6 Year-End Review

After you create year-end workfiles, you review the information in the workfiles for accuracy. If necessary, you can revise the information and recreate year-end workfiles to reflect these revisions. This ensures that the correct information prints on the year-end forms.

This chapter contains the following topics:

6.1 Reviewing Year-End Version Information

You review year-end version information to locate errors or inaccurate information and to make corrections before printing year-end forms. You should review:

-

All of the workfile builds you are processing for W-2, 499R-2, and 1099 forms

-

The amounts that the workfile build process generates for an employee or company

Reviewing year-end version information includes the following tasks:

-

Reviewing the status of IDs being processed

-

Resetting a step in the year-end cycle

-

Reviewing the W-2 count

-

Reviewing wage adjustment summaries

-

Reviewing wage adjustments detail

-

Reviewing employee wage information

-

Reviewing employee form count information

-

Reviewing employee form detail information

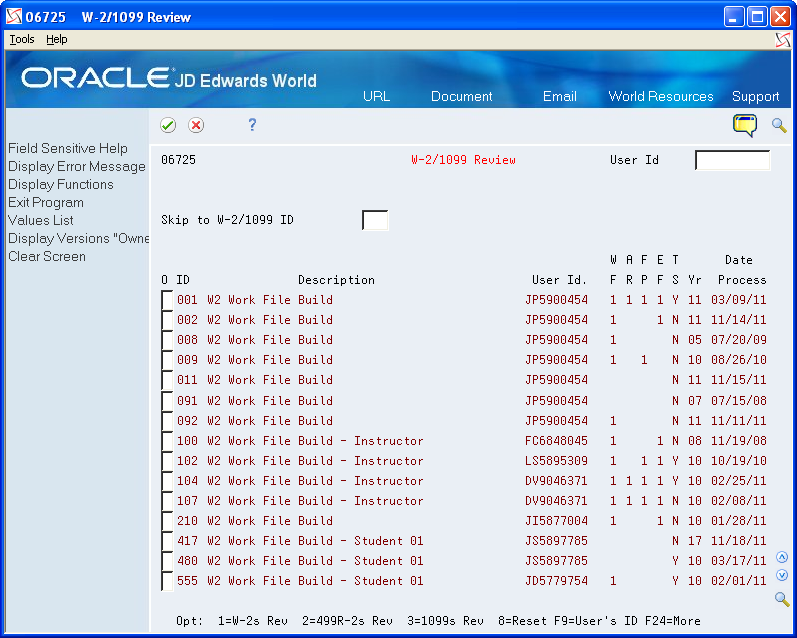

6.1.1 Reviewing the Status of IDs Being Processed

You can review information about the workfile build at any time during the workfile build process.

Use this information to determine whether you can proceed to the next step in the process. This information can also help you determine whether any errors occurred during the processing that requires you to rerun a step.

To review the status of IDs being processed

From Year End Processing (G07247), choose W-2/1099 Review

-

On W-2/1099 Review, review the following fields:

-

WF

-

AR

-

FP

-

EF

-

TS

-

-

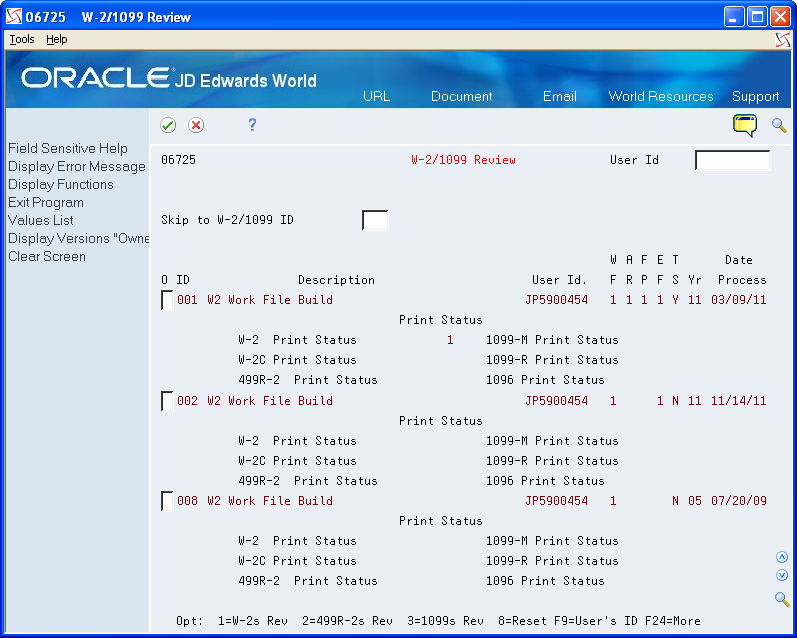

Access the detail area to review Print Status for the ID.

| Field | Explanation |

|---|---|

| W F | A code that indicates the current status (stage) of the workfile in the 1099, Releve 1, T4, and W-2 processing cycles. Valid values are:

Blank – The workfile build step has not been run. A – The workfile build step is currently active. 1 – The workfile build step has finished normally. |

| A R | A code that indicates the current status (stage) of the audit report process in the 1099 and W-2 processing cycles. Valid values are:

Blank – The audit report step has not been run. A – The audit report step is currently active. 1 – The audit report step has completed normally. S – A schedule lock is on the audit report step. Another user is currently accessing this ID. |

| P F | A code that indicates the current status (stage) of the Forms Print process in the W-2/1099 Processing Cycle. Valid values are:

