Setting Up SF Merchants

To set up SF merchants, use the SF Merchants (MERCHANT_TBL) component.

This section provides an overview of SF merchants and discusses how to define ePayment processing parameters.

An SF merchant (student financials merchant) is an entity within the Student Financials application that enables you to set up unique credit card and eCheck processing rules for different departments in your institution. You can use an SF merchant to set up credit card and eCheck processing for cashiering offices and student self-service functions. The SF merchant definition provides information needed by the ePayment service provider and defines what services it performs and what customer information the system displays on the payment page.

To process credit cards and eChecks in Student Financials, you must establish at least two SF merchant definitions—one for credit card support and one for eCheck support. If you have different processing rules for credit card processing in the cashiering office than you do in student self service, then you will need to establish multiple credit card SF merchants to handle these different processing rules.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

SF Merchants |

MERCHANT_TBL |

|

Define ePayment processing parameters. Used for cashiering offices and student self service. |

Access the SF Merchants page ).

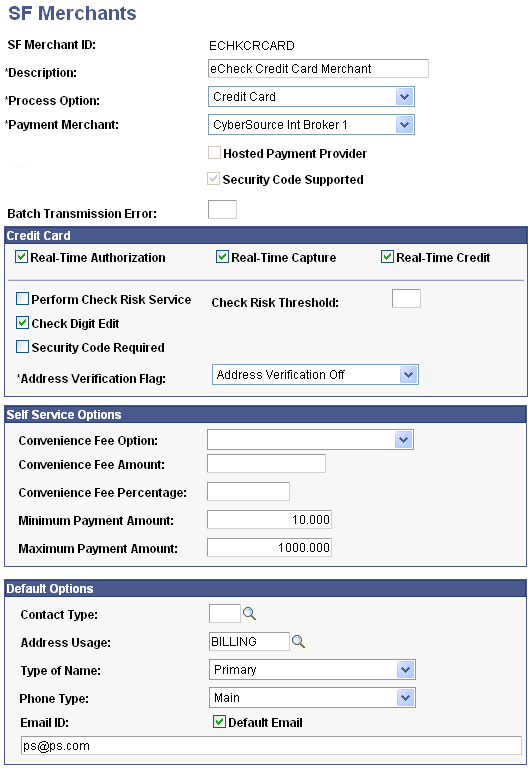

Image: SF Merchants page

This example illustrates the fields and controls on the SF Merchants page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Process Option |

Select the type of transaction that is governed by the SF Merchant rules that you are defining: Credit Card or Electronic Check. |

| Payment Merchant |

Enter the Payment Merchant that you wish to use for this SF Merchant. The ID can be shared by several SF Merchant definitions. Note: If you intend to process both credit card and eCheck self-service transactions, you must set up two SF merchants, one with a process option of Credit Card and one with a process option of Electronic Check. |

| Hosted Payment Provider |

If the payment merchant that you select on this page is a hosted payment provider and you selected the Hosted Payment Provider check box on the Payment Merchant page, the check box on this page appears selected and unavailable for edit. If the payment merchant that you select on this page is not a hosted payment merchant, the Hosted Payment Provider check box appears on this page but is cleared and is not available for edit. |

| Security Code Supported |

If you select the Security Code Supported check box on the Payment Merchant page to indicate that the merchant supports the sending of Security Code values, the check box on this page appears selected and unavailable for edit. This check box does not appear for hosted payment providers. |

| Batch Transmission Error |

Enter the maximum number of batch transmission errors that you want the system to allow before canceling the batch transmission. |

Credit Card

This group box appears if you select Credit Card in the Process Option field. Use it to enter credit card–specific processing parameters. Check with your third party provider for a list of supported services.

Note: For AAWS application fee payments, the Real-Time Authorization and Real-Time Capture check boxes are selected by default and are not available for edit. The Real-Time Credit check box is available but should not be selected for AAWS application fee payments.

|

Field or Control |

Definition |

|---|---|

| Real-Time Authorization |

Select to authorize credit card transactions in real time, actually reserving or setting aside credit card funds. If you clear this check box, you must authorize credit card transactions in batch mode. When you select this check box, the Real-Time Capture check box becomes available. For hosted payment providers, this check box is selected and is not available for edit. |

| Real-Time Capture |

Select to capture credit card transactions in real time, actually transferring funds to your institution as the transaction takes place. If you clear this check box, you must capture credit card transactions in batch mode. For hosted payment providers, this check box is selected and is not available for edit. |

| Real-Time Credit |

Select to credit in real time when you void credit card payments originating from cashiering offices. Note: Do not select this check box for self-service transactions because you can only process credits for self-service transactions in batch. |

| Perform Check Risk Service |

Select to perform a risk assessment at the time of authorization. The risk assessment is an estimation of the veracity of the transaction. Factors such as improper address, too many transactions, or transactions dispersed geographically increase the risk of fraud. This check box is not available for hosted payment providers. |

| Check Digit Edit |

Select to verify the check digit of the credit card number being used prior to processing the transaction. If the check digit is incorrect, the customer receives an error message and is asked to correct the credit card number entered. This check box is not available for hosted payment providers. |

| Check Risk Threshold |

Enter an amount above which the credit card processing merchant is alerted to the possibility of fraud. When a transaction is processed, the credit card processing vendor returns a risk assessment. The check risk threshold is the allowable risk that a school is willing to assume for a given transaction. This check box is not available for hosted payment providers. |

| Security Code Required |

This check box is available only for credit card merchants. The check box does not appear if the merchant is a hosted payment provider. If you select this check box, the Security Code field is available as a required field on all pages that accept credit card transactions—Cashiering, Make a Payment, and Purchase Miscellaneous Items. The Security Code field does not appear on any inquiry pages. Note: The Security Code is supported only if you use the Integration Broker interface for credit card processing. Do not select the check box if you use Business Interlinks. |

| Address Verification Flag |

This field controls whether the system verifies the credit card billing address during credit card processing. The options are Address Verification Off and Address Verification On. Note: If you select Address Verification On and the address given does not match, authorization will be declined, but the credit card funds will be set aside. This field appears on this page and the Payment Merchant page. |

Electronic Check

This group box appears if you select Electronic Check in the Process Option field. Use it to enter eCheck-specific processing parameters. Check with your third party provider for a list of supported services.

|

Field or Control |

Definition |

|---|---|

| Real-Time Debit |

Select to process eCheck transactions in real time. If you clear this check box, you must run the eCheck Processing process to debit eCheck payments in batch. |

| Authentication Method or Shared Secret |

Define how the system authenticates eCheck payments. For Integration Broker and Business Interlinks, the field appears as Authentication Method. If you select Birthdate, PIN, or National ID Number, students must enter the required information to authenticate an eCheck payment. If you select No Authentication, students can submit eCheck payments without authentication. You define a student's birthdate, national ID number, or PIN in PeopleSoft Campus Community. The system always uses a student's primary national ID number for authentication purposes. Note: Students should not use dashes when entering the national ID number. For Hosted Payment, the field appears as Shared Secret. When the third party payment provider authenticates the student on their site, they use the Shared Secret provided by Campus Solutions to verify the student. Valid values are and Birth Date, Constituent Birth Date, and PIN. See: |

Self Service Options

Convenience fee does not apply for AAWS application fee processing.

|

Field or Control |

Definition |

|---|---|

| Convenience Fee Option |

Select one of the following options if you want to charge students a fee for each ePayment transaction. Fixed Amount: Select to charge a fixed convenience fee for each ePayment transaction. Percentage: Select to make the convenience fee equal a percentage of the ePayment transaction. Note: In most cases, the ePayment convenience fee is posted wherever the payment is applied. For example, if a payment is allocated to charges across multiple business units, the convenience fee is based on the total payment, but is distributed proportionately across the business units. If the payment is not allocated across business units but is directed to charges in one business unit, the convenience fee will be posted in the same business unit. If a payment is not manually allocated, the convenience fee is directed to the business unit with the highest priority. |

| Convenience Fee Amount |

If you want to charge a fixed convenience fee amount, specify the amount as currency. (For example, using U.S. Dollars as the base currency, an entry of 1.50 results in a surcharge of 1.50 USD per transaction). |

| Convenience Fee Percentage |

If you want to charge a percentage convenience fee, specify the percentage as a number greater than zero. In the previous example, the entry 5.5 results in a surcharge of 5.5 percent per transaction. |

| Minimum Payment Amount |

Set the minimum amount that a student can pay during a single ePayment transaction. |

| Maximum Payment Amount |

Set the maximum amount that a student can pay during a single ePayment transaction. |

Default Options

Items in this group box relate to customer information that the system displays on the Make a Payment page for self-service transactions, and the Tender Details page for cashiering transactions.

|

Field or Control |

Definition |

|---|---|

| Contact Type |

Select the contact type representing the address for an External Org ID. |

| Address Usage |

Select the address usage type that you want to use to display default customer addresses on the payment page. |

| Default Email |

ePayment processing vendors require an email address to process transactions. Select this check box to use the default email address entered in the Email ID field rather than requiring students to enter one. When you select this check box, the Email Address field does not appear on the Make a Payment self-service page. |

| Type of Name |

Select the default name type that the system uses to look up and display the customer name on the Make a Payment page. |

| Phone Type |

ePayment processing vendors require a phone number to process transactions over the web. Select the default phone type that the system uses to look up and display the customer phone number on the Make a Payment page. |

| Email ID |

Enter the default generic email address that the system uses for all credit card transactions when you select the Default Email check box. |

See Electronic Payment Integration Developer's Reference Guide. The guide is posted to My Oracle Support.