Understanding Tax Deducted at Source Transactions

Understanding Tax Deducted at Source Transactions

This chapter provides an overview of tax deducted at source (TDS) transactions, and discusses how to:

Set up TDS organizational details.

Set up TDS processing.

Process TDS transactions.

Report TDS transactions.

Understanding Tax Deducted at Source Transactions

Understanding Tax Deducted at Source Transactions

TDS is a form of withholding with complex rules and regulations. Different rules apply to different types of payments. TDS requires that you calculate withholding when you book the liability (meaning, when you post the voucher) or when you make the payment, whichever is earlier. Some types of withholding are calculated only after you reach or exceed a set minimum basis amount. When the minimum basis amount is exceeded, the system calculates withholding for prior amounts and future transactions. TDS also has surcharges in addition to the calculated withholding. For Education Cess, you also define an additional surcharge percent.

PeopleSoft Payables provides a withholding architecture that enables you to meet the withholding requirements for India. You can easily calculate surcharge and tax amounts and report accurate TDS and Education Cess information when required. PeopleSoft Payables has modified several pages to enable TDS processing.

To process TDS reporting:

Set up withholding information at the withholding, business unit, and vendor levels.

Specify the (Basic Statistical Returns (BSR) code of the withholding entity's vendor bank account on the Vendor Bank Account Options collapsible region on the Vendor Information - Payables Options page.

Create a voucher on the withholding vendor.

Post the voucher.

Create a payment to the withholding vendor.

Post the payment.

Run the Withholding Posting Application Engine process (AP_WTHD).

Update the TDS Challan information using the Update TDS Challan Information page.

Run the Withholding Reporting Application Engine process (AP_WTHDRPT).

Run the TDS Register (APY8070) and the TDS Certificate (APY8080) reports.

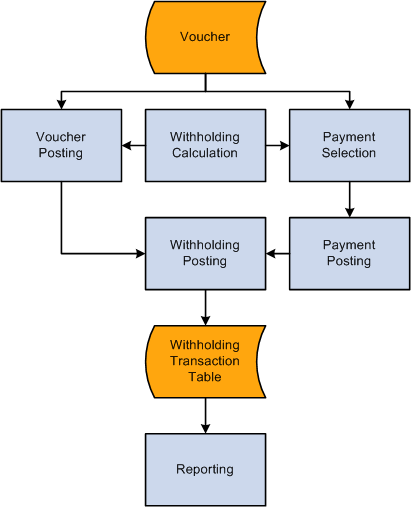

This diagram illustrates the process flow of TDS in PeopleSoft Payables:

TDS process flow

Note. The voucher must be paid and the payment posted prior to the withholding posting.

Setting Up TDS Organizational Details

Setting Up TDS Organizational Details

To set up your TDS organizational details, use the following components:

Organization Details (ORG_RGSTN_DTL).

Tax Location (ORG_TAX_LOC).

Certificate Numbering (WTHD_CRTFICATE_NUM).

This section discusses how to:

Define income tax registration details.

Define tax location details.

Set up automatic TDS certificate numbering.

Note. Setting up TDS organizational details is similar to setting up your organizational structure for excise duty, sales tax, VAT, and customs duty for India.

See Also

(IND) Setting Up Excise Duty, Customs Duty, Sales Tax, and VAT

Pages Used to Set Up TDS Organizational Details

Pages Used to Set Up TDS Organizational Details|

Page Name |

Definition Name |

Navigation |

Usage |

|

ORG_RGSTN_DTL |

Set Up Financials/Supply Chain, Common Definitions, Excise and Sales Tax/VAT IND, Organization details, Organization Details |

Specify a permanent account number (PAN), PAN ward, and PAN circle for TDS processing. |

|

|

ORG_TAX_LOC |

Set Up Financials/Supply Chain, Common Definitions, Excise and Sales Tax/VAT IND, Tax Location, Tax Location Definition |

Specify a TAN number, TAN ward, and TAN circle for TDS processing. |

|

|

WTHD_CRTFICATE_NUM |

Vendors, 1099/Global Withholding, Global Withholding Reports, TDS Certificate Numbering, Certificate Numbering |

Define the certificate numbering for each PeopleSoft Payables business unit and withholding entity. |

Defining Income Tax Registration Details

Defining Income Tax Registration Details

Access the Organization Details page (Set Up Financials/Supply Chain, Common Definitions, Excise and Sales Tax/VAT IND, Organization details, Organization Details).

|

PAN Number (permanent account number) |

Enter the number assigned by the income tax authority to identify your organization's tax returns. This number must be a 20-digit alphanumeric value. |

|

PAN Ward and PAN Circle |

Enter the location of the income tax offices to which your organization submits its taxes. Tax authorities assign these values. Wards and circles can change at the discretion of the income tax authority. |

See Also

Defining Tax Location Details

Defining Tax Location Details

Access the Tax Location - Tax Location Definition page (Set Up Financials/Supply Chain, Common Definitions, Excise and Sales Tax/VAT IND, Tax Location, Tax Location Definition).

|

TAN Number |

Enter the code assigned to you by the tax authorities that represents the location of the income tax office where your taxes are paid. |

|

TAN-Ward and TAN-Circle |

Enter the ward and circle associated with your TAN. Tax authorities assign these values. Wards and circles can change at the discretion of the income tax authority. |

|

Journal Template |

Select the journal template to use to record tax accounting entries for the general ledger business unit. These templates define the summarization rules for creating journals that are passed to the general ledger. |

See Also

Setting Up Automatic TDS Certificate Numbering

Setting Up Automatic TDS Certificate Numbering

Access the Certificate Numbering page (Vendors, 1099/Global Withholding, Global Withholding Reports, TDS Certificate Numbering, Certificate Numbering).

|

Pre Fix 1 |

Specify, for example, a company name or a PeopleSoft Payables business unit short name. |

|

Pre Fix 2 |

Specify, for example, the financial year. |

|

Start From Number |

Specify a number from which the system begins assigning a ten-digit serial number for each PeopleSoft Payables business unit. Note. Statutory returns must be filed separately for each TAN number. |

Setting Up TDS Processing

Setting Up TDS Processing

To set up your TDS processing, use the following components:

Withhold Rule (WTHD_RULE).

Withhold Type (WTHD_TYPE).

Withhold Jurisdiction (WTHD_JURISDICTION).

Vendor Categories (WTHD_VNDR_CAT).

Withholding Entity (WTHD_ENTITY).

Procurement Control (BUS_UNIT_INTFC2).

Vendor Information (VNDR_ID).

This section discusses how to:

Define TDS surcharges.

Define types and classes.

Define jurisdiction.

Define vendor categories.

Define TDS withholding entities.

Define the PAN and ward numbers.

Define the PAN and ward numbers for vendors.

Define the BSR code.

Note. Setting up TDS processing is similar to setting up your global withholding environment.

See Also

Processing Withholding in PeopleSoft Payables

Pages Used to Set Up TDS Processing

Pages Used to Set Up TDS Processing|

Page Name |

Definition Name |

Navigation |

Usage |

|

WTHD_RULE |

Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Rules, Withhold Rule |

Establish the rules that determine the actions to be taken during withholding. For example, you can create rules to define the amount of withholding and to determine different percentages based on the size of the transaction amount. |

|

|

WTHD_TYPE |

Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Types and Classes, Withhold Type |

Specify a class and description for various withholding types. Select Contract Reference if the withhold class requires a contract reference on the voucher. |

|

|

WTHD_JURISDICTION |

Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Jurisdictions, Withhold Jurisdiction |

Define withholding jurisdictions for the withholding type. |

|

|

WTHD_VNDR_CAT |

Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Vendor Categories, Vendor Categories |

Define the relationship that exists between the withholding entity and your vendor. As jurisdiction and classification do, this relationship affects your withholding percentages. |

|

|

WTHD_ENTITY |

Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Withholding Entities, Withholding Entity |

Define your withholding entities (tax authorities). The withholding entity component ties the withholding information together. |

|

|

WTHD_ENTITY_FIELDS |

Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Withholding Entities, Withholding Entity - Entity Fields - Vendor |

Indicate which information the tax authority (entity) needs for your vendors. |

|

|

BU_WTHD_ENT_FLDS |

Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Withholding Entities, Withholding Entity - Entity Fields - Business Unit |

Indicate which information the tax authority (entity) needs for your business unit. |

|

|

WTHD_BU_CF |

Set Up Financials/Supply Chain, Business Unit Related, Procurement, Procurement Control, Withholding Click the ChartField link on the Procurement Control - Withholding page. |

Define the accounting entries to record the TDS amounts. |

|

|

VNDR_LOC |

Vendors, Vendor Information, Add/Update, Vendor, Location |

Enter one or more locations for the vendor. Vendor location is a default set of rules, or attributes, which define how you conduct business with a particular vendor. |

|

|

VNDR_GBL_OPT_SEC |

Click the Global/1099 Withholding link on the Vendor Information - Location page. |

