Maintaining Institutional Financial Aid Applications

Your institution can gather additional resource information about students and their families by using the College Board PROFILE application which is electronically supported by the System or by entering your institutional application on the pages in this component.

Note: The College Board PROFILE and institutional application data share the same pages. You might unintentionally create multiple institutional aid records for a student from these three sources, which could cause unintended INAS calculation results.

Note: Question marks or blanks on College Board PROFILE data files are converted or appear as zeros in currency based numeric fields.

For further information about the fields in this component, please refer to The College Board's PROFILE User's Guide, available to College Board PROFILE subscribers.

This section lists common elements and discusses how to:

Review student information.

Review parent information.

Review currency information family information, and institutional questions.

Review all computed data for student and parents.

|

Field or Control |

Definition |

|---|---|

| Need Summary |

Click to access the Need Summary page, where you can review the student's federal and institutional need calculations. |

| FM (federal methodology) |

Click to access the INAS Fed Extension page, where you can override INAS Local Policy Options for federal data. |

| IM (institutional methodology) |

Click to access the Institutional Need Calculation Extension 1 page, where you can override INAS Local Policy Options for institutional data. |

| INAS (institutional need analysis system) |

Click to calculate an unofficial federal and institutional Expected Family Contribution (EFC) by using the College Board's Institutional Need Analysis System (INAS). A COBOL program is used to perform the INAS calculation. |

Note: The navigation paths for the pages listed in the following page introduction table are for aid year 20nn-20nn. Oracle supports access for three active aid years with valid INAS calculations. Earlier aid year institutional application data is available for display only at

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Student Data |

INST_STUDENT_nn |

|

View or enter all the information about the student. |

|

Parent Data |

INST_PARENT_nn |

|

View or enter all the parent information. |

|

Miscellaneous Data |

INST_MISC_nn |

|

View or enter signature, family member, school selection, and institutional question (the College Board PROFILE Section Q) information. You can also view FNAR messages on this page. |

|

Computation Data |

INST_COMP_SUMM_nn |

|

View or enter computed parent and student income, allowance, and asset information using your institutional and federal methodology. The computed values appear here. |

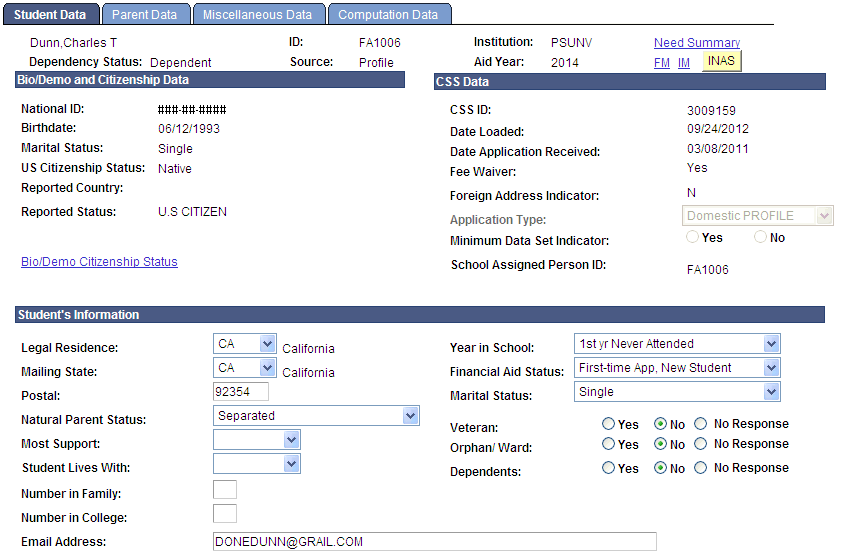

Access the Student Data page ().

Image: Maintain Institutional Application, Student Data tab (page 1 of 3)

This example illustrates the fields and controls on the Maintain Institutional Application, Student Data tab (page 1 of 3). You can find definitions for the fields and controls later on this page.

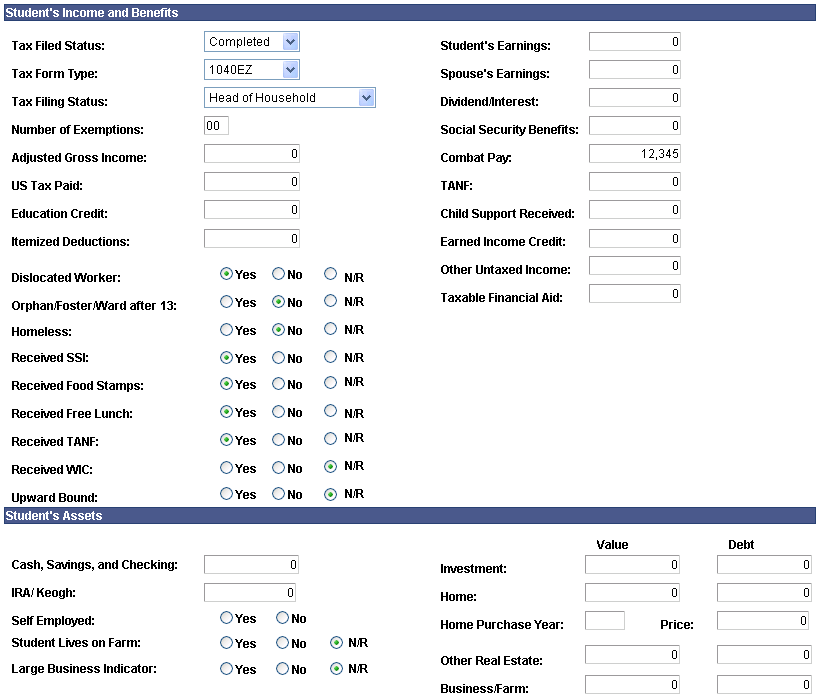

Image: Maintain Institutional Application, Student Data tab (page 2 of 3)

This example illustrates the fields and controls on the Maintain Institutional Application, Student Data tab (page 2 of 3). You can find definitions for the fields and controls later on this page.

Image: Maintain Institutional Application, Student Data tab (page 3 of 3)

This example illustrates the fields and controls on the Maintain Institutional Application, Student Data tab (page 3 of 3). You can find definitions for the fields and controls later on this page.

The system displays the student's name, ID, institution, dependency status, application source, and aid year.

Bio/Demo and Citizenship Data

The data for the fields in this group box are populated from Campus Community Bio/Demo data.

|

Field or Control |

Definition |

|---|---|

| National ID |

Displays the student's National ID. Note: PROFILE supports the loading of an International PROFILE Application Type, and PROFILE-related tables may reflect the National ID (NID) of a foreign student. During the PROFILE Data Load, the system tests if the student's NID meets the format rules defined for the specified country. If the NID meets the test, then a row is inserted into Person Data with the NID and NID Country. If the NID does not meet the test, then a row is inserted into Person Data with the NID Country and that country's default NID. |

| Reported Country |

Displays the student's reported country if not United States of America. |

| Reported Status |

Displays the reported United States citizenship status: U.S CITIZEN, ELIG NON-CITIZEN, or blank |

| Bio/Demo Citizenship Status |

Click this link to access the Campus Community Citizenship/Passport page to confirm the citizenship status of the student's Biographic/ Demographic data against the values in the Reported Country and Reported Status fields. |

CSS Data

|

Field or Control |

Definition |

|---|---|

| CSS ID |

Displays the student's unique identifying number assigned by College Board to ensure both privacy and quick retrieval of records. When you call the College Board inquiry number with questions about specific records, it is helpful to know the student's College Board ID number. |

| Date Loaded |

Displays the date the College Board application was loaded into the system. |

| Date Application Received |

Displays the date the PROFILE application was received by College Board. |

| Fee Waiver |

Displays Yes or No. |

| AP Flag |

Note: This field is not supported after aid year 2010–2011. Displays a Y value from PROFILE only if student passed two or more AP classes with a test grade of 3 or higher. This field is blank if no information is available, the student does not give permission for information to be passed, or the student does not qualify for a Y value. |

| Foreign Address Indicator |

Displays Y if the student has a foreign address. Displays N if the student does not have foreign address. |

| Application Type |

Displays 1 if the application is a Domestic PROFILE and 4 of the application is an International PROFILE. Note: The following Application Types are not loaded into the system: 2 (Noncustodial PROFILE) and 3 (Registration only record). |

| Minimum Data Set Indicator |

Displays status identifying lowest income filers. |

| School Assigned Person ID |

The student's reported ID assigned to the student by the student's school. |

Student's Information

|

Field or Control |

Definition |

|---|---|

| Legal Residence |

Select the student's state of legal residence. Values include US states, Canada (CN), or Mexico (MX). |

| Mailing State |

Select the US state in which the student is a resident. |

| Postal |

Enter the postal code or zip code for the student's state of residence. |

| Natural Parents Marital Status |

Select from Divorced, Married, Never Married Living Separate, Never Married Living Together, Separated, Single Parent Donor Conceived, Single adoptive parent, or Widowed. |

| Most Support |

Select from: Father or Mother. |

| Student Lives With |

Select from: Blank, Father, Mother, or Neither. |

| Number in Family |

Enter the total number of people in the student's household. The system displays 01 through 99 and blank for dependent students. |

| Number in College |

Enter the total number of people in college from the student's household. The system displays 1 through 9 and blank for dependent students. |

| Email Address |

Enter the student's email address. |

| Year in School |

Enter the academic year for which the student is seeking financial aid. |

| Financial Aid Status |

Enter the student's status as it relates to receiving financial aid. |

| Marital Status Code |

Select the marital status to be used for financial aid purposes. This marital status can differ from the Bio/Demo Data page marital status. |

| Veteran |

Select Yes, No or No Response to indicate whether the student is a veteran. |

| Orphan/Ward |

Select Yes, No, or No Response to indicate whether the student is an orphan or ward of the state. |

| Dependents |

Select Yes, No, or No Response to indicate whether the student has dependents. |

Student's Income and Benefits

|

Field or Control |

Definition |

|---|---|

| Tax Filed Status |

Select from blank, Completed, Non Filer, or Will File. |

| Tax Form Type |

Optional. Select from 1040, 1040A, 1040EZ, Canadian, Puerto Rican, Other US, or Other Non—US. |

| Number of Exemptions |

Select the number of exemptions the student claimed on their tax U.S. Federal tax form. |

| Combat Pay |

Displays an amount or is blank. |

| Dislocated Worker |

Select Yes, No, or N/R (not reported). |

| Orphan/Foster/Ward after 13 |

Select Yes, No, or N/R (not reported). |

| Homeless |

Select Yes, No, or N/R (not reported). |

The remaining fields refer directly to items on the U.S. federal tax form or data collected from applicable sources, such as an institutional application or other third-party sources. Enter the values from the student's tax form in the appropriate fields.

Student's Assets

|

Field or Control |

Definition |

|---|---|

| Cash, Savings, and Checking |

Enter a value. |

| IRA/ Keogh |

Enter a value. |

| Self Employed |

Select Yes or No. |

| Student Lives on Farm |

Select Yes, No, or N/R (no response). |

| Large Business Indicator |

Select Yes, No, or N/R (Not Reported). |

| Investment |

Enter the value and debt amounts. |

| Home |

Enter the value and debt amounts. |

| Home Purchase Year |

Enter year home was purchased. |

| Price |

Enter the price of the home indicated in the Home Purchase Year field. |

| Other Real Estate |

Enter the value and debt amounts. |

| Business/Farm |

Enter the value and debt amounts. |

Student's Trust Information

|

Field or Control |

Definition |

|---|---|

| Value of Trust Fund |

Enter the value of the trust in USD. |

| Trust Established by |

Select Other or Parents. |

| Trust Available |

Select Yes, No, or N/R (no response) to indicate the availability of the trust. |

Student's Expenses

Enter values from the student's tax form.

Student's Expected Resources

|

Field or Control |

Definition |

|---|---|

| Veterans Benefits |

Enter the amount of veterans benefits received. The system displays 00 through 12 or blank. |

| Months |

Enter the number of months the veterans benefits were received in the year. |

| VA Benefits Received Code |

Enter the VA Benefits received by the student. Valid values are:

|

| Student's Earnings |

Enter for both summer and school year. |

| Spouse's Earnings |

Enter for both summer and school year. |

| Other Taxable Income |

Enter for both summer and school year. |

| Untaxed Income |

Enter for both summer and school year. |

| Grant/Scholarship |

Enter a value. |

| Tuition Benefits |

Enter a value. |

| Parent(s) Contribution |

Enter a value. |

| Relative's Contributions |

Enter a value. |

| Receive Tuition Benefits |

Indicate whether or not the student receives tuition benefits from the parents' employers. |

| Agencies/Foundation Support |

Indicate whether the student expects to receive from agencies or foundations to pay for educational expenses during any year of attendance. |

| Government Support |

Indicate whether the student expects to receive from her government to pay for educational expenses during any year of attendance. |

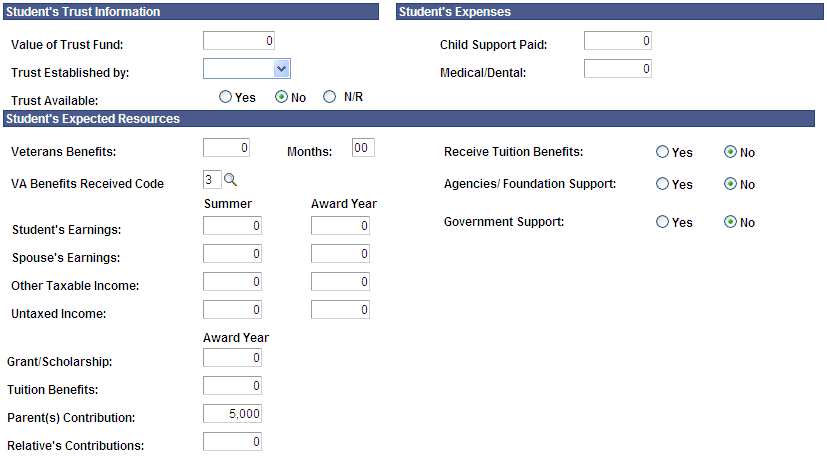

Access the Parent Data page ().

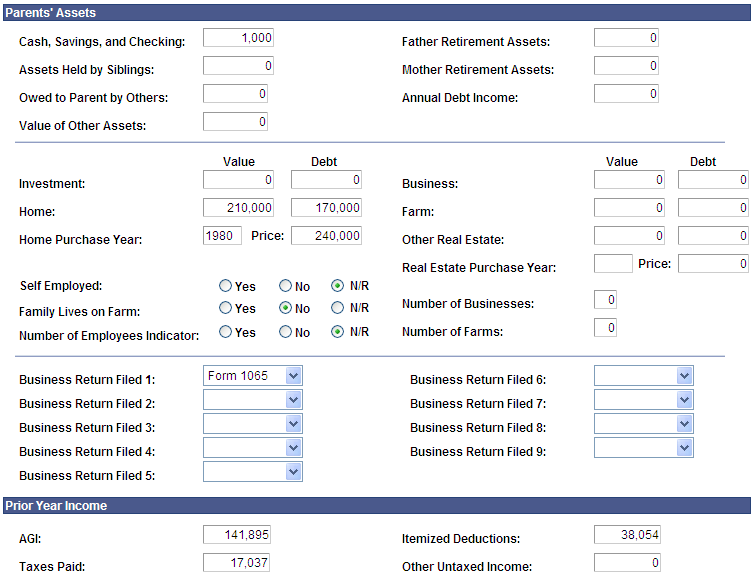

Image: Maintain Institutional Application, Parent Data tab (page 1 of 4)

This example illustrates the fields and controls on the Maintain Institutional Application, Parent Data tab (page 1 of 4). You can find definitions for the fields and controls later on this page.

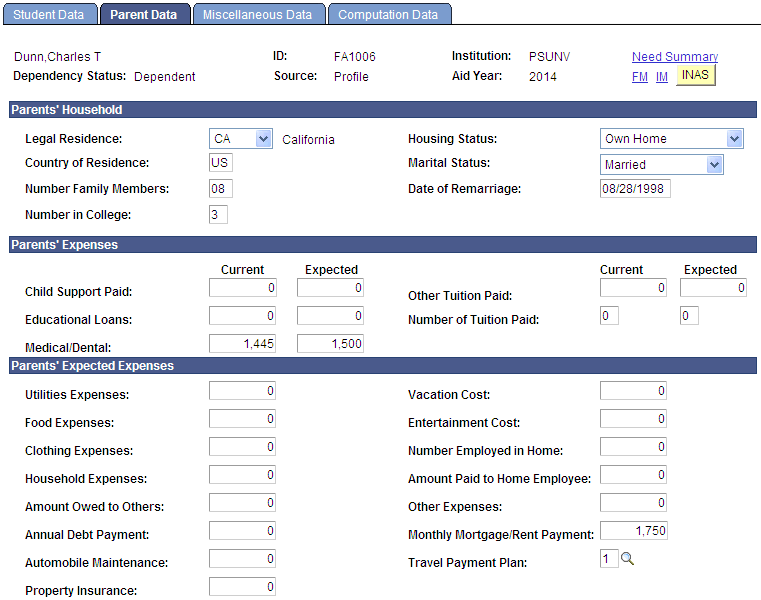

Image: Maintain Institutional Application, Parent Data tab (page 2 of 4)

This example illustrates the fields and controls on the Maintain Institutional Application, Parent Data tab (page 2 of 4). You can find definitions for the fields and controls later on this page.

