4 Fiscal Requirements

This chapter contains these topics:

4.1 About Fiscal Requirements

JD Edwards solutions for fiscal requirements in Italy include the following tasks:

-

Working with registration numbers

-

Printing the Sequential Number Report

-

Printing the General Ledger Report

-

Printing the Trial Balance Report

-

Printing the G/L Registration Report

-

Working with the annual close

4.2 Work with Registration Numbers

4.2.1 Working with Registration Numbers

In Italy, original fiscal vouchers (accounts payable) and fiscal invoices (accounts receivable) must include a registration number that is both sequential and chronological. Businesses are required to coordinate data entry so that the G/L date on each document is the same or later than the date on the previous document.

Use JD Edwards localized software to edit the dates that you enter for original fiscal documents. When you use JD Edwards standard data entry programs with date edit functionality and your user preferences are set with the country preference code of IT (Italy), you automatically access the following servers each time you enter a document.

Use JD Edwards localized software to edit the dates that you enter for original fiscal vouchers and invoices. When you use JD Edwards standard data entry programs with date edit functionality, and your user preferences are set with the country preference code of IT (Italy), you automatically access the following business functions each time you enter a document.

| Server | Description |

|---|---|

| A/P and A/R Functional Servers | The system accesses the A/P and A/R Functional Servers to validate the information that you enter for invoices and vouchers. The servers also determine the appropriate next number assignments for these documents. |

| Italian Country Servers (A/P and A/R) | The system accesses the Italian Country Servers to validate that the G/L date that you enter for the document is the same or later than that of the document immediately preceding. |

You set processing options on the servers to determine the type of edit to perform for each of the documents that you enter.

| Server | Description |

|---|---|

| Server for Voucher Entry Italian Date Edits (XT0411Z3IT) | The program performs the following edits based on the processing options for the country server:

Blank No validation is performed on the date 1 A warning message is issued 2 The system prevents you from making the entry |

| Server for Invoice Entry Italian Date Edits (XT0311Z3IT) | The program performs the following edits based on the processing options for the country server:

Blank No validation is performed on the date 1 A warning message is issued 2 The system prevents you from making the entry |

Note:

You must set up your country servers with the same DREAM Writer version as the calling base program, in this case the A/R or A/P Functional Server.After you set up the processing options for the business servers, you can set up different versions of the data entry programs for fiscal documents (invoices and vouchers that include VAT) and nonfiscal documents (other documents that do not include VAT). The versions are based on the processing options you set up for the country server, in combination with the processing options for the A/R or A/P Functional Server to default the document type. Set up the version for fiscal documents to include the date editing feature. The version for nonfiscal documents can either issue a warning or not include the date editing feature.

The following graphic illustrates how the system validates dates and registration numbers.

Figure 4-1 Validating Dates and Registration Numbers

Description of "Figure 4-1 Validating Dates and Registration Numbers"

4.2.2 Before You Begin

Set up your user display preferences with a country preference code for Italy (IT). See Section 1.2, "Setting Up User Display Preferences".

4.3 Print the Sequential Number Report

4.3.1 Printing the Sequential Number Report

From Italian Localization (G74Y), choose Additional Italian Tax Processing.

From Italian Reports (G74Y093152), choose Sequential Number Report

From the Italian Reports menu (G74Y093152), choose a Sequential Number Report option.

