Understanding CommonLine Loan Processing

Understanding CommonLine Loan Processing

This chapter provides an overview of CommonLine loan processing and discusses how to:

Manage promissory notes.

Originate CommonLine loans.

Review loan origination information.

Validate CommonLine loans.

Manage loan origination transmission data.

View loan disbursement activity.

Create CRC loan files.

Create CL 4 loan files.

Review and manage CRC XML files.

Review and manage CL 4 loan files.

Receive and process CRC inbound files.

Receive and process CL4 inbound files.

Manage loans on hold.

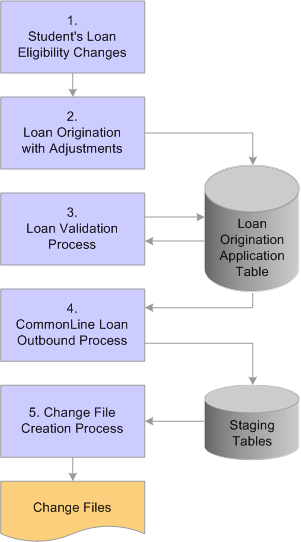

Process loan changes.

Manage disbursement hold and release processing.

Resolve change transaction errors.

Process school certification request applications.

Adjust loan disbursements manually.

Understanding CommonLine Loan Processing

Understanding CommonLine Loan Processing

This section discusses CommonLine loan process flow.

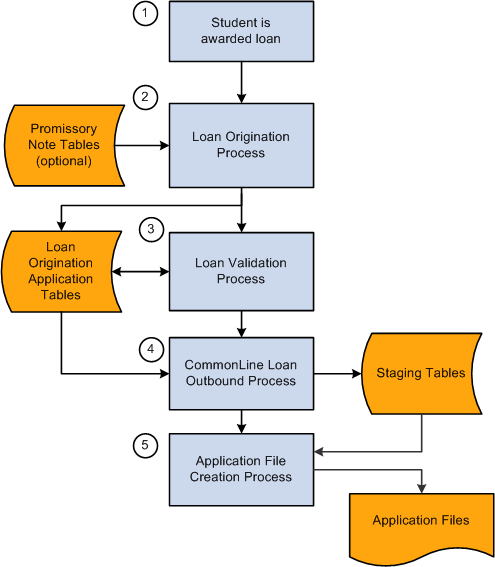

CommonLine Loan Outbound Process Flow

CommonLine Loan Outbound Process FlowTo process Federal Family Education Loan Program (FFELP) and alternative loans, the Campus Solutions system supports both versions of CommonLine, the newer Common Record CommonLine (CRC) and the older CommonLine 4 (CL 4). You use the CommonLine version supported by your lenders, guarantors, and loan servicers; you can process CRC and CL 4 loans separately or simultaneously. This chapter explains how to process loans for both CommonLine versions.

The outbound business processing flow for CommonLine FFELP and alternative loans using either CRC or CL 4 is as follows.

Student accepts the loan offer made on their financial aid package.

The Loan Origination process detects the student's newly accepted loan and calculates application information such as total loan amount, loan period, disbursement amounts and dates, loan servicer, processing type, and whether to process as a CRC or CL 4 loan. The calculated information is stored on the loan origination application tables.

Note. If a Promissory Note is submitted to the school before the loan is originated, the information is used during origination.

After origination is complete, Loan Validation process is run to check the loan application for data discrepancies. Loans failing validation are reprocessed in subsequent runs until validation is reached.

The CommonLine Loan Outbound process moves validated loans into outbound staging tables.

The Application File Creation process creates loan application files from the staging table information. CRC generates files in XML format and CL 4 uses ASCII files.

The system does not provide a method for electronically transmitting CommonLine files to their destinations as each loan servicer might require a specific method to be used, such as FTP or a Web interface.

As discussed later in this chapter, the application files you submit to the loan servicers are processed and you are notified using receipt of response files for each loan processed.

The following illustration shows the flow of CommonLine loan processing:

Loan origination outbound process

Although the CommonLine Loan Outbound business process flow is the same for CRC and CL 4, several processing steps require a separate programs for CRC and CL4. The following table indicates where the separate processes exist.

|

Business Process |

Common Record CommonLine |

CommonLine 4 |

|

Loan validation |

CRC validation (Equation Engine) |

CL 4 validation (Equation Engine) |

|

CommonLine Loan Outbound |

CRC outbound staging (FAPCLOUT) |

CommonLine 4 outbound (FAPLCOD4) |

|

Application File Creation |

CRC XML outbound (SFA_CRC_OUT) |

Outbound EC agent (EDI Manager) |

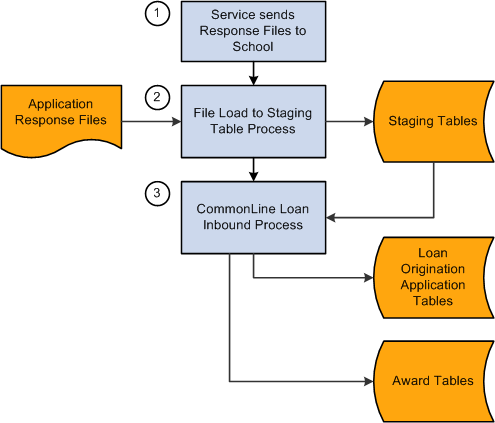

Inbound File Processing

Inbound File ProcessingInbound file processing:

Inbound Processing

Managing Promissory Notes

Managing Promissory Notes

Schools may choose to collect promissory notes from their students as a condition to process their loan. Campus Solutions components enable schools to enter promissory note information to be used by the loan origination process before the loan is originated. Information from the promissory note pages is used by the origination process to determine the loan destination, process level, and MPN serial loan status. After a loan is originated for a student, all promissory notes entered for the same loan type cannot be used for new loans. Both CRC and CL4 versions use the same components and pages for tracking promissory notes.

This section provides an overview and discusses how to:

Enter Stafford promissory note data.

Review biographical and demographic data.

Review promissory note action status.

Enter PLUS promissory note data.

Create loan reference and cosigner relationships.

Enter alternative loan promissory note data.

Track CommonLine master promissory note usage.

Pages Used to Manage Promissory Notes

Pages Used to Manage Promissory Notes

Entering Stafford Promissory Note Data

Entering Stafford Promissory Note Data

Access the CommonLine PNote Stafford page (Financial Aid, Loans, CommonLine Management, Enter Stafford Prom Notes, CommonLine PNote - Stafford).

This page is used primarily by schools who use the Guarantee Only process level. Because the school has collected the promissory note, the guarantor can immediately approve the loan upon receipt of the loan application.

|

Loan Type Code |

Select from the appropriate Stafford loan types that your institution has set up in the Loan Type Table page. |

|

Lender OPEID (lender office of postsecondary education identifier) |

Select the lender requested by the borrower on the promissory note. If the promissory note is present for the loan when origination runs, the system uses the lender and guarantor OPEIDs to determine the appropriate loan destination. When you move out of the Lender OPEID and Guarantor OPEID fields, the system displays the name of the agency. |

|

Lender Branch ID |

Select the lender branch identification. |

|

Guarantor OPEID (guarantor office of postsecondary education identifier) |

Select the guarantor requested by the borrower on the promissory note. |

|

Capitalize Interest |

Select eitherCapitalize while in school or Pay interest while in school. |

|

Borrower Signature |

Select if the borrower signed a valid promissory note. |

|

Signature Date |

Enter the date the borrower signed the note. |

|

Student Data |

Click to access the Origination Detail page to view the student's current biographical and demographic data. |

|

PNote Status |

Click to access the Loan Pnote Action Status page to view or update loan promissory note status. |

Reviewing Biographical and Demographic Data

Reviewing Biographical and Demographic Data

Access the Origination Detail page (click the Student Data link on the CommonLine PNote - Stafford page, Promissory Note Plus page, or Promissory Note Alt page).

