39 Work with A/R Prepayment Tax Accounting

This chapter contains these topics:

-

Section 39.4, "Processing Tax When Prepayment Applied to Final Invoice,"

-

Section 39.6, "Running Prepayment Tax Processing (P74R0320)."

This chapter provides an overview of tax accounting for A/R prepayments and discusses how the localization program calculates prepayment tax and processes G/L accounting when prepayment is received and when it is applied.

39.1 Understanding Prepayment Tax Processing

When a cash or bank prepayment is received, it is subject to VAT. This VAT amount is calculated and posted to the credit side of the actual VAT account. When an unapplied cash receipt is applied to an invoice, the posting of prepayment VAT amount is reversed. The prepayment tax amount is included in the Sales Book. When the prepayment is applied to the final invoice, the reversal of prepayment tax is included in the Purchase Book.

The user enters a prepayment with either manual cash receipt entry or batch cash receipt entry programs (P03103, P03550).

At that moment, the system will record the prepayment to the cash or bank account. However the user must deliberately execute the stand-alone batch program P74R0320 to generate G/L accounting entries that calculate and record the tax portion of the prepayment. The Prepayment Tax Processing program (P74R0320) can be executed from the Accounts Receivable - RUSSIA menu (G74R03). The program could also be scheduled to execute automatically at fixed times, for instance in overnight batch mode.

The Prepayment Tax Processing program creates journal entries with batch type G with tax area, and tax explanation code VT (tax only transaction). The program registers each prepayment tax transaction in file F0018. This file includes both the prepayment receipt and the reversal when the prepayment is applied to the final invoice.

Additionally, the prepayment tax accounting program creates a new Prepayment Tax file (F74R0320) that records all prepayments that have been entered into the system. If the prepayment is not subject to tax, it is reported indicating that tax was not computed for it. The file tracks the key for the prepayment G/L transaction. Any time the prepayment is applied to an invoice (full or partially), and the remaining tax amount will be updated. If the prepayment is applied to an invoice before the program P74R0320 is executed, no record is created in Prepayment Tax File (F74R0320).

39.2 Entering Tax Prepayment Received

When you enter an unapplied cash receipt, the system allows you to enter the tax area. As a default, the customer tax area displays and you can change it for other valid entry.

The tax area field is optional. Press F3 to create a prepayment tax journal entry, based on the customer´s tax area.

39.3 Processing Tax When Prepayment Received

When you run Prepayment Tax Processing, the program selects all prepayments that fulfill the following conditions:

-

Prepayment receipt has been posted

-

It was not processed previously (no tax accounting exists)

-

It has not been voided

-

It has not been completely applied to any invoice. If it has been partially applied to an invoice, the tax entries will be recorded only for the remaining amount to apply

For each prepayment selected, a new G/L entry will be created with the tax amount computed. To compute the tax amount, the program will use the default tax area from the customer. The new G/L entry will be created with the same document type indicated by a processing option. The main characteristic of this transaction is that it will be stored as a journal entry with tax. It means that Sales/Use/VAT Tax File (F0018) will be also updated.

The debit account for the new transaction is defined by the AAI RC + offset from processing option.

The credit account for the new transaction is defined by the AAI GT + offset from tax area used.

All new G/L journal entries created when you run the program are included in the same batch number. A processing option selection allows you to automatically post the journal entries.

39.4 Processing Tax When Prepayment Applied to Final Invoice

You apply the prepayment to the final invoice when it arrives. Later when the posting is executed, the localization creates accounting entries to register the reversal of the prepayment tax amount. If the prepayment has been partially applied, the tax reversal will be on the partial amount.

The localization program selects prepayments for tax reversal that meet the following condition:

-

The tax for the prepayment has already been accounted. If a record exists in the new localization file, F74R0320, it means that prepayment tax accounting has already been processed

The posting process will print a report (R74R0904) with information on the transactions processed or with information about the processing errors, if applicable.

39.5 Voiding Receipts

A receipt can be voided after it was entered. If the receipt has not been posted, the system physically deletes it. If it has been posted, a void receipt is created instead.

When the receipt void is posted, the localization program will do one of the following:

-

If the receipt being voided is the prepayment receipt and the prepayment tax has already been computed and accounted, the system will void the prepayment tax G/L transaction

-

If the receipt being voided is the prepayment application to an invoice, the system will void the prepayment tax reversal G/L transaction that was automatically created when the prepayment was originally applied to the invoice

The posting process prints a report (R74R0904) with information on the transactions processed or with information about the processing errors, if applicable.

39.6 Running Prepayment Tax Processing (P74R0320)

Run the Prepayment Tax Processing from the Accounts Receivable - Russia menu. The program runs in batch mode and prompts the user for processing options and data selection criteria.

To run the Prepayment Tax Processing program

From Accounts Receivable - Russia (G74R03), choose option 2 (Prepayment Tax Processing)

-

On Prepayment Tax Processing, select the version to run.

-

Press Enter to continue.

-

On Processing Options Revisions, complete the following processing options:

-

Complete the selection options for the transaction, using the appropriate Document Type and Address Number values for your company.

| Document Type | EQ | RU | |

|---|---|---|---|

| AND | Payment/Item Document Type | EQ | *BLANKS |

| AND | Open Amount | NE | 000000000000 |

| AND | Document Type | EQ | *BLANKS |

| AND | Document Number | EQ | *ALL |

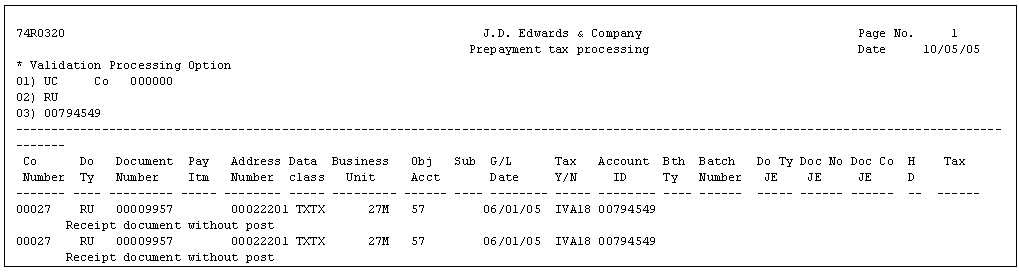

When the prepayment tax journal entries are posted, the system generates the R74R0320 report with information on the transactions processed or with information about the processing errors, if applicable, similar to the following example.

Figure 39-1 Prepayment Tax Processing report

Description of "Figure 39-1 Prepayment Tax Processing report"

39.6.2 Setup

The user should perform the following additional setup to support prepayment tax accounting for Russia.

Add the prepayment tax document types defined by processing option to the following UDC tables:

-

00/ DI Document Type - Invoices Only

-

00/ DT Document Type - All Documents

G0341 Accounts Receivable Setup:

-

Set up a new AAI, RC + offset entered by processing option 1 from P74R0320 for the trade account.

-

Set up a new AAI GT + offset from the tax area to use for the tax account.

Note:

Document Type: Defined by processing option selection. It is recommended to use a different document type than used for the original tax accounting to make it easier to distinguish the transactions in report. (Processing Option 1- P03801RU).