Defining Ownership Rules

This section provides an overview of ownership rules and discusses how to:

Establish ownership rules.

Establish ownership percentage.

Establish ownership rule sets.

Establish ownership groups.

Pages Used to Define Ownership Rules

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Ownership Rule |

GC_OWN_RULE_PG |

|

Create or modify an ownership rule |

|

Ownership Rule - Ownership Percentage |

GC_OWN_RULE_PG2 |

|

Define the ownership percentage of the parent-subsidiary relationship. The number of total shares and voting shares owned by the parent determine the equitization and non-controlling interest calculations respectively. |

|

Ownership Rule - Notes |

GC_OWN_RULE_PG3 |

|

Enter notes about the ownership rule. |

|

Ownership Rule Set |

GC_OWN_RSET_PG |

|

Create ownership rule sets. |

|

Ownership Rule Set - Notes |

GC_OWN_RSET_PG2 |

|

Enter notes about the ownership rule set. |

|

Ownership Group |

GC_OWN_GRP_PG |

|

Combine ownership rule sets to create ownership groups. |

|

Ownership Group - Notes |

GC_OWN_GRP_PG2 |

|

Enter notes about the ownership group. |

Understanding Ownership Rules

Ownership rules provide a basis for the equitization and non-controlling interest rules that are defined for a consolidation model. When equitization and non-controlling interest rules are processed, they use the information defined in ownership rules for part of their calculations.

Ownership Rules

Ownership rules determine the accounting methods, equitization thresholds, and ownership levels of a parent for a subsidiary based on the total and voting shares owned by the parent.

Note: Ownership rules are setup to accommodate different accounting methods. If a business unit is included in the consolidation tree and ownership rules are setup for that business unit, the business unit will be included as part of the consolidation with consolidation entries based on the ownership level.

An ownership rule defines the ownership and control relationships between a subsidiary and parent. Business consolidation rules use ownership rules to equitize changes in subsidiary equity, and to calculate the non-controlling interest elimination. Ownership does not necessarily imply control. For example, one company may own 60 percent of another subsidiary, but own only 20 percent of the controlling stock. The system uses the control percentage to determine whether or not to equitize. The system uses ownership percentage to determine all calculated amounts, including the amount to equitize, and the amount of non-controlling interest to eliminate.

Ownership rules identify:

All of the parents within your consolidation structure that own a part of the subsidiary.

The percentage of the subsidiary that each parent owns.

The percentage of control that each parent exerts over the subsidiary.

The controlling parent.

Note: A controlling parent is required for every subsidiary for which an ownership rule is created.

The controlling parent for a subsidiary must be specified even if that parent is not a direct owner of the subsidiary. If none of the direct owners control more than the percentage required to consolidate, the controlling parent is the business unit where the total control from the direct parents adds up to the percentage required to consolidate. If this controlling parent does not have direct control, specify zero percent as the control percentage (because the parent has indirect control). If the total control across all parents is lower than the percentage required to consolidate (for example, the subsidiary isn't even in the consolidation tree), then it really doesn't matter which parent is the controlling parent; you can specify any one.

The sum of all of the ownership percentages for a particular subsidiary-parent relationship must be less than or equal to 100. Because there may be other owners of a subsidiary that are external to your organization's consolidation structure, the total ownership and control percentages for a particular subsidiary can be less than 100.

During processing the system creates a flattened tree of the ownership structure in PS_GC_OWN_STR_TBL. The system uses this table to:

Determine the equitizing parent during equitization processing.

Determine to which parent to post the parent investment elimination during NCI processing.

Review this record to verify that your ownership structure is set up correctly.

Subsidiary equity is eliminated against the parent investment depending on the level of ownership.

You can run the ownership inquiry to review the ownership structure of your organization.

Accounting Methods

Ownership rules are setup to accommodate different accounting methods. The accounting methods available in global consolidations are pooling of interests, proportionate, and purchase.

If a business unit is included in the consolidation tree and ownership rules are setup for that business unit, the business unit will be included as part of the consolidation with consolidation entries based on the ownership level. The pooling of interests method is similar to the purchase method, except that in order to use the pooling of interests method, the parents' investment in the subsidiary must be virtually all of the common stock (at least 90 percent of voting stock). The parent uses the book value of the subsidiary's assets and liabilities. Because the parent uses the subsidiary's book values, goodwill is not recorded on the parents book for this type of ownership setup.

If you use the pooling of interests method, the subsidiary must be 100 percent owned by a single parent, eliminating the need for non-controlling interest calculations, and the equitization threshold percent must be in range from 0 to 100.

If you use the proportionate method, only one parent can own a subsidiary. If the subsidiary has two parents, the subsidiary is broken down into two different subsidiaries, each proportionately owned by the respective parent.

