Processing and Reviewing Direct Lending Origination Information

Access to the Direct Loan Application component should be restricted to key personnel who are actively involved with the Direct Lending process. The information in this component is eventually transmitted to the common origination and disbursement processing center (COD) in the origination outbound file.

This section discusses how to:

Process and review borrower bio/demo data.

Process and review miscellaneous borrower data.

Process and review financial data.

Process and review loan application acknowledgement data.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Application Bio/Demo |

LOAN_ORIG_DMO_DL01 |

|

Review and correct borrower information, student information, and parent information for PLUS loans. This information comes from Campus Community as well from ISIR load information that the system populates on the Institutional Application pages. |

|

Application Misc Data (application miscellaneous data) |

LOAN_ORIG_ELG_DL01 |

|

Process and review information about student eligibility, promissory note printing, and loan credit. |

|

Application Financial |

LOAN_ORIG_FIN_DL01 |

|

Review financial data and adjust the loan start, end, and certification dates. Use an override check box to change any of these dates. |

|

Application Acknowledgement |

LOAN_ORIG_STAT_DL0 |

|

Review loan process status, loan origination outbound, acknowledgement information, an data elements that go to the Origination files. Set and remove loans from Hold status. When the inbound files return from COD, the system acknowledges the data and populates the fields on this page. |

|

Miscellaneous Loan Detail |

LN_ORIG_TRNS_MISC |

Click the Misc Loan Detail link on the Application Acknowledgement page. |

View additional direct lending origination and acknowledgement information regarding the disclosure print option for the loan. The information displayed in this page represents an example of detail on an outbound file. |

|

Loan Eligibility Detail |

LN_ORIG_TRNS_ELIG |

Click the Eligibility Detail link on the Application Acknowledgement page. |

View origination and acknowledged direct lending eligibility detail information. The information displayed in this page represents an example of detail on an outbound file. |

|

Borrower Detail |

LN_ORIG_TRNS_BORR |

Click the Borrower Detail link on the Application Acknowledgement page. |

View origination and acknowledged detail information for the borrower. The information displayed in this page represents an example of detail on an outbound file. |

|

Student Detail |

LN_ORIG_TRNS_STU |

Click the Student Detail link on the Application Acknowledgement page. |

View origination and acknowledged detail information for the student. The information displayed in this page represents an example of detail on an outbound file. |

|

Name Detail |

LN_ORIG_TRNS_NAME |

Click the Name Detail link on the Application Acknowledgement page. |

View the origination and acknowledged name information for this loan. The information displayed in this page represents an example of detail on an outbound file. |

|

Address Detail |

LN_ORIG_TRNS_ADDR |

Click the Address Detail link on the Application Acknowledgement page. |

View origination and acknowledged address information for the borrower. The information displayed in this page represents an example of detail on an outbound file. |

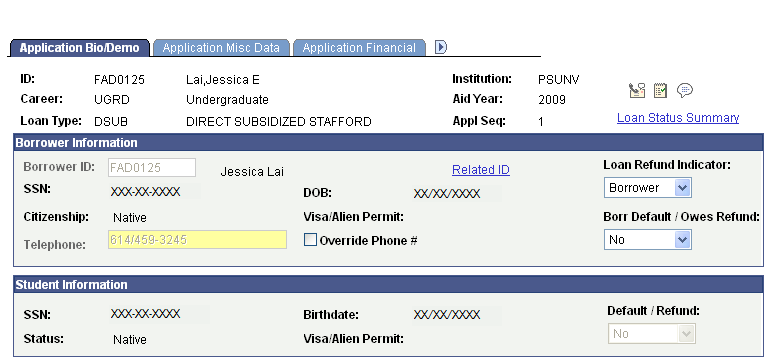

Access the Application Bio/Demo page ().

Image: Application Bio/Demo page

This example illustrates the fields and controls on the Application Bio/Demo page. You can find definitions for the fields and controls later on this page.

The Appl Seq (application sequence) number increases each time a new loan origination record is created for the ID, Career, Loan Type, Institution, and Aid Year combination.

Borrower Information

The fields in the Borrower Information group box contain information regarding the borrower of the loan. The borrower information for Stafford loans and PLUS loans for Graduate and Professional students automatically display the student's information. Information is display only.

When a PLUS for parent loan application is created, the Borrower Information is empty. Valid Borrower Information must be entered before the loan application can be communicated to COD.

|

Field or Control |

Definition |

|---|---|

| Borrower ID |

For Stafford loans and PLUS loans for Graduate and Professional students, the Borrower ID is automatically populated with the student's ID. For PLUS loans for parents, if blank, select the 'Look Up' icon to view valid Borrower IDs already established as a valid Relationship to the student's ID. Only Relationship IDs defined with the Guardian attribute of Parent or Guardian appear in the Look Up results. |

| Related ID |

Link to open the Campus Community Relationship component. Use this link to directly create a valid relationship ID, that can then be available to be entered in the Borrower ID field. When creating a relationship, the Guardian attribute must either defined as 'Parent' or 'Guardian'. |

| SSN (social security number) |

Displays the social security number for the borrower. |

| DOB (date of birth) |

Displays the date of birth for the borrower. |

| Loan Refund Indicator |

Select a value if loan refunds go to the Borrower – the parent or guardian in the case of PLUS loan or to the Student. |

| Citizenship |

Displays the Citizenship value applied to the loan application. Valid values are: 1 – Native, 2 – Naturalized, and 3 – Alien Permanent. For DL Stafford loans, the field is initially 'blank'. If the borrower's Citizenship is updated via the Override Loan Application Data component, the field displays any overridden Citizenship value. The field can also be updated for the loan application using the Population Update process. For DL PLUS for Graduate and Professional loans, the field displays the student's Citizenship defined in Campus Community. If the borrower's Citizenship is updated via the Override Loan Application Data component, the field displays any overridden Citizenship value. The field can also be updated for the loan application using the Population Update process. For DL PLUS for parent loan applications, the field displays the borrower's Citizenship defined in Campus Community. If the borrower's Citizenship is updated via the Override Loan Application Data component, the field displays any overridden Citizenship value. |

| Visa/Alien Permit |

Displays whether a borrower who is not a U.S. citizen holds a valid Visa or Alien Permit. Field can be updated via the Override Loan Application Data component. |

| Override Phone # (override phone number) |

Select this check box to activate the Telephone field and override the current information. If you select this check box and override the phone number, the new value remains regardless of changes made to Campus Community records. If you clear the check box, the system populates the Telephone field with the current Campus Community values and makes the field inaccessible. |

| Borr Default / Owes Refund (borrower default/owes refund) |

Indicates whether a borrower is in default on a student loan or owes a refund to the federal government. Values are: No, Overridden, or Yes. For Stafford loans, this value is derived from the NSLDS Match field on the Packaging Status Summary page. Note: Overridden applies to PLUS origination files only. Overridden is not an acceptable value for Direct Stafford loan origination files. The values from the NSLDS Match field are translated to this field as shown in the following table. |

|

Original Match Field Value |

Default/Refund Value |

|---|---|

|

2. Default 3. Overpayment 4. Default and Overpayment |

Yes |

|

5. Eligible Partial Title IV Aid |

Overridden |

|

All other values |

Not |

Student Information

|

Field or Control |

Definition |

|---|---|

| SSN, Birthdate, Status, and Visa/Alien Permit |

The values that appear are for the student associated with this loan. If the borrower is the student, this information is the same as the information in the Borrower Information group box. |

| Default / Refund |

This is the same field as the Borr Default / Owes Refund field in the Borrower Information group box. |

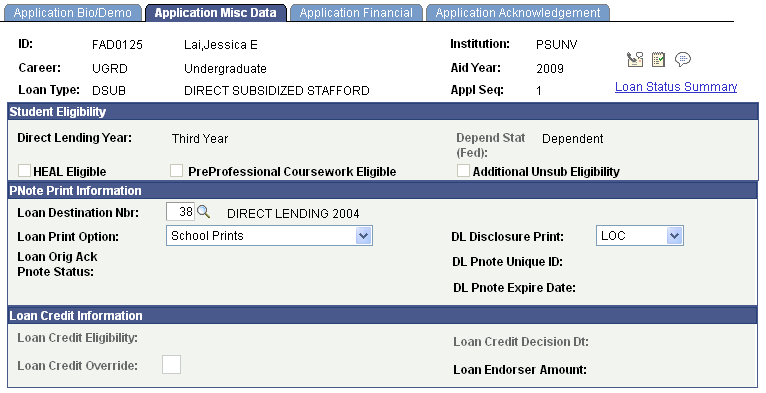

Access the Application Misc Data page ().

Image: Application Misc Data page

This example illustrates the fields and controls on the Application Misc Data page. You can find definitions for the fields and controls later on this page.

Student Eligibility

|

Field or Control |

Definition |

|---|---|

| Direct Lending Year |

Contains the direct lending grade level for this student, as defined by the U.S. Department of Education's COD Technical Reference. The term in the Direct Lending Year field in FA Term on the FA Info page is related to the first distribution used in the award for this student. That term is used to derive this Direct Lending Year value. |

| Depend Stat (Fed) (dependency status, federal) |

Displays the federal dependency status for the student. The status is derived from the FA Term table and is required on all established Direct Loans. |

| HEAL Eligible (Health Education Assistance Loan eligible) |

Indicates whether the student is eligible for a HEAL loan, as determined on the Packaging Status Summary page and is valid only on Unsubsidized loans. HEAL loans are for health profession students who meet the HEAL program requirements. HPPA indicator tag reports a true value. |

| PreProfessional Coursework Eligible |

Indicates whether the student is eligible for additional Unsubsidized Stafford due to participation in eligible undergraduate or graduate preparatory coursework. This value is derived from the Packaging Status Summary page. The student must have a Direct Lending Year of Fifth Year and above. Preprofessional Coursework indicator tag reports a true value. |

| Additional Unsub Eligible (additional unsubsidized eligible) |

This field is checked if either of two circumstances arise:

If either circumstance is met, then the Additional Unsubsidized Eligibility indicator tag reports a value of True. |

PNote Print Information

|

Field or Control |

Definition |

|---|---|

| Loan Destination Nbr (loan destination number) |

Represents the EDI destination. Select the number that corresponds to direct loan COD. |

| Loan Print Option |

Determines where the promissory note is printed. Select one of the following values: Dest Prints (return to school): Select this option to specify that the COD (the destination) prints the promissory note and sends it to the school. The school then sends the promissory note to the borrower. Dest Prints (send to Borr): Select this option to specify that the COD (the destination) prints the promissory note and sends it to the borrower. Dest Reprint: Select this option to specify that the COD (the destination) is reprinting a promissory note that was printed previously. School Prints: Select this option to specify that the school prints the promissory note and sends it to the borrower. |

| Loan Orig Ack Pnote Status (loan origination acknowledgement promissory note status) |

Displays the current status of the promissory note.

Note: Closed, Endorser, and Inactive MPN values are reported by COD. For disbursement purposes, the system treats Closed, Endorser, and Inactive MPNs as an Accepted MPN. For more information regarding how COD processes MPN's: See the U.S. Department of Education's Common Origination and Disbursement (COD) Technical Reference |

| DL Disclosure Print (direct loan disclosure print) |

Specifies whether the COD or School prints the disclosure. You can also select Reprint to indicate the disclosure was reprinted. Select COD unless the school has a custom print solution. Financial Aid does not support disclosure printing. |

| DL Pnote Unique ID (direct loan promissory note unique ID) |

Displays the unique identifier assigned to the promissory note that is attached to the loan. The loan origination acknowledgement and the PNote acknowledgement files update this value. Beginning with 2003-2004, the direct loan application processing supports master promissory note requirements for the PLUS loan types. The system adds the letter "N" to the ID to indicate that the loan is PLUS Loan MPN. The system adds the letter "M" to indicate that the loan is a Stafford (subsidized or Unsubsidized) Loan MPN. |

Loan Credit Information

These fields are used when a credit check is necessary for loan approval. This occurs with PLUS loans.

|

Field or Control |

Definition |

|---|---|

| Loan Credit Eligibility |

Displays the current status of the credit check. Values are A-Credit Approved, D-Credit Denied, or X-Credit Pending. |

| Loan Credit Decision Dt (loan credit decision date) |

Displays the date that the Loan Credit Eligibility decision occurs. |

| Loan Credit Override |

Use to override the Loan Credit Eligibility status received from the lender. If you use this field to override a credit value, you must then update the DL Disbursement Status on the Direct Loan Override page The following table explains loan credit values. |

| Ln Endorser Amount |

Represents the approved Endorser Amount from COD. Field can be edited when Loan Credit Override value equals 'L - Lower Endorser Amount'. Extreme caution should be made if Endorser Amount is overridden. Value should only be changed manually if COD is unable to provide school a Credit Override acknowledgement file with approved Endorser Amount. |

|

Loan Credit Value |

Explanation |

|---|---|

|

C – C O New Info (credit override, new information) |

Changes the Loan Credit Eligibility to Credit Approved. |

|

D – Credit Denied |

Changes the Loan Credit Eligibility to Credit Denied. |

|

E – CO Endorser OK (credit override, OK by endorser) |

Changes the Loan Credit Eligibility to Credit Approved. |

|

L – Lower Endorser Amount |

Changes the Loan Credit Eligibility to Credit Denied. Value represents a credit check where endorser is approved, but the endorsed amount is less than the award amount requested by the borrower. Credit eligibility remains denied with COD. School's action is to resubmit an award record with the award amount less than or equal to the endorser amount. COD requires an entire award record to be submitted. The Loan Origination Change process generates the appropriate award record. Schools should: 1) Reduce award amount in packaging; 2) Run Process Loans with adjustments (FAPLBOG1) to carry forward the new award amount to the loan application; 3) Generate an Origination Change. A entire award record is created only if the loan award amount is less than or equal to the endorser amount. All subsequent origination changes (except if the amount is set to zero) are held until the loan application has been updated with an accepted award adjustment by COD and response has been loaded into the system. |

|

N – Denied after Pending |

Changes the Loan Credit Eligibility to Credit Denied. |

|

X – Credit Pending |

Changes the Loan Credit Eligibility to Credit Pending. |

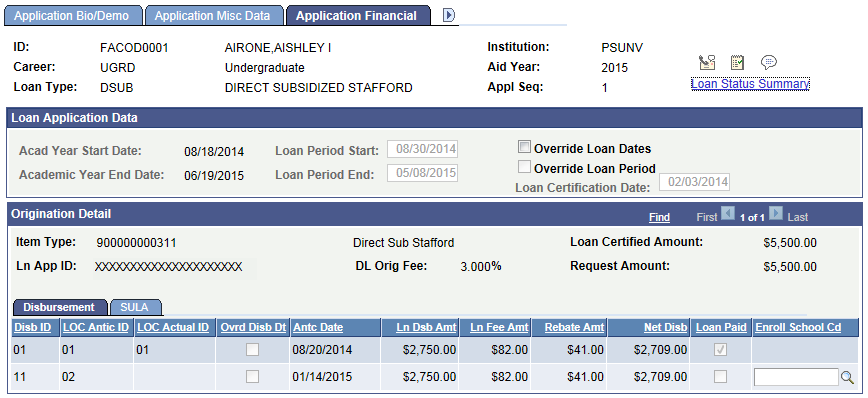

Access the Application Financial page ().

Image: Application Financial page, Disbursement tab

This example illustrates the fields and controls on the Application Financial page, Disbursement tab. You can find definitions for the fields and controls later on this page.

Loan Application Data

|

Field or Control |

Definition |

|---|---|

| Acad Year Start (academic year start) and Academic Year End Date |

These fields display the start and end dates for the academic year. These values are derived from the Aid Year table and can only be changed there. |

| Loan Period Start |

Displays the start date for the loan period. This date is generated from the Valid Careers for Terms table. This date is derived using the first day of the first term in which the anticipated distribution of the student's award is to be made. |

| Loan Period End |

Displays the end date for the loan period. This date is generated from the Valid Careers for Terms table. This date is derived using the last day of the final term in which the anticipated distribution of the student's award can be made. |

| Override Loan Dates |

Select to override and edit the loan dates. The dates are for this loan record only. When you select the check box, the date fields become available. After you edit the date fields, you must save the record. |

| Override Loan Period |

This check box is accessible only after you select the Override Loan Dates check box. Select to change the start and end dates for the loan period. In addition, when you select this check box you prevent loan adjustments from updating the changes you made to the loan period start and end dates. |

| Loan Certification Date |

Indicates the date that the loan is originated. |

Origination Detail

|

Field or Control |

Definition |

|---|---|

| Item Type |

Displays the financial aid item type and description for the loan. If available, click the link next to this field to access the Award Entry and the Award Activity pages. |

| Ln App ID (loan application ID) |

Displays the unique identifier that the Loan Origination process generated for this loan. |

| DL Orig Fee (direct lending origination fee) |

Displays the fee charged to the borrower to originate the loan. |

| Loan Certified Amount |

Displays the amount approved for the loan. This value is derived from the offer/accept amount for the award. |

| Request Amount |

Displays the Accepted amount for the award and represents the Scheduled Disbursement Amount. |

| Disb ID (disbursement ID) |

Displays the disbursement ID given to this disbursement in awarding. |

| LOC Antic ID (common origination and disbursement anticipated ID) |

Displays the sequentially ordered ID for the anticipated disbursement. The system converts the Disbursement ID that comes from the award and the anticipated disbursement date defined in the Disbursement ID setup to assist in defining the disbursement sequencing requirements. The LOC Antic ID represents the Disbursement Number for anticipated disbursements (Disbursement Release Indicator set to 'false). The LOC Antic ID may change if additional disbursements are added. However, once an associated LOC Actual ID has been assigned, the LOC Antic ID does not change. |

| LOC Actual ID (common origination and disbursement actual ID) |

Displays the numerically ordered disbursement ID, without skipping numbers. The LOC Actual ID represents the Disbursement Number for actual disbursements (Disbursement Release Indicator set to 'true'). This field is empty until the loan is disbursed to Student Financials. This field is populated when the authorization and disbursement processes are completed and the Direct Loan Out for the Disbursement Process has been run. The COD Actual ID is what is sent to the COD with the Disbursement file. |

| Ovrd Disb Dt (override disbursement date) |

Select to override and change the current requested disbursement date. If you select this check box and edit the field, the new value remains in effect regardless of future adjustments. |

| Antc Date (anticipated date) |

Displays the anticipated date for this loan disbursement. This date is derived from the disbursement date specified in the Disbursement ID table. |

| Ln Dsb Amt (loan disbursement amount) |

Displays the gross scheduled disbursement amount. This value is derived from the Accepted balance on the award disbursement. |

| Ln Fee Amt (loan fee amount) |

Displays the fee amount associated with the scheduled disbursement. This amount is derived from the Accepted fee balance. |

| Rebate Amt (amount) |

Displays the interest rebate fee amount. The system populates this field from packaging fee information. |

| Net Disb (net disbursement) |

Displays the amount scheduled for disbursement to the student. This value equals the loan disbursement amount minus the loan fee amount plus any rebate amount. |

| Loan Paid |

This check box is selected when the loan funds are disbursed to the student's account. |

| Enroll School Cd (enrollment school code) |

The Enrollment School Code represents the physical location of the student at the disbursement level. The Enrollment School Code reported is the OPEID of the Campus of the Financial Aid Term associated with the disbursement ID.

|

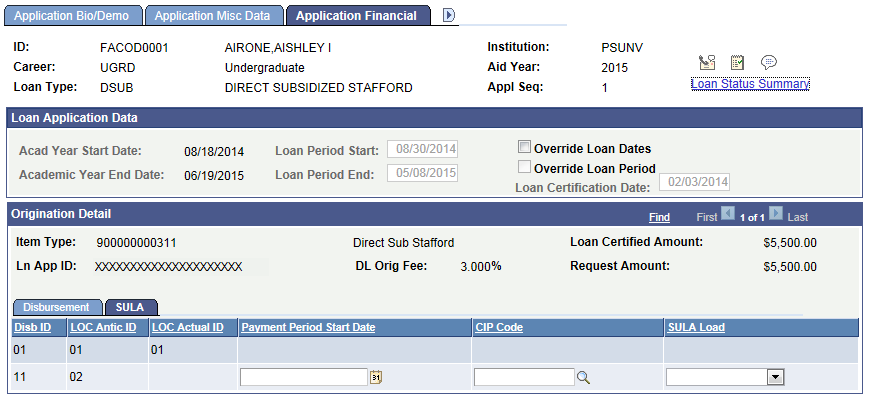

Access the Application Financial page ().

Image: Application Financial page, SULA tab

This example illustrates the fields and controls on the Application Financial page, SULA tab. You can find definitions for the fields and controls later on this page.

Use these fields to override SULA Disbursement information.

These fields can be updated in batch via Population Update.

Note: For COD Originations, all SULA Load values are reported to COD as "Full-time" for all loans unless there is a SULA Load override value entered on this page.

For COD Disbursements, either the student’s actual SULA Load or, if entered in this page, the SULA Load override is reported to COD.

Note: Once the amount associated with a particular Disbursement ID has been disbursed to the student's account, you are not permitted to override the disbursement-level SULA fields.

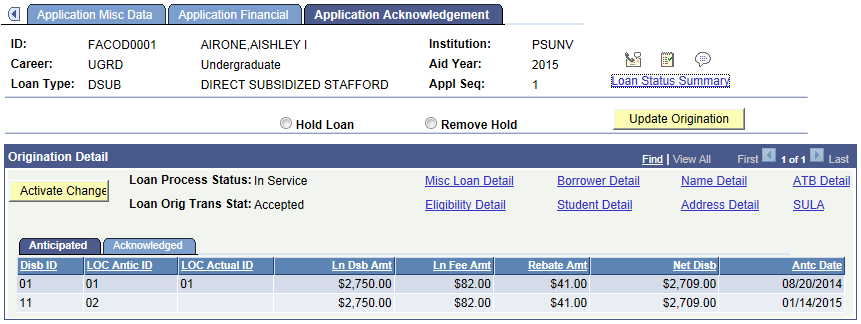

Access the Application Acknowledgement page ().

Image: Application Acknowledgement page

This example illustrates the fields and controls on the Application Acknowledgement page. You can find definitions for the fields and controls later on this page.

To perform one of the following actions, select the appropriate option and click the Update Origination button.

|

Field or Control |

Definition |

|---|---|

| Hold Loan |

Select this option to manually change the loan processing status to Hold. Selecting this option suspends processing for this loan record. If you set a loan on hold, the system generates an exception message for this activity on the Loan Exception Messages page. After the exception message is generated, you can enter a comment for audit purposes. |

| Remove Hold |

Select this option to manually remove a hold from a student's loan and permit loan processing to continue. If you remove a loan from hold, the system generates an exception message for this activity on the Loan Exception Messages page. After the exception message is generated, you can enter a comment for audit purposes. |

Note: Hold Loan and Remove Hold can be updated using Population Update.

See Using the Population Selection Process.

Origination Detail

|

Field or Control |

Definition |

|---|---|

| Activate Change |

Click this button to have the Loan Adjustment process review the student for change transactions. Data changes in the Direct Loan Application component or the Award Entry page do not require you to manually start the Loan Adjustment process here. Click the Activate Change button to start the Loan Adjustment process for other data changes (for example, the student or borrower name). |

| Loan Process Status |

Displays the current status of the loan. Values are: Cancelled: Not used for Direct Lending. Hold: Indicates the COD rejected an activity or a user manually set the loan status to Hold. The system suspends all loan processing until the hold is removed. Offered and Not Accepted: Indicates that a loan transmission based on an offer is not transmitted until the award is accepted. Origination Pending: Indicates a pending origination that has not been transmitted to the COD. In Service: Indicates the loan has been transmitted to the COD. Terminated: Indicates the award is cancelled and the Offer amount is set to zero prior to transmission to the COD. |

| Loan Orig Trans Stat (loan origination transmission status) |

Indicates the current status of the loan origination. Values are: Accepted: Indicates the COD has accepted the loan. Change Pending Transmission: Indicates an adjustment generated a change transaction that has not been sent to the COD. Any further changes entered alter the change record until the transmission occurs. Error: Represents an acknowledgement from the COD indicating a rejection of an origination or origination change record. Origination Pending Transmission: Indicates an Origination that has not been transmitted to the COD. Transmitted: Indicates that an acknowledgement from the COD is due regarding an origination or an origination change record. All loan change activity is suspended until the acknowledgement arrives. |

| Misc Loan Detail (miscellaneous loan detail) |

Click to access the Miscellaneous Loan Detail page, where you can review printing information, origination fees, and academic year start/end dates. |

| Eligibility Detail |

Click to access the Loan Eligibility Detail page, where you can review information on the student's loan eligibility. |

| Borrower Detail |

Click to access the Borrower Detail page, where you can review the borrower's demographic information. |

| Student Detail |

Click to access the Student Detail page, where you can review the student's demographic information. |

| Name Detail |

Click to access the Name Detail page, where you can review the name on the loan. |

| Address Detail |

Click to access the Address Detail page, where you can review or override the address for the loan. |

| ATB Detail (ability to benefit detail) |

Displays a link to Ability to Benefit information if present. Click the link to view Ability to Benefit data. |

| SULA (subsidized usage limit applies) |

Click to access the SULA Loan Detail page. |

Anticipated Tab

For definitions of the fields that appear on this tab:

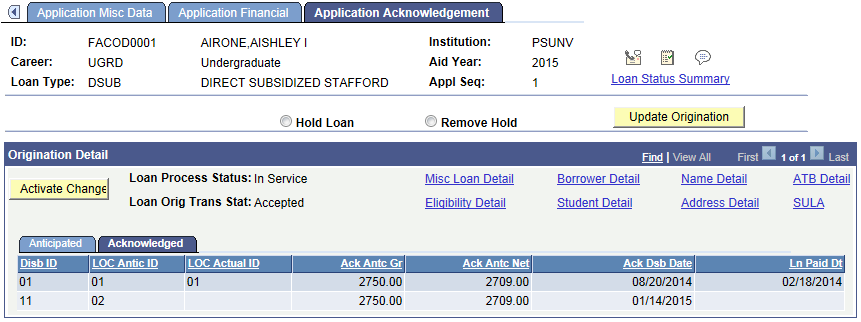

Acknowledged Tab

Select the Acknowledged tab.

Image: Application Acknowledgement page: Acknowledged tab

This example illustrates the fields and controls on the Application Acknowledgement page: Acknowledged tab. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Ack Antc Gr (acknowledged anticipated gross) |

Displays the acknowledged anticipated gross disbursement amount, as acknowledged by the COD. This amount is derived from the offer balance on the award. The sum of the anticipated gross amounts for this loan equals the loan certified amount. |

| Ack Antc Net (acknowledged anticipated net) |

Displays the acknowledged anticipated net amount, which represents the maximum disbursement for the student, as acknowledged by the COD. This amount is equal to the difference between the anticipated gross and the anticipated fee amounts. |

| Ack Dsb Date (acknowledged disbursement date) |

Displays the acknowledged disbursement date, which is the expected disbursement date, as specified on the acknowledgment record. |

| Ln Paid Dt (loan paid date) |

Displays the actual date of the disbursement after the loan funds are disbursed to the student's account and the Loan Paid check box is selected. |

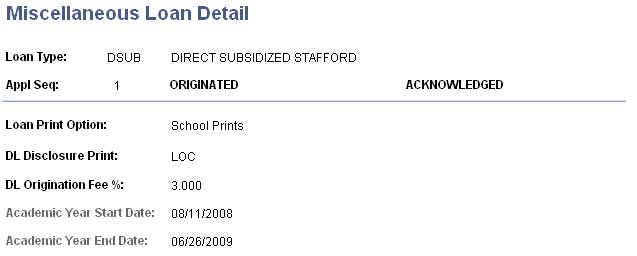

Viewing Miscellaneous Loan Details

Access the Miscellaneous Loan Detail page (click the Misc Loan Detail link on the Application Acknowledgement page).

Image: Miscellaneous Loan Detail page

This example illustrates the fields and controls on the Miscellaneous Loan Detail page. You can find definitions for the fields and controls later on this page.

The field values are derived from the Origination record and Direct Loan Application component. If the COD has sent an acknowledgment, the ORIGINATED and ACKNOWLEDGED sections are completed. If your institution has not received an acknowledgement or the Origination is rejected, only the ORIGINATED section is complete.

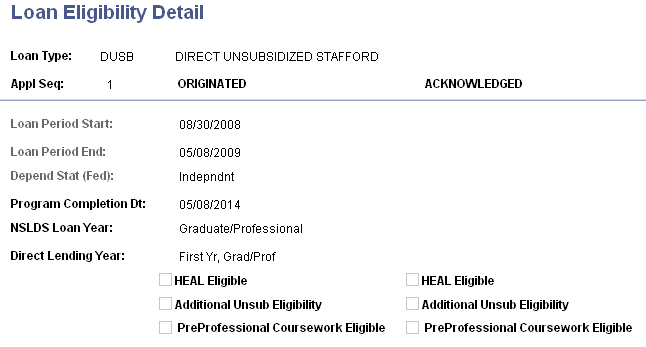

Viewing Loan Eligibility Details

Access the Loan Eligibility Detail page (click the Eligibility Detail link on the Application Acknowledgement page).

Image: Loan Eligibility Detail page

This example illustrates the fields and controls on the Loan Eligibility Detail page. You can find definitions for the fields and controls later on this page.

The field values are derived from the origination record and Direct Loan Application component. If the COD has sent an acknowledgment, the ORIGINATED and ACKNOWLEDGED sections are completed. If an acknowledgement has not been received or the origination is rejected, only the ORIGINATED section is complete.

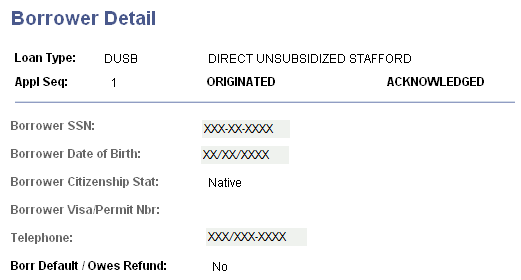

Viewing Borrower Details

Access the Borrower Detail page (click the Borrower Detail link on the Application Acknowledgement page).

Image: Borrower Detail page

This example illustrates the fields and controls on the Borrower Detail page. You can find definitions for the fields and controls later on this page.

The field values are derived from the origination record and Direct Loan Application component. If the COD has sent an acknowledgment, the ORIGINATED and ACKNOWLEDGED sections are completed. If your institution has not received an acknowledgement or the origination is rejected, only the ORIGINATED section is complete.

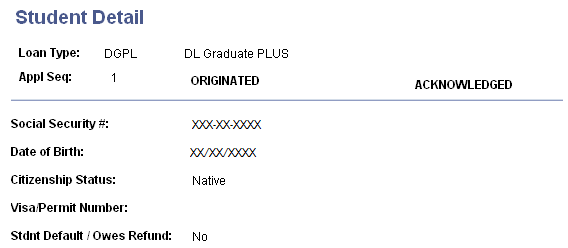

Viewing Student Details

Access the Student Detail page (click the Student Detail link on the Application Acknowledgement page).

Image: Student Detail page

This example illustrates the fields and controls on the Student Detail page. You can find definitions for the fields and controls later on this page.

The field values are derived from the origination record and Direct Loan Application component. If the COD has sent an acknowledgment, the ORIGINATED and ACKNOWLEDGED sections are completed. If your institution has not received an acknowledgement or the origination is rejected, only the ORIGINATED section is complete.

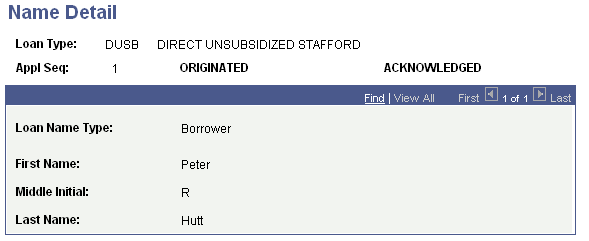

Viewing Name Details

Access the Name Detail page (click the Name Detail link on the Application Acknowledgement page).

Image: Name Detail page

This example illustrates the fields and controls on the Name Detail page. You can find definitions for the fields and controls later on this page.

The field values are derived from the origination record and Direct Loan Application component. If the COD has sent an acknowledgment, the ORIGINATED and ACKNOWLEDGED sections are completed. If your institution has not received an acknowledgement or the origination is rejected, only the ORIGINATED section is complete.

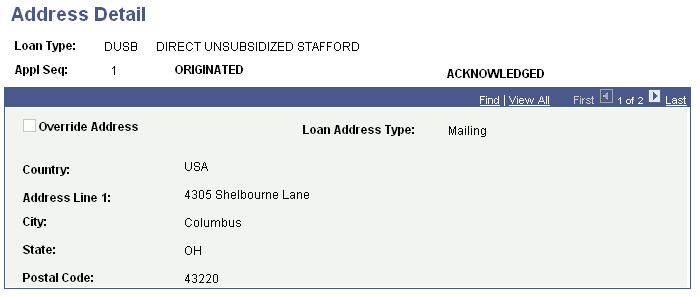

Viewing Address Details

Access the Address Detail page (click the Address Detail link on the Application Acknowledgement page).

Image: Address Detail page

This example illustrates the fields and controls on the Address Detail page. You can find definitions for the fields and controls later on this page.

The field values are derived from the origination record and Direct Loan Application component. If the COD has sent an acknowledgment, the ORIGINATED and ACKNOWLEDGED sections are completed. If your institution has not received an acknowledgement or the origination is rejected, only the ORIGINATED section is complete.

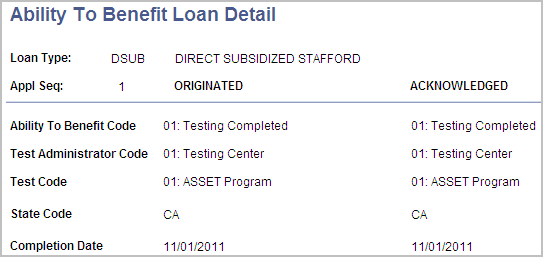

Viewing ATB Details

Access the Address Detail page (click the ATB Detail link on the Application Acknowledgement page).

Image: Ability To Benefit Loan Detail page

This example illustrates the fields and controls on the Ability To Benefit Loan Detail page. You can find definitions for the fields and controls later on this page.

The field values display the most current sequence row captured on the Manage Ability to Benefit component. The field values are derived from the origination record and Direct Loan Application component. If the COD has sent an acknowledgment, the ORIGINATED and ACKNOWLEDGED sections are both populated. If your institution has not received an acknowledgement or the origination is rejected, only the ORIGINATED section is populated.

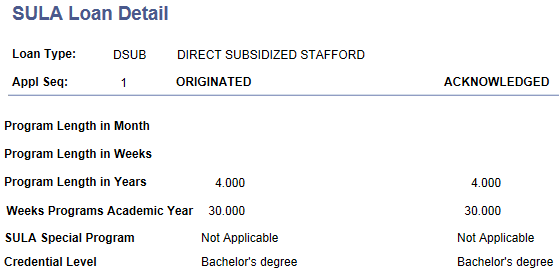

Viewing SULA Details

Access the SULA Loan Detail page (click the SULA link on the Application Acknowledgement page).

Image: SULA Loan Detail page

This illustrates the SULA loan detail page.

These are award-level fields that are reported to COD.

|

Field or Control |

Definition |

|---|---|

| Program Length in Months, Program Length in Weeks, Program Length in Years |

Displays the Program Length based on Program Length Type and Program Length values in the Academic Plan setup. See Setting Up Taxonomy. |

| Weeks Programs Academic Year |

Displays the number of weeks in a Program’s Academic Year based on the following logic:

|

| SULA Special Program |

Displays the SULA Special Program from the Financial Aid Term record. |

| Credential Level |

Displays the Credential Level based on the Credential Level Cross Reference setup. See Setting Up 150 Percent Direct Subsidized Loan Limit (SULA). |