60 Set Up SPED Accounting

This chapter contains the following topics:

60.1 Setting Up the System for SPED Accounting

Before you process records for SPED accounting, complete this required setup:

-

Set up a next unique ID number.

-

Set up user-defined codes.

-

Set up legal company information.

-

Add inscription information to address book records.

-

Assign group type codes to GL accounts

-

Enter a referential chart of accounts for SPED accounting

-

Associate GL accounts with the referential accounts

-

Define the books for SPED accounting

-

Specify blocks, sequences and versions.

-

Set up SPED register rules

-

Set up an IFS area.

60.1.1 Next Unique ID Number

The SPED Jobs program (P76B153) automatically creates a unique job number based on the setup for Table Name F76B153 in the Next Unique Numbers program (P00022). If desired, you can change the value by accesses in the Next Unique Numbers program from the General Systems menu (G00).

60.1.2 Set Up User-Defined Codes

Verify that these UDC tables include the necessary values:

-

UDC 00/S contains the State and Province codes.

-

UDC 76B/AI contains the type of registration or inscription number. You assign an inscription type to address book records. The system uses the inscription type when it generates data for the registration number and signatories for the SPED accounting electronic file.

-

UDC 76B/BN (Company Initial Situation Ind.) contains codes used to indicate the beginning of the period. Values are:

-

0: Normal (beginning on first day of the year)

-

1: Opening

-

2: Resulting of fusion (merger)

-

3: Beginning of compulsory delivery of ECD (Escrituração Contábil Digital [Digital Accounting Bookkeeping]) in the course of the calendar year

-

-

UDC 76B/BP (Bookkeeping Purpose) contains codes for the reason for the submission. Values are:

-

0: Original

-

1: Substitute with NIRE (Número de Identificação no Registro de Empresas [Company Registry Identification Number])

-

2: Substitute without NIRE

-

3: Substitute with Exchange NIRE

-

-

UDC 76B/BS contains the list of job status codes. For example, you could use these codes:

-

(Blank): Pending

-

D: Done/Completed

-

E: Error

-

P: Processing

-

-

UDC 76B/CA contains codes for the size of the company. Values are:

-

0: Large Company = NO

-

1: Large Company = YES

-

-

UDC 76B/CJ is used as the journal type indicator for the generation of Block I (P76B164). If blank, the record is considered a Standard journal (all journals except P/L (profit and loss) Closing Journals). If a Doc Type is entered in 76B/CJ, the record will be flagged with an 'E' to indicate that it's a Closing journal.

-

UDC 76B/CR specifies the relationship between the subsidiary and the legal Company. You assign a company relation code to a company when you complete subsidiary or participant information for the company in its address book record.

-

UDC 76B/DB contains the values for decentralized bookkeeping. You can assign a decentralized bookkeeping code to companies when you set up legal companies. The system uses the code in the decentralized bookkeeping field in register 0020 of block 0 for the electronic file for SPED accounting. Values are:

-

0: Legal Entity

-

1: Establishment

-

-

UDC 76B/ER contains the codes of institutions responsible for inscriptions. The system writes information about the responsible entity to block 0.

-

UDC 76B/GA specifies the Account Group Code. You assign a code from this UDC table when you set up GL accounts with information that is required for SPED accounting reporting.

-

UDC 76B/LY contains values for the version of the SPED file that you use. Values are:

1.00: Layout Version 1.00

3.01: Layout Version 3.01

-

UDC 76B/MU contains the IBGE table of municipalities. Enter the code for the code for each municipality into Description 2.

-

UDC 76B/RA specifies the government agency that provides the chart of accounts. You assign a value from this UDC table when you set up the cross-references between your chart of accounts and the legal chart of accounts. The codes indicate the agency responsible for the legal chart of accounts. The system uses this code in register I051 of block I.

-

UDC 76B/SG contains the Signatory qualification codes that specify the title of the person who is signing the Sped Accounting electronic file. You assign a value from this UDC code when you set up signatories for legal companies. The system uses this code in register J930 of block J.

