Reviewing Loan Origination Information

This section discusses how to:

Update borrower information.

Update loan demographic data.

Enter loan relationship information.

Review student loan eligibility.

Manage FFELP serial loan processing.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Loan Origination 1 |

SFA_CRC_LOAN_ORIG |

|

Review and update student and borrower information, CommonLine version, and loan destination processing options. |

|

Loan Demographic Data – THIS APPLICATION ONLY – |

LOAN_ORIG_SEC2 |

Click the Loan Demographic link on the Loan Origination 1 page. |

View the borrower's demographic data and the student's term and demographic information. Update loan demographic data used at the time the loan was originated. |

|

Loan Relationship Information |

LN_RELATE_SEC |

Click the Select Ref/Csgn button on the Loan Origination 1 page. |

View or create relationships for the student or borrower. |

|

Current Address Information |

LN_ORIG_REL_ADDR |

Click the Detail link next to the Years at Current Address field on the Loan Relationship Information page. |

View the borrower's current address. |

|

Employment Information |

LN_ORIG_REL_EMPL1 |

Click the Current Employment link on the Loan Relationship Information page. |

Review and update current job information if you are generating an Alternative Loan Detail record where this information is required by the loan destination. |

|

Current Income |

LN_ORIG_REL_INCOME |

Click the Income link on the Loan Relationship Information page. |

Review and update annual salary, other annual income, and other income sources. |

|

Employment Information |

LN_ORIG_REL_EMPL2 |

Click the Current Employment link on the Loan Relationship Information page. |

Enter data from a previous employer. |

|

Loan Origination 2 |

SFA_CRC_LN_ORIG_FN |

|

Review and adjust loan start, end, certification, and scheduled disbursement dates. |

|

Loan Origination 3 |

SFA_CRC_LN_ORIG_CL |

|

Review and update CommonLine processing options. |

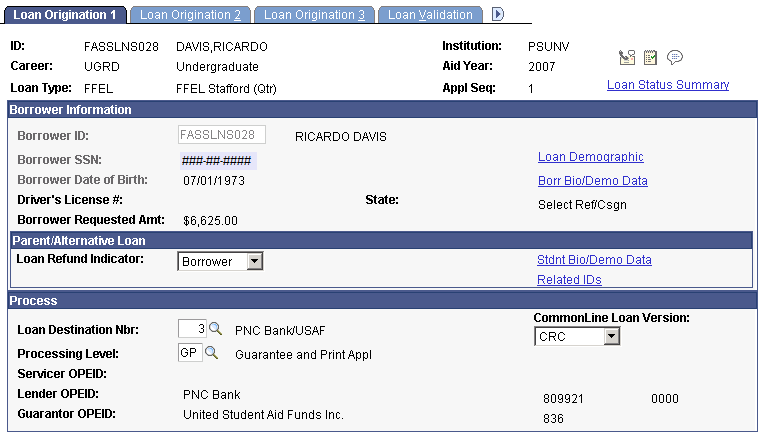

Access the Loan Origination 1 page ().

Image: Loan Origination 1 page

This example illustrates the fields and controls on the Loan Origination 1 page. You can find definitions for the fields and controls later on this page.

Borrower Information

|

Field or Control |

Definition |

|---|---|

| Borrower ID |

In most cases, the borrower is the student, but in the case of a PLUS loan, the borrower can be a parent or guardian. Select the borrower ID if no ID is present. For Graduate PLUS loans, the Borrower ID is set to the student EmplID internally to avoid defining a student-to-student borrower relationship and cannot be edited on this page. Note: Only people related to the student are available. To be an eligible borrower of a student's loan, a relationship with a guardian or parent must be created. Relationships are defined on the Relationships page. To create a relationship to the student, the related person must have an ID assigned, and the guardian status must be set to Parent, Guardian, or Self. |

| Driver's License # |

The borrower's driver's license number and state. You can update the fields using the Loan Demographic link. |

| Loan Demographic |

Click to view the borrower's demographic data and the student's term and demographic information on the Loan Demographic Data page. |

| Borr Bio/Demo Data (borrower biographic demographic data) |

Click to access the Biographical Details page and change the borrower name, gender, citizenship, marital status, date of birth, Social Security Number, and address. The link is active only if the Borrower ID field is populated. |

| Select Ref/Csgn (select references/cosigner) |

Click to view or enter data on the Loan Relationship Information page. Available if references and cosigners are required for the loan type. |

Parent/Alternative Loan

Information in this group box is used for PLUS and alternative loans.

|

Field or Control |

Definition |

|---|---|

| Loan Refund Indicator |

Used for Plus and Alternative loans. Select if loan refunds go to the Borrower or to the Student. Note: Additional refund setup is required in PeopleSoft Student Financials to generate a refund. |

| Stdnt Bio/Demo Data (student biographic demographic data) |

Click to access the Demographic and Address Data page and change the student name, gender, citizenship, marital status, date of birth, Social Security Number, and address. |

| Related IDs |

Click to open the Relationship page. After a parent or guardian has been assigned an ID, use the Relationship page to link data to that person. The person's ID then appears in the Borrower options on the Loan Origination 1 page and can be selected to process a PLUS loan. |

Process

|

Field or Control |

Definition |

|---|---|

| Loan Destination Nbr (loan destination number) |

Displays the loan destination number that represents the servicers who process the loan. The loan origination process usuallly assigns this value, but you must assign a loan destination if the origination process cannot. Selecting the appropriate loan destination is dependent on the CommonLine version of the loan. The CommonLine Loan Version field value controls the available loan destination records that you can select. When changes occur to the loan destination value, the system resets the loan process level, disbursement hold and release status, and serial loan processing fields to the new loan destination's default values. |

| Processing Level (process level) |

Values are: CR - School Certification Request: Select if you are processing a loan using the CommonLine certification request. D - Direct: Used for Direct Loan only and is invalid value for CommonLine loans. GO - Guarantee Only: Select to have the service provider only guarantee the loan. GP - Guarantee and Print Appl: Select to have the service provider guarantee the loan and then print and mail a promissory note to the borrower. M - Manual: Select if you do not want the loan to be processed electronically. No application files are created for loans with this setting. PG - Print and Guarantee: Select to have the service provider print and mail a promissory note to the borrower and guarantee the resulting loan after receipt of the promissory note. |

| Servicer, Lender, and Guarantor OPEID (office of postsecondary education identifier) |

Indicates the assigned agencies associated with the Loan Destination Number. |

| CommonLine Loan Version |

Indicates the CommonLine version of the loan destination. Can be changed to reassign the loan destination that supports the adjusted CommonLine version. CL4: CommonLine version 4 CRC: Common Record CommonLine version For more information, refer to the "Determining the CommonLine Version". |

Note: Parent or guardian borrowers must exist on the Personal Data page and have an ID assigned to them. They must be defined as a related parent or guardian for loan processing.

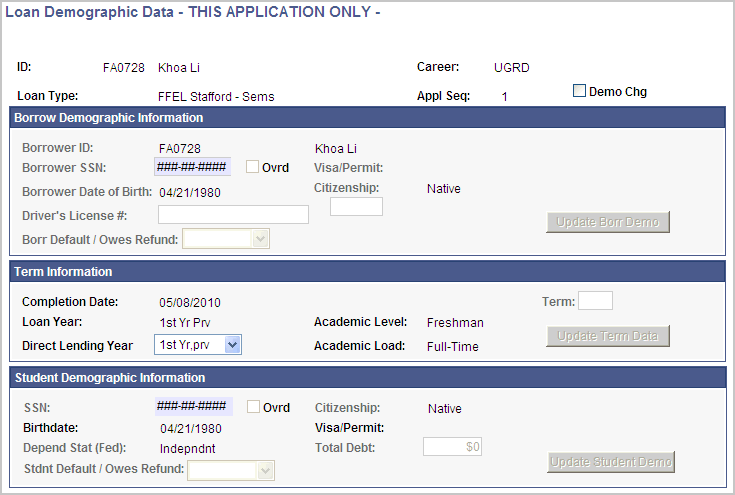

Access the Loan Demographic Data - THIS APPLICATION ONLY - page (click the Loan Demographic link on the Loan Origination 1 page).

Image: Loan Demographic Data – THIS APPLICATION ONLY – page

This example illustrates the fields and controls on the Loan Demographic Data – THIS APPLICATION ONLY – page. You can find definitions for the fields and controls later on this page.

To update the loan origination data, you must first update the student's information in Campus Community Fundamentals or FA Term record and then use this page to retrieve and update the loan information. When you run the Loan Origination process with Adjustments selected, the student's program complete date (graduation date) and National Student Loan Data System (NSLDS) Loan Year in the FA Term record.

The changes that you make on this page apply only to the current loan application. If you have several loan applications for a single student, make changes for each loan application.

|

Field or Control |

Definition |

|---|---|

| Demo Chg (demographic change) |

Select to make the updateable fields available for entry. |

Borrow Demographic Information

|

Field or Control |

Definition |

|---|---|

| Ovrd (override) |

Select this check box after selecting the Demo Chg check box to enable the Borrower SSN field for updating. Note: Changes made to the SSN field here only affect this specific loan application. |

| License # (borrower license number) |

Select a driver's license number for the borrower. The system updates the drivers license state field based on the drivers license selected. |

| Borr Default/Owes Refund (borrower in default/owes refund) |

Select No or Yes to indicate whether the borrower is in default or owes a refund to the federal government. Select Overridden to override the borrower's status. |

| Visa/Permit (borrower visa/permit) |

Indicates the borrower's visa ID. |

| Update Borr Demo (update borrower demographic) |

Click to move the most current information from Campus Community Fundamentals (personal data) to the loan application that you are currently using. For example, to change the borrower's date of birth, go to the Biographical Details page to change date of birth. Then return to the Loan Demographic Data page and click the Updt Borr Demo button to display the changed information. The system also updates the Borr SSN, BorrVs/Pmt, and Borr Citizenship fields when you click this button. |

Term Information

|

Field or Control |

Definition |

|---|---|

| Term and Update Term Data |

Select a term and then click the button to move information from the financial aid term to the loan application that you are currently using. |

Student Demographic Information

|

Field or Control |

Definition |

|---|---|

| Ovrd (override) |

Select this check box after selecting the Demo Chg check box to enable the SSN field for updating. Note: Changes made to the SSN field here only affect this specific loan application. |

| Total Debt |

Displays the student's lifetime aggregate amount for all loan types. This field is used for some alternative loans and is manually set. |

| Stdnt Default/Owes Refund (student in default/owes refund) |

Select No or Yes to indicate whether the student is in default or owes a refund. Select Overridden to override the student's default status. |

| Update Student Demo (update student demographic) |

Click to move information from Campus Community Fundamentals to the loan application that you are currently using. The system updates the SSN, Birthdate, Citizenship, and Visa/Permit fields. |

Warning! If you override these required fields, your institution takes full responsibility for the data you transmit that may be in conflict with existing institutional records. Access to this page should be limited to key personnel.

Access the Loan Relationship Information page (click the Select Ref/Csgn button on the Loan Origination 1 page).

The fields in this component represent the fields listed in the CommonLine Alternative Loan and Reference Information records in the Application Send file. The data collection requirements depend on the loan program.

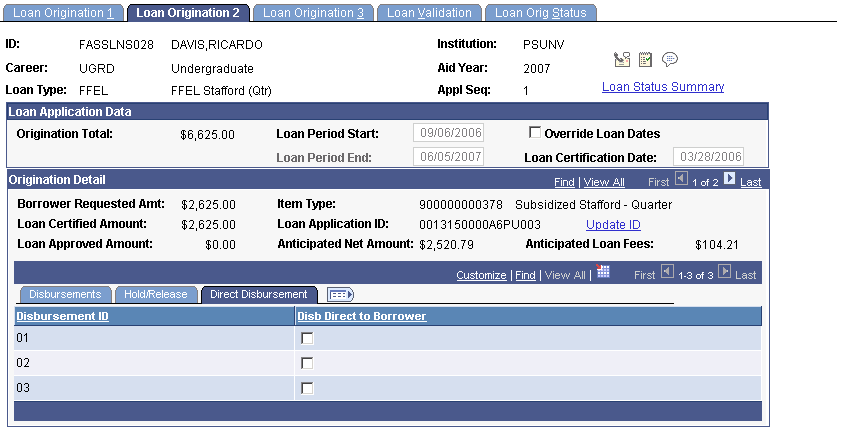

Access the Loan Origination 2 page ().

Image: Loan Origination 2 page: Disbursements tab

This example illustrates the fields and controls on the Loan Origination 2 page: Disbursements tab. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Loan Period Start and Loan Period End |

Generated from the Valid Careers for Terms table. See Updating Loan Dates. Note: Updating Loan Dates is applicable to both Direct Loans and CommonLine Loans. |

| Loan Certification Date |

The date the loan is originated. |

| Update ID |

Click to update the loan application ID. |

| Override Loan Dates |

Select to make the loan period start, loan period end, loan certification, and disbursement date fields available for editing. |

Hold Release Tab

Select the Hold/Release tab.

Image: Loan Origination 2 page: Hold/Release tab

This example illustrates the fields and controls on the Loan Origination 2 page: Hold/Release tab. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Disb Hold/Release Status (disbursement hold/release status) |

Automatically set during origination and when you use the Hold and Release process. The field can be manually set or reset by the Hold and Release process. Select from: F: Forwarded to CDA. This is an intermediate status communicated from the lender and is not a valid selection. H: Hold Disbursement. Indicates the disbursement to be held by the lender. N: Not Supported. Indicates that the loan destination does not participate in the disbursement hold and release process. R: Release Disbursement. Indicates the disbursement to be released to the school. |

Direct Disbursement Tab

Select the Direct Disbursement tab.

Image: Loan Origination 2: Direct Disbursement tab

This example illustrates the fields and controls on the Loan Origination 2: Direct Disbursement tab. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Disb Direct to Borrower (Disburse Direct to Borrower) |

Select this check box to request that a disbursement be made directly to the student by the lender. If the lender participates, this optional CommonLine process is valid for all CommonLine loan types. The value is transmitted in the application send file, but is not supported in the change transaction send file. |

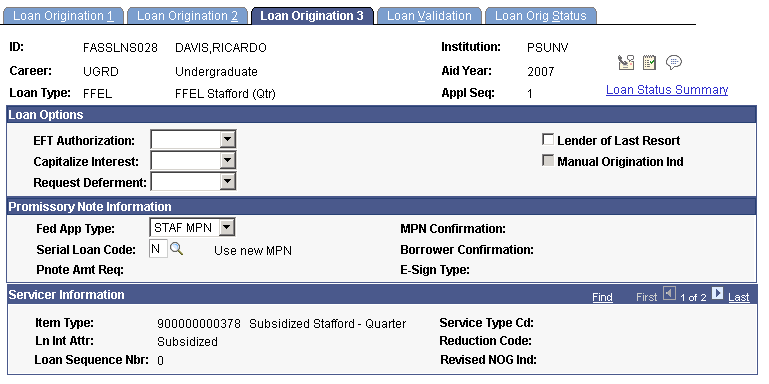

Access the Loan Origination 3 page ().

Image: Loan Origination 3 page

This example illustrates the fields and controls on the Loan Origination 3 page. You can find definitions for the fields and controls later on this page.

Loan Options

|

Field or Control |

Definition |

|---|---|

| EFT Authorization (electronic funds transfer authorization) |

Select an option for electronic funds transfer authorization. Otherwise, the origination process does this automatically, based on the tracked promissory note. Not applicable for loans using a Stafford or PLUS Master Promissory Notes where EFT authorization is automatically assumed by the loan servicer. Select from: Yes: Authorize electronic funds transfer. No: Do not authorize electronic funds transfer. |

| Capitalize Interest |

Select Capitalize or Pay Int to indicate the student's choice of making interest payments on any unsubsidized portion of the loan while in school. Otherwise, the origination process does this automatically, based on the tracked promissory note. |

| Request Deferment |

Select Yes or No to indicate a request to the lender to defer repayment of the loan if the borrower is eligible. Not applicable for loans using the Stafford or PLUS master promissory notes where a deferment is automatically assumed by the loan servicer. |

| Lender of Last Resort |

For information only. Select if this option is applicable to the loan. |

| Manual Origination Ind (manual origination indicator) |

This field is deactivated and only indicates whether the indicator was set for originated loans. |

Promissory Note Information

|

Field or Control |

Definition |

|---|---|

| Fed App Type (federal application type) |

Indicates the promissory note used to originate the FFELP loan. Assigned during origination but can be reset manually. Select from: PL 4/25/94: Old PLUS promissory note. No longer a valid selection for new loans. PLUS MPN: The current valid PLUS Master Promissory Note. STAF MPN: The current valid Stafford Master Promissory Note. Sta 1/3/94: Old Stafford Application. No longer a valid selection for new loans. Grad PLUS: The current valid Graduate PLUS promissory note. |

| Serial Loan Code |

Indicates the request for the lender to process the loan using the current master promissory note, or request a new note to be collected from the borrower. Assigned during origination but can be reset manually. SelectN (Use new MPN) or S (Serial, Renew existing MPN). |

| Pnote Amt Req (promissory note amount request) |

Displays the amount the student requested on the promissory note used to guarantee the loan. Populated by the loan origination process if a promissory note is used to originate the loan. It also can be updated upon receipt of the application response file when the loan is guaranteed, if the promissory note is issued and collected by the loan servicer. Any increases to the loan cannot exceed this value. A new loan is created if the borrower's loan eligibility exceeds the promissory note amount requested. This field is blank for Stafford and PLUS loans because the amount is no longer captured on the MPN forms. |

| MPN Confirmation (master promissory note confirmation) |

Displays master promissory note confirmation. This code is loaded from the CommonLine Application Response record and indicates whether a service provider has a valid MPN or if the status is unknown. Y: (Yes) A valid master promissory note exists. N: (No) A master promissory note does not exist. U: (Unknown) The service provider cannot confirm that the lender holds the note. |

| Borrower Confirmation |

Indicates whether the service provider has received borrower confirmation of the loan request. |

| E-Sign Type |

This is the reported holder of the student's electronic signature source for the loan promissory note. Although a school is not required to hold or report this information, if received from a loan servicer, the code is loaded to the application. |

Servicer Information

|

Field or Control |

Definition |

|---|---|

| Loan Sequence Nbr (loan sequence number) |

A value assigned by the loan servicer when the application is guaranteed. The value is used to uniquely identify the loan. |

| Service Type Cd (service type code), |

Populated by the CommonLine application response file. Except for values 01 and 02, the codes are valid for both CL4 and CRC loans: 01: For CL4, Lender requested to issue funds to school. No Reference @5 Detail Record included. 01: For CRC, File creator processed application; file initiator does not initiate disbursement. 02: For CL4, Lender requested to issue funds to disbursing agent. No Reference @5 Detail Record included. 02: For CRC, File creator processed application; file initiator to initiate disbursement. 03: Lender requested to issue funds to school. Reference @5 Detail Record included. 04: Lender requested to issue funds to disbursing agent. Reference @5 Detail Record included. 05: File creator processed application; file creator does not initiate disbursement. No Reference @5 Detail Record included. 06: File creator processed application; file creator to initiate disbursement. No Reference @5 Detail Record included. 07: File creator processed application; file creator does not initiate disbursement. Reference @5 Detail Record included. 08: File creator processed application; file creator to initiate disbursement. Reference @5 Detail Record included. |

| Reduction Code |

Populated by the CommonLine application response file. 01: Approved for requested amount. 02: Reduced to maximum for grade level. 03: Reduced to maximum for career. 04: Reduced to maximum for period. 05: Lender approved amount. 06: Reduced to unmet need. 07: Reduced to maximum for guarantor. 08: Reduced to school certification amount. 09: Reduced to maximum for endorser. 10: Reduced to maximum of guarantor policy. 11: Reduced by borrower. |

| Revised NOG Ind (revised notice of guarantee indicator) |

Populated by the CommonLine application response file. N: Revised notice of guarantee is not sent. U: Unknown. Y: Revised notice of guarantee is sent. |