14 IVA Reports

This chapter contains these topics:

-

Section 14.7, "Printing Annual IVA Reports for Customers and Suppliers"

-

Section 14.10, "Printing Annual IVA Reports for Customers and Suppliers"

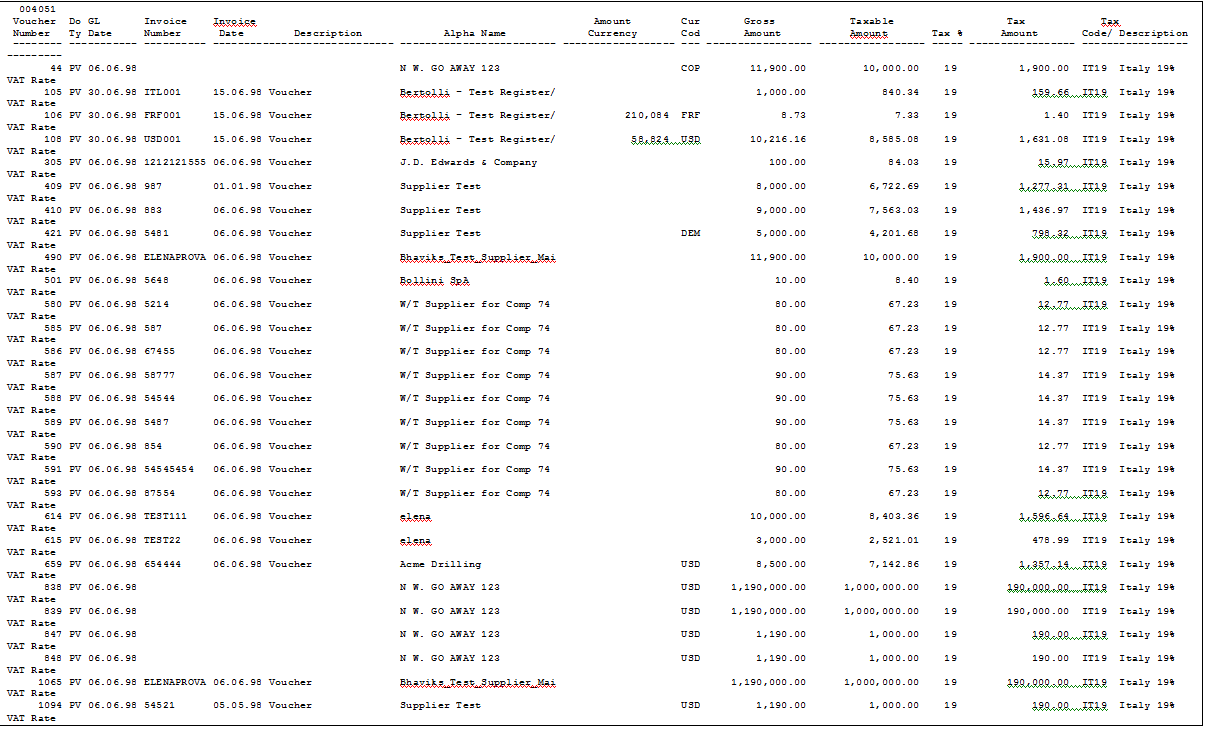

14.1 Printing Monthly IVA Reports

Navigation:

From General Systems (G00), choose Tax Processing and Reporting

From Tax Processing and Reporting (G0021), choose Italian IVA Processing

From Italian IVA Processing (G00213), choose Monthly IVA Report

From the Italian IVA Processing menu (G00213), choose Monthly VAT Report.