Image: Maintain Institutional Application, Parent Data tab (page 3 of 4)

This example illustrates the fields and controls on the Maintain Institutional Application, Parent Data tab (page 3 of 4). You can find definitions for the fields and controls later on this page.

Image: Maintain Institutional Application, Parent Data tab (page 4 of 4)

This example illustrates the fields and controls on the Maintain Institutional Application, Parent Data tab (page 4 of 4). You can find definitions for the fields and controls later on this page.

The system displays the student's name, ID, institution, dependency status, application source, and aid year.

Parent's Household

|

Field or Control |

Definition |

|---|---|

| Legal Residence |

Select the legal residence of the parent. Values include US states, Canada (CN), or Mexico (MX). |

| Country of Residence |

Enter the code for the parents' country of residence |

| Number Family Members |

Number of family members in the parent's household. The system displays 01 through 99 and blank for dependent students. |

| Number in College |

Number of dependents in college that are part of the parent's household. This number does not include parents who may be in college. The system displays 1 through 9 and blank for dependent students. |

| Housing Status |

Select Living with Others, Own Home, Provided by Employer, or Rent. |

| Marital Status Code |

Select: Divorced/No Domestic Ptship, Married/Domestic Partnership, Never Married, Remarried, Separated, Widowed or blank. |

| Date of Remarriage |

Displays the date for which the parent remarried. |

Parents' Expenses

Enter both the Current and Expected parents' expenses for these fields.

Parent's Expected Expenses

|

Field or Control |

Definition |

|---|---|

| Utilities Expenses |

Enter the amount the parents report as the annual utility expenses of the family. |

| Food Expenses |

Enter the amount the parents report as the annual food expenses of the family. |

| Clothing Expenses |

Enter the amount the parents report as the annual clothing expenses of the family. |

| Household Expenses |

Enter the amount the parents report as the annual household expenses of the family. |

| Amount Owed to Others |

Enter the amount the parents report as owed to others. |

| Annual Debt Payment |

Enter the amount the parents report as their annual payments against their total debt. |

| Automobile Maintenance |

Enter the amount the parents report as their annual automobile expenses. |

| Property Insurance |

Enter the amount the parents report as the cost of their property insurance. |

| Vacation Cost |

Enter the amount the parents report as spending on vacation costs. |

| Entertainment Cost |

Enter the amount the parents report as spending on entertainment costs. |

| Number Employed in Home |

Enter number of people the parents report as employed in the home. |

| Amount Paid to Home Employee |

Enter the amount the parents report is paid to the employees who work in the home. |

| Other Expenses |

Enter the cost of any parental expenses not reported anywhere else on the PROFILE. |

| Monthly Mortgage/Rent Payment |

Enter the parents' monthly mortgage or rent payment. |

| Travel Payment Plan |

Select the parents' Travel Payment Plan. |

Parent's Assets

|

Field or Control |

Definition |

|---|---|

| Cash, Savings, and Checking |

Enter a value. |

| Assets Held by Siblings |

Enter a value. |

| Owed to Parent by Others |

Enter the amount owed to parents by others |

| Value of Other Assets |

Enter the value of any assets not already reported. |

| Father Retirement Assets |

Can be blank or a number from 0000000 to 9999999. |

| Mother Retirement Assets |

Can be blank or a number from 0000000 to 9999999. |

| Annual Debt Income |

The annual income realized by the parents from debts owed to them. |

| Investment |

Enter both the Value and Debt for this item and all the following items. |

| Home |

Enter a value. |

| Home Purchase Year |

Purchase year of the parent's home. |

| Price |

Purchase price of the parents' home. |

| Self Employed |

Select Yes, No, or N/R (no response). |

| Family Lives on Farm |

Select Yes, No, or N/R (no response). |

| Number of Employees Indicator |

Select Yes, No, or N/R (no response). |

| Business |

Enter value and debt amounts for the business. |

| Farm |

Enter value and debt amounts for the farm. |

| Other Real Estate |

Enter value and debt amounts for other real estate. |

| Real Estate Purchase Year |

Enter purchase year of any other real estate. |

| Price |

Enter purchase price of any other real estate. |

| Number of Businesses |

Enter a number 0 to 9 or leave blank. |

| Number of Farms |

Enter a number 0 to 9 or leave blank. |

| Business Return Filed Fields 1 through 9 |

Enter the type of Business Tax return filed. |

Prior Year Income

|

Field or Control |

Definition |

|---|---|

| AGI |

Adjusted gross income from the prior year's tax form. |

| Taxes Paid |

Enter a value. |

| Itemized Deductions |

Total of the prior year's itemized deductions. |

| Other Untaxed Income |

Enter a value. |

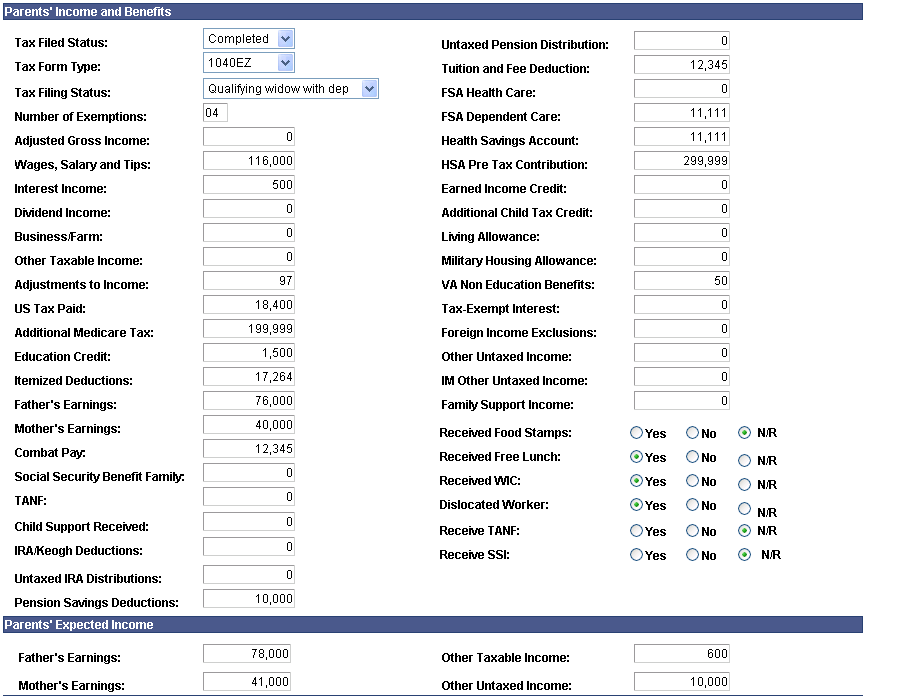

Parent's Income and Benefits

Many fields in this group box refer to items on the U.S. federal tax form or data collected from applicable sources, such as your institution's financial aid application or other third-party sources.

|

Field or Control |

Definition |

|---|---|

| Tax Filed Status |

Select from blank, Completed, Non Filer, or Will File. |

| Tax Form Type |

Optional. Select from 1040, 1040A, 1040EZ, Canadian, Puerto Rican, Other US, or Other Non—US. |

| Number of Exemptions |

Select the number of exemptions the parents claimed on their tax U.S. federal tax form. |

| Combat Pay |

Displays an amount or is blank. |

| Social Security Benefit Family |

Enter untaxed social security benefits. |

| Other Untaxed Income |

Enter other untaxed income. |

| Receive TANF |

Select Yes, No, or N/R (no response). |

| Receive SSI |

Select Yes, No, or N/R (no response). |

The remaining fields refer directly to items on the U.S. federal tax form or data collected from applicable sources, such as an institutional application or other third-party sources. Enter the values from the Parent's tax form in the appropriate fields.

Parents' Expected Income

Enter values from the parents' tax form.

Parents' Information

|

Field or Control |

Definition |

|---|---|

| Parent Type 1 and Parent Type 2 |

Select the type of parent providing information on the PROFILE and assigned to the traditional father (1) or mother (2) position.

|

| DOB Parent 1 and DOB Parent 2 |

Indicates the reported parents' dates of birth. The information is reported as MM/DD/YYYY or the field may be blank. |

| Attended College Code 1 and Attended College Code 2 |

Indicates if the parent attended college and if on a full-time or part-time basis. |

| College Type Code 1 and College Type Code 2 |

Indicates the type of college the parent attended. |

| Computed Age 1 and Computed Age 2 |

Indicates the calculated age for the parent. |

| Occupation Parent 1 and Occupation Parent 2 |

Indicates the occupation and can be blank. |

| Employer Parent 1 and Employer Parent 2 |

Indicates the employer and can be blank. |

| Custodial Parent |

Identifies a dependent student's custodial parent when the biological/adoptive parents are separated, divorced, or were never married. Values include: Father and Mother. |

| Email Address |

Displays the parents' preferred email address. This field can be blank or contain up to 35 characters. |

Non-Custodial Parent Info

|

Field or Control |

Definition |

|---|---|

| Separation Year |

Enter the year of the separation. |

| Divorce Year |

Enter the year of the divorce. |

| Non-Custodial Parent Contribution |

Enter the financial contribution to the student by the non-custodial parent. |

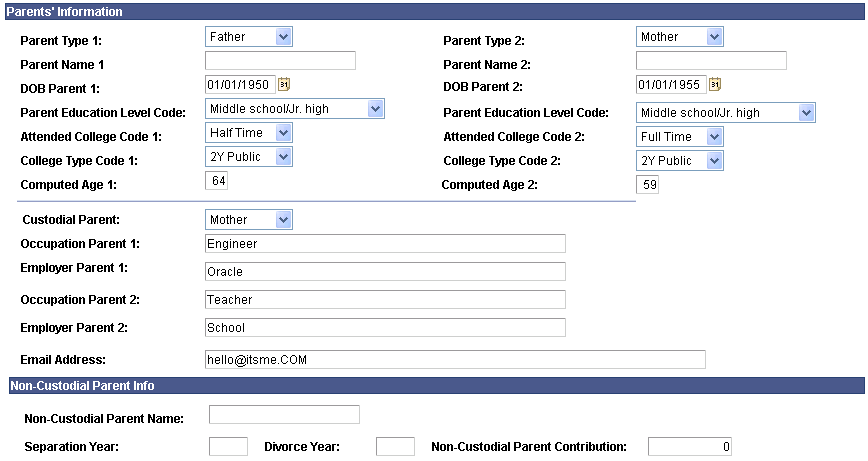

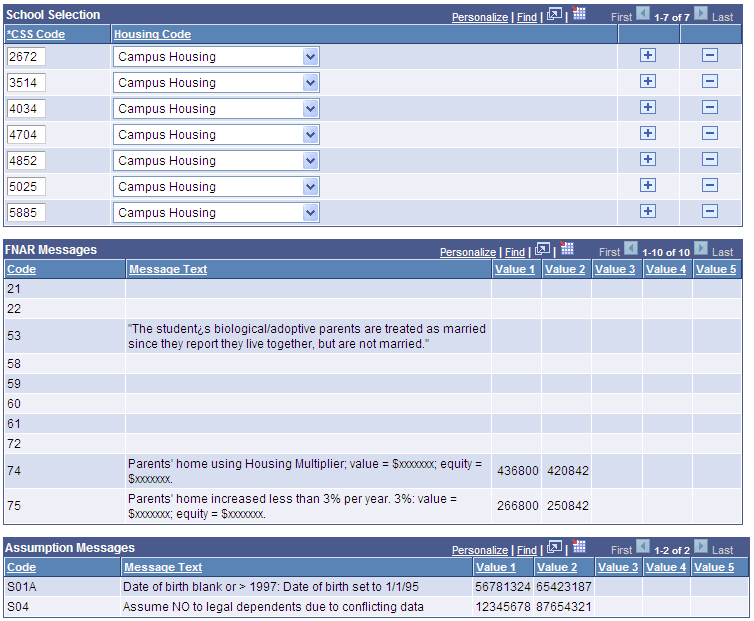

Access the Miscellaneous Data page ().

Image: Maintain Institutional Application, Miscellaneous Data tab (1 of 3)

This example illustrates the fields and controls on the Maintain Institutional Application, Miscellaneous Data tab (1 of 3). You can find definitions for the fields and controls later on this page.

Image: Maintain Institutional Application, Miscellaneous Data tab (2 of 3)

This example illustrates the fields and controls on the Maintain Institutional Application, Miscellaneous Data tab (2 of 3). You can find definitions for the fields and controls later on this page.

Image: Maintain Institutional Application, Miscellaneous Data tab (3 of 3)

This example illustrates the fields and controls on the Maintain Institutional Application, Miscellaneous Data tab (3 of 3). You can find definitions for the fields and controls later on this page.

The system displays the student's name, ID, institution, dependency status, application source, and aid year.

Currency Information

|

Field or Control |

Definition |

|---|---|

| Currency Code |

Enter the currency in which the original data was reported by the student. |

| Currency Rate |

Enter the currency conversion rate used to process the student's data. |

| Country Coefficient |

Enter the country coefficient used to process the student's data. |

| Converted Currency Code |

Enter the original currency converted into US dollars reported by citizens living abroad and Canadians. |

| Converted Currency Rate |

Enter the rate the student used in converting their currency into US dollars. Reported by citizens living abroad and Canadians. |

Explanation / Certification

|

Field or Control |

Definition |

|---|---|

| Special Circumstances |

Select this check box to indicate that the student/family has notified the institution of Special Circumstances that may affect the calculation of financial need. The College Board PROFILE also uses the information listed in Section Q to set this indicator flag to inform the institution that modified institutional questions exist for the student. |

| Explanations Text |

Displays the actual explanations and special circumstances text provided by the filer. |

Family Members

|

Field or Control |

Definition |

|---|---|

| Relationship |

Select the relationship to the student. |

| Age |

Enter the family member's age. |

| Attend College |

Select blank, Yes, Full-Time,Yes, Half-Time, or No, Will Not Attend. |

| College Type |

Select a college type. |

School Selection

|

Field or Control |

Definition |

|---|---|

| CSS Code |

This is the institution's code number as reported by the student on the PROFILE application. Each school the student selected to receive their application is listed. |

| Housing Code |

This is the type of housing the student expects to have. |

FNAR Messages

The system displays the Financial Need Analysis Report message number, message text, and message Values 1 through 5, if any. These College Board PROFILE messages inform you about processing exceptions to data received and assumptions that should be taken into consideration when reviewing the institutional application.

Assumption Messages

The system displays the CSS INAS IM Assumptions alphanumeric code, message text, and value, if any. These are the INAS Assumptions triggered during the need analysis methodology and include the full text of the e-FNAR assumption generated by the PROFILE system and any corresponding values.

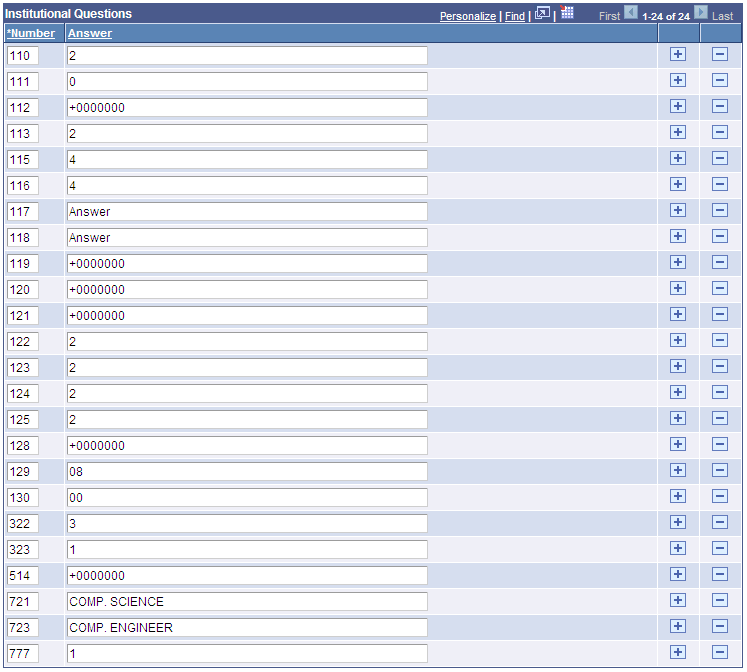

Institutional Questions

|

Field or Control |

Definition |

|---|---|

| Number |

Number of an application question that the student/family believes warrants further explanation. This number may also refer to a series of additional questions that have been modified for the institution by College Board PROFILE. |

| Answer |

Answer to the question shown in the Number field. |

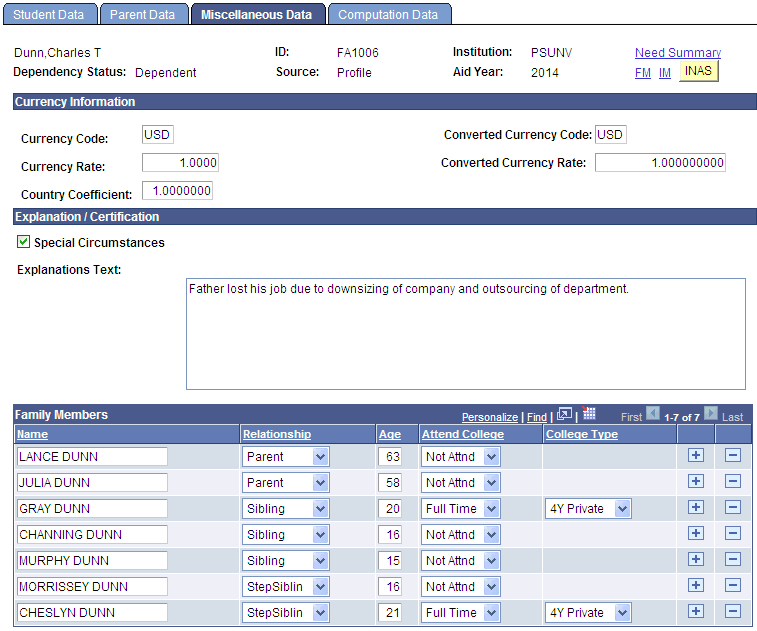

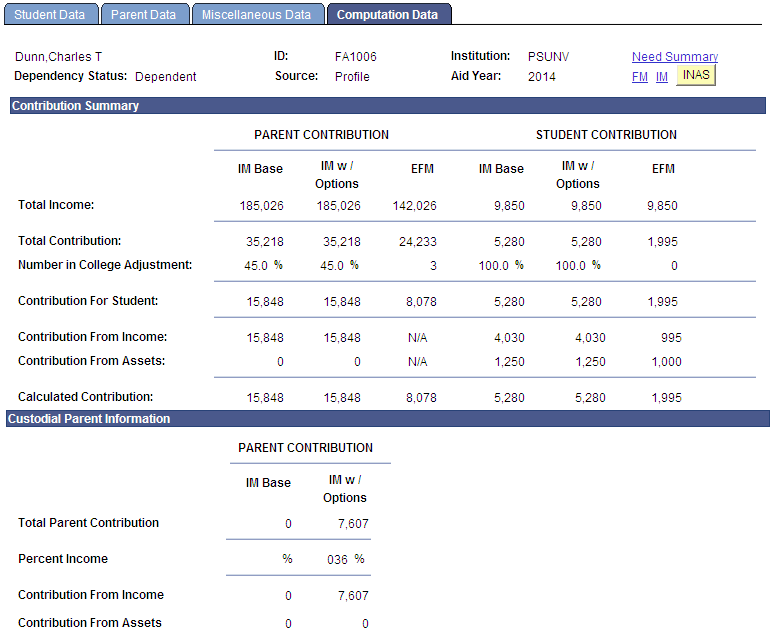

Access the Computation Data page ().

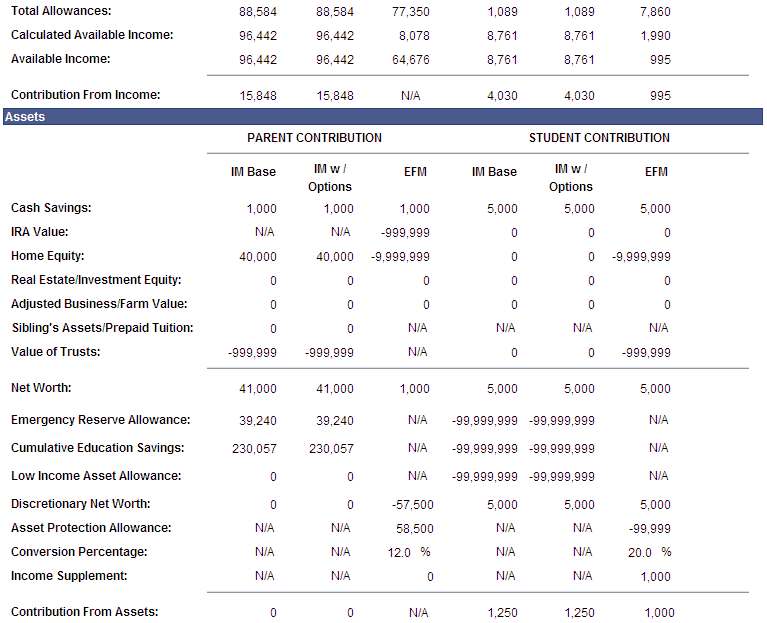

Image: Maintain Institutional Application, Computation Data tab (page 1 of 3)

This example illustrates the fields and controls on the Maintain Institutional Application, Computation Data tab (page 1 of 3). You can find definitions for the fields and controls later on this page.

Image: Maintain Institutional Application, Computation Data tab (page 2 of 3)

This example illustrates the fields and controls on the Maintain Institutional Application, Computation Data tab (page 2 of 3). You can find definitions for the fields and controls later on this page.

Image: Maintain Institutional Application, Computation Data tab (page 3 of 3)

This example illustrates the fields and controls on the Maintain Institutional Application, Computation Data tab (page 3 of 3). You can find definitions for the fields and controls later on this page.

Note: Beginning with the 2011-2012 Aid Year, the PROFILE XML file contains only the IM with Options calculations except for Custodial Parent, which contains only the IM Base calculation. However, INAS always generates both the IM Base and IM with Options calculations. This means that the Computation Data page displays data differently depending upon whether or not INAS has been invoked.

Note: Computation tables display no intermediate values until the INAS calculation is called using batch or online calculation.

The system displays the student's name, ID, institution, dependency status, application source, and aid year.

This page is designed to display computed need analysis results based on both the parent's and student's information. Therefore, the page displays a Parent Contribution Section and a Student Contribution Section. The following sections describe what each column represents.

Note: To more closely align interim calculation results with the Estimated Federal Methodology (EFM) computation worksheets from the College Board, the Computation Data page displays an N/A value for several fields. For parents of dependent students and independent students with dependents, EFM calculations display N/A for From Income, From Assets, Total Contribution - Income and Total Contribution - Assets fields.

Contribution Summary

The PARENT CONTRIBUTION section displays three columns: IM Base, IM w/Options, and EFM.

The IM Base column displays standard base INAS calculations. Although the IM Base calculation is not delivered as part of the PROFILE record, Oracle supports calculating the College Board's IM Base calculation if INAS is invoked after the initial load of the PROFILE record.

The IM w/Options column is the result of using the institutional options that you set up when you defined your institutional methodology. IM w/Options is delivered as part of the PROFILE record.

The EFM column displays the estimated federal methodology amount. Financial aid administrators are reminded that the EFM is always estimated and never official.

The STUDENT CONTRIBUTION section displays three columns: IM Base, IM w/ Options, and EFM.

The IM Base column displays standard base INAS calculations. Although the IM Base calculation is not delivered as part of the PROFILE record, Oracle supports calculating the College Board's IM Base calculation if INAS is invoked after the initial load of the PROFILE record.

The IM w/Options column is the result of using the institutional options that you set up when you defined your institutional methodology. IM w/Options is delivered as part of the PROFILE record.

The IM Estimated column displays an estimated calculation for the student's contribution. The IM Estimated result is based on using the estimated summer and academic year data. The FNAR computations for this section are based on nine-month calculation regardless of the student's dependency status.

The EFM column displays the estimated federal methodology amount. Financial aid administrators are reminded that the EFM is always estimated and never official.

|

Field or Control |

Definition |

|---|---|

| Total Income |

Indicates the custodial parent's total contribution for the student from the base IM computation. |

Custodial Parent Information

The system displays the calculations for Total Income, Total Contribution, Number in College Adjustment, Contribution for Student, contribution From Income, and contribution From Assets for Parent's Contribution and Student's Contribution.

For the PARENT CONTRIBUTION IM Base:

|

Field or Control |

Definition |

|---|---|

| Percent Income |

Indicates the custodial parent's percentage of total parents income from the base IM computation. |

| Contribution From Income |

Indicates the custodial parent's contribution from income for the student from the base IM computation. |

| Contribution From Assets |

Indicates the custodial parent's contribution from assets for the student from the base IM computation. |

For the PARENT CONTRIBUTION IM w/Options

|

Field or Control |

Definition |

|---|---|

| Percent Income |

Indicates the custodial parent's percentage of total parental income from the option IM computation. |

| Contribution From Income |

Indicates the custodial parent's contribution from income for the student from the option IM computation. |

| Contribution From Assets |

Indicates the custodial parent's contribution from assets for the student from the options IM computation. |

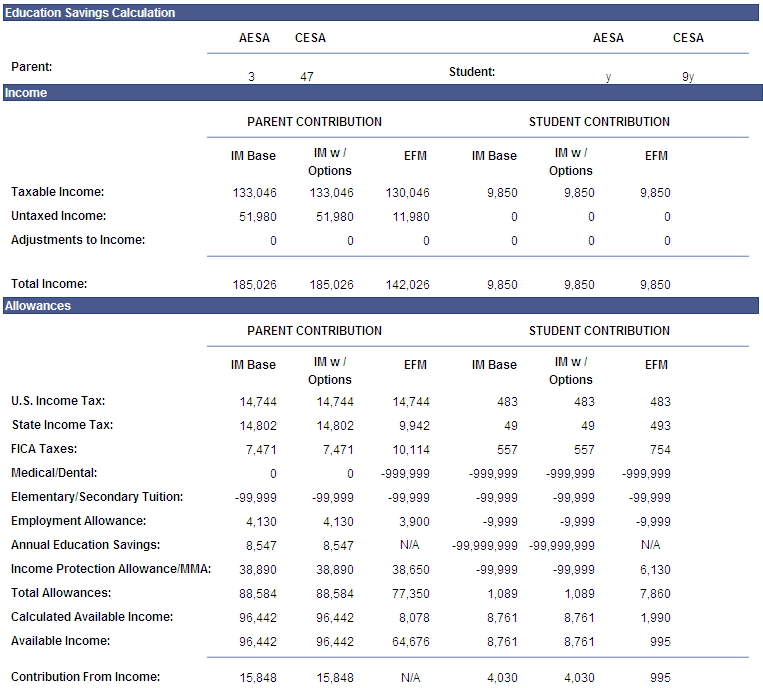

Education Savings Calculations

The system displays the Parent's and the Student's Annual Education Savings Allowance (AESA) and Cumulative Education Savings Allowance (CESA) calculations. These are PROFILE specific calculated values used in INAS calculations for Institutional Methodology.

Income

The system displays the calculations for Taxable Income, Untaxed Income, Adjustments to Income, and Total Income for Parent's Contribution and Student's Contribution.

Allowances

The system displays the calculations for U.S. Income Tax, FICA Taxes, Medical/Dental, Elementary/Secondary Tuition, Employment Allowance, Annual Education Savings, Income Protection Allowance/MMA, Total Allowances, Calculated Available Income, and Available Income for Parent's Contribution and Student's Contribution. The Total Contribution - Income amount is the sum of all the fields in the Allowances section.

Assets

The system displays the calculations for Cash Savings, IRA Value, Home Equity, Real Estate/Investment Equity, Adjusted Business/Farm Value, Sibling's Assets/Prepaid Tuition, Value of Trusts, and Net Worth for Parent's Contribution and Student's Contribution.

The system displays the calculations for Emergency Reserve Allowance, Cumulative Education Savings, Low Income Asset Allowance, Discretionary Net Worth, Asset Protection Allowance, Conversion Percentage, and Income Supplement for Parent's Contribution and Student's Contribution. The Total Contribution - Assets amount is the sum of all the fields in the Assets section.