Tax Export in XML Format Data Definition (TAX_EXPORT_XML)

The XML_TAX_EXPORT is used to fulfill the requirement that every Belgian company (i.e., hotel) must report on a yearly basis a list of Belgian companies they have invoiced. This export must be supplied to the Belgian government in XML format. For each company the export includes the total net revenue collected and total associated VAT for the fiscal year.

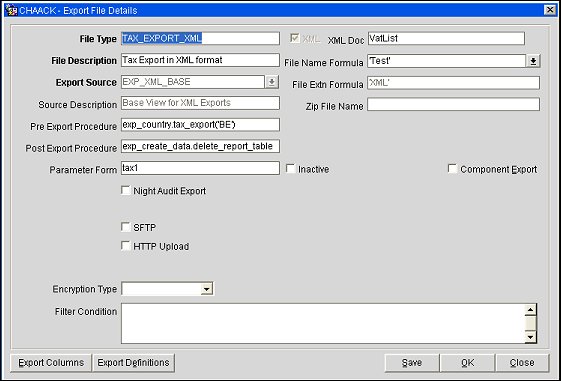

To create the XML_TAX_EXPORT export, select Miscellaneous>File Exports>Country.

Note: Make sure that the TAX ID is configured for the property (General>Property Tax ID application setting). The tax ID consists of BE followed by a 10-digit number (e.g., BE1234567890). The export will use the numeric characters of this ID to identify the hotel generating the export.

Only Company, Travel Agent, and Source profiles are included in this export. The field TAX1_NO must be screen painted on the More tab of the Company, Travel Agent, and Source profile screens to hold the tax IDs for these entities. The tax ID consists of BE followed by a 10-digit number (e.g., BE1234567890). The export will use the numeric characters of this ID to identify the customer.

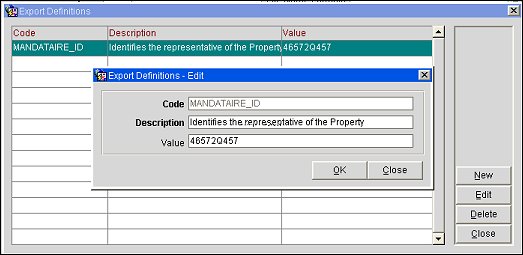

The MandataireID value identifies the representative of the company (the hotel) that is filing the tax export. MandataireID is configured for the export by using the Export Definitions feature.

For the MANDATAIRE_ID code, provide the following and select the OK button.

Description. Description of the Mandataire ID.

Value. ID value.

EXP_FOLIOTAX_SUMM_XML

The pre-export procedure populates a temp table with the export data . The pre-export procedure is: exp_country.exp_country.tax_export('BE').

The post-export procedure exp_create_data.delete_report_table cleans up the data added to the temp table by the pre-export procedure.

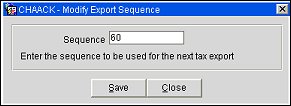

The 4-character export sequence number will be added to the TAX ID in the ControlRef attribute of the VatList element. In order to change the sequence number for the next export select Miscellaneous>File Export>Modify Sequence.

Note: This menu option is dependent on the user permission General>Change Export Sequence. The permission will only be visible when application parameter Exports>Country Exports application parameter is set to Y and the Country Mode = BE.

On selecting this menu option, the user is presented with a screen that displays the last sequence number for the XML_TAX_EXPORT.

Enter a new sequence and select Save. Upon update, the SEQ_VALUE in the CONTROL_SEQ_INFO table will be changed to the value set by the user. This value will be the sequence number that is applied to the next export.

'XML'

XML

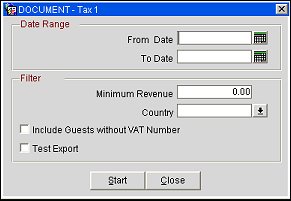

The TAX1.FMB parameter form is used to generate the export. Select the Test Export check box if you wish to include an optional Test attribute having a value set to '1'. When the check box is not selected, the Test attribute is not included in the export.

Provide the following information and select the Start button.

From Date/To Date. Dates to be included in the export.

Minimum Revenue. Minimum revenue for a reservation to be included in the export. The default is 0.00.

Country. Country attached to the reservation profile in order for the reservation to be included in the export.

Include Guests without VAT Number. Select this check box to include reservations for guests that do not have a VAT Number attached to their profile. This check box is unselected by default.

Test Export. Select this check box to run a test export. The XML export file will include a Test attribute set to '1'. The receiving entity can use this attribute to identify the export as a test. This check box is unselected by default.

Element |

Description |

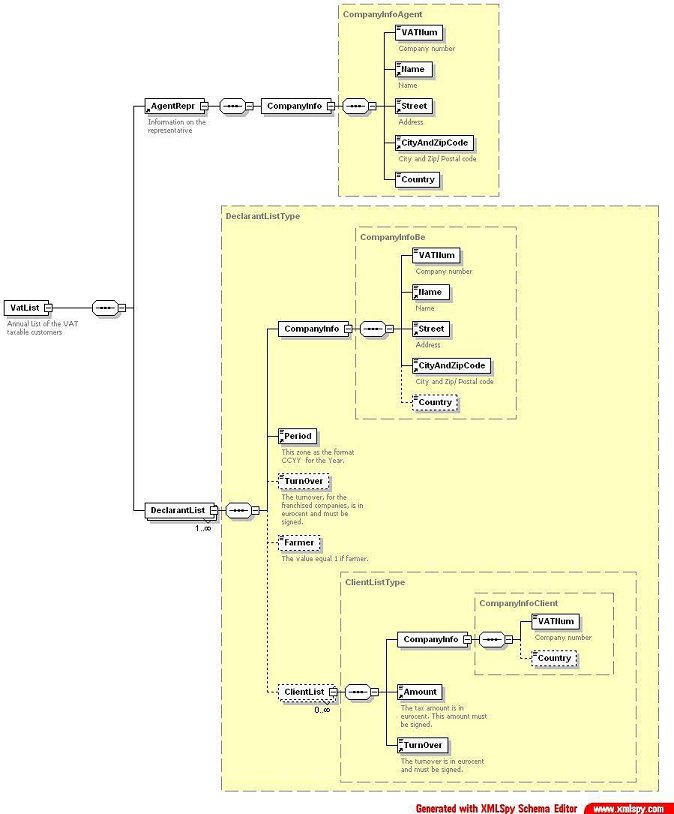

VatList |

Root element for the Annual list. |

AgentRepr |

Sending Hotel |

DeclarantList |

Contains all elements or the annual list. |

ClientList |

Customer description (Belgian account). |

CompanyInfo |

Company description. |

VATNum |

VAT number of the hotel/customer. |

Name |

Name of the hotel/customer. |

Street |

Street address of the hotel/customer. |

CityAndZipCode |

City and ZIP code of the hotel/customer address. |

CountryList |

Country code of the hotel/customer address. In the complextype CompanyAgentInfo this value is required. or the complextypes CompanyInfoBe and CompanyInfoClient the value is optional. |

Period |

Period of this declaration. |

TurnOver |

Net amount. |

Amount |

Total VAT. |

Feature |

Description |

namespace |

http://www/minfin.fgov.be/VatList |

children |

AgentRepr DeclarantList |

attributes |

RecipientId (required): This identifies the recipient of the message, which is the VAT administration. The value of the identifier is 'VATADMIN'. SenderId (required): This identifies the sender of the message. The TAX ID of the property is used for this. ControlRef (required): This is the unique reference number assigned by the sender to the message. The reference number is used for message identification and integrity purposes. The first 10 characters are again the property TAX ID and the last 4 characters are a sequential number of the sending message that should increase with each export generation but also adjustable at runtime. MandataireId (required): This identifies the representative of the sending company. This is a string of 14 characters and is specific for every property so this should be configurable on a property level. SenderDate (required): This is the date when the message was prepared following the format CCYYMMDD. VersionTech (required): This attribute receive the version number of the technical annex, currently this should be 1.2. Test (optional): If the Test Indicator is set to '1' the message is for testing purposes otherwise this attribute should not be used. The presence of the attribute should be controlled by a checkbox on the parameter form (tax1). |

annotation |

documentation Annual list of the VAT taxable customers |

source |

<xs:element name="VatList"> |

Feature |

Description |

namespace |

http://www/minfin.fgov.be/VatList |

children |

CompanyInfo |

used by |

element VatList |

attributes |

DecNumber (required): indicates how many DeclarantList elements are included in the file. |

annotation |

documentation Information on the property |

source |

<xs:element name="AgentRepr"> <xs:annotation> <xs:documentation>Information on the property</xs:documentation> </xs:annotation> <xs:complexType> <xs:annotation> <xs:documentation>Property information</xs:documentation> </xs:annotation> <xs:sequence> <xs:element name="CompanyInfo" type="CompanyInfoAgent"/> |

Feature |

Description |

namespace |

http://www/minfin.fgov.be/VatList |

type |

CompanyInfoAgent |

children |

VATNum Name Street CityAndZipCode Country |

used by |

element AgentRepr |

source |

<xs:element name="CompanyInfo" type="CompanyInfoAgent"/> |

Feature |

Description |

namespace |

http://www/minfin.fgov.be/VatList |

type |

string |

facets |

maxLength 12 |

used by |

DecNumber (required): indicates how many DeclarantList elements are included in the file. |

annotation |

Documentation When this element is used by the complex types CompanyInfoAgent of CompanyInfoBe the value should be the property tax id. When it is used by CompanyInfoClient it should be the value of the field TAX1_NO from the account screen. |

source |

<xs:element name="VATNum"> <xs:annotation> <xs:documentation>Company number</xs:documentation> </xs:annotation> <xs:simpleType> <xs:restriction base="xs:string"> <xs:maxLength value="12"/> </xs:restriction> </xs:simpleType> </xs:element> |

Feature |

Description |

namespace |

http://www/minfin.fgov.be/VatList |

type |

string |

facets |

maxLength 32 |

used by |

complextypes CompanyInfoAgent CompanyInfoBe |

annotation |

documentation Name |

source |

<xs:element name="Name"> <xs:annotation> <xs:documentation>Name</xs:documentation> </xs:annotation> <xs:simpleType> <xs:restriction base="xs:string"> <xs:maxLength value="32"/> </xs:restriction> </xs:simpleType> </xs:element> |

Feature |

Description |

namespace |

http://www/minfin.fgov.be/VatList |

type |

string |

facets |

maxLength 24 |

used by |

complextypes CompanyInfoAgent CompanyInfoBe |

annotation |

documentation Address |

source |

<xs:element name="Street"> <xs:annotation> <xs:documentation>Address</xs:documentation> </xs:annotation> <xs:simpleType> <xs:restriction base="xs:string"> <xs:maxLength value="24"/> </xs:restriction> </xs:simpleType> </xs:element> |

Feature |

Description |

namespace |

http://www/minfin.fgov.be/VatList |

type |

string |

facets |

maxLength 30 |

used by |

complextypes CompanyInfoAgent CompanyInfoBe |

annotation |

documentation City and Zip/Postal Code |

source |

<xs:element name="CityAndZipCode"> <xs:annotation> <xs:documentation>City and Zip/ Postal code</xs:documentation> </xs:annotation> <xs:simpleType> <xs:restriction base="xs:string"> <xs:maxLength value="30"/> </xs:restriction> </xs:simpleType> </xs:element> |

Feature |

Description |

namespace |

http://www/minfin.fgov.be/VatList |

type |

string |

facets |

maxLength 2 |

used by |

complextypes CompanyInfoAgent CompanyInfoBe CompanyInfoClient |

source |

<xs:element name="Country" type="CountryList" /> |

Feature |

Description |

namespace |

http://www/minfin.fgov.be/VatList |

type |

DeclarantList Type |

children |

CompanyInfoBe Period ClientList (TurnOver and Farmer are not listed as children here because in the scope of our customers these elements are not required in the export definition) |

used by |

element VatList |

attributes |

SequenceNum (required): Sequential number of the declaration DeclarantNum (required): This is the unique reference number assigned by the sender to the declaration. This number is constructed with the ControlRef number plus 5 sequential numbers which make up 19 digits. As these last 5 digits have not a real function within the scope of the OPERA properties this can be set to ‘00000’. ClientNbr (required): This attribute contains the number of clients in this declaration. This is used as a validation check. TurnOverSum (required): This attribute summarizes all turnover amounts from the clients. This is used as a validation check. If this amount is negative it should be signed. TaxSum (required): This attribute summarizes all the tax amounts from the clients. This is used as a validation check. This amount is signed. |

source |

<xs:element name="AgentRepr"> <xs:annotation> <xs:documentation>Information on the property</xs:documentation> </xs:annotation> <xs:complexType> <xs:annotation> <xs:documentation>Property information</xs:documentation> </xs:annotation> <xs:sequence> <xs:element name="CompanyInfo" type="CompanyInfoAgent"/> |

|

<xs:element name="DeclarantList" type="DeclarantListType" maxOccurs="unbounded"/> |