View the student's current address, driver's license number, and email address.

Note. The page displays current student information. This information may change when the student's loan is processed.

Reviewing Promissory Note Action Status

Reviewing Promissory Note Action Status

Access the Loan Pnote Action Status page (click the Pnote Status link on the CommonLine Pnote - Stafford page, the Promissory Note Plus page, or the Promissory Note Alt page).

|

Loan Action Cd (loan action code) |

This value is set automatically as the promissory note is processed, but you can override it. Select from: E: Select this value after you receive the promissory note. This value is automatically set when the promissory note is first entered. I: Select this value when the promissory note is set to inactive. Set this value manually to cancel the use of the promissory note. O: Select this value when the promissory note is used for origination. This value is automatically set when the promissory note is used during origination. |

|

Date Received |

Record the date when you actually received the promissory note. When you enter a promissory note, the system sets the date with today's date. |

Entering PLUS Promissory Note Data

Entering PLUS Promissory Note Data

Access the Promissory Note Plus page (Financial Aid, Loans, CommonLine Management, Enter PLUS Prom Notes, Promissory Note Plus).

This page is used primarily by schools who use the Guarantee Only process level. Because the school has collected the promissory note, the guarantor can immediately approve the loan upon receipt of the loan application.

|

Loan Type Code |

Select from the appropriate PLUS loan types that your institution has set up in the Loan Type Table page. |

|

Borrower ID |

Select the appropriate parent or guardian of the student. The information in the Borrower ID field can be changed until the Loan Origination process uses the promissory note data. The Borrower ID field becomes unavailable once the Loan Origination process uses the promissory note data. To verify if the Loan Origination process has used the Pnote data, navigate to the Loan Pnote Action Status page by clicking the Pnote Status link. Note. Only people related to the student are available. To be an eligible borrower of a student's loan, a relationship with a guardian or parent must be created. Relationships are defined on the Relationships page. To create a relationship to the student, the related person must have an ID assigned, and the guardian status must be set to Parent, Guardian, or Self. Note. Borrower ID does not display for Grad PLUS promissory notes. The Borrower ID is set to EmplID internally to avoid defining a student-to-student borrower relationship. |

|

Lender OPEID (lender office of postsecondary education identifier) and |

Select the lender requested by the borrower on the promissory note. If the promissory note is present for the loan when origination runs, the system uses the lender and guarantor OPEIDs to determine the appropriate loan destination. |

|

Guarantor OPEID (guarantor office of postsecondary education identifier) |

Select the guarantor requested by the borrower on the promissory note. |

|

Borrower Signature |

Select if the borrower signed a valid promissory note. |

|

Borrower Data |

Click to access the Origination Detail page to review borrower information. |

|

Student Data |

Click to access the Origination Detail page to view the student's current biographical and demographic data. |

|

PNote Status |

Click to access the Loan Pnote Action Status page to view or update loan promissory note status. |

|

Signature Date |

Enter the date the borrower signed the note. |

Creating Loan Reference and Cosigner Relationships

Creating Loan Reference and Cosigner Relationships

Access the Loan Relation (Ref/Cosign) page (Financial Aid, Loans, CommonLine Management, Enter PLUS Prom Notes, Loan Relation (Ref/Cosign)).

If cosigners or references are required for the loan type, the system displays the number required. Several of the fields function only when a relationship is identified in the Relationship Nbr field and the Loan Relation Type is Co-Signer or Co-Maker.

|

Loan Relation Type |

Select from Co-Maker, Co-Signer, or Reference. |

|

Relationship Nbr (relationship number) |

When you select a value for the field, the system displays the name, relation, guardian, and citizenship status. This information comes from the Relationships page. |

|

Signature Indicator |

Select to indicate a signed note from the cosigner or reference exists. |

|

Owner/Renter Indicator |

Specify if the cosigner or reference owns or rents. |

|

Related IDs |

Click to access the Relationships page to identify and create relationships between people. For PLUS loans, the relationship to the student is generally the parent or guardian. For alternative loans, the relationship can be a parent, guardian, or a cosigner. |

|

Current Address |

Click to access the Current Address Information page to view the cosigner's or reference's current address. |

|

Current Employment |

Only available when Loan Relation Type and Relationship Nbr fields are populated. Click to access the Current Employment Information page to enter the cosigner's or reference's employment information. |

|

Income |

Only available when Loan Relation Type and Relationship Nbr fields are populated. Click to access the Current Income Information page to enter the cosigner's or reference's income. |

|

Previous Employment |

Only available when Loan Relation Type and Relationship Nbr fields are populated. Click to access the Previous Employment Information page to enter the cosigner's or reference's previous employment. |

Entering Alternative Loan Promissory Note Data

Entering Alternative Loan Promissory Note DataAccess the Promissory Note Alt page (Financial Aid, Loans, CommonLine Management, Enter ALT Loan Prom Notes, CRC Promissory Note Alt, Promissory Note Alt).

|

Loan Type Code |

Select from the appropriate Alternative loan types that your institution has set up in the Loan Type Table page. |

|

Requested Amount |

Enter the requested loan amount. A loan cannot be originated for greater than the requested amount. |

|

Capitalize Interest Cd (capitalize interest code) |

Select from: Capitalize: Capitalize interest while in school. Pay Int: Pay capitalized interest immediately. |

|

Loan EFT Authorization (loan electronic fund transfer authorization) |

Select to indicate that the borrower has authorized the school to transfer the loan proceeds received by EFT to the appropriate student account. |

|

Request Loan Deferment |

If eligible, requests to begin repayment of the loan at a later date. Deferment criteria and repayment options are dependent on the particular alternative loan program. |

|

Lender OPEID (lender office of postsecondary education identifier) |

Select the lender requested by the borrower on the promissory note. If the promissory note is present for the loan when origination runs, the system uses the lender and guarantor OPEIDs to determine the appropriate loan destination. |

|

Lender Branch ID |

Select the lender branch identification. |

|

Guarantor OPEID (guarantor office of postsecondary education identifier) |

Select the guarantor requested by the borrower on the promissory note. |

|

References Complete |

Select from: Yes: Indicates references are complete. No: Indicates references are not complete. |

|

Borrower Signature |

Select if the borrower signed a valid promissory note. |

|

Signature Date |

Enter the date the borrower signed the note. |

|

Student Data |

Click to access the Origination Detail page to view the student's current biographical and demographic data. |

|

PNote Status |

Click to access the Loan Pnote Action Status page to view or update loan promissory note status. |

Tracking CommonLine Master Promissory Note Usage

Tracking CommonLine Master Promissory Note UsageAccess the Student MPN Usage page (Financial Aid, Loans, CommonLine Management, Maintain Student MPN Usage, CommonLine MPN Usage, Student MPN Usage).

Use this page to monitor the status of any Stafford or PLUS master promissory notes that have been guaranteed. The loan origination process uses this information to control whether FFEL loans can be processed serially. Information is entered in the page when a Stafford or PLUS loan is guaranteed. Subsequent loans processed for the student and borrower use the information to determine whether the loan can be processed serially.

In most cases, you are not required to monitor or update information for the student. The system automatically populates this page when confirmation of a valid MPN is reported by the service provider on the CommonLine Application Response file. However, when you must enforce a new MPN to be issued for each loan, you can set the Serial Loan Code field to New MPN. After the value is set, the system does not change this value. This ensures that all new loans that are originated request a new promissory note from the student. Users can also add MPN use information on the page to establish the desired serial loan processing in advance of originating loans for the student.

