration process, in pay runs. Depending on how you configure Time and Labor, payroll personnel can distribute the resulting costs back to payable time for other products to use. This chapter discusses the relationship between payable time created in Time and Labor, your payroll application, and other applications that can use cost data.

Note. Payable time is available to third-party applications; however, PeopleSoft does not deliver a process for publishing to third-party applications.

General Procedure for Running a Payroll with Payable Time

General Procedure for Running a Payroll with Payable TimeProcedures for including payable time in pay runs vary by payroll system; however, the general steps that apply to both Payroll for North America and Global Payroll are as follows:

In Time and Labor, a user runs the Time Administration process to create payable time for the workgroups with time reporters to pay.

In the payroll system, a user sets up the calendars and run IDs for the payroll process.

The payroll system defines who is to be paid and for what period of time. This information is used to select employees in the pay group who have been active at any time during the pay period.

Payable time entries are selected from Time and Labor and sent to the payroll system.

The first time this occurs, all payable time that meets the selection criteria is sent. After that, only payable time that has been added or changed is selected, including adjustments to the current period and prior periods.

The payroll system summarizes the payable time entries.

Summarization consists primarily of totaling reported hours, units, or amounts at the earnings code or task code level. Each payroll system has its own rules for summarizing data. Pay calculations are run and the payroll cycle is completed.

The payroll system sends cost data generated by the pay run back to Time and Labor.

The Labor Distribution and Dilution processes are invoked in Time and Labor if you have selected these features.

The Labor Distribution process attaches the costs calculated by your payroll system to the corresponding payable time entries in Time and Labor.

The Labor Dilution process averages the calculated costs and evenly distributes them across the payable time entries.

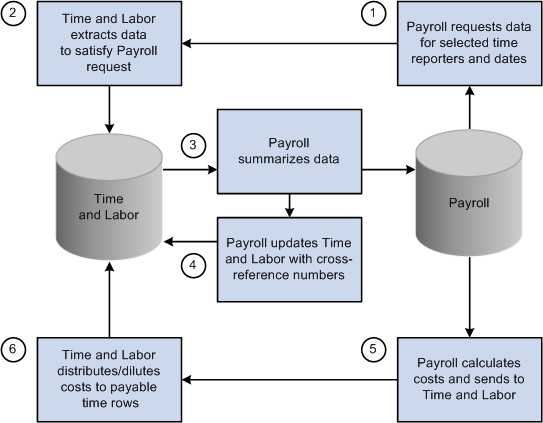

The payable status associated with each entry of payable time is updated throughout the various stages of processing. You can view payable status on the View Payable Time Detail page of the Time and Labor self-service component. The following diagram illustrates the process flow.

Process flow when Time and Labor is integrated with a payroll application

See Also

Using Manager Self-Service Components for Time Management and Reporting

Labor Distribution and Dilution

Labor Distribution and DilutionAfter a pay run is complete, payroll costs associated with time that originated in Time and Labor can be extracted from the payroll system and distributed across payable time entries. The updated time detail can then be published to other applications for additional processing.

Allocating costs back to payable time is labor distribution. Labor distribution is an optional feature of Time and Labor that you can select on the Pay System page. Select one of two options.

Labor distribution only.

This option enables you to allocate payroll costs back to the tasks for which payable time was originally reported, provided you defined the TRC as eligible for distribution. If you are not tracking time at the task level, costs are allocated to the TRCs to which time was reported.

Labor distribution and dilution.

If you select this option, the Dilution process is triggered automatically at the end of the Labor Distribution process. The system reallocates labor-distributed costs for a given day, so that payroll costs are evenly distributed over payable time entries for hourly TRCs flagged as eligible for dilution. If a time reporter is paid at different rates or—in the case of salaried workers—is not explicitly paid for overtime, Time and Labor can calculate an average hourly (diluted) amount and apply it evenly across all hours reported for the day.

Example: Effect of Labor Distribution With and Without Dilution

Assume the following time entries:

|

Date |

Hours |

TRC |

Project |

|

1 Feb |

5 |

REG |

A |

|

1 Feb |

4 |

REG |

B |

|

1 Feb |

3 |

REG |

C |

Suppose the Time Administration process applies a rule that converts hours in excess of 8 per day to overtime. The results of the rule are shown as follows.

|

Date |

Hours |

TRC |

Project |

|

1 Feb |

5 |

REG |

A |

|

1 Feb |

3 |

REG |

B |

|

1 Feb |

1 |

OT |

B |

|

1 Feb |

3 |

OT |

C |

When you run the payroll process, it consolidates the entries resulting in 8 hours of regular time and 4 hours of overtime. Regular time is paid a rate of 10.00 USD per hour; overtime is paid a rate of 19.00 USD per hour. Payroll sends the costs back to Time and Labor, which distributes the costs across the payable time entries as follows:

|

Date |

Hours |

Rate |

TRC |

Project |

Cost |

|

1 Feb |

5 |

10 |

REG |

A |

50 |

|

1 Feb |

3 |

10 |

REG |

B |

30 |

|

1 Feb |

1 |

19 |

OT |

B |

19 |

|

1 Feb |

3 |

19 |

OT |

C |

57 |

|

TOTAL |

12 |

|

|

|

156 |

The cost for project A is lower than the cost for project C, even though more hours were worked for project A. This is not equitable, given that the time reporter could have worked on the projects in any order.

The Labor Dilution process distributes costs more evenly. It divides the total cost of 156 by 12 (the total number of reported hours) to come up with a rate of 13. It then applies the same rate to all entries, as shown in the following table.

|

Date |

Hours |

Rate |

TRC |

Project |

Diluted Cost |

|

1 Feb |

5 |

13 |

REG |

A |

65 |

|

1 Feb |

3 |

13 |

REG |

B |

39 |

|

1 Feb |

1 |

13 |

OT |

B |

13 |

|

1 Feb |

3 |

13 |

OT |

C |

39 |

|

TOTAL |

12 |

|

|

|

156 |

Now project A reflects a diluted cost that is proportionate to the number of hours worked.

