5 Work with Belgium VAT Reports

This chapter contains these topics:

-

Section 5.3, "Generating the Intracommunity Statement n° 723,"

-

Section 5.5, "Updating Previous Periods for the Intracommunity Statement n° 723 Report,"

5.1 Working with Belgium VAT Reports

The Minister of Finance in Belgium requires each company to present the following VAT reports:

-

625 Monthly VAT

-

Intracommunity Statement n° 723

-

Yearly Clients List N° 725

You use the Generic VAT Reports program (P700001) to generate the required reports. You must set up a version of the report for each report that you use, and must set up processing options and spooled file export parameters for each version.

See "Generic VAT Reports" in the JD Edwards World Tax Reference Guide and Section 3.5, "Setting Up Report Versions,".

The system generates the reports in the XML format required by the government. You submit the XML files according to the government requirements.

Working with Belgium VAT reports consists of the following tasks:

-

Updating the XML Superdata Set.

Run the processes to update all of your VAT transactions, such as processing invoices and receipts.

-

Generating the reports.

Generate the 625 Monthly VAT report to produce a list of customers and a list of suppliers for your transactions that include VAT.

Generate the Intracommunity Statement n° 723 to produce a report that includes VAT amounts for all customers who are located in EU member countries, except Belgium.

Generate the Yearly Clients List N° 725 to produce a report that includes a list of your clients.

-

Reviewing and correcting records.

-

Reprocessing records if necessary.

5.1.1 Before You Begin

-

Verify that you have set up the appropriate user-defined codes and associations for Belgium reporting.

-

Execute the Generic VAT Report (P700001) program.

See "Generic VAT Reports" in the JD Edwards World Tax Reference Guide.

5.2 Generating the 625 Monthly Report

From EMEA Localizations (G74), choose Belgium

From Belgium Localizations (G74B), choose Generic VAT Reports

From Generic VAT Reports Generation (G74B00), choose XML VAT Generic Report 625

The Belgian Tax Authorities require monthly VAT reports on the detail of the VAT amounts that are declared on all of the customer invoices, and for all invoices for suppliers. You generate one report for customers and another report for suppliers. All customers and suppliers must be included on the reports, including Belgian customers and suppliers, European Union (EU) member customers and suppliers, and non-EU customers and suppliers.

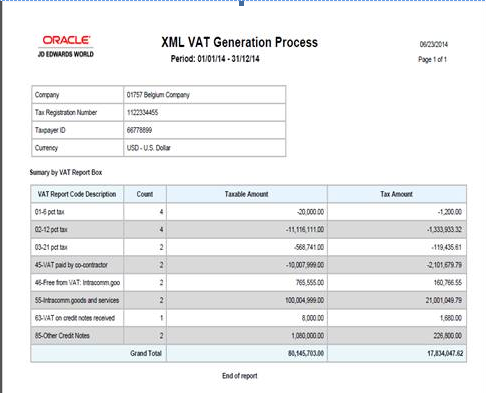

This image shows an example of the monthly 625 VAT report:

Figure 5-1 Monthly 625 VAT Report - Summary

Description of "Figure 5-1 Monthly 625 VAT Report - Summary"

The system provides version ZJDE0001 in the Generic VAT Reports (P700001) for the Monthly 625 VAT report. You can use version ZJDE0001, or create a version that is based on the ZJDE0001 version.

5.2.1 Processing Options

You must set up the processing options in the Belgium VAT Report program (P700001BE) for the same version that you run for the Generic VAT Reports program (P700001). For example, if you create and run a version of the Generic VAT Reports program named VAT625, then you must create a version named VAT625 in the Belgium VAT Report program (P700001BE) and set up the processing options in the VAT625 version. When you execute the VAT625 version of the Generic VAT Report program, the system uses the processing options in the corresponding version (VAT625) of the Belgium VAT Report program. If you do not set up a corresponding version for the Belgium VAT Report program, then the system uses version ZJDE0001.

5.3 Generating the Intracommunity Statement n° 723

From EMEA Localizations (G74), choose Belgium

From Belgium Localizations (G74B), choose Generic VAT Reports

From Generic VAT Reports Generation (G74B00), choose XML VAT Generic Report 723

The Belgian Tax Authorities require periodic reports that include VAT amounts for all customers who are located in EU member countries, except Belgium. Only non-Belgian EU member customers who are invoiced during the fiscal period need to be reported. The Belgian Tax Authorities require that this information be submitted in XML format.

The system provides version ZJDE0002 in the Generic VAT Reports (P700001) for the Intracommunity statement n° 723 report. You can use version ZJDE0002, or create a version that is based on the ZJDE0002. version.

5.4 Generating the Yearly Clients List n° 725

From EMEA Localizations (G74), choose Belgium

From Belgium Localizations (G74B), choose Generic VAT Reports

From Generic VAT Reports Generation (G74B00), choose XML VAT Generic Report 725

The Belgian Tax Authorities require yearly reports that include value-added tax (VAT) amounts for all customers who were invoiced during the fiscal year. Only Belgian customers need to be reported.

Businesses can file the electronic declaration using the INTERVAT application available on the web site, http://www.minfin.fgov.be. The web site, managed and maintained by the Belgian Tax Authorities, enables businesses to either manually enter the required VAT data in a specific web page or to upload an XML file with the necessary information. If uploading an XML file, businesses must use the official XSD scheme published by the Belgian Tax Authorities that can be downloaded from the same web site.

The system provides version ZJDE0003 in the Generic VAT Reports (P700001) for the Yearly Clients List n° 725 report. You can use version ZJDE0003, or create a version that is based on the ZJDE0003 version.

5.5 Updating Previous Periods for the Intracommunity Statement n° 723 Report

From EMEA Localizations (G74), choose Belgium

From Belgium Localizations (G74B), choose Generic VAT Reports

From Generic VAT Reports (G74B00), choose Corrections Previous Period

Use this program to enter corrections of previous periods that were already declared on the Intracommunity Statement n° 723 report. You can add taxable items for address book records.

Figure 5-2 Corrections Previous Periods screen

Description of "Figure 5-2 Corrections Previous Periods screen"

5.6 Revising Tax Reports

From EMEA Localizations (G74), choose Belgium

From Belgium Localizations (G74B), choose Generic VAT Reports

From Generic VAT Reports (G74B00), choose Work with Inf. Taxes by Report

You can revise existing data in the VAT reports. You might need to do this to correct missing or inaccurate information.

The Work with Inf. Taxes by Report screen enables these additional functions and selection options:

-

F6

When you press F6, the system deletes all of the existing records in the F700018 file that match the search criteria that you specify in the header area.

-

F17

When you press F17, the system positions the cursor in the Action Code field.

-

Selection option 3

Enter 3 in the option field to view the audit trail for a record.

To revise information in the Generic VAT file

On Work with Inf. Taxes by Report

Figure 5-3 Work with Inf. Taxes by Report screen

Description of "Figure 5-3 Work with Inf. Taxes by Report screen"

To locate a transaction in VAT reports, complete the following fields:

-

Report ID

-

Period

-

Fiscal Company

-

Company

-

Tax Area

-

G/L Date range

-

Document Number

You can remove transactions and then reprocess the reports.