Define withholding information and reporting information for the vendor location. |

|

|

VNDR_PAY_OPT_SEC |

Click the Payables link on the Vendor Information - Location page. Expand the Vendor Bank Account Options collapsible region on the Vendor Information - Payables Options page. |

Enter the BSR code in the Branch ID field to use for TDS reporting. |

|

|

VCHR_EXPRESS1 |

Accounts Payable, Vouchers, Add/Update, Regular Entry, Invoice Information |

Enter or view invoice information, including invoice header information, nonmerchandise charges, and voucher line and distribution information. |

|

|

VCHR_WTHD_EXP |

Click the Withholding link on the Invoice Information page. |

Override the withholding for the individual voucher lines, and specify a contract reference number if applicable. |

Defining TDS Surcharges

Defining TDS Surcharges

Access the Withhold Rule page (Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Rules, Withhold Rule).

|

SurCharge % (surcharge percent) |

Enter a surcharge that is to be calculated on top of the tax amount, if required. |

|

Additional Surcharge % (additional surcharge percent) |

Enter an additional surcharge percent that is to be used for calculating the Education Cess tax levy, if required. |

See Also

Defining Types and Classes

Defining Types and Classes

Access the Withhold Type page (Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Types and Classes, Withhold Type).

|

Contract Reference |

Select whether the withhold class requires a contract reference on the voucher. |

|

Active |

Select to indicate that the withholding class is active. The withholding class is available immediately for you to use to define your withholding entity options. |

Note. The Contract Reference field is mandatory on the Voucher Withholding Information page, if you select Contract Reference.

Defining Jurisdiction

Defining Jurisdiction

Access the Withhold Jurisdiction page (Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Jurisdictions, Withhold Jurisdiction).

Jurisdictions introduce an additional level of classification between the withholding type and withholding class. Jurisdiction also enables you to define different withholding percentages based on where the vendor is located, as well as on the classification (or activity) of a given transaction.

|

Withholding Jurisdiction |

Specify any jurisdictions that belong to this withholding type. |

See Also

Defining Withholding Jurisdictions

Defining Vendor Categories

Defining Vendor Categories

Access the Vendor Categories page (Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Vendor Categories).

|

Vendor Category |

Enter any category that belongs to this withholding type. |

|

Default Flag |

Select to have the vendor category or categories appear as defaults for the Withhold Status field on the Withholding Vendor Information page. |

See Also

Defining TDS Withholding Entities

Defining TDS Withholding Entities

Access the Withholding Entity page (Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Withholding Entities, Withholding Entity).

Define the withholding entity on three pages. Enter the vendor information for the entity, define the file layout, currency code and rate, and applicable withholding rules and types. You can also use the Withholding Entity page to determine whether to create a separate withholding payment, to set up accounting ChartField parameters and basis for withholding, as well as to tie business unit and vendor categories.

Withholding Entity

|

Apply Withholding |

Select either Payment or Vchr Post (voucher post) to determine when withholding occurs. The default value is Payment. |

|

Round Option |

Select to indicate how the system should round to whole monetary amounts. Options are: Down: Select this value to round amounts down to the next whole number, regardless of actual decimal amount. Natural: Selecting this value rounds decimal amounts of less than 0.5 down to the next whole number, and rounds amounts of more than 0.5 up to the next whole number. Note that this option uses a function to determine the decimal precision to which to round the amount, depending on the installed currency configuration. (IND) NRR (Nearest Rupee Rounding): Select to round to the nearest Rupee. If an amount contains a part of a rupee consisting of paise then, if such part is fifty paise or more, it will be increased to one rupee and if such part is less than fifty paise, it will be ignored. If the transaction currency is different from the base currency, the transaction amounts will not be rounded. Only the base amounts will be rounded. TDS: Selecting this value rounds decimal amounts to the appropriate zero decimal, regardless of the installed currency configuration. Up: Select this value to round amounts up to the next whole number, regardless of actual decimal amount. |

Main Information Tab

Select the Main Information tab.

|

Create Withholding Payment |

Select if you want to create separate payments for the withholding. Otherwise, withholding is not calculated, although basis amounts are reported. Note. Creating a zero percent withholding rule accomplishes the same result. |

|

Withholding Rule |

Select the withholding rule to which these categories apply. |

|

Hold Payment |

Select to hold these payments. The available options are: Hold All: Hold both the payment and the withholding amount. No Hold: Do not hold the payment or withholding amount. Wthd Only: Hold the withholding amount only. You can override the option you select here at the vendor level on the Withholding Vendor Information page. Note. If you wish to hold the vendor's payment, you can set the rule at zero percent and set the hold option to Hold All. |

Additional Information Tab

Select the Additional Information tab.

|

Min Basis (minimum basis) and Min Withhold (minimum withhold) |

These fields are not used for TDS processing. Leave these fields blank. Note. The actual threshold amount is checked against the withholding rule. |

|

Payment Terms ID |

Enter a term to indicate when the withholding portion of the voucher will be paid to the withholding entity. |

|

Cumulative |

Select to indicate that the system should monitor voucher totals until it reaches the threshold amount that you specified on the withholding rules. Vouchers must have identical values for the withhold entity, type, jurisdiction, class, rule, vendor ID, and contract reference fields. Once it reaches that amount, the system calculates withholding on previous vouchers and on future vouchers as they are entered. Note. When the cumulative flag is not selected, the system calculates withholding on vouchers once the threshold limit is crossed but does not include previous vouchers. |

See Also

Defining the PAN and Ward Numbers

Defining the PAN and Ward Numbers

Access the Withholding Entity - Entity Fields - Vendor page (Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Withholding Entities, Withholding Entity - Entity Fields - Vendor).

The Income Tax Department provides the permanent account number, which identifies you to the Income Tax Office.

|

PAN No. (permanent account number) and PAN Ward |

Select Required to make it mandatory that users enter the permanent account number and the permanent account number ward when they enter withholding information and to make the fields available on the Withholding Vendor Information page. |

See Also

Defining Vendor Information for the Entity

Defining the PAN and Ward Numbers for Vendors

Defining the PAN and Ward Numbers for Vendors

Access the Withholding Vendor Information page (click the Global/1099 Withholding link on the Vendor Information - Location page).

Note. Column order for grids may vary by implementation. All columns may not be visible.

|

PAN No. |

Enter a permanent account number for this vendor. |

|

PAN Ward |

Enter a permanent account number ward. |

See Also

Defining the BSR Code

Defining the BSR Code

Access the Vendor Bank Account Options collapsible region on the Vendor Information - Payables Options page (expand the Vendor Bank Account Options collapsible region on the Vendor Information - Payables Options page).

|

Branch ID |

If appropriate, enter a branch ID for the bank. This field may not be available, depending on the country that you selected. For India, enter the BSR code of the withholding entity's vendor's bank branch. This information is displayed on the TDS reports (APY8070 and APY8080). |

See Also

Processing TDS Transactions

Processing TDS Transactions

This section discusses how to:

Review and enter withholding information for vouchers.

Post vouchers.

Process payments.

Post payments.

Calculate withholding.

Update Challan information.

Update acknowledgement numbers.

Note. Processing TDS transactions is similar to processing withholding transactions. We've documented the additional steps required for TDS processing in this section.

See Also

Processing Withholding in PeopleSoft Payables

Pages Used to Process TDS Transactions

Pages Used to Process TDS Transactions|

Page Name |

Definition Name |

Navigation |

Usage |

|

VCHR_WTHD_EXP |

Click the Withholding link on the Invoice Information page. |

Override the withholding for the individual voucher lines, and specify a contract reference number, if applicable. |

|

|

PST_VCHR_RQST |

Accounts Payable, Batch Processes, Vouchers, Voucher Posting, Voucher Posting Request |

Initiate the Voucher Posting Application Engine process (AP_PSTVCHR). |

|

|

WTHD_CHLN_INFO |

Accounts Payable, Batch Processes, Update TDS Challan Info, Update TDS Challan Information |

View and update Challan information for TDS reporting. |

|

|

UPD_ACKNO_PG |

Accounts Payable, Batch Processes, Update TDS Akno Number |

Enter acknowledgement numbers to be printed on the TDS certificate. |

Reviewing and Entering Withholding Information for Vouchers

Reviewing and Entering Withholding Information for Vouchers

Access the Withholding Information page (click the Withholding link on the Invoice Information page).

Specify a contract reference number, if applicable. Override withholding information for the individual voucher lines.

Note. The functionality for regular and prepaid vouchers

for TDS processing is similar to processing general withholding transactions.

While applying the prepayment against a voucher, the computation of TDS is

the difference between the voucher TDS amount less the prepayment TDS amount.

During final voucher processing, PeopleSoft Payables verifies that both

the type of payment (type and class) under the voucher and prepayment are

the same.

