5 Setting Up the Year-End Workfile

The year-end workfile gathers the information that is necessary for you to print year-end reports and forms. The system also allows you to create a workfile for electronic filing reporting purposes.

After you define the criteria for your workfile, run the workfile build program. After you complete a full process and identify essential changes, make the necessary corrections to the applicable records.

Before you create the workfile, you must define the type of information that you want to print on your year-end forms.

Before you can define the criteria of your year-end workfile, you must create a W-2/1099 ID. The W-2/1099 ID identifies the version library where the system stores all of the information for year-end processing.

When you define data criteria, you determine the data and types of forms that you want to include in the workfile build. You can include W-2, 1099, and 499R-2 forms.

This chapter contains the following topics:

-

Section 5.4, "Assigning Additional Information for Building the Workfile"

-

Section 5.6, "Reviewing the Negative Dollar Integrity Report"

5.1 Creating a W-2/1099 ID

Before you can define the criteria of your year-end workfile, you must create a three-character W-2/1099 ID. The W-2/1099 ID identifies the version library that the system creates when you build the workfile. This library, W2LIBxxx, where xxx is the W-2/1099 ID, stores all of the information for year-end processing. The ID also identifies the DREAM Writer version that you use to choose employees for year-end processing. You use this ID when you run all of the subsequent steps in the year-end processing. You can set up multiple IDs to process different groups of employees.

You must assign a unique DREAM Writer version to each W-2/1099 ID that you create. You use this version to choose the employees to include in year-end processing. You can assign a DREAM Writer version to only one W-2/1099 ID. If no suitable DREAM Writer version exists, you can add a new version when you create the new ID. The system can process multiple W-2/1099 IDs simultaneously.

Caution:

You cannot assign a unique DREAM Writer version to more than one W-2/1099 ID. The system checks for duplicate DREAM Writer versions. Do not use the same ID that you have in a prior year. If you use the same ID, the data the system generates this year overwrites the data of the previous year.From Year End Processing (G07247), choose Build W-2/1099 Workfiles

-

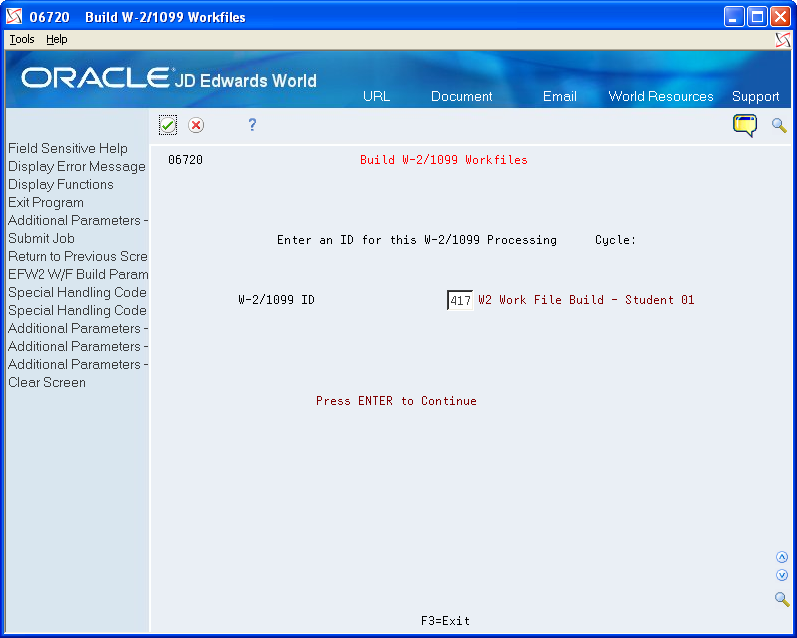

On the first Build W-2/1099 Workfiles screen, complete the following field and click Enter twice:

-

W-2/1099 ID

Description of the illustration ''buld_w2_1099_wrkfils.gif''

-

-

On the second Build W-2/1099 Workfiles screen, complete the steps for defining the workfile data criteria.

5.2 Defining Workfile Data Criteria

You define workfile data criteria to include the appropriate year-end information in your workfile. You also define data criteria to format this information properly on year-end forms.

If an employee works in more than one state or locality, you can decide whether the employee receives multiple year-end forms and what information to include on each of those forms. This option is only applicable for W-2 processing.