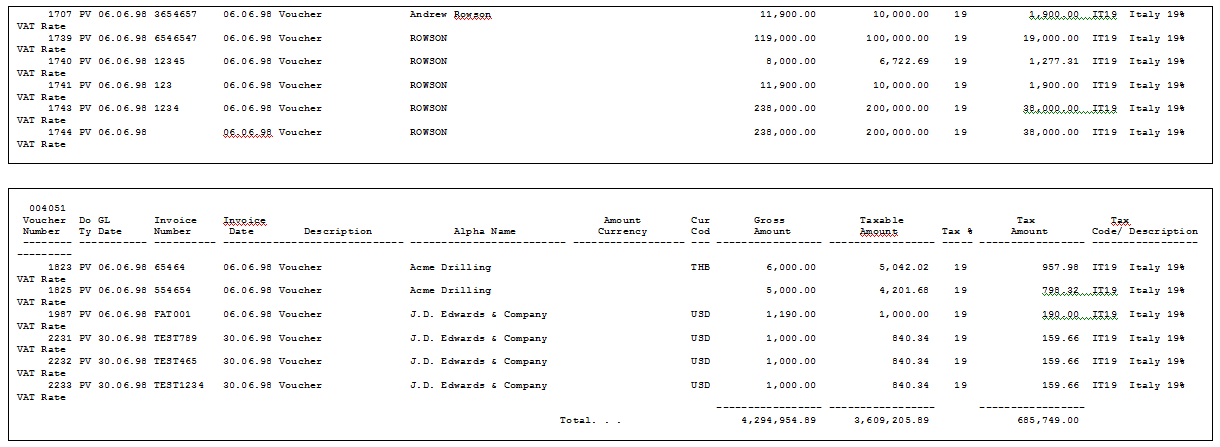

In Italy, businesses are required to print monthly reports to document Accounts Payable and Accounts Receivable IVA (or VAT) taxes. The report must be printed on a special legal form that is prenumbered and approved by the Tax Authorities.

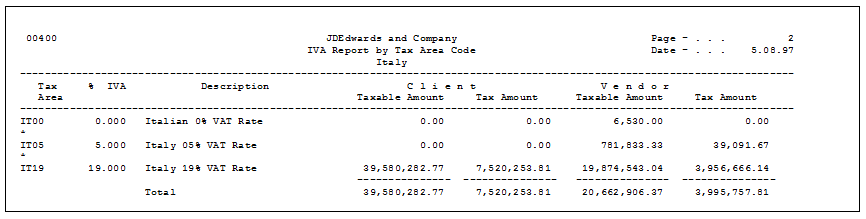

Figure 14-1 Monthly IVA Report for A/R (part 1)

Description of "Figure 14-1 Monthly IVA Report for A/R (part 1)"

Figure 14-2 Monthly IVA Report for A/P (part 2)

Description of "Figure 14-2 Monthly IVA Report for A/P (part 2)"

Figure 14-3 Monthly IVA Report for A/P (part 3)

Description of "Figure 14-3 Monthly IVA Report for A/P (part 3)"

Figure 14-4 Monthly IVA Report for A/P (part 4)

Description of "Figure 14-4 Monthly IVA Report for A/P (part 4)"

14.1.1 Processing Options

See Section 41.2, "Processing Options for A/R and A/P IVA Tax Report - Italy (P004051)."

14.2 Working with Annual IVA Reports

Businesses in Italy are required to complete annual IVA reports. The report can be submitted to the tax authorities on paper or electronically, but it must conform to the legally required format.

Annual IVA reports include summarized IVA information from customer invoice and supplier voucher records. The information must be summarized by the supplier or customer tax identification number. The system creates a cumulative record for customers or suppliers that have the same tax identification number, as in the case of a parent businesses with subsidiaries.

The system stores summarized IVA information by supplier and customer in the Annual IVA Ledger file (F00900). The Annual IVA Ledger table is based on the Sales/Use/VAT Tax file (F0018), which includes all of the IVA information for invoices and vouchers in detail.

You can distinguish supplier vouchers and customer invoices in the Sales/Use/VAT Tax table by the Batch Type. You distinguish supplier vouchers and customer invoices in the Annual IVA Ledger table by Information Type.