The following table outlines the accounting methods and their impact on consolidations:

|

Accounting Considerations |

Proportionate |

Pooling |

Purchase (% Control Based) |

|---|---|---|---|

|

Changes in ownership |

Yes |

No |

Yes |

|

Change In accounting Subsidiary assets and liabilities |

You specify book or fair market value (FMV) |

Book value On subsidiary books |

Fair market value (FMV) |

|

Goodwill present |

Yes |

No |

Yes |

|

Ownership percentage |

Assume 100 percent for consolidation calculation. |

100% |

You specify. |

|

Multiple parents |

No In the case of two parents, the subsidiary is broken down into two different subsidiaries each proportionately owned by their respective parent. |

No 100% ownership by one parent. |

Yes Employ non-controlling rules. |

|

Eliminate subsidiary equity against parent investment |

Yes |

Yes |

Yes |

|

non-controlling interest rules |

No In the case of two parents, the subsidiary is broken down into two different subsidiaries each proportionately owned by the respective parents. |

No 100% ownership by one parent. |

Yes |

|

Treatment of subsidiary's earnings |

Similar to purchase |

The subsidiary earnings are combined with the parent for the full fiscal year in which the purchase occurs. |

The subsidiary earnings are combined with the parent only from the period of purchase onwards. |

Ownership Rule Sets and Ownership Groups

Ownership rule sets are a collection of individual ownership rules. Ownership groups are a collection of ownership rule sets that you associate with a consolidation model for the consolidation business rules processing. The ownership rules, ownership rule sets, and ownership rule groups are all effective-dated allowing for changes to your organizational structure. The ownership rules enable you to specify the accounting treatment for parent/subsidiary relationships and the ownership rule sets enable you to bring together all of the various accounting treatments that the parent organization establishes for its numerous subsidiary relationships. The ownership group enables you to tie all of these relationships to the consolidation model and to determine how consolidation rule processing impacts these relationships.

On the Ownership Group page you specify the consolidation and equitization thresholds that will be used for the consolidation.

The consolidation threshold defines the percentage of ownership that requires a subsidiary to consolidate to its parent. The consolidation threshold is informational only. l.

The equitization threshold defines the threshold at which the equity method of accounting goes into effect. The equity method of accounting requires a parent to reflect its ownership percentage of the subsidiary's income in their income statement, with an offset to the investment account for the subsidiary. On the Ownership Rule page you can specify a unique equitization threshold for a subsidiary, or you can specify that the subsidiary use the equitization threshold specified on the Ownership Group page.

An ownership group is composed of one or more ownership rule sets. You associate an ownership group with a consolidation model. You assign a use order to specify the processing order of the ownership rule sets that are associated with an ownership group.

Warning! An ownership rule set can contain ownership rules with multiple subsidiary entities. It is possible for the ownership sets, made up of various ownership rules, to contain the same subsidiary entities. If this is the case, the ownership rule in the ownership set with the lowest numeric use order value is used during consolidation processing.

Ownership Rule Page

Use the Ownership Rule page (GC_OWN_RULE_PG) to .

Image: Ownership Rule page

This example illustrates the fields and controls on the Ownership Rule page. You can find definitions for the fields and controls later on this page.

Establishing the Equitization Threshold Method

Select the equitization threshold method that you want to use for the ownership rule. You can select the Use Ownership Group option which will use the threshold value that you specify on the Ownership Group page or you can select the Specify Threshold option, which enables you to specify the equitization threshold value in the Threshold Percent field.

When you run the equitization process, the system uses the selection in the Equitize Parent field on the Ownership Rule - Ownership Percentage page to determine whether to equitize changes in subsidiary equity for each parent-subsidiary relationship. When the Equitize Parent field is set to Use Threshold, the equitization threshold percent of the parent is compared to the control percentage for each subsidiary-parent relationship.

When the control percentage is greater than or equal to the equitization threshold percent, changes in subsidiary equity (for example, net income) are equitized, using the ownership percentage to determine the amount for each subsidiary-parent relationship.

The equitization threshold percentage can be specified both on the Ownership Rules page and on the Ownership Group page. The threshold value entered on the Ownership Group page applies to all entities within the Ownership Group being processed, but you can override it at the main parent level on the Ownership Rules page; the threshold for the ultimate parent is the same as the amount specified for the ownership group associated with the consolidation model.

Indicate whether to use the threshold specified for the ownership group, or to enter a threshold for that subsidiary by selecting one of these equitization threshold methods:

Note: To specify a threshold for a specific parent, select the Specify Threshold method, and then enter the amount in the Equitization Threshold Percent field on the Ownership Rule page where that parent is itself a subsidiary.

Accounting Method

Select the accounting method that you want to use for the ownership rule. You can select one of three options. Pooling, Proportionate, or Purchase.