You set up workfile data criteria to:

-

Summarize employee tax records under one parent company

-

Determine an employee's base state for taxation purposes

-

Enter Social Security wage limits

-

Specify the format for employee names

-

Identify third-party administrators

Defining workfile data criteria includes the following tasks:

-

To enter processing information

-

To enter address information for the responsible person

-

To enter annual limits

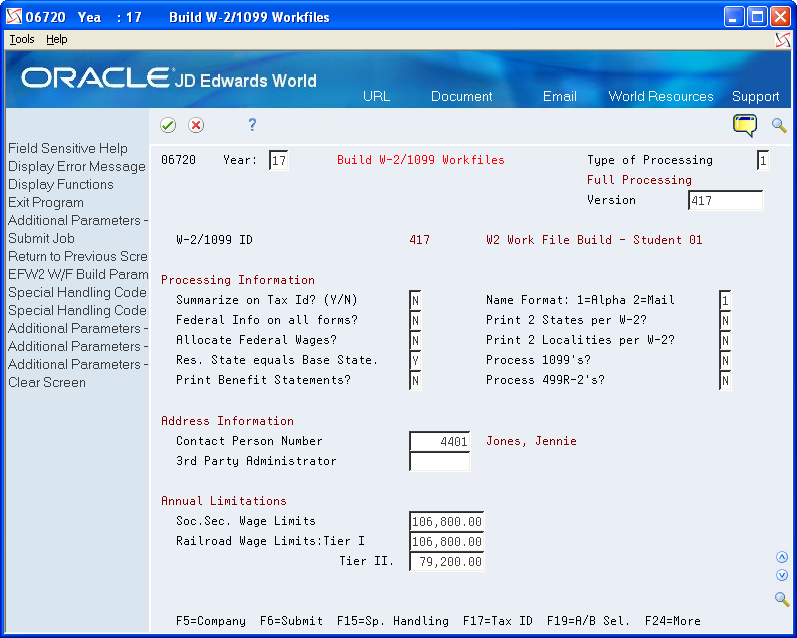

To enter processing information

-

From the second Build W-2/1099 Workfiles screen, complete the following fields and do not click OK:

-

Year

-

Type of Processing

-

Version

-

Summarize on Tax ID? (Y/N)

-

Name Format: 1=Alpha 2=Mail

-

Federal Info on all forms?

-

Print 2 States per W-2?

-

Allocate Federal Wages?

-

Print 2 Localities per W-2?

-

Res. State equals Base State

-

Process 1099's?

-

Print Benefit Statements?

-

Process 499R-2's?

Description of the illustration ''buld_w2_1099_wrkfils_1.gif''

-

-

Complete the steps for entering the address information for the responsible person.

| Field | Explanation |

|---|---|

| Type of Processing | A user defined code (07/WP) that designates valid processing types for W-2 workfile builds. Valid types are:

1 – Full workfile build. The system runs all available batch programs with the workfile process. The primary purpose is to build each workfile from scratch. 2 – Changes Only processing. The system runs the same batch programs as in a full workfile build, but against a smaller portion of the full set of employees. For example, you can use this type of processing to rebuild data for a single employee. The process completely rebuilds summary workfiles and assigns new control numbers to the changed employees' forms. When processing changes only, you must select a group of employees to process. You can select employees by home company, tax ID, tax area, or Address Book number. Use the same parameters that you used during full workfile build processing. If W-2 forms were printed with a print date, this value produces W-2c forms. 3 – Summary workfile build. The system excludes the detail employee workfile build programs and rebuilds from scratch only the summary workfiles. This type of processing is rarely necessary. 5 - Re-creates the W-2 IRS Defined Code from the DBA Year-End Parameters. |

| Summarize on Tax Id? (Y/N) | A code that specifies whether companies with the same Corporate Tax ID are to be summarized into one reporting record for W-2 reporting

To specify a parent, enter a Parent Company number in the detail area of the Corporate Tax ID screen. Access the Corporate Tax ID screen from the Taxes & Insurance menu, G0744. If you do not specify a parent company, the W-2 Workfile Build uses the lowest company number as the parent. Note: JD Edwards World recommends that when summarizing by Tax ID, you enter the Parent Company numbers in the detail area of the Corporate Tax ID screen. The Parent Company Number for the parent company is its own company number. |

| Print Benefit Statements? | A code that specifies whether the Print Benefit Statement job is to be submitted automatically when the Print W-2 form is submitted.

Please note that the special handling amounts will be printed on the W-2 for Boxes 10, 11, 12, 13, and 14 even if you answer Y to this option. The Benefit Statement provides more detail than the information printed on the W-2. |

| Print 2 States per W-2? | A code that specifies whether one or two states print on each W-2 form issued to the employee.

Y – Yes, print two states per form. N – No, print only one state per form. Caution: This field must be set to N if you use 4-part Laser W-2 forms. This form has only 1 box for state information. Note: If you specify two states per form, you cannot sort W-2s by state. All other W-2 forms (Standard and Laser) have 2 boxes for local information and print correctly if this flag is set to Y. |

| Allocate Federal Wages? | A code specifying whether the Federal Wages, Tips and Other Compensation amount should be allocated to each state where the employee had earnings. This field applies if you have multiple W-2s for employees. The following values are allowed:

N – Do not allocate the Federal Wages, Tips and Other Compensation to the states. All Federal information will print on the W-2 that contains the Base State information unless you answered Y to Print Federal Information on all forms. In this case, you will receive the same Federal information on all W-2s for the employee. Y – Allocate the Federal Wages, Tips and Other Compensation between each state in which the employee has wages. The allocation will look at total state wages and determine each state's percentage of the total. An equal percentage of Federal wages will be allocated to the different states. |

| Federal Info on all forms? | A code that specifies whether the Federal wage and tax information is to be printed on all W-2 forms to be issued to the employee.

Y – Prints the Federal wage and tax information on every form the employee receives. N – Prints only Federal wage and tax information on the form containing the employee's Base State information. Note: For railroad employees, enter N in this field if you have set up additional entries for Box 14 through special handling. |

| Res. State equals Base State | A code that indicates whether the W-2 base state for employees is derived from the Employee Master's Resident Tax Area field or from the Home State field on Category Codes and Geographical Data (P060193). Valid values are:

Y – The value in the Resident Tax Area field is used as the base state. N – The value in the Home State field is used as the base state. Blank – The value in the Resident Tax Area field will be used as the base state. When you have set up a base state other than the resident state on Category Codes and Geographical Data, you need to enter N. Note: When Res. State equals Base State field is set to N, you can leave the Home State field blank for each employee. You only need to enter a value in the Home State field when you must specify the employee is a resident of a particular state. When the Res. State equals Base State field is set to N, the system first searches for a value in the Home State field. If that field is blank, the system obtains the value in the Resident Tax Area field on the Employee Master. For example, an employee works in three different states, CO, NY, and FL. The Employee Master contains CO as both resident and work tax area. You want NY as the resident state on the W-2. In this example, you enter NY in the Home State field and ensure that the Res. State equals Base State is set to N. |

| Name Format: 1=Alpha 2=Mail | A code that specifies the name format to be used on the year-end forms and electronic filing. This code is used to determine the name format for both employees and employers. Valid values are:

1 – Alpha name from the Address Book. (ALPH) 2 – Mailing name from the Address Book. (MLNM) Note: In most cases, the federal government requires that the employee's name be entered as it is shown on the employee's Social Security card. The name on the Social Security card appears in the following format: first, middle initial, last. Choose the field from the Address Book that holds the employees' names in this order. However, this parameter will not be used for employees' names on the W-2 forms or electronic filing. The W-2 forms and EFW2 specifications require the employees' names to be in a specific format. This parameter will be used for non-W-2 forms, non-W-2 electronic file, and many year-end reports. |

| Print 2 Localities per W-2? | A code that specifies whether the system prints a maximum of two localities (city, county, school district, and so on) on each W-2 form issued to the employee.