The system uses the user defined codes table 00/IV (VAT codes) to determine whether amounts are considered taxable, nontaxable, or excluded. Records that include VAT codes that are not defined on the table are considered non-IVA. The system does not include these records in the Annual IVA Ledger table.

The Annual IVA Ledger table includes the following information for each customer and supplier:

-

Total number of invoices or vouchers

-

Total taxable amount

-

Total tax amount

-

Total nontaxable amount

-

Total nontaxable "8 comma 2" (suppliers only)

You can update the summarized IVA information in the table by using a batch program or by manually entering each record. You can also revise summarized IVA information.

-

Working with annual IVA reports consists of the following tasks:

-

Creating the Annual IVA Ledger table

-

Printing the Annual IVA Control Report

-

Revising the Annual IVA Ledger table

-

Creating the Annual IVA tape

-

Printing annual IVA reports for customers and suppliers

14.3 Creating the Annual IVA Ledger Table

From General Systems (G00), choose Tax Processing and Reporting

From Tax Processing and Reporting (G0021), choose Italian IVA Processing

From Italian IVA Processing (G00213), choose Annual IVA File Build

To create the Annual IVA Ledger table, run the Annual IVA File Build program (P00911). The system summarizes the information in the Sales/Use/VAT Tax file (F0018) by invoice or voucher, based on the current year that you define in the processing options. You can run this program once a year or as many times as you need to update the records in the Annual IVA Ledger table.

14.3.1 Processing Options

See Section 41.3, "Processing Options for Annual IVA File Build - Italy (P00911)."

