Using ITEM_SF Installments

To use the ITEM_SF installment functionality, you must select the Create Tuition Installments check box on the SF Installation 2 page. Additionally, review the Enforce Payment Restriction and Enable Billed Adjustments check boxes. To define the terms that will allow ITEM_SF installments, specify the terms in the Tuition Calculation Controls, Installment Controls page. When tuition is initially calculated, the system creates a unique ITEM_SF record, per due date calendar, for each installment. All installments are posted including future-dated installments. Past due installments can be created if the Assess Past Installments check box is selected on the Tuition Groups - Definition page. The total amount of the installment should match the original fee amount. If an additional amount is needed to match the original fee, the extra pennies are added to the last installment. For example, the original fee is 100 USD and the due date calendar creates three installments. The due dates are January 1 to March 1, each with an installment amount of 33.33 USD. The remaining 0.01 USD is added to the last installment, March 1. This gives a total installment amount that matches the original 100 USD fee.

Also, if the billing and due date calendar create all installments with due dates that are earlier than the current system date and the Assess Past Installments check box is not selected on the Tuition Groups - Definition page, the following message appears: All Installments are in the past. This message also appears on the Calculation Messages page.

After the initial tuition calculation has created the ITEM_SF installments and there is either an addition or decrease in the fee, the adjustment process will determine whether the installment has been billed (ITEM_LINE_SF.BILLING_FLAG = 'Y') and the value that is defined in the tuition group's Adjust Billed Installments check box (SEL_GROUP_TBL.SSF_ADJ_BILL_INST). The following table provides a summary of the adjustment logic that determines if an installment can be adjusted:

|

Upward Adjustments |

Downward Adjustments |

|

|---|---|---|

|

Adjust Billed Installments = Y |

|

|

|

Adjust Billed Installments = N |

|

|

Another feature of the ITEM_SF installment functionality is that it applies any associated waiver proportionally across all installments. The waiver uses the billing date of the charge item number and inherits the attributes of the charge item number. Proportionally applied waivers are subject to the fee's due date calendar.

When a new fee is calculated, but has not been posted to an account, the due date calendar ranges that are identified at the time of calculation prevails. If you make future adjustments to the fee, the initial installments or due dates that were initially calculated are retained. Subsequent fees that are added after the initial tuition calculation may fall into a different time range defined using the same billing and due calendar.

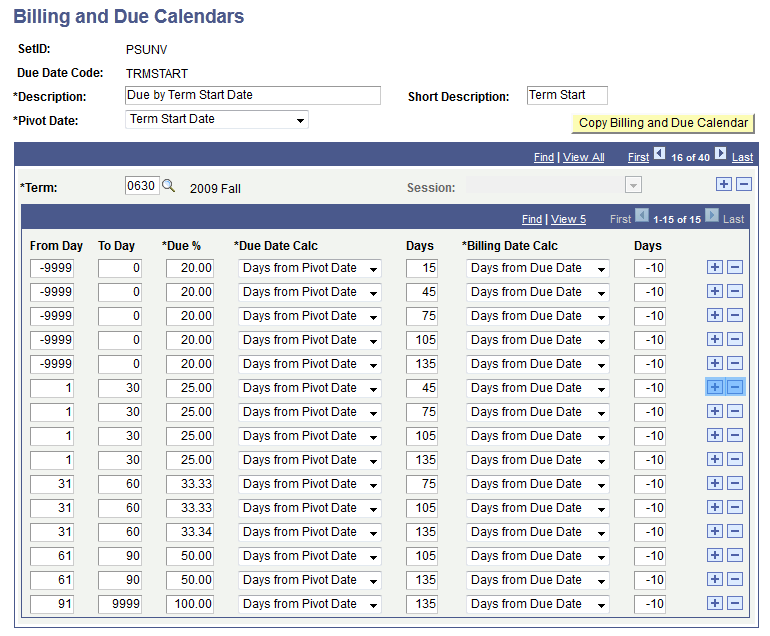

Consider this example of a fee that is calculated into a five-installment calendar and how it can still fall into line with the other remaining installments. At any time (-9999) before term starts (0), the fee is split into five installments of 20% each. If the fee is first calculated during the first month (1–30), then the fee is split into four installments of 25% each. If the fee is calculated during the second month (31–60), then the fee is split into three installments of 33.33% each. If the fee is calculated during the third month (61–90), two installments of 50% each are created. And, if the fee is calculated any time from the fourth month onward (91–9999), then it becomes due in full in the last (fifth) installment. The following page illustrates the example.

Image: Billing and Due Calendars page

This example illustrates the fields and controls on the Billing and Due Calendars page. You can find definitions for the fields and controls later on this page.

If you change the due date calendar after installments have been billed, the tuition calculation process will not use the modified due date calendar. Instead, the tuition calculation process will use the original dates that were initially calculated. You should recalculate tuition using a different tuition group and a new due date calendar.

If you want to reverse a waiver, set its Effective Status to Inactive. Billed installments will be affected.

The ITEM_SF installment functionality is unable to track class pricing (FEE_CLASS_PRICE table). The number of ITEM_SF records that are created is determined by the number of installments, but the FEE_CLASS_PRICE table does not contain the number of installments. If you create ITEM_SF installments, the track class pricing functionality is not available. The general ledger interface and third party contract course list produce an error if you attempt to use ITEM_SF installments along with the track class pricing functionality.