Y – Yes, print two localities per form if the employee has tax information in multiple localities. The local information is printed on the respective state's W-2. N – No, print only one locality per W-2 form. Caution: This field must be set to N if you are printing 4-part Laser W-2 forms because each W-2 has only 1 box for local information. You must create separate W-2s for each locality. All other W-2 forms (Standard and Laser) have 2 boxes for local information and print correctly if this flag is set to Y. |

| Process 1099's? | A code that indicates whether you are processing Payroll related 1099s within the W-2 Workfile Build process. If you enter Y, the system runs additional programs that build additional elements pertaining to 1099s. |

| Process 499R-2's? | A code that indicates whether you are processing Puerto Rico form 499R-2 forms within the W-2 Workfile Build process. If you enter Y, the system runs additional programs that build additional elements pertaining to 499R-2s. As of January 2012, due to form changes made by the government, 499R-2 forms cannot be processed simultaneously with 1099 forms. |

To enter address information for the responsible person

After you enter processing information, continue defining data criteria by entering address information for the responsible person.

-

On the second Build W-2/1099 Workfiles screen, complete the following fields and do not click OK:

If you have not previously set up the Address Book numbers for the contact person or third-party administrator, enter * in the appropriate field to display the Address Window.

-

Complete the steps for entering the annual limits.

| Field | Explanation |

|---|---|

| Contact Person Number | The Address Book Number for the person who should be contacted if a problem develops with your W-2s, 499R-2s, or 1099s. |

| 3rd Party Administrator | The Address Book Number that identifies your 3rd Party Administrator. |

After you enter address book information for the responsible person, finish defining data criteria by entering annual limits

On the second Build W-2/1099 Workfiles screen, complete the following fields and click Enter:

-

Soc. Sec. Wage Limits

-

Railroad Wage Limits: Tier I

-

Tier II

| Field | Explanation |

|---|---|

| Soc.Sec. Wage Limits | The maximum amount of taxable wages to be reported for FICA. The system uses the current year's default for this field if you define the default amount in the data dictionary item SSDL. |

| Railroad Wage Limits: Tier I | The maximum amount of taxable wages to be reported for Tier I. The system uses the current year's default for this field if you define the default amount in the data dictionary item T1DL. |

| Tier II | The maximum amount of taxable wages to be reported for Tier II. The system uses the current year's default for this field if you define the default amount in the data dictionary item T2DL. |

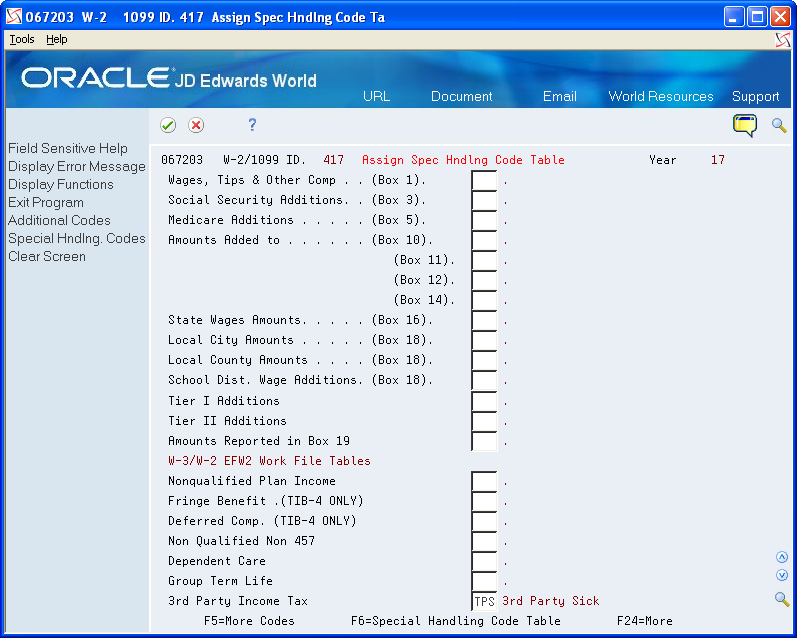

5.3 Assigning Special Handling Code Tables

You assign special handling code tables when you want to specify amounts to add to existing taxable wages or amounts that you want to report separately in the W-2 detail boxes, such as boxes 10, 11, 12, and 14. You can also identify the table codes that you use to supplement the taxable wages from the Taxation Summary History table (F06136). The table codes represent amounts that you add to the taxable wage amounts. Do not use the table codes to accumulate the taxable wages that you ultimately report on the year-end form.

