33 Sales Returns

This chapter contains these topics:

33.1 Processing Sales Returns

From Localizations - Brazil (G76B), choose Sales Order Management

From Sales Order Management - Brazil (G76B42), choose Sales Order Processing

From Sales Order Processing - Brazil (G76B4211), choose Sales Return - Ship To or Sales Return - Ship From or Sales Order Reverse

Execute one of these programs to reverse transactions related to a sales order/nota fiscal after you have run the Sales Update - Brazil program.

Sales Returns may create reversing records for General Taxes (PIS, COFINS and ISS) in the Nota Fiscal Taxes Detail - Brazil table (F76B4001) if the Tax Type Definition for the Tax is set to do this. Choose Tax Type Definition Entry from G76B40 and set the Write Rev Rec Sales Return flag to '1.'

When you work with sales returns, the system validates that the item origin information in the sales return documentation is the same as the item origin information in the original sales order.

This program generates a reverse sales order based on the original sales order/nota fiscal.

When you generate a nota fiscal for returned goods and use version 3.1 or greater of the standards for electronic notas fiscais, the system includes the fields required and performs required validations. You specify the version to use in the processing options of the NFe XML Generation program (P76B601).

To process ship-to sales returns

Use the Ship-To Sales Return process when the company to which you shipped the merchandise returns the merchandise after receiving it into its inventory. The returning company must send a nota fiscal with the returned merchandise.

Complete these steps to process a Ship-To Sales Return:

-

Use the Sales Return - Ship-To program to enter information about the nota fiscal into the system, create detail lines for the returned items, and associate the original nota fiscal with the nota fiscal that was sent with the returned merchandise.

-

Complete the following fields with information from the nota fiscal that the buyer sent with the returned merchandise:

-

Nota Fiscal Number

-

Series

-

Document Type

-

Issue Date

-

-

Select Nota Fiscal Inquiry (F6) and enter either the nota fiscal number from the nota fiscal that accompanied the order when you shipped it to your customer, or the sales order number.

-

Select the lines for which you want to process a return by entering option 6 (Return all lines, Entire Nota Fiscal) or option 7 (Return a line).

