Understanding the Pension Payment Process

Understanding the Pension Payment Process

This chapter provides an overview of the pension payment process and discusses how to:

Define and create retiree payments.

Review retiree payment results.

Create trustee extract process.

Review trustee extract data.

Understanding the Pension Payment Process

Understanding the Pension Payment Process

Pension Administration gathers and exports payment information. However, it assumes that a trustee or other third-party produces the pension checks and handles all W-2 and 1099 reporting.

Several steps are required to process retiree pension payments:

Create a payment calendar, where you assign a run ID to each pay period.

You can set up separate payment calendars for each plan, or you can set up a single payment calendar for all plans.

Run the Retiree Payment COBOL SQL process (PAPPPYMT) in Preliminary Processing mode.

The Retiree Payment process reads the relevant payment data from both the regular and one-time payment schedules. You use Preliminary Processing mode so that you can review and edit the results before finalizing the payment information. You can rerun the process as often as necessary in Preliminary Processing mode.

Run the Retiree Payment process in Confirmation Processing mode.

The Retiree Payment process confirms the results of the preliminary processing and updates retiree pension statuses.

The Trustee Extract process uses the payment information that the Retiree Payment process gathers. It writes the data to the Trustee Extract file, which you can transmit to the third-party who produces the retiree checks.

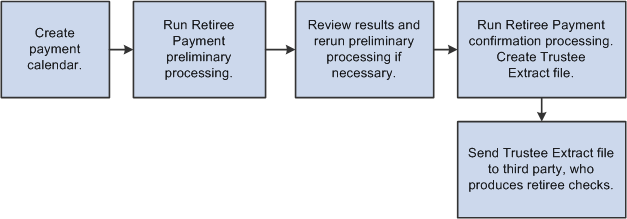

The following diagram illustrates the flow of the pension payment process from creating the payment calendar to sending a trustee extract file to a third party:

Illustration of pension payment process from creating the payment calendar to sending a trustee extract file to a third party

Note. PeopleSoft Payroll Interface includes a data import feature that you can use to import pension check data that is created by a trustee. You import this check data for viewing and ad hoc reporting only—not for issuing 1099-Rs. The system assumes that 1099-Rs are issued by the trustee.

Defining and Creating Retiree Payments

Defining and Creating Retiree Payments

This section lists the pages used to define retiree payments and discusses how to:

Define the retiree payment calendar.

Create retiree payments.

Pages Used to Define Retiree Payments

Pages Used to Define Retiree Payments|

Page Name |

Definition Name |

Navigation |

Usage |

|

PA_RT_CALENDAR |

Pension, Payments, Set Plan Pay Periods, Set Plan Pay Periods |

Set up a schedule of pay periods for pension checks for a plan. |

|

|

RUNCTL_PAPPYMNT |

Pension, Payments, Create Retiree Payments, Create Retiree Payments |

Process payments for pension payees. |

Defining the Retiree Payment Calendar

Defining the Retiree Payment Calendar

Access the Set Plan Pay Periods page (Pension, Payments, Set Plan Pay Periods, Set Plan Pay Periods).

When you create a calendar, you assign a payment calendar name and specify the benefit plan that uses this calendar. If you do not specify a plan, all plans are selected by default.

|

Retiree Payment Run Parameters |

Set up the retiree payment run parameters with one row per pay period. |

|

Run ID |

Assign a run ID to each pay period. You associate a run ID with each pay period and benefit plan, then reference that run ID when you run the Retiree Payments and Trustee Extract processes for that pay period and plan. |

|

Pmt End Dt (payment end date) |

The payment end date is the last day in a pay period. |

|

Check Date |

The check date is the date that should appear on the actual pension check. |

|

Payment Frequency |

The payment frequency indicates how many times per year you make payments under the plan. You can select one of these values: One Time Payment, Annual Payment, Monthly Payment, Semi-Annual Payment, Semi-Monthly Payment, Biweekly Payment, or Quarterly Payment. You typically make 12 payments for regular pension pay runs, so this is value is almost always Monthly Payment. This field is informational only. Payment processing picks up all scheduled payments, regardless of whether the scheduled payment frequency matches the frequency of the pay run ID. |

|

Payment Status |

The status indicates the processing stage for this pay period: Not Processed Yet, Preliminary, or Confirmed. |

|

Purge |

After you confirm the retiree payments for a particular pay period, a Purge check box appears for that period. If you select this check box, the system deletes the payment records for the run ID during the next payment processing. The system purges both payment records (created during the payment process) and trustee extract data (created when you run the Trustee Extract process). Purging does not affect the Trustee Extract file, which is saved to disk outside of the PeopleSoft system. |

Creating Retiree Payments

Creating Retiree Payments

Access the Create Retiree Payments page (Pension, Payments, Create Retiree Payments, Create Retiree Payments).

|

Run Control ID |

The run control ID is your link to Process Scheduler, the tool that manages your processing requests. |

|

Processing Selection |

Choose whether to run the processing in Preliminary Processing or Confirmation Processing mode. You cannot run confirmation processing unless you first run preliminary processing. In both modes, the Retiree Payment process creates payment data in the table PA_RT_PAY_DETL. Payments are based on scheduled payments and adjustments. Payments are identified by the run ID that you assign. If you have previously run a preliminary payment process for the same run ID, the previous payment data is deleted and the new data takes its place. |

|

Run ID |

The run ID identifies the pay period that you want to process. You can click the Table Lookup button to see a list of the run IDs that you created on the Retiree Set Plan Pay Periods page. |

|

Payment Calendar Name, Pension Benefit Plan, Pay Period End Date, Payment Frequency , and Check Date |

When you enter the run ID, the system displays the associated payment calendar name, pension benefit plan, pay period end date, payment frequency, and check date. Note. The payment frequency does not actually affect processing. For example, the monthly pay run picks up any scheduled lump sum payments. |

Running Preliminary and Confirmation Processing

In Confirmation Processing mode, the Retiree Payment process:

Updates the run ID status to Confirmed.

This is important because the Trustee Extract process only processes confirmed run IDs. To review the run ID status, access the Set Plan Pay Periods page.

Marks as complete any one-time payments that were picked up during the current run.

This prevents a payment from being picked up again during the next pay cycle. The system does not display this information.

Updates summary payment data, such as the running total of payments.

To review these totals, access the Review Balances and Totals page.

Updates the employee's pension status code for all newly started, newly deferred, or newly stopped payments.

To review pension statuses, access the Identify Pension Status page.

Creates the Trustee Extract file.

Note. The Retiree Payment process does not actually pay retirees. Rather, it translates general payment instructions, such as "pay 1,500 USD every month," into pay period-specific information. You use a separate process, the Trustee Extract, to transmit all payments and deductions for the pay period to a third-party trustee, who is responsible for creating the pension checks.

The pension status code is a three-character code:

The first character indicates the payee type (for example, R is a retired employee).

The Retiree Payment process does not change the payee type.

The second and third characters indicate the payment status:

DF: Deferred payments.

PY: Active payments (the payee is currently receiving payments).

ST: Stopped payments.

In Confirmation Processing mode, the Retiree Payment process updates the payment status, based on activity during the pay period.

The payment process changes the payment status:

From deferred to active the first time that it pays an employee.

From active to deferred if payments are suspended during a pay period.

From active to stopped when payments are stopped.

Note. The process only stops payment for a plan if all the payment streams for that plan are stopped. If you have manually set the status to deceased, the payment process does not change the status to stopped.

The effective date of a pension status is the same as the effective date on the payment schedule that starts, stops, or suspends the payment.

The following table summarizes the codes that the payment process sets:

|

Payee Type |

Deferred Payments |

Active Payments |

Stopped Payments |

|

Terminated employee |

TDF |

TPY |

TST |

|

Retired employee |

RDF |

RPY |

RST |

|

Employee retired on disability |

DDF |

DPY |

DST |

|

Beneficiary |

BDF |

BPY |

BST |

|

QDRO alternate payee |

QDF |

QPY |

QST |

If the payment process detects an initial payment and the current payment status is DF, it assumes that the person is a retiree and changes the status to RPY. Similarly, if the process detects a deferred or stopped payment and the current payment status is not PY, it assumes that the person is a retiree and changes the status to RDF or RST. In both cases, it issues a warning message.

Note. The warning message is issued when you set up a payee and you do not manually change the payment status to DF.

Click Run to run the Retiree Payment process. The Process Scheduler runs this process at user-defined intervals.

Payment process messages do not appear in the message log. Instead, you review messages by viewing the log file for a particular process. PeopleTools creates the log files in your temp directory.

Note. After you click Run, select a Process Scheduler Server, and click OK, you can see the process instance number, which you can use to access the Review Processing Messages page for information about the process.

Payment processing typically runs on the Process Scheduler server. Select a Process Scheduler server in the Server Name field and click OK to put the job into the Process Scheduler queue.

Reviewing Retiree Payment Results

Reviewing Retiree Payment Results

This section provides an overview of the pages used to review retiree payment results, lists the pages used to review retiree payment results, and discusses how to:

View retiree payment results: payment summary.

View retiree payment results: payment details.

Understanding the Pages Used to Review Retiree Payment Results

Understanding the Pages Used to Review Retiree Payment ResultsAfter you run the Retiree Payment process, you can review the resulting payment data online using the Review Payment Results component (PAYMENT_RESULTS).

This is particularly useful when you run the payment process in Preliminary Processing mode and you need to review the results before running it in Confirmation Processing mode.

You can also run the Review Payment Results Report (PARVWPMT.sqr) to review the payment results at an employee level. When you run the report, you choose the desired output: Payment Details – Total, Payment Details – NonTaxable, and Payment Information.

Pages Used to Review Retiree Payment Results

Pages Used to Review Retiree Payment Results|

Page Name |

Definition Name |

Navigation |

Usage |

|

PA_RT_SUM_INFO |

Pension, Payments, Review Payment Results, Review Payment Results |

Shows the total payments that were processed during the payment run. |

|

|

RUNCTL_RVWPMNT |

Pension, Payments, Review Payment Results Report, Review Payment Results Report |

View retiree payment details |

Viewing Retiree Payment Results: Payment Summary

Viewing Retiree Payment Results: Payment Summary

Access the Review Payment Results page (Pension, Payments, Review Payment Results, Review Payment Results).

|

Run ID, Benefit Plan, Payment Frequency, Pay Period End Date, and Check Date |

These fields are used in the Retiree Payment process. |

|

Process Instance |

The process instance is assigned by the Process Scheduler. Use it to look up processing messages on the Review Processing Messages page. |

|

Processing Selection |

The processing mode: Preliminary Processing or Confirmation Processing. |

|

Total Payments |

The sum of all payments (for all plans and all payees) that are included in this payment run. This is the total of the amounts in the following fields: Scheduled Amount, Manual Amount, and Adjust Amount. |

|

Scheduled Amount |

The total of all scheduled payments with payment reasons other than Manual. |

|

Manual Amount |

The total of all scheduled payments with payment reasons of Manual. |

|

Adjust Amount (adjusted amount) |

The total of all one-time payments entered on the Make One-Time Adjustments page. |

|

Payment Summary |

This scrolling area displays a plan-by-plan breakdown of the information—each benefit plan and its associated number of payments, total payment amount, scheduled amount, manual amount, and adjusted amount. |

Viewing Retiree Payment Results: Payment Details

Viewing Retiree Payment Results: Payment Details

Access the Review Payment Results Report page (Pension, Payments, Review Payment Results Report, Review Payment Results Report).

|

Run ID |

This field is used in the Retiree Payment process. |

|

Process Instance |

The process instance is assigned by the Process Scheduler. Use it to look up processing messages on the Review Processing Messages page. |

|

Payment Details - Total |

This option displays the following information for all retirees: Payment Amount, Adjustment Amount, Payment Total, Check Date, Set ID, Vendor ID and Vendor Name. |

|

Payment Details - NonTaxable |

This option displays the following information for all retirees: NT Payment Amount non-taxable payment amount), NT Adjustment Amount (non-taxable adjustment amount), NT Payment Total (non-taxable payment total), Check Date, Set ID, Vendor ID and Vendor Name. |

|

Payment Information |

This option displays the following information for all retirees: Form Code, Payment Number, Guaranteed Payments, Percent to Survivor and Designated Payee. |

See Also

Creating the Trustee Extract File

Creating the Trustee Extract File

This section provides overviews of the Trustee Extract process and the Trustee Extract file, lists the page used to generate the Trustee Extract file, and discusses how to generate the Trustee Extract file.

Understanding the Trustee Extract Process

Understanding the Trustee Extract Process

The Retiree Payment process includes the Trustee Extract process.

The Trustee Extract process generates the Trustee Extract file, which includes all of the payment-related data that a third-party requires in order to produce pension checks.

The system creates the Trustee Extract file when you run the Retiree Payment process in Confirmation Processing mode. It writes the data to the file that you define using the system variable TRSPYMT.

Note. The trustee extract data is also written to database records so that you can review it online; however, the online data is not the primary file. The Trustee Extract file is the output that you send to your trustee.

You can also produce the Trustee Extract file outside of the Retiree Payment process. You only do this in unusual circumstances—for example, if you lose or damage the original version created by the payment process.

When you create the extract file outside of the payment process, you still must have run the payment process in order to generate the data that is fed into the extract process. Although it is possible to create a file after preliminary payment processing, it is advisable to create it only after running confirmation processing for the retiree payments.

See Also

Creating a Logical File for the Trustee Extract

Understanding the Trustee Extract File

Understanding the Trustee Extract File

The Trustee Extract file includes the following types of payment-related data: payment data, tax elections, direct deposit instructions, and deduction data.

Payment data is only available after you run the Retiree Payment process in Confirmation Processing mode. The process creates this information using the payment schedules that you set up, both for recurring payments and one-time payments or adjustments.

You must record payee tax elections in the system prior to paying retirement benefits. There are no default elections.

If federal, state, or local tax information is missing, the Trustee Extract process logs a warning message.

Direct deposit instructions are not required. If you have entered the direct deposit information, the Trustee Extract process includes it in the extract file.

Note. There is no warning message when direct deposit information is missing.

There are two ways that you can set up deduction information if you want to include it in the Trustee Extract file:

Set up a general deduction in PeopleSoft Payroll for North America.

If you specify a deduction calculation routine that uses a flat amount, there is no need to calculate the deduction each period.

If you set up the deduction to use a percentage, the Trustee Extract process can pass that percentage to the trustee, who can then calculate the appropriate deduction amount.

If you use any other calculation routine, you must use Payroll Interface's DedCalc (deduction calculation) process to compute the deduction amount.

Enroll the payee in one or more benefit plans through the PeopleSoft HR: Manage Base Benefits or PeopleSoft Benefits Administration. This always requires that you use the DedCalc process to compute the deduction amount.

See Also

Creating a Logical File for the Trustee Extract

Pages Used to Generate the Trustee Extract File

Pages Used to Generate the Trustee Extract File|

Page Name |

Definition Name |

Navigation |

Usage |

|

RUNCTL_PAPP02 |

Pension, Reports, Flatfile Trustee Extract, Flatfile Trustee Extract |

Run the Trustee Extract process. Note. The Retiree Payment process automatically runs the Trustee Extract process. You select Pension, Payments, Create Retiree Payments to run the Retiree Payment process. |

|

|

RUNCNTL_RO_DETAIL |

Pension, Payments, Payment Rollover Report, Payment Rollover Report |

Enter run control parameters for the Payment Rollover Report. |

Generating the Trustee Extract File

Generating the Trustee Extract File

Access the Flatfile Trustee Extract page (Pension, Reports, Flatfile Trustee Extract, Flatfile Trustee Extract).

|

Run ID |

Select the run ID for the Retiree Payment process job that created the trustee extra data. The system then displays information associated with that run ID: the payment status, payment calendar name, benefit plan, pay period end date, payment frequency, and check date. |

Generating the Rollover Information Report

Generating the Rollover Information Report

Access the Payment Rollover Report page (Pension, Payments, Payment Rollover Report, Payment Rollover Report).

|

Run ID, Payment Status, Payment Calendar Name, Benefit Plan, Pay Period End Date, Payment Frequency and Check Date. |

These fields provide summary information about the pay run that is the basis for the extract. The run ID determines the payment status, payment calendar name, benefit plan, pay period end date, payment frequency and check date. |

Reviewing Trustee Extract Data

Reviewing Trustee Extract Data

This section provides an overview of how to review trustee extract data, lists the pages used to review trustee extract data, and discusses how to:

View the trustee extract summary.

View trustee extract contents: detail pages and record layouts.

View trustee extract contents: employee biographical information.

View trustee extract contents: federal tax information.

View trustee extract contents: state tax information.

View trustee extract contents: local tax information.

View trustee extract contents: general deductions.

View trustee extract contents: benefit deductions.

View trustee extract contents: direct deposits.

View trustee extract contents: additional pay.

View trustee extract contents: balance adjustments.

View trustee extract contents: scheduled payments.

View trustee extract contents: one-time payments.

View trustee extract contents: scheduled payment rollover when retirement payments are run using confirmation processing.

View trustee extract contents: contribution withdrawal rollover.

View trustee extract contents: header record.

View trustee extract contents: control totals.

Track the payee summary.

Understanding How to Review Trustee Extract Data

Understanding How to Review Trustee Extract DataThe contents of the Trustee Extract file are displayed on:

A summary page that lists summary payment information for all the employees included in the extract.

Detail pages that show, by employee, the detailed data included in the extract.

This section includes information on the summary and detail trustee extract pages. The documentation on the detail pages provides technical detail about the layout of the Trustee Extract file. This information can help you and your trustee use the file effectively.

You can also review the contents of the Trustee Extract file by running the Trustee Extract reports: PAT08 - Trustee Extract Detailed Report and PAT09 - Trustee Extract Summary Report - Record Type.

See Also

Pages Used to Review Trustee Extract Data

Pages Used to Review Trustee Extract Data|

Page Name |

Definition Name |

Navigation |

Usage |

|

PA_TE_SUM_INFO |

Pension, Reports, Review Trustee Extract Summary, Review Trustee Extract Summary |

|

|

|

PA_TE_BIO_INFO |

Pension, Reports, Review Trustee Extract Content, Employee Bio |

View personal information about a payee. Note. This information is based on one retiree record, so a payee with multiple retiree records has multiple bio records. |

|

|

PA_TE_FTX_INFO |

Pension, Reports, Review Trustee Extract Content, Federal Tax |

View a payee's federal tax elections for one retiree record. |

|

|

PA_TE_STX_INFO |

Pension, Reports, Review Trustee Extract Content, State Tax |

View a payee's state tax elections for one retiree record. Note. A payee who is subject to withholding from more than one state can have multiple state tax records for a single retiree record. |

|

|

PA_TE_LTX_INFO |

Pension, Reports, Review Trustee Extract Content, Local Tax |

View a payee's local tax elections for one retiree record. Note. A payee who is subject to withholding from more than one locality can have multiple local tax records for a single retiree record. |

|

|

PA_TE_GDED_INFO |

Pension, Reports, Review Trustee Extract Content, General Deductions |

View a payee's general deductions for one retiree record. Note. Payees can have multiple deductions per job. General deductions are typically deductions for anything other than benefits, although some organizations use general deductions for benefits, as well. |

|

|

PA_TE_BDED_INFO |

Pension, Reports, Review Trustee Extract Content, Benefit Deductions |

View a payee's benefit deductions for one retiree record. Note. Payees can have multiple deductions per job. |

|

|

PA_TE_DDEP_INFO |

Pension, Reports, Review Trustee Extract Content, Direct Deposit |

View a payee's direct deposit instructions for one retiree record. |

|

|

PA_TE_APAY_INFO |

Pension, Reports, Review Trustee Extract Content, Additional Pay |

View a payee's additional pay for one retiree record. Note. Payees can have multiple additional pay records per job. |

|

|

PA_TE_BADJ_INFO |

Pension, Reports, Review Trustee Extract Content, Balance Adjustments |

View information that can be used to adjust running payment totals for a retiree. The adjustment data is informational only; the system does not apply the adjustments to the running totals. You must make the adjustment manually. Note. Adjustments apply to one retiree record only. Payees can have multiple balance adjustments per job. |

|

|

PA_TE_SPMT_INFO |

Pension, Reports, Review Trustee Extract Content, Scheduled Payments |

View payment amounts and descriptions for recurring payments for one retiree record. Note. Each retiree record corresponds to a single plan, but payees can have multiple scheduled payment records per retiree record if there are multiple payment streams from a plan. |

|

|

PA_TE_1PMT_INFO |

Pension, Reports, Review Trustee Extract Content, One Time Payments |

View payment amounts and descriptions for one-time payments for a single payment number under a single retiree record.

Note. One-time payments can be positive or negative. |

|

|

PA_TE_SCHED_RLOVR |

Pension, Reports, Review Trustee Extract Content, Schedule Rollover |

Displays rollover information for a particular RUN ID with regard to scheduled payments. |

|

|

PA_TE_CTB_RLOVR |

Pension, Reports, Review Trustee Extract Content, Contribution Rollover |

Displays rollover information for a particular RUN ID with regard to contribution withdrawals. |

|

|

PA_RT_EMP_SUM |

Pension, Payments, Review Balances and Totals, Review Balances and Totals |

|

|

|

RUNCNTL_PMTDTL |

Pension, Reports, Online Trustee Extract, Online Trustee Extract |

|

Viewing the Trustee Extract Summary

Viewing the Trustee Extract Summary

Access the Review Trustee Extract Summary page (Pension, Reports, Review Trustee Extract Summary, Review Trustee Extract Summary).

|

Run ID, Payment Frequency, Pay Period End Date, and Check Date |

These fields provide summary information about the pay run that is the basis for the extract. The run ID determines the payment frequency, pay period end date, and check date. |

|

Total Payments |

This is the sum of all payments—for all plans and all payees—included in this pay run. This amount comprises the total of the scheduled amount and adjusted amount. |

|

Scheduled Amount |

The total of payments scheduled on the Payee Payment Schedule and Payee Manual Schedule pages. |

|

Adjust Amount (adjusted amount) |

The total of one-time payments (positive and negative) entered on the Make One-Time Adjustments page. |

Trustee Summary

This scrolling area displays a list of all employees included in the extract. If an employee is being paid based on more than one retiree job record, there is a separate row for each record.

For each retiree job record receiving payments, the page displays the EmplID and record number, the number of plans providing a benefit (typically one because you create an additional job record for each plan), and the total payments, scheduled amount, and adjusted amount for that payee.

Viewing Trustee Extract Contents: Detail Pages and Record Layouts

Viewing Trustee Extract Contents: Detail Pages and Record Layouts

The Trustee Extract file contains rows of 450 characters each. Each row starts with a two-digit record type. Payment data for a single employee occupies multiple rows.

You can access the Review Trustee Extract Content (TRUSTEE_EXTRACT) component to see pages that display the contents of the extract records for individual employees. There are separate detail pages for each record type (other than the header record) included in the extract file.

This section provides a record layout for each record type in the Trustee Extract file. Each record layout follows the sample page for that record type—for example, the bio record layout appears after the Employee Bio page. The header and control totals records appear after the other record types (there are no pages for these records).

Viewing Trustee Extract Contents: Employee Biographical Information

Viewing Trustee Extract Contents: Employee Biographical Information

Access the Employee Bio page (Pension, Reports, Review Trustee Extract Content, Employee Bio).

Bio records have the record type 20.

|

Bio Record Data |

Format |

Length |

Beginning Position |

Ending Position |

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Employee Name |

Character |

50 |

18 |

67 |

|

Alternate Name for Payee* |

Character |

30 |

68 |

97 |

|

Address 1 |

Character |

35 |

98 |

132 |

|

Address 2 |

Character |

35 |

133 |

167 |

|

Address 3 |

Character |

35 |

168 |

202 |

|

Address 4 |

Character |

35 |

203 |

237 |

|

City |

Character |

30 |

238 |

267 |

|

County |

Character |

30 |

268 |

297 |

|

State |

Character |

6 |

298 |

303 |

|

Postal |

Character |

12 |

304 |

315 |

|

Country |

Character |

30 |

316 |

345 |

|

National ID |

Character |

15 |

346 |

360 |

|

Company Code |

Character |

10 |

361 |

370 |

|

Paygroup Code |

Character |

3 |

371 |

373 |

*This is the designated payee name from the payment schedule. If there are multiple payment numbers for a single employee record number, this name comes from the first payment.

Viewing Trustee Extract Contents: Federal Tax Information

Viewing Trustee Extract Contents: Federal Tax Information

Access the Federal Tax page (Pension, Reports, Review Trustee Extract Content, Federal Tax).

Federal tax records have the record type 30.

|

Federal Tax Data |

Format |

Length |

Beginning Position |

Ending Position |

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Marital Status for Federal Withholding |

Character |

1 |

18 |

18 |

|

Allowances for Federal Withholding |

Number |

4 |

19 |

22 |

|

Additional Amount to Withhold |

Signed Decimal |

5.2 |

23 |

29 |

|

Additional Percentage to Withhold |

Signed Decimal |

2.3 |

30 |

34 |

|

Special Withholding Status |

Character |

1 |

35 |

35 |

|

FICA Status |

Character |

1 |

36 |

36 |

|

FUTA Exempt Status |

Character |

1 |

37 |

37 |

|

EIC Status |

Character |

1 |

38 |

38 |

|

Employee ID for W-2 |

Character |

11 |

39 |

49 |

Viewing Trustee Extract Contents: State Tax Information

Viewing Trustee Extract Contents: State Tax Information

Access the State Tax page (Pension, Reports, Review Trustee Extract Content, State Tax).

State tax records have the record type 31.

|

State Tax Data |

Format |

Length |

Beginning Position |

Ending Position |

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

State |

Character |

6 |

18 |

23 |

|

Resident |

Character |

1 |

24 |

24 |

|

Special Status for State Withholding |

Character |

1 |

25 |

25 |

|

Marital Status for State Withholding |

Character |

1 |

26 |

26 |

|

Allowances for State Withholding |

Number |

4 |

27 |

30 |

|

Additional Allowances for State Withholding |

Number |

4 |

31 |

34 |

|

Additional Amount to Withhold |

Signed Decimal |

5.2 |

35 |

41 |

|

Additional Percentage to Withhold |

Signed Decimal |

2.3 |

42 |

46 |

|

SDI Status |

Character |

1 |

47 |

47 |

|

SUT Exempt |

Character |

1 |

48 |

48 |

Viewing Trustee Extract Contents: Local Tax Information

Viewing Trustee Extract Contents: Local Tax Information

Access the Local Tax page (Pension, Reports, Review Trustee Extract Content, Local Tax).

Local tax records have the record type 32.

|

Local Tax Data |

Format |

Length |

Beginning Position |

Ending Position |

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

State |

Character |

6 |

18 |

23 |

|

Locality |

Character |

7 |

24 |

30 |

|

Resident |

Character |

1 |

31 |

31 |

|

Allowances for Local Withholding |

Number |

4 |

32 |

35 |

|

Additional Amount to Withhold |

Signed Decimal |

5.2 |

36 |

42 |

|

Additional Percentage to Withhold |

Signed Decimal |

2.3 |

43 |

47 |

Viewing Trustee Extract Contents: General Deductions

Viewing Trustee Extract Contents: General Deductions

Access the General Deductions page (Pension, Reports, Review Trustee Extract Content, General Deductions).

General deduction records have the record type 40.

|

General Deduction Data |

Format |

Length |

Beginning Position |

Ending Position |

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Deduction Code |

Character |

6 |

18 |

23 |

|

Deduction End Date |

Character |

10 |

24 |

33 |

|

Deduction Calculated |

Character |

1 |

34 |

34 |

|

Additional Amount to Deduct |

Signed Decimal |

8.2 |

35 |

44 |

|

Percentage Rate for Deduction |

Signed Decimal |

4.3 |

45 |

51 |

|

Goal |

Signed Decimal |

8.2 |

52 |

61 |

Viewing Trustee Extract Contents: Benefit Deductions

Viewing Trustee Extract Contents: Benefit Deductions

Access the Benefit Deductions page (Pension, Reports, Review Trustee Extract Content, Benefit Deductions).

Benefit deduction records have the record type 41.

|

Benefit Deduction Data |

Format |

Length |

Beginning Position |

Ending Position |

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Plan Type |

Character |

2 |

18 |

19 |

|

Plan |

Character |

6 |

20 |

25 |

|

Deduction Code |

Character |

6 |

26 |

31 |

|

Deduction Class |

Character |

1 |

32 |

32 |

|

Current Deduction |

Signed Decimal |

8.2 |

33 |

42 |

Viewing Trustee Extract Contents: Direct Deposits

Viewing Trustee Extract Contents: Direct Deposits

Access the Direct Deposit page (Pension, Reports, Review Trustee Extract Content, Direct Deposit).

Direct deposit records have the record type 50.

|

Direct Deposit Data |

Format |

Length |

Beginning Position |

Ending Position |

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Priority |

Number |

4 |

18 |

21 |

|

Transit Number |

Character |

11 |

22 |

32 |

|

Account Number |

Character |

17 |

33 |

49 |

|

Account Type |

Character |

1 |

51 |

55 |

|

Percentage Amount |

Signed Decimal |

3.2 |

56 |

65 |

|

Deposit Amount |

Signed Decimal |

8.2 |

54 |

63 |

|

Deposit Amount |

Signed Decimal |

8.2 |

54 |

63 |

|

Deposit Type |

Character |

1 |

65 |

65 |

Viewing Trustee Extract Contents: Additional Pay

Viewing Trustee Extract Contents: Additional Pay

Access the Additional Pay page (Pension, Reports, Review Trustee Extract Content, Additional Pay).

Additional pay records have the record type 60.

|

Additional Pay Data |

Format |

Length |

Beginning Position |

Ending Position |

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Earnings Code |

Character |

3 |

18 |

20 |

|

Earnings End Date |

Character |

10 |

21 |

30 |

|

Other Pay Amount |

Signed Decimal |

8.2 |

31 |

40 |

Viewing Trustee Extract Contents: Balance Adjustments

Viewing Trustee Extract Contents: Balance Adjustments

Access the Balance Adjustments page (Pension, Reports, Review Trustee Extract Content, Balance Adjustments).

Balance adjustment records have the record type 70.

|

Balance Adjustment Data |

Format |

Length |

Beginning Position |

Ending Position |

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Pension Plan |

Character |

6 |

18 |

23 |

|

Adjustment Reason |

Character |

1 |

24 |

24 |

|

Adjustment Amount |

Signed Decimal |

9.2 |

25 |

35 |

|

Nontaxable portion of adjustment amount |

Signed Decimal |

9.2 |

36 |

46 |

Viewing Trustee Extract Contents: Scheduled Payments

Viewing Trustee Extract Contents: Scheduled Payments

Access the Scheduled Payments page (Pension, Reports, Review Trustee Extract Content, Scheduled Payments).

Scheduled payment records have the record type 80.

|

Scheduled Payment Data |

Format |

Length |

Beginning Position |

Ending Position |

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Pension Plan |

Character |

6 |

18 |

23 |

|

Payment Number |

Number |

4 |

24 |

27 |

|

SetID |

Character |

5 |

28 |

32 |

|

Vendor ID |

Character |

10 |

33 |

42 |

|

Optional Form Code |

Character |

4 |

43 |

46 |

|

Optional Form Years Guaranteed |

Number |

4 |

47 |

50 |

|

Optional Form Percent Continued |

Signed Decimal |

3.2 |

51 |

55 |

|

Payment Frequency |

Character |

4 |

56 |

59 |

|

Payment End Date |

Character |

10 |

60 |

69 |

|

Payment Amount |

Signed Decimal |

9.2 |

70 |

80 |

|

Nontaxable Portion of Payment Amount |

Signed Decimal |

9.2 |

81 |

91 |

Viewing Trustee Extract Contents: One Time Payments

Viewing Trustee Extract Contents: One Time Payments

Access the One Time Payments page (Pension, Reports, Review Trustee Extract Content, One Time Payments).

One-time payment records have the record type 81.

|

One-Time Payment Data |

Format |

Length |

Beginning Position |

Ending Position |

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Pension Plan |

Character |

6 |

18 |

23 |

|

Payment Number |

Number |

4 |

24 |

27 |

|

SetID |

Character |

5 |

28 |

32 |

|

Vendor ID |

Character |

10 |

33 |

42 |

|

Reason for One Time Payment |

Character |

1 |

43 |

43 |

|

Amount of One Time Payment |

Signed Decimal |

9.2 |

44 |

54 |

|

Nontaxable Portion of One Time Payment Amount |

Signed Decimal |

9.2 |

55 |

65 |

Viewing Trustee Extract Flat File Contents: Payment Rollovers

Viewing Trustee Extract Flat File Contents: Payment Rollovers

Access the Schedule Rollover page (Pension, Reports, Review Trustee Extract Content, Schedule Rollover).

Records that contain rollover information from a Payment Schedule or a Manual Schedule have Record Type 82.

|

Scheduled Payment Rollover Data |

Format |

Length |

Beginning Position |

Ending Position |

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Pension Plan |

Character |

6 |

18 |

23 |

|

Payment Number |

Number |

4 |

24 |

27 |

|

Account Name |

Character |

50 |

28 |

77 |

|

Account Number |

Character |

17 |

78 |

94 |

|

Taxpayer ID |

Character |

14 |

95 |

408 |

|

Distribution Code |

Character |

2 |

109 |

110 |

|

Institution Name |

Character |

40 |

111 |

150 |

|

Institution Line Address 1 |

Character |

55 |

151 |

205 |

|

Institution Line Address 2 |

Character |

55 |

206 |

260 |

|

Institution Line Address 3 |

Character |

55 |

261 |

315 |

|

Institution City |

Character |

30 |

316 |

345 |

|

Institution County |

Character |

30 |

346 |

375 |

|

Institution State |

Character |

6 |

376 |

381 |

|

Institution Postal Code |

Character |

12 |

382 |

393 |

|

Institution Country |

Character |

30 |

394 |

423 |

|

Rollover Amount |

Signed Decimal |

9.2 |

424 |

434 |

|

Nontaxable Portion of Rollover Amount |

Signed Decimal |

9.2 |

435 |

445 |

Reviewing Trustee Extract Flat File Contents: Contribution Rollovers

Reviewing Trustee Extract Flat File Contents: Contribution RolloversAccess the Contribution Rollover page (Pension, Reports, Review Trustee Extract Content, Contribution Rollover).

Records that contain rollover information from a Contribution Withdrawal have Record Type 83.

|

Contribution Withdrawal Rollover Data |

Format |

Length |

Beginning Position |

Ending Position |

|

Record Type |

Character |

2 |

1 |

2 |

|

Employee ID |

Character |

11 |

3 |

13 |

|

Employee Record Number |

Number |

4 |

14 |

17 |

|

Pension Plan |

Character |

6 |

18 |

23 |

|

Payment Number |

Number |

4 |

24 |

27 |

|

Account Name |

Character |

50 |

28 |

77 |

|

Account Number |

Character |

17 |

78 |

94 |

|

Taxpayer ID |

Character |

14 |

95 |

408 |

|

Distribution Code |

Character |

2 |

109 |

110 |

|

Institution Name |

Character |

40 |

111 |

150 |

|

Institution Line Address 1 |

Character |

55 |

151 |

205 |

|

Institution Line Address 2 |

Character |

55 |

206 |

260 |

|

Institution Line Address 3 |

Character |

55 |

261 |

315 |

|

Institution City |

Character |

30 |

316 |

345 |

|

Institution County |

Character |

30 |

346 |

375 |

|

Institution State |

Character |

6 |

376 |

381 |

|

Institution Postal Code |

Character |

12 |

382 |

393 |

|

Institution Country |

Character |

30 |

394 |

423 |

|

Rollover Amount |

Signed Decimal |

9.2 |

424 |

434 |

|

Nontaxable Portion of Rollover Amount |

Signed Decimal |

9.2 |

435 |

445 |

Viewing Trustee Extract Contents: Header Record

Viewing Trustee Extract Contents: Header Record

The Trustee Extract file has one header record. The header record contains information about the payments that is not specific to individual employees. Therefore, the employee-based Review Trustee Extract Content pages do not display the header information.

Header records have the record type 10.

|

Header Record Data |

Format |

Length |

Beginning Position |

Ending Position |

|

Record Type |

Character |

2 |

1 |

2 |

|

Run ID |

Character |

10 |

3 |

12 |

|

Payment End Date |

Character |

10 |

13 |

22 |

|

Check Date |

Character |

10 |

23 |

32 |

Viewing Trustee Extract Contents: Control Totals

Viewing Trustee Extract Contents: Control Totals

A control total record contains a summary and count of all the records on a Trustee Extract file. This record shows the number of records of each type and the total payment amounts on the file.

You can use the control total record to verify record counts and payment amounts.

Control total records have the record type 99.

|

Control Totals |

Format |

Length |

Beginning Position |

Ending Position |

|

Record Type |

Character |

2 |

1 |

2 |

|

Payment End Date |

Number |

10 |

3 |

12 |

|

Check Date |

Number |

10 |

13 |

22 |

|

Total Type 20 Records |

Number |

4 |

23 |

26 |

|

Total Type 30 Records |

Number |

4 |

27 |

30 |

|

Total Type 31 Records |

Number |

4 |

31 |

34 |

|

Total Type 32 Records |

Number |

4 |

35 |

38 |

|

Total Type 40 Records |

Number |

4 |

39 |

42 |

|

Total Type 41 Records |

Number |

4 |

43 |

46 |

|

Total Type 50 Records |

Number |

4 |

47 |

50 |

|

Total Type 60 Records |

Number |

4 |

51 |

54 |

|

Total Type 70 Records |

Number |

4 |

55 |

58 |

|

Total Type 80 Records |

Number |

4 |

59 |

62 |

|

Total Type 81 Records |

Number |

4 |

63 |

66 |

|

Total Type 82 Records |

Number |

4 |

67 |

70 |

|

Total Type 83 Records |

Number |

4 |

71 |

74 |

|

Total Other Pay |

Signed Decimal |

9.2 |

75 |

85 |

|

Total Adjustment Amount |

Signed Decimal |

9.2 |

86 |

96 |

|

Total Adjustment Amount Nontaxable |

Signed Decimal |

9.2 |

97 |

107 |

|

Total Payment Amount |

Signed Decimal |

9.2 |

108 |

118 |

|

Total Payment Amount Nontaxable |

Signed Decimal |

9.2 |

119 |

129 |

|

Total One Time Payment Amount |

Signed Decimal |

9.2 |

130 |

140 |

|

Total One Time Payment amount Nontaxable |

Signed Decimal |

9.2 |

141 |

151 |

|

Total Rollover Amounts From Scheduled Payments |

Signed Decimal |

9.2 |

152 |

162 |

|

Total Non-Taxable Rollover Amounts From Scheduled Payments |

Signed Decimal |

9.2 |

163 |

173 |

|

Total Rollover Amounts From Contribution Withdrawals |

Signed Decimal |

9.2 |

174 |

184 |

|

Total Non-Taxable Rollover Amounts From Contribution Withdrawals |

Signed Decimal |

9.2 |

185 |

195 |

Tracking Balances and Totals

Tracking Balances and Totals

Access the Review Balances and Totals page (Pension, Payments, Review Balances and Totals, Review Balances and Totals).

Note. The payment summary does not adjust running totals based on scheduled balance-only adjustments. When you schedule a balance-only adjustment, you should manually update the payment summary information.

|

Benefit Plan |

The benefit plan is the plan paying the retirement benefits for the specified record number (job number). Remember, a payee has separate jobs for separate plan benefits. |

|

Benefit Commencement Date |

The benefit commencement date is the effective date of the first active payment record on a payee's payment schedule. This gets set after the first payment. |

|

Final Payment Date |

The final payment date is the date of the last payment. This is set during the payment period after the last payment. |

Most Recent Payment

The Most Recent Payment group box provides information about the most recently processed pension payment.

|

Check Date |

The check date of the most recently processed pension payment. |

|

Pay Period End Date |

The pay period end date of the most recently processed pension payment. |

Totals

The Totals group box contains several running totals for the payments.

|

Total Paid |

The total amount paid is the sum of all payments. This amount is updated each time a person is paid. |

|

Total Non Taxable Paid |

When the total nontaxable amount paid is equal to the final posttax contributions, the system automatically overrides instructions to treat any part of a recurring or one-time payment as nontaxable. You can still, however, make an adjustment to the nontaxable balance with a one-time balance adjustment. If such an adjustment leaves room for additional nontaxable payments, the system once again permits them. The total nontaxable amount paid is the portion of the total paid amount that was treated as nontaxable. This amount is updated each time a person is paid. |

|

Final Employee Account |

The final employee account amount is the final value of employee contributions (including interest) at the benefit commencement date. This amount includes taxable and nontaxable components. When a payee dies, you can compare this amount to the total paid amount to determine whether the payee recovered the entire value of the account. |

|

Final Post Tax Contributions |

The Final Post Tax Contributions field provides the nontaxable component of a final employee account. You can use this to track total nontaxable payments. When the total nontaxable amount paid is equal to the final posttax contributions amount, the system automatically overrides instructions to treat any part of a recurring or one-time payment as nontaxable. You can still, however, make an adjustment to a nontaxable balance with a one-time balance adjustment. If such an adjustment leaves room for additional nontaxable payments, the system once again permits them. |