See Also

Entering Invoice Information for Online Vouchers

Processing Withholding in PeopleSoft Payables

Posting Vouchers

Posting Vouchers

Access the Voucher Posting Request page (Accounts Payable, Batch Processes, Vouchers, Voucher Posting, Voucher Posting Request).

The Voucher Posting Application Engine process (AP_PSTVCHR) performs the withholding calculations. The Voucher Posting process calls the Withhold Calculation Application Engine process (AP_WTHDCALC) to determine whether withholding vouchers exist.

Note. After you pay a voucher, you cannot unpost it.

See Also

Running the Voucher Posting Process

Processing Payments

Processing Payments

Payment processing for TDS involves the following modifications:

Payment Selection and Creation

You must first post vouchers so withholding can be calculated; otherwise, the system excludes them from the pay cycle.

Withholding Calculation

A surcharge field computes the surcharge based on the tax amount calculated based on the withholding rule that you defined during TDS setup.

See Also

Running and Managing Pay Cycles

Posting Payments

Posting PaymentsAccounting Entries are created during payment posting.

Vendor Payment

This table lists the accounting entries that are to be created for a vendor payment:

|

Account |

Debit |

Credit |

|

AP Liability |

8980 |

|

|

Bank |

|

8980 |

TDS Payment

This table lists the accounting entries that are to be created for a TDS payment:

|

Account |

Debit |

Credit |

|

Withholding Liability |

1020 |

|

|

Bank |

|

1020 |

See Also

Running the Payment Posting Process

Calculating Withholding

Calculating Withholding

The Withhold Calculation process monitors the withholding basis amount. Select the Cumulative option on the Withholding Entity page to indicate that the system should monitor voucher totals until it reaches the threshold amount that you specify.

Cumulative Option Selected

When a vendor's vouchers sum exceeds the threshold amount for a contract or for a period, the system calculates withholding for that vendor based on the total accumulated amount including the vouchers entered previously. After that vendor reaches the threshold amount, the system calculates withholding on every subsequent voucher based on the gross payment amount or transaction amount.

For example, the threshold amount is 10,000 INR for a given withholding rule and the Cumulative check box is selected. You create 3 vouchers with identical values for the withhold entity, type, jurisdiction, class, rule, vendor ID, and contract reference: V1 for 8000 INR, V2 for 7000 INR, and V3 for 5000 INR for withholding period 1. When V1 is voucher posted, no withholding entity payment schedule will be created since the voucher total amount has not reached the threshold of 10,000 INR for period 1. When V2 is posted, the withholding entity payment schedule will be created based on 15,000 (8000 INR from V1 + 7000 INR from V2) since the voucher total has exceeded the threshold. When V3 is posted, the withholding will be calculated for the voucher amount (5000 INR).

Cumulative Option Not Selected

If you do not select the Cumulative option, the system bases the withholding calculation on the withholding basis amount and the period withholding tier rule defined in the system.

Scheduled Pay Date

The system determines the scheduled pay date based on the accounting date if withholding is called at the time of voucher posting. The system stores withholding basis and withholding amounts to monitor the total amounts.

Note. The PeopleSoft Payables calculation module calculates withholdings at voucher posting or at payment processing, depending on the withholding calculation setting on the withholding entity and the voucher. Calculation for TDS transactions are performed at voucher posting. For those withholding transactions calculated at payment posting, the system determines the scheduled pay date based on the payment date.

In addition to calculating withholding and the surcharge amount for TDS requirements, PeopleSoft Payables also calculates the Education Cess tax levy. Use the Withhold Rule page to define the surcharge percentages and rule details for Education Cess. The system uses the withhold rule to calculate Education Cess. For example:

Invoice amount = 50,000 INR.

Percent withheld = 20.

Surcharge % = 2.

Additional surcharge % = 2.

The withhold amount is 10,000 INR (50,000 INR * .20). The surcharge amount is 200 INR (10,000 INR * .02). The system calculates the Education Cess amount by adding the withhold amount and the surcharge amount and multiplying that amount by the additional surcharge. The Education Cess amount is 204 INR ((10,000 INR + 200 INR) * .02). Therefore, the total gross amount for the withholding vendor is 10,404 INR (10,000 INR + 200 INR + 204 INR).

See Also

Reviewing Withholding Calculations

Updating Challan Information

Updating Challan Information

Access the Update TDS Challan Information page (Accounts Payable, Batch Processes, Update TDS Challan Info, Update TDS Challan Information).

|

Calendar Setid, Calendar ID, Fiscal Year, and Period |

Enter calendar, fiscal year, and period search information. The system returns and displays payment details whose withholding declaration date is within the period entered in the Period field. |

|

Retrieve All Lines |

Select check box to retrieve all lines. The system obtains and displays all payment details regardless if a Challan ID number or date of deposit has already been entered against the payment ID. |

|

Paid Amount |

Displays the total of the amounts paid for all vendors with the same payment reference. |

|

Challan ID Num (Challan ID number) |

Enter the Challan ID number for that payment. The system displays the Challan ID number on the TDS Certificate (APY8080). |

|

Deposit Date |

Enter the date the tax payment was deposited as stamped by the bank on the Challan. The system displays the deposit date on the TDS Certificate (APY8080). |

Updating Acknowledgement Numbers

Updating Acknowledgement Numbers

Access the Update Acknowledgement Number page (Accounts Payable, Batch Processes, Update TDS Akno Number)

|

Business Unit |

Displays the business unit entered on the Add a New Value page. |

|

Withholding Entity |

Displays the withholding entity entered on the Add a New Value page. |

|

Calendar SetID |

Displays the calendar setID entered on the Add a New Value page. |

|

Calendar ID |

Displays the calendar ID entered on the Add a New Value page. |

|

Fiscal Year |

Displays the fiscal year entered on the Add a New Value page. |

|

Period |

Displays the period entered on the Add a New Value page. |

|

First Quarter, Second Quarter, Third Quarter, and Fourth Quarter |

Enter the acknowledgement number of the previous quarter's TDS return for each quarter. These are place holders for the acknowledgement numbers received from the tax department after filing the returns for first, second, third and fourth quarters respectively. The values entered here will be displayed on the TDS certificate. |

|

Tax Deducted |

Enter the amount of tax remitted in respect of the deductee in relevant quarter. |

|

Tax Deposited |

Enter the amount of tax deposited in respect of deductee in relevant quarter. |

Reporting TDS Transactions

Reporting TDS Transactions

PeopleSoft Payables provides TDS reports that conform to the withholding reporting requirements for India. These reports include:

TDS Register (APY8070).

TDS Certificate (APY8080).

TDS Challan Information report (APY8085).

Work Contract Certificate (APY8090).

This section lists the pages used to report on TDS transactions.

Pages Used to Report TDS Transactions

Pages Used to Report TDS Transactions|

Page Name |

Definition Name |

Navigation |

Usage |

|

WTHD_RPT_POST |

Vendors, 1099/Global Withholding, Global Withholding Reports, Create Reporting Information, Withhold Report Post |

Run the Withholding Reporting Application Engine process (AP_WTHDRPT) to populate the Withholding Report table with data from the Withholding Transaction table based on your report setup. Select the Withhold Certificate check box to generate the necessary information for TDS certificates. Select the Quarterly Return Certificate check box to generate the necessary information for TDS quarterly certificates. This check box is available if a quarterly calendar is selected. |

|

|

RUN_APY8070 |

Vendors, 1099/Global Withholding, Global Withholding Reports, TDS Reports, TDS Reports |

The TDS Register (APY8070) contains information that is similar to the TDS Challan Information report (APY8085). Use the TDS Register to view detailed information for each withholding class and vendor on TDS applicable vouchers and related payments issued to the withholding entity. It also includes total amounts of applicable invoice on which tax has not been deducted. Use the TDS Challan Information report to provide information for the TDS Challan. Generate the TDS Challan Information report every month when you pay the government TDS for that month. Note. Run the Withholding Reporting Application Engine process (AP_WTHDRPT) prior to running the TDS Register. |

|

|

RUN_APY8080 |

Vendors, 1099/Global Withholding, Global Withholding Reports, TDS Certificates, TDS Certificates |

The TDS Certificate (APY8080) is issued by the payer for deduction of tax. Use the TDS Certificate for proof of deduction of income tax by the payer to the payee. The Work Contract Certificate (APY8090) is issued by the payer for works contract. Use the Work Contract Certificate to issue to the payee for proof of deduction of tax on Work Contract. |

|

|

RUN_APY8081 |

Vendors, 1099/Global Withholding, Global Withholding Reports, TDS Quarterly Returns |

Run TDS quarterly returns. |

|

|

RUN_AP8081A |

Vendors, 1099/Global Withholding, Global Withholding Reports, TDS Quarterly Return Annexure |

Run the TDS Quarterly Return Annexure program. |

See Also