Tax Exempt (taxexempt_02 with GEN1.FMX)

Note: When printing this Report help topic, we recommend printing with Landscape page orientation.

When the Cashiering>Tax Type Calculation application setting is set to Reservation, and the Cashiering>Advanced Generates application parameter is set to Y, the Tax Exempt report can be run. The Tax Exempt report gives a detailed daily breakdown of room revenue and the taxes that each specific guest is exempt from. Main areas of the report display the Tax Exempt, Auto Adjust, and Adjusted Tax Exempt data. The Tax exempt Section displays the Room Revenue for after when the guest became tax exempt, number of nights of the reservation after the guest became tax exempt, and the tax on the room revenue after the guest became tax exempt.

Note: This report does not include and does not display No Show or Cancelled reservations.

This date range will only display guests that were already tax exempt and fall within the selected dates.

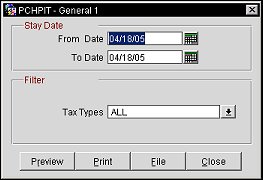

From Date. Manually enter, or select the Calendar button to choose, for the beginning date of the date range.

To Date. Manually enter, or select the Calendar button to choose, for the ending date of the date range.

Tax Types. Select the down arrow to select one or more tax exempt types from the multi-select list of values. Tax Types are configured in Configuration>Cashiering>Tax Types.

Preview. Select to preview the report in a PDF format.

Print. Select to print the report.

File. Select to save the report as a file.

Close. Select to exit the specific report.

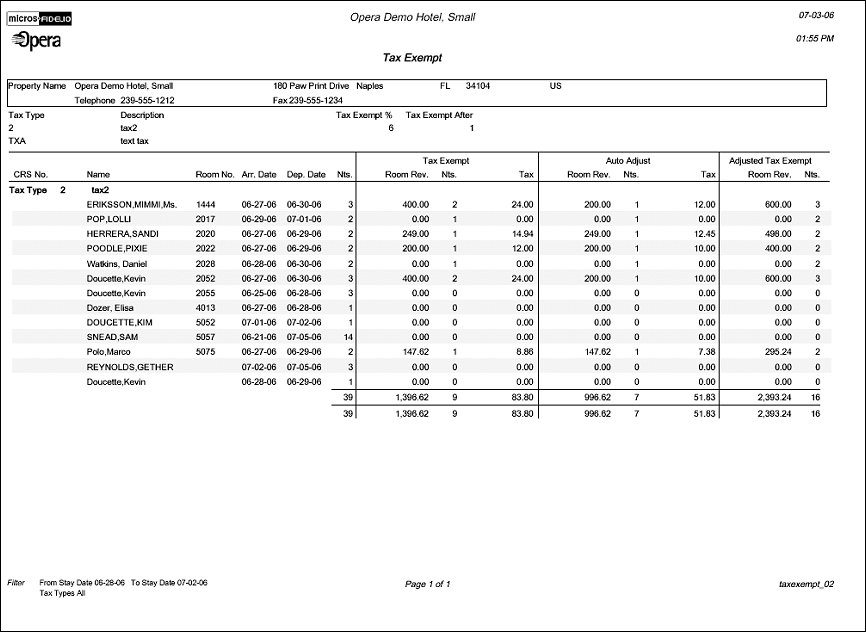

At the top of the report, property information (name, address, phone, fax) is displayed. Then the configuration of the tax types (code, description, tax %, exempt after x days) is displayed.

In the main section of the report, one row for each reservation that has a tax type attached to the reservation (not to the profile) and has at least one stay date within the report's date range and is already tax exempt. This main section is divided horizontally into four sections: Reservation information, Tax Exempt, Auto Adjust, and Adjusted Tax Exempt.

CRS No.

Name of the Guest

Room No.

Arrival Date

Departure Date

Nights

Room Revenue - Room revenue that was posted within the date range of the report, but only for days after the guest became tax exempt (trx_date>= exempt_date).

Nights - Number of nights within the reports date range after the guest became tax exempt.

Tax - Tax on room revenue within the reports date range, but only for days after the guest became tax exempt. This cannot be calculated from financial_transaction because there are never any taxes posted due to the fact that the guest is tax exempt. This value is calculated by applying the tax percentage from the tax type configuration to the room revenue amount in the same section.

Room Revenue - Room revenue for all days before the guest became tax exempt. This (and all other columns in this section) will only print if the day on which the guest became tax exempt falls within the date range of the report. If that is the case then all days before that exempt day will be considered even if they fall outside the report's date range. If the exempt date does not fall within the date range of the report then all columns in this section will display zero.

Nights - Number of nights before the guest became tax exempt.

Tax - Tax paid on room revenue for all days before the guest became tax exempt. This is taken from financial_transaction and will exclude the automatic tax adjustment postings.

Room Revenue - Sum of the room revenue columns from the 'Tax Exempt' and the 'Auto Adjust' sections.

Nights - Sum of the nights columns from the 'Tax Exempt' and the 'Auto Adjust' sections.