Understanding the Treasury Management Accounting Process

Understanding the Treasury Management Accounting Process

This chapter provides an overview of the Treasury Management accounting process and discusses how to:

Establish accounting templates.

Process accounting entries.

Manage accounting entries.

Review accounting information.

Maintain fiscal period closure.

Understanding the Treasury Management Accounting Process

Understanding the Treasury Management Accounting Process

You use accounting templates to define the ChartFields to use for various kinds of accounting activities, called accounting events. By associating accounting templates with accounting events, you can automate most of the accounting process. In addition, you can also manually adjust accounting entries and create ad hoc entries.

Accounting Templates

Accounting Templates

The accounting template depicts the correct accounting and debit and credit configuration for a given treasury transaction and business event. For example, the purchase of a U.S. Treasury bond may involve the construction of two debit lines, Bonds Receivable and Unamortized Bond Discount, as well as one credit line, Cash. The accounting template for this type of transaction would include three predefined records to depict this particular debit or credit configuration.

The accounting template contains the following characteristics:

A unique template ID.

Options that determine how the correct ChartField combination is selected.

An attribute (calculation type) that describes how the accounting monetary amount is calculated or derived.

An attribute that designates whether the accounting build requires review.

Accounting Events

Accounting Events

An accounting event describes an event in the treasury business process that triggers the construction of a pending accounting build.

Oracle delivers the following treasury accounting event types with the system:

Deal transactions.

Facility, deal, wire, and letter of credit fees.

Bank transfers.

Bank statement processing transactions.

Hedges.

Electronic File Transfer (EFT) requests.

Internal account interest.

Investment pool transactions.

To automate accounting entries, you assign each accounting event type to a corresponding accounting template for all accounting events except bank transfers. Bank transfers do not have accounting templates because the accounting is derived from the bank and business unit of the bank. The template controls which ChartFields and monetary amounts to use in each accounting entry.

For treasury deals, you define the accounting event at the instrument level. You associate each instrument with various accounting events, depending on the instrument base type. In addition, you define each accounting event based on the accounting treatment (Held to Maturity, Available for Sale, Trading, or Other) and assign each accounting template to the appropriate accounting treatment. At deal entry, you select the appropriate accounting treatment. The system then automatically associates the appropriate accounting template, based on the accounting treatment of the instrument type.

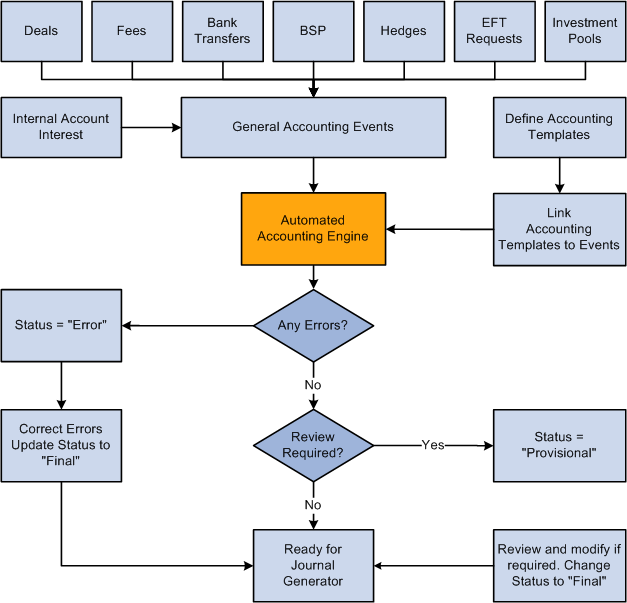

The following diagram illustrates the process flow:

Process flow for treasury accounting

Interunit and Intraunit Processing in Accounting

Interunit and Intraunit Processing in Accounting

The PeopleSoft centralized processor generates the due-to and due-from entries for both interunit and intraunit balancing. PeopleSoft Treasury Management provides functionality to support interunit and intraunit processing using the centralized processor on the Accounting Template and Accounting Entries pages.

Interunit and Intraunit Balancing Methods

Interunit refers to balancing transactions that involve two general ledger business units. The bank accounts contain the ChartFields and the rules by which their values should be determined.