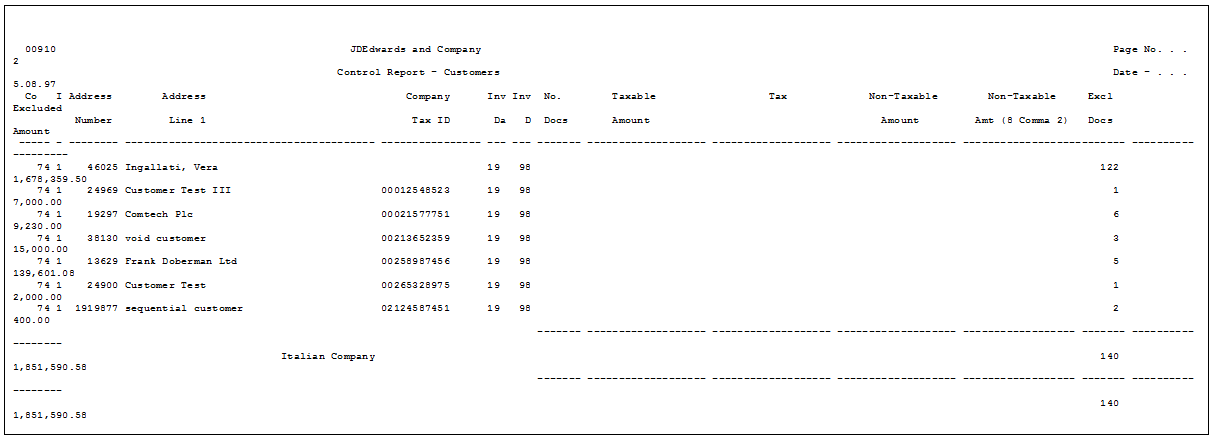

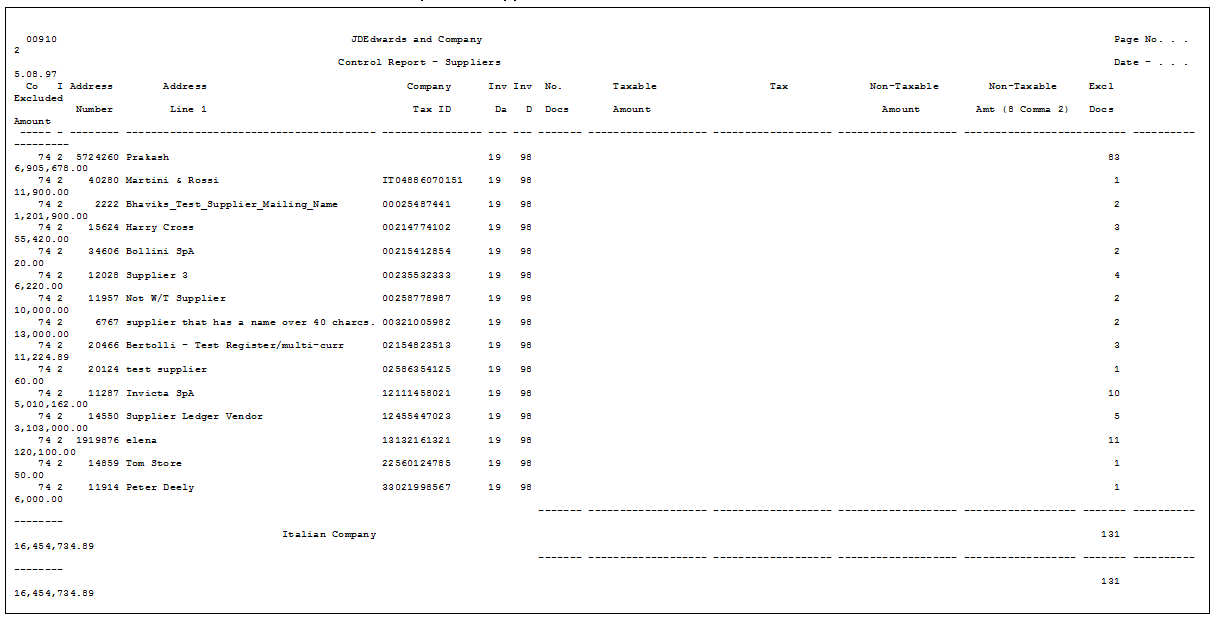

14.4 Printing the Annual IVA Control Report

From General Systems (G00), choose Tax Processing and Reporting

From Tax Processing and Reporting (G0021), choose Italian IVA Processing

From Italian IVA Processing (G00213), choose Annual IVA Control Reports

To review a paper copy of the information in the Annual IVA Ledger file (F00900) before you transfer the Annual IVA Report to tape or print the Annual IVA Report on special forms, print the Annual IVA Control Report.

You can use the control report to simulate figures as they will be printed on the special form or on a tape. You can also use the report to verify that the amounts in the Annual IVA Ledger table correspond to the amounts in the Sales/Use/VAT Tax file (F0018).

14.5 Revising the Annual IVA Ledger Table

In exceptional cases, you might need to revise existing records or create new records in the Annual IVA Ledger table.

To revise the annual IVA ledger table

On Annual IVA File Revision

-

To locate an existing record or add a new record, complete the following fields:

-

Company Number

-

Information Type

-

Address Number

-

Invoice Date - CTRY

-

Invoice Date Year

-

-

To revise or complete the record, complete any of the following fields:

-

Number of Documents

-

Taxable Amount

-

Tax

-

Non-Taxable Amount

-

Amount (8 Comma 2)

-

Excluded Number Documents

-

Excluded Amount

-

14.6 Creating the Annual IVA Tape

Run the Year-End IVA Tape Creation program to transfer the information from the Annual IVA Ledger table to tape in the format required by the tax authorities in Italy.

If you decide to transfer the information to tape, you do not have to print the special form reports for suppliers and customers.

14.6.1 Processing Options

SeeSection 41.4, "Processing Options for Annual IVA Control Report (P00910)."

14.7 Printing Annual IVA Reports for Customers and Suppliers

You can submit paper copies of the annual IVA reports for customers and suppliers. You do not have to print paper copies of the annual IVA reports if you submit the reports on tape.