Note. If your school does not process serial loans for all students, use the Deactivate the Serial Loan Activation option on the Financial Aid Installation page.

|

Serial Loan Code |

When a Stafford loan is originated and is guaranteed, the lender indicates whether it is a serial loan. This field displays the value that was requested when the loan was originated. This value is on the Loan Origination 3 page in the CommonLine Management component. |

|

Lender MPN Confirmation |

When the loan response file is received, this field displays what the lender determined. When the system loads the response, it updates the Lender OPEID and Lender MPN Confirmation fields. Values are: No: A valid MPN does not exist for the borrower. Unknown: The lender was unable to determine the borrower's serial MPN status. Yes: A valid serial MPN exists. |

For future loans, the origination program checks this page to verify serial loan status. For example, if a student applies for another Stafford loan a year later, the system can verify if the previous loan was a serial loan. If it is a serial loan with the same lender, the system originates the new loan as a serial loan and gives it a new effective date.

You can also manually override the default serial MPN setting. Select N - Use New MPN from the Loan Origination 3 page in the CommonLine Management component if you do not want a student to be processed for a serial loan. For example, a serial-MPN-eligible school might always want to generate new MPNs for a specific portion of its borrowers, such as law students. If law students are updated on the page so that the Serial Use field is N-Use New MPN, all future loans originated require a new MPN until the Serial Loan Code field is reset to S-Serial, Renew existing MPN. For PLUS loans, use the loan validation edit to verify that the information for the student, parent, and lender on the page matches that of the originated PLUS loan.

Originating CommonLine Loans

Originating CommonLine Loans

This section provides an overview and discusses how to originate CommonLine loans.

Understanding the Loan Origination Process

Understanding the Loan Origination Process

Use the loan origination process (FAPLBOG1) to determine student loan eligibility. Eligibility is determined by checking student award information, promissory notes, the student's loan history, and the loan setup parameters used to calculate a new student loan. You can view all originated loans in the Maintain Originated Loans component. During the origination process, key elements are determined to create a complete loan record that can be transmitted to the appropriate lending agency. How these key elements are determined is discussed in this section:

CommonLine version.

Process level.

Serial Loan Code, which supports master promissory note functionality.

Determining the CommonLine Version

The origination process uses loan destination to determine the correct CommonLine version. As described in the Setting Up CommonLine 4 Loans chapter, the origination process determines the assigned lender and guarantor for each loan and then attempts to match the lender or guarantor to an existing CRC loan destination. If found, the system assigns the CL version and destination number to the loan. If not found, then a lender or guarantor match is attempted with the CL 4 loan destinations, and if one is found, the system assigns the CL version and destination number.

Note. If no destination is found for a loan during the Loan

Origination process, the program uses the set up on the Loan Destination Default

page (Set up SACR, Product Related, Financial Aid, Loans, Define Loan Institutions,

Loan Destination Default) to determine the CL version.

If the Use CRC Destination check box is

selected on the Loan Destination Default page and the loan destination (CL4

or CRC) cannot be determined when a loan is originated, a CL version of CRC

is used.

If the Use CRC Destination check box is

cleared on the Loan Destination Default page and the loan destination (CL4

or CRC) cannot be determined when a loan is originated, a CL version of CL4

is used.

The exception to this rule is when the Loan Origination program uses

CRC Certification Request data to originate a loan (setup is ignored). If

CRC Certification Request data is used and no destination

is found, a CL version of CRC is used.

After the CL version is set, if you assign or change the loan destination number online, you can only select loan destinations that support the assigned CL version. If you change the CL version, the available loan destination numbers change accordingly. After the destination is assigned online, the system automatically sets the process level, disbursement hold and release, and serial MPN settings to match the loan destination settings.

Note. For the CL version and loan destination number to be assigned correctly, ensure the setup of the schools' loan destination is complete and accurate before you originate loans for the aid year. Refer to the chapter on CL setup for additional details on this topic.

See Setting Up Loan Origination.

Determining the Process Level

The process level field represents the CommonLine process type code value that is reported to the loan servicer. Each process type and level defines a specific loan business process. The supported CommonLine process types are:

Guarantee Only (GO)

Guarantee and Print (GP)

Print and Guarantee (PG,)

Certification Request (CR)

The process level is based on how the loan promissory note is collected from the borrower. GO implies that the school has collected the promissory note, while GP and PG requests that the note be generated, if necessary, and collected by the loan servicer. The loan origination process automatically determines the process level to use based on the default process levels assigned for each loan destination.

Note. Oracle also provides a process level of Manual (M). Assigning along this process level indicates that the loan is being processed manually and should not be reviewed by any of the automated loan processes or generate an electronic application. This process level is used in cases where the loan servicer does not support electronic loan processing, or you are overriding an existing loan and do not want the loan adjustment or outbound processes to review and possibly manipulate the borrower's loan eligibility.

Determining Serial MPN Eligibility

The serial loan code is set for all originated Stafford and PLUS loans and indicates whether the loan is to be processed as part of a multi-year note (serial processing) or if a new note must be collected for the loan. The system displays these fields on the Loan Origination 3 page in the Maintain Originated Loans component and they are reported using the CommonLine Application Send file.

By default, the system sets the serial loan code based on the loan destination setup unless the process can confirm that the student has a prior loan with the same borrower and the lender confirms possession of the MPN form. The system maintains MPN serial confirmation in the Maintain Student MPN Usage component. Use component. If confirmation is successful, the system sets the serial loan code to S – Serial, Renew existing MPN. The loan origination process attempts to determine serial eligibility by confirming that the originated loan has the same borrower and student maintained in the Maintain Student MPN Usage component.

If the loan origination process is unable to assign the borrower ID or the loan destination, the process might not be able to verify the loan's serial eligibility:

If the origination process cannot assign a borrower ID, then the system sets the serial loan code to N – Use new MPN.

If the borrower ID is set, but not the loan destination, the origination process attempts to determine serial loan eligibility by using both the student ID and borrower ID to find MPN information in the Maintain Student MPN Usage component so it can assign a serial loan code value. If a match cannot be made using this criteria, then the system sets the serial loan code to N – Use new MPN.

When a loan is originated with missing borrower or loan destination information, you must complete the loan information before it can be validated and transmitted to the servicer. The system attempts to determine the serial loan code field value when the Borrower ID or Loan Destination Nbr field is modified. For PLUS, if the Borrower ID field is changed, the system checks the CommonLine MPN Use table for a PLUS record that matches the student ID, institution, and borrower ID. If a match occurs, the system sets the serial loan code to comply with the matched record in the Maintain Student MPN Usage component. Renew sets the value to S – Serial, Renew existing MPN. If no match occurs, the serial loan code is set to N – Use new MPN. When the Loan Destination Nbr is changed and if the Borrower ID field is not blank, the same check occurs.

Note. The system intentionally does not confirm that the lender in the loan destination matches the lender in the MPN Use record. If you require a student to use a new MPN for each loan, use the Maintain Student MPN Usage component to enforce this requirement. For serial PLUS loans, a loan validation edit ensures that the lender for the loan matches the lender listed in the MPN Use record.

Understanding the Loan Processing Status and Loan Origination Transmission

From the time a loan is originated until it is processed by the loan servicer, the system uses a loan processing status field and a loan transmission status field to monitor the loan status:

The loan process status field monitors the current internal processing state of the loan. Values are:

Cancelled: A loan cancellation has been initiated.

Hold: The loan is on hold and the system suspends all loan processing until the hold is removed.

Offered and Not Accepted: Used by Direct Loans. Origination Pending: Loan has been originated or reset due to a loan rejection, and waiting loan validation.

In Service: The loan has been transmitted to the appropriate servicer.

Terminated: A pre-guarantee loan cancellation has been initiated.

The loan transmission status field monitors the current transmission state of the loan between the school and the loan servicer. Values are:

Accepted: The servicer has accepted the loan.

Change Pending Transmission: An adjustment generated a change transaction that has not been sent to the servicer.

Error: Not used for CommonLine loans.

Origination Pending Transmission: An Origination that has not been transmitted to the servicer.

Transmitted: An origination or change transaction has been sent to the loan servicer.

The two fields are displayed throughout the loan process with different labels on three pages:

|

Page |

Loan Process Status |

Loan Transmission Status |

|

Loan Status Summary Information |

Loan Process Status |

Transmission Status |

|

Loan Orig Status |

Ln Proc Stat |

Orig Trans Stat |

|

CommonLine Loan Origination Transmission |

(Loan Processing Stat |

Orig Trans Stat |

The following table shows how to interpret the loan status based on the field values:

|

Loan Process Status |

Loan Transmission Status |

Explanation |

|

Origination Pending |

Origination Pending Transmission |

Set when a loan is originated. The loan is waiting for the validation process to authorize its transmission. |

|

In Service |

Transmitted |

Set by the CommonLine outbound process. The loan application record is in the staging tables and application files can be created by running the EDI Manager (CL 4) or XML creation (CRC) processes. Note. The loan is considered transmitted to the servicer after the data has been sent to the staging tables and not when the school actually transmits the files. |

|

In Service |

Accepted |

Set by the CommonLine inbound process. The loan has been processed successfully by the loan servicer. |

|

In Service |

Change Pending Transmission |

Set by the origination process when a previously approved loan is adjusted. The loan is waiting for the loan validation process to authorize its transmission. |

|

Cancelled |

Change Pending Transmission |

Set by the origination process when a previously approved loan is cancelled. The loan is waiting for the loan validation process to authorize its transmission. |

|

Cancelled |

Transmitted |

Set by the CommonLine outbound process when a loan cancellation record is processed. The loan application record is in the staging tables and application files can be created by running the EDI Manager (CL 4) or XML creation (CRC) processes. |

|

Hold |

Origination Pending Transmission |

Set by the CommonLine Inbound process when a loan has been denied by the loan servicer. If the student is eligible for the loan, the user must perform the corrective action and then remove the hold status. This allows the loan to be reprocessed and retransmitted. |

|

Terminated |

Origination Pending Transmission |

Set by the origination process for a loan that has been cancelled prior to transmission. |

Pages Used to Originate CommonLine Loans

Pages Used to Originate CommonLine Loans|

Page Name |

Definition Name |

Navigation |

Usage |

|

RUNCTL_LNORIG |

Financial Aid, Loans, Process Loans, Loan Origination |

Originate loan item types that have an accepted award status. |

|

|

PMN_PRCSLIST |

Click the Process Monitor link on the Loan Origination page. |

View Process Monitor status and messages generated by the load process. |

|

|

PMN_PRCSRQSTDETAIL |

Click the Detail link on the Process List page. |

View information on the run status. |

|

|

PMN_BAT_MSGLOG |

Click the Message Log link on the Process Detail page. |

View any messages generated by the selected process. |

|

|

PMN_MSG_EXPLAIN |

Click the Explain button on the Message Log page. |

View additional information for the selected Message Log message text entry. |

Originating CommonLine Loans

Originating CommonLine Loans

Access the Loan Origination page (Financial Aid, Loans, Process Loans, Loan Origination).

Use this page to initiate the Loan Origination process (FAPLBOG1), a COBOL SQL process.

|

CL Orig Options (CommonLine origination options) |

Select from: Ignore Prom. Notes: The loan origination process originates the loan whether or not a tracked promissory note exists. Require Prom. Notes: The loan is not originated unless a tracked promissory note can be used to originate the loan. Use Prom. Note: The system uses the tracked promissory note, but if one is not available, it still originates the loan. This is the default setting. The loan origination process checks for unused promissory notes in the CommonLine Pnote Stafford, CommonLine Pnote PLUS, and CommonLine Pnote Alt pages. |

|

Adjustments |

Select to evaluate and process adjustments to existing loans. The system selects and processes origination adjustments for loans in which information has changed that requires a CommonLine change record to be generated. New loans are also originated when this option is selected. |

|

Use Loan Program |

Select the check box to activate the loan program field. Users can restrict the origination process to the selected loan program. |

The information that you enter in the Selection Criteria group box and the Student Override group box is restricted by the institution, aid year, career, and loan program that you selected in the Control Information group box.

|

Last Name FROM and Last Name TO |

Enter two student last names to originate loans for a range of students. Only students with the selected institution, aid year, career, and loan program (optional) are selected. For example, you could originate loans for students with last names from Atkins to McMurphy. You can enter here only if the Student Override check box is clear. |

|

Student Override and ID |

Select Student Override and an individual student ID to originate loans for a single student or a specific group of students in the selected institution, aid year, career, and loan program (optional). Only students with loans that have a loan award in the Accepted status and have remaining loan eligibility are available. |

Reviewing Loan Origination Information

Reviewing Loan Origination Information

This section discusses how to:

Update borrower information.

Update loan demographic data.

Enter loan relationship information.

Review student loan eligibility.

Manage FFELP serial loan processing.

Pages Used to Review Loan Origination Information

Pages Used to Review Loan Origination Information|

Page Name |

Definition Name |

Navigation |

Usage |

|

SFA_CRC_LOAN_ORIG |

Financial Aid, Loans, CommonLine Management, Maintain Originated Loans, Loan Origination 1 |

Review and update student and borrower information, CommonLine version, and loan destination processing options. |

|

|

LOAN_ORIG_SEC2 |

Click the Loan Demographic link on the Loan Origination 1 page. |

View the borrower's demographic data and the student's term and demographic information. Update loan demographic data used at the time the loan was originated. |

|

|

LN_RELATE_SEC |

Click the Select Ref/Csgn button on the Loan Origination 1 page. |

View or create relationships for the student or borrower. |

|

|

LN_ORIG_REL_ADDR |

Click the Detail link next to the Years at Current Address field on the Loan Relationship Information page. |

View the borrower's current address. |

|

|

LN_ORIG_REL_EMPL1 |

Click the Current Employment link on the Loan Relationship Information page. |

Review and update current job information if you are generating an Alternative Loan Detail record where this information is required by the loan destination. |

|

|

LN_ORIG_REL_INCOME |

Click the Income link on the Loan Relationship Information page. |

Review and update annual salary, other annual income, and other income sources. |

|

|

LN_ORIG_REL_EMPL2 |

Click the Current Employment link on the Loan Relationship Information page. |

Enter data from a previous employer. |

|

|

SFA_CRC_LN_ORIG_FN |

Financial Aid, Loans, CommonLine Management, Maintain Originated Loans, Loan Origination 2 |

Review and adjust loan start, end, certification, and scheduled disbursement dates. |

|

|

SFA_CRC_LN_ORIG_CL |

Financial Aid, Loans, CommonLine Management, Maintain Originated Loans, Loan Origination 3 |

Review and update CommonLine processing options. |

Updating Borrower Information

Updating Borrower Information

Access the Loan Origination 1 page (Financial Aid, Loans, CommonLine Management, Maintain Originated Loans, Loan Origination 1).

Borrower Information

|

Borrower ID |

In most cases, the borrower is the student, but in the case of a PLUS loan, the borrower can be a parent or guardian. Select the borrower ID if no ID is present. For Graduate PLUS loans, the Borrower ID is set to the student EmplID internally to avoid defining a student-to-student borrower relationship and cannot be edited on this page. Note. Only people related to the student are available. To be an eligible borrower of a student's loan, a relationship with a guardian or parent must be created. Relationships are defined on the Relationships page. To create a relationship to the student, the related person must have an ID assigned, and the guardian status must be set to Parent, Guardian, or Self. |

|

Driver's License # |

The borrower's driver's license number and state. You can update the fields using the Loan Demographic link. |

|

Loan Demographic |

Click to view the borrower's demographic data and the student's term and demographic information on the Loan Demographic Data page. |

|

Borr Bio/Demo Data (borrower biographic demographic data) |

Click to access the Biographical Details page and change the borrower name, gender, citizenship, marital status, date of birth, Social Security Number, and address. The link is active only if the Borrower ID field is populated. |

|

Select Ref/Csgn (select references/cosigner) |

Click to view or enter data on the Loan Relationship Information page. Available if references and cosigners are required for the loan type. |

Parent/Alternative Loan

Information in this group box is used for PLUS and alternative loans.

|

Loan Refund Indicator |

Used for Plus and Alternative loans. Select if loan refunds go to the Borrower or to the Student. Note. Additional refund setup is required in PeopleSoft Student Financials to generate a refund. |

|

Stdnt Bio/Demo Data (student biographic demographic data) |

Click to access the Demographic and Address Data page and change the student name, gender, citizenship, marital status, date of birth, Social Security Number, and address. |

|

Related IDs |

Click to open the Relationship page. After a parent or guardian has been assigned an ID, use the Relationship page to link data to that person. The person's ID then appears in the Borrower options on the Loan Origination 1 page and can be selected to process a PLUS loan. |

Process

|

Loan Destination Nbr (loan destination number) |

Displays the loan destination number that represents the servicers who process the loan. The loan origination process usuallly assigns this value, but you must assign a loan destination if the origination process cannot. Selecting the appropriate loan destination is dependent on the CommonLine version of the loan. The CommonLine Loan Version field value controls the available loan destination records that you can select. When changes occur to the loan destination value, the system resets the loan process level, disbursement hold and release status, and serial loan processing fields to the new loan destination's default values. |

|

Processing Level (process level) |

Values are: CR - School Certification Request: Select if you are processing a loan using the CommonLine certification request. D - Direct: Used for Direct Loan only and is invalid value for CommonLine loans. GO - Guarantee Only: Select to have the service provider only guarantee the loan. GP - Guarantee and Print Appl: Select to have the service provider guarantee the loan and then print and mail a promissory note to the borrower. M - Manual: Select if you do not want the loan to be processed electronically. No application files are created for loans with this setting. PG - Print and Guarantee: Select to have the service provider print and mail a promissory note to the borrower and guarantee the resulting loan after receipt of the promissory note. |

|

Servicer, Lender, and Guarantor OPEID (office of postsecondary education identifier) |

Indicates the assigned agencies associated with the Loan Destination Number. |

|

CommonLine Loan Version |

Indicates the CommonLine version of the loan destination. Can be changed to reassign the loan destination that supports the adjusted CommonLine version. CL4: CommonLine version 4 CRC: Common Record CommonLine version For more information, refer to the "Determining the CommonLine Version" section earlier in this chapter. |

Note. Parent or guardian borrowers must exist on the Personal Data page and have an ID assigned to them. They must be defined as a related parent or guardian for loan processing.

Updating Loan Demographic Data

Updating Loan Demographic Data

Access the Loan Demographic Data - THIS APPLICATION ONLY - page (click the Loan Demographic link on the Loan Origination 1 page).

To update the loan origination data, you must first update the student's information in Campus Community Fundamentals or FA Term record and then use this page to retrieve and update the loan information. When you run the Loan Origination process with Adjustments selected, the student's program complete date (graduation date) and National Student Loan Data System (NSLDS) Loan Year in the FA Term record.

The changes that you make on this page apply only to the current loan application. If you have several loan applications for a single student, make changes for each loan application.

|

Demo Chg (demographic change) |

Select to make the updateable fields available for entry. |

Borrow Demographic Information

|

License # |

Select a driver's license number for the borrower. The system updates the drivers license state field based on the drivers license selected. |

|

Borr Default/Owes Refund |

Select No or Yes to indicate whether the borrower is in default or owes a refund to the federal government. Select Overridden to override the borrower's status. |

|

Visa/Permit (borrower visa/permit) |

Indicates the borrower's visa ID. |

|

Update Borr Demo (update borrower demographic) |

Click to move the most current information from Campus Community Fundamentals (personal data) to the loan application that you are currently using. For example, to change the borrower's date of birth, go to the Biographical Details page to change date of birth. Then return to the Loan Demographic Data page and click the Updt Borr Demo button to display the changed information. The system also updates the Borr SSN, BorrVs/Pmt, and Borr Citizenship fields when you click this button. |

Term Information

|

Term and Update Term Data |

Select a term and then click the button to move information from the financial aid term to the loan application that you are currently using. |

Student Demographic Information

|

Total Debt |

Displays the student's lifetime aggregate amount for all loan types. This field is used for some alternative loans and is manually set. |

|

Stdnt Default/Owes Refund (student default/owes refund) |

Select No or Yes to indicate whether the student is in default or owes a refund. Select Overridden to override the student's default status. |

|

Update Student Demo (update student demographic) |

Click to move information from Campus Community Fundamentals to the loan application that you are currently using. The system updates the SSN, Birthdate, Citizenship, and Visa/Permit fields. |

Entering Loan Relationship Information

Entering Loan Relationship Information

Access the Loan Relationship Information page (click the Select Ref/Csgn button on the Loan Origination 1 page).

The fields in this component represent the fields listed in the CommonLine Alternative Loan and Reference Information records in the Application Send file. The data collection requirements depend on the loan program.

See Creating Loan Reference and Cosigner Relationships.

Reviewing Student Loan Eligibility

Reviewing Student Loan Eligibility

Access the Loan Origination 2 page (Financial Aid, Loans, CommonLine Management, Maintain Originated Loans, Loan Origination 2).

|

Loan Period Start and Loan Period End |

Generated from the Valid Careers for Terms table. |

|

Loan Certification Date |

The date the loan is originated. |

|

Update ID |

Click to update the loan application ID. |

|

Override Loan Dates |

Select to make the loan period start, loan period end, loan certification, and disbursement date fields available for editing. |

Hold Release Tab

Select the Hold/Release tab.

|

Disb Hold/Release Status (disbursement hold/release status) |

Automatically set during origination and when you use the Hold and Release process. The field can be manually set or reset by the Hold and Release process. Select from: F: Forwarded to CDA. This is an intermediate status communicated from the lender and is not a valid selection. H: Hold Disbursement. Indicates the disbursement to be held by the lender. N: Not Supported. Indicates that the loan destination does not participate in the disbursement hold and release process. R: Release Disbursement. Indicates the disbursement to be released to the school. |

Direct Disbursement Tab

Select the Direct Disbursement tab.

|

Disb Direct to Borrower (Disburse Direct to Borrower) |

Select this check box to request that a disbursement be made directly to the student by the lender. If the lender participates, this optional CommonLine process is valid for all CommonLine loan types. The value is transmitted in the application send file, but is not supported in the change transaction send file. |

Managing FFELP Serial Loan Processing

Managing FFELP Serial Loan Processing

Access the Loan Origination 3 page (Financial Aid, Loans, CommonLine Management, Maintain Originated Loans, Loan Origination 3).

Loan Options

|

EFT Authorization (electronic funds transfer authorization) |

Select an option for electronic funds transfer authorization. Otherwise, the origination process does this automatically, based on the tracked promissory note. Not applicable for loans using a Stafford or PLUS Master Promissory Notes where EFT authorization is automatically assumed by the loan servicer. Select from: Yes: Authorize electronic funds transfer. No: Do not authorize electronic funds transfer. |

|

Capitalize Interest |

Select Capitalize or Pay Int to indicate the student's choice of making interest payments on any unsubsidized portion of the loan while in school. Otherwise, the origination process does this automatically, based on the tracked promissory note. |

|

Request Deferment |

Select Yes or No to indicate a request to the lender to defer repayment of the loan if the borrower is eligible. Not applicable for loans using the Stafford or PLUS master promissory notes where a deferment is automatically assumed by the loan servicer. |

|

Lender of Last Resort |

For information only. Select if this option is applicable to the loan. |

|

Manual Origination Ind (manual origination indicator) |

This field is deactivated and only indicates whether the indicator was set for originated loans. |

Promissory Note Information

|

Fed App Type (federal application type) |

Indicates the promissory note used to originate the FFELP loan. Assigned during origination but can be reset manually. Select from: PL 4/25/94: Old PLUS promissory note. No longer a valid selection for new loans. PLUS MPN: The current valid PLUS Master Promissory Note. STAF MPN: The current valid Stafford Master Promissory Note. Sta 1/3/94: Old Stafford Application. No longer a valid selection for new loans. Grad PLUS: The current valid Graduate PLUS promissory note. |

|

Serial Loan Code |

Indicates the request for the lender to process the loan using the current master promissory note, or request a new note to be collected from the borrower. Assigned during origination but can be reset manually. SelectN (Use new MPN) or S (Serial, Renew existing MPN). |

|

Pnote Amt Req (promissory note amount request) |

Displays the amount the student requested on the promissory note used to guarantee the loan. Populated by the loan origination process if a promissory note is used to originate the loan. It also can be updated upon receipt of the application response file when the loan is guaranteed, if the promissory note is issued and collected by the loan servicer. Any increases to the loan cannot exceed this value. A new loan is created if the borrower's loan eligibility exceeds the promissory note amount requested. This field is blank for Stafford and PLUS loans because the amount is no longer captured on the MPN forms. |

|

MPN Confirmation (master promissory note confirmation) |

Displays master promissory note confirmation. This code is loaded from the CommonLine Application Response record and indicates whether a service provider has a valid MPN or if the status is unknown. Y: (Yes) A valid master promissory note exists. N: (No) A master promissory note does not exist. U: (Unknown) The service provider cannot confirm that the lender holds the note. |

|

Borrower Confirmation |

Indicates whether the service provider has received borrower confirmation of the loan request. |

|

E-Sign Type |

This is the reported holder of the student's electronic signature source for the loan promissory note. Although a school is not required to hold or report this information, if received from a loan servicer, the code is loaded to the application. |

Servicer Information

|

Loan Sequence Nbr (loan sequence number) |

A value assigned by the loan servicer when the application is guaranteed. The value is used to uniquely identify the loan. |

|

Service Type Cd (service type code), |

Populated by the CommonLine application response file. Except for values 01 and 02, the codes are valid for both CL4 and CRC loans: 01: For CL4, Lender requested to issue funds to school. No Reference @5 Detail Record included. 01: For CRC, File creator processed application; file initiator does not initiate disbursement. 02: For CL4, Lender requested to issue funds to disbursing agent. No Reference @5 Detail Record included. 02: For CRC, File creator processed application; file initiator to initiate disbursement. 03: Lender requested to issue funds to school. Reference @5 Detail Record included. 04: Lender requested to issue funds to disbursing agent. Reference @5 Detail Record included. 05: File creator processed application; file creator does not initiate disbursement. No Reference @5 Detail Record included. 06: File creator processed application; file creator to initiate disbursement. No Reference @5 Detail Record included. 07: File creator processed application; file creator does not initiate disbursement. Reference @5 Detail Record included. 08: File creator processed application; file creator to initiate disbursement. Reference @5 Detail Record included. |

|

Reduction Code |

Populated by the CommonLine application response file. 01: Approved for requested amount. 02: Reduced to maximum for grade level. 03: Reduced to maximum for career. 04: Reduced to maximum for period. 05: Lender approved amount. 06: Reduced to unmet need. 07: Reduced to maximum for guarantor. 08: Reduced to school certification amount. 09: Reduced to maximum for endorser. 10: Reduced to maximum of guarantor policy. 11: Reduced by borrower. |

|

Revised NOG Ind (revised notice of guarantee indicator) |

Populated by the CommonLine application response file. N: Revised notice of guarantee is not sent. U: Unknown. Y: Revised notice of guarantee is sent. |

See Also

NCHELP CommonLine Network for FFELP and Alternative Loans Reference Manual

Validating CommonLine Loans

Validating CommonLine Loans

This section discusses how to:

Validate CRC loans.

Validate CommonLine 4 loans.

Review CommonLine validation edit error messages.

Review CommonLine loan status information.

Pages Used to Validate CommonLine Loans

Pages Used to Validate CommonLine Loans|

Page Name |

Definition Name |

Navigation |

Usage |

|

SFA_CRCLNED_RUNCTL |

Financial Aid, Loans, CommonLine Management, Validate CRC Loans |

Create loan validation requests and run the loan validation process for CRC loans. You can also run this process in simulation mode where edit error messages are generated, but the status of the loan is not updated. |

|

|

LN_EDIT_RUNCTL |

Financial Aid, Loans, CommonLine Management, Validate CL 4 Loans |

Create loan validation requests and run the loan validation process for CL 4 loans. You can also run this process in simulation mode where edit error messages are generated, but the status of the loan is not updated. |

|

|

SFA_CRC_LN_ORIG_ER |

Financial Aid, Loans, CommonLine Management, Maintain Originated Loans, Loan Validation |

Review edit error messages found after the loan validation process. After you correct the errors, rerun the loan validation process. Make sure that no errors exist before generating outbound loan files. Use the online loan validation process to validate CRC loans. |

|

|

LN_ORIG_TRANS_SEC |

Financial Aid, Loans, CommonLine Management, Override Loan Status. Click the top Detail link. |

Manually set the Loan Action Status field to Authorized. |

|

|

SFA_CR_STATSUM_SEC |

Click the Loan Status Summary link on any page in the Originate Loan component. |

View information about a student's loan eligibility by viewing the current loan level and disbursement level statuses. |

Validating CRC Loans

Validating CRC Loans

Access the Validate CRC Loans page (Financial Aid, Loans, CommonLine Management, Validate CRC Loans).

If you originate loans under Common Record CommonLine, run the CRC loan validation process (FAPREQRN) to check loan origination records for errors. You must validate originated loans for the system to create and transmit a CommonLine Application Send file to the loan servicer. Each validation request comprises one or many selection criteria. To control the frequency that loan validation requests are executed, run the validation process by maintaining multiple validation requests.

Validating CommonLine 4 Loans

Validating CommonLine 4 Loans

Access the Validate CL 4 Loans page (Financial Aid, Loans, CommonLine Management, Validate CL 4 Loans).

If you originate loans under CommonLine 4, run the CommonLine 4 loan validation process (FAPREQRN) to check loan origination records for errors. Originated loans must be validated for a CommonLine Application Send file to be created and transmitted to the loan servicer. Each validation request comprises one or many selection criteria. To control the frequency that loan validation requests are executed, run the validation process by maintaining multiple validation requests.

|

Loan Edit Update Run |

Select to have the loan validation process update the target loan origination records action status. If you clear this check box and run the process in simulation mode, only edit error messages are produced. |

Reviewing CommonLine Validation Edit Error Messages

Reviewing CommonLine Validation Edit Error Messages

Access the Loan Validation page (Financial Aid, Loans, CommonLine Management, Maintain Originated Loans, Loan Validation).

When the Loan Edit Update Run Option process validates a loan, the system sets the loan action status to Authorized for transmission on the Loan Status Summary Information page. If the loan fails validation, the loan action status is set to Failed (authorization) and an explanatory edit error messages is displayed. If the loan contains separate subsidized and unsubsidized item type origination detail records, there are separate loan action statuses and edit error messages for each.

To resolve loan validation edit errors, review the CL 4 or CRC loan edit table in the CommonLine setup chapters for information on causes for validation failure. Correct the edit error condition and then rerun the validation process. Failed loans become authorized when all the error conditions have been corrected.

If an edit error is not appropriate for the loan destination, you can permanently deactivate the edit in the corresponding loan destination component. To authorize a failed loan without clearing the edit error conditions, manually set the loan action status to Authorized on the Origination Detail page. Review the CL Validation Errors report for a complete list of CommonLine loans that have failed the loan validation processes.

For CRC loans, the online loan validation process is made available; click the Validate Loan button to initiate the Loan Validation process for that specific loan. This option is not available for CL 4 loans. If a loan contains separate subsidized and unsubsidized records, you must validate each one.

Reviewing CommonLine Loan Status Information

Reviewing CommonLine Loan Status Information

Access the Loan Status Summary Information page (click the Loan Status Summary link on any page in the Originate Loan component).

Use this page at various stages of the loan origination process, including after origination, after validation, after disbursements, and after information from the loan servicer has been processed.

Student Eligibility

|

Total Certified Loan Amt (total certified loan amount) |

Displays the total amount certified including both subsidized and unsubsidized item types used for the same origination record. |

Origination Detail

|

Loan Process Status |

Displays the overall status of the loan. Used in conjunction with the Transmission Status. Values are: Origination Pending: Loan has been originated or reset due to a loan rejection, and waiting loan validation. In Service: Indicates the loan has been transmitted to the appropriate servicer. Terminated: Indicates that a pre-guarantee loan cancellation has been initiated. Hold: The loan is on hold and the system suspends all loan processing until the hold is removed. Canceled: A loan cancellation has been initiated. |

|

Loan Action Code |

Displays the most recent origination level action taken on the loan. |

|

Transmission Status |

Displays the current status of the loan in relation to the loan servicer. Used in conjunction with the loan process status to know the overall status of the loan. Values are: Accepted: Indicates the servicer has accepted the loan. Change Pending Transmission: Indicates an adjustment generated a change transaction that has not been sent to the servicer. Error: Not used for CommonLine loans. Origination Pending Transmission: Indicates an Origination that has not been transmitted to the servicer. Transmitted: Indicates that an origination or change transaction has been sent to the loan servicer. |

|

Action Status |

Displays the status of the loan action code. |

Disbursement Information

Shows the most recent actions performed on the individual loan disbursements.

|

Disbursement ID |

Indicates the disbursement number of the selected loan and the disbursement sequence. |

|

Action Status |

Displays the status and date of the most recent action. |

Amounts Tab

Select the Amounts tab.

View the calculated loan disbursement amounts.

Payment Tab

Select the Payment tab.

View actual disbursement amounts received by the school and paid to the student's account.

Managing Loan Origination Transmission Data

Managing Loan Origination Transmission Data

This section discusses how to:

View a student's originated loans.

View loan application summary.

View loan origination information.

View loan origination change.

View loan period change.

Override loan origination transmission data.

Pages Used to Manage CommonLine Loan Origination Transmission Data

Pages Used to Manage CommonLine Loan Origination Transmission Data|

Page Name |

Definition Name |

Navigation |

Usage |

|

LOAN_ORIG_SUMM |

Financial Aid, Loans, View Originated Loans, Origination Student Summary |

View a student's originated loans for a selected aid year. |

|

|

LOAN_ORIG_SUMM_DTL |

Click the Appl Data link on the Origination Student Summary page. |

View one originated loan for a student in a particular aid year. |

|

|

LOAN_ORIG_SEC |

Click the Origination Status link on the Loan Application Summary page. |

View loan level actions that monitor the progress of the loan application. |

|

|

LOAN_DISBURSEMENT |

Click the Disbursement Status link on the Loan Application Summary page. |

Review activity related to each disbursement record for a student's loan. |

|

|

LN_CL_ORIG_CHG_SEC |

Click the Change link on the Loan Origination Information page. |

When you run adjustments, view the type of loan change record or the changes that occurred. |

|

|

LN_CL_ORIG_CHG_07 |

Click the Change link on the Loan Origination Change page. |

View the change information that is sent to the loan servicer. |

|

|

LOAN_ORIGACTN_SEC |

Click the Message link on the Loan Origination Information page. |

View any change error messages received on the CommonLine application response record that generated the origination action. |

|

|

LOAN_ORIG_TRANS |

Financial Aid, Loans, CommonLine Management, Override Loan Status, CommonLine Loan Origination Transmission |

Manually update loan status values to synchronize with the loan servicers. Can be used to manually approve or deny a loan record. |

Viewing a Student's Originated Loans

Viewing a Student's Originated Loans

Access the Origination Student Summary page (Financial Aid, Loans, View Originated Loans, Origination Student Summary).

|

Appl Data (application data) |

Click to open the Loan Application Summary page. |

Viewing Loan Application Summary

Viewing Loan Application Summary

Access the Loan Application Summary page (click the Appl Data link on the Origination Student Summary page).

|

LnAmt Borr (loan amount borrowed) |

Displays the actual amount the student has borrowed. |

|

Loan Start and Loan End |

Displays the loan period dates. |

|

Remaining Loan Eligibility |

The difference between the origination amount detail and the borrower requested amount. |

|

Student Loan Summary |

Click to access the Origination Student Summary page. |

|

Origination Status |

Click to access the Loan Origination Information page. |

|

Disbursement Status |

Click to access the Origination Loan Disbursement page. |

Viewing Loan Origination Information

Viewing Loan Origination Information

Access the Loan Origination Information page (click the Origination Status link on the Loan Application Summary page).

The page displays loan level activity. The action rows are displayed in reverse chronological order so that the most recent changes appear on top.

|

Action Code |

Loan action codes are predefined and delivered with the system to indicate actions performed on the loan. |

Note. The Change and Message links are available only when a change or message is associated with the record. Links are available to view the CRC status codes and the corresponding CRC staging table information for the selected loan action row.

Detail 2 Tab

Select the Detail 2 tab.

Use to view secondary loan action information.

|

Transfer Batch |

Indicates the ID for the specific batch in which the loan was transmitted or received. CommonLine 4 loans only. |

|

User ID |

Indicates the person who ran the process that inserted the loan action code. |

|

Process Instance |

Indicates the unique ID of the process that posted the loan action message on the page. You can use this on the Messages page to select the instance. |

Viewing Loan Origination Change

Viewing Loan Origination Change

Access the Loan Origination Change page (click the Change link on the Loan Origination Information page.

This page is only available for approved loans that have been adjusted by the loan origination process.

|

Change |

Click to access the Loan Period Change page. This link is active if additional change information exists. |

|

Message |

This link, if active, enables you to view any errors reported by the loan servicer when the change record is processed. |

|

Change Status |

Displays status of the change record type. Change status values are: Ready: The change record type is ready to be transmitted. Pending: Additional action is required before the change record type can be transmitted. This status only occurs with Change Record Types 11 and 12. Accepted: The change transaction has been received and approved by the loan servicer. Error: The change transaction sent to the loan servicer has not been approved. The Message link is active to enable you to view change errors. |

Note. This page varies depending on the loan change record type.

Viewing Loan Period Change

Viewing Loan Period Change

Access the Loan Period Change page (click the Change link on the Loan Origination Change page).

This page is only available for approved loans that have been adjusted by the loan origination process. In this example, the system displays the fields changed for the Loan Period Change (07) record. The system displays a different page for each of the following change record types:

Loan Period Change (07)

Ln (Loan) Cancellation/Reinstatement (08)

Loan Increase (24)

Note. Change record types 11, 12, 13, and 14 are not supported.

Overriding Loan Origination Transmission Data

Overriding Loan Origination Transmission Data

Access the CommonLine Loan Origination Transmission page (Financial Aid, Loans, CommonLine Management, Override Loan Status, CommonLine Loan Origination Transmission).

Use this page to override loan status information. You should only override the status of an originated loan in cases where the processing of loans using the automated processes cannot process the loan properly. Overriding loan information should be done with a clear understanding of the purpose and expected result from overriding the loan status. New problems can be created for the loan if information is changed without performing correct analysis.