Intraunit refers to balancing transactions within the same general ledger business unit in which the transaction involves more than one value on the lower level balancing ChartField. For all transactions that Treasury Management generates, the system obtains the ChartFields from either the bank account or an accounting template. Inherited ChartFields obtain their values from the corresponding ChartField on the offsetting entry.

Treasury System Transaction Definitions

To facilitate interunit and intraunit processing, you segregate your interunit and intraunit payable and receivable accounts by the type of transaction. The interunit and intraunit system transactions are a predefined list of transactions, with one system transaction for each major type of Treasury transaction that generates interunit and intraunit entries. By defining transaction codes and associating them with system transactions, you control the level by which you segregate your Interunit and intraunit balances.

Important! Oracle delivers predefined system transactions, which you can view on the System Transaction Definition page. You should not change the information on this page because it affects the intraunit and interunit processing.

See Running the Centralized Interunit and Intraunit Processor.

This table associates a system-defined transaction with a PeopleSoft accounting source.

|

Accounting Source |

System Transactions |

|

Deals |

TRDEAL |

|

Hedges |

TRHEDGE |

|

Letter of Credit, Deal, Facility, or EFT Fees |

TRFEE |

|

Bank Statement Items |

TRBSP |

|

EFT Requests |

TREFT |

|

Bank Transfers |

TRBAX |

|

Interunit Interest |

TRIUINT |

|

Manual Entry |

TRMANUAL |

|

Investment Pools |

TRINPOOL |

Intraunit and Interunit Accounting Entries Generation Using the Centralized Processor

Here is an overview of the process:

Specify an anchor entry in the accounting template as a model for any interunit and intraunit entries.

The anchor entry cannot be a line where the ChartField is determined by Bank Account.

Process treasury accounting using the Automated Accounting process (TR_ACCTG), which invokes the centralized processor. The centralized processor automatically creates any necessary offset entries that are tagged with the source identifier label System IU (viewable on the Additional Details tab of the Accounting Entries page) and inserts these data into the accounting tables.

If you make any changes to an accounting entry line, you must click the Update Accounting button to invoke the centralized processor and regenerate accounting entries.

See Also

Entering Accounting Template Information

Processing Automated Accounting

Product Interface and System Transaction Categorization

Establishing Accounting Templates

Establishing Accounting Templates

To define accounting templates, use the Accounting Templates component (ACCTG_TEMPLATES).

This section discusses how to:

Enter accounting template information.

Define additional substitution criteria.

Link templates with associated accounting events.

Pages Used to Establish Accounting Templates

Pages Used to Establish Accounting Templates|

Page Name |

Definition Name |

Navigation |

Usage |

|

Template |

TRA_TMPL_DETL |

Cash Management, Treasury Accounting, Accounting Templates |

Enter general accounting template and template line information. |

|

Substitution Rule |

TRA_SUB_RULE |

Select the Substitution Rule tab on the Template page. |

Specify a different ChartField for a template line when certain criteria exist. |

|

VAT Defaults Setup |

VAT_DEFAULTS_DTL |

Click VAT Defaults link on the Template page. |

Define value-added tax (VAT) default processing options for the specified accounting template. |

Entering Accounting Template Information

Entering Accounting Template Information

Access the Accounting Templates - Template page (Cash Management, Treasury Accounting, Accounting Templates).

|

Select to force review of the accounting transactions that use this template. When you select this check box, the system assigns error-free accounting entries and a status of Provisional. To finalize the provisional entry, use the View/Approve Entries page to review and change the status to Final. If you do not select this check box, the system assigns error-free accounting entries using this template and a status of Final. |

|

|

Source Type |

Displays the source of the accounting entry, which can be BSP (bank statement processing), Deals, Fees, Hedge Accounting, Interest, EFT Requests, or Investment Pools. |

|

Status |

Indicate whether this accounting template is Active or Inactive. This determines which templates are available to users. The system selects only active accounting templates for display and use. This feature enables you to:

When an accounting template is marked inactive, it is not available for processing, but is retained for historical reference. If you need to review accounting entries processed by an inactive accounting template, the template is still present in the system. |

|

Document Type |

Select the document type to use as the basis for assigning document sequencing numbers to these types of transactions. |

|

VAT Defaults (value-added tax defaults) |

Click to access the VAT Defaults Setup page. The VAT Defaults Setup page is a common page used to set up VAT defaults for all PeopleSoft applications that process VAT transactions. On this page, you can define accounting template defaults as applicable. You must first specify one of the accounting lines as a VAT-applicable line to establish VAT defaults for this template. |

Select the Calc Type (calculation type) to use on each template line—this varies depending on the source type. For deal-related calculation types, you must also specify a transaction line and leg of the deal.

The following table lists each available calculation type by source type.

|

Source Type |

Available Calculation Types |

|

Bank Statement Processing (BSP) |

Cashflow Amount |

|

Fees |

Cashflow Amount |

|

Fees |

Fee Accrued |

|

Deals |

Cashflow Amount |

|

Deals |

Deal Amount |

|

Deals |

Price |

|

Deals |

Purchased Interest |

|

Deals |

Interest Compounded into Principal |

|

Deals |

Interest Accrued |

|

Deals |

Mark to Market Gain/Loss |

|

Deals |

Forward Points |

|

Deals |

FX Deal Cash-flow Amount |

|

Deals |

Forward Points Accrued |

|

Deals |

Maturity Interest |

|

Deals |

Maturity Principal |

|

Deals |

Amortized Discount/Premium |

|

Deals |

Sale Current Accounted Value |

|

Deals |

Premium Accrued |

|

Deals |

Sale Settlement |

|

Deals |

Sale Price (Clean) |

|

Deals |

Sold Accrued Interest |

|

Deals |

Gain/Loss on Sale |

|

Deals |

Accumulated MTM Gain/Loss |

|

Deals |

Bond Discount/Premium |

|

Deals |

Principal Payment |

|

Deals |

Interest Payment |

|

Deals |

Amounts Rolled Out |

|

Deals |

Principal Rolled Out |

|

Deals |

Interest Rolled Out |

|

Deals |

Amounts Rolled In |

|

Deals |

Principal Rolled In |

|

Deals |

Interest Rolled In |

|

Deals |

Write-Off Unamort Disc/Premium |

|

Deals |

Write-Off Unamort Fee |

|

Deals |

Day Delay Price |

|

Deals |

Day Delay Purchased Interest |

|

Deals |

Dividend Payment |

|

Deals |

FV Excluded time Value G/L |

|

Deals |

CF Excluded Time Value G/L |

|

Deals |

FX Net Investment Excluded G/L |

|

Deals |

Fair Value Hedge Gain/Loss |

|

Deals |

Cash Flow Hedge Gain/Loss |

|

Deals |

FX Net Investment Gain/Loss |

|

Deals |

Not Hedge Designated Gain/Loss |

|

Hedges |

Fair Value Hedged Item G/L |

|

Hedges |

Firm Commitment to Carrying |

|

Hedges |

Amortize Adj to Carrying |

|

Hedges |

De-recognize Firm Commitment |

|

Hedges |

AOCI Adjustments |

|

Hedges |

AOCI Reclassify |

|

Hedges |

Will Not Occur-AOCI Reclassify |

|

Interest |

Cashflow Amount |

|

Investment Pools |

Cashflow Amount |

|

Investment Pools |

Interest Payment |

|

Investment Pools |

Mark-to-Market Gain/Loss |

|

EFT Requests |

Cashflow Amount |

|

Trans Line (transaction line) |

For Deals source type, indicates the line from the deal instrument. All other sources have a default of 1. |

|

Leg |

Indicates the deal accounting leg number. |

|

Specify one line of the template as the anchor. This is a required field because the centralized processor uses it to generate interunit entries. The anchor line cannot be a line where the ChartField is determined by bank account. |

|

|

Sign |

Select the numerical sign for a transaction Credit, Debit, Keep Sign, or Rev Sign (reverse sign). |

|

Determined by |

Indicate how to inherit ChartField values for the specified template line. Values are: Bank Account: ChartField values are inherited from the bank account that is specified by the source transaction. Fields on the ChartField tab for this line are then disabled. Explicit ChartField: You define specific ChartField values on the ChartField tab. |

|

Acct Type (account type) |

If the ChartField is determined by bank account, then you must choose the General Ledger account type. For Treasury, select Cash Account. If the ChartField is determined by Explicit ChartField, then leave this field blank. |

ChartFields Tab

Enter the appropriate ChartField values.

|

Stat (statistic) |

Select a statistics code for the specific accounting line. This field can be edited on the accounting entry. |

|

VAT Line (value-added tax line) |

Click to specify that VAT is applicable for this accounting line. You can specify VAT options only for accounts with:

|

See Also

Entering Accounting Template Information

Defining Additional Substitution Criteria

Defining Additional Substitution Criteria

Access the Substitution Rule page (select the Substitution Rule tab on the Template page).

Use substitution rule functionality to make minor adjustments to templates without having to rebuild them. For example, you might require that certain departments perform deal accounting on deals by dealers by specifying criteria for each dealer's user ID. In this example, when the DEALER_OPRID equals a particular dealer, such as BIA1, then the department ChartField equals 13000.

|

Substitute ChartFields |

Select to specify which template line is affected by a rule. You define criteria for each line |

|

Test Attribute |

Define the database object to test in. Your selection for this field determines the available attribute values. You can have more than one substitute rule per template line, but additional rules must control a different ChartField value. |

|

Set ChartField |

Select which ChartField to set against the test attribute, and enter the ChartField value in the ChartField Value field to substitute when the defined test attribute equals the specified attribute value. |

Linking Templates with the Associated Accounting Events

Linking Templates with the Associated Accounting Events

Accounting events are linked with their corresponding accounting templates on various pages, as defined in this table:

|

Accounting Event Source |

Page Name |

Navigation |

|

Bank Statement items |

External Transactions |

Banking, Reconcile Statements, External Transactions, Transactions Detail tab, Accounting Template ID field |

|

Deals |

Accounting Templates |

Deal Management, Administer Deals, Define Instruments, Accounting Templates |

|

EFT Requests |

EFT Template |

Cash Management, Fees and Transfers, EFT Requests, Origin tab, Template ID field |

|

Letter of Credit, Deal, Facility, or Wire Fees |

Fee Codes |

Set Up Financials/Supply Chain, Product Related, Treasury, Fee Codes, Fee CodesExpense Template or Accrual Template field |

|

Hedges |

Deal Accounting |

Risk Management, Analyze Hedge, Hedges, Deal Accounting |

|

Hedges |

Item Accounting |

Risk Management, Administer Risk, Hedged Item Sources |

|

Investment Pools |

Pool Information Participant Transactions Pool Position |

Cash Management, Investment Pools, Pool Information Cash Management, Investment Pools, Participant Transactions Cash Management, Investment Pools, Pool Position |

Processing Accounting Entries

Processing Accounting Entries

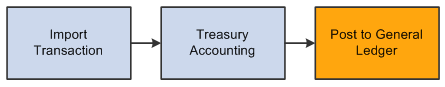

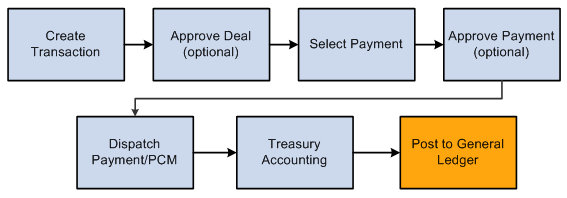

This section presents a diagram of the inbound and outbound transaction process and provides an overview of the Automated Accounting Build process and discusses how to process automated accounting.

Understanding the Inbound and Outbound Transaction Process Flow

Understanding the Inbound and Outbound Transaction Process Flow

During processing, the program calls the centralized processor to generate interunit and intraunit balancing (IU_PROCESSOR).

These diagrams illustrate the inbound and outbound transaction processes.

Inbound transaction process

Outbound transaction process

Understanding the Automated Accounting Build Process

Understanding the Automated Accounting Build Process

The Automated Accounting process populates the treasury accounting event calendar with transaction reference information, event type, event date, template ID, and processing state.

When specific processing events occur (as shown in the following table), the program that builds automatic accounting entries selects any unprocessed transactions from the treasury accounting event calendar and copies them into the Accounting Entries table.

|

Accounting Event Type |

Processing Event |

|

Treasury Deals |

The open deal is saved and the Cash Flows button is clicked. |

|

Bank Transfers, EFT transfers |

The transaction is dispatched. |

|

Fees and Charges |

Fees are saved. |

|

Mark to Market |

During revaluation processing. |

|

Investment Pools |

|

When the underlying data are established, the Automated Accounting process works in the following way:

Selects unprocessed records with the correct event date from the Accounting Event table.

Processes inbound cash flows unconditionally upon receipt of cash.

Processes outbound cash flows after transactions have been approved and sent to the bank.

Constructs the ChartField combination according to the appropriate accounting template.

If ChartField combination errors occur, the system will insert error details for each of the accounting entries. You can review and fix these ChartField combination errors by accessing the Accounting Entries component.

Retrieves the correct monetary amount according to the calculation type.

Page Used to Process Accounting Entries

Page Used to Process Accounting Entries|

Page Name |

Definition Name |

Navigation |

Usage |

|

Automated Accounting |

TRA_ACCTG_REQ |

Cash Management, Treasury Accounting, Automated Accounting |

Run the Automated Accounting process, which creates accounting entries and prepares them for the Journal Generator (FSPGJGEN) process. |

Processing Automated Accounting

Processing Automated Accounting

Access the Automated Accounting page (Cash Management, Treasury Accounting, Automated Accounting).

Note. The process creates accounting entries even if errors occur. Use the Accounting Entries page to correct any errors, and then change the status from Error to Provisional. Use the View/Approve Entries page to change the status from Provisional to Final.The accounting entries are then ready for General Ledger. You do not have to rerun the Automated Accounting process.

Managing Accounting Entries

Managing Accounting Entries

This section lists common elements used in this section and discusses how to:

Adjust accounting entries.

Create ad hoc accounting entries.

Review and approve accounting entries

View the accounting summary.

Common Elements Used in This Section

Common Elements Used in This Section|

Created By |

Displays the userID of the user who created the entry. |

|

Created Dttm (created date and time) |

Displays the entry creation date and time. |

|

Last Changed By |

Displays the userID of the most recent user to edit the entry. |

|

Last Dttm (last updated date and time) |

Displays the most recent modification date and time. |

|

Source Code |

Indicates the source for the accounting entry or fee. Values are:

|

Pages Used to Manage Accounting Entries

Pages Used to Manage Accounting Entries|

Page Name |

Definition Name |

Navigation |

Usage |

|

Accounting Entries |

TRA_ACCTG_LINE |

Cash Management, Treasury Accounting, Accounting Entries |

|

|

View/Approve Entries |

TRA_ACCTG_LINE |

Cash Management, Treasury Accounting, View/Approve Entries |

Approve accounting entries that are awaiting review. |

|

Accounting Summary |

TRA_ENT_SUM_PNL |

Cash Management, Treasury Accounting, Accounting Summary |

View line-by-line accounting events. You can retrieve information according to ad hoc search criteria and navigate to all functional areas of accounting. |

|

Treasury VAT Information |

TRV_ACCTG_LINE_VAT |

Click VAT on the Accounting Entries page. |

Review VAT information for a VAT-applicable accounting entry line. |

Adjusting Accounting Entries

Adjusting Accounting Entries

Access the Accounting Entries page (Cash Management, Treasury Accounting, Accounting Entries).

|

Event |

Displays a descriptive label for the accounting entry, based on the source code value. |

|

Source Code |

Displays the accounting entry source, as processed by the Automated Accounting process, or entered on a manual accounting entry. |

|

Source ID |

Displays the unique identification number on the source side for the accounting entry. |

|

Acctg Date (accounting date) |

Displays the date that the entry was processed through Automated Accounting, or entered as a manual accounting entry. |

|

Status |

Indicates the current condition of the accounting entry. Values are: Provisional: The entry is not finalized. You can make any required changes. Error: An error exists within the accounting entry. The system assigns this status—you cannot select it. When you correct an error, change the status to Provisional. After the status has been changed to Provisional, use the View/Approve Entries page to change the status to Final. The entry is then ready for the Journal Generator process—you do not need to reprocess it. Final: The entry is ready for Journal Generator processing and is free from errors. Until the entry is processed through the Journal Generator process, you can continue to make changes to it, even if the status is Final. When the Journal Generator processes the entry, the distribution status changes to Distributed, indicating that it has been posted to a General Ledger journal and no further modifications can be made. |

|

Acctg Template (accounting template) |

Displays the name of the accounting template that is attached to the accounting entry. Note. If you use General Ledger, you can automatically reverse any unrealized gain/loss accounting that is generated by Treasury Management at the next accounting period. You need to create a journal template for this type of treasury accounting and enable the feature for automatic journal reversal. You must assign this journal template to the treasury accounting template for General Ledger to perform the automatic reversals. |

|

Error |

Indicates the error source of an automated accounting entry. Values are: None: No error condition exists. This appears when the status is provisional or final. Unbalanced: Debits do not equal credits, or debits and credits are not equal, but refer to different General Ledger business units. CF Combo Error (ChartField combination error): The ChartField generated is invalid. No Exchange Rate: The currency exchange rate for the applicable currency pair is missing. The base amount could not be converted to the accounting entry currency. Account Not Specified: The account was undefined, and the amounts cannot be distributed. IU Processor Error: The centralized processor encountered an error. Review the accounting entries, correct any errors, and click the Update Accounting button to regenerate accounting. |

|

Requires Review |

If a check mark appears in this check box and it is unavailable for selection, this indicates that the Review Required check box was already selected on the Template page on which this was based. |

|

Integration Status |

Displays the status of the integration between Treasury and JD Edwards General Accounting. This field appears only if the integration is enabled on the Installation Options - Treasury page. Values are:

Note. If an entry must be resent, the integration status can be changed to Pending unless the integration status is already displayed as Posted. See Defining Treasury Installation Options. See JD Edwards Application Integrations with PeopleSoft Applications, "Using the PeopleSoft Treasury with JD Edwards General Accounting Integration" |

Accounting Entries

|

Line |

Displays the line number of the automated accounting process. |

|

Error |

Displays this column and a X link next to the lines with ChartField combination editing errors. Click the X link to access an Accounting Entries secondary page, which contains a Line Errors grid that has these fields:

Note. The Errors column only appears in the Accounting Entries page when there is a ChartField combination editing error. A ChartField combination error does not stop the Accounting Entries creation process (ACCOUNTING_BUILD). You can review and fix the errors after the process has finished. |

|

GL Unit |

Displays the associated General Ledger unit. |

|

|

Click the Exchange Rate Detail button to view currency exchange rate information. |

|

Base Amount |

Displays the GL BU (General Ledger business unit) amount in the base system currency. |

|

IU Anchor (interunit anchor) |

Specify one line of the template as the anchor. This is a required field, because the centralized processor uses it to generate interunit entries. |

|

If you edit any of the information in the Accounting Entries group box, click this button to run the centralized interunit processor. Note. If you are editing information only in the page header (Status field or Requires Review check box), do not click the Update Accounting button. |

|

|

VAT (value-added tax) |

Appears for VAT-applicable accounting entries. Click the link to access the Treasury VAT Information page. |

ChartFields Tab

Select the ChartFields tab.

|

Stat (statistic) |

If a statistics code is set for this accounting line on the template, that code appears here. You can edit this field. Select a statistics code—the associated unit of measure (UOM) appears for the selected code. You must also enter a statistic amount with which to measure the statistic. |

Important! If a ChartField combination editing error occurs, an Errors column will appear after the Line # column. An X link will appear next to an transaction line with a ChartField combination error. You click the X link to access an Accounting Entries secondary page, which contains a grid that describes the error message for each transaction. You can click on a transactions Line # link and access the accounting transaction with the ChartField combination error, and fix the problem. See the Accounting Entries subtopic in this section for additional details.

See ChartField Values.

Additional Details Tab

Select the Additional Details tab.

|

Displays either Treasury for accounting lines that are generated by the treasury accounting program, or System IU for accounting lines that are generated by the centralized processor. |

Journal Tab

Select the Journal tab.

|

Combo Status |

Indicates whether the ChartField combination that the system built based on the accounting template is Valid or Invalid. |

|

GL Status (General Ledger status) |

Provides information about the posting status of the entry. Possible values include:

|

|

Ledger Group |

Indicates the general ledger group that is associated with the General Ledger Unit on the accounting line. |

|

Ledger |

Indicates the general ledger that is associated with the General Ledger Unit on the account line. |

See Also

Establishing Accounting Templates

Reviewing VAT Accounting Entries

Creating Ad Hoc Accounting Entries

Creating Ad Hoc Accounting Entries

Access the Accounting Entries page.

The Source Code, Source ID, Event, and Accounting Template fields are optional.

If you complete the Source Code, Source ID, and Event fields, the system can create a link between the manual and the automated accounting results.

If you enter entries manually on a recurring basis, you can create and use an accounting template to minimize the data entry process for these entries. Any template that you create appears in the Accounting Template field. When you select an accounting template for this ad hoc entry, the system automatically populates the accounting lines with the template data.

To create ad hoc accounting entries:

Enter the business unit and optionally, an accounting ID. Click Add.

Select an accounting event from the following values:

(none)

AOCI Adjustment

AOCI Reclassify

Amortize Adj of Carrying

Barrier Rebate Payment

Commodity Cash Difference

Commodity Settlement

Deal Booking

Deal Maturity

Derecognize Firm Commitment

Discount Accrual

Fair Value Hedged Item G/L

Fee Accrual

Firm Commitment to Carrying

Forward Points Accrual

Generic Cash Flow

Initial Payment

Interest Accrual

Interim Principal Payment

Mark to Market

Maturity Payment

Option Cash Difference

Option Exercise

Option Premium Accrual

Periodic Payment

Premium Payment

Sell / Buyback

Transaction Fee

Will Not Occur - AOCI Reclassify

Specify a source code.

Select a specific source ID of the selected source code.

Review the accounting date for accuracy.

Leave the default status for ad hoc entries as Provisional. Do not change this setting.

The Require Review check box is automatically selected for ad hoc entries. You cannot deselect this check box.

(Optional) Enter a description.

Select an accounting template.

Enter at least one debit and one credit line to balance the entry, and select one line as the IU anchor.

Enter an account and any other ChartFields for each line.

Select TR_ENTRIES for the journal template.

Click Update Accounting to run the centralized processor function, which creates any necessary offset entry lines and saves the manual accounting entry.

If the debits and credits do not balance, you receive an error message and the accounting entry is not saved. Make the necessary corrections, and then save the page.

Note. When the Journal Generator processes the entry, the distribution status changes from None to Distributed, and no further changes can be made.

See Also

Reviewing and Approving Accounting Entries

Reviewing and Approving Accounting Entries

Access the View/Approve Entries page (Cash Management, Treasury Accounting, View/Approve Entries).

|

Status |

Initially displays the status of accounting entries that are displayed in the Accounting Entries grid. Values are:

|

Note. Use PeopleSoft Security functionality to identify which users have access and approval privileges to provisional accounting entries. You can define permission lists and accessible pages for a specific userID.

See Also

PeopleTools PeopleBook: Security Administration

Viewing the Accounting Summary

Viewing the Accounting Summary

Access the Accounting Summary page (Cash Management, Treasury Accounting, Accounting Summary).

|

Acctg Date (accounting date) |

Displays the creation date of the accounting transaction. |

|

Status |

Select Error, Final, or Provisional. |

|

Line |

Click a link to access the Accounting Entries page for that event. |

|

Event ID |

Click to navigate back to the source transaction. |

Reviewing Accounting Information

Reviewing Accounting Information

You can inquire on various aspects of your accounting activity. This section lists common elements used in this section and lists the pages used to review accounting information.

Common Elements Used in This Section

Common Elements Used in This Section|

Event ID |

Displays the source identifier mapped by the originating source transaction. |

|

Status |

Select Accruing, Deactiva'd (deactivated), Error, In Process, Not Proc (not processed), or Processed. |

|

Template |

Displays the associated accounting template. For events that have not been processed yet, or are only partially accrued, you can modify the template. However, for BSP and Fee accounting events, if VAT is associated with the source transaction, you cannot change the template. You must adjust VAT charges at the source transaction level—this ensures that the VAT accounting is kept in synchronicity in the system. |

|

|

Click to access a specific Accounting Template page. |

Pages Used to Review Accounting Information

Pages Used to Review Accounting Information|

Page Name |

Definition Name |

Navigation |

Usage |

|

Accounting Events |

TRA_EVENT_CAL |

Cash Management, Treasury Accounting, Accounting Events, Accounting Events |

View accounting events generated from deals, facility fees, and bank transfers. |

|

Bank Statement Processing Accounting (BSP) |

TRA_EVENT_CAL_2 |

Cash Management, Treasury Accounting, Accounting Events Select the BSP Accounting Events tab. |

View accounting events generated from bank statement processing. |

|

Accounting Summary |

TRA_ENT_SUM_PNL |

Cash Management, Treasury Accounting, Accounting Summary |

View line by line accounting entries. You can retrieve information according to ad hoc search criteria and navigate to all functional areas of accounting. |

|

TR Journal Drill |

TR_DRILL_PNL |

Cash Management, Treasury Accounting, Journal Drill |

View accounting entries and associated General Ledger journal data. A link to the General Ledger Journal page enables you to view the journal in greater detail. |

Maintaining Fiscal Period Closure

Maintaining Fiscal Period Closure

This section provides an overview of the Fiscal Period Summary page, lists prerequisites, and discusses how to maintain fiscal period closure functionality.

