Using FM and IM Extensions to Override Options

This section reviews overriding global policy options at the student level. FM and IM extensions can be accessed from ISIR corrections, INAS simulation, or the Maintain Institutional Application component. This section discusses how to:

Override INAS federal extension options.

Override INAS institutional extension options 1.

Override INAS institutional extension options 2.

Override INAS institutional extension options 3.

Override INAS institutional extension options 4.

Override INAS institutional extension options 5.

Note: The navigation paths for the pages listed in the following page introduction table are for aid year 20nn-20nn. Oracle supports access for three active aid years.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

FAFSA Student Information |

ISIR_PIA_CS1_nn |

|

Correct information on the FAFSA Student Information page. |

|

FAFSA Parent Information |

ISIR_PIA_CS4_nn |

|

Correct information on the FAFSA Parent Information page. |

|

INAS Federal Extension |

INAS_FED_EXTnn_SEC |

Click the FM link on any tab in the Correct 20nn-20nn ISIR records component. |

Override INAS global policy options. |

|

INAS Federal Extension Budget Durations |

INAS_FEDEX_DUR_SEC |

Click the Budget Durations link on the INAS Federal Extension page. |

Override INAS global policy options for federal academic and non-standard budget duration. |

|

INAS Federal Extension EFC Proration Options |

INAS_FEDEX_PRO_SEC |

Click the EFC Proration Options link on the INAS Federal Extension page. |

Override EFC proration options for academic and non-standard months. |

|

INAS Federal Extension EFC Override |

INAS_FEDEX_EFC_SEC |

Click the Override Federal EFC link on the INAS Federal Extension page. |

Override EFC components for academic and non-standard award periods. |

|

INAS Institutional Extension 1 |

INAS_PROF_EXT1_Snn |

Click the FM link on any tab in the Correct 20nn-20nn ISIR records component. |

Override INAS global policy options. |

|

Institutional Budget Durations |

INAS_PRFEX_DUR_SEC |

Click the Budget Durations link or the Override Institutional EFC link on the INAS Institutional Extension 1 page. |

Override INAS global policy options for institutional academic and non-standard budget duration. |

|

Institutional EFC Override |

INAS_PROF_EFC_SEC |

Click the Override Institutional EFC link on the INAS Institutional Extension 1 page. |

Override EFC components for academic and non-standard award periods. |

|

INAS Institutional Extension 2 |

INAS_PROF_EXT2_Snn |

Click the IM Extension 2 link on the INAS Institutional Extension 1 page. |

Override INAS global policy options. |

|

INAS Institutional Extension 3 |

INAS_PROF_EXT3_SEC |

Click the Extension 3 link on the INAS Institutional Extension 1 page. |

Override INAS global policy options. |

|

INAS Institutional Extension 4 |

INAS_PROF_EXT4_Snn |

Click the Extension 4 link on the INAS Institutional Extension 1 page. |

Override INAS global policy options. |

|

INAS Institutional Extension 5 |

INAS_PROF_EXT5_SEC |

Click the Extension 5 link on the INAS Institutional Extension 1 page. |

Override INAS global policy options. |

|

Monthly EFC |

NEED_SMRY_EFC_SEC |

Click the Monthly EFC link on the ISIR Corrections EFC/DB Matches page. |

View the monthly breakdown of the expected family contributions for months 1–8 and 10–12. The 9–month EFC displays on the EFC/DB Matches\Corr page. |

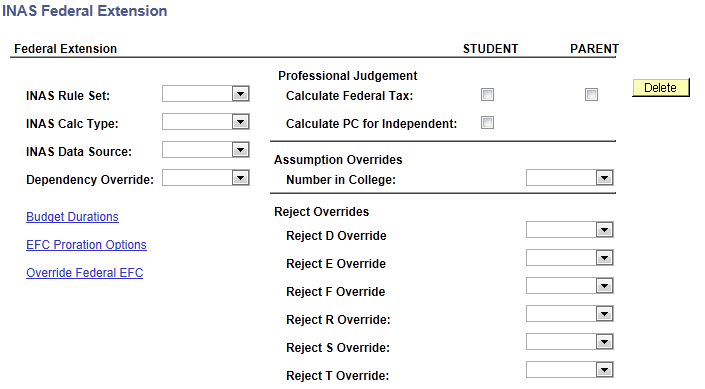

Access the INAS Federal Extension page (click the FM link on any tab of the Correct 20nn-20nn ISIR records component).

Image: INAS Federal Extension page

This example illustrates the fields and controls on the INAS Federal Extension page. You can find definitions for the fields and controls later on this page.

Federal

|

Field or Control |

Definition |

|---|---|

| INAS Rule Set |

Select a rule set. |

| INAS Calc Type (INAS calculation type) |

Select a calculation type from FM, IM, or FM & IM. |

| INAS Data Source |

Select FM, IM, or Both F/I. |

| Dependency Override |

Select either Ind Prof J (individual professional judgement) or No (no override). |

| Budget Durations |

Click this link to access the INAS Federal Extension Budget Durations page. You can enter any value for FM academic and/or non-standard budget duration. Federal rules allow whole numbers only for budget duration. If the total allocation for the budget duration is greater than 12 months, a 9–month EFC is calculated and used in the academic award period, and no EFC is calculated for the non-standard award period. This field can be populated using Population Update as long as the records being updated are aid year activated for the intended aid year. |

| Override Federal EFC |

Professional Judgement

|

Field or Control |

Definition |

|---|---|

| Calculate Federal Tax |

Select to calculate federal tax as defined by INAS. |

| Calc a PC for Independent (calculate a parent contribution for independent) |

Select to calculate a parental contribution for independent students if parental data is available. The parental contribution is calculated but not added to the EFC. |

Assumption Overrides

|

Field or Control |

Definition |

|---|---|

| Number in College |

Select one of the following: Ovrd Asmpt (override assumption) to override the number in college assumption when calculating the parent contribution. Don't Ovr (don't override) to accept the number in college assumption when calculating the parent contribution. |

Reject Overrides

|

Field or Control |

Definition |

|---|---|

| Reject D Override |

Select Don't Supp (Do not suppress) to enforce Reject D. Select Supp Rej D (suppress reject D) to override Reject D. |

| Reject E Override |

Select Don't Supp (Do not suppress) to enforce Reject E. Select Supp Rej E (suppress reject E) to override Reject E. |

| Reject F Override |

Select Don't Supp (Do not suppress) to enforce Reject F. Select Supp Rej F (suppress reject F) to override Reject F. |

| Reject R Override |

Select Don't Supp (Do not suppress) to enforce Reject R. Select Supp Rej R (suppress reject R) to override Reject R. |

| Reject S Override |

Select Don't Supp (Do not suppress) to enforce Reject S. Select: Supp Rej S (suppress reject S) to override Reject S. |

| Reject T Override |

Select Don't Supp (Do not suppress) to enforce Reject T. Select Supp Rej T (suppress reject T) to override Reject T. |

See The College Board's INAS User Manual.

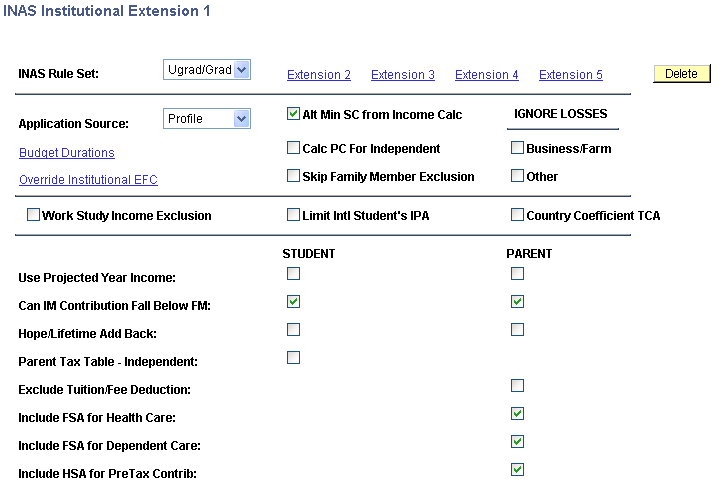

Access the INAS Institutional Extension 1 page (click the IM link on any tab of the Correct 20nn-20nn ISIR records component).

Image: INAS Institutional Extension 1 page

This example illustrates the fields and controls on the INAS Institutional Extension 1 page. You can find definitions for the fields and controls later on this page.