Labor distribution rules are:

The Labor Distribution process allocates costs back to payable time entries according to the level of detail supported by the payroll system.

The criteria that the payroll system uses to consolidate payable time entries determines the level of detail.

When all TRCs participating in labor distribution are of the same type (amount, units, or hours), costs are allocated evenly, based on the reported values.

When one or more TRCs are defined with an amount type, the Labor Distribution process:

Allocates the amounts that were originally reported back to TRCs with an amount type.

Allocates the remaining costs across TRCs with a type of hours or units.

When payable time status is set to Closed and the associated reason code is Not Distributed (NDS), (that is, it will not be sent to a payroll system or will not participate in labor distribution), the estimated gross amount (Est_Gross) populates both the labor distribution amount field (Lbr_Dist_Amt) and the diluted labor distribution amount field (Diluted_Gross).

In addition, the currency code (Currency_Cd) used to calculate estimated gross populates the currency code used for the labor-distributed and labor-diluted amounts (Currency_Cd2).

Record-only adjustments are not sent to payroll for processing, thus they are not included in the Labor Distribution process.

You can manually update the labor distribution and labor dilution amount through the Adjust Paid Time page.

See Understanding Payable Time.

Integrating Time and Labor and Payroll for North America

Integrating Time and Labor and Payroll for North AmericaThis section provides an overview of integrating Time and Labor and Payroll for North America, and discusses how to:

Configure Time and Labor for use with Payroll for North America.

Prepare Time and Labor data for Payroll for North America.

Load Time and Labor data.

Run the payroll process.

Reverse or adjust a paycheck.

Extract costs after a pay run.

Adjust payable time.

Refresh data.

Correct errors generated during the load and extract processes.

Processing Overview

Processing OverviewThis section describes the steps involved in preparing for and running a payroll when Time and Labor is integrated with Payroll for North America.

To prepare for and run the payroll:

Configure Time and Labor for use with Payroll for North America.

Run the Time Administration process in Time and Labor to create payable time for the time reporters to be paid.

Load payable time created by the Time Administration process into Payroll for North America.

Run the payroll process and confirm the pay run.

Extract data from payroll and send to Time and Labor.

The Extract process triggers the Labor Distribution and Labor Dilution processes if you've enabled these features in Time and Labor.

Steps 1 and 2 are the steps you perform in Time and Labor. The other interactions are initiated through Payroll for North America.

Configuring Time and Labor for Use with Payroll for North America

Configuring Time and Labor for Use with Payroll for North America

Before you can use Time and Labor with Payroll for North America, you must configure both systems appropriately. You must also select options on the Installation table and set up employee job data in the Administer Workforce business process of PeopleSoft Human Resources.

This section discusses how to:

Configure Time and Labor.

Configure Human Resources.

Configure the Installation table.

Configuring Time and Labor

To configure Time and Labor for integration with Payroll for North America:

On the Pay System page, select the distribution features to use for Payroll for North America.

By default, Labor Distribution is selected and Labor Dilution is not.

On the Time Reporting Codes - Definition page, map each time reporting code to the appropriate earnings code defined in Payroll for North America.

If you want the TRC to be eligible for labor distribution, select the Distribute Costs option. If you want an hourly TRC to be eligible for labor dilution, select the Used in Labor Dilution option.

If a TRC is set up for labor distribution or dilution, but Labor Distribution or Labor Dilution is not enabled on the Pay System page, distribution and dilution don't occur.

Note. We recommend that you use the Sync (synchronize) feature on the TRC Setup 1 page to synchronize time reporting codes with the earnings codes defined in Payroll for North America.

On the Create Time Reporter Data page or the Maintain Time Reporter Data page, select the Send Time to Payroll option for each employee.

Payroll for North America does not create paysheets for non-employees.

On the TL Installation page, select the appropriate settings in the TL/ NA Payroll Options group box.

Configuring Human Resources

To configure PeopleSoft Human Resources for integration of Time and Labor with Payroll for North America:

For each employee, ensure the Payroll System field on the Job Data - Payroll page is set to Payroll for North America.

Set the Employee Type field on the Job Data - Payroll page to E (exception hourly) or H (hourly).

If the Employee Type field on the Job Data - Payroll Page is set to S (salaried), any hours mapped to the default REG earnings code aren't loaded to paysheets. However, costs are labor-distributed across these hours if the Distribute Costs option is selected for the TRC. Select E or H. This enables the system to send updated costs for prior period adjustments to payroll and your general ledger application. If you set up employees with S, Time and Labor populates the labor distribution amount and the diluted gross amount with an estimated gross for these entries. These entries are available as actual costs to publish to Project Costing, but don't flow through Payroll for North America to your general ledger application.

Configuring the Installation Table

Select the Time and Labor and Payroll for North America paysheet options on the Product Specific page of the Installation Table component (INSTALLATION_TBL).

Use this information to determine your settings:

Change Final Check, Change Online Check, or Change Reversal Adjustments options.

We recommend that you do not select these options because they control whether users can make paysheet changes to data that is retrieved from Time and Labor. If you select these options, any changes made directly to the paysheets aren't transmitted back to Time and Labor.

Load in Preliminary Calc (load in preliminary calculations) option.

The Pay Calculation process uses the value of the Load in Preliminary Calc field to determine whether to load new available time (additional time that was worked before the job change but not previously entered on paysheets):

If you select this check box, the system loads all valid available time to the new paysheets, including new available time.

If you clear this check box, the process does not load any new available time to paysheets.

Note. If an employee had a Job data change that caused paysheets to be rebuilt, the preliminary Pay Calculation process attempts to reload all valid time and rejects time that is no longer valid as a result of the job change. This is true regardless of the setting of the Load in Preliminary Calc field. As a result, some new time might be loaded for employees who had a Job data change, even when this option is not selected on the Installation table.

See Also

Setting Up Implementation Defaults

Setting Up the Interface with Time and Labor

Preparing Time and Labor Data for Payroll for North America

Preparing Time and Labor Data for Payroll for North AmericaBefore a payroll user starts the payroll process, you must run the Time Administration process for the population of time reporters to be paid.

