59 Overview to the SPED Accounting Process

This chapter contains these topics:

59.1 About SPED Accounting

The SPED accounting process requires that you enter additional data to report on, and then run new programs to generate text files. You organize the generation of the data by setting up blocks and rules for the registers. After creating the output file, you then use the Export function to create text files that you submit to the government.

The text files are uploaded to the Sped Contabil, a government system provided by Brazilian Federal Tax Authority, and then transmitted through the Internet to the Brazilian Federal Tax Authority database. The process for reporting this information is referred to as SPED (Sistema Publico de escrituracao Digital [Public System of Digital Accounting]) accounting.

When you process records for SPED accounting, the system obtains data from these files:

-

Company Constants (F0010)

-

Address Book Master (F0101)

-

Address Book - Who's Who (F0111)

-

Address by Date (F0116)

-

Address Book Brazilian Tag Table (F76011)

-

Account Master (F0901)

-

Account Balances (F0902)

-

Account Ledger (F0911)

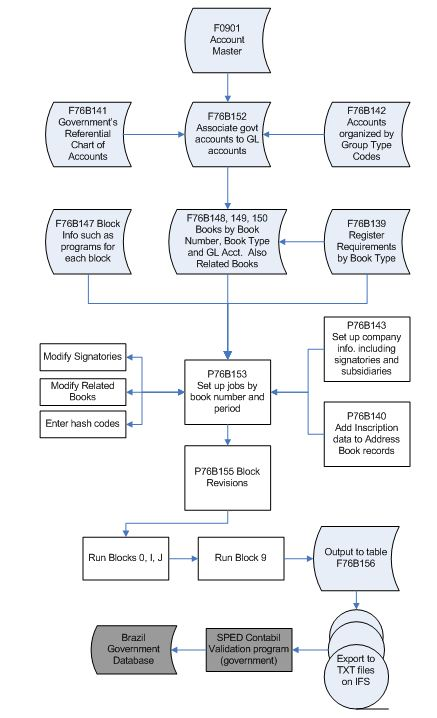

This process flow illustrates the SPED accounting process:

59.1.1 Blocks, Registers, and Records

The SPED accounting reporting process consists of generating data for reporting and then sending that data to the government. The data that you generate includes:

59.1.1.1 Blocks

Blocks include groupings of registers with similar information. For example, block J includes financial statement information.

59.1.1.2 Registers

Registers include records which are detailed information for each register. Oracle programming creates all of the registers for the blocks that it generates, but populates the detailed information for only required data that resides in the JD Edwards World tables. For example, registers for block J include balance sheet information (register J100) and income statement information (register J150).