The 499R-2 form contains special boxes for reporting amounts. To identify these amounts, JD Edwards World reserves the following special handling codes:

-

WAG (Wages)

-

COD (CODA Amounts)

-

COM (Commission Amounts)

-

CON (Concession Amounts)

-

REM (Reimbursed Expenses)

-

RET (Retirement)

-

EHC (Employer Health Coverage)

-

CCS (Charitable Contributions)

Note:

Do not add pay types back to boxes 1, 3, 5, 16, and 18. The system adds wages to these boxes using the Taxation Summary History table (F06136).In addition, you no longer need to special handle amounts to the Deferred Compensation table for 2019 for W-3 and W-2 Electronic Filing Tables. The system calculates deferred compensation amounts using employee detail history records. However, the box remains on the Assign Spec. Hndlng Code Tables screen for the 2019 tax year so that you can make corrections for previous years.

The Fringe Benefit box no longer exists on the W-2 form. However, the box remains on the Assign Spec. Hndlng Code Tables screen so that you can make corrections for years prior to 2001, if necessary.

To assign special handling code tables

From Year End Processing (G07247), choose Build W-2/1099 Workfiles

-

On the first Build W-2/1099 Workfiles screen, complete the steps for setting up your year-end workfile.

-

On the second Build W-2/1099 Workfiles screen, choose Special Handling Code Review (F15).

Description of the illustration ''assng_spl_hndlng_code_tbl.gif''

-

On Assign Spec Hndlng Code Tables, complete any of the following fields:

-

Wages, Tips, & Other Comp (Box 1)

-

Social Security Additions (Box 3)

-

Medicare Additions (Box 5)

-

Amounts Added to (Box 10)

-

(Box 11)

-

(Box 12)

-

(Box 14)

-

State Wages Amounts (Box 16)

-

Local City Amounts (Box 18)

-

Local County Amounts (Box 18)

-

School Dist. Wage Additions (Box 18)

-

Tier I Additions

-

Tier II Additions

-

Amounts Reported in Box 19

-

Nonqualified Plan Income

-

Fringe Benefit (TIB-4)

-

Deferred Comp (TIB-4)

-

Nonqualified Non 457

-

Dependent Care

-

Group Term Life

-

3rd Party Income Tax

-

-

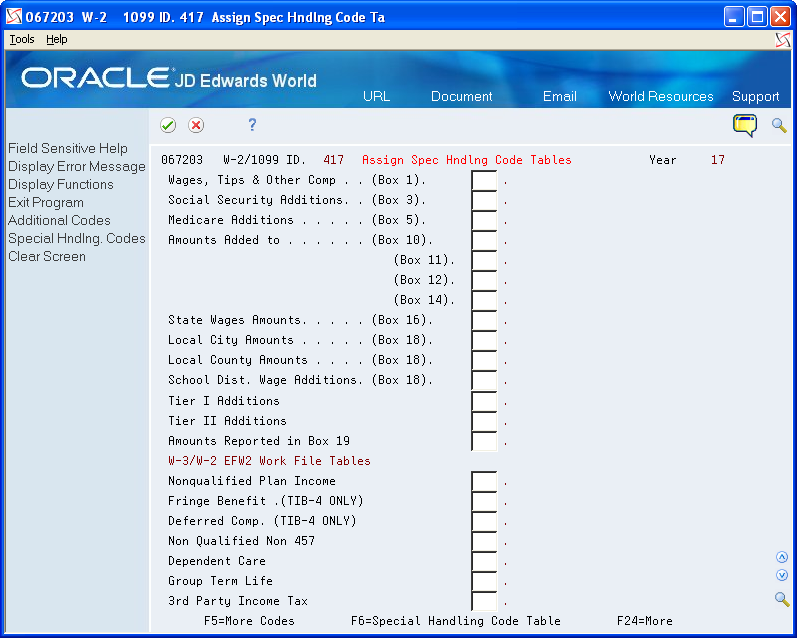

To access additional special handling codes, choose Additional Codes (F5).

Description of the illustration ''asgn_spl_hdlng_code_tbl_1.gif''

-

On Assign Spec Handling Code Tables, complete any of the following fields and click Enter:

-

Pension Amount

-

Gross Distribution

-

Employee Contributions

-

1099 Rent Amounts/499 Health Coverage

-

1099 Royalties/499 Charitable Cont

-

1099 Rent Amounts

-

1099 Royalties

-

1099 Excess Golden Parachute

-

Prizes & Awards

-

Non-Employee Compensation

-

Medical & Health Care

-

Substitute Payments

-

Allocated Tips

-

Wages

-

Commissions

-

Concession

-

Reimbursed Expenses

-

Retirement Funds

-

CODA Fund

-

New Jersey Family Leave

-

| Field | Explanation |

|---|---|

| Wages, Tips & Other Comp (Box 1) | A code that identifies a table of pay, deduction, and benefit types that are added to Wages, Tips and Other Compensation (Box 1). |

| Social Security Additions (Box 3) | A code that identifies a table of pay, deduction, and benefit types that are added to Social Security Wages (Box 3). |

| Medicare Additions (Box 5) | A code that identifies a table of pay, deduction and benefit types that are added to Medicare Wages and Tips (Box 5). |

| Amounts Added to (Box 10) | A code that identifies a table of pay, deduction and benefit types that are used to report Dependent Care Benefits (Box 10). |

| (Box 11) | A code that identifies a table of pay, deduction and benefit types that are used to report Nonqualified Plans (Box 11). |

| (Box 12) | A code that identifies a table of pay, deduction and benefit types that are used to report in Box 12 (See Instructions for Form W-2). |

| (Box 14) | A code that identifies a table of pay, deduction and benefit types that are used to report in Box 14 (Other). |

| State Wages Amounts (Box 16) | A code that identifies a table of pay, deduction and benefit types that are added to State Wages, Tips, etc. (Box 16). |

| Local City Amounts (Box 18) | A code that identifies a table of pay, deduction and benefit types that are added to Local Wages, Tips, etc. (Box 18). |

| Local County Amounts (Box 18) | A code that identifies a table of pay deduction, and benefit types that are added to Local County Wages, Tips, etc. (Box 18). |

| School Dist. Wage Additions (Box 18) | A code that identifies a table of pay, deduction, and benefit types that are used in the calculation of various W-2 and 1099 amounts added to Box 18. |

| Tier I Additions | A code that identifies a table of pay, deduction and benefit types that are added to Tier I Wages. |

| Tier II Additions | A code that identifies a table of pay, deduction and benefit types that are added to Tier II Wages. |

| Amounts Reported in Box 19 | A code that identifies a table of pay, deduction, and benefit types that are added to Local Income Tax (Box 19). |

| Nonqualified Plan Income | A code that identifies a table of pay, deduction, and benefit types that are used in reporting Nonqualified Plan Income on W-2 Magnetic Media. |

| Fringe Benefit. (TIB-4 ONLY) | This code identifies a table of pay, deduction and benefit types which are used in reporting Fringe Benefits on W-2 Magnetic Media. |

| Deferred Comp. (TIB-4 ONLY) | This code identifies a table of pay, deduction and benefit types which are used in reporting Deferred Compensation on W-2 Magnetic Media. |

| Non Qualified Non 457 | This code identifies a table of pay, deduction and benefit types which are used in reporting Nonqualified Non 457 on W-2 Magnetic Media. |

| Dependent Care | This code identifies a table of pay, deduction and benefit types which are used in reporting Dependent Care Benefits on W-2 Magnetic Media. |

| Group Term Life | This code identifies a table of pay, deduction and benefit types which are used in reporting Group Term Life on W-2 Magnetic Media. |

| 3rd Party Income Tax | A code that identifies a table of pay, deduction and benefit types that are used in reporting 3rd Party Sick Income Tax Paid on the W-3 Summary Form. |

| Pension Amount | A code that identifies a table of pay, deduction and benefit types that are used in reporting Pension Amounts on the 1099-R forms. |

| Gross Distribution | A code that identifies a table of pay, deduction and benefit types that are used in reporting Gross Distributions on the 1099-R Form. |

| Employee Contributions | A code that identifies a table of pay, deduction and benefit types that are used in reporting Employee Contributions on the 1099-R Form. |

| 1099 Rent Amounts | A code that identifies a table of pay, deduction, and benefit types that are used in reporting Rents on the 1099-MISC Form. This is also used for 499 R-2 Cost of Employer Health Coverage. |

| 1099 Royalties | A code that identifies a table of pay, deduction and benefit types that are used in reporting Royalties on the 1099-MISC Form. This is also used for 499 R-2 Charitable Contributions. |