Note. Payroll for North America uses pay groups to define the population of employees to be paid. Before a pay run, verify that the Time Administration process has run for all members of the pay groups to be paid.

See Also

Launching the Time Administration Process

Loading Time and Labor Data

Loading Time and Labor Data

These processes, run from Payroll for North America, load payable time for payroll processing:

Time and Labor/Payroll Update COBOL SQL process (PSPLDTL1).

Pay Calculation process.

Final check.

Online check.

If your payroll department prepares paysheets several days before the preliminary pay run, you may want to run the Time and Labor/Payroll Update process directly to retrieve payable time at the beginning of the process. Payable time created or changed after this point can be quickly loaded into the paysheets when you run the preliminary Pay Calculation process.

The load processing performs several steps:

Selects payable time entries in Time and Labor.

Passes payable time entries to payroll.

Consolidates payable time entries.

Updates paysheets or creates new paysheets if none exist.

Time and Labor selects the payable time; Payroll for North America does the rest.

Selecting Payable Time

Time and Labor retrieves payable time that meets the criteria defined by the pay run ID, pay calendars, and other selection criteria specified in the Time and Labor/Payroll Update process run control parameters in Payroll for North America. For each calendar, Time and Labor selects all payable time that meets the selection criteria, excluding record-only adjustments, up to the pay end date for all time reporters associated with the calendar.

A payroll user initiates the Time and Labor/Payroll Update process from the Load Time and Labor component (PY_LDTL_RC), specifying the pay run ID, additional filtering criteria, and identifying which data should be loaded to separate checks. Based on the options selected in this component, the process selects appropriate payable time from Time and Labor records.

For Time and Labor to load payable time into Payroll for North America, the following criteria must also be met:

The payable status of the payable time entry must be set to one of the following:

ES (Estimated – Ready for Payroll)

AP (Approved – Goes to Payroll)

SP (Sent to Payroll)

RP (Rejected by Payroll)

TP* (Taken-Used by Payroll)

PD* (Paid – Labor Distributed)

DL* (Paid – Labor Diluted)

CL* (Closed)

* Entries with a payable status of TP, PD, DL, or CL are selected only if you choose the Refresh Request option when initiating the load process, or if the Payroll Request Number has been reset to 0 because of a payroll unsheet. Time and Labor loads payable time for closed entries if the Pay System flag is set to NA. Closed entries are first set to RP by the refresh request and are then reselected. Refresh requests should be used only when payable time data has become corrupted or lost.

RV (Reversed)

The Reversed payable time status exists to handle check reversals in Payroll for North America. The Payroll for North America Reversal process generates payable time rows with this status. Time and Labor generates the reversed payable time row and any new payable time to be loaded in a subsequent Load process. This process occurs after Payroll for North America has successfully completed the Confirm Pay process.

The process of generating an additional row to be loaded in a subsequent Load process depends on the option selected in the Reversal process from Payroll for North America.

See Correcting Unconfirmed Time and Labor Payable Time Generated by a Check Reversal.

Note. Time with a payable status of NA (needs approval) is never selected.

The employee who reported the time has been set up for payroll processing.

The time reporting code associated with the payable time has been mapped to an active earnings code.

The currency used in Time and Labor matches the currency defined for the pay group in Payroll for North America when the reported quantity is an amount.

How Payroll for North America Updates Selected Payable Time Records

Payroll for North America updates each payable time entry for the selected time reporters.

For payable time entries loaded into Payroll for North America, the system:

Sets payable status to SP for payable time entries that have a payable status of ES, AP, or RP.

If the entry has already been labor-distributed or labor-diluted, it retains its current payable status of PD or DL. If the entry currently has a payable status of CL , but is not subject to labor distribution, it retains its current status.

Sets the TL Pay System indicator to NA Payroll for North America.

Sets the payroll request number to the appropriate payroll request.

The system-generated request number is important if payroll clerks need to refresh or reload data later.

For payable time entries not accepted by Payroll for North America, Time and Labor sets the payable status to RP.

Note. You can see the payable status for a selected time reporter's payable time entries on the View Payable Time Details page.

Consolidating Payable Time and Creating Paysheets

Paysheets are the pages and tables that contain all current payroll information—earnings, deductions, hours, taxes, and other accounting data—for the specified employees and pay period. When the Time and Labor/Payroll Update process loads payable time entries into Payroll for North America, it summarizes the entries according to the application's consolidation rules. Use the Pay Group Table - Time and Labor page in Payroll for North America to instruct the system to create separate rows on the paysheets for payable time entries that have the same combo code, business unit, department, job code, locality, position number, Project Costing business unit, project ID, activity ID, or state.

Note. If Time and Labor passes an override rate to Payroll for North America, and a rate already exists on the earnings code definition, the rate on the earnings code definition takes precedence. If Time and Labor passes an amount, and the earnings code has a flat amount value defined on a flat amount earnings type, the flat amount on the earnings code takes precedence.

Payroll for North America keeps track of how it consolidates payable time and tracks the combined entries by passing back a payroll cross-reference (XREF) number to Time and Labor for each Time and Labor sequence number. At the same time, the system:

Updates entries with a payable status of SP to TP, RP, or CL if labor distribution is not enabled.

When payable status is set to CL, actual costs can be published to PeopleSoft Financials.

Sets the Frozen Flag to Yes, and sets the Frozen Date field to the pay period end date of the associated pay calendar.

After consolidating entries, Payroll for North America automatically creates paysheets—the tables and pages that summarize all payment data. If current paysheets have already been created for any of the time reporters, the payroll process updates the existing paysheets, rather than creating new ones.

See Also

Configuring Time and Labor for Use with Payroll for North America

Integrating with PeopleSoft Enterprise Time and Labor

Running the Payroll Process

Running the Payroll Process

After creating paysheets, a payroll user runs the Pay Calculation and the Pay Confirmation processes as usual.

Depending on the options selected on the Installation Table - Product Specific page, any payable time that has not been sent to payroll before may be automatically loaded when the preliminary Pay Calculation process begins. This includes data that has been updated, such as data for employees who have had a job change.

