Setting Up Direct Lending

To set up direct lending, use these components:

Maintain EDI Transactions component (FA_ECTRANS).

Create Loan Destinations component (LN_DEST_PROFILE).

Direct Loan Change Rules component (LN_DL_INST_PARM).

Define Loan Institutions component (LOAN_INST_TABLE).

Loan Attended Routing ID component (SFA_COD_LN_ATTEND)

Maintain Loan Report Packages component (LOAN_RPT_PKGS02).

Define Serial Promissory Notes component (LN_PNOTE_TYPE).

Define School Servicers component (LOAN_SERVICE_TABLE).

Maintain Loan Transfer ID component (LN_XFER_FILE_ID).

Create Loan Types component (LOAN_TYPE).

Credential Level Cross Reference component (SFA_COD_CRDLV_XREF).

SULA Load Rules component (SFA_SULA_LD_TBL).

This section discusses how to:

View EDI profile defaults.

Set up loan destination profiles for Direct Lending.

Set up global Direct Lending change parameters.

Set up Loan Institution Table for Direct Lending COD.

Set up destination defaults for Direct Lending.

Set up Loan Attended Routing ID's

Set up loan report packages for Direct Lending.

Set up DL Serial Promissory Note table.

Set up Loan Servicer table for Direct Lending.

Set up loan transfer IDs for Direct Lending.

Set up loan types for Direct Lending.

Set up credential level cross reference.

Set up SULA load rules.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Financial Aid EDI Transactions |

FA_ECTRANS |

Set Up SACR, Product Related, Financial Aid, File Management, Maintain EDI Transactions, Financial Aid EDI Transactions |

Define electronic data transactions. |

|

Loan Dest Profile |

LOAN_DEST_PROFILE |

|

Define the participants your institution uses to exchange loan application data. You can designate multiple destinations for a given loan program. |

|

Ln Dl Inst Parm (loan direct lending institution parameter) |

LN_DL_INST_PARM |

|

Set up change parameters for your institution. By setting change parameters for specific fields, you can determine how direct lending change processing handles the specified fields. |

|

Ln Pnote Type (loan promissory note type) |

LN_PNOTE_TYPE |

|

Add the master promissory note (MPN), PLUS note, health, Perkins, and university/institutional loan types to the loan promissory note table. You must do this before using the promissory note functionality. |

|

Loan Institution Table |

LOAN_INST_TABLE |

|

Set up Common Origination and Disbursement (COD) for Direct Lending. Define how your school processes loans for the academic year. You must define your loan processes for each academic career at your institution. |

|

Loan Institution Address Information |

LN_INST_ADDR_SEC |

Click the Loan Institution Contact link on the Loan Institution Table page. |

Enter address information for your department that works with loans. |

|

Loan Institution Contact Information |

LN_INST_CNTCT_SEC |

Click the Loan Institution Contact link on the Loan Institution Table page. |

Enter address information for your loan contact personnel. |

|

Loan Destination Default |

LOAN_INST_TABLE2 |

|

Set up your default loan destination parameters. |

|

Loan Attended Routing ID |

SFA_COD_LN_ATTEND |

|

Associate Attended School Routing ID's with Reporting School Routing ID's. |

|

Loan Report Packages |

LN_RPT_PCKG02 |

|

Define and associate loan document types to loan types. |

|

Loan Servicer Table |

LOAN_SERVICE_TABLE |

|

Identify the servicers that your institution uses for processing loans. You can also use this page to add a new servicer. |

|

Servicer Electronic Address |

SERV_ADDR_SEC |

Click the Electronic Address link on the Loan Servicer Table page. |

Enter an email address for the loan servicer. |

|

Servicer Contact Information |

SERV_ADDR_SEC |

Click the Contact Address link on the Loan Servicer Table page. |

Enter address and email information for the individual contact that you entered on the Loan Servicer Table page. |

|

Loan Transfer IDs |

LN_XFER_ID_UPDT |

Set Up SACR, Product Related, Financial Aid, Loans, Maintain Loan Transfer ID, Loan Transfer IDs |

Set up your EC transaction ID for all inbound and outbound loan file transactions. |

|

Loan Type Table |

LOAN_TYPE_TABLE |

|

Enter specific processing types and loan requirements for a particular loan type. You can also associate specific loan item types to the loan type. |

|

Direct Loan Options |

LOAN_TYPE_TABLE_DL |

|

Specify direct lending options for the loan type setup. This page is used to define your disbursement options from Financial Aid to PeopleSoft Student Financials. Additional options define when disbursements are transmitted to the Common Origination and Disbursement (COD). |

|

Checklist Setup |

LOAN_TYPE_DOCUMENT |

|

Define checklist to be associated with loan type. |

|

Credential Level Cross Reference |

SFA_COD_CRDLV_XREF |

|

Map academic career/academic plan/National Student Clearinghouse (NSC) Classification combinations to COD Credential Levels. |

|

SULA Load Rules |

SFA_SULA_LD_TBL |

|

Set up COD Enrollment Status rules. |

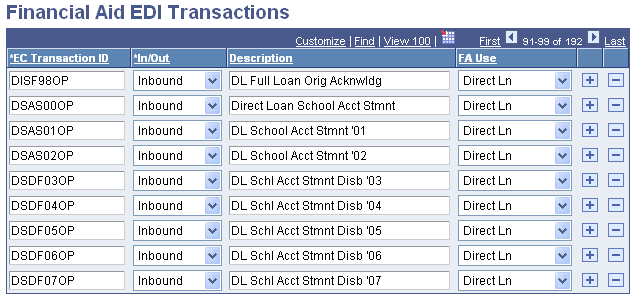

Access the Financial Aid EDI Transactions page ().

Image: Financial Aid EDIT Transactions page

This example illustrates the fields and controls on the Financial Aid EDIT Transactions page. You can find definitions for the fields and controls later on this page.

The EDI Profile table defines electronic data transactions both inbound and outbound for COD processing. PeopleSoft Student Administration uses the EDI functionality to exchange data from the COD system to PeopleSoft Student Administration. EDI transactions support data files for Direct Loans and Pell Grant. The system updates and populates the EC Transaction ID on a regulatory basis.

|

Field or Control |

Definition |

|---|---|

| EC Transaction ID |

The ID is based on the message classes used for direct lending. See the COD Technical Reference for further information. Use the Add link to add additional EC transaction IDs for this partner profile. Add all the direct lending message classes that you use at your institution. |

| In/Out |

The system indicates whether the file is Inbound or Outbound. |

Direct Lending EC Transaction IDs

The following table illustrates the value provided in your system for Direct Lending processing. File types are updated during annual regulatory releases for Direct Lending.

|

EC Transaction ID |

Inbound/Outbound |

Data Exchange |

File Type Data Definition |

|---|---|---|---|

|

DSLFnnOP, where nn is the aid year. |

Inbound |

Import From COD |

School Account Statement (Fixed-Length, Loan Level Loan Detail) |

|

DSDFnnOP, where nn is the aid year. |

Inbound |

Import from COD |

School Account Statement (Fixed-Length, Disbursement Level Loan Detail) |

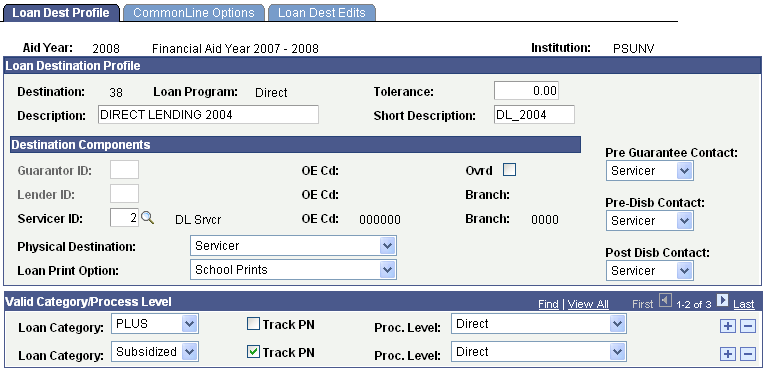

Access the Loan Dest Profile page ().

Image: Loan Dest Profile (loan destination profile) page

This example illustrates the fields and controls on the Loan Dest Profile (loan destination profile) page. You can find definitions for the fields and controls later on this page.

Loan Destination Profile

|

Field or Control |

Definition |

|---|---|

| Destination |

The system assigns and displays a unique numeric identifier when you create a destination. |

| Loan Program |

This should display Direct for direct lending. |

| Tolerance |

Enter the tolerance value to determine the amount difference that the system should allow with loans. |

Destination Components

|

Field or Control |

Definition |

|---|---|

| Guarantor ID |

This field does not apply to direct loans. |

| Lender ID |

This field does not apply to direct loans. |

| Servicer ID |

Select the servicer ID for direct lending. This value is delivered with your system. |

| OE Cd Branch (Office of Education code branch) |

The system displays the OE Cd and Branch for the Servicer ID that you select. |

| Physical Destination |

Select Servicer for direct lending. The physical destination refers to the destination that you intend to receive the loan application. |

| Loan Print Option |

Select the default promissory note print code to report to COD on each individual loan award. Value updates the COD Promissory Note Print Code field. Select the appropriate option depending on your institution's arrangement with COD. The Loan Print Option can also be overridden on an individual loan application level. COD processing recommends leaving the Loan Print Option blank. If left blank, the 'Promissory Note Print Code' tag is not submitted, and the school's Promissory Note Print Indicator is set to 'Y'. When the Promissory Note Print Indicator is set to 'Y', this indicates to COD that the loan promissory note correspondence is eligible to be sent electronically by COD. See the U.S. Department of Education's Common Origination and Disbursement (COD) Technical Reference, Electronic Master Promissory Notes and Submitting a Promissory Note Print Code.

|

| Ovrd (override) |

Select this check box to save the page without having designated a Guarantor ID, Lender ID, and Servicer ID. But, this does not apply to direct lending, so you can save the page with only the Servicer ID without selecting this check box. |

Contact Order

The fields in this group box determine who to contact depending on the stage of the loan.

|

Field or Control |

Definition |

|---|---|

| Pre-Guarantee Contact |

Select Servicer for direct lending. |

| Pre-Disb Contact (pre-disbursement contact) |

Select Servicer for direct lending. |

| Post Disb Contact (post disbursement contact) |

Select Servicer for direct lending. |

Valid Category/Process Level

|

Field or Control |

Definition |

|---|---|

| Loan Category |

Identify the loan category for the loan destination to process. The loan categories include PLUS, Sub/Unsub, Subsidized, and Unsub. The category Sub/Unsub does not apply to direct lending. Direct lending institutions should use Subsidized, Unsub, and PLUS. You should add a loan category for all three Direct Lending loan types: subsidized, unsubsidized, and PLUS. |

| Track PN (track promissory note) |

This field does not apply to direct lending. |

| Proc. Level (process level) |

Identify the loan processing level that the loan destination performs for the corresponding loan category. For direct lending, select Direct for all of your loan categories. |

Note: The other two pages in this component, CommonLine Options and Loan Dest Edits, do not apply to direct lending.

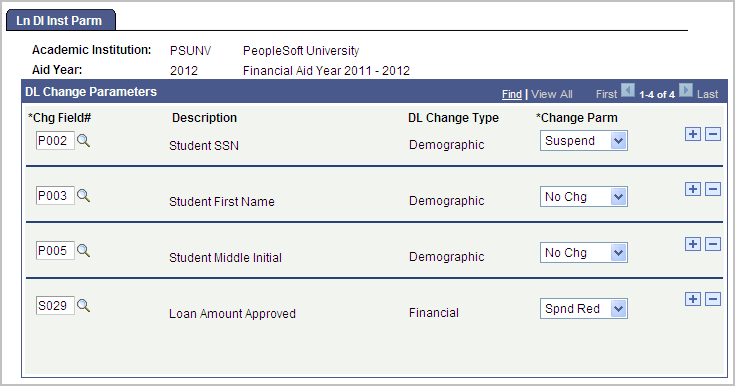

Access the Ln Dl Inst Parm page ().

Image: Ln Dl Inst Parm (loan direct lending institutional parameters) page

This example illustrates the fields and controls on the Ln Dl Inst Parm (loan direct lending institutional parameters) page. You can find definitions for the fields and controls later on this page.

You can use this setup page to set globally what data changes should be automatically submitted to COD. These data changes can be for a change file, for a record held for institutional review, or for an automatically suspended record because of reductions to financial data. After these global parameters are defined, they are applied to all direct loan records to which changes to data have been made. This global setup assists you in administering what and when multiple data changes should be submitted to COD.

The global setup does not preclude you from holding/suspending change information on a student-by-student level. Individual suspend, change, or hold decisions can be made through the DL Stu Change Hold/Suspense page

The system displays the Academic Institution and Aid Year.

DL Change Parameters

|

Field or Control |

Definition |

|---|---|

| Chg Field # (change field number) |

Select the field to change. The change field numbers correspond to those assigned by COD, as defined in the COD Technical Reference. |

| DL Change Type |

Indicates whether the specified change field number represents a demographic or financial change. |

| Change Parm (change parameter) |

Select the parameter for each field. No Chg (no change). The system does not consider the specified field during change processing. When you make changes to fields to which this change parameter is assigned, the system does not create a change transaction. Note: Change rule processing analyzes all change fields by default unless a 'No Chg' value is specified. Spnd Red (suspend reduced). This is used for financial change types only. If the change results in a reduced disbursement amount, the system suspends the loan. Suspend When you make changes to fields to which this change parameter is assigned, the system creates a change transaction and places the loan on hold. This enables you to review the loan to determine whether the change is appropriate. If the change is fine, you can remove the hold. |

Note: The above change parameters affect those loans that have been transmitted to the COD. Prior to submission, you can change the fields on the loan record without generating a change transaction. Change transactions occur when you make changes to loans that you have previously transmitted to COD.

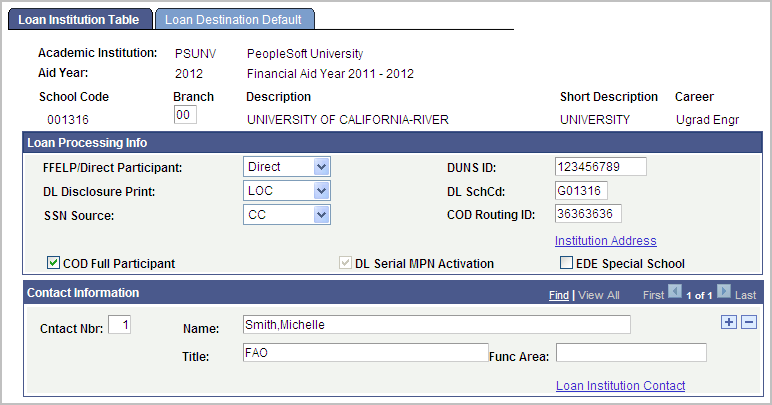

Access the Loan Institution Table page ().

Image: Loan Institution Table page

This example illustrates the fields and controls on the Loan Institution Table page. You can find definitions for the fields and controls later on this page.

Loan Institution setup defines loan processing attributes and definitions. A student's awarded loans are matched to a Loan Institution option based on their ISIR Owning School Code, Academic Career, and FFELP/Direct Participant level.

Loan Processing Info

|

Field or Control |

Definition |

|---|---|

| FFELP/Direct Participant |

Indicate whether your loan institution can originate All Loans (both FFELP and direct lending) Direct (Lending only), or FFELP (only). Alternative loans are not affected by this setting. |

| DL Disclosure Print |

Indicate where the loan disclosure is printed. Select from COD, Reprint, and School. Reprint indicates that the Department of Education has authorized the institution to reprint copies of the Direct Loan Disclosure Statement. In most cases, you should select COD. |

| SSN Source (social security number source) |

Indicate the source for the student's Social Security Number, CC (Campus Community) or ISIR. Note: The COD Direct Loan processes always report the SSN from the student's ISIR, regardless of the SSN Source option selected. |

| DUNS ID (data universal numbering scheme) |

Enter your DUNS ID. The Department of Education assigns the DUNS number to the reporting institution. |

| DL SchCd (direct lending school code) |

Enter your school code for direct lending. This field is hidden if your school does not participate in the direct lending program. School code is used to create the loan application ID for COD loan application processing. |

| COD Routing ID |

Enter the Common School ID number that is assigned to your institution by the U.S. Department of Education. This value is used as the COD Routing ID for students associated with the context School Code, Career, and FFELP/Direct Participant level. |

| COD Full Participant |

Select to activate the COD Common ID field. |

| DL Serial MPN Activation (direct lending serial master promissory note activation) |

Displays as "checked" (default value) and is required for Direct Loan processing. |

| EDE Special School |

Select this check box if your institution as been approved as an EDE special school. |

Contact Information

In this group box, enter the contact information for each of your financial aid administrators in charge of loan processing.

|

Field or Control |

Definition |

|---|---|

| Cntact Nbr (contact number) |

Use this number to prioritize the list of contacts. The person with a contact number of one is considered the primary contact. |

| Name |

Enter the name of the loan officer. |

| Title |

Enter the title of the loan officer. |

| Func Area (functional area) |

Enter information about the functional area that this contact person administrates. |

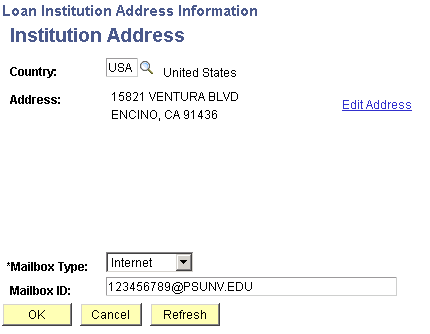

Entering Loan Institution Address Information

Access the Loan Institution Address Information page (click the Loan Institution Contact link on the Loan Institution Table page).

Image: Loan Institution Address Information page

This example illustrates the fields and controls on the Loan Institution Address Information page.

Enter the required address information. Select a Mailbox Type of either Internet or Compuserve. Enter a Mailbox ID or email address. The Mailbox Type and Mailbox ID are used to determine where data files are sent when the files are transmitted using the internet or a private communication network.

Note: You must enter a Mailbox Type and Mailbox ID to save this page.

Entering Loan Institution Contact Information

Access the Loan Institution Contact Information Loan Institution Contact page (click the Loan Institution Contact link on the Loan Institution Table page).

Image: Loan Institution Contact Information page

This example illustrates the fields and controls on the Loan Institution Contact Information page.

Enter the required address information for the individual loan contact. Select a Mailbox Type of either Internet or Compuserve. Enter the Mailbox ID or email address.

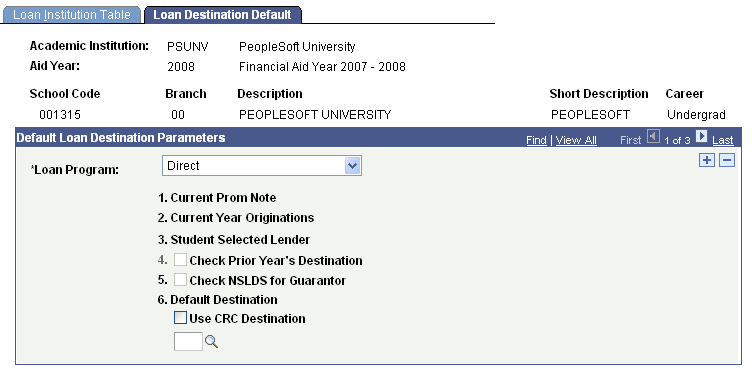

Access the Loan Destination Default page ().

Image: Loan Destination Default page

This example illustrates the fields and controls on the Loan Destination Default page. You can find definitions for the fields and controls later on this page.

Default Loan Destination Parameters

|

Field or Control |

Definition |

|---|---|

| Loan Program |

Select Direct for direct lending. |

| 6. Default Destination |

Indicates the default loan destination. Select the loan destination number that you created for this processing year for direct lending COD. The loan destination number is created on the Loan Dest Profile page. |

Note: The 1. Current Prom Note, 2. Current Year Originations, 3. Student Selected Lender, 4. Check Prior Year Originations, and 5. Check NSLDS for Guarantor fields do not apply to direct lending.

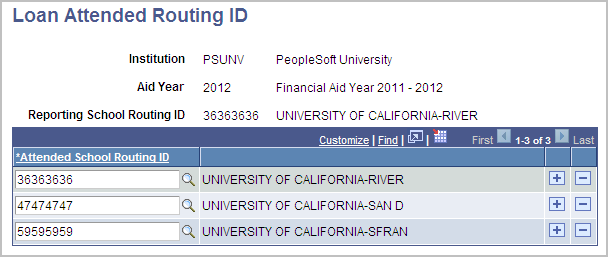

Access the Attended School Routing ID page ().

Image: Loan Attended Routing ID page

This example illustrates the fields and controls on the Loan Attended Routing ID page. You can find definitions for the fields and controls later on this page.

Use this page to associate one or more COD Attended School Routing ID's to a single COD Reporting School Routing ID. Available Reporting School Routing ID values are based on unique COD Routing IDs established on the Loan Institution setup page.

|

Field or Control |

Definition |

|---|---|

| Attending School Routing ID |

Enter at least one Attending School Routing ID. |

Note: Attending School Routing IDs must be created for each Aid Year requiring COD processing.

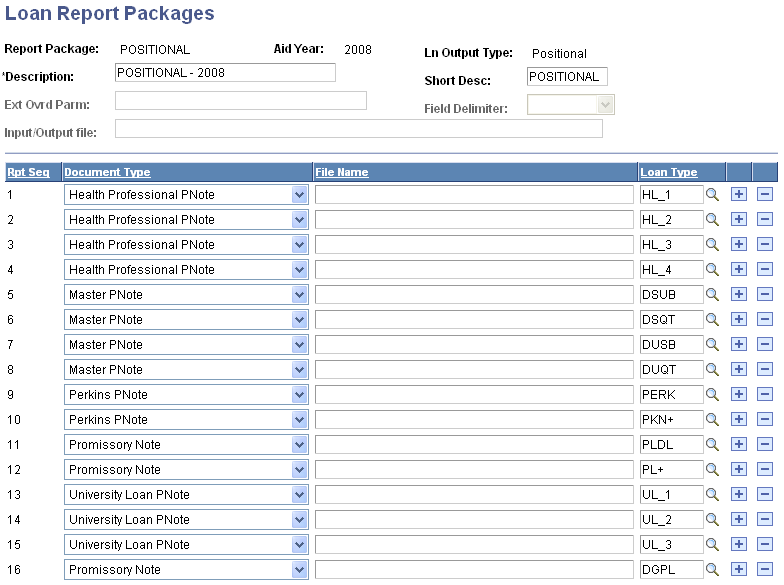

Access the Loan Report Packages page ().

Image: Loan Report Packages page

This example illustrates the fields and controls on the Loan Report Packages page. You can find definitions for the fields and controls later on this page.

The Loan Report Packages page associates pre-defined promissory document types to Direct Loan types. You can print Federal Direct Subsidized and Unsubsidized Stafford and PLUS MPNs on preprinted forms approved by the Department of Education, using the positional print option. When the Office of Management and Budget (OMB) revises approved formats, Oracle delivers updated code to all schools.

Note: Direct PLUS Loan (this includes DL Graduate PLUS loans) master promissory notes print based on positional format with data labels.

Direct Subsidized and Direct Unsubsidized Stafford Loan master promissory notes print based on positional format without data labels.

The system displays the Report Package, Aid Year, and Ln Output Type (loan output type) based on your selection when accessing the page.

|

Field or Control |

Definition |

|---|---|

| Ext Ovrd Parm (external override parameter) |

If you are using an external product, you can enter values in this field using the guidelines set by the external product. This field appends parameters to the JOB line in the external product extract file. Review your external product user's guide. Leave this field blank if you do not use an external product. |

| Field Delimiter |

This field is not used for promissory note processing. |

| Input/Output file |

If you are using an external product, you must enter a file name to export the report package. This specifies where the output goes when you run the print process. Leave this field blank if do not use an external product. |

| Rpt Seq (report sequence) |

This designates the order in which the system creates the output for each loan document. |

| Document Type |

These are delivered with your system. You must insert a new row for each loan document type to be included in the package: Master PNote: Stafford MPN document type. Associate Stafford Subsidized and Unsubsidized loan type values with Master PNote. Promissory Note: PLUS MPN document type. Associate PLUS and Graduate PLUS loan type values with Promissory Note. |

| File Name |

If you are using an external product, you must enter the file name of the external product form to associate with the document type. For example, if the document type is Master Pnote, enter MPN0400_E. For document type Perkins Pnote, enter PERKNS_E. Leave this field blank if you do not use an external product. |

|

Field or Control |

Definition |

|---|---|

| Loan Type |

Enter the loan types associated with the Master PNote or Promissory Note. |

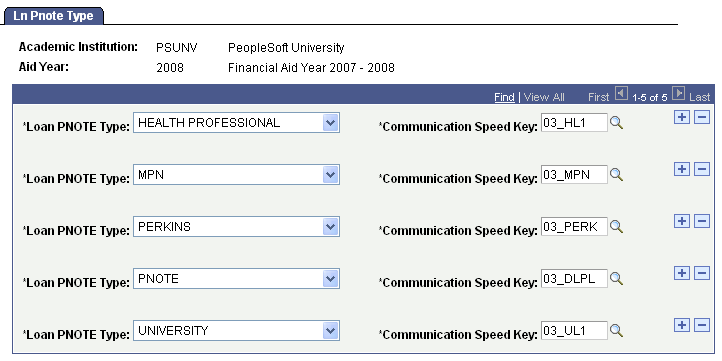

Access the Ln Pnote Type page ().

Image: Ln Pnote Type (loan promissory note type) page

This example illustrates the fields and controls on the Ln Pnote Type (loan promissory note type) page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Loan PNOTE Type (loan promissory note type) |

Enter a type for MPN, the Stafford MPN document type. Associate Stafford Subsidized and Unsubsidized loan type values with MPN. Insert a row to add PNOTE, the PLUS MPN document type. Associate PLUS and Graduate PLUS loan type values with PNOTE. You might also need to add health, Perkins, and university/institutional loans to this setup page. |

| Communication Speed Key |

On each row, enter the Communication Key to be associated with the loan PNOTE type. |

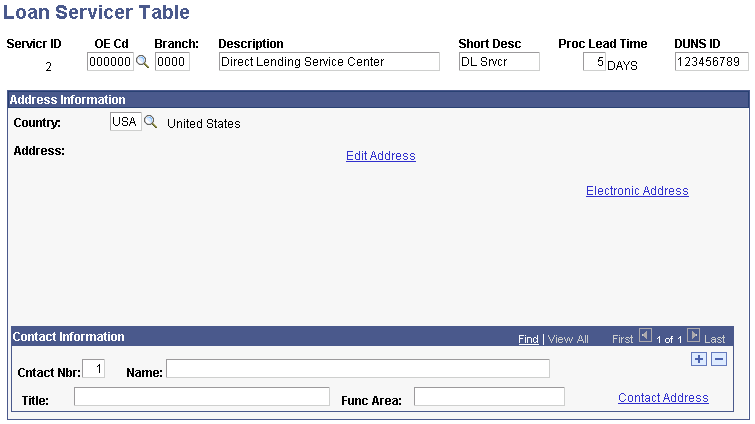

Access the Loan Servicer Table page ().

Image: Loan Servicer Table page

This example illustrates the fields and controls on the Loan Servicer Table page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Servicer ID |

This number identifies the servicer associated with the requested loan. |

| OE Cd (Office of Education code) |

When you select a value, the system uses data from the Servicer Load Maintenance database and automatically populates the rest of the information. |

| Proc Lead Time (process lead time) |

Indicates the number of days a loan destination needs to freeze its data to prepare for a transfer to the school. For example, if the lead-time is 5 days, changes can only be made to the student's loan 5 days prior to the first disbursement. |

| DUNS ID (data universal numbering scheme ID) |

The system displays this field if your institution is required to report a DUNS ID in the processing of loans. You can also enter your DUNS ID. The Department of Education assigns the DUNS number to the reporting institution. |

Address Information

Enter the address of the loan servicer in the fields in this group box.

Click the Electronic Address link to access the Servicer Electronic Address page, where you can enter an email address for this loan servicer.

Contact Information

Enter the name and title of individual contacts at the loan servicer. You can enter multiple contacts by inserting rows. The Cntact Nbr (contact number) field is used to prioritize the order of your contacts.

Click the Contact Address link to access the Servicer Contact Information page, where you can enter the address and email information for an individual contact at the loan servicer.

Entering Servicer Electronic Addresses

Access the Servicer Electronic Address page (click the Electronic Address link on the Loan Servicer Table page).

Image: Servicer Electronic Address page

This example illustrates the fields and controls on the Servicer Electronic Address page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Mailbox Type |

Select the servicer's mailbox type of None, Internet, or Compuserve. |

| Mailbox ID |

Enter the servicer's mailbox identification or address to which data files are sent when the files are transmitted using the internet or a private communication network. |

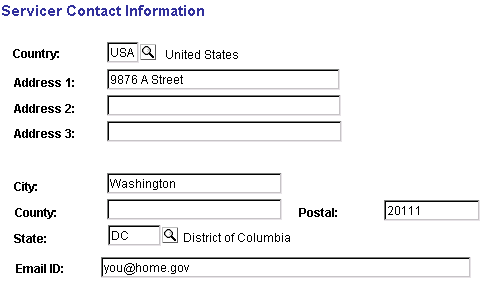

Entering Servicer Contact Information

Access the Servicer Contact Information page (click the Contact Address link on the Loan Servicer Table page).

Image: Servicer Contact Information page

This example illustrates the fields and controls on the Servicer Contact Information page.

Enter the address and email information in the fields provided.

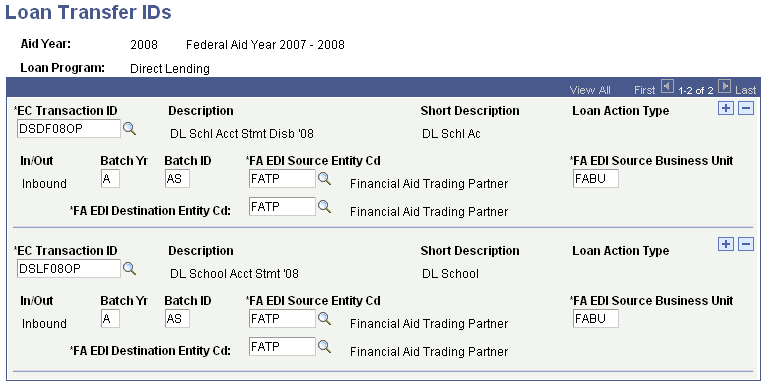

Access the Loan Transfer IDs page ().

Image: Loan Transfer IDs page

This example illustrates the fields and controls on the Loan Transfer IDs page. You can find definitions for the fields and controls later on this page.

Verify that the Loan Transfer IDs are set for the current aid year. Use the Loan Transfer ID Table page to set up loan transfer IDs and descriptions. This is a system definition table used for COD data file processing. EC Transaction ID correlates to Common Origination Message Classes used by Full Participants for sending and receiving data from the COD system for each processing year.

Oracle supports the following message classes for your Direct Lending process:

DSDFnnOP School Account Statement Disbursements (Fixed Length).

DSLFnnOP School Account Statement Loan Level (Fixed Length).

|

Field or Control |

Definition |

|---|---|

| EC Transaction ID (electronic commerce transaction ID) |

Select a value. When you tab to the next field, the system displays the Description and Short Desc (descriptions) for the EC Transaction ID. The EC Transaction ID is based on the Message Classes used for Direct Lending. |

| Loan Action Type |

This field does not apply to direct lending. |

| In/Out |

The system indicates whether the file is Inbound or Outbound. |

| Batch Yr (batch year) |

Enter the last digit of the appropriate aid year. For example, enter 8 for 2008. |

| Batch ID |

Indicates the unique ID for the batch. It is used when transferring data to the loan destination. |

| FA EDI Source Entity Cd (Financial Aid EDI source entity code) |

Select the appropriate value for your institution. For most institutions, you select FATP. |

| FA EDI Source Business Unit |

The system populates this field after an FA EDI Source Entity Cd is selected. The default value should be FABU. This allows the EDI Manager to retrieve and generate the appropriate file structure. |

| FA EDI Destination Entity Cd (Financial Aid EDI destination entity code) |

You must update your system annually. You should continue to review and update your setup pages for current year processing. |

Note: You must update your system annually. You should continue to review and update your setup pages for current year processing.

Valid Loan Transfer IDs

This table lists Direct Lending Loan Transfer ID information current for this publication. Ensure that these transaction IDs are in your system if you plan to use direct lending.

|

EC Transactions ID |

In/Out |

File Type Data Definition |

Batch Year |

Batch ID |

FA EDI Entity Source Code and EDI Destination Source Code |

FA Entity Source Business Unit |

|---|---|---|---|---|---|---|

|

DSDFnnOP |

In |

Import COD Statement of Account Summary file- Disbursement Level |

Last digit of aid year. For example, Batch Year value of 9 represents 2008-2009 aid year. |

AS |

FATP |

FABU |

|

DSLFnnOP |

In |

Import COD Statement of Account Summary file-Loan Level |

n |

AS |

FATP |

FABU |

You set up loan types, such as a direct lending subsidized type, to group processing information together and then associate certain item types to the loan type. This information is kept in the Loan Type Table, which is accessed from the Loan Type Table component. You can associate certain loan item types with the information you enter in the Loan Type Table.

Three of the four pages in this component are used for Direct Lending. The fourth page, the CommonLine NSLDS Xref page, is not shown here.

Entering the Loan Type

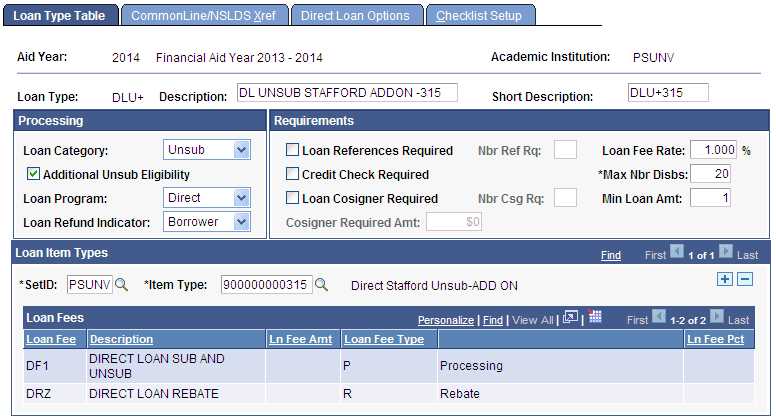

Access the Loan Type Table page ().

Image: Loan Type Table page

This example illustrates the fields and controls on the Loan Type Table page. You can find definitions for the fields and controls later on this page.

The Loan Type setup allows you to provide further loan processing attributes to a Financial Aid Item Type defined as a loan.

Any Item Type defined as a loan must have a corresponding Loan Type if you want to use the Campus Solutions Loan Processing module.

Below are the specific attributes required to process your Direct Loan financial aid item types.

Processing

|

Field or Control |

Definition |

|---|---|

| Loan Category |

Select Subsidized, Unsubsidized, or PLUS depending on the type of loan that you are defining. Do not select any option except one of these for direct lending. If you select PLUS, a Graduate PLUS Indicator check box appears. Select the check box for Grad PLUS loans. |

| Additional Unsub Eligibility |

Select if loan type is used to identify an additional unsubsidized Stafford loan Financial Aid Item Type awarded specifically for a dependent student with a PLUS Loan denied. Note: Creating a unique Unsubsidized Stafford Direct Loan Financial Aid Item Type allows awarding and COD loan processing to specifically identify the loan awards as a loan based on PLUS Denied assessment. The loan detail gets communicated and reported to the NSLDS system, resulting in the loan displaying the Additional Unsubsidized Code (P-PLUS loan denial). |

| Loan Program |

Select the Direct option for direct lending. For example, to set up a Subsidized Stafford loan processed through direct lending, the Loan Category is Subsidized and the Loan Program is Direct. |

| Loan Refund Indicator |

Select one of the following. Borrower: The borrower of the loan receives any refunds from the loan. For example, the borrower could be a parent or guardian for a PLUS loan. Student: The student receives any refunds from the loan, whether they are the borrower or not. You can override the loan refund indicator at the loan application level. |

Requirements

Select the appropriate options for the loan by selecting the check boxes. Only those check boxes used for direct lending are explained.

Note: The Loan References Required, Nbr Ref Rq (number of references required), Loan Cosigner Required, Nbr Csg Rq (number of cosigners required), and Cosigner Required Amount fields are used for CommonLine loans only and are not relevant for direct lending.

|

Field or Control |

Definition |

|---|---|

| Credit Check Required |

Select if a credit check is required for the type of loan. If selected, direct loan disbursements to the students and transmissions to COD do not occur until the credit check is accepted. Select this check box for PLUS loans. |

| Loan Fee Rate |

Enter the rate to print on the promissory note for this type of loan and transmitted on the loan origination record. Ensure that the loan fee rate matches the loan fee setup for the financial aid item type you associate with this loan type. |

| Max Nbr Disbs (maximum number of disbursements) |

Enter the maximum number of disbursements that are allowed per loan. The recommended values are 20 for Stafford loans and 4 for PLUS loans. |

| Min Loan Amt (minimum loan amount) |

Enter the minimum loan amount that your institution allows. The value should not be less than the COD minimum. |

Loan Item Types

|

Field or Control |

Definition |

|---|---|

| SetID |

The set ID that you select determines the item types that are available for you to select. |

| Item Type |

The selection available depends on the set ID that you entered. For direct lending you cannot have multiple financial aid item types associated with the same loan type. You must create a separate loan type for each direct lending item type to process. You cannot share financial aid item types across multiple loan types. If you try to use the same item type with a new or another loan type setup, you receive an error message. |

The following field values are associated with the item type that you select.

|

Field or Control |

Definition |

|---|---|

| Loan Fee |

Displays the type of loan fee associated with the item type selected. When you insert a row, you can use the inner scroll bar to view the new rebate loan fee percentage. |

| Ln Fee Amt (loan fee amount) |

Displays the dollar amount of the loan fee for the item type selected. |

| Loan Fee Type |

Displays the loan fee type associated with the financial aid item type. For direct lending you should have a row for rebate and a row for loan fees. |

| Ln Fee Pct (loan fee percentage) |

Displays the loan fee percentage charged for the item type selected. These values are from your item type setup. The system also displays the interest rebate provided on the item type setup. Note: DL-COD reporting reports the Direct Loan Interest Rebate Percentage based on the associated Loan Type setup. |

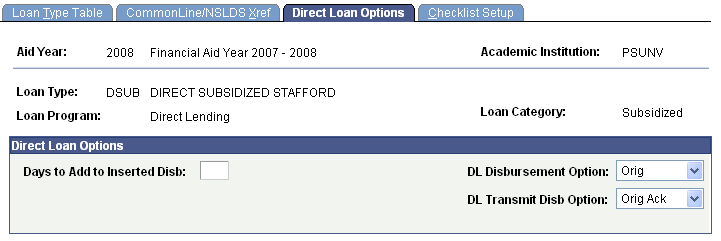

Entering Direct Lending Loan Options

Access the Direct Loan Options page ().

Image: Direct Loan Options page

This example illustrates the fields and controls on the Direct Loan Options page. You can find definitions for the fields and controls later on this page.

The system displays the Aid Year, Academic Institution, Loan Type, Loan Program, and Loan Ctgry (loan category).

Direct Loan Options

This group box allows you to specify the conditions for disbursing funds to the students and sending disbursement files to the direct lending Loan Origination Center.

|

Field or Control |

Definition |

|---|---|

| Use Direct Loan Version |

Displays the direct lending version you are using. |

| Days to Add to Inserted Disb (disbursement) |

This is used for Stafford loans only. When entering an additional disbursement, the system adds the value specified in this field to the current date. This date becomes the anticipated disbursement date on the Origination Change Record for the added disbursement. Use this field to add days to the anticipated disbursement date so the money is actually disbursed later than the anticipated disbursement date. For example, you can take a loan that is being processed today and use this field to add days to the anticipated disbursement date that is placed on the Loan Origination record. This makes the date reported to the COD later than the disbursement date. This field is not commonly used because generally institutions disburse sooner, not later. |

| DL Disbursement Option |

Select when the system allows loans to be disbursed to the student's accounts. Orig Ack: Disburses loans after you receive the Origination Acknowledgment. Orig: Disburses loans after you originate the loan. Orig+PNote: Disburses loans after you receive the origination and promissory note acknowledgments. PNote Ack: Disburses loans after you receive the promissory note acknowledgment. |

| DL Transmit Disb Optn (direct lending transmit disbursement option) |

Select when the system should allow transmission of disbursement files to COD. Orig Ack: Transmits direct lending disbursements after you receive the origination acknowledgment. Orig+PNote: Transmits direct lending disbursements after you receive the origination acknowledgment and COD accepts the promissory note. |

Note: If the Credit Check Required check box is selected on the Loan Type Table page, direct loan disbursements to students and transmissions to the COD do not occur until the credit check is accepted. Therefore, the values entered in the DL Disbursement Option and DL Transmit Disb Option fields are subject to the Credit Check Required check box value.

Warning! Changes to either of the DL Disbursement Option or DL Transmit Disb Option parameter settings do not affect loans already originated if the parameter settings are changed after the loans have been originated. Changes to these settings only affect loans originated at the time of the setting. If you have loans originated in error, please contact the Global Support Center.

Selecting DL Disbursement Option Values

Use this table to help determine when you can disburse loans to Student Financials, depending on the field value selected in the DL Disbursement Option field on the Direct Loan Options page.

|

Process Completed |

Direct loan Disbursement Option field on Direct Loan Options page |

Authorize and Disburse? |

If NO disbursement, what is step before I can disburse the Direct Loan? |

|---|---|---|---|

|

Originate Loan |

Orig |

YES |

If loan is DLPLUS (parent or graduate and professional) check to ensure record reflects an approved credit check. If loan is DL Stafford, check authorization error message for more information. |

|

Originate Loan |

Orig Ack |

NO |

Outbound the Originations file then wait for the Origination Acknowledgment file and import the file. |

|

Originate Loan |

Orig + PNote |

NO |

Outbound the Originations file. Wait for the Origination Acknowledgment file and import the file. The loan application must be updated with an approved accepted promissory note. Promissory Note information maybe provided on an Origination Acknowledgement or Promissory Note Acknowledgement file. |

|

Originate Loan |

PNote Ack |

NO |

The loan application must be updated with an approved accepted promissory note. Promissory Note information maybe provided on an Origination Acknowledgement or Promissory Note Acknowledgement file. |

Selecting Direct Loan Transmit Disbursement Option Values

Use this table to help determine when you can send the disbursement file to the COD, depending on the field value selected in the DL Transmit Disb Option field on the Direct Loan Options page.

|

Direct Loan Transmit Disbursement Option field on Direct Loan Options page |

OK to Process Disbursement Transmission Out? |

If NO, what is next step before I can transmit the Direct Loan disbursement record? |

|---|---|---|

|

Orig Ack |

Yes, if Origination Acknowledgement has been imported and Loan Origination is accepted. |

If Loan Origination Acknowledgement has not been imported, wait for the Loan Origination Acknowledgement file, load and import the file. |

|

Orig + PNote |

Yes, if Origination Acknowledgement has been imported and Loan Origination is accepted. The loan application must be updated with an approved promissory note. Promissory Note information maybe provided on an Origination Acknowledgement or Promissory Note Acknowledgement file. |

If a Loan Origination Acknowledgement file has not been imported, wait for the Loan Origination Acknowledgement file, then load and import the file. The loan application must be updated with an approved promissory note. Promissory Note information maybe provided on an Origination Acknowledgement or Promissory Note Acknowledgement file. |

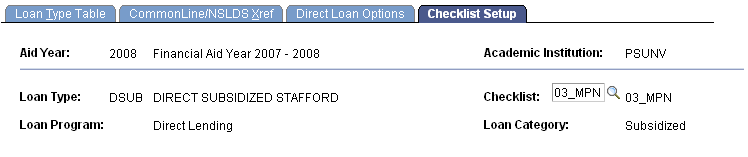

Entering Checklists for the Loan Type

Access the Checklist Setup page ().

Image: Checklist Setup page

This example illustrates the fields and controls on the Checklist Setup page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Checklist |

Select a Checklist item to associate with the loan type. You define the checklist items available. The primary use of attaching a checklist requirement is to prevent disbursement of loan funds until the required documents on the checklist are completed. You can also use it to send reminders and for statistical reporting. Some examples of possible checklist items are Direct Loan Promissory Note, Direct PLUS Prom Note, FFELP Promissory Note, FFELP PLUS Promissory Note, Perkins Promissory Note, Health Professional Note, and an Institutional/University Note. |

Note: While the official name of this federal statutory requirement is "150 Percent Direct Subsidized Loan Limit", for ease of reference in the system, the acronym "SULA" is used. It is understood that COD defines SULA as "Subsidized Usage Limit Applies" (a flag indicating whether or not a person is subject to a subsidy limit for a Direct Subsidized Loan); however, “SULA” is being used for most things related to "150 Percent Direct Subsidized Loan Limit".

In order to monitor Direct Lending Subsidized loan limits, schools are required to report Program Classification of Instructional Program (CIP) code, Published Program Length, Program Period Start Date, Weeks Program Academic Year, Enrollment Status, Program Credential Level, and Special Programs Indicator (Non-Credential Teacher Certification Program or Preparatory Coursework) to COD.

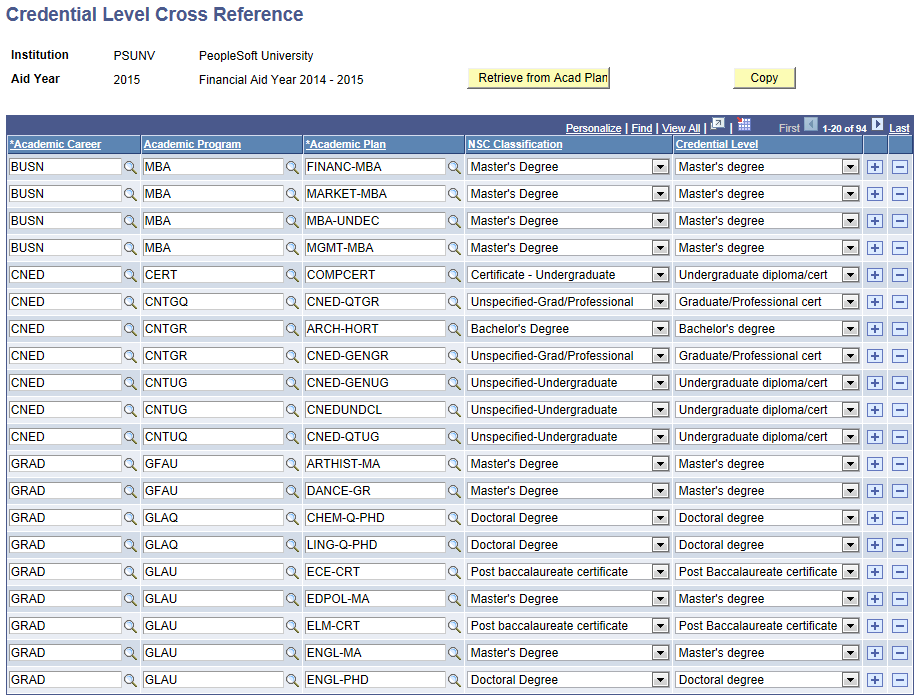

Setting Up Credential Level Cross References

Use the Credential Level Cross Reference page to map academic career/academic program/academic plan/National Student Clearinghouse (NSC) Classifications combinations to COD Credential Levels.

Access the Direct Loan Options page ().

Image: Credential Level Cross Reference page

This example illustrates the fields and controls on the Credential Level Cross Reference page. You can find definitions for the fields and controls later on this page.

Note: This table should reflect every Academic Career/Academic Program/Academic Plan combination that exists on Student FA Term. If a combination exists on Student FA Term that is not reflected on this table, the student's DL loan fails Validation.

COD Credential Level values are mapped to Academic Plan NSC Classification values as follows for purposes of populating the table when you click on the Retrieve from Acad Plan button:

|

NSC Classification |

COD Credential Level |

|---|---|

|

Associate’s Degree |

Associate’s degree |

|

Bachelor’s Degree |

Bachelor’s degree |

|

Certificate – Undergraduate |

Undergraduate diploma/cert |

|

Doctoral Degree |

Doctoral degree |

|

Master’s Degree |

Master’s degree |

|

Post baccalaureate certificate |

Post Baccalaureate certificate |

|

Postdoctorate |

First Professional degree |

|

Professional |

First Professional degree |

|

Unspecified-Grad/Professional |

Graduate/Professional cert |

|

Unspecified-Undergraduate |

Undergraduate diploma/cert |

|

Non-credential programs |

|

Field or Control |

Definition |

|---|---|

| Retrieve from Acad Plan (retrieve from academic plan) |

Click this button to automatically populate the Career, Academic Program, Academic Plan, and NSC Classification from the Academic Plan table instead of having to manually populate the table. Please note that even though you may click this button to auto-populate the table, you can still override the values here so that they can be different than what's contained on the Academic Plan table. |

| NSC Classification (National Student Clearinghouse classification) |

Select a NSC Classification value to associate with the Academic Career and Academic Plan. Valid values include:

|

| Credential Level |

Select a corresponding COD Credential Level to associate with the selected NSC Classification. Valid values include:

Note: The system assigns the credential level based only on the matching Academic Career/Academic Program/Academic Plan combination from the student's FA Term record. If no matching Career/Program/Plan combination is found, a "No SULA Data found" message is logged in the COD Outbound Message Log. If there is a matching Career/Program/Plan combination found, but there is no Credential Level specified on the setup table, a DLOVL055 - Credential level missing error is given. |

See also Defining Academic Plans.

Setting Up SULA Load Rules

Use the SULA Load Rules page to define COD Enrollment Status (SULA) loads for reporting purposes to COD.

Access the Direct Loan Options page ().

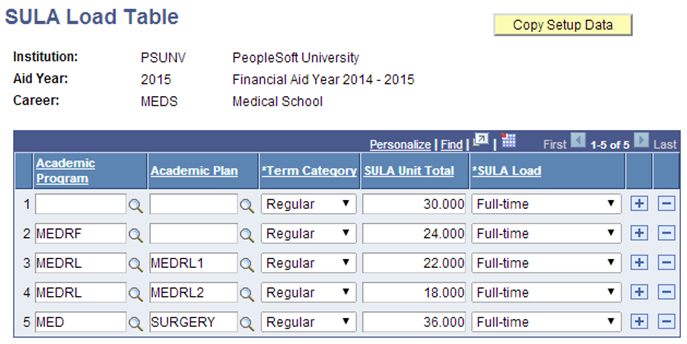

Image: SULA Load Table page

This example illustrates the fields and controls on the subsidized usage limit applies Load Table page. You can find definitions for the fields and controls later on this page.

This is setup determines the SULA Load value in the Financial Aid Term record and what is reported to COD.

The following hierarchical evaluation is used in the SULA Load assignment when using Academic Plan and Academic Program (assigned from most to least restrictive match):

Academic Program and Academic Plan match (both are non-blank).

Academic Program match (Academic Program non-blank, Academic Plan blank).

Career match (Academic Program and Academic Plan are blank).

|

Field or Control |

Definition |

|---|---|

| Term Category |

Select the term category for the default term enrollment limits of the academic program. |

| SULA Unit Total (Subsidized Usage Limit Applies unit total) |

Enter the SULA unit total threshold for each term category. The SULA unit total represents the summed number of Anticipated plus Current plus Remote units for the given SULA Load. |

| SULA Load (Subsidized Usage Limit Applies load) |

Select the SULA Load value. Values for this field are delivered with your system as translate values. Note: While you are permitted to establish a Less than Half-time value here, COD will reject Direct Lending loans that have an Enrollment Status that is Less than Half-time |

Note: For COD Originations, all SULA Load values are reported to COD as "Full-time" for all loans unless there is a SULA Load override value entered for the student.

For COD Disbursements, either the student’s actual SULA Load or the SULA Load override is reported to COD.

For information on how to override SULA Load Values, see Processing and Reviewing Financial Data.