-

UDC 76B/SL defines the SPED bookkeeping types. You assign a value from this UDC code when you set up book types for legal companies. The system uses this code to identify the type of bookkeeping files that you submit. The reporting requirements differ based on the book type. The system writes this value to the I010 register of book I, and uses the value to determine the data to write to other registers and books.

-

UDC 76B/SS contains the company special situation indicator. You assign a value from this UDC code when you set up information for legal companies. These codes indicate that a special situation, such as a merger or closure, exists for the company. The system uses this code in register 0000 of block 0.

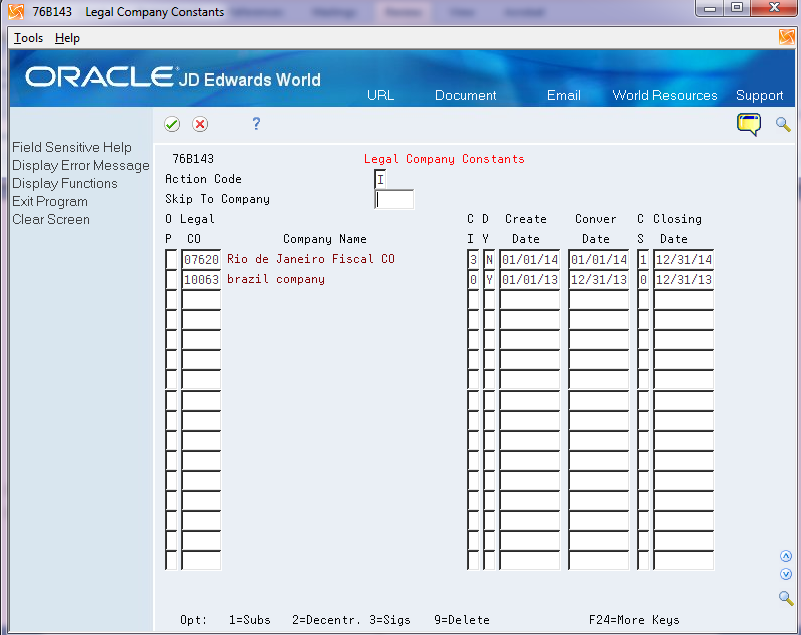

60.1.3 Setting up Legal Company Information

From Localizations - Brazil (G76B), choose G/L Reports

From Financial Reports - Brazil (G76B09), choose SPED Setup

From SPED General Account System Setup Brazil (G76B0941), choose Legal Company Constants

A legal company is the company for which you report the accounting data. You use the Legal Company Constants program (P76B143) to associate data about decentralized bookkeeping, subsidiaries, and signatories for the reporting company. The system uses the data that you enter to populate fields in the files that you submit for SPED accounting.

Before you can enter legal company constants, the legal company must exist in the Company Constants File (F0010) and in the Branch/Plant - Fiscal Company Cross Reference File (F7606B).

For each legal company, you can specify the following information:

-

Subsidiary.

If the legal company has subsidiary companies, you can set up information about the relationship between the companies. Select option 1 on the Legal Company Constants form to access subsidiary information.

-

Decentralized bookkeeping.

If a legal company is using decentralized bookkeeping, you can enter information about the associated company. Select option 2 on the Legal Company Constants form to access the form for decentralized bookkeeping.

-

Signatories.

You can specify the address book number and enter a code associated with the title of the person who signs the SPED accounting file submissions. Select option 3 on the Legal Company Constants form to access the form for the signatory information.

The system uses the address book number of the signatories to retrieve email, phone, and other information about signatories that it includes in block J of the SPED files.

The system writes the data that you enter to these tables:

-

Legal Company Constants (F76B143)

-

Legal Company - Subsidiaries (F76B144)

-

Decentralized Accounting Bookkeeping (F76B145)

-

Signatories (F76B146)

To enter legal company constants

On Legal Company Constants

Figure 60-1 Legal Company Constants screen

Description of "Figure 60-1 Legal Company Constants screen"

-

Complete the following fields:

-

Legal Co

-

CI (company special situation indicator)

-

DY (decentralized bookkeeping)

-

Create Date

-

Conver Date (conversion date)

-

CS (company size)

-

Closing Date

Field Description Legal Co Enter the legal company for which you set up the corresponding data. The legal company must exist in the Company Constants File (F0010) and in the Branch/Plant - Fiscal Company Cross Reference File (F7606B). CI (company special situation indicator) Enter a value from the Co Special Situation Indicator UDC table (76B/SS) to specify if the company experienced a special event, such as a merger or a change in legal status, during the reporting year. DY (decentralized bookkeeping) Enter a code to specify if the company uses decentralized bookkeeping. Decentralized bookkeeping occurs when some or all of the accounting activities take place with a company or accountant outside of the legal company. Enter Y (yes) if the bookkeeping is decentralized. Otherwise, enter N (no).

Create Date Enter the date that the company started. Conver Date (conversion date) Enter the date that the company converted its legal status from a simple association to a company association. CS (company size) Enter a code from UDC 76B/CA (Company Size Indicator) to specify if the company meets the threshold of being a large company. Closing Date Enter the fiscal year closing date. The system includes this date in the Opening Terms section of block I. -

-

Enter 1 in the OP (option) field to access subsidiary information.

On Legal Company Constants

-

Enter 1 in the OP (option) field for the legal company to work with and then click Enter.

-

On Legal Company Subsidiaries, complete these fields:

-

Co (Company)

-

PF (participant flag)

-

Part Code

-

Part Rel From Date (participant relationship from date)

-

Part Rel To Date (participant relationship to date)

-

Contrib Address (contributor address)

-

| Field | Description |

|---|---|

| Co (company) | Enter the company number of the company that is a subsidiary of the legal company. |

| PF (participant flag) | Enter Y (yes) if the company fulfills the requirements of a participant company. Otherwise, enter N (no).

A value for the participant flag is written to the 0150 and 0180 registers. |

| Part Code (participant code) | Enter a value from UDC 76B/CR (Company Relation Code) to specify the relationship between the subsidiary and legal companies. You must complete this field if you entered Y in the PF field.

A value for the participant code is written to the 0150 and 0180 registers. |

| Part Rel From Date (participant relationship from date) | Enter the date that the relationship between the subsidiary and the legal company began. |

| Part Rel To Date (participant relationship to date) | Enter the date that the relationship between the subsidiary or participant and the legal company ended. If the relationship extends beyond the fiscal year, enter the last day of the reporting period. |

| Contrib Address (contributor address) | Enter the address book number for a participant other than a subsidiary who contributed to the accounting data. |

To add centralized bookkeeping information

On Legal Company Constants

-

Enter 2 in the OP (option) field for the legal company to work with and then click Enter.

-

On Legal Company Decentral. Book, complete the following fields:

-

Address Number

-

DI (decentralized indicator)

-

| Field | Description |

|---|---|

| Address Number | Enter the address book number of the entity who contributed some or all of the accounting data. |

| DI (decentralized indicator) | Enter a value from the Decentralized Bookkeeping Entity (76B/DB) UDC table to specify the type of entity. Values are:

0: Legal entity 1: Establishment |

To add legal company signatories

On Legal Company Constants

-

Enter 3 in the OP (option) field, and then click Enter.

-

On Legal Company Signatories, complete the following fields

-

Address Number

-

Sig Cde (signatory code)

-

| Field | Description |

|---|---|

| Address Number | Enter the address book number of the person who is authorized to sign the SPED accounting electronic file.

The system uses the address book number to option the email, phone, and other information for block J - Accounting Statements, Record J930 - Bookkeeping Signatories Identification. |

| Sig Cde (signatory code) | Enter a value from the Signatory qualification Codes (76B/SG) UDC table to specify the title of the person who is signing the SPED accounting electronic file. |

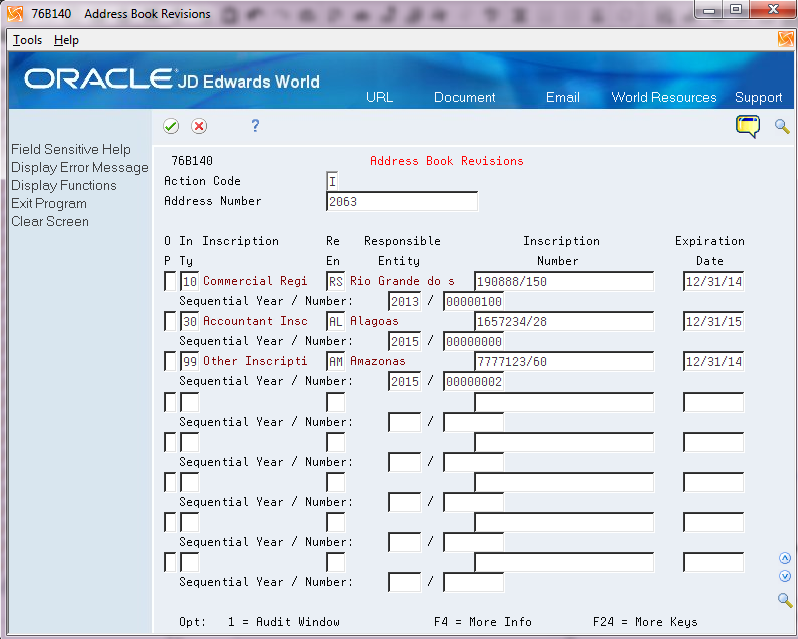

60.1.4 Adding Inscription Information to Address Book Records

From Localizations - Brazil

From Financial Reports - Brazil (G76B09), choose SPED Setup

From SPED General Account System Setup - Brazil (G76B0941), choose Address Book Revisions

You use the Address Book Additional Information program (P76B140) to add registration or inscription information to address book records. Registration or inscription information includes the type of registration or inscription, the number, issuer, and date. The system saves the inscription information to the Address Book Additional Information - Registrations file (F76B140) and writes inscription information to registers 0007, 0150, and J930.

The Address Book Number must exist in Address Book Master File (F0101) and in the Address Book additional Information Brazil File (F76011).

To enter inscription information

On Address Book Revisions

Figure 60-2 Address Book Revisions screen

Description of "Figure 60-2 Address Book Revisions screen"

| Field | Description |

|---|---|

| In Ty (inscription type) | Enter a value from the Inscription Type (76B/AI) UDC table. |

| Re En (responsible entity) | Enter a value from the Responsible for Inscriptions (76B/ER) UDC table. |

| Inscription Number | Enter the inscription number |

| Expiration Date | Enter the expiration date of the inscription number.

The system writes the expiration date to Block J - Accounting Statements., Record J930 - Bookkeeping Signatories Identification . |

| Sequential Year | Enter the year of the file. |

| Sequential Number | Enter the number of the file. |

60.1.5 Assigning Group Type Codes to Your GL Accounts

From Localizations _ Brazil (G76B), choose G/L Reports

From Financial Reports - Brazil (G76B09), choose SPED Setup

From SPED General Account System Setup - Brazil (G76B0941), choose Brazilian Account Information

You use the Brazilian Account Information program (P76B142) to assign Account Group Type Codes to each of the World General Ledger accounts. These codes provide a method of grouping accounts together as assets, liabilities, etc.

You can assign a Group Type Code from UDC 76B/GA to each GL account individually, or you can update the Group Type Code for a range of GL accounts. The system stores the data that you enter in the F76B142 file.

60.1.6 Entering a Referential Chart of Accounts for SPED Accounting

From Localizations - Brazil (G76B), choose G/L Reports

From Financial Reports - Brazil (G76B09), choose SPED Setup

From SPED General Account System Setup - Brazil (G76B0941), choose Referential Chart of Accounts

This section provides an overview of how to enter a government recognized chart of accounts and associate your GL accounts with it. Depending on your business, you might associate your GL accounts to the chart of accounts from the Secretaria da Receita Federal or the Banco Central do Brasil.

The Referential Chart of Accounts is stored in the F76B141 file and includes:

-

Chart of Account Responsible from UDC 76B/RA.

Specify the government agency that provided the chart of accounts.

-

Referential Account.

Account ID from the government chart of accounts.

-

Description.

The description of the account.

60.1.6.1 Importing the Government Referential Chart of Accounts

Instead of entering each record separately, you can interactively import the government chart of accounts from a spreadsheet. You must set up the spreadsheet with columns for each of the fields on the multiple Add Referential Chart Accounts video in the order in which the fields appear on the video.

60.1.7 Associating Your GL Accounts with the Referential Accounts

From Localizations - Brazil (G76B), choose G/L Reports

From Financial Reports - Brazil (G76B09), choose SPED Setup

From SPED General Account System Setup - Brazil (G76B0941), choose Ref Accounts by Account

You use the Ref Accounts by Account program to manually add or modify associations between the accounts in your chart of accounts and the Referential Chart of Accounts provided by the government agency. You should define a referential account for each account in your chart of accounts. The system saves the data for the associations in the Reference Accounts by Account file (F76B152).

If you need to delete a referential account, you must first remove the association between the referential account and the account in the chart of accounts.

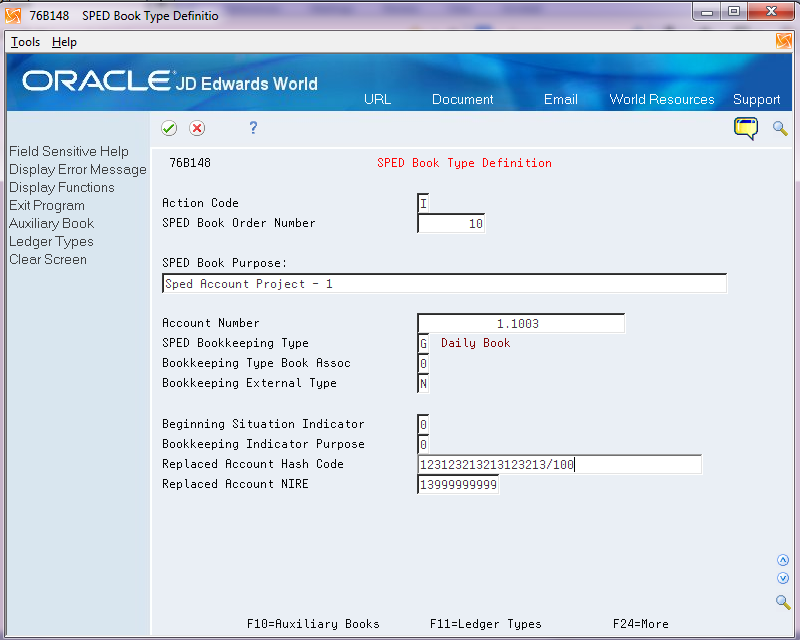

60.1.8 Defining the Books for SPED Accounting

From Localizations - Brazil (G76B), choose G/L Reports

From Financial Reports - Brazil (G76B09), choose SPED Setup

From SPED General Account System Setup - Brazil (G76B0941), choose SPED Book Type Definition

You use the Book Type Definition program (P76B148) to set up information about the SPED books that you must report. You specify the purpose of the book, the order in which it appears in the file, the book type, and other related information. You also specify the ledger type from which the system reads the transaction information for the SPED book.

Most companies need to set up and report only book type G (daily books). You must set up other book types if some of the data that you must report resides in another software system, or if you generate some of the data files from another system for any other reason. When you generate data from more than one source, you must:

-

Set up additional book types in UDC 76B/SL:

Note:

Book G also exists in the 76B/SL table, but it is the standard book, not an additional book type.-

R (Daily Book with resumed bookkeeping)

-

A (Auxiliary daily book with resumed bookkeeping)

-

B (Daily Balance books and balance sheet)

-

Z (Auxiliary major book)

-

-

Associate the auxiliary book to the main book. For example, auxiliary book A with the main book R.

-

Specify the ledger type from which the system reads the transaction information.

The system stores the data that you enter in these tables:

-

F76B148 - SPED Book Type Definition contains information about the main SPED Books.

-

F76B149 - SPED Book Type Relation stores the auxiliary book information.

-

F76B150 - SPED Book Ledger Types associates the ledger type with the book/account.

To set up book type definitions

Figure 60-3 SPED Book Type Definition screen

Description of "Figure 60-3 SPED Book Type Definition screen"

| Field | Description |

|---|---|

| SPED Book Order Number | Enter a number for the book. You use the book number when you set up the jobs to extract data for reporting. |

| SPED Book Purpose | Enter the purpose of the Bookkeeping Type. |

| Account Number | Enter the GL account from which the system will obtain transaction data for the SPED book types A or Z.

You do not associate a GL account number to book types G, R, or B. |

| SPED Bookkeeping Type | Enter the SPED Bookkeeping Type specified by Brazilian Government. Values are in UDC 76B/SL:

A: Auxiliary daily book with resumed bookkeeping B: Daily Balance books and Balances G: Daily Book (Complete, without auxiliary bookkeeping) R: Daily Book with Resumed bookkeeping (with auxiliary bookkeeping) Z: Auxiliary Major Book |

| Bookkeeping Type Book Assoc | Enter the bookkeeping type of the associated book. Values are:

0: Digital, included in SPED 1: Others |

| Bookkeeping External Type | Specify whether the SPED book information is generated by a system other than JD Edwards World. Values are:

N: No. The book is generated by the JD Edwards World system. Y: Yes. The SPED book is generated by a different system. |

| Beginning Situation Indicator | Enter a value from UDC 76B/BN to indicate whether the company has a special reporting situation. Values are:

0: Normal 1: Opening 2: Result of fusion (merger) 3: Beginning of ECD (Escrituração Contábil Digital [Digital Accounting Bookkeeping]) delivery The system includes the value that you enter in the Opening section of block 0. |

| Bookkeeping Indicator Purpose | Enter a value from UDC 76B/BP to indicate the purpose of the SPED book submission. Values are:

0: Original 1: Substitute with NIRE (Número de Identificação no Registro de Empresas [Company Registry Identification Number]) 2: Substitute without NIRE 3: Substitute with exchange NIRE The system includes the value that you enter in the Opening section of block 0. |

| Replaced Account Hash Code | Enter the replacement hash code, if applicable. |

| Related Account NIRE | Enter the replacement account NIRE, if applicable. |

60.1.9 Specifying Blocks, Sequences and Versions

From Localizations - Brazil (G76B), choose G/L Reports

From Financial Reports - Brazil (G76B09), choose SPED Setup

From SPED General Account System Setup - Brazil (G76B0941), choose Block Setup

You use the Block Setup program (P76B147) to set up the batch programs and versions to run for each block. You set up versions of the programs provided by Oracle, and can also set up versions of custom programs that you create to generate blocks or populate registers for data that does not reside in the JD Edwards World software.

The blocks are defined in UDC 76B/BL as Blocks 0, I, J, and 9. A process ID should be created for SPED Accounting in UDC 76B/VC. The process ID separates the sequence of steps for SPED Accounting from other processes that use this same setup program.

When you set up the blocks, you specify the sequence, or order, in which the blocks appear in the flat file.

This table provides an example of block sequencing::

| Block | Block Sequence |

|---|---|

| 0 | 1 |

| 1 | 2 |

| J | 3 |

| 9 | 4 |

The system stores the block setup data in F76B147.

Note:

The version field shows the version as ZJDE0001, even if the program is not a Dream Writer version.

60.1.10 Setting Up SPED Register Rules

From Localizations - Brazil (G76B), choose G/L Reports

From Financial Reports - Brazil (G76B09), choose SPED Setup

From SPED General Account System Setup - Brazil (G76B0941), choose SPED Register Rules

The tax authority determines which registers in each block must be included in the SPED accounting files for each book type. The mandatory registers vary based on the type of book that you submit. For example, register I012 (Daily Auxiliary Books) is mandatory when you generate book type B (Daily Balance Book and Balance Sheet) but is not mandatory when you generate book type G (Daily Books).

Each register, as defined in UDC 76B/BR, must be assigned to a book type and given a rule value of Mandatory or Not Included.

The system stores the register rules in F76B139.

60.1.11 Set Up an IFS Area

You must set up an IFS area on your iSeries for the TXT files that you will provide to the government's fiscal authority.

See "Set Up Import/Export" in the JD Edwards World Technical Tools Guide.