Understanding Contributory Plans

Understanding Contributory Plans

This chapter provides an overview of contributory plans and discusses how to:

Define pension plan contributions.

Track contributions.

Administer contribution withdrawals and service buyback.

Administer service purchase.

Manage multiple withdrawal or purchase accounts.

Ensure that retirees recover their contributions.

Understanding Contributory Plans

Understanding Contributory Plans

Contributory plans require employees to contribute a specified portion of their wages to help fund their pension benefits. In this section, you look at some of the administrative tasks necessary for collecting, tracking, and administering employee contributions.

If you sponsor contributory plans, you can use the PeopleSoft HCM system to deduct employees' pension contributions from their paychecks. The Pension Administration standalone configuration does not support payroll deduction processing.

Defining Pension Plan Contributions

Defining Pension Plan Contributions

To define pension plan contributions, use the Pension Plan Table (PENS_PLAN_TABLE_US) component. This section provides an overview of pension plan contributions, lists the page used to define pension plan contributions, and discusses how to define pension plan contributions.

Understanding Pension Plan Contributions

Understanding Pension Plan ContributionsThe process of taking pension deductions from employee paychecks is identical to the process used for other benefit deductions such as those for medical or life benefits. After you set up a benefit plan with the appropriate calculation rules, you administer the deduction process using other HRMS applications:

Use PeopleSoft HR: Base Benefits or PeopleSoft Benefits Administration to enroll employees in the plan.

It is not enough for a plan to simply exist; you must also sign employees up for pension deductions.

Use PeopleSoft Payroll for North America or PeopleSoft Payroll Interface to calculate and apply the deductions in a particular pay run.

See Also

PeopleSoft HR 9.1 PeopleBook: Manage Base Benefits

PeopleSoft Benefits Administration 9.1 PeopleBook

PeopleSoft Payroll for North America 9.1 PeopleBook

PeopleSoft Payroll Interface 9.1 PeopleBook

Page Used to Define Pension Plan Contributions

Page Used to Define Pension Plan Contributions|

Page Name |

Definition Name |

Navigation |

Usage |

|

PENS_PLAN_TABLE_US |

Set Up HRMS, Product Related, Base Benefits, Plan Attributes, Pension Plan Table, Pension Plan Table |

Set up the pension plan for which deductions are processed. |

Defining Pension Plans

Defining Pension Plans

Access the Pension Plan Table page (Set Up HRMS, Product Related, Base Benefits, Plan Attributes, Pension Plan Table, Pension Plan Table).

US Pension Plans

|

Allow Contingent Beneficiaries |

Select if the plan allows non-spouse beneficiaries. |

|

Plan Yr Begins (Month\Day) (plan year begins [month\day]) and Plan Yr Ends (Month\Day) (plan year ends [month\day]) |

Specify the month and day when the plan year begins and ends. A plan year normally ends the day before the next year begins. However, if you change the plan year, the row for the resulting short plan year will have nonstandard beginning and end dates. Important! Be sure to include a row for a short plan year. Failure to do this can cause calculation errors. |

Contributory Plans

You can only incorporate a U.S. pension plan (plan types 82 to 87) into a manual or automated benefit program if the plan is defined as a contributory plan in which employees contribute some portion of their earnings.

Use this group box to enter information about a contributory plan.

Note. The system makes no determination as to whether the rules that you set up meet Internal Revenue Code qualification standards. Such compliance is your responsibility.

|

Voluntary Contributns Allowed (voluntary contributions allowed) |

Select this option if the plan allows voluntary contributions. There are no parameters for defining voluntary contribution rates. These are established on an employee-by-employee basis when you enroll employees in the plan. |

|

Special Accumulator Code |

Select the code that tracks pensionable earnings. |

|

Rates of Deduction |

Enter the contribution rates. You can have different rates above and below a threshold. For example, employees can contribute 2 percent of earnings up to 50,000 USD and 3 percent of earnings above that. Enter the rate up to the threshold in the first Rates of Deduction field, the threshold in the next field, and the rate beyond the threshold in the final field. If the threshold changes—for example, if you use the taxable wage base as the threshold—insert additional effective-dated rows to record the changes. |

See Also

Tracking Contributions

Tracking Contributions

This section provides an overview of contribution tracking and lists the pages used to track contributions.

Understanding Contribution Tracking

Understanding Contribution TrackingPeriodic pension processing includes two processes that help you track employee contributions:

The consolidation process reads payroll tables and puts the contributions into monthly or annual categories.