To print paper copies of the annual IVA reports, run the Supplier IVA Form and the Customer IVA Form programs.

The annual IVA reports for suppliers and customers include the following information:

-

Supplier or customer name

-

Street

-

Postal Code

-

City

-

Province

-

Tax Identification Number

-

Total taxable amount of vouchers or invoices for the current year

-

Total taxable amount of vouchers or invoices for the previous year

-

Total tax amount of voucher or invoices for the current year

-

Total tax amount of voucher or invoices for the previous year

-

Total non-taxable amount of vouchers or invoices for the current year

-

Total non-taxable amount of vouchers or invoices for the previous year

To revise the annual IVA ledger table

From the Italian IVA Processing menu (G00213), choose Annual IVA File Revision.

From the Italian IVA Processing menu (G00213), choose IVA Tape File Creation.

From the Italian IVA Processing menu (G00213), choose Supplier IVA Form or Customer IVA Form.

Figure 14-5 Annual IVA Control Report for Customers

Description of "Figure 14-5 Annual IVA Control Report for Customers"

Figure 14-6 Annual IVA Control Report for Suppliers

Description of "Figure 14-6 Annual IVA Control Report for Suppliers"

14.7.1 Processing Options

See Section 41.4, "Processing Options for Annual IVA Control Report (P00910)."

14.8 Revising the Annual IVA Ledger Table

Navigation:

From General Systems (G00), choose Tax Processing and Reporting

From Tax Processing and Reporting (G0021), choose Italian IVA Processing

From Italian IVA Processing (G00213), choose Annual IVA File Revisions

In exceptional cases, you might need to revise existing records or create new records in the Annual IVA Ledger table.

To revise the annual IVA ledger table

On Annual IVA File Revision

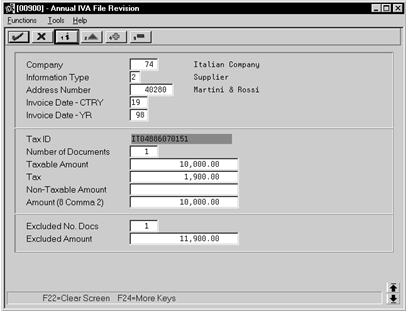

Figure 14-7 Annual IVA File Revision screen

Description of "Figure 14-7 Annual IVA File Revision screen"

-

To locate an existing record or add a new record, complete the following fields:

-

Company

-

Information Type

-

Address Number

-

Invoice Date - CTRY

-

Invoice Date Year

-

-

To revise or complete the record, complete any of the following fields:

-

Number of Documents

-

Taxable Amount

-

Tax

-

Non-Taxable Amount

-

Amount (8 Comma 2)

-

Excluded Number Documents

-

Excluded Amount

-

| Field | Explanation |

|---|---|

| Company | A code that identifies a specific organization, fund, entity, and so on. This code must already exist in the Company Constants file (F0010). It must identify a reporting entity that has a complete balance sheet. At this level, you can have intercompany transactions.

NOTE: You can use company 00000 for default values, such as dates and automatic accounting instructions (AAIs). You cannot use it for transaction entries. |

| Information Type | Indicates whether the information for the year-end report refers to:

1 Customer 2 Supplier or 3 Customs Authority |

| Address Number | A number that identifies an entry in the Address Book system. Use this number to identify employees, applicants, participants, customers, suppliers, tenants, and any other Address Book members. |

| Date - Invoice - CTRY | The century on the invoice date. This may be either the date on the supplier's invoice to you or the date on your invoice to a customer. |

| Date - Invoice - YR | This is the year of the invoice date. This may be either the date of the supplier's invoice to you or the date of your invoice to a customer. |

| Number of Documents | Number of customer invoices or supplier vouchers. This number is accumulated throughout the year. |

| Amount - Taxable | The amount on which taxes are assessed. |

| Amount - Tax | This is the amount assessed and payable to tax authorities. It is the total of the VAT, use, and sales taxes (PST). |

| Amount - Non-Taxable | This identifies the amount upon which taxes are not assessed. This is the portion of the transaction not subject to sales, use, or VAT taxes because the products are tax-exempt or zero-rated. |

| Non-Taxable Amount (8 Comma 2) | Total amount of non-taxable vouchers for special code 8 comma 2. |

| Excluded Number of Documents | Number of customer invoices, or supplier vouchers which have been excluded in VAT year-end reports. Used only to balance on the Control Report. |

| Excluded Amount | Total amount of documents excluded from VAT year-end reports. |

14.9 Creating the Annual IVA Tape

From General Systems (G00), choose Tax Processing and Reporting

From Tax Processing and Reporting (G0021), choose Italian IVA Processing

From Italian IVA Processing (G00213), choose an option under the IVA Tape Creation heading

Run the Year-End IVA Tape Creation program to transfer the information from the Annual IVA Ledger table to tape in the format required by the tax authorities in Italy.

If you decide to transfer the information to tape, you do not have to print the special form reports for suppliers and customers.

14.9.1 Processing Options

See Section 41.5, "Processing Options for Annual IVA Tape Creation (P00918)."

14.10 Printing Annual IVA Reports for Customers and Suppliers

From General Systems (G00), choose Tax Processing and Reporting

From Tax Processing and Reporting (G0021), choose Italian IVA Processing

From Italian IVA Processing (G00213), choose an option under the Annual IVA

Special Forms Print heading

You can submit paper copies of the annual IVA reports for customers and suppliers. You do not have to print paper copies of the annual IVA reports if you submit the reports on tape.

To print paper copies of the annual IVA reports, run the Supplier IVA Form and the Customer IVA Form programs.

The annual IVA reports for suppliers and customers include the following information:

-

Supplier or customer name

-

Street

-

Postal Code

-

City

-

Province

-

Tax Identification Number

-

Total taxable amount of vouchers or invoices for the current year

-

Total taxable amount of vouchers or invoices for the previous year

-

Total tax amount of voucher or invoices for the current year

-

Total tax amount of voucher or invoices for the previous year

-

Total nontaxable amount of vouchers or invoices for the current year

-

Total nontaxable amount of vouchers or invoices for the previous year

14.10.1 Processing Options

See Section 41.6, "Processing Options for A/P Annual IVA Report (P00917)."

See Section 41.7, "Processing Options for A/R Annual IVA Report (P00916)."

14.11 Printing IVA by Tax Area Code

From General Systems (G00), choose Tax Processing and Reporting

From Tax Processing and Reporting (G0021), choose Italian IVA Processing

From Italian IVA Processing (G00213), choose By Tax Area Code

In Italy, businesses are required to print a report of IVA by Tax Area Code. The report must print the IVA for Accounts Payable and Accounts Receivable in two separate columns. In addition, the report must be printed on a special legal form that is prenumbered and approved by the Tax Authorities.

14.11.1 Processing Options

See Section 41.8, "Processing Options for IVA by Tax Area Code - Italy (P00400)."

14.12 Work with Summary IVA

In Italy, the government requires businesses to report IVA taxes on accounts receivable and accounts payable transactions. You can meet this reporting requirement by assigning each transaction a register type and class.

You specify different register types for sales and purchases. Register classes are subsets of register types. For example, the register classes for a sales register type might include:

-

Sales within Italy

-

Sales within the European Union

-

Sales outside the European Union

You must set up register types and classes to track and report IVA tax in a summarized format. Then, create a link between the register types and classes and the appropriate type of transaction (document type).

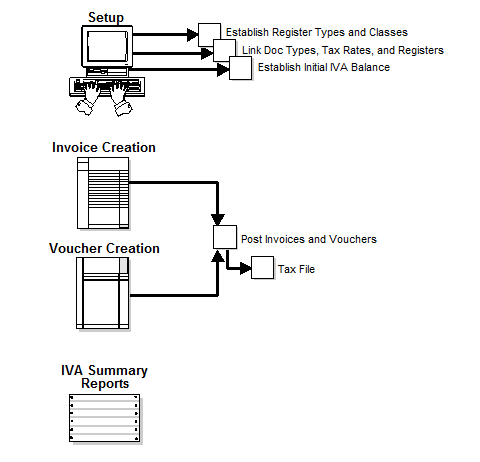

The following graphic illustrates how you use J.D. Edwards software to process Summary IVA.

Working with summary IVA includes the following tasks:

-

Linking register types and classes to document types

-

Revising IVA balances

-

Printing the Summary IVA report

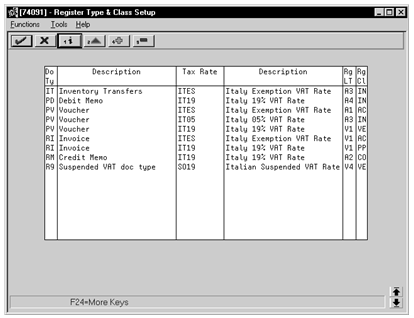

14.12.1 Linking Register Types and Classes to Document Types

From EMEA Localization (G74), choose Summary IVA Reports

From Additional Italian Tax Processing (G002131), choose Register Type and Class Setup

When you link register types and classes to document types, you establish and maintain the relationships between document types, IVA rates, register types and classes. You can use these relationships to create summarized IVA reports.

To link register types and classes to document types

On Register Type & Class Setup

Figure 14-10 Register Type & Class Setup screen

Description of "Figure 14-10 Register Type & Class Setup screen"

Complete the following fields:

-

Document Type

-

Tax Rate

-

Register Type

-

Register Class

| Field | Explanation |

|---|---|

| Document Type | A user defined code (system 00/type DT) that identifies the origin and purpose of the transaction.

J.D. Edwards reserves several prefixes for document types, such as vouchers, invoices, receipts, and timesheets. The reserved document type prefixes for codes are: P Accounts payable documents R Accounts receivable documents T Payroll documents I Inventory documents O Order processing documents J General ledger/joint interest billing documents The system creates offsetting entries as appropriate for these document types when you post batches. |

| Tax Rate/Area | A code that identifies a tax or geographic area that has common tax rates and tax distribution. The tax rate/area must be defined to include the tax authorities (for example, state, county, city, rapid transit district, or province), and their rates. To be valid, a code must be set up in the Tax Rate/Area file (F4008).

Typically, U.S. sales and use taxes require multiple tax authorities per tax rate/area, whereas VAT requires only one simple rate. The system uses this code to properly calculate the tax amount. |

| VAT Register Class | You define the valid codes for VAT register classes on user defined codes table 74/01. For example, you might set up a register class for purchases and one for sales.

You link document types, tax rates, register types and register classes on the Register Type and Class Setup screen to meet your reporting requirements. Then, you can run the Summary VAT Report (P74093) to print your VAT information, based the register classes and types you link to various document types. You can group and classify transactions for reporting purposes by defining register classes and types in conjunction. For example, you might set up register types and classes as follows: Register Class: Sales Register Type A: VAT on Sales, Italy rate 19 percent Register Type B: VAT on Sales, out of EU, not subject to VAT (art. 8/A) |

| VAT Register Type | You define the valid codes for VAT register types on user defined codes table 74/02. For example, you might set up a register type for transactions that are eligible for VAT and another for transactions that are not eligible for VAT.

You link document types, tax rates, register types and register classes on the Register Type and Class Setup screen to meet your reporting requirements. Then, you can run the Summary VAT Report (P74093) to print your VAT information, based the register classes and types you link to various document types. You can group and classify transactions for reporting purposes by defining register classes and types in conjunction. For example, you might set up register types and classes as follows: Register Class: Sales Register Type A: VAT on Sales, Italy rate 19 percent Register Type B: VAT on Sales, out of EU, not subject to VAT (art. 8/A) |

14.12.1.1 Before You Begin

Set up user defined codes for register classes (system 74, type 01) and register types (system 74, type 02). See Section 1.3, "Set Up User Defined Codes for Italy."

14.12.2 Revising IVA Balances

From EMEA Localization (G74), choose Summary IVA Reports

From Additional Italian Tax Processing (G002131), choose IVA Balances Revisions

You can review and revise the IVA balances that print on your summarized IVA report.

On IVA Balances Revisions

Figure 14-11 IVA Balances Revisions screen

Description of "Figure 14-11 IVA Balances Revisions screen"

-

To locate a specific IVA balance record, complete the following fields:

-

Balance Date

-

Company

-

-

To revise the IVA balance, complete the following fields:

-

Credit IVA Balance

-

Debit IVA Balance

-

Description

-

Second Description

-

| Field | Explanation |

|---|---|

| Balance Date | Balance date. This date is associated with a VAT balance for the Summary VAT Process. It can be revised in the VAT Balances Revisions screen (P74092). The print program P74093 searches the VAT balance file by this date. |

| Credit IVA Balance | VAT Credit Balance. This VAT credit balance is maintained in the IVA Balances Revisions screen (P74092) and is used in the IVA Summary Report program (P74093). |

| Debit IVA Balance | VAT Debit Balance. This VAT debit balance is maintained in the IVA Balances Revisions screen (P74092) and is used in the IVA Summary Report program (P74093). |

From the Additional Italian Processing menu (G002131), choose IVA Balances History.

On Work wish IVA Balances History - Italy

Figure 14-12 Work with IVA Balances History

Description of "Figure 14-12 Work with IVA Balances History"

-

Locate a record and click Select.

Figure 14-13 IVA Balances History Revision

Description of "Figure 14-13 IVA Balances History Revision"

-

On IVA Balances History Revision - Italy, revise any of the following fields:

-

Credit Balance

-

Debit Balance

-

Description 1

-

Description 2

Field Explanation Credit Balance VAT Credit Balance. This VAT credit balance is maintained in the IVA Balances Revisions screen (P74092) and is used in the IVA Summary Report program (P74093). Debit Balance VAT Debit Balance. This VAT debit balance is maintained in the IVA Balances Revisions screen (P74092) and is used in the IVA Summary Report program (P74093).

-

14.12.3 Printing the Summary IVA Report

From EMEA Localization (G74), choose Italy

From Italy Localizations (G74Y), choose Additional Tax Processing

From Additional Italian Tax Processing (G74Y002131), choose Print IVA Summary Reports

To review the total amount of IVA that is due to the Italian government, print the Summary IVA report. The report prints IVA totals by:

Register type

Register class

Previous balance

When you print the Summary IVA Report, the system:

-

Creates a temporary workfile (F74093), based on the links you establish for document type, register class, and register and the information in the Sales/Use/VAT Tax file (F0018)

-

Prints an error report that lists records from the Sales/Use/VAT Tax table that do not include register type or register class information

-

Prints the Summary IVA Report

14.12.3.1 Rounding Logic

Rounded euro amounts are reported in thousand euro increments. The rounding logic for the Summary IVA Report program is hard-coded as follows:

If the last three digits of the total amount are greater than or equal to 500, then the rounding amount is the result of the subtraction of this value from the upper 1000 euros. For example, if the total is 1.154.750, the rounding amount is 250 and the total IVA to pay is 1.155.000.

If the last three digits of the total amount are lower than or equal to 500, then the rounding amount is the difference between this value and the lower 1000 euros. For example, if the total is 1.154.350, the rounding amount is 350- and the total IVA to pay is 1.154.000.

14.12.3.2 Processing Options

See Section 41.9, "Processing Options for Print Summary IVA Report (R74093)."

See Section 41.10, "Processing Options for IVA Summary Report (P74093)."