-

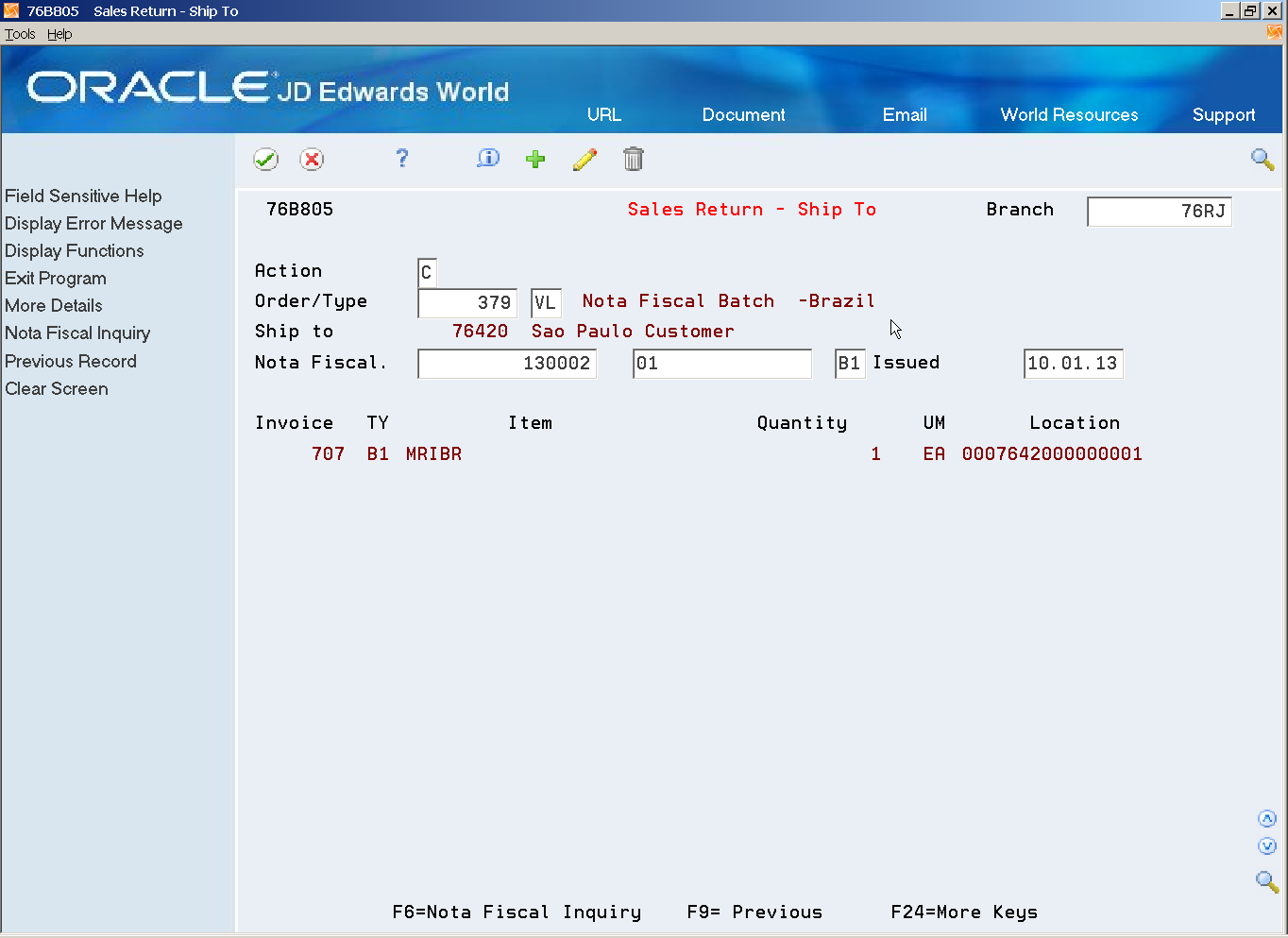

On the Sales Return - Ship-To screen, enter C in the action code and press Enter

-

On the Sales Order Detail Revisions screen, you will notice that all amounts are negative numbers.

-

Run the Confirm Shipments program, P4205.

-

Generate the return nota fiscal by running Generate Nota Fiscal - Ship To from the Sales Order Processing - Brazil menu (G76B4211).

To process ship-from sales returns

Use the Ship-From Sales Return process when you ship merchandise that is returned to you before the buyer receives it. You must print a nota fiscal to account for this type of transaction.

Complete these steps to process a Ship-From Sales Return:

-

Use the Sales Return - Ship-From program to create detail lines for the returned items and associate the original nota fiscal with the nota fiscal that you create for the return.

-

Select Nota Fiscal Inquiry (F6) and enter either the nota fiscal number from the nota fiscal that accompanied the order when you shipped it to your customer, or the sales order number.

-

Select the lines for which you want to process a return by entering option 6 (Return all lines, Entire Nota Fiscal) or option 7 (Return a line).

-

On the Sales Return - Ship-From screen, enter C in the action code and press Enter.

On the Sales Order Detail Revisions screen, you will notice that all amounts are negative numbers.

-

Run the Confirm Shipments program, P4205.

-

Generate the return nota fiscal by running Generate Nota Fiscal - Ship To from the Sales Order Processing - Brazil menu (G76B4211).

-

Print the Nota Fiscal.

33.2 Sales Order Reverse

Use Sales Order Reverse to reverse a transaction related to a nota fiscal that have not been sent to the customer yet. The Branch Plant and Location will not change.

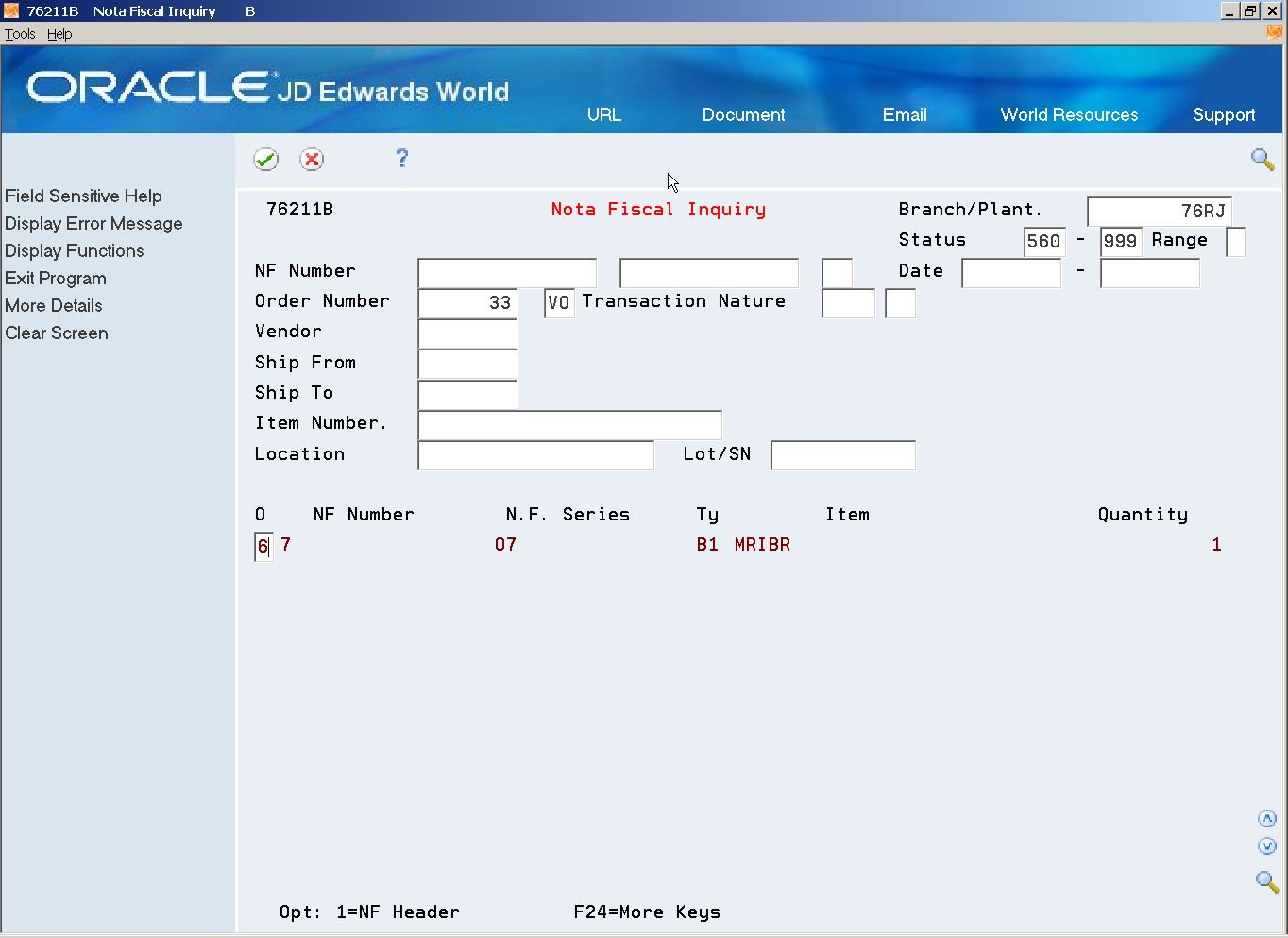

Figure 33-1 Example of Sales Return - Ship To screen

Description of "Figure 33-1 Example of Sales Return - Ship To screen"

-

Press F6 (Nota Fiscal Inquiry) to Select the Original Nota Fiscal Number to be reversed.

-

Enter 6 in the Option field to select all lines in the order.

-

Enter 7 in the Option field to select a specific line.

-

Press F3 to return to Sales Return (P76B805).

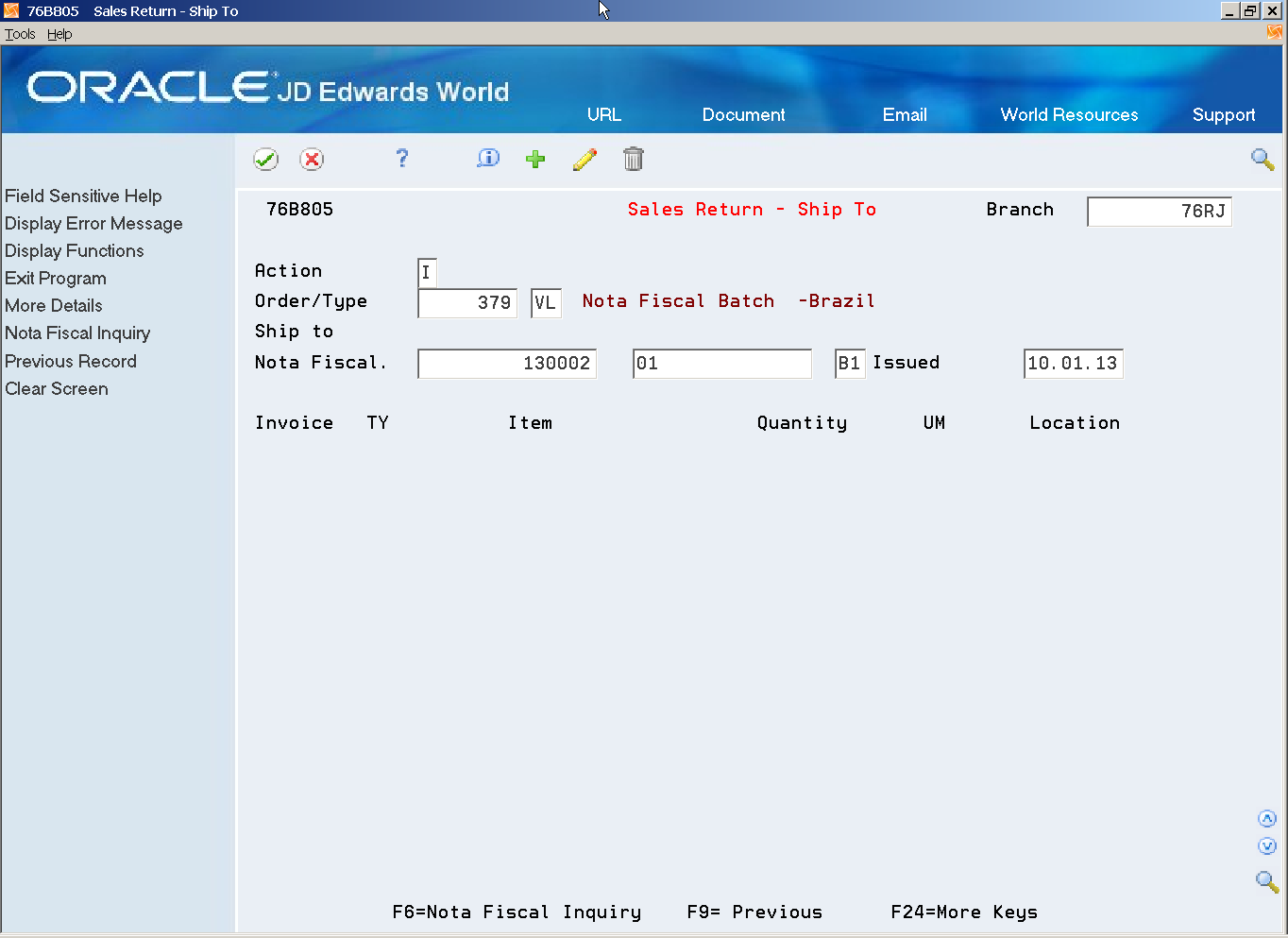

Figure 33-3 Sales Return - Ship To screen

Description of "Figure 33-3 Sales Return - Ship To screen"

-

Press Enter to generate the Sales Order.