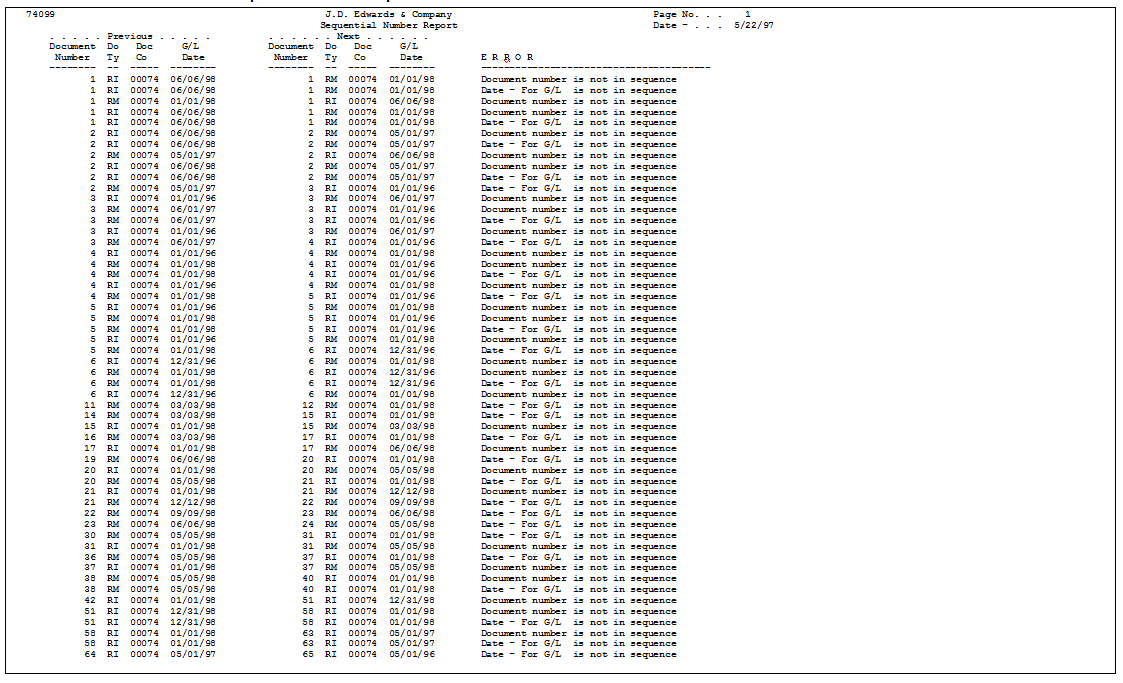

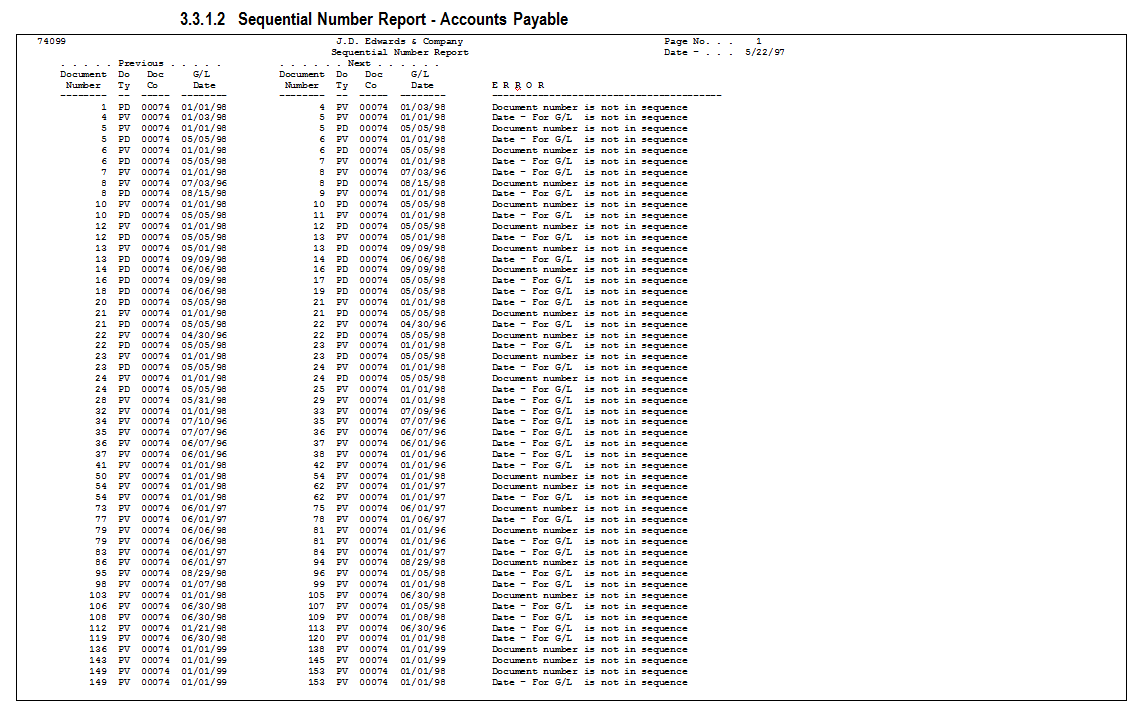

Businesses in Italy are required by law to number each original fiscal document both sequentially and chronologically. Fiscal documents are documents that include IVA taxes, such as accounts payable vouchers and accounts receivable invoices. Because each revenue and expense event must be documented in chronological order, businesses must include the numeric sequencing of each document number in the IVA registers.

You use the Sequential Number report to identify any document numbers that are out of sequence. When you print the report, the system checks the number for each document that includes an IVA amount in the following tables:

-

Sales/Use/VAT Tax (F0018)

-

Accounts Payable Ledger (F0411)

-

Accounts Receivable Ledger (F0311)

The report prints the appropriate error message for each document that meets the following conditions:

-

The document number is not sequential.

-

The General ledger date is lower than that of the previous document.

You must manually correct any errors in the sequential numbering or justify the gap in the numbering of your documents.

JD Edwards recommends that you print the Sequential Number Report daily and if not daily, at least before you change the G/L date.

You can use processing options to indicate which file you want to perform the sequential document number validation.

| File | Description |

|---|---|

| Sales/Use/VAT Tax (F0018) | To run a report that verifies that document numbers are in sequential order without interruptions, leave the processing option blank. The system prints a report based on the Sales/Use/VAT Tax file (F0018).

Create one version of the report for each print version of the monthly VAT purchasing and VAT sales reports. For example, if you use the document types PV and PD to identify Italian invoices and credit memos, create a special version of the report that selects the control data for document types PV and PD only. |

| Accounts Receivable Ledger (F0311) | To run a report that verifies that document numbers are in sequential order without interruptions, enter 1 in the processing option. The system prints a report based on the Accounts Receivable Ledger (F0311).

Create one version of the report for each document number series in the monthly VAT sales report. |

| Accounts Payable Ledger (F0411) | To run a report that verifies that document numbers are in sequential order without interruptions, enter 2 in the processing option. This report is based on the Accounts Payable Ledger (F0411).

Create one version of the report for each document number series in the monthly VAT purchasing report. |

Figure 4-2 Sequential Number Report - Accounts Receivable

Description of "Figure 4-2 Sequential Number Report - Accounts Receivable"

Figure 4-3 Sequential Number Report - Accounts Payable

Description of "Figure 4-3 Sequential Number Report - Accounts Payable"

Figure 4-4 Sequential Number Report - Accounts Receivable VAT

Description of "Figure 4-4 Sequential Number Report - Accounts Receivable VAT"

Figure 4-5 Sequential Number Report - Accounts Payable VAT

Description of "Figure 4-5 Sequential Number Report - Accounts Payable VAT"

4.3.1.1 Processing Options for Sequential Number Report (P74099)

| Processing Option | Processing Option Requiring Further Description |

|---|---|

| 1. Specify the date range to select the documents to be controlled.

From Date Thru Date |

|

| 2. Indicate on which file the control should be performed:

' ' - V.A.T. File (F0018) '1' - A/R Detail (F0311) '2' - A/P Detail (F0411) |

4.4 Print the General Ledger Report

4.4.1 Printing the General Ledger Report

From EMEA Localization (G74), choose Italian Reports

From Italian Reports (G74Y093152), choose an option under the G/L Reports heading

The General Ledger report includes detailed information about account transactions. You can use the report to:

-

Review transactions within individual accounts

-

Research accounts that are out-of-balance

-

Verify account accuracy

You also use the General Ledger report to open and audit accounts with the same control totals as the journal report. The accounts and the totals are the basis of the trial balance.

In Italy, businesses use the General Ledger report as a basis for:

-

Internal auditing, as a control of account accuracy

-

External auditing by a third party, such as a fiscal authority or auditing firm

The General Ledger report includes the following information:

-

Beginning and ending balances for each account

-

Accumulation of amounts from different ledger types for the same account

-

Transactions based on a period selection or a date range selection

-

G/L registration numbers for each transaction

-

Currency codes for each transaction

-

Company codes and names on the header of the report

-

Business units (optional)

Businesses print the General Ledger report at least once a year for all accounts, typically at the end of the fiscal year. The total debits and credits that print on the report should equal the total debits and credits of the following:

-

Trial Balance Report

-

G/L Registration Report

You can print the General Ledger report by object and subsidiary or by category code, depending on whether your accounts are defined in the Account Master table by object and subsidiary, or in category codes 21, 22, or 23.

4.4.2 Accumulating Ledger Types for One Account

You can print General Ledger reports for a single ledger type by specifying the ledger type in the processing options. To print reports that accumulate up to three ledger types for the same accounts, set up the ledger types that you want to accumulate on user defined codes table 74/LT. Then, specify the table in the processing options.

Note:

The Ledger Type processing option replaces the user defined code 74/LT.See Also:

Section 1.4, "Set Up an Alternate Chart of Accounts" and Section 1.3, "Set Up User Defined Codes for Italy"

Figure 4-6 General Ledger Report by Object Account

Description of "Figure 4-6 General Ledger Report by Object Account"

4.4.2.1 Processing Options for General Ledger by Object (P7409C1)

| Processing Option | Processing Option Requiring Further Description |

|---|---|

| REPORTING PERIOD: | |

| 1. Beginning month: (mandatory)

Beginning year: (mandatory) Ending month: (mandatory) Ending year: (mandatory) |

|

| LEDGER TYPE SELECTION: | |

| 2. Enter the requested Ledger Type. The default is 'AA'. For multiple Ledger Types, enter the User Defined Codes table in which they are listed. System Code:

Record Type: |

|

| SUBLEDGER INFORMATION: | |

| 3. Enter '1' to print the Subledger and Subledger Type on the report. Leave blank to omit these columns. | |

| BUSINESS UNITS: | |

| 4. Enter '1' to print the Business unit on the report. Leave blank to omit this column. | |

| 5. Enter the model Business Unit to use to retrieve the account descriptions. By default, the transaction description will be printed. | |

| POSTING: | |

| 6. Enter '1' to print unposted transactions. Leave blank to print only posted transactions. | |

| 7. Enter '1' to print a total for posted transactions and a total for unposted transactions. By default, these totals will not be printed. | |

| ZERO BALANCES | |

| 8. Enter '1' to print the accounts with a zero balance in the period and year requested. By default, these accounts will not be printed. | |

| FORMAT SELECTION: | |

| 9. Enter '1' to print the G/L Registration Number and Currency Code instead of Batch Number and Batch Type. | |

| PROOF OR FINAL MODE: | |

| 10. Enter '1' to run the report in final mode. In final mode, only records that have been printed in final mode on the Trial Balance report (P7409C3) will be printed. |

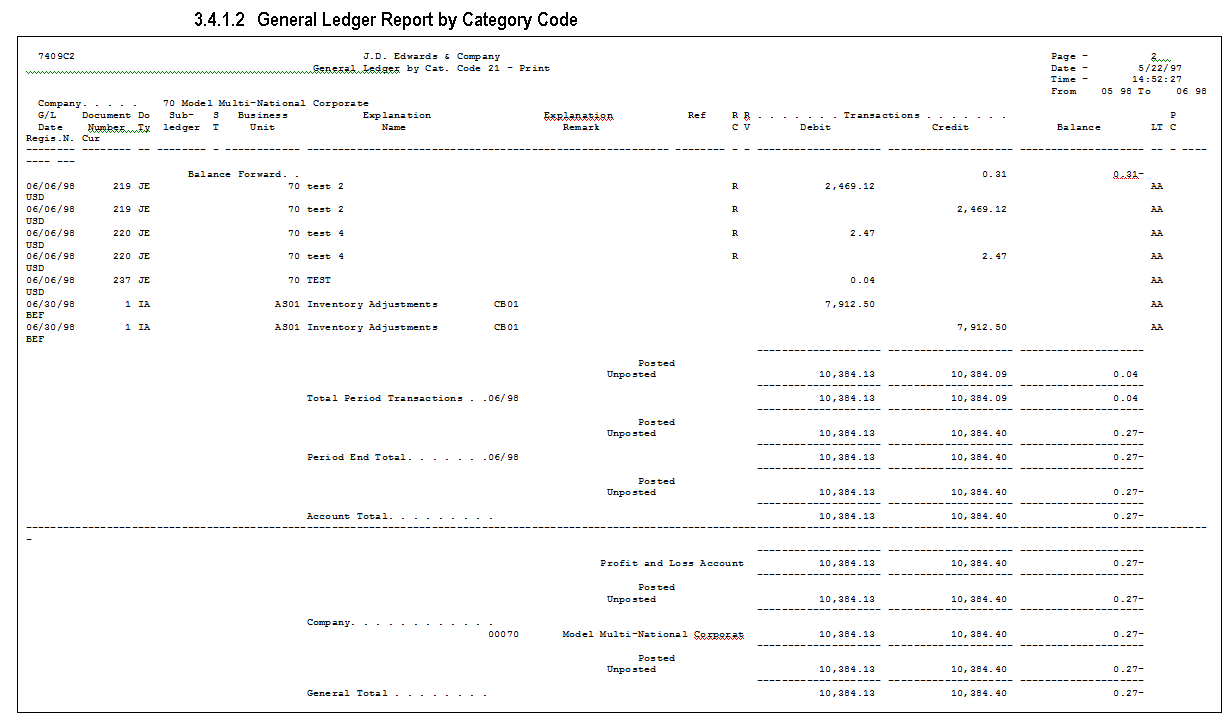

Figure 4-7 General Ledger Report by Category Code

Description of "Figure 4-7 General Ledger Report by Category Code"

4.4.2.2 Processing Options for General Ledger by Category Code (P7409C2)

| Processing Option | Processing Option Requiring Further Description |

|---|---|

| REPORTING PERIOD: | |

| 1. Beginning month: (mandatory) Beginning year: (mandatory) Ending month: (mandatory) Ending year: (mandatory) | |

| LEDGER TYPE SELECTION: | |

| 2. Enter the requested Ledger Type. The default is 'AA'. For multiple Ledger Types, enter the User Defined Codes table in which they are listed. System Code: Record Type: | |

| ALTERNATE CHART OF ACCOUNTS: | |

| 3. Enter the first Profit and Loss account for the alternate chart of accounts. | |

| 4. Enter the Category Code used for the alternate chart of accounts. (R021, R022 or R023) | |

| SUBLEDGER INFORMATION: | |

| 5. Enter '1' to print the Subledger and Subledger Type on the report. Leave blank to omit these columns. | |

| BUSINESS UNITS: | |

| 6. Enter '1' to print the Business Unit on the report. Leave blank to omit this column. | |

| POSTING: | |

| 7. Enter '1' to print unposted transactions. Leave blank to print only posted transactions. | |

| 8. Enter '1' to print a total for the posted transactions and a total for the unposted transactions. By default these totals will not be printed. | |

| ZERO BALANCES: | |

| 9. Enter '1' to print the accounts with a zero balance in the requested period. By default, these accounts will not be printed. | |

| DREAM WRITER VERSION: | |

| 10. Enter the DREAM Writer Version of the General Ledger report program (P7409C2A) to run. By default, the version will be 'XJDE0001'. Depending on which category code is used, the DREAM Writer version of this program has a different data selection. | |

| REPORT SELECTION: | |

| 11. Enter '1' to print the G/L Registration Number and Currency Code instead of Batch Number and Batch Type. | |

| PROOF OR FINAL MODE: | |

| 12. Enter '1' to run the report in final mode. In final mode, only records that have been printed in final mode on the Trial Balance report (P7409C4) will be printed. |

4.5 Print the Trial Balance Report

4.5.1 Printing the Trial Balance Report

From EMEA Localization (G74), choose Italian Reports

From Italian Reports (G74Y093152), choose an option under the G/L Reports heading

Businesses in Italy use the Trial Balance report to verify the accuracy of transactions in individual account ledgers. When all the transactions are accurate, the totals of this report equal the totals of the General Ledger report and the General Ledger Registration report. Businesses often print the Trial Balance report to facilitate:

-

Internal audits, to verify one or more accounts

-

External audits, as required by a fiscal authority or auditing firm

You can print the Trial Balance report to review the total debit and credit amounts for each account in any given ledger. You can also find errors that cause the General Ledger to be out of balance. Possible errors might include incorrect entries or missing transactions.

When you print this report, you can use data selections to specify:

-

The company chart of accounts (defined in the Account Master table) or an alternate chart of accounts (defined in category codes 21, 23, or 23)

-

Business units and subsidiaries

-

Totals by object account

-

Beginning and ending dates

-

Multiple ledger types

-

Exclusion of accounts with a zero balance

-

Account balance totals based on the level of detail of the account

4.5.2 What You Should Know About

| Topic | Description |

|---|---|

| Accumulating ledger types for one account | You can print Trial Balance reports for a single ledger type by specifying the ledger type in the processing options. To print reports that accumulate up to three ledger types for the same accounts, set up the ledger types that you want to accumulate on user defined codes table 74/LT. Then, specify the table in the processing options. |

| Accumulating ledger types for one account | You can print General Ledger reports that accumulate up to three ledger types for the same account by specifying the Ledger Types in the processing options. |

Note:

The Ledger Type processing option replaces the user defined code 74/LT.See Also:

Section 1.4, "Set Up an Alternate Chart of Accounts" and Section 1.3, "Set Up User Defined Codes for Italy".

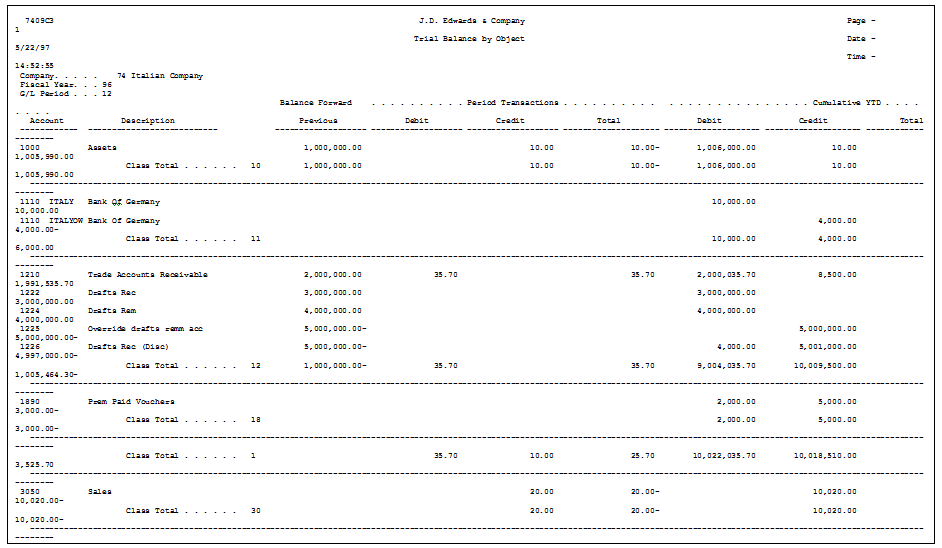

Figure 4-8 Trial Balance Report by Object Account (part 1)

Description of "Figure 4-8 Trial Balance Report by Object Account (part 1)"

Figure 4-9 Trial Balance Report by Object Account (part 2)

Description of "Figure 4-9 Trial Balance Report by Object Account (part 2)"

4.5.2.1 Processing Options for Trial Balance by Object (P7409C3)

| Processing Option | Processing Option Requiring Further Description |

|---|---|

| REPORTING PERIOD: | |

| 1. Enter the accounting period and the fiscal year. Leave blank to use the period and fiscal year of the Financial Reporting Date. Period: Year: | |

| LEDGER TYPE SELECTION: | |

| 2. Enter the requested Ledger Type. The default is 'AA'. For multiple Ledger Types, enter the User Defined Codes table in which they are listed. System Code: Record Type: | |

| MODEL BUSINESS UNIT: | |

| 3. Enter the model Business Unit to be used for retrieving the account descriptions. By default, the transaction descriptions will be used. | |

| ZERO BALANCE: | |

| 4. Enter '1' to print the accounts with a zero balance in the requested period. By default, these accounts will not be printed. | |

| TOTALING LEVEL: | |

| 5. Enter the totaling level for the account (1 to 4 characters). The default level is 2. Example: totaling level 2 = class total (1) sub-class total (10) | |

| PROOF OR FINAL MODE: | |

| 6. Enter '1' to run the report in final mode. CAUTION: The report can be run in final mode ONLY ONCE for the selected period and fiscal year. The transactions printed will not appear again on subsequent executions. |

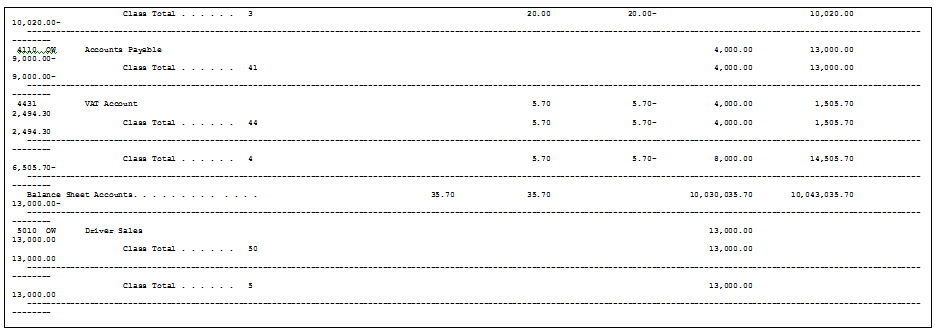

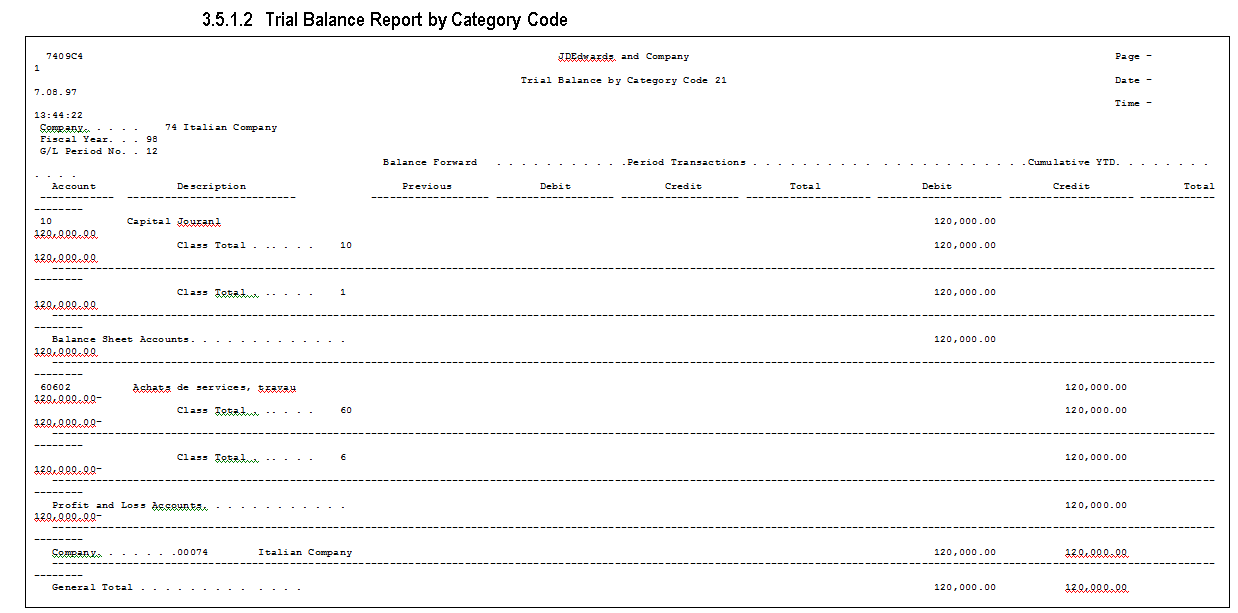

Figure 4-10 Trial Balance Report by Category Code

Description of "Figure 4-10 Trial Balance Report by Category Code"

4.5.2.2 Processing Options for Trial Balance by Category Code (P7409C4)

| Processing Option | Processing Option Requiring Further Description |

|---|---|

| REPORTING PERIOD: | |

| 1. Enter the accounting period and the fiscal year. Leave blank to use the period and fiscal year of the Financial Reporting Date. Period: Year: | |

| LEDGER TYPE SELECTION: | |

| 2. Enter the requested Ledger Type. The default 'AA'. For multiple Ledger Types, enter the User Defined Codes table in which they are listed. System Code: Record Type: | |

| ALTERNATE CHART OF ACCOUNTS: | |

| 3. Enter the first P&L account for the alternate chart of accounts.

4. Enter the category code used for the alternate chart of accounts. (R021, R022 or R023) |

|

| ZERO BALANCES: | |

| 5. Enter '1' to print the accounts with a zero balance in the requested period. By default, these accounts will not be printed. | |

| TOTALING LEVEL: | |

| 6. Enter the totaling level for the account (1 to 4 characters). The default level is 2. Example: totaling level 2 = class total (1) sub-class total (10) | |

| PROOF OR FINAL MODE: | |

| 7. Enter '1' to run the report in final mode. CAUTION: The report can be run in final mode ONLY ONCE for the selected period and fiscal year. The transactions printed will not appear again on subsequent executions. |

4.6 Print the G/L Registration Report

4.6.1 Printing the G/L Registration Report

Navigation:

From Italian Localization (G7Y4), choose Italian Reports

From Italian Reports (G74Y093152), choose G/L Registration Report/Update

From the Italian Reports menu (G74Y093152), choose G/L Registration Report

Businesses in Italy are required to print a journal report (Giornale Bollato) that lists all of the general ledger transactions for each month in chronological and sequential order. To do this, you can print a G/L Registration report.

You can print the G/L Registration report in proof or final mode. When you select final mode, the system assigns each general ledger transaction in the Account Ledger (F0911) a chronological and sequential registration number. The system stores the registration number for each transaction in a dedicated field (REG#). You can use a processing option to control whether the system assigns registration numbers to journal entries or to each individual journal entry line.

To ensure that the registration number for each transaction is sequential by date, run the G/L Registration Report/Update program in final mode only after:

-

You enter all of the transactions for the month

-

You review the G/L Registration report generated in proof mode

4.6.1.1 Registration Numbers for Adjusting Journal Entries

After the year end, you might need to enter general ledger transactions to record adjustments for the previous fiscal year. You can enter these adjusting journal entries with a special document type (&&) and the general ledger date for the end of the fiscal year, such as 31/12/98.

Italian law requires that the date on which you actually enter the adjustment is also included in the journal entry record. To satisfy this requirement, the system records both the general ledger date that you specify for the end of the fiscal year and the actual date that you enter the adjusting entry. You can use a processing option to control the actual date of the adjustment entry that prints on the G/L Registration report. In addition, adjusting entries must include a chronological and sequential registration number, as any other general ledger transaction.

Print the G/L Registration report to assign registration numbers to adjusting journal entries for the previous fiscal year. You can specify registration numbers for adjusting journal entries based on the following numbering patterns:

-

Start with the next available number for the previous fiscal year

-

Start with the next available number for the current fiscal year

When you print the G/L Registration report for the adjusting entries in final mode, the system:

-

Updates the Adjustments Registration Date with the date that you specify in the processing option for adjusting entries

-

Assigns chronological and sequential registration numbers to each transaction

The following graphic illustrates how you maintain and print G/L Registration information.

Figure 4-11 Maintaining and Printing G/L Registration Information

Description of "Figure 4-11 Maintaining and Printing G/L Registration Information"

4.6.2 What You Should Know About

| Topic | Description |

|---|---|

| Multicompany environments | You can print the G/L Registration report for multicompany environments, in which general ledger transactions are entered for different document companies that belong to the same legal entity.

To do this, set the processing options so that you can enter the legal company that you want to print on the header of the report. Then, use data selection to identify the document companies that belong to the legal company. |

| Revisions | If your company implements J.D. Edwards software in the middle of a fiscal year, you will need to indicate the continuing registration number from your previous numbering system (manual or automated). To do this, access the Revise G/L Registration File screen. |

| Reprinting the report | You can reprint the G/L Registration Report to review transactions for which registration numbers are already assigned. You can reprint the G/L Registration report in proof mode only. |

See Also:

-

Assign VAT Registration Numbers in the JD Edwards World Tax Reference Guide for information about how to set up the system to edit vouchers and invoices for appropriate dates and to assign sequential numbering.

-

See Working with the Annual Close in JD Edwards World Fixed Assets Guide for more information about printing the G/L Registration report as part of the annual close procedure.

4.6.2.1 Processing Options for G/L Registration Report - Italy (P09404)

| Processing Option | Processing Option Requiring Further Description |

|---|---|

| PROCESSING MODE: | |

| 1. Enter a '1' for Final Mode. Enter a '2' for Final Mode with Headings and Titles. Leave blank for Proof mode. Default Proof Mode. | |

| PROCESS DATES: | |

| 2. Enter the From Date.

3. Enter the Thru Date. |

|

| COMPANY NUMBER: | |

| 4. Enter Company Number. | |

| PRINT OPTIONS: | |

| 5. Enter the Account Number Category Code to print on the report. Valid values are only 21, 22 and 23. Leave blank to print the account number. | |

| LEGAL NUMBER ASSIGNMENT: | |

| 6. Enter a '1' to assign legal numbers for each individual JE line. Leave blank to assign legal numbers for each document. Default is blank. | |

| ADJUSTMENTS LEGAL NUMBER REGISTER REPORT | |

| 7. Enter the legal number date to print for the adjustments instead of the G/L Date printed for the regular transactions. | |

| ADJUSTMENTS LEGAL NUMBER REGISTER | |

| 8. Enter '1' to number the adjustments starting with the next available number for the fiscal year of the adjustment G/L Date. The default of blank will use the next available legal number for the current fiscal year. | |

| LEGAL COMPANY | |

| 9. Enter the Legal Company to print when using multiple companies. |

4.6.2.2 Processing Options for G/L Registration Report - Italy (R09404)

| Processing Option | Processing Option Requiring Further Description |

|---|---|

| Mode | |

| 1. Enter a '1' for a final mode. Enter a '2' for a final mode with headings and titles. Leave blank for Proof Mode. Default Proof Mode | |

| Processing Mode | |

| Dates

1. From Date 2. Thru Date |

|

| Company

1. Enter the company number to be used to store and retrieve G/L balance values. If left blank company '00000' is used. |

|

| Legal Company | |

| Options

1. Enter the Account Number Category code to print on the report. Valid values are only 21, 22 and 23. Leave blank to print account number. Select Account Number Category Code |

|

| Registration

1. Enter a '1' to assign registration numbers for each individual JE line. Leave blank to assign registration number for each document. Default is blank. |

|

| Registration Number Assignment | |

| Adjustments

1. Enter the Registration Date to print for the adjustment instead of G/L Date printed for the regular transactions. 1. Registration Date 2. Enter a '1' to number the adjustments starting with the next available number for the previous fiscal year. Leave blank to use the next available registration number for the current fiscal year. Registration Number |

4.7 Work with the Annual Close

4.7.1 Working with the Annual Close

You can use J.D. Edwards base software to complete the annual close for the fiscal year. When you close the fiscal year, you must:

-

Close and calculate retained earnings

-

Make adjustments

-

Close profit and loss accounts

-

Record the profit and loss for the fiscal year

-

Close balance sheet accounts

-

Print the G/L Registration Report with adjustments and closing entries

-

Re-open balance sheet accounts

-

Print the G/L Registration report with re-opening journal entries

-

Print the General Ledger report

During the beginning months of the new fiscal year, you can make adjustments to the transactions of the previous year. To identify journal entries for adjustments in the system, the adjustment entries must include the following information:

-

The G/L date must equal the end of the previous fiscal year

-

The document type must be ##, to indicate that the entry is an adjustment

The system prevents you from recording journal entries in the previous year unless the entries have a document type of &&. In addition, when you update the beginning balance in the Account Balances file (F0902), the system includes journal entries with the document type of &&.

In Italy, businesses complete the following phases at the close of the fiscal year to prepare the year-end balance sheet:

-

Adjustment and integration of journal entries

-

Close profit and loss accounts for revenues and expenses that were recorded during the year without carrying over the balance

-

Calculate retained earnings

-

Close balance sheet accounts on a summary account "ending balance sheet" and reopen the same balance sheet accounts for the following fiscal year.

During the close of the fiscal year and the preparation of the balance sheet, Italian businesses complete the following control reports:

-

Trial Balance

-

General Ledger

All the journal entries that the system generates for the close of the fiscal year are recorded on the G/L Registration report.

See Also:

-

Closing a Fiscal Year in the JD Edwards World General Accounting I Guide

-

Assigning VAT Registration Numbers in JD Edwards World Tax Reference Guide for information about assigning sequential registration numbers to closing and adjusting entries