Blank – The Forms Print step has not been run. A – The Forms Print step is currently active. 1 – The Forms Print step has finished normally. S – A schedule lock is on the Forms Print step. Another user is currently accessing this ID. Note: This code changes to a 1 when any form type has been printed, whether it is a W-2, 1099-R, 1099-MISC, and so on. To determine which form type has been printed; choose More Detail (F4) on the W-2/1099 Review. The type of form printed is marked with a 1. |

| E F | A code that indicates the current status (stage) of the Electronic File Generation process in the W-2/1099 Processing Cycle. Valid values are:

Blank – The Electronic Filing step has not been run. A – The Electronic Filing step is currently active. 1 – The Electronic Filing step has finished normally. S – A schedule lock is on the Electronic Filing step. Another user is currently accessing this ID. |

| T S | A code that specifies whether companies with the same Corporate Tax ID are to be summarized into one reporting record.

To specify a parent, enter a Parent Company number in the detail area of the Corporate Tax ID screen. Access the Corporate Tax ID screen from the Taxes & Insurance menu, G0744. If you do not specify a parent company, the W-2 Workfile Build uses the lowest company number as the parent. Note: JD Edwards World recommends that, when summarizing by Tax ID, you enter the Parent Company numbers in the detail area of the Corporate Tax ID screen. The Parent Company Number for the parent company is its own company number. |

6.1.2 Resetting a Step in the Year-End Cycle

You might encounter errors during year-end processing that cause you to run a process again. Resetting a step in the year-end cycle allows you to restore your data to its condition prior to running the process.

To reset a step in the year-end cycle

From Year End Processing (G07247), choose W-2/1099 Review

-

On W-2/1099 Review, enter 8 in the Option field next to the W-2/1099 ID that you want to reset.

-

On the first Version Reset Control screen, click Enter twice.

-

On the second Version Reset Control screen, remove the status codes from any of the following fields that you want to reset:

-

Workfile Build

-

Audit Reports

-

Print Forms

-

Electronic Filing

-

Workfile Clear

-

W-2C Workfile Build Status

If you incorrectly change the status codes, the system displays an error.

-

-

Choose Update Status Code (F6).

| Field | Explanation |

|---|---|

| Workfile Clear | A code that identifies the current status (stage) of the Clear Workfile process in the W-2/1099 processing cycle. The following values currently apply:

Blank – The Clear Workfile step has not been run. A – The Clear Workfile step is currently active. 1 – The Clear Workfile step has finished normally. S – There is a schedule lock on the Clear Workfile step. Another user is currently accessing this ID. |

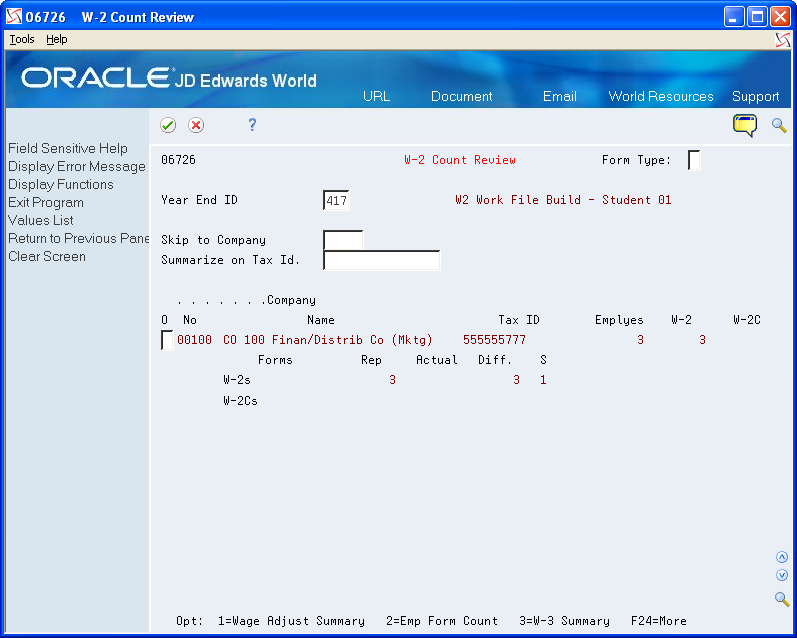

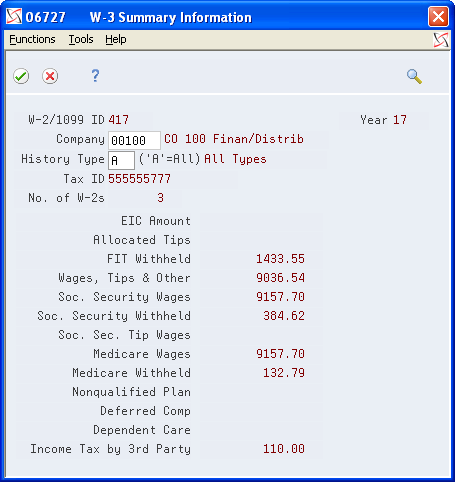

6.1.3 Reviewing the W-2 Count

Review the W-2 count to review dollars at the company level or to evaluate employee information such as form counts and detail dollar amounts.