| 1099 Excess Golden Parachute | A code that identifies a table of pay, deduction, and benefit types that are used in reporting special handling on the year-end forms. |

| Prizes & Awards | A code that identifies a table of pay, deduction and benefit types that are used in reporting Prizes and Awards on the 1099-MISC Form. |

| Non-Employee Compensation | A code that identifies a table of pay, deduction and benefit types that are used in reporting Non-Employee Compensation on the 1099-MISC Form. |

| Medical & Health Care | A code that identifies a table of pay, deduction and benefit types that are used in reporting Medical and Health Payments on the 1099-MISC Form. |

| Substitute Payments | A code that identifies a table of pay, deduction and benefit types that are used in reporting Substitute Payments on the 1099-MISC Form. |

| Allocated Tips | A code that identifies a table of pay, deduction and benefit types that are used in reporting Allocated Tips on the W-2 Form. |

| Wages | A code that identifies a table of pay, deduction, and benefit types that are used in reporting wages on the 499R-2 Form. |

| Commissions | A code that identifies a table of pay, deduction and benefit types that are used in reporting Commissions on the 499R-2 Form. |

| Concession | A code that identifies a table of pay, deduction and benefit types that are used in reporting Concessions on the 499R-2 Form. |

| Reimbursed Expenses | A code that identifies a table of pay, deduction and benefit types that are used in reporting Reimbursed Expenses on the 499R-2 Form. |

| Retirement Funds | A code that identifies a table of pay, deduction and benefit types that are used in reporting Retirement Funds on the 499R-2 Form. |

| CODA Fund | A code that identifies a table of pay, deduction and benefit types that are used in reporting CODA Plans on the 499R-2 Form. |

| New Jersey Family Leave | A code that identifies a table of pay, deduction, and benefit types that are used in the calculation of various W-2 and 1099 amounts. |

5.4 Assigning Additional Information for Building the Workfile

To further define what the system processes when you run the workfile build program, you can assign additional information for building the workfile. For example, if you need to run the workfile build for a select group of employees without changing the data selection in your program version, you can assign additional information.

You might want to test the setup of your workfile build by running the process with a small number of employees. To shorten processing time during your test, use additional information to select this group of employees. Additionally, you can use this feature to process changes to employee information since the original workfile build process.

Additional information includes the following:

-

Requesting processing by company

-

Requesting processing by tax ID

-

Requesting processing by tax area

-

Requesting processing by address number (use this for Changes Only processing only)

Note:

You cannot enter additional information for companies, tax IDs, tax areas, or employees who do not meet the data criteria of the data selection for the program version. You use additional information to reduce the number of employees that you process. To include additional employees in the workfile build process, you must change the data selection of the program version.See Also:

-

Creating Electronic Filing for additional information and instructions about creating electronic files

-

Defining Workfile Data Criteria for additional information and instructions about defining workfile criteria

To assign additional information for building the workfile

From Year End Processing (G07247), choose Build W-2/1099 Workfiles

-

On the first Build W-2/1099 Workfiles screen, complete the steps for setting up your year-end workfile.

-

On the second Build W-2/1099 Workfiles screen, choose Additional Parameters - Home Company (F5) to request processing by company.

-

On W-2 Additional Parameters, complete the following field with the company number:

-

Value

-

-

Click Add.

-

Exit W-2 Additional Parameters.

-

On the second Build W-2/1099 Workfiles screen, choose Additional Parameters - Tax ID (F17) to identify the federal tax IDs to include in your workfile build.

-

On W-2 Additional Parameters, complete the following field with the tax ID:

-

Value

-

-

Click Add.

-

Exit W-2 Additional Parameters.

5.5 Creating the Year-End Workfile

After you set up the workfile, you must create the workfile. You create the year-end workfile to gather the information that is necessary to print government forms, audit reports, and year-end reports, and to create the electronic file that you send to the SSA.

When you create the workfile, the system also prints a report of the negative amounts that are in the workfiles. This report specifies the employee number, company number, PDBA code, tax area, tax type, and amount. You must correct these negative amounts and then rerun the workfile build. The workfile build does not create a W-2 for an employee with a negative amount. The IRS and SSA do not allow you to report negative amounts.

