Transaction Code Tax Types

Set the Cashiering>Tax Types application function to Y to activate the Tax Types feature. When the Cashiering>Tax Types application function is set to Y, the Cashiering>Tax Type Calculation application setting is available. This setting may be set to Reservation or to Profile, depending on whether the tax type will be associated with a guest's reservation or to the profile attached to the reservation. (See Reservation Tax Type Calculation, below, for additional details.)

The Tax Types feature can be used to control whether or not a generate is applied to a posting, and if it is, how it is to be calculated. The feature can also determine the effective dates for application of particular generates. Tax Types can't be set on transaction codes that have been configured as a Payment or as part of a Wrapper group.

Note: Please keep in mind that when the Cashiering>Allow Routing of Tax Transactions application parameter is set to N, that tax transaction codes can't be routed and a message is displayed when this situation occurs to notify the user.

When the Cashiering>Tax Type Calculation application setting is set to Reservation, and a charge is posted to a reservation with tax type A (for example), then the charge is routed to a reservation with tax type B, the taxes are always based on the tax type associated with the originating reservation (tax type A in this example) and not on the tax type of the target reservation. (See Reservation Tax Type Calculation, below, for additional details.)

When the tax applicable to a transaction code is defined using the Tax Types feature on the Generates - New screen or Generates - Edit screen, the tax can be calculated differently for each of the tax types. (Tax types are set up for a property in Configuration>Cashiering>Tax Types prior to applying tax types to generates.)

For example, a property might have a Regular Guest tax type that is set to 4% for the restaurant food transaction code and an F&B Tax Exempt tax type that is set to 0% for the same transaction code. Which tax type will be applied to a guest's postings is determined either at the reservation level or at the payee profile level, depending on the value of the Cashiering application setting Tax Type Calculation. (Tax types are entered onto the More Fields tab of the Reservation screen or the Profile screen, as appropriate.) In addition, a default tax type (specified by the Cashiering application setting Default Tax Type) can be automatically assigned to either new reservations or new profiles.

To access the Tax Types screen, select Configuration>Cashiering>Codes>Groups, >Subgroups, or >Transaction Codes. Select the Generates button from the Transaction Codes Groups, Transactions Codes Subgroups, or Transaction Codes Setup screen. Select the New or Edit button, as appropriate from the Generates screen. From the Generates - New or Generates - Edit screen, select the transaction code for the generate; then select the Tax Types radio button. The Tax Types ellipsis icon becomes active at this point. Select the ellipsis icon to display the Tax Types screen.

This screen allows you to create a new tax type, edit an existing tax type, or delete a tax type. The screen shows the following information for the tax types set up for the transaction code.

Start Date. The effective date for the tax type. This is the date when this tax type will begin to be applied.

Currency. The currency in which the generate is calculated with this tax type.

Tax Type. The tax type code for the tax type.

Formula. The method of calculation of the generate for the tax type. The following options are available:

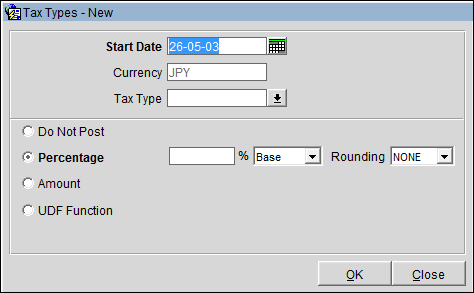

Select the New button to create a new tax type for the property, or highlight a tax type and select the Edit button to modify an existing tax type. The Tax Type - New or Tax Type - Edit screen appears.

Provide the following information.

Start Date. Select the date that the tax type is to become effective. This tax type will not be available prior to this date. Use the calendar tool or enter the date manually.

Currency. The currency in which the generate is calculated for this tax type. This is a view-only field and is set to the local currency for the property.

Tax Type. Select the down arrow to display a list of tax types. From the list, choose the tax type you wish to configure.

Formula. Select a radio button to specify the method to be used to calculate the tax type.

Note: The amount entered here is not carried over as a default amount when manually posting directly to the generate transaction code on the Transaction Posting screen.

Example: Two generates have been defined for the transaction code 1200 – Group Room Revenue:

The Tax Type Calculation parameter is set to Reservation (Setup>Application Parameters).

The following tax types have been configured within Configuration>Cashiering>Tax Types:

Code |

Description |

R |

Regular Guest |

ST |

State Tax Exempt |

CT |

City Tax Exempt |

ALL |

All Tax Exempt |

When setting tax types for transaction code 8300 (State Tax – 6%), the following information has been set up:

Tax Type |

Do Not Post |

Percentage |

Amount |

UD Function |

R |

|

6 |

|

|

ST |

X |

|

|

|

CT |

|

6 |

|

|

ALL |

X |

|

|

|

All start dates are today's date.

If a reservation has a tax type of:

When selecting the transaction code 8350 (City Tax – 4%), the following information has been set up:

Tax Type |

Do Not Post |

Percentage |

Amount |

UDF Function |

R |

|

4 |

|

|

ST |

|

4 |

|

|

CT |

X |

|

|

|

ALL |

X |

|

|

|

All start dates are today's date.

If a reservation has a tax type of:

If you create a tax type generate (say, Luxury Tax - transaction code 11111) for a subgroup (see Transaction Code Subgroups), and then attach this generate to, say, transaction code 99999 - Dog Grooming, be aware of the following behavior:

When configuring the tax type generates for a transaction code, if no generate is specified for a particular tax type, and a reservation exists with this tax type, then when posting to the main transaction code the generate is posted based on the Cashiering>Default Tax Type application setting; in this scenario a generate does not post if a default tax type is not configured.

When the Cashiering>Tax Type Calculation application setting is set to Reservation, and the tax type of the reservation changes (either because the reservation is edited or because the posting is routed to a reservation having a different tax type), the tax type calculation is not changed unless the posting is edited. Examples follow:

Scenario 1: Reservation 1 has tax type 1 associated with it. Transactions posted to Reservation 1 will have taxes posted based on tax type 1. If a transaction is edited, the tax type applied to the tax calculation does not change.

Scenario 2: Reservation 1 has tax type 1 associated with it. Transactions posted to reservation 1 will have taxes posted based on tax type 1. Now Reservation 1 is edited and tax type 2 is associated with the reservation. Existing postings will not be re-calculated due to the change; however, if a transaction originally posted as tax type 1 is edited, the tax will be re-calculated according to the current tax type for the reservation (tax type 2).

Scenario 3: Reservation 1 has tax type 1 associated with it. Transactions posted to reservation 1 will have taxes posted based on tax type 1. Routing instructions exist such that transactions posted to Reservation 1 are routed to Reservation 2, which has tax type 2 associated with it. The routed charges will not be recalculated according to tax type 2; however, if the routed charges originally posted as tax type 1 are edited on Reservation 2, the tax will be re-calculated according to the tax type for Reservation 2 (tax type 2).

When copying transaction codes that have tax type generates associated with them between properties (assuming the OPP_MHOT Multi-property PMS add-on license is active), the generate will not be copied to the target property if the target property's Cashiering>Tax Types application function is not active and the matching tax type is not configured at the target property. However, the main transaction code will be copied between properties without its generate.

See Also