29 Address Book Information

This chapter contains these topics:

29.1 Intrastat Tax ID Format

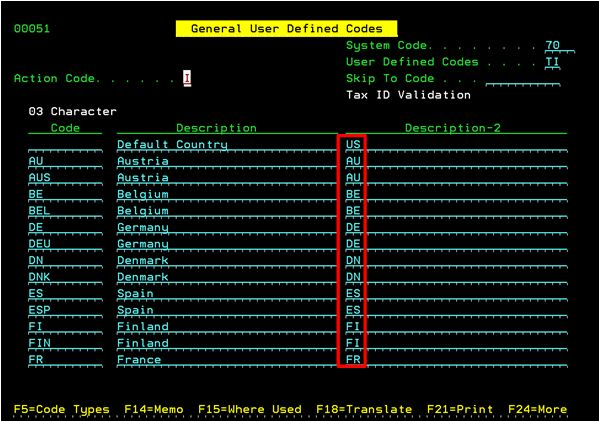

The Tax ID numbers to use in a Declaration must have the ISO Country Code at the beginning. The ISO code of the EU member country is in the Description 2 field of UDC 70/TI - "Tax Id Validation" which is accessed with the Customer/Supplier Country code defined in the Address Book. Otherwise, if it is not set up in this UDC, A/B Country Code will be used.

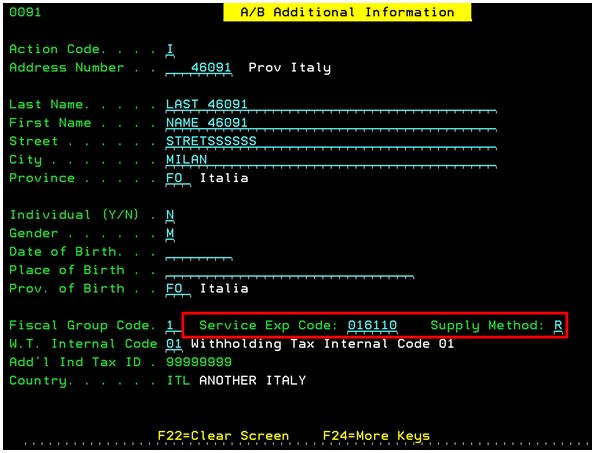

29.2 Italian Address Book Information

From Italian Localizations (G74Y), choose EU VAT Package INTRASTAT

From EU VT Package INTRASTAT (G74Y001), choose A/B Additional Information

The program was changed to allow the user to enter additional default information, Service Explanation Code and Method of Supply, for A/B numbers.

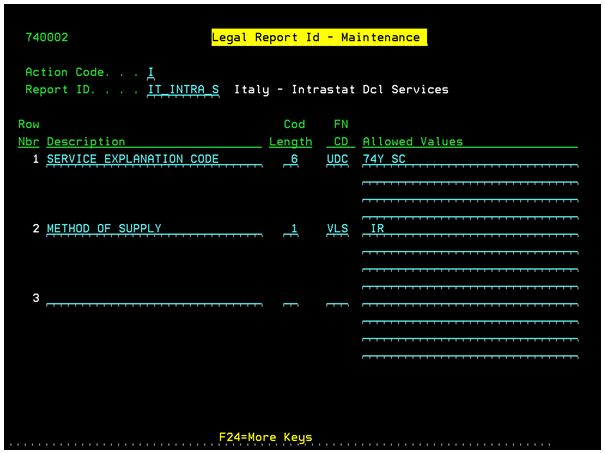

29.2.1 Tax Area Set Up

In order to define the attribute needed for the Tax Areas to use, the user will have to follow these steps:

From European Union Localizations (G7400), choose Generic Report

From Generic Report (G740001), choose Legal Report Id - Maintenance

See the Special Instructions included with Software Update A921804075 regarding file F740002.

Figure 29-3 Legal Report ID - Maintenance screen

Description of "Figure 29-3 Legal Report ID - Maintenance screen"

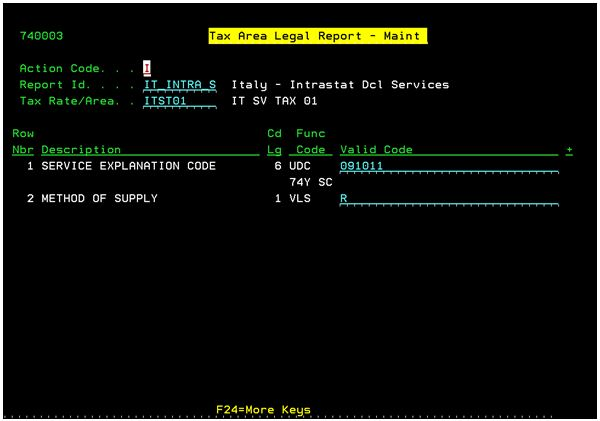

From European Union Localizations (G7400), choose Generic Legal Report

From Generic Report (G740001), choose Tax Area Legal Report - Maint

Enter the following information:

Figure 29-4 Tax Area Legal Report - Maintenance screen

Description of "Figure 29-4 Tax Area Legal Report - Maintenance screen"