51 Fiscal Books

This chapter contains these topics:

51.1 Overview

In Brazil, the government requires that business maintain detail information about all merchandise and associates taxes during the delivery process. The information accompanies shipments in the form of a document known as fiscal note.

The fiscal notes that are generated by the Sales and Procurement systems are converted into the Fiscal Books module.

Fiscal books reports provide supplementary data for the fiscal books that you submit to the government. You produce fiscal books reports for the same tax-reporting period as the fiscal books.

51.1.1 Tasks

JD Edwards's solutions for Fiscal Books Brazil consist of the following tasks:

FISCAL BOOKS

NOTA FISCAL CONVERSION

Fiscal Note on line

Enter Input Nota Fiscal

Enter Output Nota Fiscal

Fiscal Note batch conversion

Convert Nota Fiscal for Report

Process Input Fiscal Note

Process Output Fiscal Note

GENERATE REPORTS

Industry

Output Trans Register Model 2

Input Trans Register Cat 21

Input Transactions Register

Output Transactions Register

Commerce

Input Transactions Register

Output Transactions Register

Municipal

DIPAN Declaration

DECLAN Declaration

Statement Register Complement

ICMS Statement Report

IPI Statement Report

GIA

Tax Collection Report

ICMS by State

Input Transactions

Output Transactions

Nota Fiscal W/Retained ICMS

DIPI Register - Summary

DIPI Register

GIA ICMS - Input transactions

GIA ICMS - Output transactions

CREATE TAPES

Build ICMS Outfile

Inter State Transactions

Collection National Guide

IN86 PROCESSING

WORK FILE CREATION

Accounting transactions

Monthly Account balance

Accounts receivable

Accounts payable

Goods register

Merch/serv F.N.issued by comp.

Service F.N. issued by company

Merch/Serv F.N.issued by other

Stock checking

Inventory Register

Bill of material

Export Transactions

Import Transactions

WORK FILE MAINTENANCE & INQUIRY

MAIN FILES

Accounting Transactions

Monthly Account Balances

Vendors / Customers

Goods Register

Merch/Serv F.N. issued by comp

Services F.N. issued by comp.

Merch/Serv F.N.issued by other

Stock checking

Inventory registry

Bill of material

COMPLEMENTARY FILES

Physical / Juridic Person

Chart of accounts

Cost Center / Branch Plant

Operation Type

Merchandise and Services

Profit and Discount Codes

NON JD Edwards World SYSTEM TRANSACTIONS

Export Transactions

Import Transactions

Payment Sheet

Employee Register

TEXT FILE CREATION & EDITING

MAIN FILES

Accounting Transactions

Monthly Account Balances

Vendors / Customers

Goods Register

Merch/Serv F.N. issued by comp

Services F.N. issued by comp.

Merch/Serv F.N.issued by other

Stock checking

Inventory registry

Bill of material

COMPLEMENTARY FILES

Physical / Juridic Person

Chart of accounts

Cost Center / Branch Plant

Transaction Code

Merchandise/ Services

Profit/ Discount Codes

NON JD Edwards World SYSTEM TRANSACTIONS

Export Transactions

Import Transactions

Payment Sheet

Employee Register

STOCK REPORTING

MONTHLY CLOSE

Monthly processes

Average cost calc and balance

Create detail for model 3

GENERATE REPORTS

Inventory Register

Inventory Register by MCU

Stock Production Register

Goods coding Table

51.2 Fiscal Books

Fiscal books are required by the Brazilian government to report information about taxable transactions and the taxes due on those transactions. You print fiscal books on the 10th, 20th, and the last day of the month for ICMS tax and at the end of the month for IPI tax.

The fiscal notes that are generated by the Sales and Procurement systems are automatically converted into the Fiscal Books module. You must manually enter stand-alone fiscal notes.

A program is provided that populates a fiscal note header and a fiscal note detail work file with data from the fiscal note header and fiscal note detail files. Then you run reports from the work files to generate reports that comply with the layout, which is defined by the ICMS Ordinance 57/95, and you generate electronic media files according to the layout that is defined by the ICMS Ordinance 57/95 (Systema Integrado de Informacoes). Additionally, programs are provided that generate supporting reports and programs that submit fiscal book data to the tax authority electronically.

When you generate Fiscal Books, the system prints an opening and closing page. You create the text for opening and closing pages by using the Fiscal Books Next Numbers program.

|

Caution: First you must set up the system for Fiscal Books:

|

51.3 Fiscal Note Conversion

The Sales and Procurement systems write data to the Fiscal note Header - Brazil and the Fiscal note Detail - Brazil files when you generate fiscal notes. The system writes data in these files to the Fiscal note - Header (Fiscal Books) file and the Fiscal note - Detail (Fiscal Books) file when you run the Fiscal note Conversion program. The system uses the data in Fiscal Book files to create Fiscal Books.

If you generate stand-alone fiscal notes or you generate fiscal notes outside of the JD Edwards World systems, the data is not included in those files. Therefore, data for those fiscal notes is not written to fiscal files when you run the Nota Fiscal Conversion program. You use the Maintenance of Fiscal Books program to add data for inbound and outbound fiscal notes before you run the Nota Fiscal Conversion program. You can also use this program to revise or delete fiscal note records.

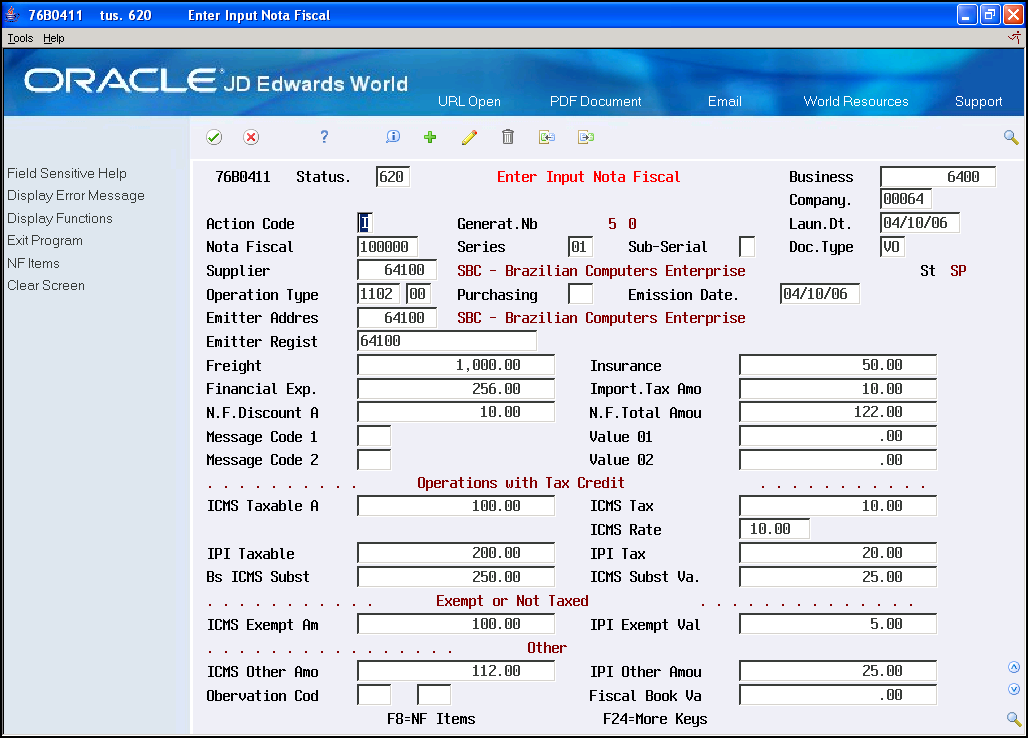

51.3.1 Fiscal Note Online - Enter Input/Output Fiscal Note

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 2 - Nota Fiscal Conversion

From Fiscal Note Data Collection - Brazil (G76B0010), choose 2 - Enter Input Fiscal note or choose 3 - Enter Output Fiscal note

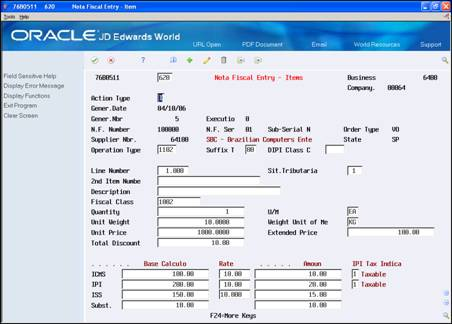

Figure 51-1 Enter Input Nota Fiscal screen

Description of ''Figure 51-1 Enter Input Nota Fiscal screen''

Complete the following fields:

| Field | Explanation |

|---|---|

| Status | The user defined code (file 40/AT) for the status code. The system retrieves the status code that you entered in the processing option 2 or you can enter a code in this field. This code represents the status that will be written in file in case of update or the status the NF is recorded-.low end of the range |

| B.Unit | An alphanumeric field that identifies a separate entity within a business for which you want to track the fiscal note. User can enter it manually or set up it in P.Option 3 |

| Company | Code that identifies the NF organization, Default P.Option 1 |

| Generate NB | Fiscal note generation number, according to bookkeeping order in the entry fiscal notes book. (Output field) |

| Launc DT | N.F. Launch date |

| Fiscal note | You use this numeric, six-character field to identify the Fiscal note number. The Fiscal note Number field is the first key that the system uses to access a specific Fiscal note. |

| Series | You use this alphanumeric, two-character field to identify the Fiscal note Series. The Fiscal note Series field is the second key that the system uses to access a specific Fiscal note. |

| Sub-Serial | Alphanumeric field (1-char) used to identify a sub-serial of Fiscal note. This is the third field of the concatenated key to access the Fiscal note. |

| Doc.Type | A user defined code (00/DT) that identifies the type of document |

| Supplier | Number that identifies the supplier for a Fiscal note. |

| ST | A code defined for the state or province in F0075, in conjunction with a country code defined in UDC 00/CN. This code is usually a postal service abbreviation. |

| Operation Type | Use this four-character code to indicate different types of transactions for tax purposes.

To enter valid values for the Transaction Nature code, use the following convention: XYYY A value for X will default to define the origin of the transaction (inbound or outbound). Valid values for X are: 1 - Inbound, inside the state 2 - Inbound, other states 3 - Inbound, import 5 - Outbound, inside state 6 - Outbound, other states 7 - Outbound, export The values for YYY are defined by the fiscal authority to identify products. and Complete the two-character field in conjunction with the Transaction Nature code to identify the complementary implications of a type of transaction. For example, the suffix might indicate that a certain type of transaction represents an inventory change, or that a transaction is eligible for a certain type of tax. Valid values might include: 01 Bonus 02 Demo 03 Sample 04 Return merchandise 05 Back order 06 Donation |

| Purchasing | Code used to identify what the purchased items will be used for.

For instance: 1 - Raw Material 2 - Raw Material for resale products 3 - Raw Material for sample manufacturing 4 - Packing Material 5 - Consumption products purchase 6 - Fixed Assets purchase 7 - Other |

| Emission Date | Fiscal note Issue Date |

| Emitter Address | Address book number, which identifies the emitter of the fiscal note. |

| Emitter Regist | Identify the Company according to Union (Federal Revenue). Mandatory field for Fiscal Notes and Legal Reports. Edited as follows:

XXX.XXX.XXX/YYYY-WW Where: XXX.XXX.XXX = Company Name Code YYYY = Head Office or Branch Code WW = Check Digit |

| Freight | Complete the Fiscal note Freight field whenever you classify freight as a complementary expense to your customer. The system prorates this expense amount among each of the Fiscal note listed and adds the prorated amount to the ICMS taxable amounts for each document. |

| Insurance | The insurance amount that you charge the client as complementary expense. This amount must be included on the Fiscal note. |

| Financial Exp | The amount of the total financial expenses that are printed on the Fiscal note. |

| Import. Tax Amo | This is the tax amount related to importation by the company that purchased the goods/services. The tax amount is reported in the Importation Declaration. |

| N.F.Discount | The amount of the discount amount available for the Fiscal note. |

| N.F.Total Amount | The total amount of the Fiscal note. The system calculates the total as follows:

Merchandise + IPI tax amount + ICMS Substitute tax amount + Complementary Expenses - Discounts |

| Message Code 1 | In/Outbound Book-Message Code |

| Value 01 | Fiscal note Amount 1 |

| Message Code 2 | In/Outbound Book-Message Code |

| Value 02 | Fiscal note Amount 2 |

| ICMS Taxable Amount | The amount on which ICMS taxes are assessed. |

| ICMS Tax | The ICMS tax amount that is printed on the Fiscal note |

| ICMS Tax Rate | ICMS Tax Rate specified for every "Unidade da Federacao" of goods destination. Note: Access through menu option 3/G76B41B. |

| IPI Taxable | The amount on which IPI taxes are assessed |

| IPI Tax | The IPI tax amount that is printed on the Fiscal note. |

| Bs ICMS Subst | The amount on which ICMS Substitute tax is assessed. Products that are eligible for ICMS Substitute tax are listed in ICMS government directive 14. |

| ICMS Substi. Va | The ICMS Substitute amount that your customer must remit in advance if they are subject to Tax Substitution Mark-up. |

| ICMS Exempt | The amount that is not eligible for ICMS tax |

| IPI Exempt | The amount that is not eligible for IPI tax |

| ICMS Other | Any merchandise value amount that is classified as Other for ICMS taxing purposes. |

| IPI Other | Any merchandise value amount that is classified as Other for IPI taxing purposes. |

| Observation CO | Fiscal Message / Observations |

| Fiscal Book Va | Amount to be used on Fiscal Books linked to fiscal text (BD03 or BD04) according to client's need. |

Addition: Press Enter to Access to Fiscal note Item.

Inquiry or Change: Press F8 to Access to Fiscal note Item.

Figure 51-2 Nota Fiscal Entry - Items screen

Description of ''Figure 51-2 Nota Fiscal Entry - Items screen''

Complete the following fields:

| Field | Explanation |

|---|---|

| B.Unit | An alphanumeric field that identifies a separate entity within a business for which you want to track the fiscal note. User can enter it manually or set up it in P.Option 3 |

| Company | Code that identifies the NF organization, Default P.Option 1 |

| Generate Date | Fiscal note generation date |

| Generate NB | Fiscal note generation number, according to bookkeeping order in the entry fiscal notes book. (Output field) |

| Execution | Execution sequence number for a fiscal book. |

| Fiscal note | You use this numeric, six-character field to identify the Fiscal note number. The Fiscal note Number field is the first key that the system uses to access a specific Fiscal note. |

| Series | You use this alphanumeric, two-character field to identify the Fiscal note Series. The Fiscal note Series field is the second key that the system uses to access a specific Fiscal note. |

| Sub-Serial | Alphanumeric field (1-char) used to identify a sub-serial of Fiscal note. This is the third field of the concatenated key to access the Fiscal note. |

| Doc.Type | A user defined code (00/DT) that identifies the type of document |

| Supplier | Number that identifies the supplier for a Fiscal note. |

| ST | A code defined for the state or province in F0075, in conjunction with a country code defined in UDC 00/CN. This code is usually a postal service abbreviation. |

| Operation Type/Suffix Type | Use this four-character code to indicate different types of transactions for tax purposes.

To enter valid values for the Transaction Nature code, use the following convention: XYYY A value for X will default to define the origin of the transaction (inbound or outbound). Valid values for X are: 1 - Inbound, inside the state 2 - Inbound, other states 3 - Inbound, import 5 - Outbound, inside state 6 - Outbound, other states 7 - Outbound, export The values for YYY are defined by the fiscal authority to identify products. and Complete the two-character field in conjunction with the Transaction Nature code to identify the complementary implications of a type of transaction. For example, the suffix might indicate that a certain type of transaction represents an inventory change, or that a transaction is eligible for a certain type of tax. Valid values might include: 01 Bonus 02 Demo 03 Sample 04 Return merchandise 05 Back order 06 Donation |

| DIPI Class | The DIPI Classification code is a four-character, alphanumeric field that you can use for tax reporting. Use this code to link the product with the Transaction Nature. |

| Line Number | A number that identifies multiple occurrences, such as line numbers on a purchase order or other document. |

| SIT Tributaria | Enter a two-character code to indicate the ICMS tax eligibility of a product. The values you enter for the first character of the code indicates the origin of the product, based on the BORI edit rules. The value you enter for the second character of the code indicates how the product will be taxed by ICMS. Valid values to indicate the ICMS tax condition of a product are:

O 0 - Totally taxed O 1 - Taxed, with ICMS collection by tax substitution O 2 - Taxed, with taxable amount reduction O 3 - Exempt or non-taxable, with ICMS collection by tax substitution O 4 - Exempt or non-taxable O 5 - Suspended and deferred 6 - ICMS previously charged by tax substitution O 7 - Reduced taxable amount, with ICMS collection by tax substitution O 9 - Other |

| 2nd Item Number | A number that identifies the item. |

| Description | Brief information about an item. |

| Fiscal Class | Use the Fiscal Classification code to identify groups of products, as defined by the local tax authorities. The product groups are based on taxing conventions and other national statistics. The system uses this code to determine the applicable tax rate for a product. |

| Quantity | The quantity of units affected by this transaction |

| U/M | A user defined code (00/UM) that indicates the quantity in which to express an inventory item, for example, CS (case) or BX (box). |

| Unit Weight | The weight of one unit in the primary unit of measure. |

| Weight unit of measure | The unit of measure that indicates the weight of an individual item |

| Unit Price | A base or default price that is used with multipliers from the pricing rules to develop discounted prices. If no formula applies to an item or no discounts apply to a customer, the system uses this price without adjustments. |

| Extended Price | The number of units multiplied by the unit price |

| Total Discount | This is the total discount amount related to a fiscal note line item. |

| ICMS Taxable Amount | Goods amount that will be applied to tax rate about Goods and Services Circulation. |

| ICMS Tax Rate | ICMS Tax Rate specified for every "Unidade da Federacao" of goods destination |

| ICMS Amount | This is the ICMS tax (good transit tax) printed with each line item of the fiscal note. |

| ICMS - IPI Tax Indicator | This is a flag that indicates the ICMS tax type. Allowed values are in the UDC 76B/CV. |

| IPI Taxable Amount | Goods amount of industrialized products to which an IPI tax rate will be calculated. It refers to items of Fiscal note. |

| IPI Tax Rate | IPI Tax Rate is a percentage applied to industrialized products. The IPI Tax rate is related to the fiscal classification of the item and it will be accessed through menu option 4/G76B41B. |

| IPI Amount | This is the IPI tax (industrial products tax) printed with each line item of the fiscal note. |

| IPI - Tax Indicator | This flag indicates the IPI tax type (Example: 1 - Taxable, 2 - Not Taxable, 3 - Other) |

| ISS Taxable Amount | The amount on which ISS taxes are assessed. |

| ISS Tax Rate | ISS Tax Rate according to what is defined for each municipality. |

| ISS Amount | The ISS tax amount that is printed on the Fiscal note |

| Substitute Taxable Amount | The amount on which ICMS Substitute tax is assessed. Products that are eligible for ICMS Substitute tax are listed in ICMS government directive 14 |

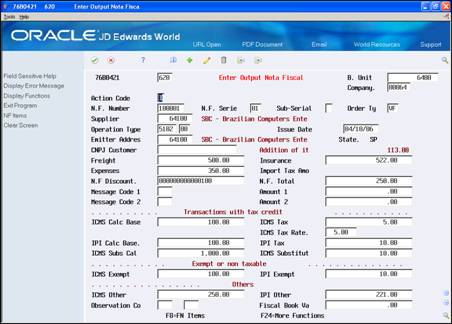

Figure 51-3 Enter Output Nota Fiscal screen

Description of ''Figure 51-3 Enter Output Nota Fiscal screen''

Complete the following fields:

| Field | Explanation |

|---|---|

| Status | The user defined code (file 40/AT) for the status code. The system retrieves the status code that you entered in the processing option 2 or you can enter a code in this field. This code represents the status that will be written in file in case of update or the status the NF is recorded-.low end of the range |

| B.Unit | An alphanumeric field that identifies a separate entity within a business for which you want to track the fiscal note. User can enter it manually or set up it in P.Option 3 |

| Company | Code that identifies the NF organization, Default P.Option 1 |

| Fiscal note | You use this numeric, six-character field to identify the Fiscal note number. The Fiscal note Number field is the first key that the system uses to access a specific Fiscal note. |

| Series | You use this alphanumeric, two-character field to identify the Fiscal note Series. The Fiscal note Series field is the second key that the system uses to access a specific Fiscal note. |

| Sub-Serial | Alphanumeric field (1-char) used to identify a sub-serial of Fiscal note. This is the third field of the concatenated key to access the Fiscal note. |

| Doc.Type | A user defined code (00/DT) that identifies the type of document |

| Emitter Address | Address book number that identifies the emitter of the fiscal note. |

| Operation Type | Use this four-character code to indicate different types of transactions for tax purposes.

To enter valid values for the Transaction Nature code, use the following convention: XYYY Use a value for X to define the origin of the transaction (inbound or outbound). Valid values for X are: 1 - Inbound, inside the state 2 - Inbound, other states 3 - Inbound, import 5 - Outbound, inside state 6 - Outbound, other states 7 - Outbound, export The values for YYY are defined by the fiscal authority to identify products. and Complete the two-character field in conjunction with the Transaction Nature code to identify the complementary implications of a type of transaction. For example, the suffix might indicate that a certain type of transaction represents an inventory change, or that a transaction is eligible for a certain type of tax. Valid values might include: 01 Bonus 02 Demo 03 Sample 04 Return merchandise 05 Back order 06 Donation |

| Issue Date | Fiscal note Issue Date |

| Emitter Address | Address book number, which identifies the emitter of the fiscal note. |

| State | A code defined for the state or province in F0075, in conjunction with a country code defined in UDC 00/CN. This code is usually a postal service abbreviation. |

| CNPJ Customer | Identify the Company according to Union (Federal Revenue). Mandatory field for Fiscal Notes and Legal Reports. Edited as follows:

XXX.XXX.XXX/YYYY-WW Where: XXX.XXX.XXX = Company Name Code YYYY = Head Office or Branch Code WW = Check Digit |

| Freight | Complete the Fiscal note Freight field whenever you classify freight as a complementary expense to your customer. The system prorates this expense amount among each of the Fiscal note listed and adds the prorated amount to the ICMS taxable amounts for each document. |

| Insurance | The insurance amount that you charge the client as complementary expense. This amount must be included on the Fiscal note. |

| Expenses | The amount of the total financial expenses that are printed on the Fiscal note. |

| Import. Tax Amo | This is the tax amount related to importation by the company that purchased the goods/services. The tax amount is reported in the Importation Declaration. |

| N.F.Discount | The amount of the discount amount available for the Fiscal note. |

| N.F.Total Amount | The total amount of the Fiscal note. The system calculates the total as follows:

Merchandise + IPI tax amount + ICMS Substitute tax amount + Complementary Expenses - Discounts |

| Message Code 1 | In/Outbound Book-Message Code |

| Amount 01 | Fiscal note Amount 1 |

| Message Code 2 | In/Outbound Book-Message Code |

| Amount 02 | Fiscal note Amount 2 |

| ICMS Calc Base | The amount on which ICMS taxes are assessed. |

| ICMS Tax | The ICMS tax amount that is printed on the Fiscal note |

| ICMS Tax Rate | ICMS Tax Rate specified for every "Unidade da Federacao" of goods destination.

Note: Access through menu option 3/G76B41B. |

| IPI Calc Base | The amount on which IPI taxes are assessed |

| IPI Tax | The IPI tax amount that is printed on the Fiscal note. |

| ICMS Subst Calc | The amount on which ICMS Substitute tax is assessed. Products that are eligible for ICMS Substitute tax are listed in ICMS government directive 14. |

| ICMS Substit | The ICMS Substitute amount that your customer must remit in advance if they are subject to Tax Substitution Mark-up. |

| ICMS Exempt | The amount that is not eligible for ICMS tax |

| IPI Exempt | The amount that is not eligible for IPI tax |

| ICMS Other | Any merchandise value amount that is classified as Other for ICMS taxing purposes. |

| IPI Other | Any merchandise value amount that is classified as Other for IPI taxing purposes. |

| Observation CO | Fiscal Message / Observations |

| Fiscal Book Va | Amount to be used on Fiscal Books linked to fiscal text (BD03 or BD04) according to client's need. |

Addition: Press Enter to Access to Fiscal note Item.

Inquiry or Change: Press F8 to Access to Fiscal note Item.

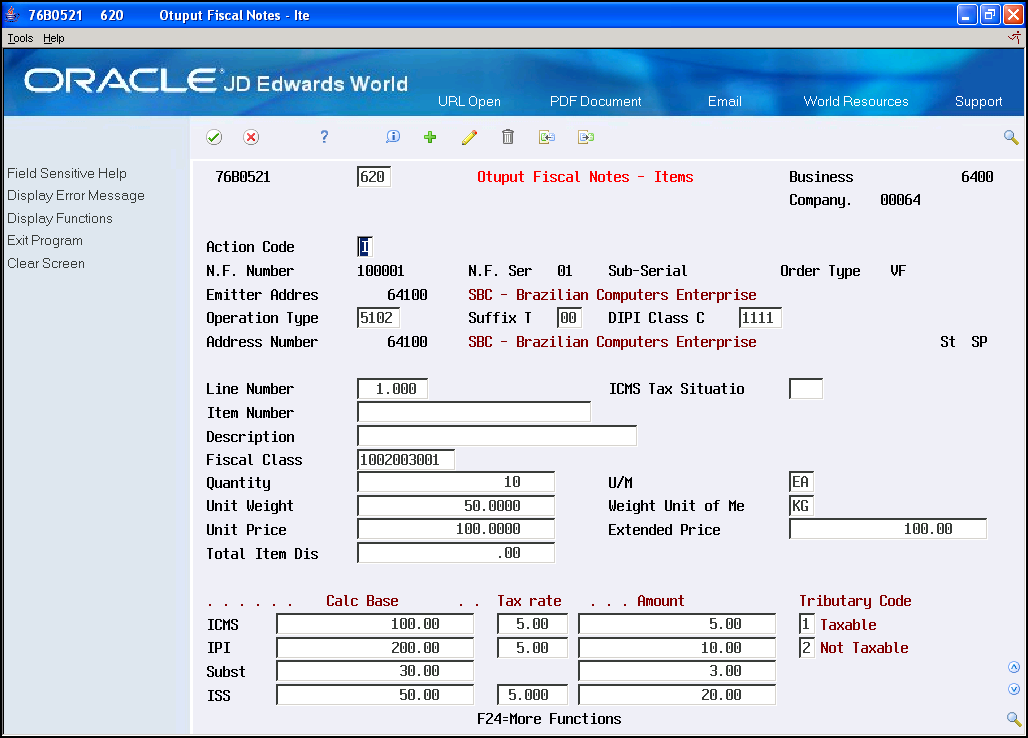

Figure 51-4 Output Fiscal Notes - Items screen

Description of ''Figure 51-4 Output Fiscal Notes - Items screen''

Complete the following fields:

| Field | Explanation |

|---|---|

| Status | The user defined code (file 40/AT) for the status code. The system retrieves the status code that you entered in the processing option 2 or you can enter a code in this field. This code represents the status that will be written in file in case of update or the status the NF is recorded-.low end of the range |

| B.Unit | An alphanumeric field that identifies a separate entity within a business for which you want to track the fiscal note. User can enter it manually or set up it in P.Option 3 |

| Company | Code that identifies the NF organization, Default P.Option 1 |

| Fiscal note | You use this numeric, six-character field to identify the Fiscal note number. The Fiscal note Number field is the first key that the system uses to access a specific Fiscal note. |

| Series | You use this alphanumeric, two-character field to identify the Fiscal note Series. The Fiscal note Series field is the second key that the system uses to access a specific Fiscal note. |

| Sub-Serial | Alphanumeric field (1-char) used to identify a sub-serial of Fiscal note. This is the third field of the concatenated key to access the Fiscal note. |

| Order Type | A user defined code (00/DT) that identifies the type of document |

| Emitter Address | Address book number which identifies the emitter of the fiscal not |

| Operation Type/Suffix Type | Use this four-character code to indicate different types of transactions for tax purposes.

To enter valid values for the Transaction Nature code, use the following convention: XYYY A value for X will default to define the origin of the transaction (inbound or outbound). Valid values for X are: 1 - Inbound, inside the state 2 - Inbound, other states 3 - Inbound, import 5 - Outbound, inside state 6 - Outbound, other states 7 - Outbound, export The values for YYY are defined by the fiscal authority to identify products. and Complete the two-character field in conjunction with the Transaction Nature code to identify the complementary implications of a type of transaction. For example, the suffix might indicate that a certain type of transaction represents an inventory change, or that a transaction is eligible for a certain type of tax. Valid values might include: 01 Bonus 02 Demo 03 Sample 04 Return merchandise 05 Back order 06 Donation |

| DIPI Class | The DIPI Classification code is a four-character, alphanumeric field that you can use for tax reporting. Use this code to link the product with the Transaction Nature. |

| Address Number | A number that identifies an entry in the Address Book system. Use this number to identify employees, applicants, participants, customers, suppliers, tenants, a location, and any other address book members. |

| ST | A code defined for the state or province in F0075, in conjunction with a country code defined in UDC 00/CN. This code is usually a postal service abbreviation. |

| Line Number | A number that identifies multiple occurrences, such as line numbers on a purchase order or other document. |

| ICMS Tax Situation | Enter a two-character code to indicate the ICMS tax eligibility of a product. The values you enter for the first character of the code indicates the origin of the product, based on the BORI edit rules. The value you enter for the second character of the code indicates how the product will be taxed by ICMS.

Valid values to indicate the origin of the product are: O 0 - Domestic goods O 1 - Foreign product, direct import O 2 - Foreign product, purchased in local market Valid values to indicate the ICMS tax condition of a product are: O 0 - Totally taxed O 1 - Taxed, with ICMS collection by tax substitution O 2 - Taxed, with taxable amount reduction O 3 - Exempt or non-taxable, with ICMS collection by tax substitution O 4 - Exempt or non-taxable O 5 - Suspended and deferred O 6 - ICMS previously charged by tax substitution O 7 - Reduced taxable amount, with ICMS collection by tax substitution O 9 - Other |

| Item Number | A number that identifies the item. |

| Description | Brief information about an item. |

| Fiscal Class | Use the Fiscal Classification code to identify groups of products, as defined by the local tax authorities. The product groups are based on taxing conventions and other national statistics. The system uses this code to determine the applicable tax rate for a product. |

| Quantity | The quantity of units affected by this transaction |

| U/M | A user defined code (00/UM) that indicates the quantity in which to express an inventory item, for example, CS (case) or BX (box). |

| Unit Weight | The weight of one unit in the primary unit of measure. |

| Weight unit of measure | The unit of measure that indicates the weight of an individual item |

| Unit Price | A base or default price that is used with multipliers from the pricing rules to develop discounted prices. If no formula applies to an item or no discounts apply to a customer, the system uses this price without adjustments. |

| Extended Price | The number of units multiplied by the unit price |

| Total Discount | This is the total discount amount related to a fiscal note line item. |

| ICMS Taxable Amount | Goods amount that will be applied to tax rate about Goods and Services Circulation. |

| ICMS Tax Rate | ICMS Tax Rate specified for every "Unidade da Federacao" of goods destination |

| ICMS Amount | This is the ICMS tax (good transit tax) printed with each line item of the fiscal note. |

| ICMS - Tax Indicator | This is a flag that indicates the ICMS tax type. Allowed values are in the UDC 76B/CV. |

| IPI Taxable Amount | Goods amount of industrialized products to which an IPI tax rate will be calculated. It refers to items of Fiscal note. |

| IPI Tax Rate | IPI Tax Rate is a percentage applied to industrialized products. The IPI Tax rate is related to the fiscal classification of the item and it will be accessed through menu option 4/G76B41B. |

| IPI Amount | This is the IPI tax (industrial products tax) printed with each line item of the fiscal note. |

| IPI - Tax Indicator | This flag indicates the IPI tax type (Example: 1 - Taxable, 2 - Not Taxable, 3 - Other) |

| ISS Taxable Amount | The amount on which ISS taxes are assessed. |

| ISS Tax Rate | ISS Tax Rate according to what is defined for each municipality. |

| ISS Amount | The ISS tax amount that is printed on the Fiscal note |

| Substitute Taxable Amount | The amount on which ICMS Substitute tax is assessed. Products that are eligible for ICMS Substitute tax are listed in ICMS government directive 14 |

| Substitute Amount | The ICMS Substitute amount that your customer must remit in advance if they are subject to Tax Substitution Mark-up. |

51.3.1.1 Processing Options

See Section 69.1, "Processing Options for Nota Fiscal of Input (P76B0411)".

See Section 69.2, "Processing Options for Exit Review Fiscal Note Online (P76B0421)".

51.4 Fiscal Note Batch Conversion

Before you can generate fiscal book reports and the electronic media that you must submit to Sintegra (Systema Integrado de Informacoes), you must create the fiscal book work files. The fiscal note conversion batch program lets you specify the fiscal notes that you write to the work files. When you run the Fiscal Notes Conversion program, the system writes information from the Fiscal Notes Header - Brazil (F7601B) and the Fiscal Note Detail - Brazil (F7611B) files to the Fiscal Note - Header (Fiscal Books) file (F76B04) and the Fiscal Note - Detail (Fiscal Books) file (F76B05). Other batch programs that you use to generate fiscal book reports use data from files F76B04 and F76B05.

51.4.1 Process Input Fiscal Note

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 2 - Nota Fiscal Conversion

From Fiscal Note Data Collection - Brazil (G76B0010), choose 7 - Convert Nota Fiscal for report

From Load Data for Input /Output Fiscal Note - Brazil (G76B0015), choose 1 - Process Input Fiscal Note

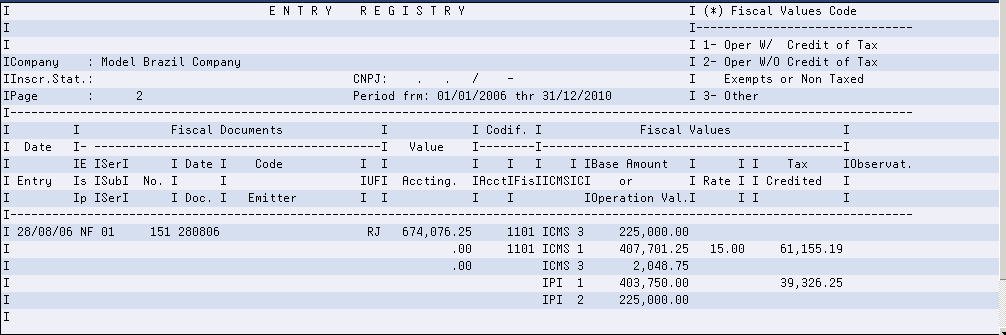

This program incorporates the fiscal Note in localization files. All fiscal reports will be printed taking information from them. This information should correspond to operation type code less than 5000 (Purchase).

This process generates a report that list the document processed (Input Date, Emitter, Nota Fiscal, Line, ICMS Information, IPI Information).

|

Note: Selection data: Operation Code must be lower than 5000. |

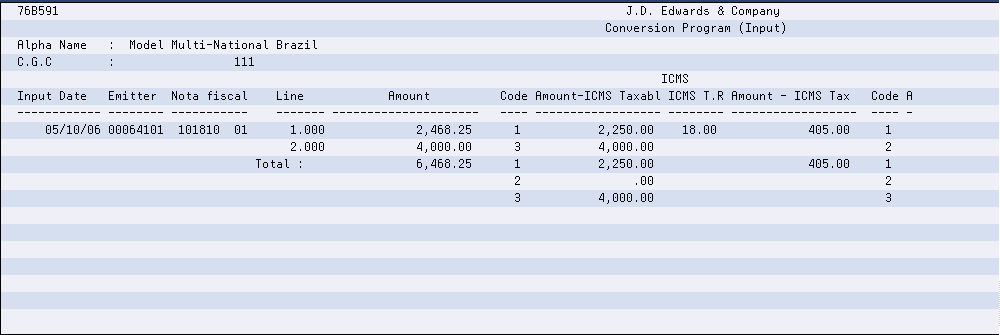

Figure 51-5 Report: Conversion Program Input - R76B591

Description of ''Figure 51-5 Report: Conversion Program Input - R76B591''

51.4.1.1 Processing Options

See Section 69.3, "Processing Options for Conversion Program (Input) (P76B591)".

51.4.2 Process Output Fiscal Note

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 2 - Nota Fiscal Conversion

From Fiscal Note Data Collection - Brazil (G76B0010), choose 7 - Convert Nota Fiscal for report

From Load Data for Input /Output Fiscal Note - Brazil (G76B0015), choose 2 - Process Output Fiscal Note

This program incorporates the fiscal Note in localization files. All fiscal reports will be printed taking information from them. This information should correspond to operation type code greater than 5000 (Sales).

This process generates a report that summarizes the result of the process (Total Written Header, Total Updated Header Total Written Detail, Total Updated Detail, and Total Read Detail).

|

Note: Selection data: Operation Code must be greater than 5000. |

51.4.2.1 Processing Options

See Section 69.4, "Processing Options for Conversion Program (Output) (P76B592)".

51.5 Generate Reports

Fiscal books reports provide supplementary data for the fiscal books that you submit to the government. You produce fiscal books reports for the same tax-reporting period as the fiscal books.

Before you complete the tasks in this section:

-

Verify ICMS and IPI Taxes.

-

Revise nota fiscal records, as necessary.

-

Revise GNRE records, as necessary.

-

Generate the Fiscal Books work files.

51.6 Industry

51.6.1 Output Transaction Register Model 2

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 2 - Output Transaction Register Model 2

You can print the Output Transaction Report to list all output transaction for all fiscal documents and fiscal value by company for a specific accounting period.

In the detail section, the report totals the fiscal notes ICMS and IPI taxes for each date according a selected period.

In the summary section, the report total ICMS tax by transaction nature for each state.

The report includes totals by day, total by fortnight and total accumulated. The report shows for each fiscal document the accounting amount, the tax rate, and the tax debit and separates the transactions exempts or non-taxable.

You can print the Output Transactions Report in proof or final mode. When you print the report in final mode, the system updates the company's fiscal books next number.

The program prints Beginning and Closing Messages (Access with RSA+Company, for example RSA00063).

|

Note: In Data Selection and Data Sequence, use the following fields:QUBNOP for CFO with 3 digits and QUBNOC for CFO with 4 digits. |

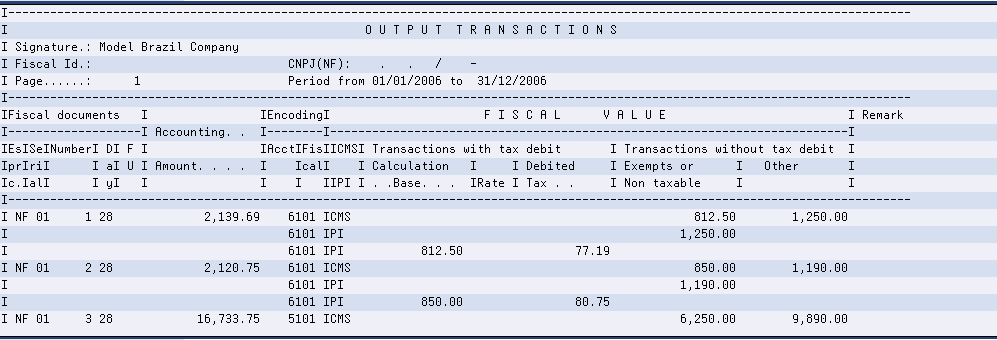

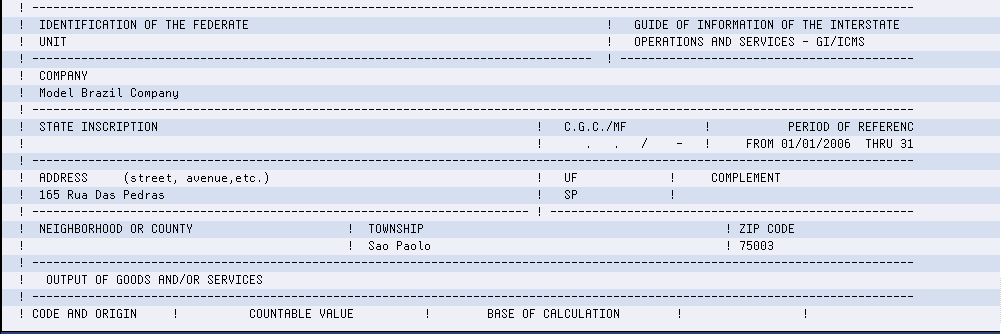

Figure 51-6 Report - Output Transaction Model 2 - R75B54111

Description of ''Figure 51-6 Report - Output Transaction Model 2 - R75B54111''

51.6.1.1 Processing Options

See Section 69.5, "Processing Options for Output Transaction Ledger - Model 2 (P76B45111)".

51.6.2 Input Trans. Register Cat. 21

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 3 - Input Trans. Register Cat. 21t

You can print the Input Transaction Report to list all input transaction for all documents and fiscal value by company for a specific accounting period.

The input registry batch program generates a report that with the requirements for the inbound fiscal books. The report includes information about inbound fiscal notes, including the transaction nature, state, value and the tax amount and percentage.

In the detail section, the report totals the fiscal notes ICMS and IPI taxes for each date according a selected period.

In the summary section, the report total ICMS tax by transaction nature for each state.

The report includes totals by day, total by fortnight and total accumulated. The report shows for each fiscal document the accounting amount, and separates the fiscal value ICMS and IP fiscal Amounts.

You can print the Input Transactions Report in proof or final mode. When you print the report in final mode, the system updates the company's fiscal books next number.

The program prints Beginning and Closing Messages (Access with REA+Company, for example REA00063).

|

Note: Selection data: Operation Code must be greater than 5000. |

Figure 51-7 Report: Input Transactions Register - R76B49111

Description of ''Figure 51-7 Report: Input Transactions Register - R76B49111''

51.6.3 Input Transactions Register

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 4 - Input Transactions Register

You can print the Input Transaction Report to list all input transaction, detailing the fiscal documents and fiscal value by company for a specific accounting period.

The input registry batch program generates a report with the requirements for the inbound fiscal books. The report includes information about inbound fiscal notes, the transaction nature, state, value and the tax amount and percentage.

In the detail section, the report totals the fiscal notes ICMS and IPI taxes for each date according a selected period.

In the summary section, the report total ICMS tax by transaction nature for each state.

The report shows for each fiscal document the tributary substitution calculation base and substitute ICMS.

In addition, the report includes totals by day, total by fortnight and total accumulated. The report shows for each fiscal document the accounting amount, and separates the fiscal value ICMS and IP fiscal Amounts.

You can print the Input Transactions Report in proof or final mode. When you print the report in final mode, the system updates the company's fiscal books next number.

The program prints Beginning and Closing Messages (Access with REA+Company, for example REA00063).

|

Note: Selection data: Operation Code must be lower than 5000. |

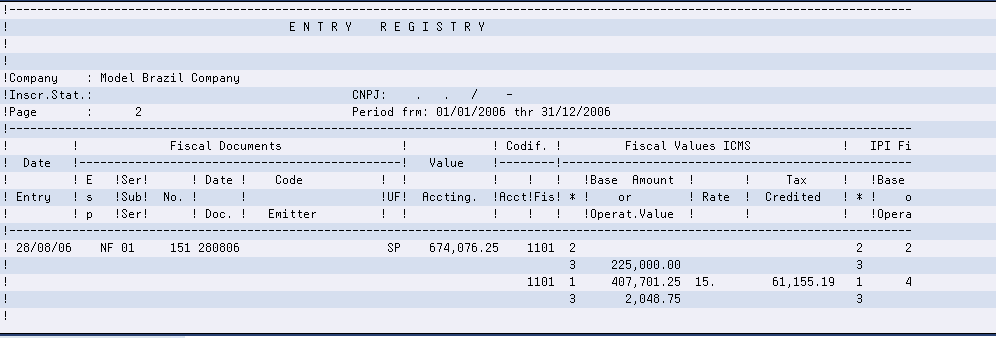

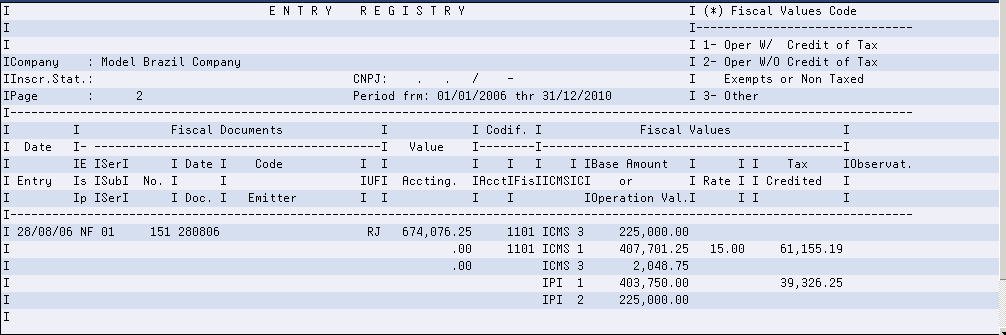

Figure 51-8 Report: Input Transactions Register - R76B45031

Description of ''Figure 51-8 Report: Input Transactions Register - R76B45031''

51.6.3.1 Processing Options

See Section 69.7, "Processing Options for Entry Registry - Proof Mode (P76B45031)".

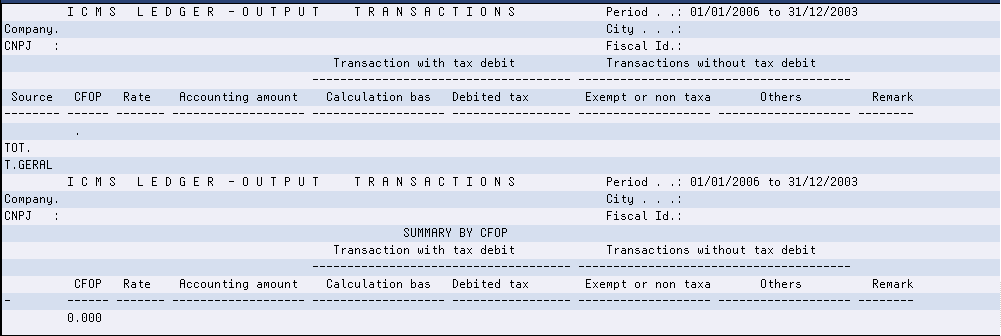

51.6.4 Output Transactions Register

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 5 - Output Transactions Register

You can print the Output Transaction Report to list all output transaction, detailing the fiscal documents and fiscal value by company for a specific accounting period.

In the detail section, the report totals the fiscal notes ICMS and IPI for each date in according a selected period.

In the summary section, the report total ICMS tax by transaction nature for each state. You specify how the report handles IPI tax by setting processing options.

The report includes totals by day, total by fortnight and total accumulated. The report shows for each fiscal document the accounting amount, the tax rate, and the tax debit and separates the transactions exempts or non-taxable.

You can print the Output Transactions Report in proof or final mode. When you print the report in final mode, the system updates the company's next number.

The program prints Beginning and Closing Messages (Access with RSA+Company, for example RSA00063).

|

Note: UDCs that must be set up:76B/RE - Messages Entry/Exit Reg.Sum. 76B/M1 - Fiscal Message / Observations 76B/M2 - Fiscal Message 02 76B/CM - In/Outbound Book-Message Code Selection data: Operation Code must be greater than 5000 |

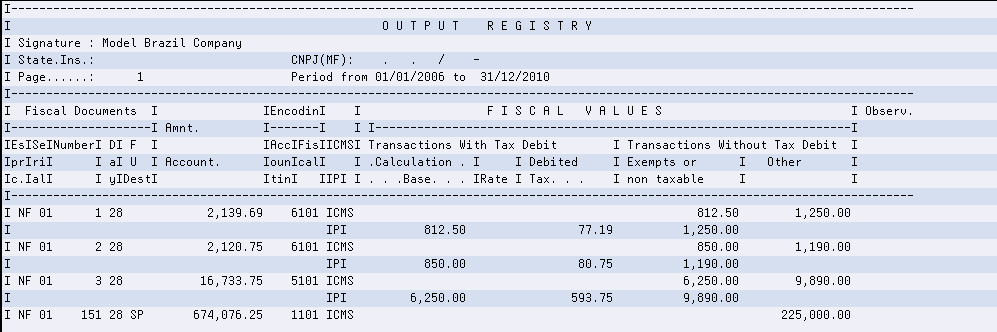

Figure 51-9 Report: Output Transactions Register - R76B45131

Description of ''Figure 51-9 Report: Output Transactions Register - R76B45131''

51.6.4.1 Processing Options

See Section 69.8, "Processing Options for Output Transactions - WO IPI Rate Break (P76B45131)"

51.7 Commerce

51.7.1 Input Transactions Register

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 8 - Input Transaction Register

You can print the Input Transaction Report to list all input transaction, detailing the fiscal documents and fiscal value by company for a specific accounting period.

The report includes totals by day, total by fortnight and total accumulated. The report shows for each fiscal document the accounting amount, and separate the fiscal value ICMS.

You can print the Input Transactions Report in proof or final mode. When you print the report in final mode, the system updates company's Fiscal Notes dates.

The program prints Beginning and Closing Messages (Access with REA+Company, for example REA00063).

|

Note: UDCs that must be set up:76B/RE - Messages Entry/Exit Reg.Sum. 76B/M1 - Fiscal Message / Observations 76B/M2 - Fiscal Message 02 76B/CM - In/Outbound Book-Message Code Selection data: Operation Code must be lower than 5000 |

Figure 51-10 Report: Input Transactions Register - R76B45021

Description of ''Figure 51-10 Report: Input Transactions Register - R76B45021''

51.7.1.1 Processing Options

See Section 69.9, "Processing Options for Entry Registry - Proof Mode (P76B45021)".

51.8 Municipal

51.8.1 DIPAM Declaration

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 12- Other Register

From Other Fiscal Reports - Brazil (G76B0030), choose 2- DIPAM Declaration

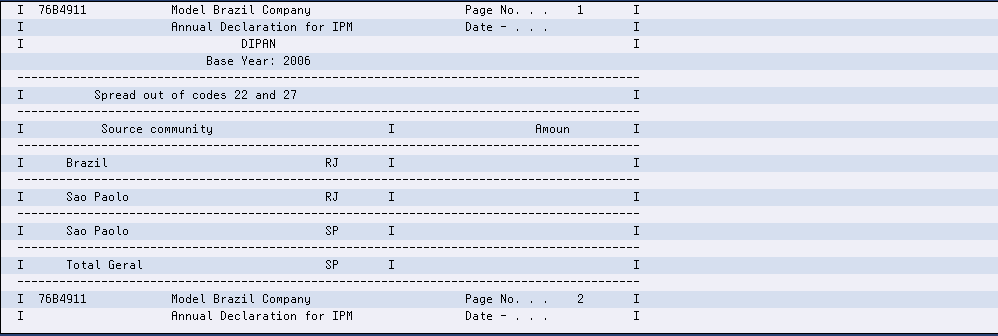

The DIPAM Declaration Report provides an IPM taxes summary by transaction nature code.

|

Note: UDCs that must be set up:76B/DQ - CFOP DIPAM 4 digits Selection data: Is based on file F76B05 |

Figure 51-11 Report: Input Transactions Register - R76B4911

Description of ''Figure 51-11 Report: Input Transactions Register - R76B4911''

51.8.1.1 Processing Options

See Section 69.10, "Processing Options for Statement of DIPAM (P76B4911)"

51.8.2 DECLAN Declaration

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 12- Other Register

From Other Fiscal Reports - Brazil (G76B0030), choose 3- DECLAN Declaration

The DECLAN Declaration Report provides an IPM summary by transaction nature code.

|

Note: UDCs that must be set up:76B/CN - Transaction Nature digits Selection data: Is based on file F76B05 |

Figure 51-12 Report: Input Transactions Register - R76B49111

Description of ''Figure 51-12 Report: Input Transactions Register - R76B49111''

51.8.2.1 Processing Options

See Section 69.11, "Processing Options for Statement of DECLAN (P76B49111)".

51.8.3 Statement Register Complement

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 12- Other Register

From Other Fiscal Reports - Brazil (G76B0030), choose 13- Statement Register Complement

The "ICMS Statement Report" and "IPI Statement Report" take information from the file Book Model 9 Auxiliary (F76B30). This program allows incorporating complementary information into this file.

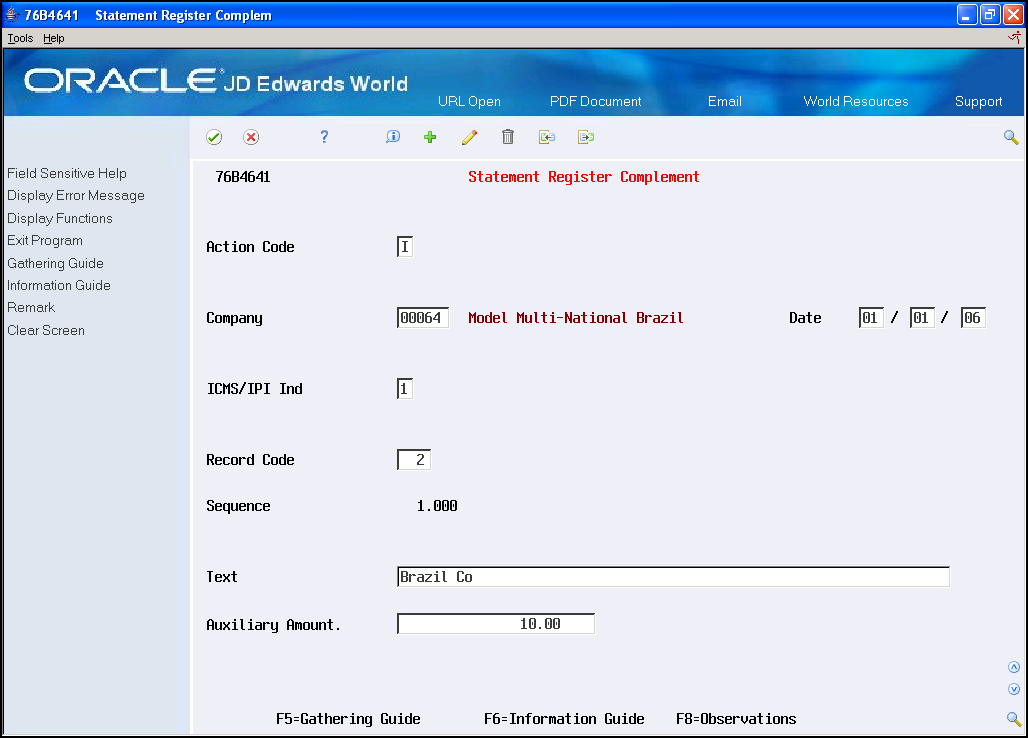

Figure 51-13 Statement Register Complement screen

Description of ''Figure 51-13 Statement Register Complement screen''

Complete the following fields:

| Field | Explanation |

|---|---|

| Action Code | A code that indicates the activity you want to perform. Valid codes are:

A Add C Change D Delete I Inquire |

| Company | Company selection value |

| Date | Nota Fiscal Issue date |

| ICMS/IPI Ind | ICMS or IPI Indicator. Allowed values are:

1 - IPI 2 - ICMS 3 - ICMS Tributary Substitution. |

| Record Code | Identifies the summary line for purge record. The codes are described as follows:

ICMS '002' - Other Debits '003' - Credit Reversal '006' - Other Credits '007' - Debit Reversal '009' - Credit Balance for Prev. Period '012' - Deductions IPI '004' - Debit Reversal '005' - Other Credits '007' - Credit Balance for Prev Period '010' - Credit Reversal '011' - Credit Repayment |

| Sequence | A number that identifies multiple occurrences, such as line numbers on a purchase order or other document. Generally, the system assigns this number, but in some cases you can override it. |

| Text | Additional Information |

| Auxiliary Amount | Amount |

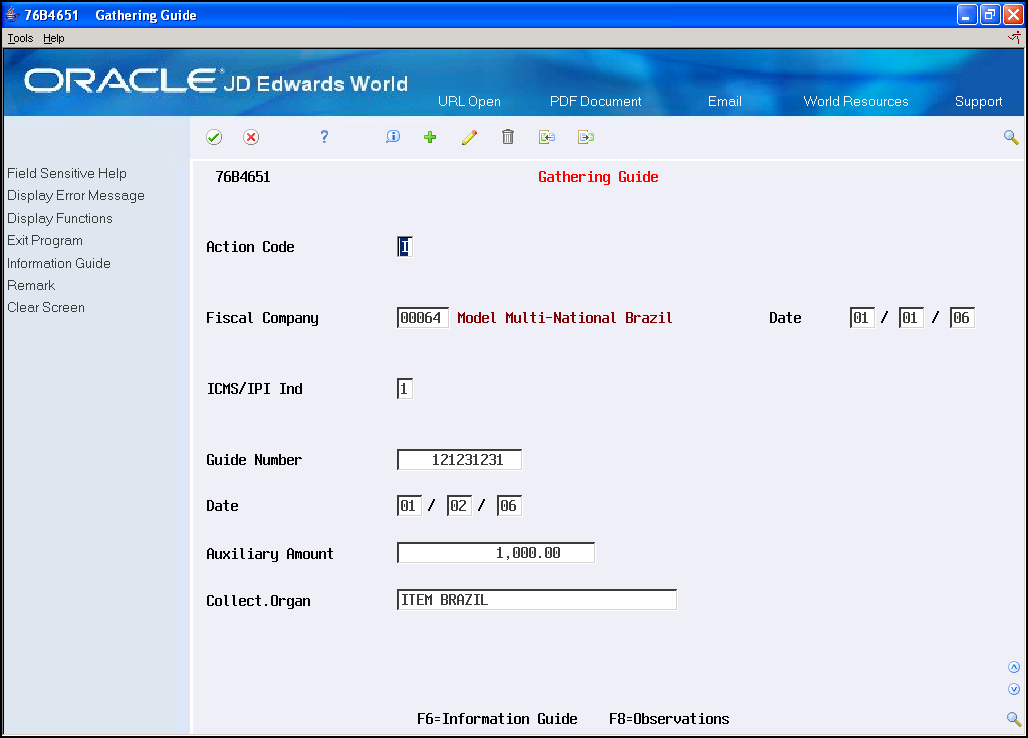

From P76B461, press F5 - Gathering Guide.

| Field | Explanation |

|---|---|

| Action Code | A code that indicates the activity you want to perform. Valid codes are:

A Add C Change D Delete I Inquire |

| Company | Company selection value |

| Date | Nota Fiscal Issue date |

| ICMS/IPI Ind | ICMS or IPI Indicator. Allowed values are:

1 - IPI 2 - ICMS 3 - ICMS Tributary Substitution. |

| Guide Number | Gathering guide number |

| Date | Date information entered |

| Auxiliary Amount | Amount |

| Collect Organ | A brief description of an item, a remark, or an explanation. |

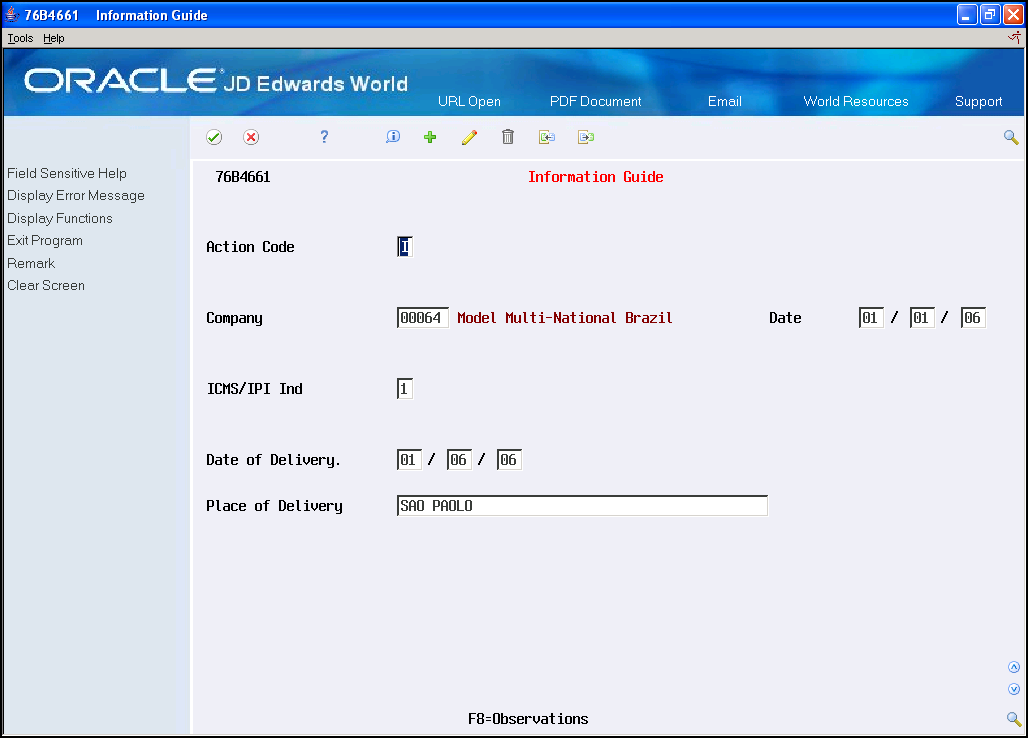

From P76B461 or P76B4651 press F6 - Information Guide.

| Field | Explanation |

|---|---|

| Action Code | A code that indicates the activity you want to perform. Valid codes are:

A Add C Change D Delete I Inquire |

| Company | Company selection value |

| Date | Nota Fiscal Issue date |

| ICMS/IPI Ind | ICMS or IPI Indicator. Allowed values are:

1 - IPI 2 - ICMS 3 - ICMS Tributary Substitution. |

| Date of delivery | Date |

| Place of delivery | Place description |

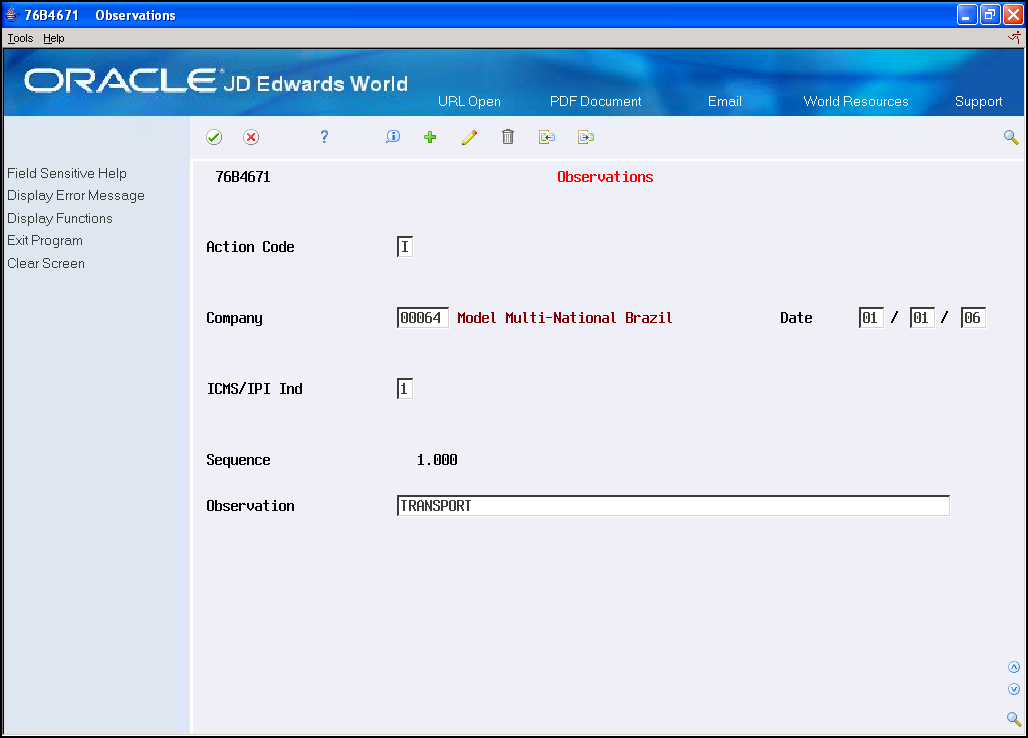

From P76B461 or P76B4651 or P76B4661, press F8 - Observations.

| Field | Explanation |

|---|---|

| Action Code | A code that indicates the activity you want to perform. Valid codes are:

A Add C Change D Delete I Inquire |

| Company | Company selection value |

| Date | Nota Fiscal Issue date |

| ICMS/IPI Ind | ICMS or IPI Indicator. Allowed values are:

1 - IPI 2 - ICMS 3 - ICMS Tributary Substitution. |

| Sequence | A number that identifies multiple occurrences (previously assigned) |

| Observations | Internal text |

|

Note: Updates Model 9 Auxiliary FileF76B30 F76B31 F76B32 F76B33 |

51.8.4 ICMS/IPI Statement Report

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 12- Other Register

From Other Fiscal Reports - Brazil (G76B0030), choose 14 ICMS Statement Report or 15 IPI Statement Report

This program reports the Fiscal Notes with detailed ICMS or IPI for a company in a certain period. Produces an input and output operations of IPI/ICMS tax amounts based on fiscal notes by states, other states or foreign.

This report also lists total debits, credits, and balances for each operation type.

The program prints Beginning and Closing Messages (Access with RCA+Company, for example RCA00063 or RPA+Company, for example RPA00063 depending if it's IPI or ICMS, or RCX+Company, for example RCA00063 or RPX+Company, for example RPA00063 depending if it's IPI or ICMS).

|

Note: Base File: F76B05. |

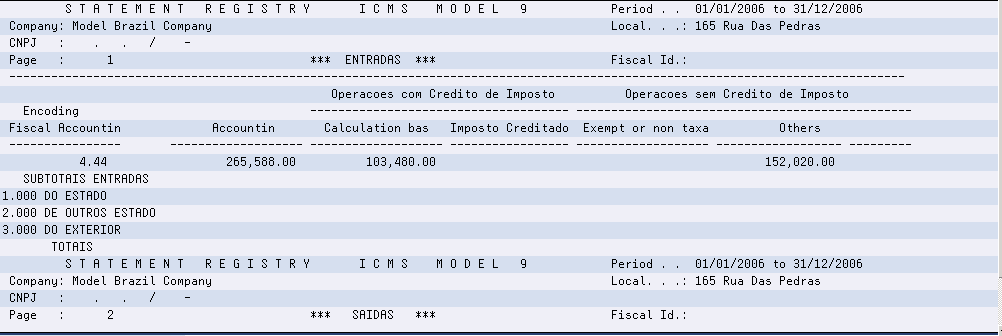

Figure 51-17 Report: ICMS Statement - R76B4711

Description of ''Figure 51-17 Report: ICMS Statement - R76B4711''

51.9 GIA

51.9.1 Tax Collection Report

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 12 - Other Register

From Other Fiscal Reports - Brazil (G76B0030), choose 18 - Tax Collection Report

GIA de Imposto sobre Circulação de Mercadorias e Serviços (ICMS) is the ICMS Assessment and Information form. Taxpayers use the GIA to report their economic activities, such as the selling and purchasing of goods within a state and between states. The GIA provides two reports of the ICMS tax that is due to the state government with totals by operation type code.

|

Note: First at all generated a file F76B471 "Transaction by Company" according to the selected data and then emits a report by Operation Type Code.Selection data: Is based on file F76B05, status code different than 997 and 998. |

Figure 51-18 Report: Tax Collection - R76B4741 (part 1)

Description of ''Figure 51-18 Report: Tax Collection - R76B4741 (part 1)''

Figure 51-19 Report: Tax Collection - R76B4741 (part 2)

Description of ''Figure 51-19 Report: Tax Collection - R76B4741 (part 2)''

51.9.1.1 Processing Options

See Section 69.14, "Processing Options for GIA Report Generation (P76B4741)".

51.10 ICMS by State

51.10.1 Input Transactions

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 12- Other Register

From Other Fiscal Reports - Brazil (G76B0030), choose 21 - Input Transactions

This program generates a report based on the Input transaction with and without tax a company in a certain period totalize by source and CFOP.

|

Note: Selection data: Is based on file F76B05, status code different than 997 and 996, Operation Type Code (4 dig.) less than 5000. |

51.10.1.1 Processing Options

See Section 69.15, "Processing Options for Statement of ICMS - Entry (P76B6001)".

51.10.2 Input Transactions

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 12- Other Register

From Other Fiscal Reports - Brazil (G76B0030), choose 22 - Output Transactions

This program generates a report based on the Input transaction with and without tax company in a certain period totalize by source and CFOP.

|

Note: Selection data: Is based on file F76B05, status code different than 997 and 996, Operation Type Code (4 dig.) greater than 5000. |

Figure 51-20 Report: ICMS Output Transactions - R76B6051

Description of ''Figure 51-20 Report: ICMS Output Transactions - R76B6051''

51.10.2.1 Processing Options for Statement of ICMS - Exits (P76B6051)

See Section 69.16, "Processing Options for Statement of ICMS - Exits (P76B6051)".

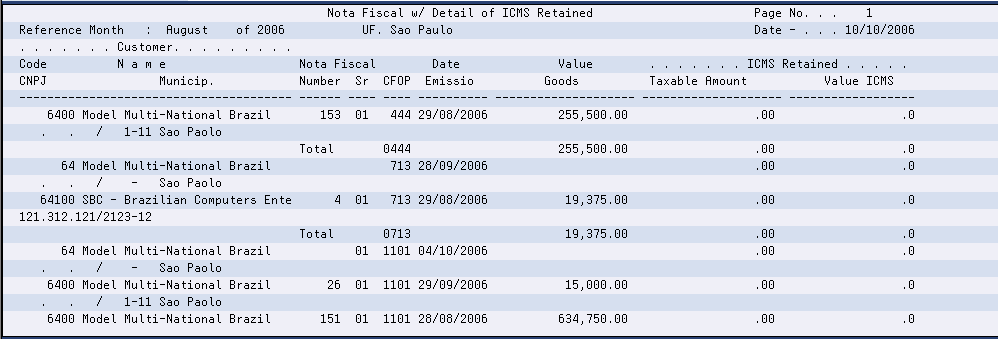

51.10.3 Fiscal Note with Retained ICMS

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 13- Nota Fiscal w/retained ICMS

This report lists the Fiscal Notes that contained ICMS substitution for a specified period. You generate this report by state, based on the client state and operation type.

|

Note: Selection data: Is based on file F76B05, Operation Code Type greater than 5000. ICMS Substitute amount not equal zero. |

Figure 51-21 Report: Input Transactions - R76B4561

Description of ''Figure 51-21 Report: Input Transactions - R76B4561''

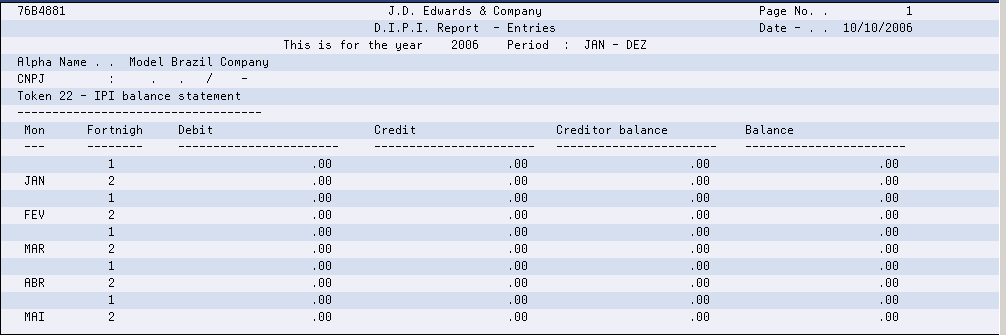

51.10.4 DIPI Register Summary

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 14 - DIPI Register Summary

The DIPI Summaries and Statements program produces a report that contains a summary of IPI taxes based on transaction nature codes:

-

Token 23:Inbounds and Credits provides information about inbound transactions

-

Token24: Outbounds and Debits provides information about outbound transactions.

-

Token 22: IPI Balance Statement

|

Note: Selection data: Is based on file F76B05, company must be entered, period is about NF generation code.Set up UDC: 76B/IQ - Verify when to consider Transaction Nature. |

Figure 51-22 Report: DIPI Register Summary - R76B4881

Description of ''Figure 51-22 Report: DIPI Register Summary - R76B4881''

51.10.4.1 Processing Options

See Section 69.17, "Processing Options for DIPI Report - Entries (P76B4881)".

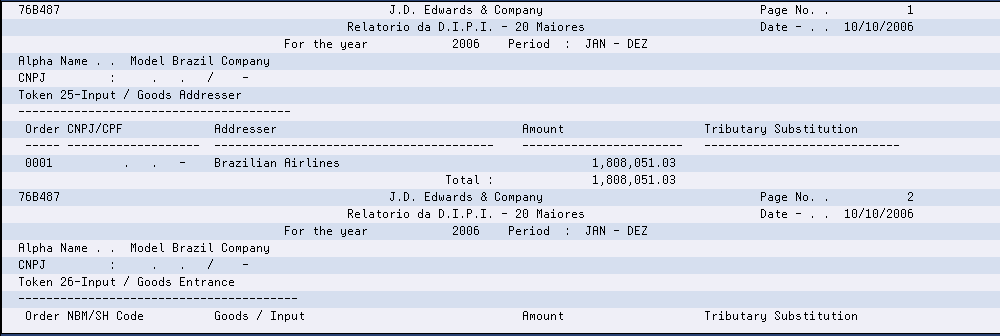

51.10.5 DIPI Register

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 15 - DIPI Register

The DIPI Annual Movements program produces a report that lists the customers who comprise the top 80 percent of the sales that are generated for a company, up to 100 customers. If more than 100 customers comprise the top 80 percent, the report lists only the top 100 customers.

The report lists the customers by each of these categories:

-

Token 25 section of the report lists the issuers of raw materials/merchandise (Remetentes de Insumos/Mercadorias).

-

Token 26 section of the report lists the customers for inbound raw materials and merchandise (Entradas de Insumos/Mercadorias).

-

Token 27 section of the report lists the recipients of raw materials and merchandise (Destinatarios de Produtos/Mercadorias/Insumos).

-

Token 28 section of the report lists the customers for outbound raw materials and merchandise (Saidas de Produtos/Mercadorias/Insumos).

|

Note: Selection data: Is based on file F76B05, company must be entered, period is about NF generation code.Set Up UDC: 76B/IQ - Verify when to consider Transaction Nature. Verify CFOP to process (it must have a '1' in first position of special handling code). |

Figure 51-23 Report: DIPI Register - R76B4871

Description of ''Figure 51-23 Report: DIPI Register - R76B4871''

51.10.5.1 Processing Options

See Section 69.18, "Processing Options for Relatorio da DIPI - 20 Maiores (P76B4871)".

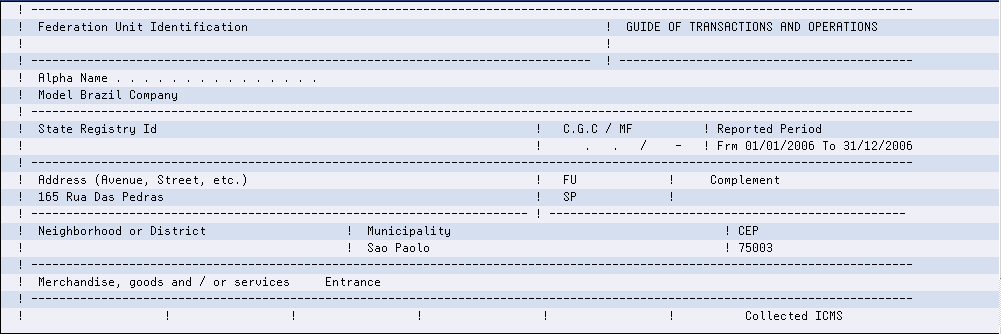

51.10.6 GIA ICMS - Input Transactions

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 16 - GIA ICMS - Input Transactions

GIA de Imposto sobre Circulação de Mercadorias e Serviços (ICMS) is the ICMS Assessment and Information form. Taxpayers use the GIA input transactions to report their economic activities, such as purchasing of goods within a state and between states. The GIA provides a record of the ICMS tax that is due to the state government.

|

Note: Selection data: Is based on file F76B05, and Operation Type Code less than 5000.Set Up UDC: 76B/CF - CFOP oil and energy - 4 digits. |

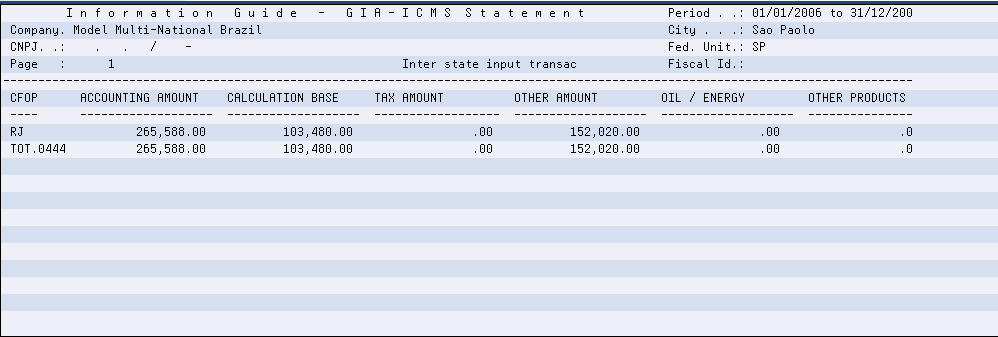

Figure 51-24 Report: GIA ICMS - Input Transactions - R76B4801

Description of ''Figure 51-24 Report: GIA ICMS - Input Transactions - R76B4801''

51.10.6.1 Processing Options

See Section 69.19, "Processing Options for GIA ICMS - Annual Entries (P76B4801)".

51.10.7 GIA ICMS - Output Transactions

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 3 - Generate Reports

From Reports - Brazil (G76B0025), choose 17 - GIA ICMS Output Transactions

GIA de Imposto sobre Circulação de Mercadorias e Serviços (ICMS) is the ICMS Assessment and Information form. Taxpayers use the GIA input transactions to report their economic activities, such as sales of goods within a state and between states. The GIA provides a record of the ICMS tax that is due to the state government.

|

Note: Selection data: Is based on file F76B05 and Operation Type Code greater than 5000. |

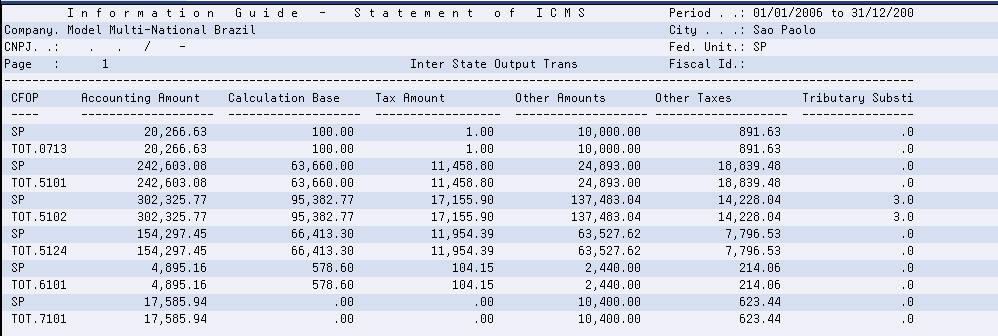

Figure 51-25 Report: GIA ICMS - Output Transactions - R76B4802

Description of ''Figure 51-25 Report: GIA ICMS - Output Transactions - R76B4802''

51.10.7.1 Processing Options

See Section 69.20, "Processing Options for GI/ICMS - Outputs (P76B4802)".

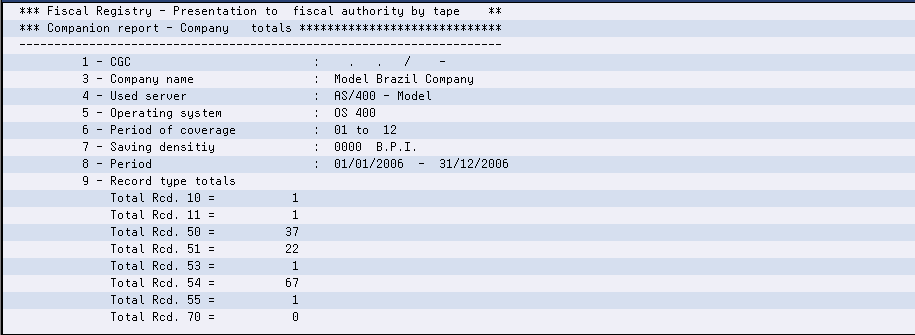

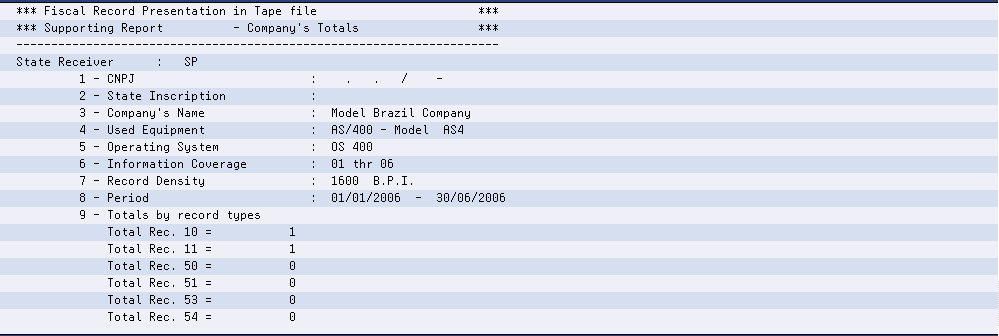

51.10.8 Create Tape

The Generate ICMS Magnetic Files - Sintegra program, P76B0611, lets you create the flat file that you must submit for fiscal books reporting, and also creates the same flat file for each state. From January 2003, the Brazilian government requires that you use the flat file layout as described in law Convenio ICMS 69/02 when you electronically submit the fiscal books. The Generate ICMS Magnetic Files - Sintegra program is called when you run either the Build ICMS Outfile or the Interstate Transactions programs.

51.10.8.1 Build ICMS Outfile

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 4 - Create Tapes

From Reports - Brazil (G76B0035), choose 1 - Build ICMS Outfile

The files below are populated by program P76B0611, Record of Entries - Tape Files Creation SINTEGRA. The information is recovered from these files: Nota Fiscal Header -F76B04, Nota Fiscal - Items - F76B05 and F76B4001 - Nota Fiscal Taxes Detail.

The program:

-

Generates record type 54 records in Nota Fiscal - Product Data- F76B213 - file.

-

Generates record type 74 records in Inventory Item Detail - F76B261 file.

-

Generates record type 50 records in Nota Fiscal - Tape Data ICMS- F76B211 - file.

-

Generates record type 51 records in Nota Fiscal - Tape Data IPI- F76B221 - file.

-

Generates record type 53 records in Nota Fiscal - Tape Data ICMS- F76B231 - file.

-

Generates record type 55 records in National Guide of Tribute Coll - F76B223 - file.

-

Generates record type 70 records in Nota Fiscal - Transport - Reco - F76B233 - file.

The Build ICMS Outfile program creates a text file, F76B241 with a member name of F plus the company number. For example, if the company is 00063, the member will be F0063. The member file text will indicate the period from /to.

Figure 51-26 Report: Nota Fiscal - Creation New File Sintegra - R76B0601

Description of ''Figure 51-26 Report: Nota Fiscal - Creation New File Sintegra - R76B0601''

51.10.8.2 Processing Options

See Section 69.33, "Processing Options for Fiscal Note Transp. Reg. 75 - C/Units Fed (P76B0601)".

51.10.9 Interstate Transactions

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 4 - Create Tapes

From Reports - Brazil (G76B0035), choose 2 - Inter State Transactions

The files below are populated by program P76B0611, Record of Entries - Tape Files Creation SINTEGRA. The information is recovered from these files: Nota Fiscal Header -F76B04, Nota Fiscal - Items - F76B05 and F76B4001 - Nota Fiscal Taxes Detail. Two temporary flat files, F76B45726 and F76B45722-Interstate Operations, are used by the program.

This program creates text files in for each state by populating the following:

-

Generates record type 54 records in Nota Fiscal - Product Data- F76B213 - file.

-

Generates record type 50 records in Nota Fiscal - Tape Data ICMS- F76B211 - file.

-

Generates record type 51 records in Nota Fiscal - Tape Data IPI- F76B221 - file.

-

Generates record type 53 records in Nota Fiscal - Tape Data ICMS- F76B231 - file.

-

Generates record type 55 records in National Guide of Tribute Coll - F76B223 - file.

-

Generates record type 70 records in Nota Fiscal - Transport - Reco - F76B233 - file.

The Inter State Transactions program creates a text file, F76B45711 with a member name of F plus the company number, plus the state. For example, if the company is 00063, and the state is MG, the member will be F0063MG. The member file text will indicate the period from /to.

Figure 51-27 Report: Nota Fiscal - Interstate Operations - Tape File - R76B45711

Description of ''Figure 51-27 Report: Nota Fiscal - Interstate Operations - Tape File - R76B45711''

51.10.9.1 Processing Options

See Section 69.21, "Processing Options FOR Interstate Operations - Tape File (P76B45711)".

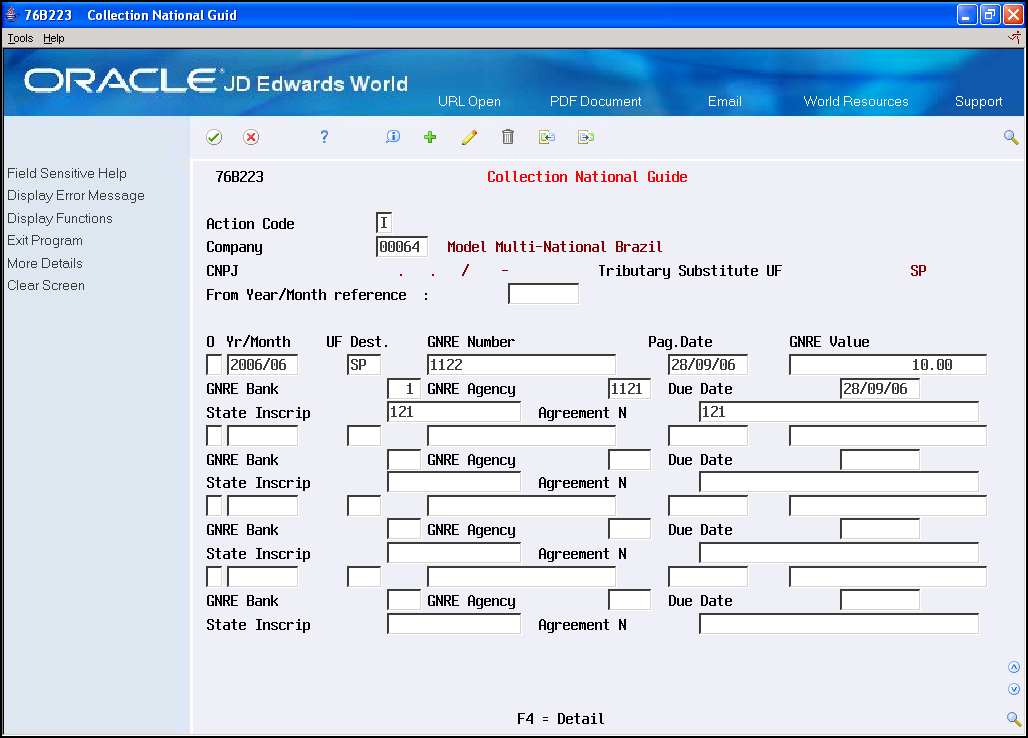

51.10.10 Collection National Guide

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 4 - Create Tapes

From Reports - Brazil (G76B0035), choose 3 - Collection National Guide

GNRE (Guia Nacional De Recolitimento de Tributos Esaduais) is a document that you use to pay ICMS substitution tax in Brazil. When you pay the tax, the bank gives you a confirmation number to acknowledge that you paid the tax. You must enter the confirmation number into the JD Edwards World system so that the number can be reported in the fiscal books. The system writes the information to the GNRE File (F76B223) and uses the information to generate record type 55 when you create the magnetic tape for reporting purposes.

51.10.10.1 Setting up Collection National Guide

Figure 51-28 Collection National Guide screen

Description of ''Figure 51-28 Collection National Guide screen''

Complete the following fields:

| Field | Explanation |

|---|---|

| Action Code | A code that indicates the activity you want to perform. Valid codes are:

A Add C Change D Delete I Inquire |

| Company | The company whose data you want to work with. |

| CNPJ | CNPJ number for alternate taxpayer. Note: Must contain only numbers. |

| Tributary Substitute UF | This is the unit federation code for the tributary substitute. |

| From Year/Month reference: | Year and month when the transaction was created. Format YYYYMM |

| O | Option. To delete a line, enter 9. |

| Yr/Month | Base month and year |

| UF Dest. | Specifies the state or province. This code is usually a postal service abbreviation. |

| GNRE Number | The confirmation number that a bank gives to you, acknowledging that you paid ICMS Substitution tax by using a GNRE document. |

| Pag.Date | For inbound fiscal notes, the date that you received the nota fiscal. For outbound fiscal notes, the date that you issued the nota fiscal. |

| GNRE Value | Base or default price that is used with multipliers from the pricing rules to develop discounted prices. If no formula applies to an item or no discounts apply to a customer, the system uses this price without adjustments. |

| GNRE Bank | The bank code number. |

| GNRE Agency | The bank agency number. |

| Due Date | The date of the nota fiscal. |

| State Inscrip | State registry in the remitted federation unit of the alternate tributary contributor. |

| Agreement N | Number that identifies the agreement or protocol. |