Use the INAS Institutional Extension 1 page to set your basic overrides. From this page, access other extension pages, budget duration or EFC overrides.

|

Field or Control |

Definition |

|---|---|

| INAS Rule Set |

Select an INAS rule set value to determine which global policy option rule to use as a base. |

| Application Source |

Select an application source from: FT CSL (full-time Canada Student Loan): Used in Canadian Need Analysis. Inst App (institutional application). PT CSL (part-time Canada Student Loan): Used in Canadian Need Analysis. Profile. |

| Budget Durations |

Click this link to access the Institutional Budget Durations page. You can enter any value for IM academic and/or non-standard budget duration. Institutional rules allow whole numbers with one decimal place. This field can be populated using Population Update as long as the records being updated are aid year activated for the intended aid year. |

| Override Institutional EFC |

Click this link to access the Override Institutional EFC page, where you can override the institutional EFC amount. |

| Alt Min SC from Income Calc (alternate minimum student contribution from income calculation) |

Select this check box to override the Alt Min SCI option set for the student on the IM Yes/No Options page. |

| Calc PC For Independent (calculate parental contribution for independent) |

Select this check box to override the Calc PC For Independent option set for the student on the IM Yes/No Options page. |

| Skip Family Member Exclusion |

Select to override the Rstrct # Household - Max Age and Rstrct # in College - Max Age options set on the IM Tax/Assess & Parms options page. |

| IGNORE LOSSES—Business/Farm |

Select to override the Allow Parent Bus/Farm Loss option set on the IM Yes/No Options page. |

| IGNORE LOSSES—Other |

Select to override the Allow Parent Other Loss option set on the IM Yes/No Options page. |

| Work Study Income Exclusion |

Select to exclude the student's work-study earnings from the income exclusion calculation. This option allows (includes) federal workstudy income back into regular income by excluding it from the income exclusion calculation.

|

| Limit Intl Student's IPA(Limit International Student's Income Protection Allowance) |

Select to limit an international student's Income Protection Allowance (IPA) to an amount greater than or equal to 25% of the parental income.

Note: This is a local-only option applicable to international (non-domestic) students only. |

| Country Coefficient TCA(Country Coefficient Total Contribution from Assets) |

Select to calculate an optional contribution from assets by applying the country coefficient to the percentage used to calculate the step increment

Note: This is a local-only option applicable to international (non-domestic) students only. |

| Use Projected Year Income |

Select to override the Use Projected Year Income option set on the IM Yes/No Options page. |

| Can IM Contribution Fall Below FM |

Select to override the IM < FM option set on the IM Yes/No Options page. |

| Hope/Lifetime Add Back |

Select to override the Add Hope/LTL option set on the IM Yes/No Options page. |

| Parent Tax Table — Independent |

Select to override the Ind Use Par St Tax Alwnc (independent use parent state tax allowance) option set on the IM Yes/No Options page. |

| Exclude Tuition/Fee Deduction |

Select to override the Exclude Tuition/Fee Deduction option set on the IM Yes/No Options page. |

| Include FSA for Health Care(Include Flexible Spending Account for Health Care) |

Select to add Flexible Spending Account for Health Care funds to total untaxed income. If not selected, Flexible Spending Account for Health Care funds is excluded from total untaxed income. |

| Include FSA for Dependent Care |

Select to add Flexible Spending Account for Dependent Care funds to total untaxed income. If not selected, Flexible Spending Account for Dependent Care funds is excluded from total untaxed income. |

| Include HSA for PreTax Contrib |

Select to add Health Saving Account funds to total untaxed income. If not selected, Health Saving Account funds are excluded from total untaxed income. |

See Maintaining Institutional Financial Aid Applications.

See the College Board's INAS User Manual.

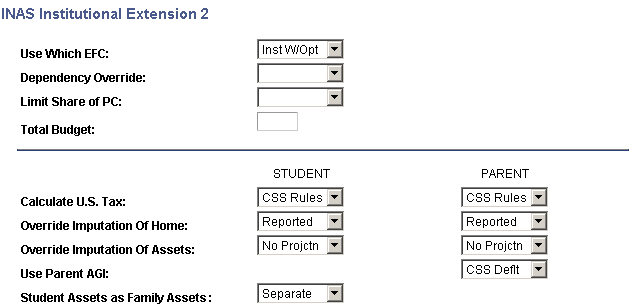

Access the INAS Institutional Extension 2 page (click the IM Extension 2 link on the INAS Institutional Extension 1 page).

Image: INAS Institutional Extension 2 page

This example illustrates the fields and controls on the INAS Institutional Extension 2 page. You can find definitions for the fields and controls later on this page.

Use the INAS Institutional Extension 2 page to override options used to determine the student's total budget.

|

Field or Control |

Definition |

|---|---|

| Use Which EFC |

Select a value to determine the institutional EFC displayed on the Need Summary page and used in the Award Entry component. Your selection overrides the value selected on the Global and Federal Options page. |

| Dependency Override |

Select either Ind Prof J ( individual professional judgement) or No (no override). INAS calculates a dependent student as independent when Ind Prof J is selected. |

| Limit Share of PC |

Select from Lowest, No, Ratio Bdg (ratio budget), or Sum of Bdg (sum of budget). Your selection overrides the value selected on the Minimum PC Range page and the Budget Options page. |

| Calculate U.S. Tax |

Select to override the value selected for the Fed Tax Allwnc Against Income field on the IM Tax/Assess & Parms page. |

| Override Imputation of Home |

Select from Alt Calc, Highest, Proj/Diff, Projected, or Reported to override the value on the Home/Asset Projections page. |

| Override Imputation of Assets |

Select Combined or No Projctn to override the value on the Asset Options page. |

| Use Parent AGI (use parent adjusted gross income) |

Select a value to override the value selected for the Use Parent AGI field on the IM Tax/Assess & Parms page. Select how the parent AGI is represented from: CSS Deflt (CSS default) Use Cmptd (use computed) Use Rptd (use reported) Use TaxRtrn (use tax return) |

| Student Assets as Family Assets (student assets as family assets) |

Select a value to override the value selected for the Studnt Assets as Family Assets field on the IM Tax/Assess & Parms page. |

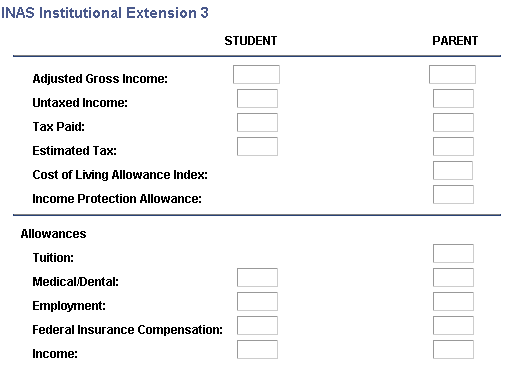

Access the INAS Institutional Extension 3 page (click the Extension 3 link on the INAS Institutional Extension 1 page).

Image: INAS Institutional Extension 3 page

This example illustrates the fields and controls on the INAS Institutional Extension 3 page. You can find definitions for the fields and controls later on this page.

Use the INAS Institutional Extension 3 page to override INAS global policy options for the given income, tax, and allowances.

|

Field or Control |

Definition |

|---|---|

| Adjusted Gross Income |

Enter an amount to override the student or parent adjusted gross income. |

| Untaxed Income |

Enter an amount to override the student or parent untaxed income. |

| Tax Paid |

Enter an amount to override the value used in the Fed Tax Allwnc Against Income (federal tax allowance against income) on the IM Tax/Assess & Parms page. |

| Estimated Tax |

Enter an amount to override the estimated tax calculated by the IM method. |

| Cost of Living Allowance Index |

Enter an amount to override the Adjust IPA/MMA Regional COL (Income Protection Allowance/Monthly Maintenance Allowance Regional Cost of Living) value based on options set on the IM Tax/Assess & Parms page. |

| Income Protection Allowance |

Enter an amount to override the Adjust IPA/MMA Regional COL calculated based on options set on the IM Tax/Assess & Parms page. |

Allowances

|

Field or Control |

Definition |

|---|---|

| Tuition |

Enter an amount to override the Max Tuition Allowance (maximum tuition allowance) per child on the IM Value Parms 1 page |

| Medical/Dental |

Enter an amount to override the % Unreimbursed Med/Dent Expense (percent unreimbursed medical/dental expense) on the IM Value Parms 1 page. |

| Employment |

Enter an amount to override % Employment Allowance (percent employment allowance) and Max Employment Allowance (maximum employment allowance) on the IM Value Parms 1 page. |

| Federal Insurance Compensation |

Enter an amount to override the allowance calculated by IM. |

| Income |

Enter an amount to override allowance against income calculated by IM. |

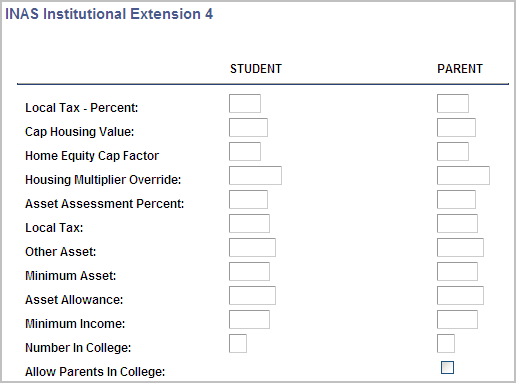

Access the INAS Institutional Extension 4 page (click the Extension 4 link on the INAS Institutional Extension 1 page).

Image: INAS Institutional Extension 4 page

This example illustrates the fields and controls on the INAS Institutional Extension 4 page. You can find definitions for the fields and controls later on this page.

Use the INAS Institutional Extension 4 page to override global policy options.

|

Field or Control |

Definition |

|---|---|

| Local Tax — Percent |

Enter an amount to override the amount calculated by IM. |

| Cap Housing Value |

Enter an amount to override the value selected for the Home Cap field on the Home/Asset Projections page. |

| Home Equity Cap Factor |

Enter an amount to override the value selected for the Home Equity Cap Factor field on the Home/Asset Projections page. |

| Housing Multiplier Override |

Enter an amount to override the delivered housing multiplier table value that projects home equity. |

| Asset Assessment Percent |

Enter an amount to override the value selected for the Asset Assessment Rate field on the Home/Asset Projections page |

| Local Tax |

Enter an amount to override amount calculated by IM. |

| Other Asset |

Enter an amount to add to calculated assets. |

| Minimum Asset |

Enter an amount to override Minimum Contribution from Asset on the IM Value Parms 1 page. |

| Asset Allowance |

Enter an amount to offset discretionary net worth calculated by IM. |

| Minimum Income |

Enter an amount to override the Minimum SC or PC values from the Minimum SC Income and Minimum PC Range pages. |

| Number in College |

Enter a number to override the number of students in college. |

| Allow Parents in College |

Enter an amount to allow parents in college. |

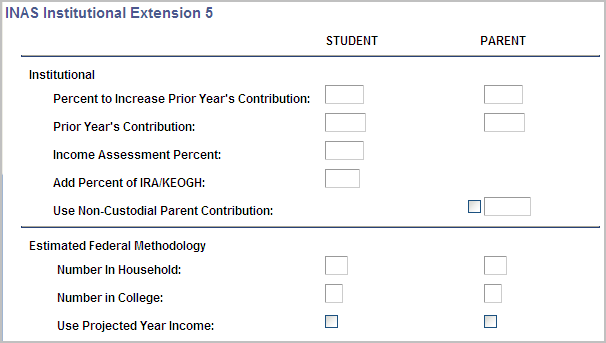

Access the INAS Institutional Extension 5 page (click the Extension 5 link on the INAS Institutional Extension 1 page).

Image: INAS Institutional Extension 5 page

This example illustrates the fields and controls on the INAS Institutional Extension 5 page. You can find definitions for the fields and controls later on this page.

Use the INAS Institutional Extension 5 page to override INAS global policy options for family factors such as past contributions.

Institutional

|

Field or Control |

Definition |

|---|---|

| Percent to Increase Prior Year's Contribution |

Enter an amount to override increase last year SC (or PC) on the IM Value Parms 1 page. |

| Prior Year's Contribution |

Enter the prior year's contribution for use with the Percent to Increase Prior Year's Contribution option. |

| Income Assessment Percent |

Enter an amount to override Use 70% Income Assmnt for Ind or Income Assmnt Rate for Dep from the IM Tax/Assess & Parms page. |

| Add Percent of IRA/KEOGH |

Enter an amount to override the value in the % Of Stdnt IRA Include In NW field from the IM Value Parms 1 page. |

| Use Non Custodial Parent Contribution |

Select to override the value entered on Add Non Custodial PC to PC on the IM Yes/No Options page. Enter a value in the accompanying field if you want to override and use an amount other than the self reported value. |

Estimated Federal Methodology

|

Field or Control |

Definition |

|---|---|

| Number In Household |

Enter an amount to override amount calculated by EFM. |

| Number In College |

Enter an amount to override amount calculated by EFM. |

| Use Projected Year Income |

Select to override the value entered in the Use Projected Year Income field on the EFM Yes/No Options page. |