Unsheeting a Pay Run

When a pay run is unsheeted, Payroll for North America changes the payable status of Time and Labor entries from Taken – Used by Payroll (TP) to Rejected by Payroll (RP) with the reason code Cancelled, and resets the payroll request number to 0. Entries with a payable status of Distributed (PD) or Diluted (DL) retain their payable status, but the payroll request number is set to 0. Resetting the payroll request number enables Payroll for North America to reselect the time. (Only time that has a payroll request number of 0 is selected.)

Reversing or Adjusting a Paycheck

Reversing or Adjusting a Paycheck

Payroll for North America check reversals enable you to track reversed time in Payable Time, or repay time in a new check. Check reversals can be done in the same pay cycle or different pay cycle and can be done before or after the Extract Cost process.

The way in which Time and Labor and Payroll for North America handle paycheck reversals and adjustments depends on the selections you make on the Paycheck Reversal/Adjustment page in Payroll for North America. This page contains two options in the Process Request Parameter(s) group box. These options are available on the page if payable time exists in the paycheck with any of these statuses: Taken – Used by Payroll (TP), Distributed (PD), Diluted (D), and Closed (CL). The options are:

Reversal – generates a new row in Payable Time with the status of Check Reversal (RV).

Reversal/Adjustment – generates a new row in Payable Time with the payable status of Check Reversal (RV) and an additional row to be loaded for future payment. The payable status of the additional row is Estimated – Ready for Payroll (ES).

Note. Payable Time with the Check Reversal status is not displayed on the Adjust Paid Time page in Time and Labor.

The process that creates the offset and new rows in Payable Time is triggered after the Pay Confirmation process completes successfully. This ensures that check reversal is confirmed and not unsheeted. If an Unconfirm occurs in Payroll for North America, followed by deletion of a check reversal, Time and Labor removes the reversed and new rows in Payable Time.

The rows with a payable status of Check Reversal (RV) that are created in Payable Time are published to Project Costing to keep track of reversed time. This occurs when the Extract Costs process is run, or when the Time and Labor Pay Reversal process is triggered after the Pay Confirm process.

See Reversing Time and Labor Payable Time.

See Also

Correcting Unconfirmed Time and Labor Payable Time Generated by a Check Reversal

Extracting Costs After a Pay Run

Extracting Costs After a Pay Run

After loading payable time into Payroll for North America and running and confirming the payroll calculation process, Payroll for North America initiates the Extract Time and Labor Costs Application Engine process (PY_PULL_COST) to extract cost data that was generated through:

On-cycle and off-cycle pay runs.

Final check.

Online check.

What the Extract Process Does

The Extract process updates the payable time entries in Time and Labor as follows:

If the payable time is distributed, but not diluted, the Extract process changes the payable status to Distributed (PD).

If the payable time is distributed and diluted, the Extract process changes the status to Diluted (DL).

Note. For time that is not being distributed , the Load Time and Labor process sets the payable time status to Closed (CL).

Provides the cross-reference (XREF) numbers generated during the consolidation process, the calculated costs, and percentages that represent how payroll consolidated the payable time rows.

The system uses percentages when the consolidation process is not clean.

Triggers the Labor Distribution and Labor Dilution processes in Time and Labor, if applicable.

Sets the publish date and publish switch.

Note. If Payable Time is pulled into paysheets, and Ok to Pay is cleared for those related earnings, these rows of payable time are not paid.

Example: Percentages Returned by the Extract Process

Of a time reporter's total hours, 75 percent are subject to New York state tax and 25 percent are subject to Connecticut state tax. In this case, the consolidation process creates two pay earnings rows for the individual—one for each state. The Extract process would return the percentages along with the resulting costs, so Time and Labor can distribute the costs during the Labor Distribution process.

Distributing and Diluting Costs

Costs are always distributed across payable time for the current period, prior period adjustments, and advance payments. You can view distributed and diluted costs on the Payable Time Detail page in the Time and Labor self service transactions.

If the pay calendar is on-cycle, then on-cycle earnings can only be distributed once; off-cycle earnings can be distributed multiple times. If the Pay Calendar is off-cycle, then its off-cycle earnings can only be distributed once. The system overlays existing labor distribution amounts with new amounts. This iterative processing makes it possible to redistribute earnings after modifying or adjusting pay-related information. Subsequent runs create offsets for existing paid time entries.

If Project Costing is installed, actual payable time entries that are closed, diluted, or distributed are published automatically to Project Costing after running the extract job.

Labor Distribution with Paycheck Reversals

For a discussion of labor distribution and paycheck reversals:

See Check Reversals (Payroll for North America).

Adjusting Payable Time

Adjusting Payable Time

This section discusses the adjustment of payable time.

Normal Adjustments

Normal adjustments to payable time are changes or additions to payable time using any of the time reporting pages. If you make normal adjustments after loading payable time into Payroll for North America, run the Time Administration process again so that the changes are sent to Payroll for North America during the next load process.

If you enter an adjustment after the Frozen flag is set (that is, once the payable status is set to AP, CL, or SP), and the Time Administration process finds an existing entry that has the same time reporting code and task information as your adjusting entry, it creates a new row of payable time and a row that offsets the original entry. Both the new and offsetting rows are sent to Payroll for North America when you next load payable time.

Record-Only Adjustments

Record-only adjustments entered on the Record Only Adjustment page are not sent to Payroll for North America; however, they can affect the results of the Labor Distribution process and the costs that are published to Project Costing.

If you run the Labor Distribution process, make a record adjustment to a payable time record that's already been distributed, and then rerun Labor Distribution, no cost is distributed for the adjusted record.

An error message will display the sequence number of the payable time entry that isn't redistributed.

If you make a record-only adjustment to an entry that was previously sent to Payroll for North America, the labor distribution amount and diluted labor distribution amount are copied to both the offset row and the new row.

You can alter the values for labor distribution and labor dilution on the new row, if needed. The amounts associated with the new row are the amounts that will be published to Project Costing.

If you insert a new row on the Record Only Adjustment page (rather than correct an existing row), you can enter values in both the Labor Distribution Amount and Diluted Labor Distribution Amount fields.

If you do not enter a value in the Diluted Labor Distribution Amount field, a zero amount will be published to Project Costing as the actual diluted labor distribution amount when the payable status changes to CL.

See Also

Using Manager Self-Service Components for Time Management and Reporting

Integrating with PeopleSoft Financials and Enterprise Performance Management

Refreshing Data

Refreshing Data

A Refresh Request option in Payroll for North America enables users to reselect all payable time passed to payroll during the original load process. This includes current data, prior period adjustments, and any new payable time entries where the payable status is set to ES, CL, SP, or RP. This feature enables a user to recapture lost data, and should be used only as a recovery measure.

Warning! Refresh requests have a significant impact on system performance and should be used only when time has been corrupted or lost and you need to reload all time associated with a particular Payroll Request Number.

See Also

Integrating with PeopleSoft HRMS and Enterprise Expenses

Correcting Errors Generated During the Load and Extract Processes

Correcting Errors Generated During the Load and Extract Processes

This section discusses the correction of errors generated during the Load and Extract processes. The Review Time and Labor Load component enables you to identify and view load messages by employee.

See Reviewing Results and Correcting Errors.

Load Process Errors

Payroll personnel are advised to review the paysheets and check for error messages created during processing. During the Load Time and Labor process, payable time can trigger the processing errors listed in the following table. In all cases, the payroll system changes the payable time status to RP. Correct the error, run the Time Administration process again, if necessary, and advise the payroll clerk to rerun the Load Time and Labor process.

|

Error |

Action |

|

Invalid Mapping of TRC to NA Earnings Code |

Correct the mapping on the TRC page. It's possible the earnings code was inactivated after it was mapped to the TRC. |

|

Invalid Currency of TRC for the NA Pay Group |

Correct the currency on the TRC page. Time and Labor does not perform any currency conversion. |

Other reasons that payable time can be rejected are:

A time reporter is not active in JOB.

A time reporter has changed pay groups in the pay period that is being processed.

The TRC in payable time is mapped to an earnings code in Payroll for North America that is not in the time reporter's earnings program.

You run PayUnsheet and all payable time is set to a payable status of Rejected.

Reported state and locality overrides are not found in the Employee Tax Data tables.

Note. Depending on the Installation table options selected, payroll users may be able to modify paysheet data that originated in Time and Labor when producing a final check, online check, or doing reversal adjustments. However, because changes made on the payroll pages will not be reflected in Time and Labor, we recommend that you make all corrections in Time and Labor.

Extract Process Errors

|

Error |

Action |

|

Multiple currencies cannot be distributed. |

Depending on the source of the error, adjust the currency for the reported time in Time and Labor or change the currency for the entry in Payroll for North America. |

See Also

Reviewing Results and Correcting Errors

Integrating Time and Labor with Global Payroll

Integrating Time and Labor with Global PayrollThe Global Payroll core application handles both payroll and absence processing.

This section provides an overview of integrating Time and Labor and Global Payroll and discusses how to:

Configure Time and Labor for Integration with Global Payroll.

Load Time and Labor data.

Correct errors generated by Payable Time.

Update Payable Time after a pay run.

Share work schedules with Global Payroll.

Integrate absence event data.

Processing Overview

Processing OverviewThe steps involved in preparing for and running a payroll when Time and Labor is integrated with Global Payroll are listed as follows.

To prepare for and run the payroll:

Prepare the time and labor data by running the Time Administration process for the time reporters to be paid.

Global Payroll uses pay groups to define the population of employees to be paid, while the Time Administration process uses work groups to generate payable time. Be sure to run the Time Administration process for all work groups that include the time reporters in the pay groups that will be selected for payment.

Run the payroll process.

This automatically loads payable time from Time and Labor. Global Payroll retrieves the appropriate set of payable time from Time and Labor at the beginning of the process. The first time the payroll process runs, Global Payroll processes all employees identified in the current calendars. During subsequent runs, Global Payroll processes only those payees in error or with changes.

Finalize the pay run.

Run the Time and Labor process to distribute payroll costs to payable time rows in Time and Labor.

You can run both Labor Distribution and Labor Dilution if these features are enabled based on the settings on Time and Labor's Pay System page.

Perform step 1 in Time and Labor. All other interactions are initiated through Global Payroll.

See Running a Payroll with Time and Labor Data.

Planning Considerations

While Global Payroll and Time and Labor are designed to integrate seamlessly, both are rules-based systems capable of executing some of the same types of rules. Before integrating the two products, think carefully about which rules you want each system to apply. In general, you should define all rules that calculate payable time, including rules for overtime, shift differentials, and other special situations in Time and Labor. Create rules that calculate pay in Global Payroll.

See Also

Configuring Time and Labor for Integration with Global Payroll

Configuring Time and Labor for Integration with Global Payroll

This section discusses how to:

Configure Time and Labor.

Configure Human Resources.

Configuring Time and Labor

Decide on a strategy for mapping time reporting codes to earnings elements. Consider the following options:

Define one earnings element that accumulates to gross.

This is the earnings element the payroll process uses to calculate a payee's pay slip. Do not map this element to a TRC.

Define a second earnings element that does not contribute to gross pay.

This earnings element is used for costing purposes only and, in addition to the payee's salary, can include overhead costs or any other costs (such as an employer-paid health insurance premium). You map this element to a TRC so that accurate cost data can be sent back to Time and Labor and made available to cost accounting, planning, or budgeting applications.

Time from Time and Labor can be reported in hours, units or amounts, based on TRC type. When mapping TRCs to earnings elements, consider how the TRC type corresponds to the calculation rule defined for the element.

To set up Time and Labor:

For each type of payable time to send to Global Payroll, map the TRC to the appropriate earnings, deduction, or absence Take element defined in Global Payroll.

Use the TRC 1 page to map TRCs to elements. The system selects the Send to Payroll option on the TRC Setup page when you map a TRC to an element.

Select the desired distribution options for Global Payroll on the Pay System page.

By default, Labor Distribution is selected and Labor Dilution is not. The Labor Distribution option enables Global Payroll to send costs generated by a pay run back to Time and Labor so that Time and Labor can distribute the costs across the original payable time entries. The dilution feature is an extension of the distribution process. It enables Time and Labor to evenly distribute payroll costs across payable time.

On the Create Time Reporter Data page or the Maintain Time Reporter Data page, select the Send Time to Payroll option for each time reporter.

Configuring Human Resources

To set up PeopleSoft Human Resources:

For each time reporter, verify that the Payroll System field on the Payroll page is set to Global Payroll.

Repeat step 1 for non-employees if you want to send their payable time to the payroll system.

See Also

Establishing Time Reporting Codes

Entering and Maintaining Time Reporter Data

Integrating with PeopleSoft Financials and Enterprise Performance Management

Loading Time and Labor Data

Loading Time and Labor DataPayroll personnel use the Payroll/Absence Run Control page to initiate loading payable time into Global Payroll.

When a user starts the Identify phase of the payroll process, it identifies the time reporters who have payable time during the time period defined by pay calendar.

How Global Payroll Selects Payable Time and Updates Payable Status

Global Payroll pulls only the subset of payable time that falls within the time period specified by the calendar. It does not include record-only adjustments. The following criteria must also be met:

For the current period, the payable status of the payable time entry can be:

ES – Estimated

AP – Approved

SP – Sent to Payroll

RP – Rejected by Payroll

For retro periods entries, any payable status except:

NA – Needs Approval

CL – Closed, when the Pay System field is not set to GP.

The employee has been set up for payroll processing and the TRC associated with the payable time has been mapped to an earnings or absence Take element.

The TRC is mapped to the calendar's run type (on Global Payroll's Run Type page.)

Global Payroll also updates each payable time entry as follows:

For payable time entries loaded into payroll:

Sets the payable status to SP, unless it already reads PD or DL.

Sets the Time and Labor Pay System flag to Global Payroll.

For payable time entries not accepted by payroll:

Sets the payable status to Rejected by Payroll (RP) or Ignore (IG).

Note. A time manager can close payable time that has a status of Rejected by Payroll (RP) on the Adjust Paid Time page. This sets the payroll request number to 1 and prevents the system from loading this time to payroll. Global Payroll never pulls any payable time rows which have a payroll request number equal to 1. The payable time status, however, remains Rejected by Payroll (RP).

See Adjusting Time.

The Time Administration process refers to the payable status to determine when to create offsets for adjustments to payable time. Offsets are created for all payable statuses except ES and NA.

When Time and Labor creates an offset as the result of an adjustment to payable time, Global Payroll ignores the original row of payable time and the offset row and processes the newly created row. The adjustment generates a retro trigger in Global Payroll, which causes the pay period to be recalculated and corrected in either the current pay period or in a forwarding period.

Sets the Frozen flag to Yes.

Actual costs associated with payable time can be published to PeopleSoft Financials only after the Frozen flag is set.

Set the frozen date and publish date to the system date.

Note. The View Payable Time Details page displays the payable status, pay system flag, and frozen flag for a selected time reporter's payable time entries.

Global Payroll bundles similar instances of payable time for efficient processing. It keeps track of how it bundles payable time and sends to Time and Labor a set of sequence and cross-reference numbers for each time entry at the end of the payroll process. This information is important to the distribution process. When a user starts the Calculate phase of the payroll process, Global Payroll automatically selects the payable time entries; bundles them, and inserts the bundled entries into Global Payroll's positive input tables.

If a pay run is canceled, Global Payroll deletes the payable data loaded from Time and Labor and updates the payable status for each payable time entry to RP unless the following are true:

Payable status is PD, DL, or TP.

The payable time has also been sent to another payroll system.

Global Payroll checks the Pay System flag to see if the entry was sent to another system.

During a retroactive pay run, Global Payroll always loads payable time from Time and Labor back into its generated positive input table. Payable time that was adjusted in Time and Labor has two rows of data: one row that reverses or offsets the old value and one row that contains the new value. Global Payroll only needs the new value, which it uses to determine the variance.

Correcting Errors Generated by Payable Time

Correcting Errors Generated by Payable TimeAfter a preliminary pay run is complete, review the Payable Status Report for payable time entries that Global Payroll rejected. Errors that are most likely to occur result from incorrect TRC mapping to Global Payroll earnings and deduction elements. Because Global Payroll rejects incorrectly mapped entries during the calculate phase of processing, you see the rejected items on the Payable Status report—not on the payroll inquiry pages. Use the TRC 1 page to correct mapping errors, run the Time Administration process again, and launch the pay run again. Other reasons that payable time may be rejected by Global Payroll include the use of the wrong or no Time and Labor processing period; an employee being inactive in the pay entity; cancellation of the pay run, or the TRC being omitted from the run type.

Correct discrepancies that are caused by Time and Labor data in the Time and Labor system, then run the payroll process again.

See Generating a Payable Status Report.

Currency Differences

Global Payroll converts the TRC currency into the currency of the country being processed and returns cost data in the Global Payroll processing currency. During the distribution process, the currency code for Global Payroll processing populates the CURRENCY_CD2 field in the payable time record (TL_PAYABLE_TIME) so that you can identify the currency in which the time was paid.

Updating Payable Time After a Pay Run

Updating Payable Time After a Pay Run

After a pay run is finalized in Global Payroll, a Global Payroll user initiates a batch process, GPTLCOST, that updates the payable time entries in Time and Labor. The actions that the batch process performs depend on whether the Labor Distribution and Labor Dilution features are enabled in Time and Labor.

Labor Distribution and Labor Dilution Disabled

During the batch process, Global Payroll does the following:

Changes the payable status to CL for each entry coded SP that was successfully processed and the pay system in not configured for the Time and Labor distribution process.

Sets the Pay System flag to GP.

Populates the Labor Distribution Amount field and the Diluted Labor Distribution Amount field with the estimated gross.

Labor Distribution and Labor Dilution Enabled

For each entry with a payable status of SP that was retrieved but not processed, the batch process changes the payable status to RP, unless the record was previously sent to another payroll system.

Global Payroll doesn't process a payable time entry when a user manually enters positive input for the same earnings or deduction element. User-entered positive input always takes precedence.

For each entry with a payable status of SP that was successfully processed, the batch process:

Changes the payable status to TP.

Sets the Pay System flag to GP.

Sets the Frozen flag to Yes and the frozen date to the current date.

Global Payroll also sends the cost data associated with payable time entries to Time and Labor. It also returns the original Time and Labor sequence number for each payable time entry and the corresponding cross-reference numbers that Global Payroll generated during the bundling process. The cross-reference numbers indicate which entries were bundled, making it possible to link the costs calculated for earnings and deduction back to the daily detail. At the end of the batch process, Global Payroll invokes the Labor Distribution process and the Labor Dilution process, if applicable.

See Also

Sharing Work Schedules with Global Payroll

Sharing Work Schedules with Global PayrollTime and Labor and Global Payroll use many of the same pages and records for schedule setup and assignment. In some cases, the page names vary slightly. If you're using both applications, you need to create and assign schedules only once. However, the information displayed on the scheduling pages may vary somewhat, depending on which application you access them with.

See Also

Creating Work Schedules and Schedule Definitions

Integrating Absence Event Data

Integrating Absence Event Data

This section provides an overview of integrating absence event data with Time and Labor and the payroll system, and discusses how to:

Integrate Absence Management, Time and Labor, and Payroll for North America.

Integrate the absence functionality of Global Payroll with Time and Labor.

Understanding Absence Event Integration with Time and Labor

Understanding Absence Event Integration with Time and LaborAbsence Management integration involves absence event data that is entered in Absence Management or Time and Labor, and is either integrated with either Payroll for North America or Global Payroll.

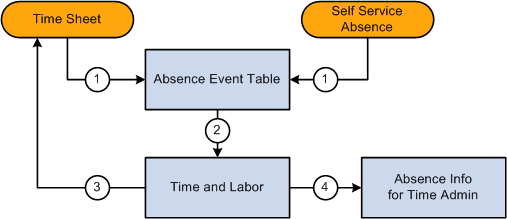

This diagram shows that absence events can be entered through either Absence Management or on the Timesheet page in Time and Labor:

Absence Event Points of Entry

The Timesheet component in Time and Labor provides a link that enables you to enter absence event information. You can add, delete, cancel, and edit absence events for the current period of interest. Employees must be enrolled in Time and Labor to use the absence grid on the Timesheet page.

The Allow entry in Timesheets check box must be selected on the Country-Take setup page in Absence Management to make the absence Take eligible for use on the Absence Event grid on the Timesheet page. Absence event data that is entered in Absence Management using an ineligible Take code (for Time and Labor) may appear on the Absence Event grid in Time and Labor, but cannot be modified.

Note. During implementation of the integration of Absence Management and Time and Labor, you must complete an analysis of your current absence Take codes that are linked to TRCs. Enable those Take codes that you want to make available for absence event entries on the Timesheet page using the Country-Take setup page in Global Payroll and Absence Management.

See Setting Up Self-Service Absence Transactions.

During implementation, align the setup of security for absence requests (in Absence Management) with absences entered on the Timesheet page (Time and Labor) so that the same manager is responsible for viewing or approving absences regardless of where the absence event entry is made. Setup the system so that absences that require multiple levels of approval cannot be entered using the Timesheet page.

Integrating Absence Management,

Time and Labor, and Payroll for North America

Integrating Absence Management,

Time and Labor, and Payroll for North America

This section discusses:

Absence event processing.

Levels of Absence Management and Time and Labor integration.

Absence Event Processing

When Payroll for North America, Absence Management, and Time and Labor are integrated, you run the Absence Conversion process after the Absence Entitlement process is completed to send absence event data directly from Absence Management to Payable Time in Time and Labor.

See Running the Absence Conversion Process to Payroll for North America.

Note. This process is to generate payable time rows for absence for North American Payroll only.

All absence rows for employees that are enrolled in Time and Labor are sent, regardless of whether the Take codes are mapped to TRCs. Time and Labor processes the rows that are mapped to TRC and deletes these rows. For the rows where the Take code is not mapped to a TRC the process ends and a message log is generated to display all those Take codes. You need to map the remaining rows to a TRC. After you map the rows, restart the process using the Process Monitor. When the process restarts, it determines if unprocessed rows exist and it processes the mapped rows first. If other rows are still not mapped, the process stops, a message log is created, and you need to repeat the procedure to map the Take codes to a TRC. The process terminates when there are no more unprocessed rows.

Note. If data is intentionally not mapped, and you do not want these rows to be sent to Time and Labor, the Process Instance can be cancelled or deleted by selecting one of those options in the Update Process group box on the Process Monitor page.

At this stage, no cost is associated with the time. When all the payroll processes are completed, the associated costs and details are sent to Time and Labor. Payable Time rows will get updated with distributed and diluted costs, if needed.

Levels of Absence Management and Time and Labor Integration

The levels of integration between Absence Management, Time and Labor, and Payroll for North America include:

Mapping. Absence pay groups must be set up and configured, time reporting codes in Time and Labor for Payroll North America and Absence Management must be set up, and Absence Management Earnings to Payroll for North America Earnings must be set up.

Job Level. Assign the Job record to Payroll for North America and Absence Management (PNA/AM mapped pay groups) and enroll the time reporter in Time and Labor.

Absence Management Process. Run the Absence Management conversion (AE program) that invokes a Time and Labor process to update Payable Time. After the process is completed, Payable Time in Time and Labor will include absence positive input, if available.

Note. Absence Management allows you to define multiple earnings while setting up the absence take. This enables a single absence take to produce multiple rows of payable time in Time and Labor.

Time and Labor and Payroll for North America Process . Run the Time Administration process in Time and Labor to generate payable time. Run the Load Time and Labor to Paysheets process from Payroll for North America and then the Paysheets process.

Note. The Time Administration process enables rules to process all of the absence time reporting codes associated with the generated positive input, whether the absence take has one or many earnings as part of the positive input membership list.

Examples of Absence Takes with Multiple Earnings

Absence Management enables you to define multiple earnings during the set up of an absence take.

For example, the following sample page displays the Absence Take - Day Formula page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Elements, Absence Elements, Absence Takes, Day Formula) with two earnings listed in the Generate Positive Input Member List region:

For the following examples, each of the earnings displayed on the Absence Take – Day Formula page is associated with a valid Time Reporting Code.

This table illustrates the relationship between the Absence Earnings Code, the Time Reporting Code, and the Payroll for North America Earnings Code for the example K0WAT TL-PTO absence take element:

|

Absence Earnings Code |

Time Reporting Code |

PNA Earnings Code |

|

K0PHOL |

K0PTO |

PTO |

|

K0WVAC PAID |

KW7 |

VAC |

Example One:

This table displays the absence hours entered by a Time Reporter:

|

TRC |

Mon |

Tue |

Wed |

Thu |

Fri |

Process Generating Payable Time |

|

K0PTO |

8 |

8 |

8 |

N/A |

Running the Absence Management conversion program creates the payable time shown in the following table:

|

TRC |

Mon |

Tue |

Wed |

Thu |

Fri |

Process Generating Payable Time |

|

K0PTO |

8 |

8 |

8 |

N/A |

||

|

KW7 |

8 |

8 |

8 |

Absence Conversion |

This table illustrates the payable time created once the Time Administration process runs, which enables rules to process all of the absence time reporting codes associated with the generated positive input:

|

TRC |

Mon |

Tue |

Wed |

Thu |

Fri |

Process Generating Payable Time |

|

K0PTO |

8 |

8 |

8 |

N/A |

||

|

KW7 |

8 |

8 |

8 |

Absence Conversion |

||

|

KUOVT |

8 |

Time Administration Rules (Create Overtime Rule Threshold > 40 of KUREG + K0PTO + KW7) |

Example Two:

The following table displays the absence hours entered by a Time Reporter:

|

TRC |

Mon |

Tue |

Wed |

Thu |

Fri |

Process Generating Payable Time |

|

K0PTO |

8 |

8 |

8 |

8 |

8 |

N/A |

Running the Absence Management conversion program creates the payable time shown in the following table:

|

TRC |

Mon |

Tue |

Wed |

Thu |

Fri |

Process Generating Payable Time |

|

K0PTO |

8 |

8 |

8 |

8 |

8 |

N/A |

|

KW7 |

8 |

8 |

8 |

8 |

8 |

Absence Conversion |

This table illustrates the payable time created once the Time Administration process runs, which enables rules to process all of the absence time reporting codes associated with the generated positive input:

|

TRC |

Mon |

Tue |

Wed |

Thu |

Fri |

Process Generating Payable Time |

|

K0PTO |

8 |

8 |

8 |

8 |

8 |

N/A |

|

KW7 |

8 |

8 |

8 |

8 |

8 |

Absence Conversion |

|

KUOVT |

8 |

8 |

Time Administration Rules (Create Overtime Rule Threshold >24 of KUREG + KW7) Note. K0PTO is not part of the value list. |

See Also

Integrating Absence Management and the Payroll System

Integrating the Absence Functionality of Global Payroll with Time and

Labor

Integrating the Absence Functionality of Global Payroll with Time and

Labor

Prerequisites for enabling absence event data on Timesheets are listed in the Managing Time chapter in this PeopleBook:

See Prerequisites for Enabling Absences on Timesheets.

Displaying Absence Event Data from Global Payroll on Timesheets

In Global Payroll, elements identify each type of earnings, deduction, and absence a time reporter can have. An element represents the set of rules that are applied during the payroll process and are somewhat similar to time reporting codes.

To integrate Time and Labor with Global Payroll absence event data, map TRCs to absence Take elements. If you're using task reporting, you may also need to map certain task codes to variable or system elements defined in Global Payroll.

When a time reporter is absent, the absence may be recorded through an Absence Entry page in Global Payroll. Time and Labor extracts and resolves absence events whenever you access the time reporting pages. First, Global Payroll checks to see if the employee is enrolled in Time and Labor, then it sends the absence event details, Take configuration, the employee's holiday schedule for the period of interest, a list of holidays, and the employee's schedule to Time and Labor. Time and Labor then generates the rows of data and displays the information on the Absence Event grid on the Timesheet page.

The setup of Time and Labor on the TL Installation page and the setup of the workgroup with which a time reporter is associated determine the way that absence information is displayed in Time and Labor.

Note. If you use the validation set delivered with Time and Labor, absences entered before a time reporter's hire date create an exception during the TR Status validation phase of the Time Administration process.

Note. Absence event data from Global Payroll is not stored in Reported Time in Time and Labor.

Example: Absence Data from Global Payroll

For each absence, Absence Management sends the code for the absence Take element, the beginning and end dates of the absence, and partial hours for absences that are less than a full day (when applicable). It also triggers the Schedule Resolution process, which looks at any full-day absences (that is, days for which no partial hours or half-days were reported), and determines the number of hours the time reporter was absent, based on his default schedule in Absence Management.

Assume a time reporter is scheduled to work 8 hours a day, Monday through Friday. An absence event is entered on Global Payroll absence pages for Monday, August 14 through Friday, August 18. A partial absence of 4 hours is reported for Monday and Friday. No hours are entered for the other absent days.

|

Monday |

Tuesday |

Wednesday |

Thursday |

Friday |

|

4 |

Hours not reported |

Hours not reported |

Hours not reported |

4 |

Absence Management sends 4 hours for Monday and 4 hours for Friday. It also invokes the Schedule Resolution process, which looks at the time reporter's schedule in Global Payroll to determine that he was absent 8 hours on Tuesday, Wednesday, and Thursday.

Note. Although Time and Labor can use absences reported in Global Payroll as criteria for rules, it never alters the reported absence data in Global Payroll.

See Integrating with PeopleSoft Enterprise Time and Labor.