Note. Because this page enables you to change important financial eligibility information, access should be restricted to users with the appropriate security access.

|

Accept Orig (accept origination) |

When you select this option and click Update Status, you accept current originated and adjusted loan amounts. The transmitted fields are filled with the same amount as the originated fields. The system generates a new origination action code of PSMA (manually accepted). This is the same as receiving a CommonLine application response file where the student's loan is reported guaranteed or a CommonLine application response file in response to a CommonLine change transaction. This action also manually releases a loan from error status. The loan is eligible for loan adjustment processing as long as the process level is not set to M (manual). |

|

Error Loan |

When you select this option and click Update Status, the system manually rejects the loan by generating a new origination action code of PSMR (manually rejected). The system then resets the loan to a pending status. This enables you to correct the reason for the manual rejection and re-originate the loan. Note. If you are rejecting a loan because the borrower is no longer eligible, you must adjust the student's package to reflect the change in eligibility. |

|

Hold Loan |

When you select this option and click the Update Status button, the system changes the Loan Processing Stat (loan processing status) field to Hold. |

|

Remove Hold |

When you select this option and click the Update Status button, the system resets the Loan Processing Stat (loan processing status) field to In Service. |

The loan processing status and origination transmission status values are updated when a manual action is initiated.

Accept Origination Value Changes

|

Original Loan Processing Stat Value |

Original Orig Trans Stat Value |

New Loan Processing Stat Value |

New Orig Trans Stat Value |

|

Origination Pending |

Origination Pending |

In Service |

Accepted |

|

In Service |

Transmitted (not previously accepted) |

In Service |

Accepted |

|

In Service |

Change Pending |

In Service |

Accepted |

|

In Service |

Transmitted (previously accepted) |

In Service |

Accepted |

|

Cancelled |

Change Pending |

In Service |

Accepted |

|

Cancelled |

Transmitted |

In Service |

Accepted |

Error Value Changes

|

Original Loan Processing Stat Value |

Original Orig Trans Stat Value |

New Loan Processing Stat Value |

New Orig Trans Stat Value |

|

Origination Pending |

Origination Pending |

Origination Pending |

Origination Pending |

|

In Service |

Transmitted (not previously accepted) |

Origination Pending |

Origination Pending |

|

In Service |

Change Pending |

In Service |

Error |

|

In Service |

Transmitted (previously accepted) |

In Service |

Error |

See Also

Viewing Loan Disbursement Activity

Viewing Loan Disbursement Activity

This section provides common elements and discusses how to:

Review loan disbursement activity.

Review loan disbursement actions.

Review loan disbursement changes.

Review cancelled and reinstated loans.

Review loan award disbursement information.

Review loan award transmission status.

Pages Used to View Loan Disbursement Activity

Pages Used to View Loan Disbursement Activity|

Page Name |

Definition Name |

Navigation |

Usage |

|

LOAN_DISBURSEMENT |

Financial Aid, Loans, View Disbursement Status, Origination Loan Disbursement |

Review activity related to each disbursement record for a student's loan including current payment information. |

|

|

Loan Application Summary |

LOAN_ORIG_SUMM_DTL |

Click the Appl Data link on the Origination Student Summary page. |

View one originated loan for a student in a particular aid year. |

|

LOAN_DISBACTN_SEC |

Click the Detail link on the Origination Loan Disbursement page. |

Review secondary loan disbursement action information. |

|

|

LN_CL_DISB_CHG_SEC |

Click the Disbursement Action Detail button on the Loan Disbursement page. |

Review loan disbursement level changes of transaction record type that was calculated by the loan adjustment program. |

|

|

LN_CL_DISB_CHG_09 LN_CL_DISB_CHG_10 |

Click the Change link on the Loan Disbursement Change page. |

View the disbursement related change record information. |

|

|

LOAN_DISB_MSG_SEC |

Click the Message link on the Loan Disbursement page. |

View loan disbursement error messages received on the CommonLine change response record. |

|

|

LN_AWRD_DISB_INQ |

Financial Aid, Loans, View Award Disbursements, Loan Award Disbursement Inquiry |

Review loan disbursement information as it relates to the student's packaged loan awards. |

|

|

LOAN_ORIG_TRNS_INQ |

Financial Aid, Loans, CommonLine Management, Loan Transmission Information, Loan Transmission Status |

Review loan award transmission status as well as all loan and disbursement level activity. |

Reviewing Loan Disbursement Activity

Reviewing Loan Disbursement Activity

Access the Origination Loan Disbursement page (click the Disbursement Status link on the Loan Application Summary page).

Disbursement Information

|

Percentage |

Indicates the percentage of the total loan award the disbursement represents. |

|

Loan Paid |

Indicates whether the first disbursement has been credited to the student's account in Student Financials. |

|

H/R Stat (hold/release status) |

Indicates whether the disbursement is on hold (H) or release (R) status. |

Disbursement Actions

As changes to the disbursement occur, a new row of disbursement information is inserted. The information is sorted in reverse chronological order so that the most recent action appears first.

|

Sequence |

Displays the most recent action. |

|

Return to Application |

Click to access the Loan Application Summary page. |

|

Detail |

Click to access the Loan Disbursement Action page to view secondary disbursement action data. |

|

Change |

Click to view the disbursement level CommonLine 4 Change transaction record type that is required to be sent to the loan servicer. |

|

Message |

Click to view loan disbursement error messages received. |

Note. The Change and Message links are available only when a change or message is associated with the record.

Reviewing Loan Disbursement Actions

Reviewing Loan Disbursement Actions

Access the Loan Disbursement Action page (click the Detail link on the Origination Loan Disbursement page).

View secondary disbursement action information.

|

Loan Disbursement Amt (loan disbursement amount) |

Displays the gross loan amount. This is the same value that displays on the parent page. |

|

Net Loan Disbursement |

Displays the net loan amount after fees are subtracted. This is the same value that displays on the parent page. |

|

Seq Nbr (sequence number) |

Displays the sequence number of the disbursement action. This is the same value that displays on the parent page. You can view all disbursement actions by pressing the View All link. |

|

Action Code |

Displays a code that represents a disbursement action message. |

|

Actn Amt (action amount) |

Displays the gross disbursement amount. |

|

Actn Net (action net) |

Displays the net disbursement amount after subtracting fees. |

|

Actn Fee (action fee) |

Displays the loan fee amount for the disbursement. |

|

Actn Adj (action adjustment) |

Displays the adjusted disbursement amount reported. This field is only populated if applicable. |

|

Transfer Batch |

Displays the number generated by the institution to uniquely identify a specific batch of records. |

Reviewing Loan Disbursement Changes

Reviewing Loan Disbursement Changes

Access the Loan Disbursement Change page (click the Disbursement Action Detail button on the Loan Disbursement page).

This page is only available for approved loans that have been adjusted by the loan origination process.

|

Change |

Click to access the Cancel/Reinstate Loan page and view any errors reported by the loan servicers when the change record is processed. |

|

Message |

Click to access the Disbursement Message Information page and view disbursement related change information that is sent to the loan servicer. |

See Also

Viewing Loan Origination Change

Reviewing Cancelled and Reinstated Loans

Reviewing Cancelled and Reinstated Loans

Access the Cancel/Reinstate Loan page (click the Change link on the Loan Disbursement Change page).

In this example, the system displays the fields changed for the 09 record. The system displays a different page for each of the following change record types:

Pre Disbursement Change (09)

Post Disbursement Change (10)

Reviewing Loan Award Disbursement Information

Reviewing Loan Award Disbursement Information

Access the Loan Award Disbursement Inquiry page (Financial Aid, Loans, View Award Disbursements, Loan Award Disbursement Inquiry).

Use the upper scroll area to view the student's different loan awards. This information is derived from the Award Summary component.

|

Award Status |

Displays the current status of the student's loan item type from the Award Summary page. |

|

Disbursement Plan |

Displays the disbursement distribution rule applied when the loan item type is awarded to the student. |

|

Offered and Accepted |

Indicates the current offered and accepted loan amounts in the student's award summary. |

Use the middle scroll area to view the status of each disbursement for the loan award. This information is derived from the disbursement level information on the Award Summary component.

|

Disbursed Balance |

Displays the disbursement amount that has been applied to the student's financial account. |

|

Net Disbursed Balance |

Displays the net balance of the disbursement amount calculated at the time the loan was awarded to the student. |

The section in the lowermost scroll area displays loan disbursement information for any loans originated for the loan item type shown in the upper scroll areas.

|