Feature |

Description |

namespace |

http://www/minfin.fgov.be/VatList |

type |

string |

children |

VATNum Name Street CityAndZipCode Country |

source |

<xs:element name="CompanyInfo" type="CompanyInfoBe"/> |

Feature |

Description |

namespace |

http://www/minfin.fgov.be/VatList |

type |

year |

used by |

complexType DeclarantListType |

annotation |

documentation This zone as the format CCYY for the Year. |

source |

<xs:element name="Period" type="xs:gYear"> <xs:annotation> <xs:documentation>This zone as the format CCYY for the Year.</xs:documentation> </xs:annotation> </xs:element> |

Feature |

Description |

namespace |

http://www/minfin.fgov.be/VatList |

type |

ClientList Type |

children |

CompanyInfoClient Amount TurnOver |

attributes |

SequenceNum (required): Sequential number of the declaration |

source |

<xs:element name="ClientList" type="ClientListType" minOccurs="0" maxOccurs="unbounded"/> |

Feature |

Description |

namespace |

http://www/minfin.fgov.be/VatList |

type |

CompanyInfoClient |

children |

VATNum Country |

source |

<xs:element name="CompanyInfo" type="CompanyInfoClient"/> |

Feature |

Description |

namespace |

http://www/minfin.fgov.be/VatList |

type |

long |

facets |

totalDigits 13 |

used by |

complextype ClientListType |

annotation |

documentation The tax amount is in eurocent. Total VAT amount (TAX1 + TAX2 + TAX3). |

source |

<xs:element name="Amount"> <xs:annotation> <xs:documentation>The tax amount is in eurocent. This amount must be signed.</xs:documentation> </xs:annotation> <xs:simpleType> <xs:restriction base="xs:long"> <xs:totalDigits value="13"/> </xs:restriction> </xs:simpleType> </xs:element> |

Feature |

Description |

namespace |

http://www/minfin.fgov.be/VatList |

type |

long |

facets |

totalDigits 13 |

used by |

complextype ClientListType |

annotation |

documentation The turnover is in eurocent and must be signed. Net revenue including city tax (NETAMT1 + NETAMT2 +NETAMT3 +TAX10). |

source |

<xs:element name="TurnOver"> <xs:annotation> <xs:documentation>The turnover is in eurocent and must be signed.</xs:documentation> </xs:annotation> <xs:simpleType> <xs:restriction base="xs:long"> <xs:totalDigits value="13"/> </xs:restriction> </xs:simpleType> </xs:element> |

Notes:

1. Export seq 6 Tag MadataireId: This should always be 14 characters.

Variable Length unchecked

Length set to 14

Value = “LPAD(EXPORT_DATA_P.GET_PARAMETER('MANDATAIRE_ID'),14)”

2. Export seq 7 Tag SenderDate: The date format is RRRR-MM-DD.

Value = “TO_CHAR(TZ.GET_PROPERTY_DATE(PMS_P.RESORT,SYSDATE),'RRRR-MM-DD')”

3. Export seq 15 Tag DeclarantList: This is a complex element:

• Seq 2 Tag DeclarantNum: The definition is "This is the unique reference number assigned by the sender to the declaration. This number is constructed with the ControlRef number plus 5 sequential numbers which make up 19 digits. As these last 5 digits have not a real function within the scope of the OPERA properties this can be set to ‘00000’."

• Seq 8 Tag ClientList: This is a complex element:

- Seq 3 Tag Amount: Due to recent VAT changes in Belgium, there are now 4 VAT percentages possible in Belgium. So to reflect this new regulation in the VAT export the value should be “TO_CHAR((TAX1+TAX2+TAX3+TAX4)*(POWER(10,RESORT_CURRENCY_DECIMALS)),'FM9999999999999999')”

- Seq 2 Tag CompanyInfo: This is a complex element: