7 Year-End Reporting

After you review information online and make any necessary corrections, print your audit reports and review them for accuracy. JD Edwards World recommends that you run your audit reports and compare them with your taxation history reports. Review audit reports for accuracy before printing year-end forms.

You print year-end forms to create an audit trail for reporting to the government and to send to your employees for their tax reporting purposes.

You can report year-end information to the federal government using paper or electronic filing.

Caution:

The IRS requires electronic filing if you have a specific number of returns. The Accounts Payable system can also produce 1099 returns. Therefore, consider the number of returns that you generate by both the Accounts Payable and the Payroll systems when deciding whether you must use electronic filing reporting. For more information about electronic filing reporting requirements, contact your IRS office.This chapter contains the following topics:

7.1 Printing Audit Reports

After you create the workfile, but before you print year-end forms, carefully verify the amounts on the audit reports. You can run audit reports as many times as necessary without affecting the workfiles that the system creates in the W-2 workfile build process. Additionally, you can review the amounts online using the W-2/1099 Review program on the Year-End Processing menu.

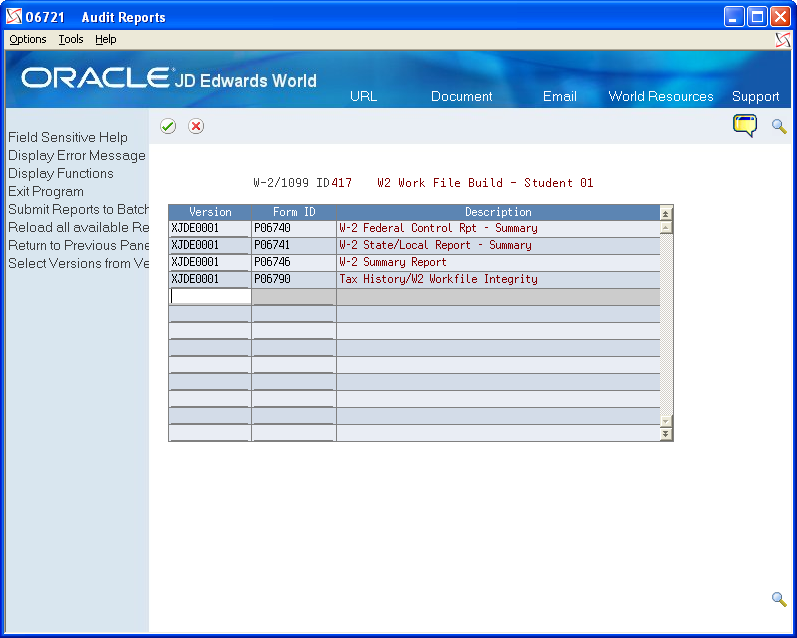

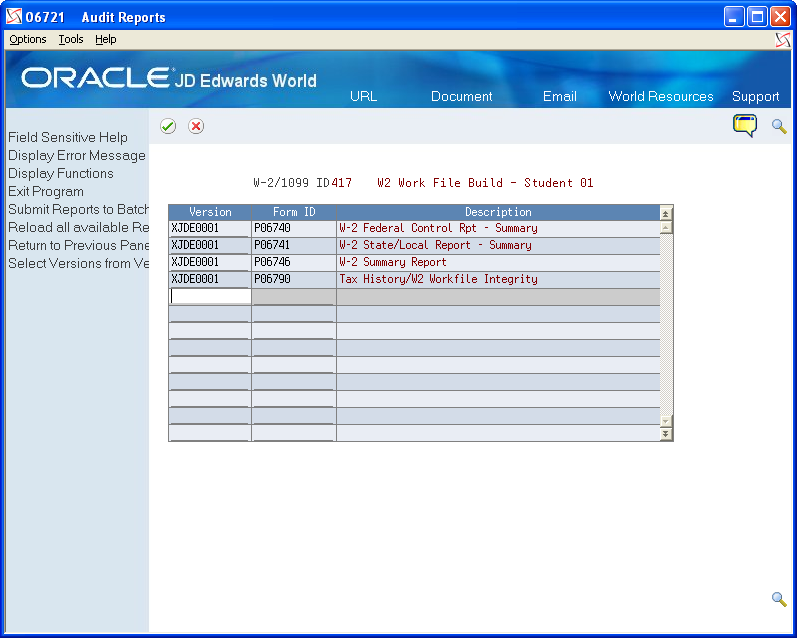

The first time that you access the Audit Report version screen, the system automatically displays all of the available DREAM Writer versions. The next time you access this screen; the system displays only the versions that you have run previously. By choosing the Reload all available Reports for select (F10), you can redisplay all versions. To identify the specific versions to process, you can enter the version number or choose Field Sensitive Help (F1) in the Version field to review the valid versions. To create a new version of the report, choose Field Sensitive Help (F1) in the Version field, and then choose Call DREAM Writer from the Functions menu to access the DREAM Writer version list screen.

For W-2 purposes only, you can enter more than one version number for a form ID. This action allows you to submit different versions of the same report to process simultaneously. For example, you can run version 001 and 002 of DREAM Writer form P06740. When identifying your versions for the first time, enter version numbers for only those forms that you want the system to process. The system does not add remaining forms to the W-2 Audit Report table (F06723).

After you print audit reports, compare them with their corresponding history reports. Many audit reports have summary and detail versions. You must choose the appropriate report from the versions list.

Note:

You must use the Audit Reports program (P06721) to print audit reports. You cannot print audit reports from the W-2 Reports & Forms Setup menu (G072473), but you can choose the Versions List option on Audit Reports program to access a versions list for each report. Use the W-2/1099 Setup menu (G072472) or the Additional Year-End Reports & Forms menu (G072474) to set up versions of these reports for your environment.Printing audit reports is similar to using the Reports Only menu selection in the payroll cycle.

Each audit report contains different information and displays totals at company levels, as well as all information that is in the year-end workfile. You cannot change the data sequence for any of the audit reports.

The following includes the type of totals that each report includes:

| Audit Report | Displays totals | Displays grand totals |

|---|---|---|

| W-2 Summary Report (P06746) | YES | YES |

| Tax History/W-2 Workfile Integrity Report (P06790) | NO | NO |

| W-2 Federal Detail Report (P06740A) | YES | YES |

| State/Local Detail Report (P06741A) | YES | YES |

| W-2 Special Handling Detail Report (P067421) | YES | YES |

| Employee Form Count Detail Report (P06754) | YES | YES |

| W-2 Federal Control Detail Report (P06740) | YES | YES |

| W-2 Federal Adjusted Wage Detail Report (P06743) | YES | NO |

| W-2 State/Local Adjusted Wage Detail Report (P06744) | YES | NO |

| W-2 Restaurant Control Report (P06749) | YES | YES |

| W-2 Benefit Statement Report (P06750) | YES | NO |

| W-2 Box 13 Flag Audit Report (P06776) | NO | NO |

| W-2 Summary Report (P06746) | YES | YES |

From Year End Processing (G07247), choose Audit Reports

-

On the first Audit Reports screen, complete the W-2/1099 ID field and then click Enter twice.

The second Audit Reports screen displays.

Description of the illustration ''audt_rptrs.gif''

-

On the second Audit Reports screen, enter a valid DREAM Writer version in the Version field for each report that you want to print

-

Click Enter to load the reports.

If you do not click Enter before submitting, the system does not print your reports.

The system verifies each version and displays the report name in the Description field.

-

Choose Submit (F6) to print the reports.

7.2 Reviewing Additional Year-End Audit Reports

In addition to audit reports that you run from the DREAM Writer, there are a variety of other year-end audit reports you can run to verify the amounts in your system.

Use the menu selections on the W-2 Reports & Forms Setup (G072473) or Additional Year-End Reports and Forms (G072474) menus to set up the DREAM Writer versions for the reports. Execute the reports from the Year End Processing menu (G07247), and choose Forms.

Reviewing additional year-end audit reports includes:

-

Reviewing the W-2 Federal Control (Summary) Report (P06740)

-

Reviewing the Federal Detail Report (P06740A)

-

Reviewing the State/Local Control Report (P06741)

-

Reviewing the State/Local Detail Report (P06741A)

-

Reviewing the W-2 Special Handling Report (P067421)

-

Reviewing the W-2 Federal Adjusted Wage Detail Report (P06743)

-

Reviewing the W-2 State/Local Adjusted Wage Detail Report (P06744)

-

Reviewing the W-2 Summary Report (P06746)

-

Reviewing the Federal Allocation Report (P06748)

-

Reviewing the W-2 Restaurant Control Report (P06749)

-

Reviewing the W-2 Benefit Statement Report (P06750)

-

Reviewing the Federal Railroad Control Report (P06753)

-

Reviewing the Employee Form Count Report (P06754)

-

Reviewing the 1099-MISC Summary Report (P06756)

-

Reviewing the 1099-R Summary Report (P067561)

-

Reviewing the 499R-2 Summary Report (P06758)

-

Reviewing the W-2 Box 13 Flag Audit Report (P06776)

-

Reviewing the Tax History/W-2 Workfile Integrity Report (P06790)

7.2.1 Reviewing the W-2 Federal Control Report (P06740)

The W-2 Federal Control report prints all of the information for each employee's W-2. You should consider producing this report as a mandatory step in the year-end process because it is your hard copy of the information that prints on the W-2 forms that you distribute to your employees. This report is the only report that includes all of an employee's data as it displays on the W-2 form.

This report prints summary information by company as reported on your W-2s. The report includes federal reportable wage (taxable and adjustments) and tax.

You can run this report in summary or detail mode.

From Additional Year End Reports & Forms (G072474), choose W-2 Federal Control Report

7.2.2 Reviewing the Federal Detail Report (P06740A)

This Report displays the taxable wages, adjustments, adjusted wages and taxes for the various federal tax types for each tax type that is applicable for a given employee.

If you choose the detail version of this report, the report lists the following information by employee:

From W-2 Reports & Forms Setup (G072473), choose Federal Detail Report

7.2.2.2 Data Selection

The Type of Form field must have a value of 0 to insure that you are reporting W-2 records for the employees.

7.2.2.3 Data Sequence

The data sequence is hard coded and any changes to the report will cause a program error.

7.2.3 Reviewing the W-2 State/Local Report (P06741)

The W-2 State/Local Control Report allows you to print the detail information for the State/Local Wages and Taxes.

From Additional Year End Reports & Forms (G072474), choose W-2 State/Local Report

7.2.3.2 Data Sequence

To print summary information correctly, you cannot have Page Skip equal to Y for Work State, Work City, and Work County. To print detail and summary information, Page Skip can equal Y for Work State, Work City, or Work County.

7.2.4 Reviewing the State/Local Detail Report (P06741A)

The State/Local Detail report prints the following information:

-

State and local taxable wages

-

Special handling adjustments

-

Reportable wages

-

Tax by employee, tax area, and tax history type, as reported on the W-2 forms

If you choose summary information, the report lists detail by company, tax area, and tax type.

From W-2 Reports & Forms Setup (G072473), choose State/Local Detail Report

7.2.4.2 Data Selection

Type of form must have a value of 0 to insure that you are reporting W-2 records for the employees.

7.2.5 Reviewing the W-2 Special Handling Report (P067421)

This report lists DBA amounts on the W-2 forms by box, DBA, and employee. You can run this report for only one special handling box at a time. Summary information displays a total by box, DBA, and company.

From W-2 Reports & Forms Setup (G072473), choose Special Handling Report

7.2.5.2 Data Selection

-

Because you enter a value for the Special Handling Tag in the processing option, it is not necessary for you to enter this in the data selection. Doing so can cause the report to fail.

-

Form Type must have a value of 1 and 0 to insure that you are reporting W-2 records for the employees.

7.2.6 Reviewing the W-2 Federal Adjusted Wage Detail Report (P06743)

The W-2 Federal Adjusted Wage Detail Report lists taxable wages and any special handling adjustments for FIT, FICA, and Medicare. This report groups the information by employee if you choose detail information or by company if you choose summary information. This report also lists error messages if the adjusted wages on the report do not match the adjusted wages on the W-2.

From W-2 Reports & Forms Setup (G072473), choose Federal Adjusted Wage Report

7.2.6.3 Example: Federal Adjusted Wage Detail Report

7.2.7 Reviewing the W-2 State/Local Adjusted Wage Detail Report (P06744)

The W-2 State/Local Adjusted Wage Detail Report prints employees' taxable wages, fringe benefits, and reportable wages, as reported on the individual W-2 forms. A processing option allows you to specify up to three states or localities for which to print this information. This report also prints error messages if adjusted wages on the report do not match adjusted wages on the W-2.

From W-2 Reports & Forms Setup (G072473), choose State/Local Wage Adjustments

7.2.7.2 Example: W-2 State/Local Adjusted Wage Detail Report

7.2.8 Reviewing the W-2 Summary Report (P06746)

You should consider producing this report as a mandatory step in the year-end process. The report is your hard copy of the information that prints on the W-2 forms and is the only report that includes all of an employee's data the W-2 form.

Additionally, JD Edwards World recommends that you run the following reports:

-

The 1099-MISC Summary report (P06756) for detailed information for each employee's 1099-MISC.

-

The 1099-R Summary report (P067561) for detailed information for each employee's 1099-R.

-

Tax History/W-2 Workfile Integrity report (P06790)

From W-2 Reports & Forms Setup (G072473), choose W-2 Summary Report

7.2.9 Reviewing the Federal Allocation Report (P06748)

This report provides a detailed list of federal taxable wages that are allocated to the various states where the employee worked.

From Additional Year End Reports & Forms (G072473), choose Federal Allocation Report

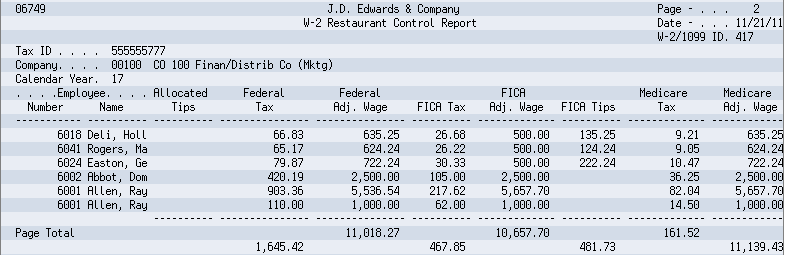

7.2.10 Reviewing the W-2 Restaurant Control Report (P06749)

The W-2 Restaurant Control report provides detailed information about employees that receive tips as a form of compensation.

The report includes all federal wages you report, federal taxes, allocated tips, and taxable tips that you report on the individual W-2 forms.

From Additional Year End Reports & Forms (G072474), choose W-2 Restaurant Control Report

7.2.11 Reviewing the W-2 Benefit Statement Report (P06750)

The W-2 Benefit Statement Report (P06750) prints a summary of benefits for select employees by state.

From W-2 Reports & Forms Setup (G072473), choose W-2 Benefit Statements

7.2.12 Reviewing the W-2 Railroad Control Report (P06753)

This report provides detailed tax and wage information that is specific to railroad employees.

From W-2 Reports & Forms Setup (G072474), choose W-2 Railroad Control Report

7.2.13 Reviewing the Form Count Reports (P06754)

These reports provide a listing of the form you submit to employees. It lists the total amount of earnings for employees that are on the forms.

This report lists federal, state, and local reportable wages by employee, as well as an employee count by company and tax ID as reported on the individual forms. If you choose summary information, only the company and tax ID totals appear.

From this menu selection, you can run the following reports:

-

W-2 and W-2C Count Report (Summary or Detail)

-

1099-R Count Report (Summary or Detail)

-

1099-Misc. Count Report (Summary or Detail)

From W-2 Reports & Forms Setup (G072473), choose W-2 Count Report

7.2.14 Reviewing the 1099-MISC Summary Report (P06756)

The 1099-MISC Summary report lists all of the information that displays on 1099-MISC forms for contract employees. You should consider producing this report as a mandatory step in the year-end process and it is mandatory if you are creating 1099-MISC forms during the payroll year-end process. This is the only report that lists all of the data on each employee's 1099-MISC form.

From Additional Year End Reports & Forms (G072474), choose 1099-MISC Summary Report

7.2.15 Reviewing the 1099-R Summary Report (P067561)

This report allows you to review all of the retirement or pension amounts earned by employees within a given company and version.

The 1099-R Summary report lists all of the information that displays on 1099-R forms for pension employees. You should consider producing this report as a mandatory step in the year-end process and it is mandatory if you are creating 1099-R forms during the payroll year-end process. This is the only report that lists all of the data on each employee's 1099-R form.

From Additional Year End Reports & Forms (G072474), choose 1099-R Summary Report

7.2.16 Reviewing the 499R-2 Summary Report (P06758)

This report provides a detailed listing of all information pertaining to a 499R-2 and the non-form hardcopy of the 499R-2 that you issue to the employee.

From Additional Year End Reports & Forms (G072474), choose 499R-2 Summary Report

7.2.17 Reviewing the W-2 Box 13 Flag Audit Report (P06776)

The W-2 Box 13 Flag Audit Report lists which employees have information that prints in Box 13 of the W-2 form.

From Year End Processing (G07247), choose Audit Reports

7.2.17.1 Example: W-2 Box 13 Flag Audit Report

Description of the illustration ''sw_ch7_pg7147229.gif''

7.2.18 Reviewing the Tax History/W-2 Workfile Integrity Report (P06790)

Once you build and balance the workfiles, there can be occasions when you need to modify employee history because of late corrections. Modifications might include manual or void checks that you did not process promptly or DBA's which were previously unidentified. When you process these items through the standard payroll cycle or update them directly into the history, the integrity report creates a variance. The main purpose of this integrity report is to identify employees with variance amounts so you can correct the information, by running a Changes Only workfile, before printing year end forms.

The Tax History/W-2 Workfile Integrity Report lists any variances by employee when comparing the actual W-2 forms to the payroll history tables. The EC (Error Code) column identifies the error numbers that appear on the error table at the end of the report. This table lists which integrity test the system performs to identify the variance.

This report displays variances between the following history files and the W-2/1099 Workfile build files:

-

Taxation Summary History (F06136)

-

Transaction Summary History (F06146)

-

Tax Area Transaction History (F06148)

-

Employee Federal Control Record (F06730)

-

Employee State/Local Control Record (F06731)

-

Employee Special Handling Control Record (F06732)

The report includes the following fields and descriptions:

-

Tax Area, Tax Type, Description of the Problem

-

History Type, History Amounts and Taxes

-

Workfile Amounts and Taxes

-

Variance Amounts and Taxes

-

Error Code (EC)

The EC column prints a numeric error code (01-06) that identifies which history files and W-2 workfiles contain errors.

Following are the error codes for this report:

-

01 = Tax History Taxable Wage VS. W-2 Workfile (Federal)

When this error occurs, the program locates a variance between the Federal Taxation History (F06136) and the W-2 Employee Federal Control Record (F6730) files. This error can occur on each of the employee's Federal tax records and on each company in which the employee worked. This variance is for only Federal Taxes Areas and Tax Types.

-

02 = Tax History Taxable Wage VS. W-2 Workfile (State/Local)

When this error occurs, the program locates a variance between the State and Local Taxation History (F06136) and the Employee State/Local Control Record (F06731) files. This error can occur on each State record and on each company in which the employee worked. This variance is for only Tax Areas and Tax Types.

-

03 = Transaction Summary VS. W-2 Workfile (Federal)

When this error occurs, the program locates a variance between the total Transaction History file (F06146) and the PDBA's in the Special Handling Tables that create the Employee Federal Control Record file (F06730). This error can occur on the following forms and boxes:

-

W-2 Forms:

-

Box 11 - Non-qualified Plans

-

Box 10 - Dependent Child Care

-

Box 12 - Benefits included in Box 1

-

-

Magnetic Media (W-2)

-

Fringe Benefit Amounts

-

Deferred Compensation

-

Non-Qualified Non 457 Amounts

-

Dependent Child Care

-

Group Term Life

-

-

1099-R Forms

-

Non-Qualified Plan Income

-

Gross Distributions

-

Employee Contributions

-

-

1099-Misc Forms

-

Rents

-

Royalties

-

Prizes and Awards

-

Non-Employee Compensations

-

Medical and Health

-

Substitute Payments

-

-

499R-2 Forms

-

Commissions

-

Concessions

-

Reimbursed Expenses

-

Retirement Funds

-

CODA Plans

-

If the total of the PDBA's in a Special Handling table does not match the grand total in the field, the program issues an error.

-

-

04 = Transaction Summary VS. W-2 Special Handling Workfile

When this error occurs, the program locates a variance between the Transaction History file (F06146) defined in a Special Handling Table and the Employee Special Handling Control Record file (F06732). This error can occur when you enter Special Handling Table codes for the W-2 form, in the following boxes:

-

Box 13 - Statutory employee, Retirement plan, Third-party sick pay

-

Box 14 - Other

The program is comparing each Special Handling record to a related Transaction History record. Because each DBA in the Special Handling Table must be handled separately, the program performs the comparison on a record by record basis. If a variance exists, the program issues an error.

-

-

05 = Tax Area Trans. History VS. W-2 Special Handling Workfile

When this error occurs, the program locates a variance between the Tax Area Transaction History file (F06148) and the PDBA's defined in a Special Handling Table that create the Employee Special Handling Control Record file (F06732). The only time this error occurs is when you enter Special Handling Table codes for any of following boxes on the W-2 form:

-

Box 17 - State Wages, tips, etc.

-

Box 20 - Local wages, tips, etc.

The program is comparing each Special Handling record to the related Tax Area Transaction History record. Because each DBA in the Special Handling Table must be handled separately, the program performs the comparison on a record by record basis.

-

-

06 = Arreared Payroll Taxes VS. W-2 Special Handling Workfile

When this error occurs, the program locates a variance between the Federal Taxation History (F06136) and the Employee Special Handling Control Record files (F06732). This error identifies variances when it encounters an arrearage in FICA and Medicare taxes and the system creates unique Special Handling records to accommodate the following codes in Box 13:

-

A - Uncollected FICA on Tipped Employees

-

B - Uncollected MEDICARE on Tipped Employees

-

M - Uncollected FICA on Group Term Life

-

N - Uncollected MEDICARE on Group Term Life

Note:

The only time that an A or B Special Handling can occur is when the employee is defined as a Tipped Employee in the Basic Employee Data. If the program finds FICA or Medicare taxes in arrears on a non-tipped employee, the Special Handling record creates codes M and N to note the uncollected taxes.The program is comparing each Special Handling record to the related Tax History record.

-

From W-2 Reports & Forms Setup (G072473), choose W-2 Workfile Integrity

7.3 Working with Year-End Forms

After printing your audit reports and making any necessary corrections, you can print year-end forms. You can also reset year-end forms when you need to reprint forms to correct inaccurate information.

You can print 1099-MISC, 1099-R, 499R-2, W-2, and W-2c forms, as well as 1096 summary information.

You can print the W-3 form for each type of W-2. The W-3 summarizes the amounts that you report for all employers' W-2 forms. Use the W-3 form only if you file paper copies of Copy A of the W-2 form with the SSA. Those filing electronically transmit this information differently.

If you use Release A9.3 and subsequent releases, you can use Business Intelligence Publisher (BIP) for JD Edwards World to print W-2 and W-2C forms. Ensure that you use the appropriate template. See Business Intelligence Publisher for JD Edwards World Guide for more information. You must also set up distribution lists using Electronic Document Delivery. See the Electronic Document Delivery section in the Technical Tools Guide for more information about distribution lists.

Working with year-end forms includes the following tasks:

-

Printing forms using BIP

-

Printing year-end forms

-

Resetting year-end forms

-

Adjusting laser forms

7.3.1 Printing Forms Using BIP

Following is the process to set up, create, and print the W-2 and W-2C forms using BIP.

JD Edwards World strongly recommends that you review the following documentation in the JD Edwards World Technical Tools Guide prior to performing this task:

-

Setting Up Import/Export for IFS folder and security set up information.

-

Set Up EDD

-

Working with Distribution Profiles

-

Working with PDF Profiles

-

Working with Transformation Templates

-

Create an IFS Folder.

-

Copy the S067702.rtf or S06771L.rtf file from the software update into the IFS Folder.

-

Set up Electronic Document Delivery (EDD).

-

Set up a Distribution Profile. Ensure you enter the following:

-

S067702 or S06771L in the Profile field

-

2 in the Print Application Flag field

-

Your Print Server (UDC 00E/PS) or the name of the IPP Print server in the EDD Server Configuration file (xdodelivery.cgf) in the Print Server Alias field.

-

-

Set up a PDF Profile. Ensure you enter S067702 or S06771L in the PDF Profile field.

-

Set up a Transformation Template.

-

Ensure you enter S067702 or S06771L in the following fields:

-

Template Name

-

PDF Profile

-

-

Ensure you enter S067702.rtf or S06771L.rtf in the Template File field.

-

Ensure you enter S067702.pdf or S06771L.pdf in the Output File field.

-

Ensure the values in the Template Path and Output Path fields match the IFS path that you set up.

-

-

Create a DREAM Writer using version XJDE0001 and enter P067702 or S06771L in the Form field.

-

In the DREAM Writer, on Additional Parameters choose Batch Export Parameters (F6).

-

On Batch Export Parms:

-

Ensure you enter S067702 or S06771L in the Distribution Profile and Transformation Template fields.

-

Ensure S067702.xml or S06771L.xml is in the Import Export File field.

-

Ensure the value in the IFS path is the path you set up.

-

-

Print the W-2's.

See Section 7.3.2, "Printing Year-End Forms".

The pdf document that contains the W-2 Forms is in the IFS folder.

7.3.2 Printing Year-End Forms

You print year-end forms to report wage and tax information to your employees and to government agencies. If you are filing EFW2, you print year-end forms to create an audit trail for reporting to your employees and the government.

The year-end form IDs that are available in the Forms program are in a DREAM Writer version that you use because of its processing options, data selection, and data sequence. The first time that you access this form, the system displays all of the available year-end forms. The next time that you access this form, the system displays only the forms that you have run previously. To display all available forms again, choose the Reload function.

You can use the following programs to print year-end forms:

-

Print W-2 Laser Forms (2 pt) (P067701)

-

Print W-2 Laser Forms (4 part)(P067702)

-

Print W-2c Forms (Laser) (P06771L)

-

Print W-2 Laser Forms (employer 4 part) (P067703)

-

Print 1099-Misc. Form (Laser) (P06751L)

-

Print 1099-R Form (Laser) (P06752L)

-

Print W-3 Forms (Laser) (P06775L)

-

Print 499R-2 (Laser) (P06772L)

-

1096 Summary Report (Laser) (P06757L)

-

Print W-3c Forms (Laser) (P067751L)

Note:

The DREAM Writer forms for Print W-2 Laser Forms (2 pt) (P067701), Print W-2 Laser Forms (employer 4 part) (P067703), Print W-2 Laser Forms (4 part)(P067702), and Print 1099-R Form (Laser) (P06752L) contain the Version Number processing option that allows you to process an unprinted form count version of the W-2 Forms Count Report (P06754).-

To avoid wasting forms, test-print year-end forms on plain paper first to verify that the data is correct. Make corrections, if necessary, and then input and realign the actual forms. Forms have a lineup feature that prints Xs in the control number on the first form.

From Year End Processing (G07247), choose Forms

-

On the first Forms screen, complete the W-2/1099 ID field and click Enter twice.

-

On the second Forms screen, enter a valid DREAM Writer version in the Version field for each form that you want to print.

-

Click Enter to load the DREAM Writer versions.

If you do not click Enter before submitting, the system does not print the forms.

The system verifies each version and displays the report name in the Description field.

-

Choose Submit Reports to Batch (F6) to send the forms to the printer.

-

When the forms print, review the following fields:

-

Date Printed

-

EE's

-

Forms Req'd

-

Forms Printed

-

| Field | Explanation |

|---|---|

| Date Printed | If you are printing a trial run on plain paper, leave the date blank. After you enter a date, the system assumes you are using form paper, and it updates the individual employee records with the date. W2cs are generated for any subsequent "changes only" processing that you perform. |

| EE's | The total number of employees who are to receive copies of the selected form. If more than one company is reported under a parent company's tax ID, this number includes all of those companies. It does not contain the number of W2c employees processed. |

| Req'd | The total number of forms, supplied by the system for the form ID selected, to be printed with a "date printed." If more than one company is being processed in the version, this number includes all of the employees for those companies. For W2c forms, this number includes one for federal and one for each state, if applicable. |

| Printed | The total number of forms, supplied by the system for the form ID selected, that have been printed with a print date. If more than one company is processed in the version, this number includes the employees for those companies.

It does not contain the number of W2c forms that have printed. |

You can change the data selection to choose the forms you want to print. For example, you can limit the forms you print to a single company or a specific tax area.

Caution:

In the Data Sequence, the W-2 Control Number and W-2 Base State Flag 1 (in this order) must remain the last two fields in the data sequence for all W-2 forms. Additionally, set the W-2 Control Number to ascending order, and the W-2 Base State Flag 1 to descending order.See Print Laser W-2's (2pt) (P067701).

7.3.3 Resetting Year-End Forms

You reset year-end forms to correct inaccurate information when you have not yet reported year-end data to the government and your employees. For example, suppose that an employee's address change does not appear on the W-2 form that you print because you did not enter the new address into your Payroll system. If you did not yet distribute W-2 forms to your employees or report your year-end information to the government, you can enter the address change, reset your year-end forms, and reprint them.

You might also need to reset year-end forms when the information does not align and print properly on the forms.

You can reset and reprint year-end forms for an entire version or for a select group of employees, based on your version data selections. Resetting year-end forms removes the print date in the employee's record when you print the forms. You must remove the print date to prevent the system from producing a W-2c form.

-

Use this procedure only to reprint forms that had a print date when they were printed, and only if you did not yet report year-end information to the government or distribute year-end forms to your employees.

-

You do not need to use this procedure before rerunning forms that print without a print date.

If you need to make corrections to a form and you have already distributed year-end forms to your employees or reported year-end information to the government, you must generate W-2c forms.

See Also:

-

Printing Year-End Forms for information and instructions about printing forms after you reset them

From Year End Processing (G07247), choose W-2/1099 Print Date Reset

-

On W-2/1099 Print Date Reset, run the version that you want to reset.

-

In the processing option, enter the version ID that you want to reset, and click Enter.

The system displays a message to report the status of the reset procedure. The reset does not generate a report.

-

After you have reset the W-2 forms, reprint the forms.

Data Selection for W-2/1099 Print Date Reset

You can change the data selection in the W-2 Processing ID to specify which W-2 forms you want to reset.

Data Sequence for W-2/1099 Print Date Reset

Do not change the sequencing of the DREAM Writer. If you do, the print reset does not remove the print date from all of the workfile records.

7.3.4 Adjusting Laser Forms

The system allows you to adjust the printing of laser forms if the text does not line up correctly on the forms. The system allows you to adjust two-part or four-part laser forms. Your system administrator usually performs this task.

-

JD Edwards World strongly recommends that you create a source library and a custom object library.

When you create a custom object library, you must include the source physical table JDESRC. If you do not have authority to add a new library to your library list, contact your system administrator. If you use a custom object library, it must appear at the top of the library list.

If you are using the JDFSRC library, the system adds each change to the last because you are altering the original source.

From W-2/1099 Setup (G072472), choose W-2 Laser Forms Adjustment

7.4 Creating Electronic Filing

You can use electronic filing to report year-end information to both federal and state governments. The software supports electronic filing processing for state and federal W-2 reporting and for 1099 reporting. Contact your SSA office for more information about electronic filing.

Creating electronic filing includes the following tasks:

-

Building the federal EFW2 work file

-

Creating state EFW2 and 499R-2 files

-

Building the 1099 workfile

7.4.1 Building the Federal EFW2 Work File

To build the federal EFW2 work file

From Electronic Filing Processing (G072475), choose Build EFW2 Work File

-

On the Build EFW2 Work File screen, complete the W-2/1099 ID field and click Enter twice.

Description of the illustration ''sw_ch7_pg719.gif''

-

On the second Build EFW2 Work File screen, complete the following fields:

-

Transmitter Address

-

Contact Address

-

| Field | Explanation |

|---|---|

| Transmitter Address | A code that identifies a specific organization, fund, entity, and so on. This code must already exist in the Company Constants table (F0010). It must identify a reporting entity that has a complete balance sheet. At this level, you can have intercompany transactions.

Note: You can use company 00000 for default values, such as dates and automatic accounting instructions (AAIs). You cannot use it for transaction entries. |

| Contact Address | The Address Book number to which the electronic file should be returned if problems occur. |

7.4.2 Creating State EFW2 and 499R-2 Files

You can use electronic filing to report year-end information to state governments, including Puerto Rico. Some states require that you report year-end information via electronic file if the total number of year-end forms for a company exceeds a specific number for the year.

Many states accept year-end information in the same format as the federal government. For these states, you can submit a copy of the federal W-2 electronic file to the state.

Some states require that you report year-end information in a different format from that of the federal government. Other states require that you extract specific information from the Federal W-2 information. When you create state files, you can specify the state that you want to process, along with the records that you want to extract.

When you create electronic filing for Puerto Rico, the system automatically formats the information using the MMW2PR-1 format, which Puerto Rico requires.

The system accommodates reporting formats for states that differ from the federal format. You enter additional information that these states require through processing options. You enter a value in the State Code field in the second step for one of these states. After you choose Update in the fourth step, the processing options display. Complete the processing options for that state and click Enter to complete the process. The states with formats that differ from the federal format include:

-

Alabama

-

Arkansas

-

Colorado

-

Connecticut

-

Georgia

-

Idaho

-

Illinois

-

Indiana

-

Kansas

-

Maine

-

Maryland

-

Massachusetts

-

Mississippi

-

Nebraska

-

New Jersey

-

New Mexico

-

North Carolina

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Vermont

-

Virginia

-

West Virginia

-

Wisconsin

Note:

The postal codes or Federal Information Processing Standard (FIPS) codes are in the Description -2 field of UDC 07/SC. These codes are also in UDC 07/PO. When you revise UDC tables, you must use the system code that corresponds to the software release that you are using.When you submit this information, the program creates the F06765xx table (where xx is the numeric postal code for the state that you are processing) in your W-2 library W2LIBxxx.

-

Build your federal EFW2 workfile (F06765).

-

Research the records that your state requires for year-end reporting. See the IRS and SSA Resources List for a list of resources.

To create state EFW2 and 499R-2 files

From Electronic Filing Processing (G072475), choose Build State EFW2 Work File

-

On the first Build State EFW2 screen, complete the W-2/1099 ID field and click Enter twice.

Description of the illustration ''sw_ch7_pg721.gif''

-

On the second Build State EFW2 screen, complete the Enter the State Code to extract field.

To create 499R-2 information to report to Puerto Rico, enter the state code for Puerto Rico.

-

Complete the following fields:

-

Do you want to extract RA records?

-

Include Federal User ID?

-

Do you want to extract RE records?

-

Do you want to extract RW records?

-

Do you want to extract RO records?

-

Do you want to extract RS records?

-

Do you want RT records (recalculated)?

-

Do you want RU records (recalculated)?

-

Do you want RV records (recalculated)?

-

Do you want RF records (recalculated)?

-

-

Choose Update (F6).

| Field | Explanation |

|---|---|

| Enter the State Code to extract. | This code specifies the two-character or three-character state or locality code that prints on statutory reports such as W-2 and 941.

For example, on W-2s and 941s, instead of printing 06, which might be the taxing authority for the state of Colorado, the system prints the statutory code CO. Enter an alpha code from UDC 07/SC. |

| Do you want to extract RA records? | The Yes or No Entry field is a single character entry field for yes or no responses on prompt screens.

Screen-specific information A code that specifies whether to extract RA records (transmitter records) for state EFW2. Valid codes are: Y – Extract RA records. N – Do not extract RA records. |

| Include Federal User ID? | The Yes or No Entry field is a common single character entry field for simple yes or no responses on prompt screens. |

| Do you want to extract RE records? | The Yes or No Entry field is a common single character entry field for simple yes or no responses on prompt screens.

Screen-specific information A code that specifies whether to extract RE records (employee records) for state EFW2. Valid codes are: Y – Extract RE records. N – Do not extract RE records. |

| Do you want to extract RW records? | The Yes or No Entry field is a common single character entry field for simple yes or no responses on prompt screens.

Screen-specific information A code that specifies whether to extract RW records (employee wage records) for state EFW2. Valid codes are: Y – Extract RW records. N – Do not extract RW records. |

| Do you want to extract RO records? | The Yes or No Entry field is a common single character entry field for simple yes or no responses on prompt screens.

Screen-specific information A code that specifies whether to extract RO records (employee wage records) for state EFW2. Valid codes are: Y – Extract RO records. N – Do not extract RO records. |

| Do you want to extract RS records? | The Yes or No Entry field is a common single character entry field for simple yes or no responses on prompt screens.

Screen-specific information A code that specifies whether to extract RS records (supplemental records) for state EFW2. Valid codes are: Y – Extract RS records. N – Do not extract RS records. |

| Do you want RT records (recalculated)? | The Yes or No Entry field is a common single character entry field for simple yes or no responses on prompt screens.

Screen-specific information A code that specifies whether to extract RT records (total records) for state EFW2. Valid codes are: Y – Extract RT records. N – Do not extract RT records. |

| Do you want RU records (recalculated)? | The Yes or No Entry field is a common single character entry field for simple yes or no responses on prompt screens.

Screen-specific information A code that specifies whether to extract RU records (total records) for state EFW2. Valid codes are: Y – Extract RU records. N – Do not extract RU records. |

| Do you want RV records (recalculated)? | The Yes or No Entry field is a common single character entry field for simple yes or no responses on prompt screens.

Screen-specific information A code that specifies whether to extract RV records (total records) for state EFW2. Valid codes are: Y – Extract RV records. N – Do not extract RV records |

| Do you want RF records (recalculated)? | The Yes or No Entry field is a common single character entry field for simple yes or no responses on prompt screens.

Screen-specific information A code that specifies whether to extract RF records (final records) for state EFW2. Valid codes are: Y – Extract RF records. N – Do not extract RF records. |

7.4.3 Building the 1099 Workfile

After you print year-end forms, build the 1099 workfile. You can submit 1099 forms to the IRS via electronic file. You can process the two types of payroll 1099 forms together or separately. The IRS allows you to submit multiple types of 1099 forms together as long as you separate them by the correct record type on the file.

Caution:

The Accounts Payable system can also produce 1099 returns. You should consider the number of returns that you generate by both the Accounts Payable system and the Payroll system when deciding whether you must use electronic file reporting.Set the data selection and data sequence for the year-end workfile to process 1099 forms, and then process the workfile build. For more information about workfile data criteria. Section 5.5, "Creating the Year-End Workfile"

From Electronic Filing Processing (G072475), choose Build 1099 Work File

-

On the Build 1099 Work File screen, complete the W-2/1099 ID field and click Enter twice.

Description of the illustration ''sw_ch7_pg724.gif''

-

Complete the following optional fields:

-

Payer Name Control

-

Transmitter Ctl Code

-

Transmitter Company

-

Contact Address

-

Transfer Agent

-

Foreign Corp Ind

-

Test/Corr Indicator

-

-

Choose Submit Job (F6) to build the workfile.

| Field | Explanation |

|---|---|

| Payer Name Control | The Payer Name Control can be obtained from the mail label on the Package 1099, which is mailed to most payers on record each December. Names of fewer than four letters should be left-justified, filling the unused positions with blanks. If you have not received a Package 1099 or you do not know your Payer Name Control, this field should be filled with blanks. |

| Transmitter Ctl Code | The five-character Transmitter Control Code supplied by the IRS. It is required in order to report 1099 data magnetically. |

| Transfer Agent | The Address Book number of the Transfer Agent, if used. |

| Foreign Corp Ind | Enter 1 if the payer is a foreign corporation and income is paid by the corporation to a U.S. resident from sources outside of the United States. If it is not a foreign corporation, enter a blank. |

| Test/Corr. Indicator | For W-2 processing: This field contains either blank or A. The A indicates that the W-2 or W-2c has been corrected and that no changes should occur to this record because it is the basis for the "before" information on a new W-2c.

For 1099 processing, valid values are: blank – The original file submission or the original file submission that has been returned from the IRS for replacement T – A test file submission C – A correction file submission If your electronic file was returned from the IRS, your files contained format errors that were encountered during processing, and you must send a replacement to the IRS. A correction submission is submitted to correct records that were successfully processed by the IRS but contained erroneous information. |

7.5 Working with W-2c Forms

After you print W-2 forms, you might need to make corrections to the amounts. To make corrections, you must issue a correction form, W-2c, which replaces or supplements the original W-2. Corrections can include:

-

Incorrect amounts

-

Changes in Social Security Numbers

-

Changes in employee names

The system allows you to reset the W-2c workfile if you encounter errors on your W-2c forms. You can reset and reprint W-2c forms for an entire version or for a select group of employees based on your DREAM Writer selections.

When you make corrections, you must also send form W-3c to the SSA. You print the IRS form W-3c that summarizes information that you correct on the individual W-2c forms.

Note:

You can also submit corrections to W-2 information electronically in the EFW2C format. Visit My Oracle Support located in the World Product Information category for more information about EFW2C processing.Working with W-2c forms includes the following tasks:

-

Creating W-2c records

-

Reviewing employee W-2c information

-

Printing W-2c forms

-

Creating EFW2C Files for W-2 Corrections

-

Resetting and Rerunning the W-2c workfile build

-

Resetting the W-2c print date

-

Printing W-3c forms

7.5.1 Creating W-2c Records

You create W-2c records when W-2 forms contain errors. The process that you use to create a W-2c workfile is similar to the process that you use to create the original W-2 workfile.

To generate W-2c forms, you must first print the original W-2 forms that you are correcting with a print date. When you print the original W-2 forms, the system updates the print date in the employee's records. Without a print date, the workfile program deletes and rebuilds the original W-2 records instead of creating W-2c records.

Using a print date, print the original W-2 forms that you are correcting. When you print the original W-2 forms, the system updates the print date in the W-2 workfiles. Section 7.3.2, "Printing Year-End Forms"

From Year End Processing (G07247), choose Build W-2/1099 Workfiles

-

On the first Build W-2/1099 Workfiles screen, complete the W-2/1099 ID field and click Enter twice.

-

On the second Build W-2/1099 Workfiles screen, enter 2 in the Type of Processing field.

-

Choose Additional Parameters - Address Number (F19).

-

On W-2 Additional Parameters, complete the Skip to Value field.

-

Enter the employee numbers for the employees requiring W-2 changes.

-

Click Add.

-

Exit the W-2 Additional Parameters screen.

-

Choose Submit (F6) to build the workfile.

The system determines whether a W-2c is necessary by verifying there is a printed W-2 with a print date. If it locates a printed W-2, it automatically generates the qualifying W-2c records.

7.5.2 Reviewing Employee W-2c Information

You review employee W-2c information to determine how the information displays on the actual form before you print it.

You can use the following function exits to:

-

Access the Address Window to verify and change an employees address (F11)

-

Access the W-2 form for the employee (F14)

-

Print the W-2c form (F21)

To review employee W-2c information

From Year End Processing (G07247), choose Form W-2c

-

On Form W-2c, complete the W-2/1099 ID field and click Enter twice.

-

On W-2c Inquiry, to select a specific W-2c form for review, choose Field Sensitive Help (F1) in the Employee field.

-

On W-2c Employees, select an employee.

-

On W-2c Inquiry, review the following fields:

-

Employee No

-

Home Company

-

Date Printed

-

Hist Type

-

SSN

-

STE

-

RET

-

TPS

-

-

Review the Prev Reported amounts and Correct Info amounts for the following fields:

-

Wages, Tips & Other

-

Federal Income Tax

-

Social Security Wages

-

Social Security Tax

-

Medicare Wages

-

Medicare Tax

-

Social Security Tips

-

Allocated Tips

-

Advance EIC

-

Dependent Care

-

Non Qualified Plans

-

Additional Boxes (for Box 12)

-

If any of the amounts are incorrect, you must correct the information.

7.5.3 Printing W-2c Forms

After you create and review W-2c workfile records, you can print the W-2c forms. The Print W-2c Forms (Laser) program (P06771L) includes demo versions for federal forms.

See Also:

-

Printing Year-End Forms for step-by-step instructions on printing forms

From Year End Processing (G07247), choose Forms

7.5.4 Printing W-3c Forms

From Year End Processing (G07247), choose Forms

After you generate W-2c forms and review them for accuracy, you must print the W-3c form. You print the IRS form W-3c that summarizes amounts for all of the W-2c forms that you are submitting to the government. You must submit the W-3c to the SSA if you are submitting W-2c forms. You can use the W-3c Print Form (Laser) program (P067751L) to generate W-3c forms.

See Also:

-

Printing Year-End Forms for step-by-step instructions on printing forms.

7.5.5 Creating EFW2C Files for W-2 Corrections

You can submit corrections to W-2 information that you process using paper W2-cs and W3-cs, or you can submit the corrections electronically in the EFW2C format.

Visit My Oracle Support located in the World Product Information category for more information about EFW2C processing.

7.5.6 Resetting and Rerunning the W-2c Workfile Build

If you encounter errors on your W-2c forms, you can correct the errors, reset the workfile and then run the W-2c workfile build again.

See Working with W-2c Forms for more information about correcting errors and running the workfile build.

To reset the W-2c workfile build

From Year End Processing (G07247), choose W-2/1099 Review

-

On W-2/1099 Review, choose the Version Reset Control option for the W-2/1099 ID that you want to reset.

-

On the first Version Reset Control screen, click Enter twice.

-

On the second Version Reset Control screen, remove the status code from the W-2c Workfile Build Status field and click Enter.

If you incorrectly change the status codes, the system displays an error.

-

Choose Update (F6).

7.5.7 Resetting the W-2c Print Date

You run this DREAM Writer only when you need to reprint year-end forms that include a print date. You do not need to run this program when the printed forms do not include a print date.

Reset the print date on year-end forms after you correct inaccurate information that you have not yet reported to the government and your employees. For example, an employee's address change does not print on the W-2c form because you did not enter the information into your Payroll system. You can enter the address change, reset the W-2c print date for year-end forms, run the W-2c build, and print them again.

You might also need to reset the W-2c print date for year-end forms when the information does not align and print properly on the government forms. In this situation, you do not need to run the W-2c build.

You can reset the print date on year-end forms for an entire version or for a select group of employees based on the DREAM Writer data selection. This removes the print date from the employee's record that you set when you printed the original forms.

Enter the version ID that you want to reset in the processing option, and then run that version. The system displays a message to report the status of the reset procedure but does not generate a report. After you reset the W-2c forms, you might need to run the W-2c build and then reprint the forms.

See Also:

-

Printing Year-End Forms for step-by-step instructions on printing forms

From Year End Processing (G07247), choose W-2/1099 Print Date Reset