Understanding the Fiscal Period Summary Page

Understanding the Fiscal Period Summary Page

The Fiscal Period Summary page enables you (or those users with end-of-period accounting responsibilities) to manage your fiscal period close process and the integrity of closed fiscal periods. When you close a fiscal period, system processes prevent users from running Treasury Management accounting processes for that period. This helps ensure accurate end-of-period reporting and analytical results, because any additional accounting for the period is transferred to and handled by the next accounting cycle. This type of fiscal period close is considered a soft-close of your accounting ledger, because the closure occurs only in the Treasury Management product, not the General Ledger product.

If another user (such as an accounting clerk) attempts to run accounting on entries of the closed fiscal period, the system will not run the accounting request. Functionality on the Automated Accounting and the Process Scheduler pages prevents the process request from occurring.

When you close or reset an entry or entries in a series of entries, the system enforces closing or resetting the entries in a certain logical order. This is to maintain the integrity of your Treasury Management accounting entries. You can also reset (open) any fiscal period that may have been closed in error. The system tracks and displays your most recent action for each fiscal period row on the Audit Detail page, providing an activity log.

In addition, individual business units can maintain their own Treasury Management close cycle calendars, independent of the close cycle performed for the general ledger. This means that one of your Treasury business units can close using a weekly calendar, while another Treasury business unit can close using a monthly calendar.

Prerequisites

PrerequisitesBefore configuring the Fiscal Period Accounting Summary page:

Confirm that only those users who need access to this page have access permission, as defined in the permission lists associated with their user profile.

Verify that the Treasury business units that you will use in this page are defined with a calendar ID on the Treasury Options page (BUS_UNIT_OPT_TR).

See Also

Defining Treasury Business Unit Options

PeopleTools PeopleBook: Security Administration

Page Used to Maintain Fiscal Period Closure

Page Used to Maintain Fiscal Period Closure|

Page Name |

Definition Name |

Navigation |

Usage |

|

Fiscal Period Summary |

TR_FISCPRD_CLS |

Cash Management, Treasury Accounting, Fiscal Period Summary |

Close or lock down the accounting for a specified fiscal period, in preparation for end-of-period financial-report generation and analysis. This prevents other users from rerunning Treasury Management accounting processes for the closed fiscal period. You can also reset a fiscal period that has been closed in error. |

Maintaining Fiscal Period Closure

Maintaining Fiscal Period ClosureAccess the Fiscal Period Summary page (Cash Management, Treasury Accounting, Fiscal Period Summary).

When you add rows to existing fiscal period information, the system automatically populates the Fiscal Year and Period fields with the next chronological period.

Note. Rows must be closed in ascending entry order, from first entered row to last entered row. For example, if you want to close Fiscal Year 2002, Period 2, you must first close Fiscal Year 2002, Period 1. Conversely, rows must be reset in descending entry order. In the previous example, you need to reset (or open) Fiscal Year 2002, Period 2, before you can reset Fiscal Year 2002, Period 1.

Enter the business unit and a calendar ID. Click Add.

Select a fiscal year.

Select an accounting period.

If you want to close this fiscal period, select the Close Acctg (close accounting) check box.

To reset a closed fiscal period:

Click Reset. The system enables theFiscal Year and Period fields, and automatically deselects the Close Acctg (close accounting) check box.

In Reset Reason, overwrite any existing text with the reason for the fiscal period reset.

The Audit Detail page lists audit information for each row.

|

Create Dttm (creation date and time) |

Indicates the entry creation date and time. |

|

Last Dttm (last changed by date and time) |

Indicates the most recent edit date and time of the entry. |

|

Reset Dttm (reset date and time) |

Indicates the most recent reset date and time of the entry. |