If you did not assign special handling code tables to the electronic file fields, a warning message prompts you to do so.

The system generates the Negative Dollar Integrity report (R06730) that displays any negative wage and tax errors. If no negative wages or tax errors exist, the system prints only a report cover page.

The system creates the following employee-level records when you process 499R-2, 1099, and W-2 forms:

-

F06730 is a single federal control record that contains the U.S. federal taxes.

-

F06731 is a state (territory) control record that contains state and local taxes.

-

F06732 is a special handling record that depends on the special handling table setup.

The system creates the W2LIBxxx library and workfiles (where xxx is the ID number). This unique, permanent library contains the employee detail tables. The company summary tables are in the production library. The system uses these tables to produce year-end forms. Each time that you build a workfile, the system creates a library that remains on the system until you purge it. In addition, the system generates permanent summary control tables in the production library.

After you build the workfile, you might want to review your work before you begin printing audit reports and year-end forms.

See Also:

-

Assigning Special Handling Code Tables for more information about special handling code tables

-

Reviewing Year-End Version Information for information about reviewing the workfile build

-

Setting Up the Year-End Workfile Setting Up the Year-End Workfile.

Note:

If a company has both regular and Puerto Rico employees, you need to consider:If there is one, or just a few Puerto Rican employees in the build, remove the employees from the build and file separately on paper. Submit the electronic file for the remaining employees.

If there are multiple Puerto Rican employees in the build, build two separate workfiles, even if it is the same company and Tax ID. One build for the non-Puerto Rican employees and one build for the Puerto Rican employees. You will have two separate electronic files for the same company and same Tax ID.

5.5.1 What You Should Know About

| Tax Area Information Setup | Description |

|---|---|

| For Ohio tax type M records | It is critical that you are aware of the description in the Tax Type Description field in the Tax Area Information program (P069012) on the Tax and Insurance menu (G0744).

The system uses these descriptions for:

|

To create the year-end workfile

From Year End Processing (G07247), choose Build W-2/1099 Workfiles

-

On the first Build W-2/1099 Workfiles screen, complete the steps for setting up your year-end workfile.

-

On the second Build W-2/1099 Workfiles screen, choose Submit Job (F6).

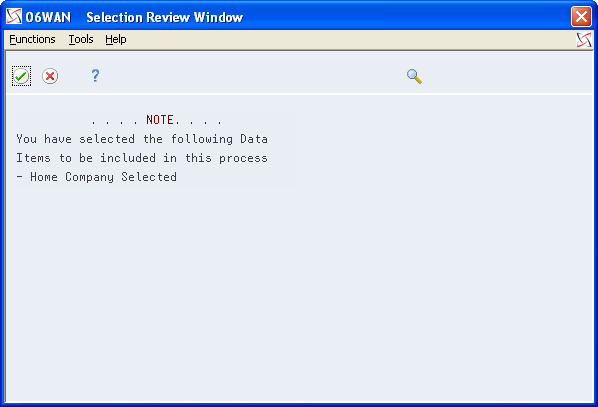

If you choose selection criteria, the system displays the Selection Review Window, which displays the criteria that you chose.

Description of the illustration ''selc_revew_wndw.gif''

-

Choose Continue Processing.

5.5.3 Data Selection for Build W-2/1099 Workfiles

If you do not choose specific companies or tax IDs, the workfile build process uses the DREAM Writer data selection for that version and selects the appropriate records. The data selection is based on information in the Employee Master table.

5.5.4 Data Sequence for Build W-2/1099 Workfiles

The system always sequences records in the year-end workfile by address book number. Do not change the data sequencing on the W-2 Workfile Build DREAM Writer version. For the other steps of year-end processing, you can change the data sequence of reports and forms.

5.6 Reviewing the Negative Dollar Integrity Report

The system generates the Negative Dollar Integrity report after you run the Build W-2/1099 Workfiles program. If the system finds any negative amounts in the Taxation Summary History table (F06136) or the Payroll Month PDBA Summary History table (F06146), it includes the employee with the negative amount on the report.

Note:

Only the first instance of a negative amount for an individual employee is on the report. If an employee is on the report, you must check all of the other history records for that employee to verify any other possible negative amounts. The system does not generate and print a W-2 for an employee with a negative amount.