When you use tax ID numbers to summarize a child company's tax information to a parent company's information, you cannot review the child company's W-2, 499R-2, or 1099 count information separately. The system adds form and dollar totals for the child company to the totals for the parent company. Use the company number of the parent company to review totals that include both the child and the parent company.

From Year End Processing (G07247), choose W-2/1099 Review

-

On W-2/1099 Review, enter 1 in the Option field next to the W-2/1099 ID that you want to review.

-

On W-2 Count Review, review the following fields:

-

Company No

-

Company Name

-

Tax ID

-

Employees

-

W-2

-

-

After you review totals by company, exit the W-3 Summary screen.

-

On W-2 Count Review, access the detail area to view the number of each type of form you need to print.

| Field | Explanation |

|---|---|

| Form Type: | A code that specifies the various types of year-end forms that are available. |

| Employees | The total number of employees who are to receive copies of the selected form. If more than one company is reported under a parent company's tax ID, this number includes all those companies. It will not contain the number of W2c employees processed. |

| W-2 | The total number of W-2 forms to be printed. If more than one company is reported under a parent company's tax ID, this number includes all employees for those companies. |

| W-2C | The total number of Federal and State W2C forms. For W2c forms, this number includes one for federal and one for each state, if applicable. |

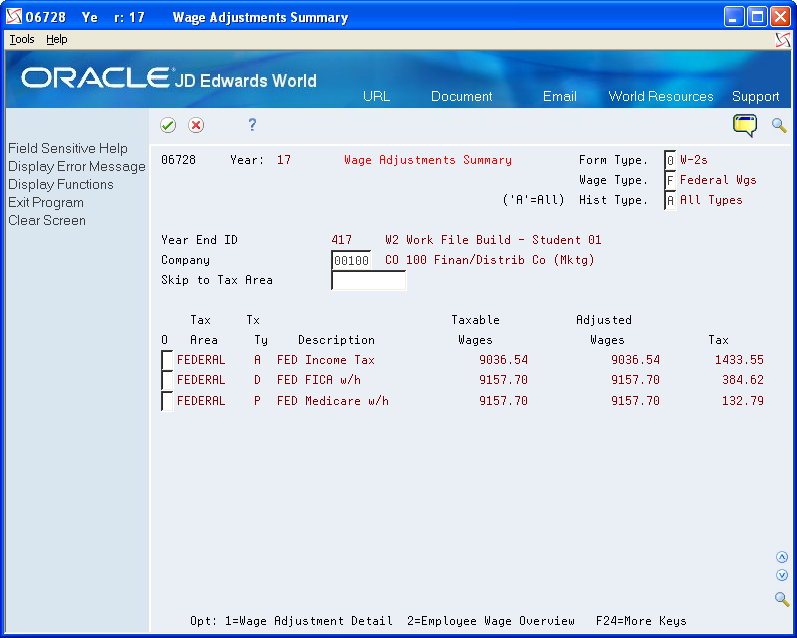

6.1.4 Reviewing Wage Adjustment Summaries

You review wage adjustment summaries to view the taxable wage, adjusted wage, and tax summary information by company and tax area. You can review wage adjustment summaries for the following:

-

Federal wages

-

State wages

-

Local wages

See Also:

-

Working with Tax History Integrity for more information about history types

To review wage adjustment summaries

From Year End Processing (G07247), choose W-2/1099 Review

-

On W-2/1099 Review, enter 1 in the Option field next to the W-2/1099 ID that you want to review.

-

On W-2 Count Review, enter 1 in the Option field for the company with the wage adjustments summary that you want to view.

| Field | Explanation |

|---|---|

| Wage Type | A code that specifies whether the type of wages and so on that appear are State (S), Local (L), or Federal (F). |

| Hist Type | A code that indicates the type of employee for W-2/1099 history purposes. |

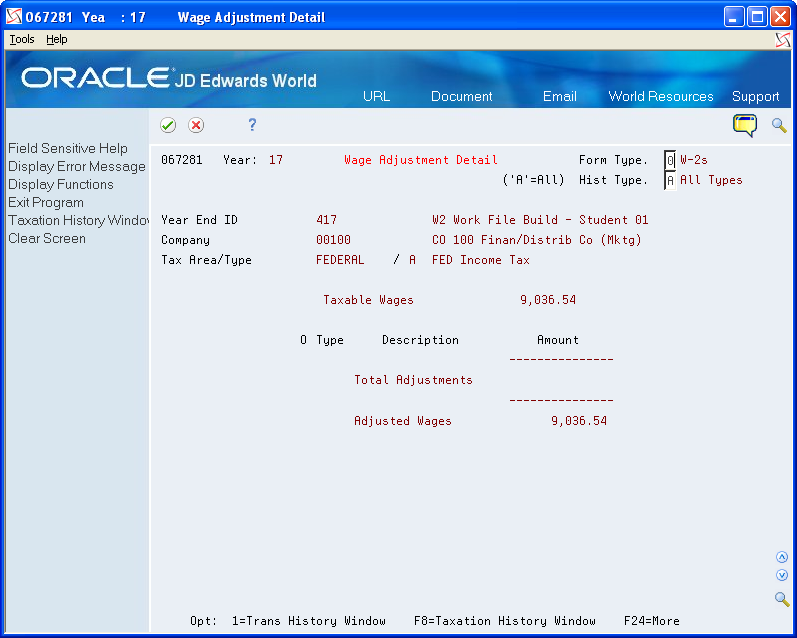

6.1.5 Reviewing Wage Adjustments Detail

You review wage adjustments detail to view the taxable wages, adjustments, and adjusted wages by company and tax area.