The employee accounts process keeps running totals of the contributions and the interest they earn.

Pages Used to Track Contributions

Pages Used to Track Contributions|

Page Name |

Definition Name |

Navigation |

Usage |

|

PA_CONS_EARNS_HIST |

Pension, Pension Information, Review Consolidation Results, Contribution History |

|

|

|

PA_CONTR_HIST |

Pension, Pension Information, Review Plan History, Employee Account History |

View the results of periodic processing for employee accounts. |

See Also

Maintaining Consolidated Payroll Data

Viewing Plan-Related Information

Administering Contribution Withdrawals and Service Buyback

Administering Contribution Withdrawals and Service Buyback

This section provides overviews of contribution withdrawals and service buyback and the administration of withdrawals, lists the page used to define contribution withdrawals, and discusses how to:

Define payee contribution withdrawals.

Credit a return of contributions and service buyback.

Credit a return of contributions.

Understanding Contribution Withdrawals and Service Buyback

Understanding Contribution Withdrawals and Service BuybackEmployees who lose their plan eligibility, particularly terminated nonvested employees, often withdraw their contributions when they leave a plan. Depending on the plan rules, this usually means forfeiting the service earned during the period when the employee was contributing to the plan.

In this situation, you need to issue a check for the employee, change the account balance to zero (contributions and interest), change the service balance to zero, and store pertinent information in case the employee is later rehired and chooses to repay the contributions in order to restore the forfeited service.

Later, if the employee rejoins the plan and elects to buy back the forfeited service, you need to establish the repayment amount, which is the withdrawal amount plus interest. You need to get the employee's payments either by check or by payroll deduction. Finally, as you receive payments, you need to credit the employee's contributory account and the service balance.

Understanding the Administration of Withdrawals

Understanding the Administration of Withdrawals

If your plan allows employees to repay contributions after they have been withdrawn, then set up the system to include one or more withdrawal accounts. A withdrawal account is a subaccount of a plan's main (or "parent") contributory account. The withdrawal account is also associated with the plan service accrual.

When an employee withdraws contributions, you establish a corresponding negative balance in the withdrawal account. This negative adjustment rolls up to the main contributory account to reduce its balance to zero—and, if you specify, it also reduces the balance in the corresponding service credit to zero.

If the employee later elects to repay the contributions, you can use periodic processing to apply interest to the withdrawal account and establish the amount to be repaid. The repayments are then applied to the withdrawal account and rolled up to the main contributory account. In any period when no repayment is made, periodic processing continues to apply interest to the withdrawal account. In any period when a repayment is made, the system does not apply additional interest to the withdrawal account.

As the payments are made, the service is restored using the restoration rule associated with the withdrawal account. The three available methods are restoring service on any payment, on full payment, or on a prorated basis as payments are made.

For example, when Mary leaves the company with three years of service, her employee account is worth 3,000 USD. Processing the withdrawal establishes a value of -3,000 USD in the withdrawal account. When the withdrawal account is rolled up to the main account, there is a zero balance in the main account. Processing the withdrawal additionally creates a service adjustment of negative three years, so her service is also zero.

Two years later, you rehire Mary, and she wants to repay her contributions and get back her three years of service. In order to do this, she has to pay back 3,000 USD with interest. Assume that the plan interest rate is 6 percent annually. Periodic processing calculates the interest and brings the withdrawal account up to date; with interest, the new balance is -3,370.80 USD.

Note. The interest calculation for a withdrawal account appears as negative activity in the withdrawal account, and it does not roll up to the main account, which still has a balance of zero.

If Mary writes you a check for 2,000 USD, apply the payment to the withdrawal account. Because this is positive activity, it rolls up to the main account. Now the withdrawal account balance is -1,370.80 USD, and the main account balance is 2,000 USD.

If the withdrawal account specifies service restoration on partial payment, Mary gets her entire three years of service back as soon as the 2,000 USD payment is processed. If the account requires full payment, Mary does not get any service back until she's paid back the last 1,370.80 USD she owes. If the account allows prorated restoration of service, Mary gets part of her service restored now and part later as she makes additional payments. In all cases, the system restores the service by generating a positive service adjustment to the appropriate amount.

If Mary buys back the service over an extended period of time, you can use periodic processing to continue adding interest to the amount due.

Note. All payments (positive adjustments) to a withdrawal account roll up to the main contributory account and, if appropriate, also generate service adjustments. However, the only negative activity that rolls up from a withdrawal account is an initial withdrawal of contributions entered on the Withdraw Contribution page. Other negative activity, including interest charges and any adjustments you manually enter, does not roll up.

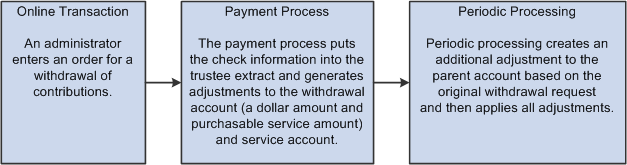

Withdrawal processing is triggered by an online transaction request, but actually occurs during two separate processes:

The payment process pays out the contributions and sets up appropriate account adjustment requests.

Periodic processing for employee accounts and service applies the adjustment requests, calculates the additional interest due if the employee decides to repay the withdrawal, and applies repayments.

Repayments can come from payroll deductions. In this case, periodic processing puts the deductions into consolidated contribution categories and then into the withdrawal account.

An employee can also make direct repayments by writing a check to the plan. In this case, you record the repayment using an online transaction (an adjustment request), which periodic processing subsequently applies to the account.

During the next Retiree Payments process, the system:

Includes the withdrawal payment in the Trustee Extract file so that the third-party who cuts your pension checks will pay the employee the specified amount.

Automatically enters adjustments to the withdrawal account and the master contributory account. If you select the option to forfeit service credit, the withdrawal changes the balance in the contributory account to zero.

Enters an adjustment that changes the associated service to zero (service is not adjusted unless all contributions are withdrawn).

Although the adjustments are set up during the Retiree Payments process, they are actually applied during the next periodic processing.

The following diagram illustrates the flow for withdrawing contributions, including period processing:

Illustration of process flow for withdrawing contributions

Page Used to Define Contribution Withdrawals

Page Used to Define Contribution Withdrawals|

Page Name |

Definition Name |

Navigation |

Usage |

|

PA_WTHDRW_CTB |

Pension, Payments, Withdraw Contribution, Withdraw Contribution |

Enter the transaction when an employee elects to withdraw contributions. |

Defining Payee Contribution Withdrawals

Defining Payee Contribution Withdrawals

Access the Withdraw Contribution page (Pension, Payments, Withdraw Contribution, Withdraw Contribution).

Plan Information

|

Empl Record |

Displays the active employment record number. |

|

Benefit Plan |

Identify the plan from which the employee is withdrawing contributions. |

|

Effective Date |

Enter the date that the withdrawal is effective. The first payment process (for one-time payments) that you run after this effective date picks up the withdrawal request and includes the payment in the Trustee Extract file. |

Withdrawal Information

|

Number |

This is a sequence number that you can use to distinguish among multiple withdrawals that you make from a plan on the same day. Typically, you only do this if you need to enter a payment in multiple components because there are multiple funding providers. |

|

SetID and Vendor ID |

Select an ID to identify the funding source for the withdrawal. The provider is typically the plan itself. You enter providers into the system from the provider table. The provider table is effective-dated, so the provider must be valid for the effective date of the payment. If you specify valid funding providers for the plan in the Plan Administration component, only those providers are available. |

|

Function Result Name |

Select the function result name for the withdrawal account that tracks the withdrawal. A withdrawal account rolls up to its parent account. By debiting a withdrawal account instead of the parent account, you enable the system to track interest on the withdrawn amount without forcing the main account to go negative. |

|

Parent Contribution Account and Service Function Result Name |

When you enter a withdrawal account, the system displays the associated parent contribution account and service function result name. These are the accruals that are affected by the activity in the withdrawal account. When the withdrawal is processed, the negative adjustment to the withdrawal account (and thus to the parent account) is based on the last completed periodic processing for the parent account. |

|

Withdraw All Contributions |

Select Withdraw All Contributions to change the balance in the parent contribution account to zero in a single transaction. |

|

Forfeit Service Credit |

If an employee forfeits all service as a result of the withdrawal, select Forfeit Service Credit. If you select this option, the withdrawal account's "purchasable service" balance is set to the total value of the service account minus the amount paid out. Note. The only option is to forfeit all service. The system does not support partial service forfeiture. |

|

Adjustment Amount |

If you break the withdrawal into multiple components, either because there are multiple funding providers or because the employee is not withdrawing all contributions, enter the total amount to be withdrawn. |

|

Adjustment Amount Non Taxable |

This is the portion of a withdrawal that is treated as nontaxable. When an employee's pension contribution is a posttax deduction, the employee has already paid taxes on that money. Contributions refunded are nontaxable. The interest portion of the employee account, however, is taxable. |

|

Comment |

Enter any comments associated with this withdrawal. |

Crediting a Return of Contributions and Service Buyback

Crediting a Return of Contributions and Service Buyback

In order to buy back service that was forfeited as the result of withdrawing contributions, an employee has to reimburse the plan with interest.

Note. The calculation page enables you to run calculations that give an employee full credit for all purchasable service, even if the employee has not made all the required payments. You control this option by selecting Grant Full Service Credit on the Define Calculation (CALCULATE_PENSION) - Main Page. Select this option only for estimates—not for final calculations.

The withdrawal account definition, like all employee account definitions, includes interest rules. Periodic processing of this account applies the appropriate interest and increases the amount due. After an employee is rehired, you can run periodic processing to update the account and establish the current buyback price. Interest continues to accrue until the employee repays all the money and the withdrawal account balance is zero. You can review current balances on the Employee Account History page.

Note. In any period when no repayment is made, periodic processing continues to apply interest to the withdrawal account. In any period when a repayment is made, the system does not apply additional interest to the withdrawal account.

An employee can make repayments through payroll deductions or by a writing checks directly to the plan.

For direct payments, enter the amounts on the Account Adjustments page.

For payroll deductions, set up an appropriate general deduction in Payroll for North America. This feeds into the purchase account through the consolidated deductions definition that you entered in the original definition of the purchase account.

Note. When Payroll for North America processes the general deduction, it does not check the remaining balance in the withdrawal account. Therefore, to ensure that you stop taking deductions after the entire balance is repaid, you may want to set up the deduction with a target amount. As interest accrues on the account, you may have to increase the target.

See Also

Crediting a Return of Contributions

Crediting a Return of Contributions

This topic discusses how to use the Account Adjustments page to credit a return of contributions. The complete documentation on the Account Adjustments page is in "Adjusting Contributory Accounts."

See Adjusting Contributory Accounts.

|

Benefit Plan and Function Result Name |

Enter the plan and the function result name for the withdrawal account used to track the buyback amount. |

|

Transaction Date |

Enter the transaction date of the repayment. |

|

Sequence number |

If there are multiple adjustments to the account in a single day, enter a number to identify the adjustment. |

|

Transaction Status |

Displays Pending until period processing applies the adjustment to the employee's permanent cash balance account history. Then, the system updates the status to Applied. |

|

Credit Adjustment and Interest Adjustment |

These are the amounts to be applied to the credit and interest amounts in the employee account. To get the total adjustment amount, add these values. |

|

Tax Type |

The tax type indicates the employee account type to which the system should apply the credit and interest adjustments: posttax or pretax. Normally, the full amount of an employee's repayment check is applied to posttax credits. However, there are cases when it is applied to pretax credits—for example, if the repayment is a rollover from a pretax account (such as certain types of IRAs). Some repayments that are input as payroll deductions are also pretax credits; in this case, the consolidation process automatically determines the appropriate type. Note. With normal employee account processing, the posttax interest credits indicate the interest on the posttax contributions. However, the interest itself is pretax. Do not put posttax money into this category; otherwise, pretax and posttax amounts are mixed, and you cannot distinguish between them. The only appropriate category for posttax amounts—both credits and interest—is posttax credits. |

|

Comment |

Enter any comments to explain the nature of the adjustment transaction. |

When you save a transaction, the adjustment is not yet applied to the account. This is done in periodic processing. During periodic processing, both payroll activity and manual adjustments are applied to the withdrawal account. This also automatically adjusts the master contribution account.

Depending on whether you specify that you restore service on partial payment, on full payment, or on a prorated basis, this may also generate a service adjustment.

Administering Service Purchase

Administering Service Purchase

In certain situations, employees might purchase service for times when they were not contributing to a plan—for example, military leaves or periods where they were working but were not eligible to participate in the plan. In such cases, employees pay the contributions and interest that the plan would have collected if they had been working and contributing during that time.

Understanding Service Purchase Accounts

Understanding Service Purchase Accounts

If your plan allows employees to purchase service, then set up the system to include one or more service purchase accounts. A service purchase account is a subaccount of a plan's main contributory account. The service purchase account is also associated with the plan service accrual.

To administer a service purchase transaction for an employee, you first establish the amount of purchasable service and the cost of that service. Using this information, you establish a negative dollar balance in a service purchase account. The amount corresponds to the cost of the purchasable service and a positive purchasable service amount in the same account.

Employees can make purchase payments through payroll deductions, in which case periodic processing applies the deductions to the consolidated contribution amounts and from there into the service purchase account. An employee can also make a direct payment by writing a check to the plan. In this case, you record the repayment using an online transaction (an adjustment request), which periodic processing subsequently applies to the purchase account.

If an employee makes the payments over time, you can apply interest to the purchase price by using periodic processing. In any period when no payment is made, periodic processing applies interest to the purchase account. In any period when a payment is made, the system does not apply any interest to the purchase account.

As payments are credited to a purchase account, the negative balance eventually reaches zero. Depending on the account rules, the purchasable service is reduced to zero, with corresponding adjustments to the plan service—on the first payment, after complete repayment, or on a prorated basis.

Establishing Purchasable Service

Establishing Purchasable Service

When an employee decides to purchase service, decide how much the employee currently owes in contributions and back interest and enter this as a negative adjustment to the purchase account.

You can make subsequent adjustments if you discover any errors in your original calculation. You do this on the Account Adjustments page.

Note. This section discusses how to use the Account Adjustments page to establish purchasable service. The complete documentation on the Account Adjustments page is in "Adjusting Contributory Accounts."

See Adjusting Contributory Accounts.

Establishing the Amount of Service

Establishing the Amount of Service

You can establish the amount of purchasable service that corresponds to a purchase amount. You do this Account Adjustments page.

Note. Use the Account Adjustments page, not the Service Adjustments page, to establish a purchasable service amount. The purchasable service amount is tracked in the service purchase accounts. As an employee makes payments, the system generates service adjustments to credit the service.

|

Calculate Purchasable Service |

The system includes an online calculator to help you determine how much service an employee can purchase. After you select Purchasable Service Adjustment in the Reason field, the Calculate Purchasable Service button appears. You can click this button to bring up a dialog box, where you can enter the date range for which the employee can purchase service. |

|

Calculate |

In the service calculator, enter the dates for the service period, then click Calculate to have the system perform the calculation and display the result. The system calculates the service purchase period using the method that you specify on the Plan Aliases page. |

See Also

Crediting Service Purchase Payments

Crediting Service Purchase Payments

In order to purchase service under a service purchase agreement, employees have to pay the established amount.

Note. The calculation page enables you to run calculations that give an employee full credit for all purchasable service, even if the employee has not made all the required payments. You control this option by selecting Grant Full Service Credit on the Define Calculation - Main Page. Use this flag only for estimates—not for final calculations.

If a payment takes place over time, the plan normally charges interest. The purchase account definition, like all employee account definitions, includes interest rules. Periodic processing of this account applies the appropriate interest and increases the amount due. Interest continues to accrue until the employee repays all the money and the withdrawal account balance is zero. You can review current balances on the Employee Account History page.

In any period when no repayment is made, periodic processing continues to apply interest to the purchase account. In any period when a repayment is made, the system does not apply interest to the purchase account.

Employees can make payments directly to the plan or through payroll deductions. For direct payments, you enter the amounts into the Account Adjustments page. For payroll deductions, you set up an appropriate general deduction in Payroll for North America. This feeds into the purchase account through the consolidated deductions definition you enter into the original definition of the purchase account.

Note. When Payroll for North America processes the general deduction, it does not check the remaining balance in the purchase account. Therefore, to ensure that you stop taking deductions after the entire balance is paid, you may want to set up the deduction with a target amount. As interest accrues on the account, you may have to increase that target.

Recording a Payment as a Manual Adjustment to the Withdrawal Account

Recording a Payment as a Manual Adjustment to the Withdrawal Account

When an employee pays money directly, use the Account Adjustments page to record the payment as a manual adjustment to the withdrawal account.

Note. This section discusses how to use the Account Adjustments page to make manual adjustments to the withdrawal account. The complete documentation on the Account Adjustments page is in "Adjusting Contributory Accounts."

See Adjusting Contributory Accounts.

|

Benefit Plan and Function Result Name |

Enter the plan and the function result name for the service purchase account used to track the purchase payments. |

|

Transaction Date |

Enter the transaction date for the repayment. |

|

Sequence number |

If there are multiple adjustments to the account in a single day, enter a number to identify the adjustment. |

|

Transaction Status |

Displays Pending until period processing applies the adjustment to the employee's permanent cash balance account history. Then, the system updates the status to Applied. |

|

Credit Adjustment and Interest Adjustment |

These are the amounts to be applied to the credit and interest amounts in the employee account. To get the total adjustment amount, add these values. |

|

Tax Type |

The tax type indicates the employee account type to which the system should apply the credit and interest adjustments: posttax or pretax. Normally, the full amount of an employee's repayment check is applied to posttax credits. However, there are cases when it is applied to pretax credits—for example, if the repayment is a rollover from a pretax account (such as certain types of IRAs). Some repayments that are input as payroll deductions are also pretax credits; in this case, the consolidation process automatically determines the appropriate type. Note. With normal employee account processing, the posttax interest credits indicate the interest on the posttax contributions. However, the interest itself is pretax. Do not put posttax money into this category; otherwise, pretax and posttax amounts are mixed, and you cannot distinguish between them. The only appropriate category for posttax amounts—both credits and interest—is posttax credits. |

|

Comment |

Enter any comments to explain the nature of the adjustment transaction. |

When you save a transaction, the adjustment is not yet applied to the account. This is done in periodic processing. During periodic processing, both payroll activity and manual adjustments are applied to the withdrawal account. This also automatically adjusts the master contribution account.

Depending on whether you specify that you restore service on partial payment, on full payment, or on a prorated basis, this may also generate a service adjustment.

Managing Multiple Withdrawal or Purchase Accounts

Managing Multiple Withdrawal or Purchase Accounts

Service buyback and service purchase arrangements associate a specific dollar amount with a specific amount of service. Therefore, you probably do not want to combine these amounts. For example, if an employee is purchasing service for two separate periods of time, you need to track the payments separately. The same rule applies for employees who get terminated and rehired multiple times and withdraw contributions each time.

For example, Charlie works for a company that restores service on a prorated basis. For the sake of simplicity, this example does not incorporate interest on the withdrawals.

|

Date |

Event |

Account Balances |

|

January 1, 2000 |

Charlie terminates and withdraws 6,000 USD of contributions, representing three years of service. |

Withdrawal Account 1: -6,000 USD for six years. |

|

January 1, 2001 |

Charlie is rehired and agrees to start repaying the account. |

Withdrawal Account 1: -6,000 USD for six years. |

|

January 1, 2003 |

Charlie terminates. Over the last two years, he's paid back 3,000 USD of his previous contributions. Because he's been making monthly payments, there's been no additional service charge. In the meantime, he's also contributed another 2,000 USD for the two years he's worked since he was rehired. Charlie withdraws this money, too. |

Withdrawal Account 1: -3,000 USD for three years. Withdrawal Account 2; -5,000 USD (the 3,000 USD previously repaid plus the 2,000 USD additional contributions) for five years (the three years previously restored plus the two additional years worked). Total: -8,000 USD for eight years. |

By keeping separate accounts for the separate withdrawals, you keep a clear audit trail associating the correct monetary amounts with the correct amounts of service.

Note. If a plan restores service on any payment or on full payment, you may have to make manual adjustments to the monetary value of the employee account in order to keep the purchasable service amounts associated with the correct repayment amounts.

Ensuring That Retirees Recover Their Contributions

Ensuring That Retirees Recover Their Contributions

You need to keep track of an employee's final contributory balances and compare them to their benefits when they retiree. Employees are entitled to full recovery of their contributions. Any posttax contributions are recovered as nontaxable benefits.

The first time you pay a retiree, the system looks up the final employee account balances for the plan in order to track payments against these balances. The system identifies the appropriate employee account using information you enter on the Plan Aliases page.

Defining Plan Aliases

Defining Plan AliasesUse the Plan Aliases page to identity the appropriate employee accounts and track final employee contributory balances.

Note. You identify the account in the Employee Contribution Account file.

The pension payment process copies the account information to a payment summary record. The system also uses this record to keep a running balance of the total benefits paid and the nontaxable benefit paid. You can view the final account balances and the running payment totals on the Review Balances and Totals page.

Every time you make payments, the system compares an employee's final posttax contributions to the total nontaxable benefit paid out by the plan. After a retiree has recovered all the posttax contributions as nontaxable income, the system no longer treats any portion of the retiree's benefit payments as nontaxable.

See Also

Adding Miscellaneous Plan Specification Information