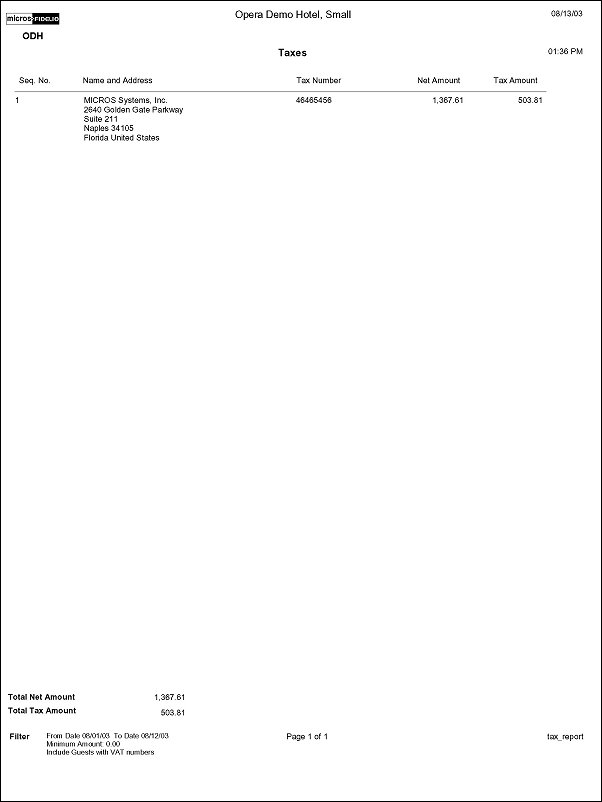

Tax Report (tax_report with TAX1.FMX)

Note: When printing this Report help topic, we recommend printing with Landscape page orientation.

The Tax Report was created to adhere to legal reporting requirements in Belgium. However, the report was created to only use Belgium requirements when the country field is configured to Belgium in the Property Details setup. The report can therefore be used by anyone, regardless of the Country.

The output contains the total amounts posted to a Company/Travel Agent/Source/Group Profile. The report output will display the Sequence Number, Tax Number, Net Amount and Tax amount posted to a Company, Travel Agents, Source, or Group Profiles. If there are any transfers of charges, then the target account will have the charges displayed.

Date Range. Select a date range to display. It must be equal to or less than current Business Date.

Minimum Revenue. Select the minimum amount of revenue that was posted to the AR Account.

Country. Select a single country or all countries attached to the Profile for the AR Account.

Include Guests with no VAT Number. When checked, the report displays all guest accounts. Only Company, Travel Agent, Source and Group Profiles can have a VAT number assigned.

Preview. Select to preview the report in a PDF format.

Print. Select to print the report.

File. Select to save the report as a file.

Close. Select to exit the specific report.