For each tax authority, you can review the following information:

If you deduct Tier I and Tier II taxes, only the amount of the tax displays on the screen. Taxable and adjusted wages are blank for tax types R and T, and no option line for additional information exists.

If additional adjustments cause Social Security wages to exceed the maximum wage base, the system creates a Social Security adjustment that reverses the adjustment amount.

On Federal Wage Adjustments, the system adjusts the Federal D Taxable Wages by the portion of wages that were tips (shown as Federal DT Adjusted Wages).

To review wage adjustments detail

From Year End Processing (G07247), choose W-2/1099 Review

-

On W-2/1099 Review, enter 1 in the Option field next to the W-2/1099 ID that you want to review.

-

On W-2 Count Review, enter 1 in the Option field for the company with the wage adjustments summary that you want to view.

-

On Wage Adjustments Summary, enter 1 in the Option field for the tax area for which you want to view detail information.

-

On Wage Adjustment Detail, review the following fields:

-

Description

-

Amount

-

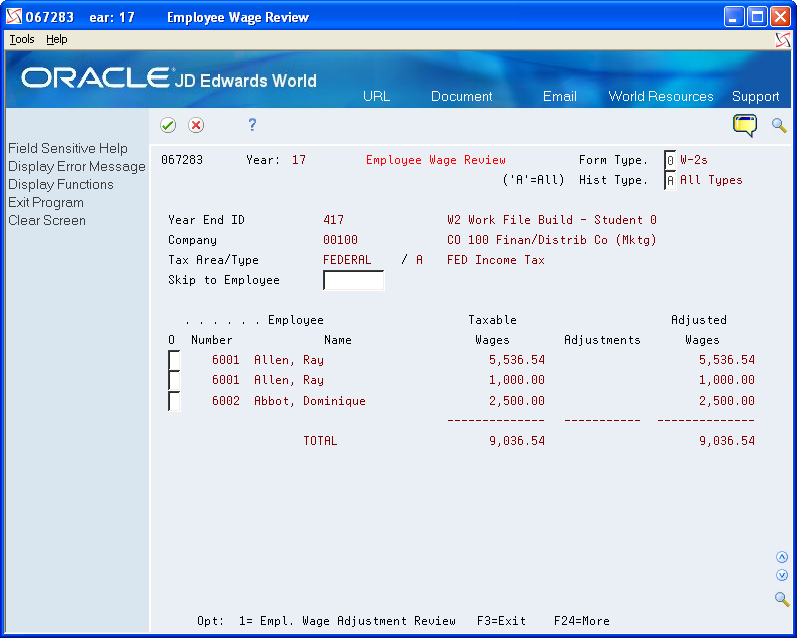

6.1.6 Reviewing Employee Wage Information

You review employee wage information to review each employee who earns wages in the respective taxing authority and the amounts that make up those wages that you report.

Employee wage information includes three areas for your review:

-

Taxable wages

-

Adjustments

-

Adjusted wages

See Also:

-

Reviewing Wage Adjustments Detail for descriptions of the three areas that you can review

To review employee wage information

From Year End Processing (G07247), choose W-2/1099 Review

-

On W-2/1099 Review, enter 1 in the Option field next to the W-2/1099 ID that you want to review.

-

On W-2 Count Review, enter 1 in the Option field for the company with the wage adjustments summary that you want to view.

-

On Wage Adjustments Summary, enter 2 in the Option field for the tax area for which you want to view detail information.

-

On Employee Wage Review, review the following fields:

-

Employee Number

-

Employee Name

-

Taxable Wages

-

Adjustments

-

Adjusted Wages

-

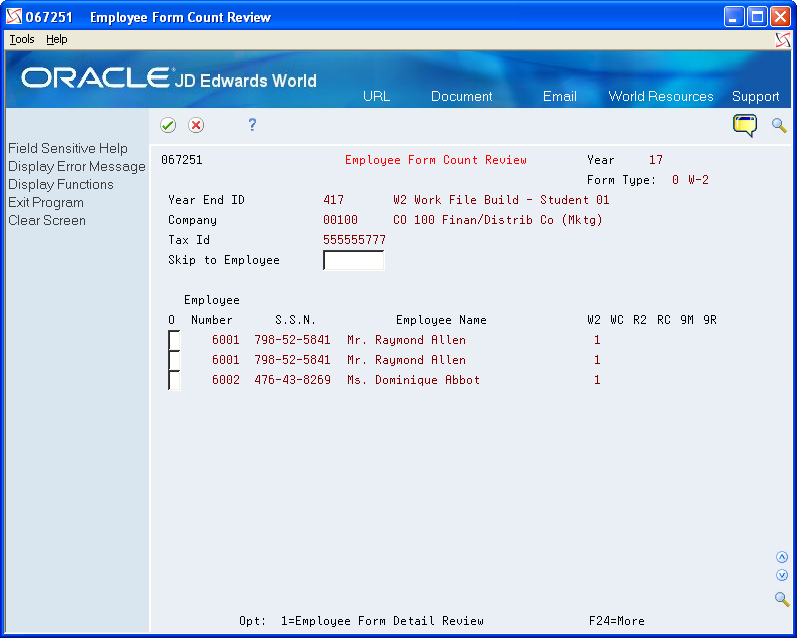

6.1.7 Reviewing Employee Form Count Information

Review employee form count information to locate the number of forms to print for each employee in the company.

When the workfile build generates more than one year-end form for an employee, the number of forms displays on Employee Form Count Review. For example, the workfile build can generate multiple W-2 forms for an employee when:

-

The employee is working in multiple states.

-

You enter third-party sick pay for the employee by using the Third Party Sick Entry program.

-

The W-2 form contains an overflow of information from box 12 or 14.

To review employee form count information

From Year End Processing (G07247), choose W-2/1099 Review

-

On W-2/1099 Review, enter 1 in the Option field next to the W-2/1099 ID that you want to review.

-

On W-2 Count Review, enter 2 in the Option field for the company with the employee form count that you want to view.

Description of the illustration ''emp_form_cunt_review.gif''

-

On Employee Form Count Review, review the following fields:

-

Employee Number

-

S.S.N.

-

Employee Name

-

W2

-

WC

-

R2

-

RC

-

9M

-

9R

-

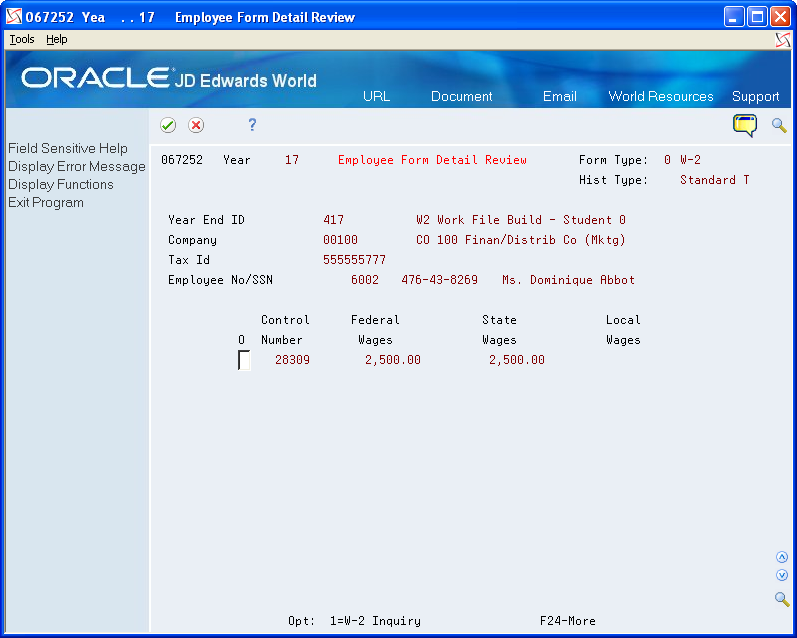

6.1.8 Reviewing Employee Form Detail Information

You review employee form detail information to view detailed information for each form that you select, such as federal, state, and local taxable wages.

To review employee form detail information

From Year End Processing (G07247), choose W-2/1099 Review

-

On W-2/1099 Review, enter 1 in the Option field next to the W-2/1099 ID that you want to review.

-

On W-2 Count Review, enter 2 in the Option field for the company with the employee form count that you want to view.

-

On Employee Form Count Review, enter 1 in the Option field for the employee whose detail information you want to view.

Description of the illustration ''emp_frm_detail_review.gif''

-

On Employee Form Detail Review, review the following fields:

-

Control Number

-

Federal Wages

-

State Wages

-

Local Wages

-

6.2 Reviewing Employee Form Information

You review employee form information online to evaluate how the information displays on the actual form before you print it.

Reviewing employee form information includes the following tasks:

-

Reviewing and changing employee W-2 information

-

Reviewing employee wage adjustments

-

Reviewing employee wage allocations

-

Reviewing W-2 special handling information

-

Reviewing employee 1099 and 499R-2 information

-

Printing a single year-end form

6.2.1 Reviewing and Changing Employee W-2 Information

You review employee W-2 information to evaluate how the information displays on the actual form before you print it.

If the employee works in more than one state and all federal wages are to print on one form, the system displays the following message: Federal wages printed on another W-2 for all state and local forms on which the system does not include federal wages.

If you set up box 1 to allocate wages and taxes to the states, the system displays only part of the wages and tax with a message that indicates that allocation has occurred.

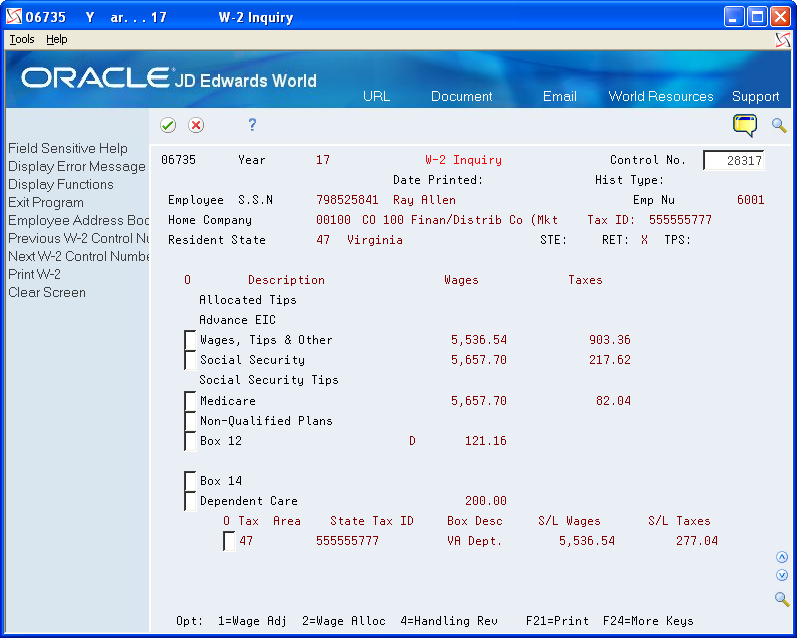

To review and change employee W-2 information

From Year End Processing (G07247), choose Form W-2

-

On Form W-2, complete the W-2/1099 ID field.

-

On W-2 Inquiry, enter the control number of the employee whose W-2 information you want to review in the Control No field.

If you do not know the employee's control number, use Field Sensitive Help (F1) to access the Control Window.

-

To review and change an employee's mailing address so that you can print a new form, choose Exit to Address Book (F11).

Description of the illustration ''adrs_wndw.gif''

| Field | Explanation |

|---|---|

| Control No | The number assigned to each W-2 by the W-2 Workfile Build. |

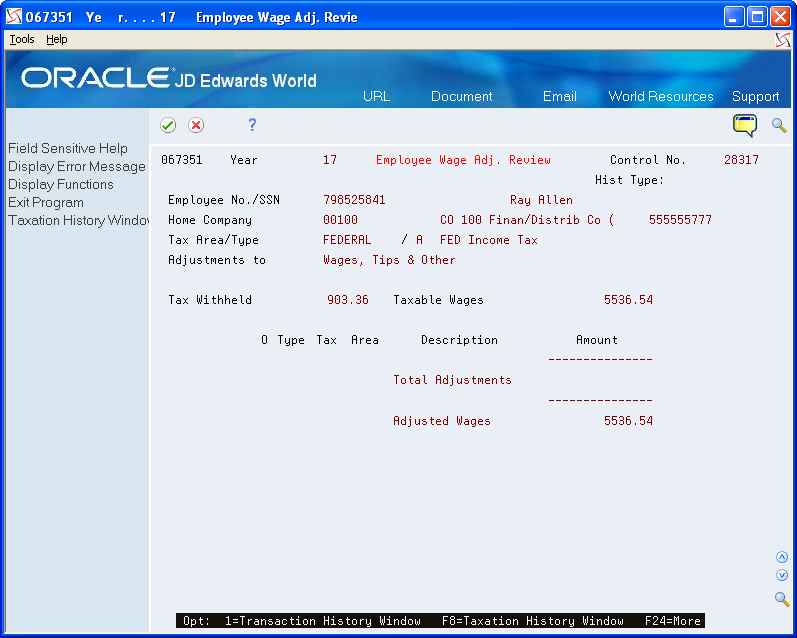

6.2.3 Reviewing Employee Wage Adjustments

You review employee wage adjustments to view adjustments to specific types of wages, such as Social Security or Medicare wages.

To review employee wage adjustments

From Year End Processing (G07247), choose Form W-2

-

On Form W-2, complete the W-2/1099 ID field and click Enter twice.

-

On W-2 Inquiry, enter 1 in the Option field for the employee whose wage type adjustments you want to review.

Description of the illustration ''emp_wage_adjust_review.gif''

6.2.4 Reviewing Employee Wage Allocations

Review employee wage allocations to view the taxable (reported) wages for the taxing authority. These wages include the taxable wages and the total of the adjustments.

If you allocate federal wages to each state, you can view the exact detail of that allocation.

The system also displays each state in which the employee worked, along with the respective allocation percentage. From these percentages, the system allocates federal wages to the state level. In addition, the system displays state wages and taxes.

Note:

To review employee wage allocations, you must choose to allocate federal wages when you build your year-end workfile.To review employee wage allocations

From Year End Processing (G07247), choose Form W-2

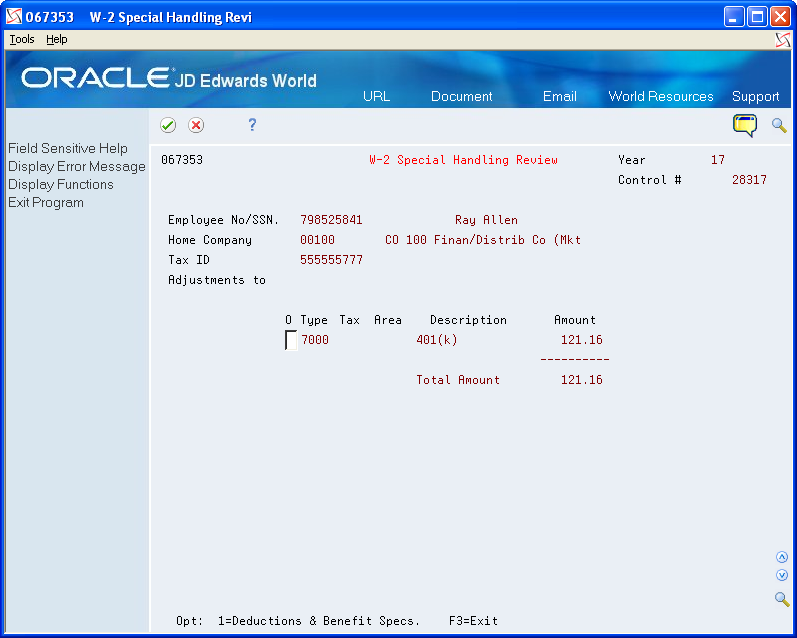

6.2.5 Reviewing W-2 Special Handling Information

You review W-2 special handling information to check the DBAs that compose the amounts in boxes 10, 11, 12, and 14. Each DBA displays with its tax area (if applicable), description, and amount.

To review W-2 special handling information

From Year End Processing (G07247), choose Form W-2

-

On Form W-2, complete the W-2/1099 ID field and click Enter twice.

-

On W-2 Inquiry, enter 4 in the Option field for the special handling code that you want to review.

Description of the illustration ''w2_spl_handlng_review.gif''

-

On W-2 Special Handling Review, to view specifications for a DBA, choose Deductions and Benefit Specifications.

-

On Basic DBA Information, review the PDBA specifications.

6.2.6 Reviewing Employee 1099 and 499R-2 Information

Before you print 1099 and 499R-2 forms, review the employee information that displays on these forms and verify that it is correct.

Reviewing employee 1099 and 499R-2 information includes the following tasks:

-

Review employee 1099-MISC information

-

Review employee 1099-R information

-

Review employee 499R-2 information

See Also:

-

Verifying Employee Names and Addresses for more information about entering an employee's mailing address

To review employee 1099-MISC information

From Year End Processing (G07247), choose Form 1099-Misc.

-

On Form 1099-Misc, complete the 1099 Version field and click Enter twice.

-

On 1099-Misc. Inquiry, complete the Employee Number field.

-

To review and revise an employee's mailing address so that you can print a new form, choose Exit to Address Book (F11).

-

On 1099-Misc. Inquiry, choose Print 1099 (F21) to print a single 1099 form.

-

On Print Control Window, review the values in the following fields:

-

Form Size

-

Form Id

-

-

Make changes, if necessary.

-

Choose Submit (F6).

6.2.7 Processing Options

See Processing Option for 1099-Misc. (P06737).

To review employee 1099-R information

From Year End Processing (G07247), choose Form 1099-R

-

On Form 1099-R, complete the 1099 Version field and click Enter twice.

-

To review and revise an employee's mailing address so that you can print a new form, choose Exit to Address Book (F11).

-

On 1099-R Inquiry, choose Print 1099 (F21) to print a single 1099 form.

-

On Print Control Window, review the values in the following fields and make changes, if necessary:

-

Form Size

-

Form Id

-

-

Choose Submit (F6).

6.2.8 Processing Options

See Processing Option for 1099-R (P067371).

To review employee 499R-2 information

From Year End Processing (G07247), choose Form 1099-R

-

On Form 499R-2, complete the ID field and click Enter twice.

-

On 499R-2 Inquiry, in the Employee field, enter the employee number of the employee whose 499R-2 information you want to review.

If you do not know the employee's number, use the Field Sensitive Help function in this field to display the Control Window.

-

To review and change an employee's mailing address so that you can print a new form, choose Exit to Address Book (F11).

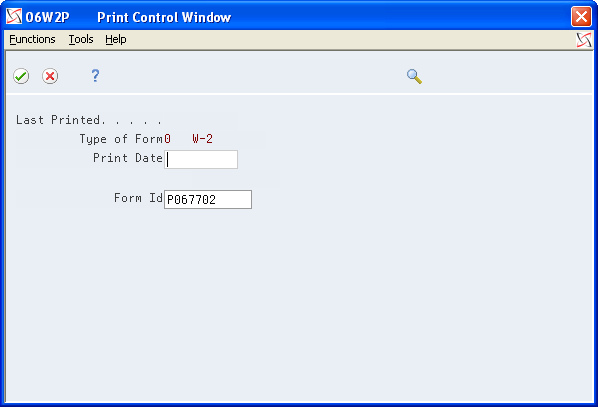

6.2.9 Printing a Single Year-End Form

You can print a single W-2, 1099-R, 1099-MISC, or 499R-2 form for an individual employee. You might print a single year-end form to determine whether the information prints correctly, instead of running the mass print program to print forms for all of the employees who are in the workfile build.

When you print individual W-2 forms, you have the option of choosing the print program during the print process.

Note:

If you enter a print date for a W-2 form and need to reprint the form, you must either reset the print date or print a W-2c form.When you print an employee's form as a test, you should remove the date from the Print Date field so that when you run the mass print program, the system disregards the test print scenario and allows a reprint of the employee's W-2.

Printing a single year-end form includes the following tasks:

-

Print a single W-2 form

-

Print a single 1099-MISC form

-

Print a single 1099-R form

-

Print a single 499R-2 form

From Year End Processing (G07247), choose Form W-2.

-

On Form W-2, complete the W-2/1099 ID field and click Enter twice.

-

On W-2 Inquiry, complete the Control Number field.

-

On Print Control Window, review the values in the following fields:

-

Print Date

-

Form Id

-

-

Make changes, if necessary.

-

Choose Submit (F6).

After the system processes the job, the system displays W-2 Inquiry.

To print a single 1099-MISC form

From Year End Processing (G07247), choose Form 1099-Misc.

-

On Form 1099-Misc., complete the 1099 Version field and click Enter twice.

-

On 1099-Misc. Inquiry, complete the Employee field.

-

After the system processes the job, the system displays 1099-Misc. Inquiry.

From Year End Processing (G07247), choose Form 1099-R

-

On Form 1099-R, complete the 1099 Version field and click Enter twice.

-

On 1099-R Inquiry, complete the Employee field.

-

After the system processes the job, the system displays 1099-R Inquiry.

From Year End Processing (G07247), choose Form 499 R-2

-

On Form 499R-2, complete the ID field and click Enter twice.

-

On 499R-2 Inquiry, complete the Employee field.

-

Choose Print 499R-2 (F21).

-

On Print Control Window, review the values in the following fields:

-

Print Date

-

Form Id

-

-

Make changes, if necessary.

-

Choose Submit (F6).

After the system processes the job, the system displays 499R-2 Inquiry.

| Field | Explanation |

|---|---|

| Form ID | The DREAM Writer form ID for the program to execute. You can choose from:

P067701 - Print Laser W-2s, 2-part P067702 - Print laser W-2s, 4-part P06771L - Print Laser W-2c P06772L - Print Laser 499R-2 |

6.3 Reviewing History Reports

JD Edwards World recommends that you run history reports and compare them to your audit reports. The data on these reports should match the data on the corresponding audit reports. If there are discrepancies between the reports, you might need to make changes to the information in the year-end workfiles.

Reviewing history reports includes the following tasks:

-

Reviewing the Federal Taxation History Report

-

Reviewing the State/Local Taxation History Report

-

Reviewing the Employee Pay and Tax Register

-

Processing year-end workfile changes

6.3.1 Reviewing the Federal Taxation History Report

For each employee, the Federal Taxation History report lists all of the federal taxable wages and tax from the Taxation Summary History table (F06136).

From History Reports (G0715), choose Federal Taxation Report

6.3.2 Processing Options

See Federal Taxation History Report (P06347).

6.3.3 Reviewing the State/Local Taxation History Report

The State/Local Taxation History report shows all of the state and local taxes paid by the employee. This report retrieves information from the Taxation Summary History table (F06136).

From History Reports (G0715), choose State/Local Taxation Report

6.3.4 Processing Options

See State/Local Taxation History (P06348).

6.3.5 Reviewing the Employee Pay and Tax Register

The Employee Pay & Tax Register shows taxable wages and taxes paid by the employee. This report retrieves information from the Taxation Summary History table (F06136).

From History Reports (G0715), choose Employee Pay & Tax Register

6.3.6 Processing Options

See Employee Pay & Tax Register (P063231).

6.3.7 Processing Year-End Workfile Changes

After you complete a full workfile build processing (type 1), identify changes that you need to make, and then make the necessary corrections to the applicable records.

When you rerun the workfile build, you can reduce processing time by choosing changes-only processing (type 2). Changes-only processing reduces the computer processing time by rerunning only the records to which you make changes. For example, to process changes that you make by employee, you can limit your data selection to choosing the Additional Parameters - Address Number function and entering the address numbers for only those employees with changes. You can also use the corresponding functions to limit the data selection for the tax ID, tax area, and company.

You can request changes-only processing by employee, company, tax area, or tax ID. The following list includes the valid combinations for changes-only processing:

-

By company

-

By tax ID

-

By tax area

-

By employee

-

By company and tax area

-

By company and employee

-

By tax ID and tax area

-

By tax ID and employee

-

By tax area and employee

Note:

You cannot process changes by both company and tax ID. You cannot enter data that otherwise is not in the additional parameters of the workfile build. You use additional parameters to narrow the data selection criteria of your workfile build version. You cannot use additional parameters to include additional employees in your workfile build process. To include additional employees you must change the data selection of your workfile build version, reset, and rerun your workfile build process.6.3.8 Before You Begin

Process the workfile build successfully, and make any necessary corrections to employee and company information.

To process year-end workfile changes

From Year End Processing (G07247), choose Build W-2/1099 Workfiles

-

On the first Build W-2/1099 Workfiles screen, enter the W-2/1099 ID for the workfile that contains records for which you need to process changes and click Enter twice.

-

On the second Build W-2/1099 Workfiles screen, enter 2 in the Type of Processing field.

-

To process changes only, perform any of the following:

-

By company, choose Additional Parameters - Home Company (F5).

-

By tax ID, choose Additional Parameters - Tax I.D. (F17).

-

By tax area, choose Additional Parameters - Tax Area (F18).

-

By employee, choose Additional Parameters - Address Number (F19).

The system displays W-2 Additional Parameters when you process changes by company, tax ID, tax area, and employee. The system displays a different data item value, depending on the function that you chose to process, such as HMCO for company, TAXX for tax ID, TARA for tax area, and AN8 for employee.

-

-

On W-2 Additional Parameters, specify the changes.

-

Exit W-2 Additional Parameters.

-

On Build W-2/1099, choose Submit (F6).

If you did not specify a print date for W-2 forms, the system reprocesses W-2 information. If you did enter a print date when you printed W-2 forms and did not reset the print function, the system creates W-2c information.