The method that you select impacts the field edits on the Ownership Percentage page. For example, if you select Pooling, the Subsidiary Entity must be 100 percent owned by a single parent, the Equitization Threshold Percent must range from 0 to 100, and the option to calculate/specify the ownership is not available on ownership percentage page of the ownership rule.

Ownership Rule - Ownership Percentage Page

Use the Ownership Rule - Ownership Percentage page (GC_OWN_RULE_PG2) to define the ownership percentage of the parent-subsidiary relationship.

Image: Ownership Rule - Ownership Percentage page

This example illustrates the fields and controls on the Ownership Rule - Ownership Percentage page. You can find definitions for the fields and controls later on this page.

Add a row for each parent in the Specify Parents grid, and complete these fields:

Subsidiary Entity Shares

The values you enter in this section determine the ownership level and controlling interest of the parent for the subsidiary.

Specify Parents

The values you enter in this section determine the ownership level and the controlling interest of the parent for the subsidiary.

Note: The formula used to calculate Control Percentage = Voting shares of the parent/Total voting shares of subsidiary * 100 %.

The formula used to calculate Ownership Percentage = Total shares of the parent/Total shares of subsidiary * 100 %.

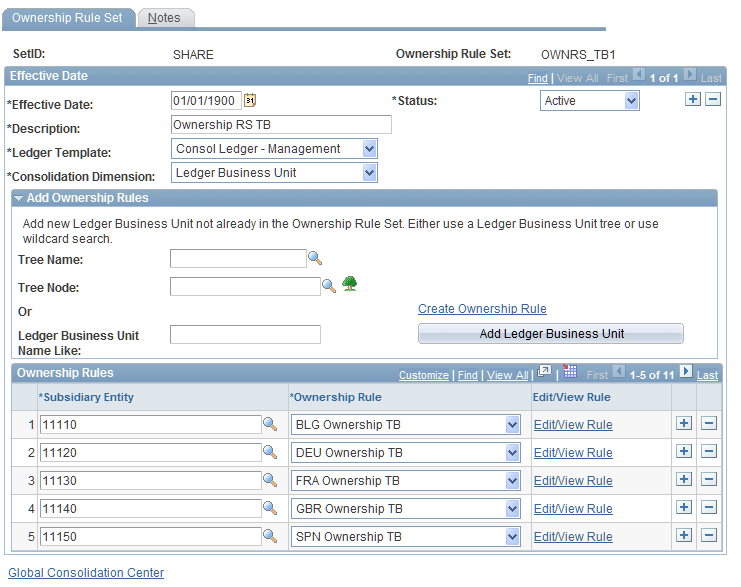

Ownership Rule Set Page

Use the Ownership Rule Set page (GC_OWN_RSET_PG) to create ownership rule sets.

Image: Ownership Rule Set page

This example illustrates the fields and controls on the Ownership Rule Set page. You can find definitions for the fields and controls later on this page.

Add Ownership Rules

You can optionally populate the Ownership Rules grid with subsidiary entities by either using a tree and optionally specifying a node, or by using a wildcard search to select the values. You can use one option or the other but not in combination with each other.

All business units or departments in a specified tree name are added to the Ownership Rules grid unless you specify a tree node.

Similarly, if you use the wildcard search mode and click Add Department or in the case of a ledger business unit tree Add Ledger Business Unit, the systems adds all business units whose name matches the pattern specified are added to the Ownership Rules grid.

Using the methods in the Add Ownership Rules section to populate the Ownership Rules grid is optional. You can add business units or departments individually to the grid.

Ownership Rules

Add a row for each subsidiary entity in the Ownership Rules grid that you want to include in the ownership rule set and complete these fields:

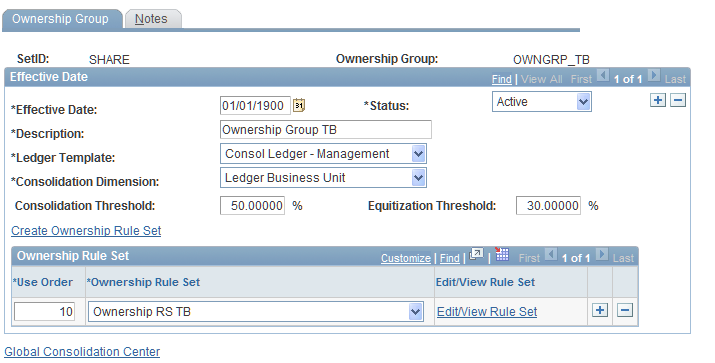

Ownership Group Page

Use the Ownership Group page (GC_OWN_GRP_PG) to combine ownership rule sets to create ownership groups.

Image: Ownership Group page

This example illustrates the fields and controls on the Ownership Group page. You can find definitions for the fields and controls later on this page.

Ownership Rule Set

In the Ownership rule set grid, add a row for each ownership rule set that you want to include in the ownership group, and complete these fields: