57 Work Files Maintenance and Inquiry

This chapter contains these topics:

57.1 Overview

This process allows you to work with the information of the workfiles generated in the Work File Creation step.

You can inquire, update, delete, or add records to the workfile.

57.2 Main Files

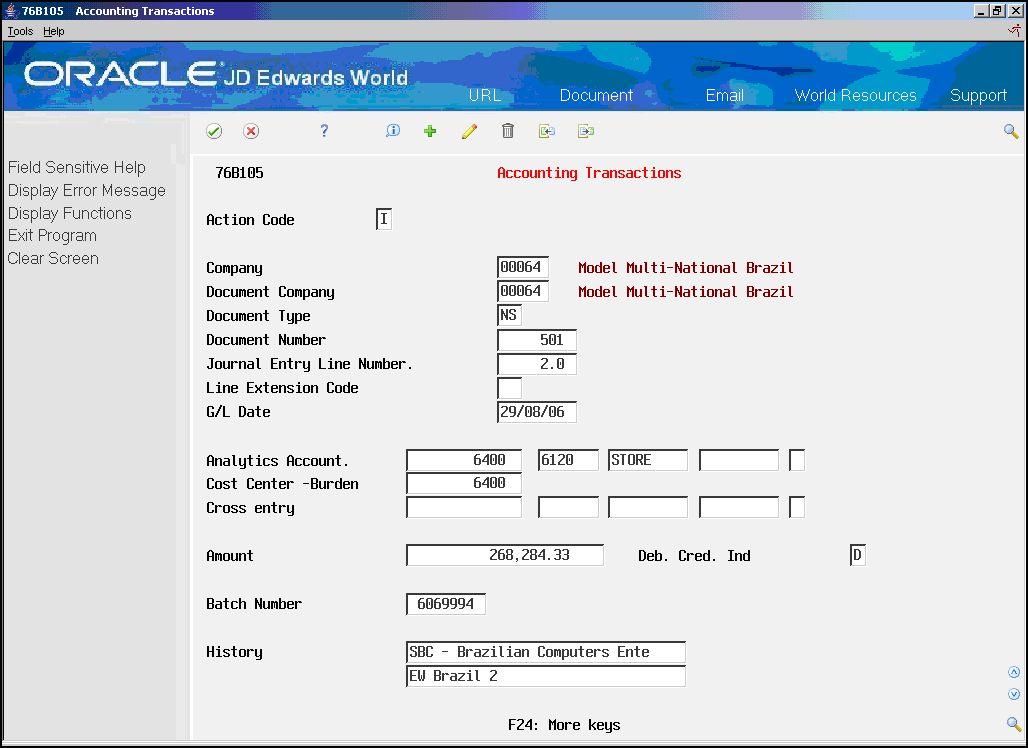

57.2.1 Accounting Transactions

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 2 - Account Transactions

Resolution IN86 establishes that the data related to Accounting Transactions must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user to generated for the purpose of correcting values or adding new records from/to the workfile Accounting Projection.

The following complementary files will be updated:

-

Accounts Plan (F76B72)

-

Business Unit/Expenditure (F76B74)

Figure 57-1 Accounting Transactions screen

Description of ''Figure 57-1 Accounting Transactions screen''

Complete the following fields:

| Field | Explanation |

|---|---|

| Company | Code that identifies the organization inside the system. |

| Document Company | Number that along with document number, type and G/L date uniquely identifies an original document. |

| Document Type | Code from user defined code 00/DT that identifies the origin and purpose of the transaction. |

| Document Number | Number that identifies the original document. |

| Journal Entry Line Number | Number that identifies the record within the journal entry. |

| Line Extension Code | Identifier of extension code of the line, if it exists. |

| G/L Date | Date that identifies the financial period to which the transaction will be posted. |

| Analytics Account | Code that identifies the ledger account. |

| Cost Center -Burden | Business Unit number to which the burden was charged. |

| Cross Entry | Account Number. |

| Amount | Amount of the transaction. |

| Deb. Cred. Ind. | Indicator of Debit/Credit. Values allowed are D or C. |

| Batch Number | Number that a group of transactions that the system processes and balances as a unit. |

| History | A description, remark, name or address to identify the transaction. |

57.2.2 Monthly Account Balances

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 3 - Monthly Account Balances

Resolution IN86 establishes that the data related to Monthly Account Balance must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user to visualize the data generated for the purpose of correcting values or adding new records from/to the workfile, Monthly Account Balance (F76B80).

The following complementary files will be also updated:

-

Accounts Plan (F76B72)

-

Cost Center Tag File (F76B74)

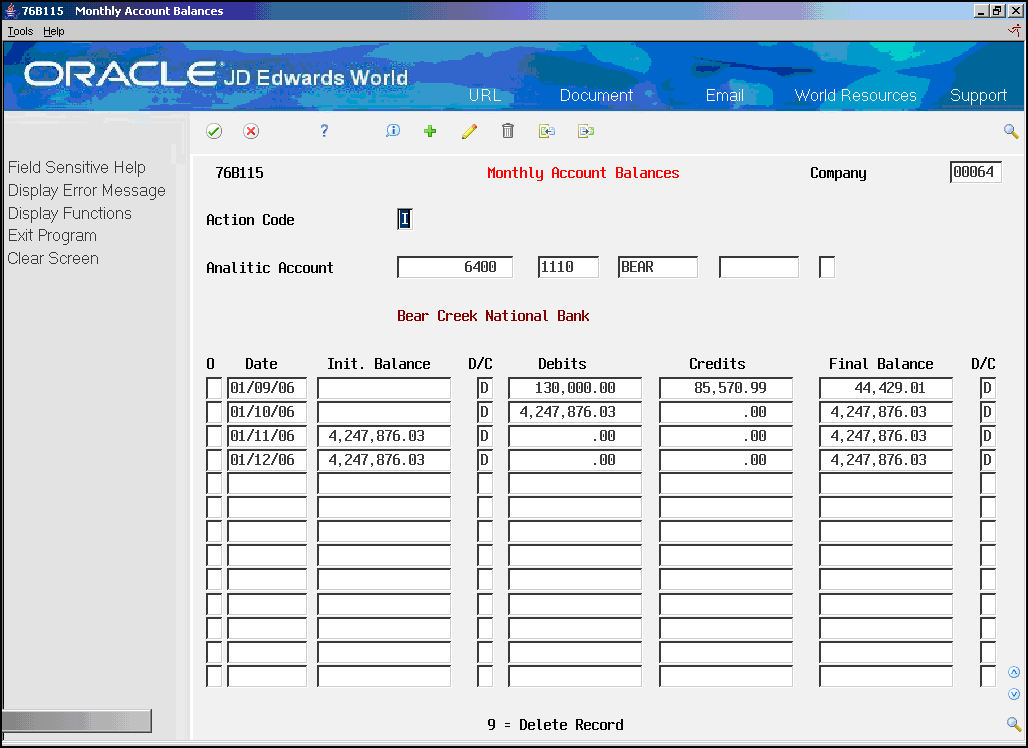

Figure 57-2 Monthly Account Balances screen

Description of ''Figure 57-2 Monthly Account Balances screen''

Complete the following fields:

| Field | Explanation |

|---|---|

| Company | Code that identifies the organization. The system retrieves this value from processing option 1 to use as a default value. |

| Analytic Account | Code that identifies the ledger account. |

| Date | Date that the document was entered to the system |

| Initial Balance | Beginning amount. |

| D/C | Indicator of debit/credit of the Initial Balance. |

| Debits | Total amount of debits. |

| Credits | Total amount of credits. |

| Final Balance | Final amount, compute from the Initial balance after subtracting debits and adding credits. |

| D/C | Indicator of debit/credit of the Final Balance. |

| Option | The only allowed value is '9' to delete a record. |

57.2.2.1 Processing Options for Maintenance for Monthly Balance File (P76B115)

See Section 70.14, "Processing Options for Maintenance for Monthly Balance File (P76B115)".

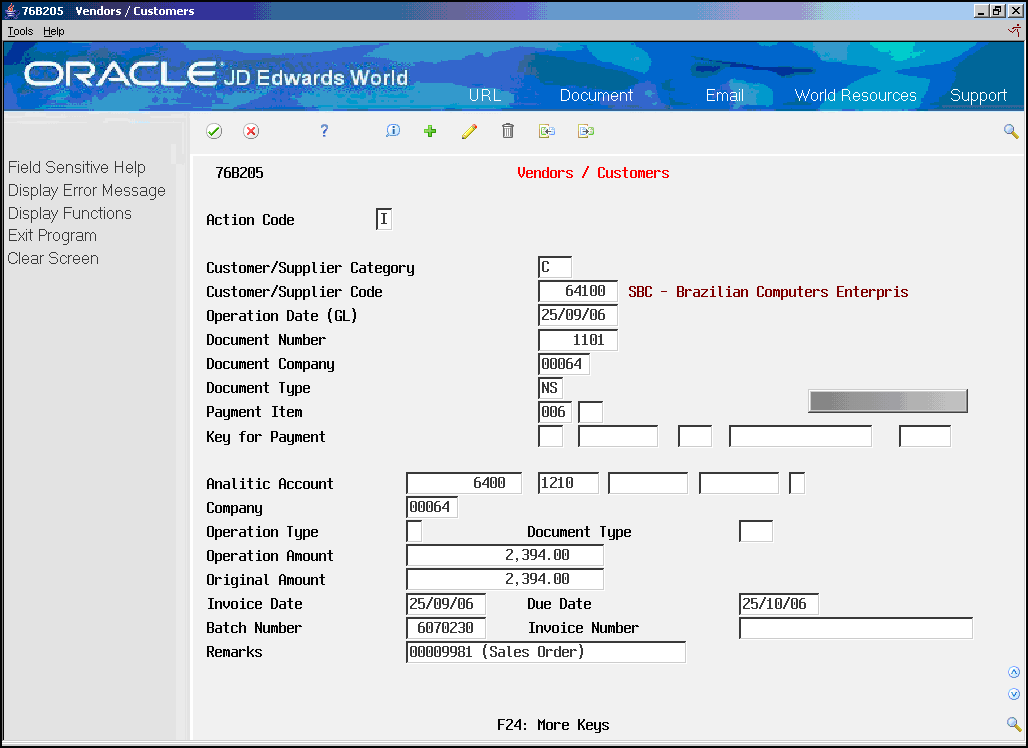

57.2.3 Vendors / Customers

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 4 - Vendors / Customers

Resolution IN86 establishes that the data related to Accounts Receivable and Accounts Payable must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This process executes the Workfile Maintenance and Inquiry step, allowing the user to visualize the data generated for the purpose of correcting values or adding new records from/to the workfiles of Customers and Suppliers (F76B20).

The following complementary files will be also updated:

-

Accounts Plan (F76B72)

-

Address Book Registry (F76B70)

Complete the following fields:

| Field | Explanation |

|---|---|

| Customer/Supplier Category | Code that identifies the related category of the physical/juridical persons. Allowed values are 'V' for Suppliers, 'C' for Customers. |

| Customer/Supplier Code | Number that identifies in Address Book the customer or the supplier. |

| Operation Date (G/L) | G/L Date of the operation. |

| Document Number | Number that identifies the original document. |

| Document Company | Number that along with document number, type and G/L date uniquely identifies an original document. |

| Document Type | Code from user defined code 00/DT that identifies the origin and purpose of the transaction. |

| Payment Item/Suffix | Identifier of the item inside the payment group. |

| Key for Payment | Internal identification of the payment inside the system. |

| Analytic Account | Code that identifies the ledger account. |

| Company | Code that identifies the organization inside the system. |

| Operation Type | Allowed values are: 'C' Initial Title Register, 'P' Payment, 'R' Receipt, 'B' Other Decreases (user defined code 76B/OD). |

| Document Type | Allowed values are: 'DUP' Duplicate or 'REC' Receipt. |

| Operation Amount | Amount of the transaction. |

| Original Amount | Original amount of the transaction. |

| Invoice Date | Date of the invoice. |

| Due Date | Date of payment due. |

| Batch Number | Number that a group of transactions that the system processes and balances as a unit. |

| Invoice Number | Number that identifies the invoice document. |

| Remarks | A description, remark, name or address to identify the transaction. |

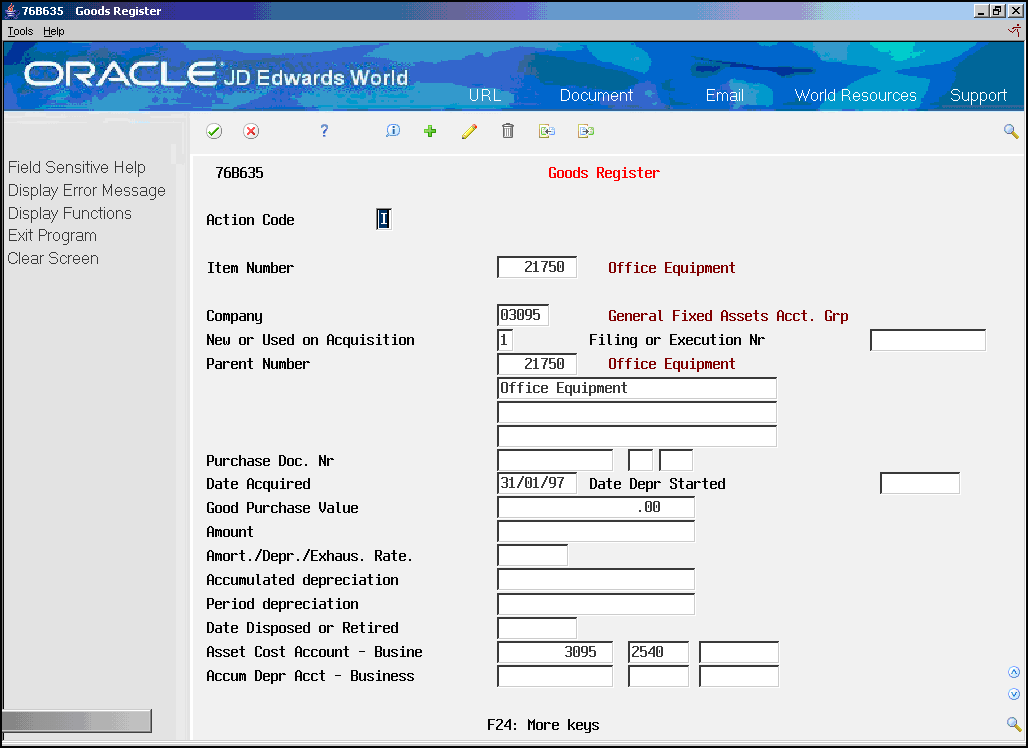

57.2.4 Goods Register

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 5 - Goods Register

Resolution IN86 establishes that the data related to Goods Register must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This process executes the Workfile Maintenance and Inquiry step, allowing the user to visualize the data generated for the purpose of correcting values or adding new records from/to the workfile of Goods Register (F76B63).

The following complementary files will be also updated:

-

Accounts Plan (F76B72).

Complete the following fields:

| Field | Explanation |

|---|---|

| Item Number | Code of 8 digits that uniquely identifies an asset. |

| Company | Code that identifies the organization inside the system. |

| New or Used on Acquisition | Code that identifies the asset. Allowed values are: 'N' indicates a new asset, 'U' indicates a used asset. |

| Filing or Execution Number | Filing or Number of execution |

| Parent Number | Specify a group of components that are associated together for a cause. |

| Purchase Document Number | Identification of nota fiscal, with number, series and 'DUP' if is a duplicate or 'REC' if is a receipt. |

| Date Acquired | Date of asset was acquired. |

| Date Depreciation Started | Date when the depreciation computation begin for an asset. |

| Good Purchase Value | Value of purchase of the good. |

| Amount | Amount of the good. |

| Amort./Depr./Exhaus. Rate | Rate of amortization, depreciation or exhaust. |

| Accumulated depreciation | Depreciation accumulated. |

| Period depreciation | Period of depreciation. |

| Date disposed or retired | Date of the asset was disposed. |

| Asset Cost Account | Code that identifies the asset cost account. |

| Accumulated Depr. Account | Code that identifies the asset accumulated depreciation account. |

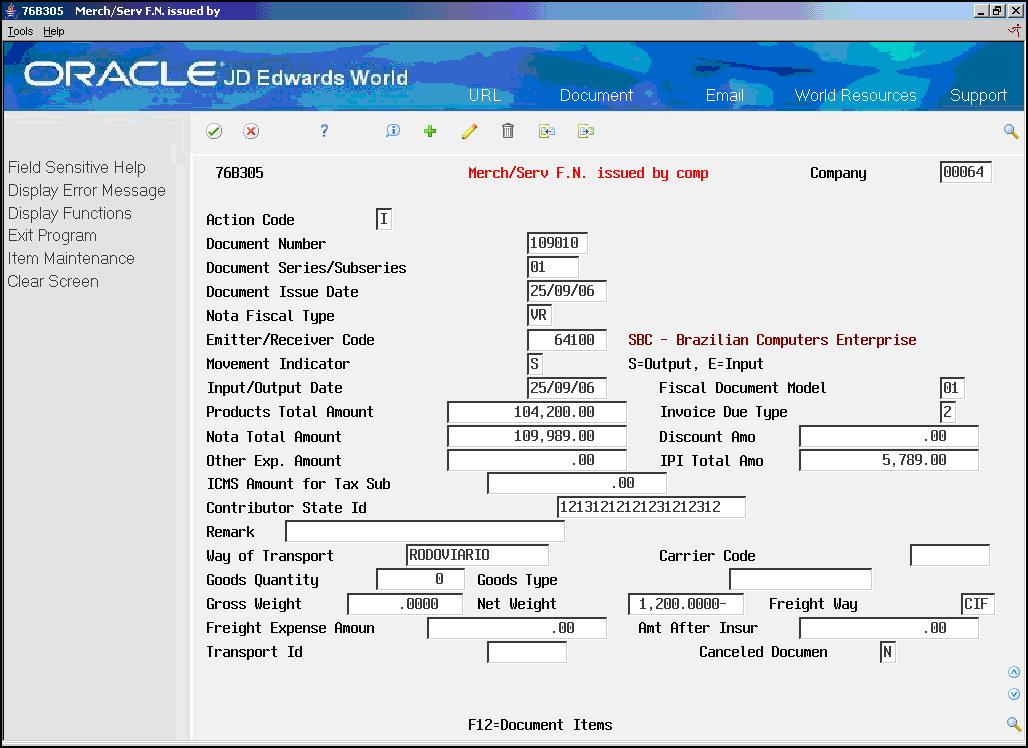

57.2.5 Merchandise/Service Fiscal Note Issued by Company

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 6 - Merchandise/Service Fiscal Note issued by Company

Resolution IN86 establishes that the data related to Merchandise/services Fiscal Note must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user generated for the purpose of correcting values or adding new records from/to the workfiles of Fiscal Note Master Merchandise/services and Fiscal Note Master Merchandise/services - Items (F76B81 and F76B82).

The following complementary files will be also updated:

-

Address Book Registry (F76B70)

Figure 57-5 Merch/Serv F.N. Issued by screen

Description of ''Figure 57-5 Merch/Serv F.N. Issued by screen''

Complete the following fields:

| Field | Explanation |

|---|---|

| Company | Code that identifies the organization inside the system. |

| Document Number | Number that, along with the number of series/subseries, identifies the Nota Fiscal. |

| Document Series/Subseries | Number of Series/Subseries that, along with the document number, identifies the Nota Fiscal. |

| Document Issue Date | Date that the log entry was issued. |

| Nota Fiscal Type | Code that identifies the type of Nota Fiscal (user defined code 00/DT). |

| Emitter/Receiver Code | Number that identifies in Address Book the emitter or the receiver. |

| Movement Indicator | Indicator of movement. Allowed values are: 'S' output, 'E' input. |

| Input/Output Date | Date of input or output. |

| Fiscal Document Model | Indicator of document template. |

| Products Total Amount | Total amount without discounts that will be printed in the Nota Fiscal (financial discount, IPI or ICMS). |

| Invoice Due Type | Bill type. Allowed values are: '1' at sight operation, '2' long term operation. |

| Nota Total Amount | Total amount of the Nota Fiscal. The system calculates the total as: Merchandise + IPI tax amount + ICMS Substitute tax amount + Additional Expenses - Discounts. |

| Discount Amount | Amount of discount available for the Nota Fiscal. |

| Other Exp. Amount | Total amount of the additional expenses printed on the Nota Fiscal. This amount is the sum of Freight plus Insurance plus Finance Expenses. |

| IPI Total Amount | Amount of IPI tax. |

| ICMS Amount for Tax Sub | Amount of ICMS Substitution that the customer must remit in advance if they are subject to Tax Substitution Mark-up. |

| Contributor State Id | Fiscal identification of the company. This information will be printed on Fiscal Notes and Fiscal Books. |

| Remark | Field used like identification of the transaction. |

| Way of Transport | Transport way used. |

| Carrier Code | Number that identifies the carrier from Address Book. |

| Goods Quantity | Volume used by the merchandise included in the Nota Fiscal. |

| Goods Type | Volume Type related to a Nota Fiscal. |

| Gross Weight | Gross Weight for an item included in the Nota Fiscal. |

| Net Weight | Net Weight for an item included in the Nota Fiscal. |

| Freight Way | Freight Mode. |

| Freight Expense Amount | Complete the Nota Fiscal Freight field whenever you classify freight as an additional expense to your customer. |

| Amount After Insurance | The insurance amount that you charge the client as an additional expense. |

| Transport Id | Transport truck identification number. |

| Canceled Document | Cancel Situation Indicator. |

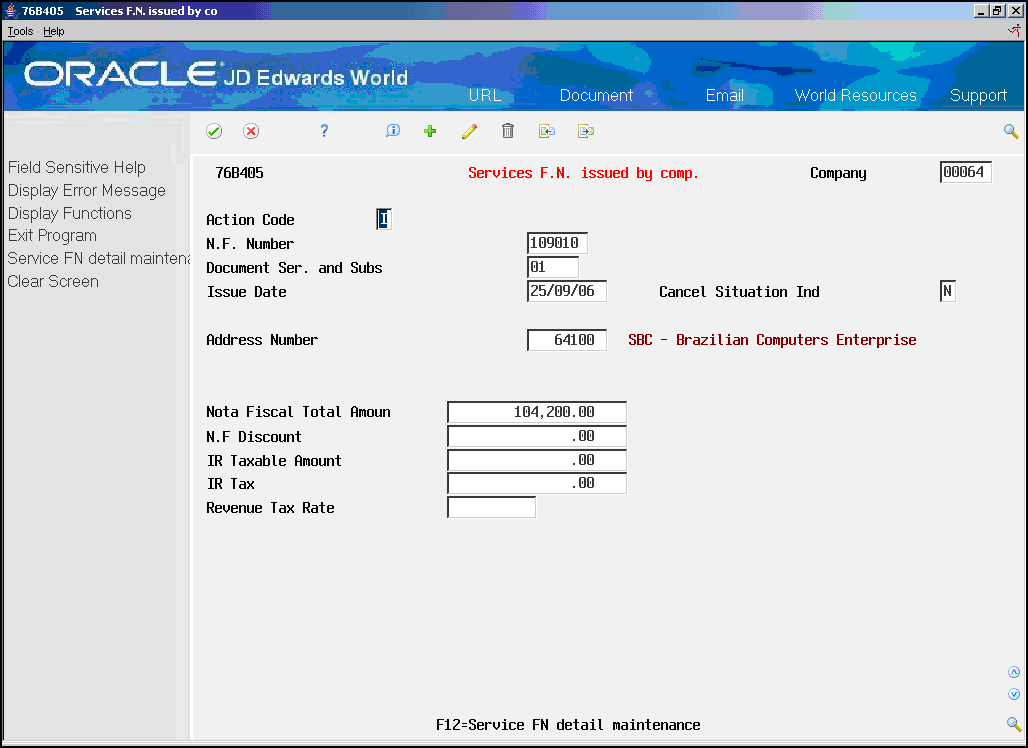

57.2.6 Services Fiscal Note Issued by Company

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 7 - Services Fiscal Note issued by Company

Resolution IN86 establishes that the data related to Services Fiscal Notes must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user to visualize the data generated for the purpose of correcting values or adding new records from/to the workfiles of Services Fiscal Notes and Services Fiscal Notes Detail (F76B40 and F76B41).

The following complementary files will be also updated:

-

Address Book Registry (F76B70)

Figure 57-6 Services F.N. Issued by comp. screen

Description of ''Figure 57-6 Services F.N. Issued by comp. screen''

Complete the following fields:

| Field | Explanation |

|---|---|

| Company | Code that identifies the organization inside the system. |

| N.F. Number | Number that, jointly with number of series/subseries, identifies the Nota Fiscal. |

| Document Series/Subseries | Number of Series/subseries that jointly with the document number identifies the Nota Fiscal. |

| Issue Date | Date the log entry was issued. |

| Cancel Situation Indicator | Cancel Situation Indicator. |

| Address Number | Number that identifies the person in the Address Book. |

| Nota Fiscal Total Amount | Total amount of the Nota Fiscal. The system calculates the total as: Merchandise + IPI tax amount + ICMS Substitute tax amount + Additional Expenses - Discounts. |

| N.F. Discount | Amount of discount available for the Nota Fiscal. |

| IR Taxable Amount | Amount on which IR taxes are assessed. |

| IR Tax | Amount of IR tax. |

| Revenue Tax Rate | Percentage from the tax authority that has jurisdiction in the tax area. |

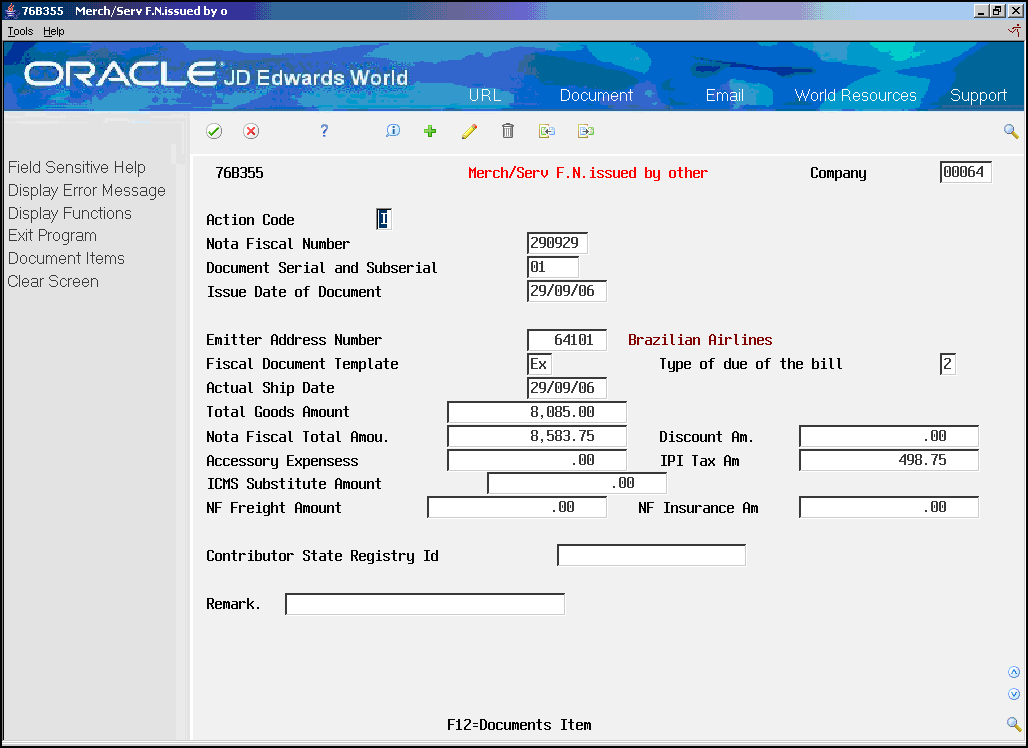

57.2.7 Merchandise/Service Fiscal Note Issued by Other

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 8 - Merchandise/Service Fiscal Note Issued by Other

Resolution IN86 establishes that the data related to Fiscal Note Goods/Services emitted by Thirds must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user to visualize the data generated for the purpose of correcting values or adding new records from/to the workfile, Master Notes of Goods/Services emitted by Third Parties (F76B35).

The following complementary files will be also updated:

-

Items Notes of Goods/Services emitted by Third Parties (F76B36)

-

Address Book Registry (F76B70).

Figure 57-7 Merch/Serv F.N. Issued by other screen

Description of ''Figure 57-7 Merch/Serv F.N. Issued by other screen''

Complete the following fields:

| Field | Explanation |

|---|---|

| Company | Code that identifies the organization inside the system. |

| N.F. Number | Number that jointly with number of series/subseries identifies the Nota Fiscal. |

| Document Serial and Subserial | Number of Series/subseries that jointly with the document number identifies the Nota Fiscal. |

| Issue Date of Document | Date the log entry was issued. |

| Emitter Address Number | Number that identifies the emitter in the Address Book. |

| Fiscal Document Template | Document Template |

| Type of Due of the Bill | Bill type. Allowed values are: '1' at sight operation, '2' long term operation. |

| Actual Ship Date | Date that is confirmed to the customer like of shipment. |

| Total Goods Amount | Total amount without discounts. |

| Nota Fiscal Total Amount | Total amount of the Nota Fiscal. The system calculates the total as: Merchandise + IPI tax amount + ICMS Substitute tax amount + Additional Expenses - Discounts. |

| Discount Amount | Amount of discount available for the Nota Fiscal. |

| Accessory Expenses | Total amount of the accessory expenses printed on the Nota Fiscal. This amount is the sum of Freight plus Insurance plus Finance Expenses. |

| IPI Tax Amount | Amount of IPI tax. |

| ICMS Substitute Amount | Amount of ICMS Substitute that the customer must remit in advance if they are subject to Tax Substitution Mark-up. |

| NF Freight Amount | Complete the Nota Fiscal Freight field whenever you classify freight as an additional expense to your customer |

| NF Insurance Amount | The insurance amount that you charge the client as an additional expense. |

| Contributor State Register Id | Fiscal identification of the company. This information will be printed on Fiscal Notes and Fiscal Books. |

| Remark | A description, remark, name or address to identify the transaction. |

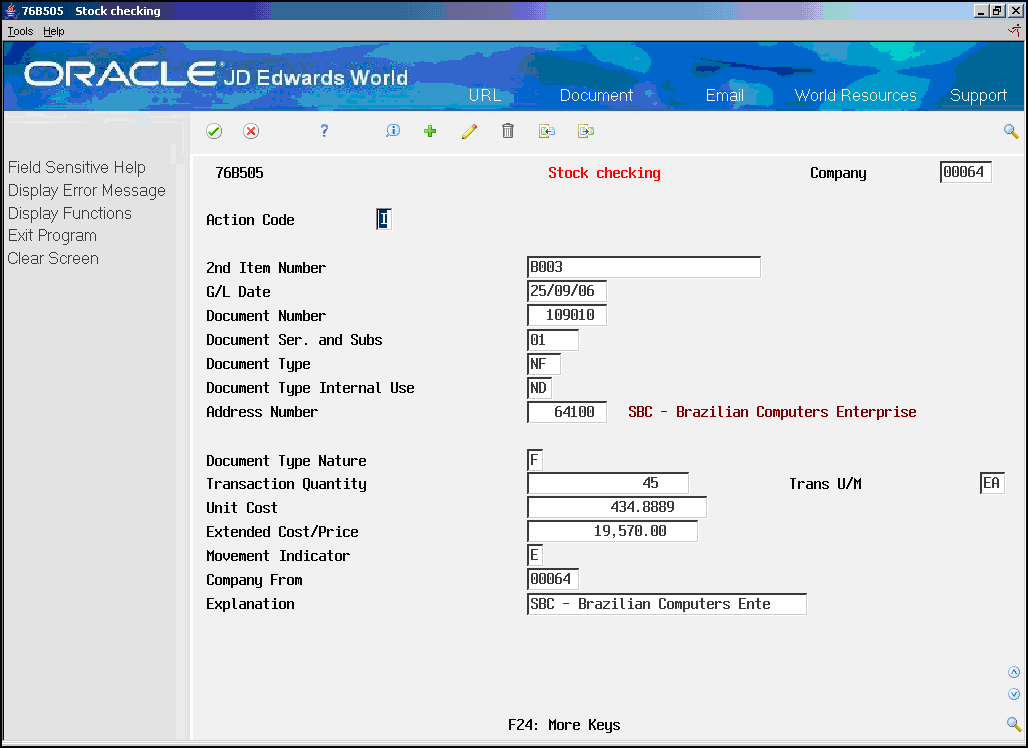

57.2.8 Stock Checking

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 9 - Stock Checking

Resolution IN86 establishes that the data related to Stock Checking must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user to visualize the data generated for the purpose of correcting values or adding new records from/to the workfile, Stock Checking (F76B50).

The following complementary files will be also updated:

-

Item list (F76B78).

Complete the following fields:

| Field | Explanation |

|---|---|

| Company | Code that identifies the organization inside the system. |

| 2nd Item Number | Code of 25 digits that identifies an item |

| G/L Date | Date that identifies the financial period to which the transaction will be posted. |

| Document Number | Number that jointly with number of series/subseries identifies the Nota Fiscal. |

| Document Serial and Subserial | Number of Series/subseries that jointly with the document number identifies the Nota Fiscal. |

| Document Type | Code of user defined code 00/DT that identifies the origin and purpose of the transaction. |

| Document Type Internal Use | Code of user defined code 00/DT that identifies the origin and purpose of the sub-transaction. |

| Address Number | Number that identifies the person in the Address Book. |

| Document Type Nature | Nature of the document. Allowed values are: 'F' Legal document according to fiscal legislation, 'I' Internal document of the company. |

| Transaction Quantity | Quantity of the transaction. |

| Transaction U/M | The unit of measure of the transaction. |

| Unit Cost | Amount per unit (total cost divided by the unit quantity). |

| Extended Cost/Price | The extended cost/price value of an inventory transaction for an inventory item. |

| Movement Indicator | Indicator of movement. Allowed values are: 'S' output, 'E' input. |

| Company From | Company selection value. |

| Explanation | Text that indicates the reason of a transaction occurs. |

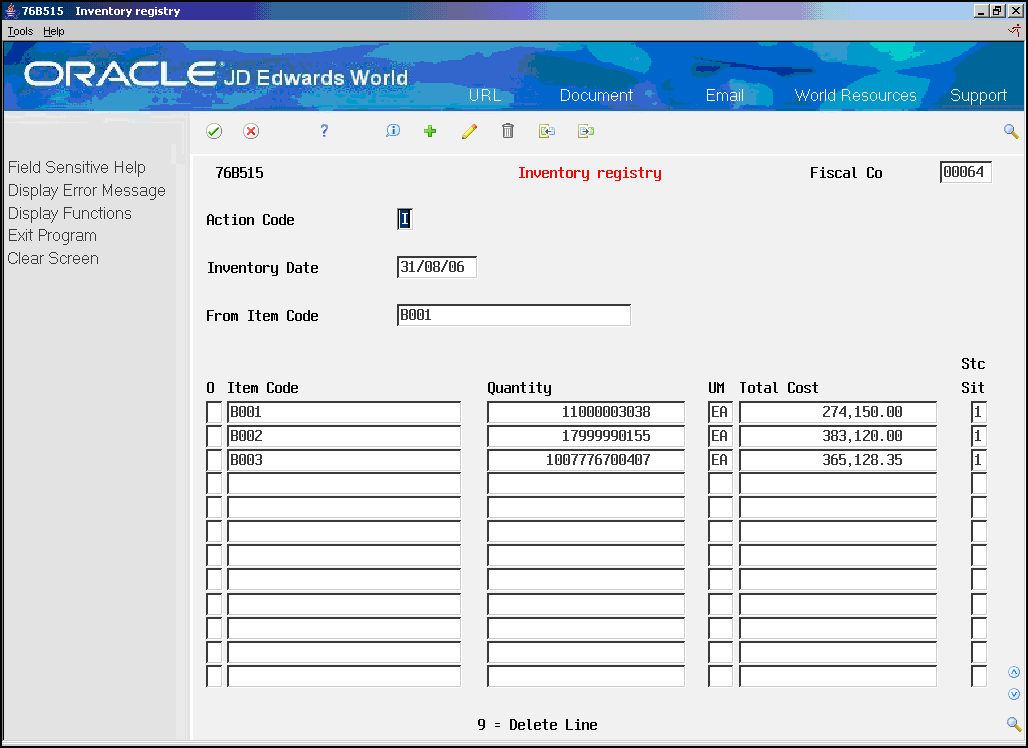

57.2.9 Inventory Registry

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 10 - Inventory Registry

Resolution IN86 establishes that the data related to Inventory Register must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user to visualize the data generated for the purpose of correcting values or adding new records from/to the workfile Registration of Stock (F76B51).

The following complementary files will be also updated:

-

Item list (F76B78)

Complete the following fields:

| Field | Explanation |

|---|---|

| Fiscal Company | Code that identifies the organization inside the system. The system retrieves this value from processing option 1 to use as a default value. |

| Inventory Date | Date of the inventory |

| From Item Code | Code of 25 digits that identifies an item |

| Item Code | Code of 25 digits that identifies an item |

| Quantity | Quantity of the inventory transaction. |

| UM | Unit of measure of the inventory transaction. |

| Total Cost | Extended cost/price value of an inventory transaction. |

| Stc. Sit. | Stock situation. Allowed values are: '1' stock held by contributor, '2' own stock held by third parties, '3' third parties stock held by contributor. |

| Option | The only allowed value is '9' to delete a record. |

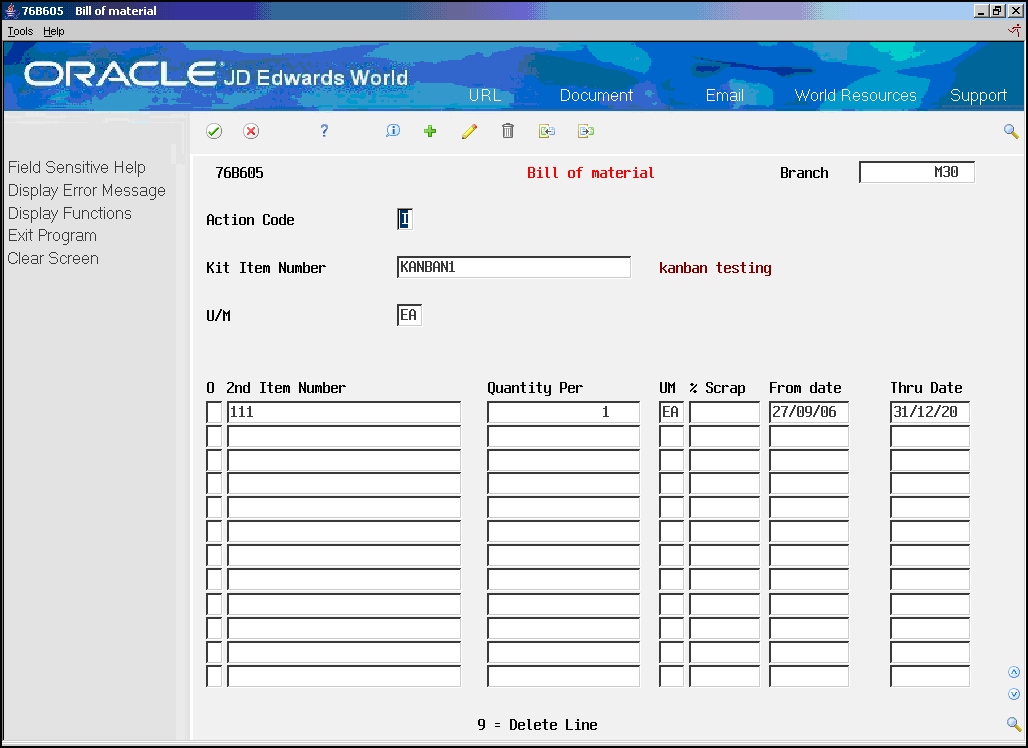

57.2.10 Bill of Material

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 11 - Bill of Material

Resolution IN86 establishes that the data related to Bill of material must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user to visualize the data generated for the purpose of correcting values or adding new records from/to the workfiles Bill of material for Reporting purpose (F76B60) and Item list (F76B78).

Complete the following fields:

| Field | Explanation |

|---|---|

| Branch | Code that identifies the business unit of the company inside the system. The system retrieves this value of the processing option to use as a default value. |

| Kit Item Number | Code that identifies the kit item. |

| U/M | Unit of measure of the item. |

| 2nd Item Number | Code of 25 digits that identifies an item |

| Quantity Per | Quantity of units that the system applies to the transaction. |

| UM | Unit of measure of the item. |

| % Scrap | Percentage of unusable component material created during the manufacture of a particular parent item. |

| From Date | Date when a component part goes into effect on a bill of material. |

| Thru Date | Date when a component part is no longer in effect on a bill of material. |

| Option | The only allowed value is '9' to delete a record. |

57.2.10.1 Processing Options

See Section 70.19, "Processing Options for Bill of Material Maintenance (P76B605).".

57.3 Complementary Files

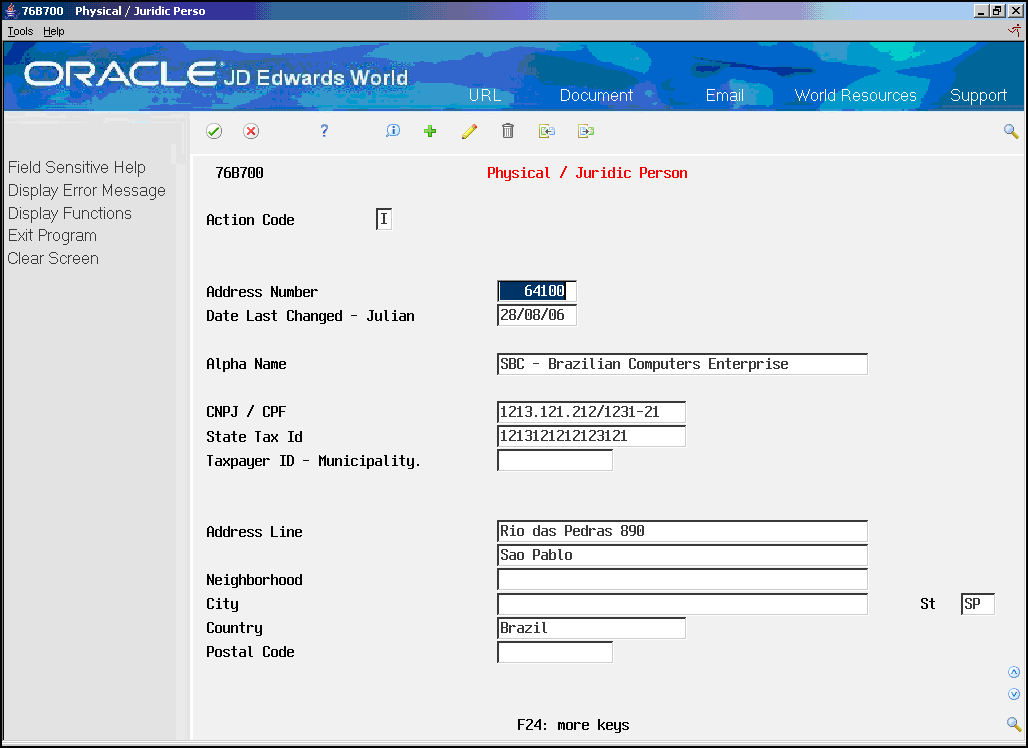

57.3.1 Physical / Juridic Person

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 14 - Physical / Juridic Person

Resolution IN86 establishes that the data related to Physical / Juridic Person must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user generated for the purpose of correcting values or adding new records from/to the workfile Address Book Registry (F76B70).

Figure 57-11 Physical/Juridic Person screen

Description of ''Figure 57-11 Physical/Juridic Person screen''

Complete the following fields:

| Field | Explanation |

|---|---|

| Address Number | Number that identifies the person in the Address Book. |

| Date Last Changed | Date of transaction last change. |

| Alpha Name | |

| CNPJ / CPF | Identification code required by various tax authorities. It can be a social security number, federal or state corporate tax Id, sales tax number. |

| State Tax id | Additional identification number that a tax authority assigns to an individual. |

| Tax Payer Id - Municipality | Code of 12 characters to identify a corporation for tax purposes. |

| Address Line | The first and second lines of the mailing address of the Address Book. |

| Neighborhood | Neighborhood associated with the address. |

| City | City associated with the address. |

| St | Code defined for the state or province. |

| Country | Country associated with the address. |

| Postal Code | ZIP code or postal code attached to the address for delivery. |

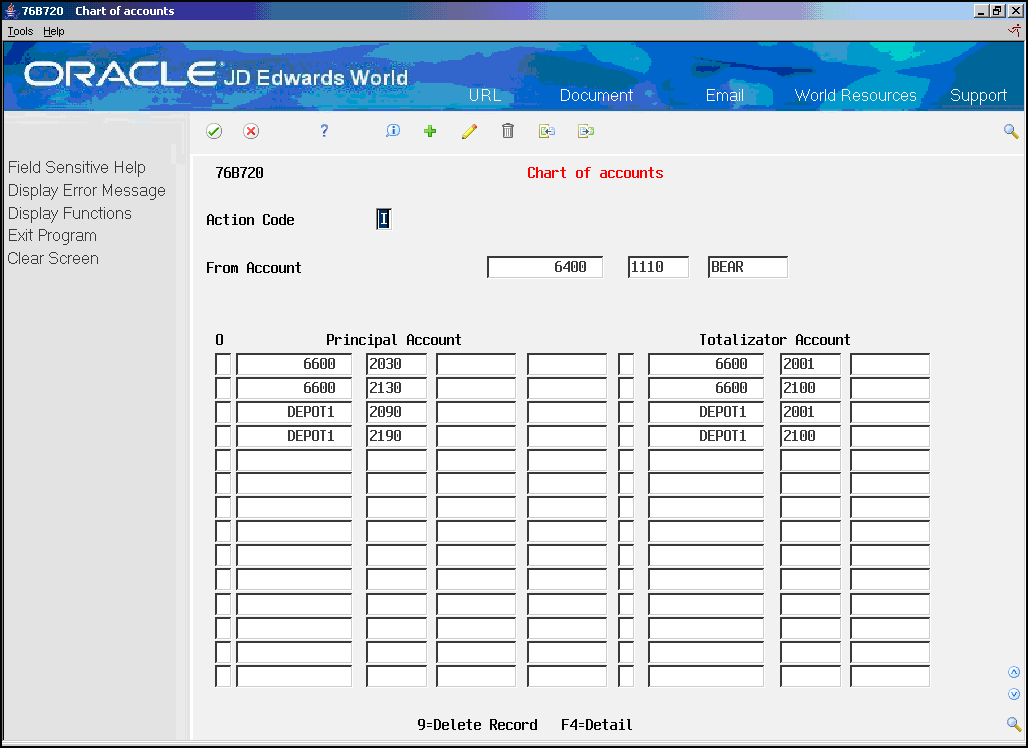

57.3.2 Chart of Accounts

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 15 - Chart of Accounts

Resolution IN86 establishes that the data related to Chart of Accounts must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user to correct values or add new records from/to the workfile Accounts Plan (F76B72).

Complete the following fields:

| Field | Explanation |

|---|---|

| From Account | Code that identifies the ledger account. |

| Principal Account | Code that identifies the ledger account. |

| Totalizator Account | Code that identifies the ledger account. |

| Option | The only allowed value is '9' to delete a record. |

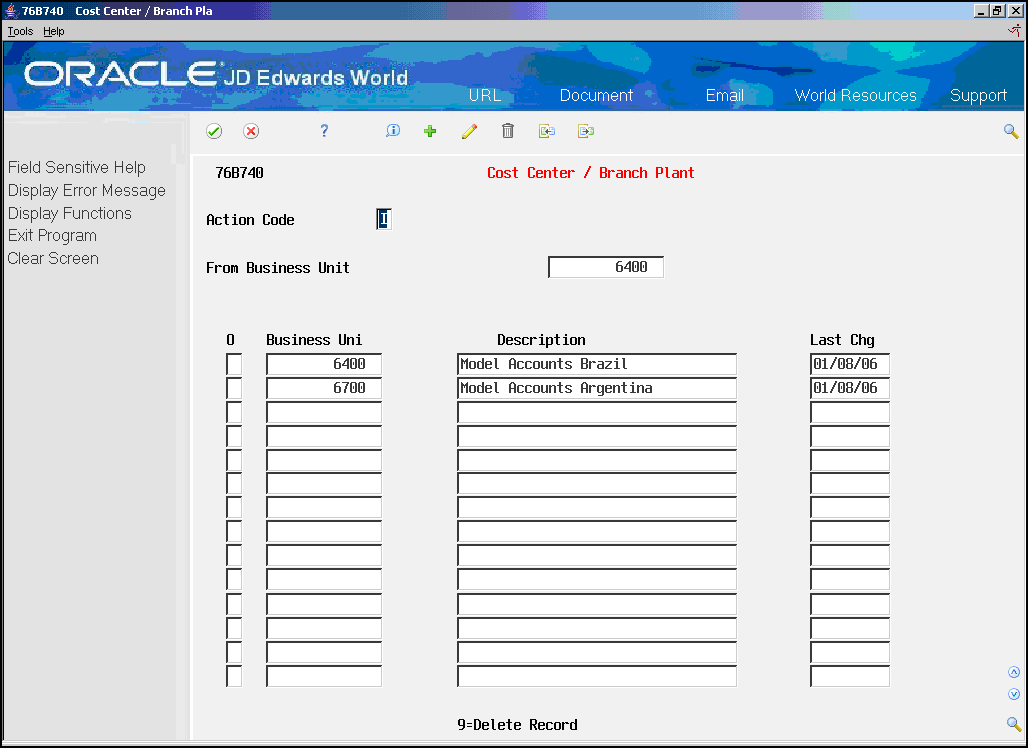

57.3.3 Cost Center / Branch Plant

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 16 - Cost Center / Branch Plant

Resolution IN86 establishes that the data related to Cost Center Maintenance must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user generated for the purpose of correcting values or adding new records from/to the workfile Business Unit/Expenditure (F76B74).

Figure 57-13 Cost Center/Branch Plant screen

Description of ''Figure 57-13 Cost Center/Branch Plant screen''

Complete the following fields:

| Field | Explanation |

|---|---|

| From Business Unit | Code that identifies the business unit of the company inside the system. |

| Business Unit | Code that identifies the business unit of the company inside the system. |

| Description | Business Unit description. |

| Last change | Date of transaction last change. |

| Option | The only allowed value is '9' to delete a record. |

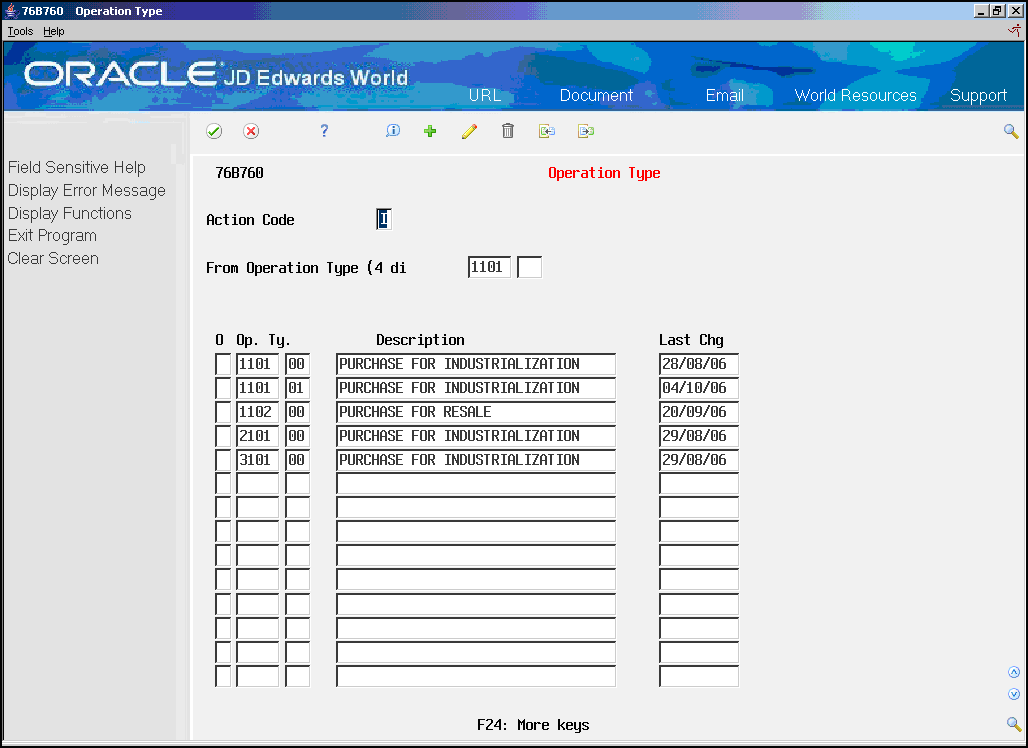

57.3.4 Operation Type

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 17 - Operation Type

Resolution IN86 establishes that the data related to Maintenance of Transaction Nature must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user generated for the purpose of correcting values or adding new records from/to the workfile Transaction Nature (F76B76).

Complete the following fields:

| Field | Explanation |

|---|---|

| From Operation Type | Code of transaction nature plus suffix that identifies different types of transactions for tax purposes. |

| Operation Type | Code of transaction nature plus suffix that identifies different types of transactions for tax purposes. |

| Description | Description of code of transaction nature. |

| Last change | Date of transaction last change. |

| Option | The only allowed value is '9' to delete a record. |

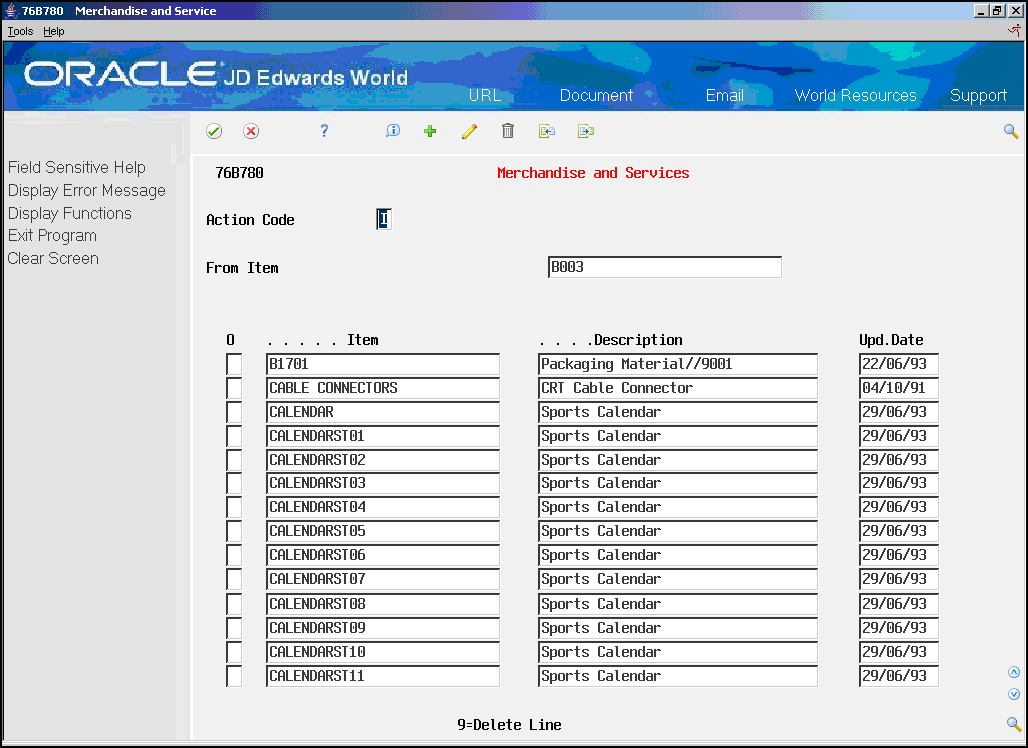

57.3.5 Merchandise and Services

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 18 - Merchandise and Services

Resolution IN86 establishes that the data related to Merchandise and Services must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user generated for the purpose of correcting values or adding new records from/to the workfile Merchandise and Services (F76B78).

Figure 57-15 Merchandise and Service screen

Description of ''Figure 57-15 Merchandise and Service screen''

Complete the following fields:

| Field | Explanation |

|---|---|

| From Item | Identifier for an item. |

| Item | Identifier for an item. |

| Description | Description of the item. |

| Update Date | Date of transaction last change. |

| Option | The only allowed value is '9' to delete a record. |

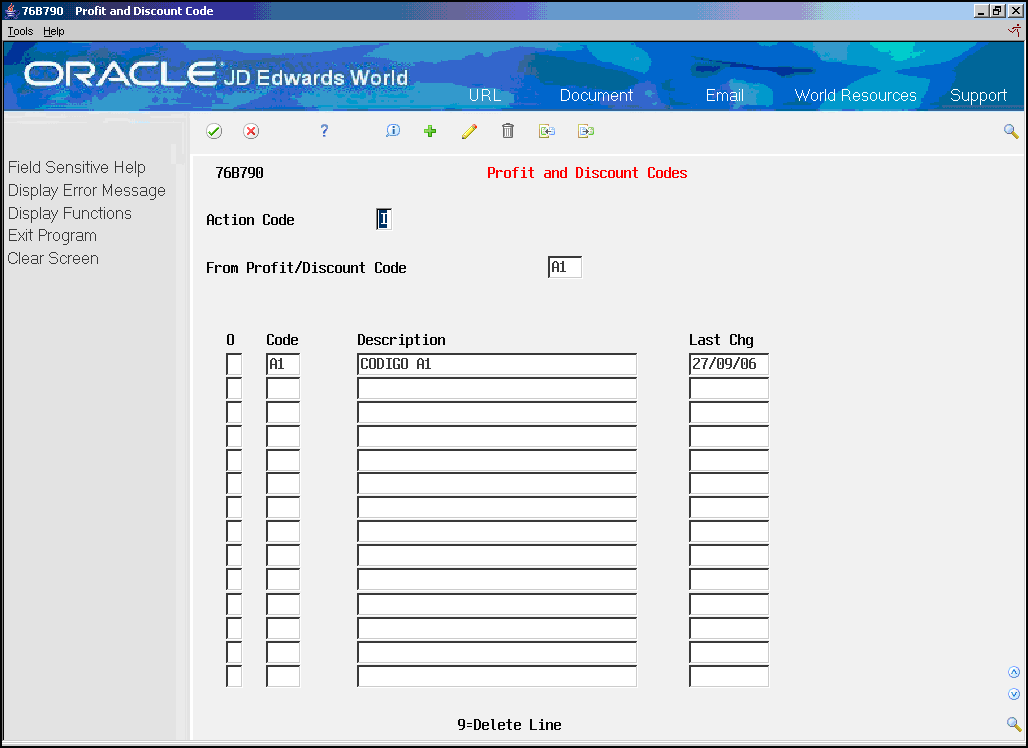

57.3.6 Profit and Discount Codes

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 19 - Profit and Discount Codes

Resolution IN86 establishes that the data related to Profit and Discount Codes must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user generated for the purpose of correcting values or adding new records from/to the workfile Profit and Discount Codes (F76B79).

Figure 57-16 Profit and Discount Code screen

Description of ''Figure 57-16 Profit and Discount Code screen''

Complete the following fields:

| Field | Explanation |

|---|---|

| From Profit/Discount Code | Code of profit or discount. |

| Code | Code of profit or discount. |

| Description | Description of the code profit or discount. |

| Last change | Date of transaction last change. |

| Option | The only allowed value is '9' to delete a record. |

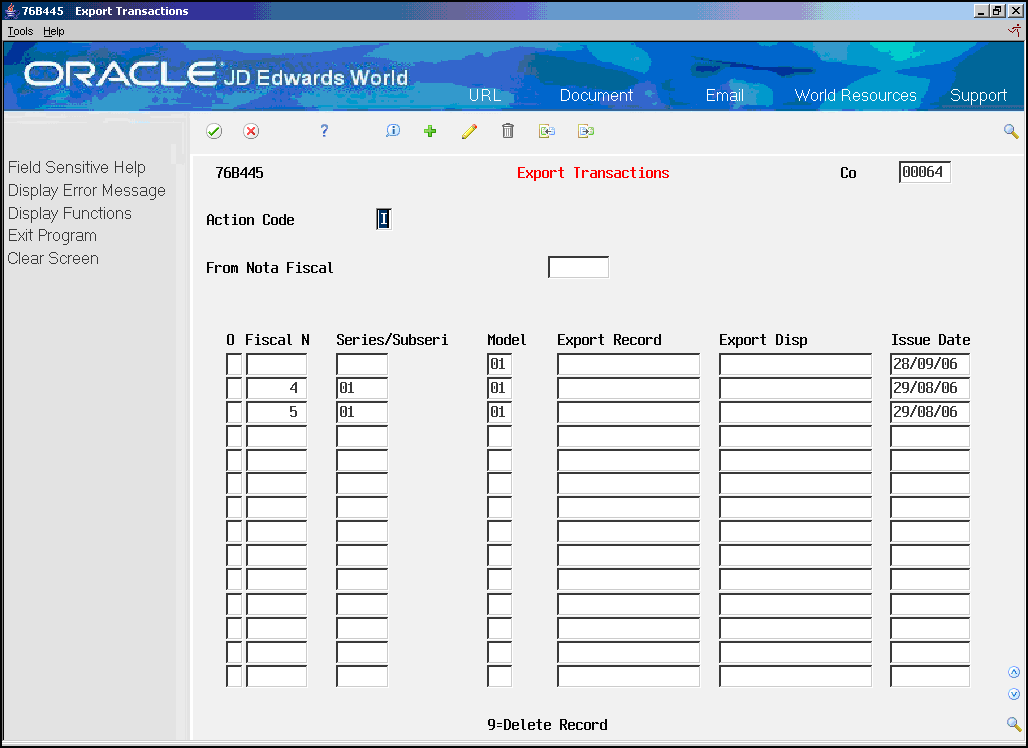

57.4 Non JD Edwards System Transactions

57.4.1 Export Transactions

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 21 - Export Transactions

Resolution IN86 establishes that the data related to Export Transactions must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user generated for the purpose of correcting values or adding new records from/to the workfile Export File (F76B44).

Complete the following fields:

| Field | Explanation |

|---|---|

| Company | Code that identifies the organization inside the system. The system retrieves this value from processing option 1 to use as a default value. |

| From Fiscal Note | Number that, jointly with number of series/subseries, identifies the Nota Fiscal. |

| Fiscal Note | Number that, jointly with number of series/subseries, identifies the Nota Fiscal. |

| Series/subseries | Number of Series/subseries that jointly with the document number identifies the Nota Fiscal. |

| Model | Indicator of document template. |

| Export Record | Registry number assigned by the Integrated System for Exterior Commerce (SISCOMEX) |

| Export Disp. | DDE number assigned by SISCOMEX (External Commerce Integrated System). |

| Issue Date | Date the log entry was issued. |

| Option | The only allowed value is '9' to delete a record. |

57.4.1.1 Processing Options

See Section 70.15, "Processing Options for Maintenance for Export File (P76B445)."

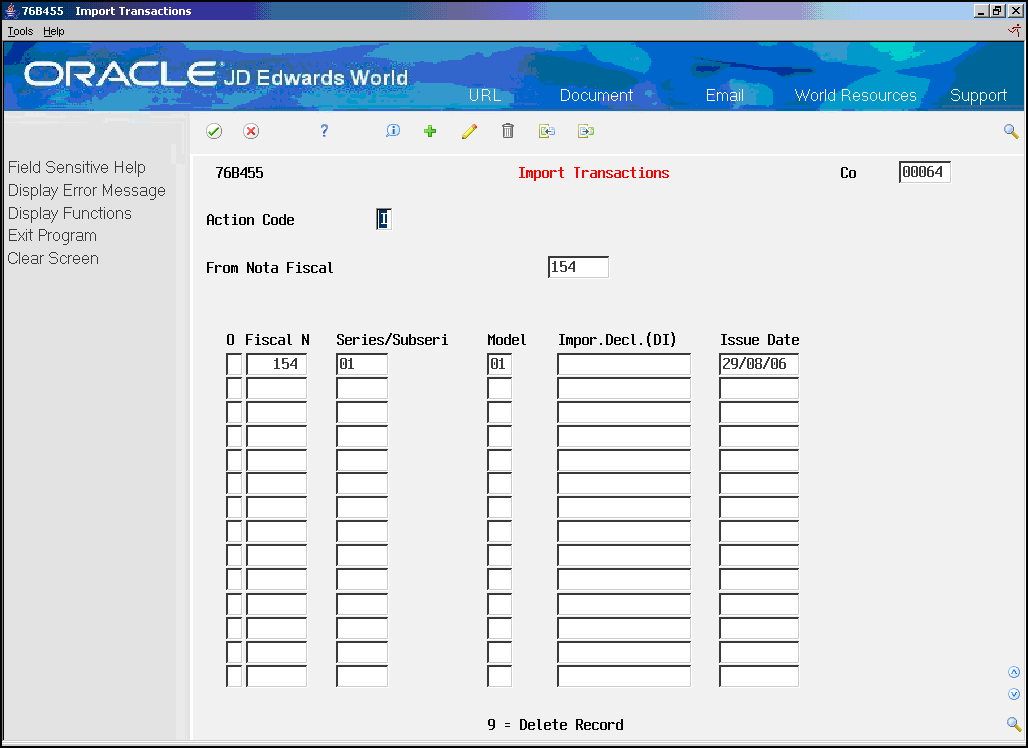

57.4.2 Import Transactions

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 22 - Import Transactions

Resolution IN86 establishes that the data related to Import Transactions must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user generated for the purpose of correcting values or adding new records from/to the workfile Import File (F76B45).

Complete the following fields:

| Field | Description |

|---|---|

| Company | Code that identifies the organization inside the system. The system retrieves this value from processing option 1 to use as a default value. |

| From Fiscal Note | Number that, jointly with number of series/subseries, identifies the Nota Fiscal. |

| Fiscal Note | Number that, jointly with number of series/subseries, identifies the Nota Fiscal. |

| Series/subseries | Number of Series/subseries that jointly with the document number identifies the Nota Fiscal. |

| Model | Indicator of document template. |

| Inport Declaration (DI) | Import Declaration Number assigned by Foreign Trade Integrated System (SISCOMEX). |

| Issue Date | Date the log entry was issued. |

| Option | The only allowed value is '9' to delete a record. |

57.4.2.1 Processing Options

See Section 70.15, "Processing Options for Maintenance for Export File (P76B445)."

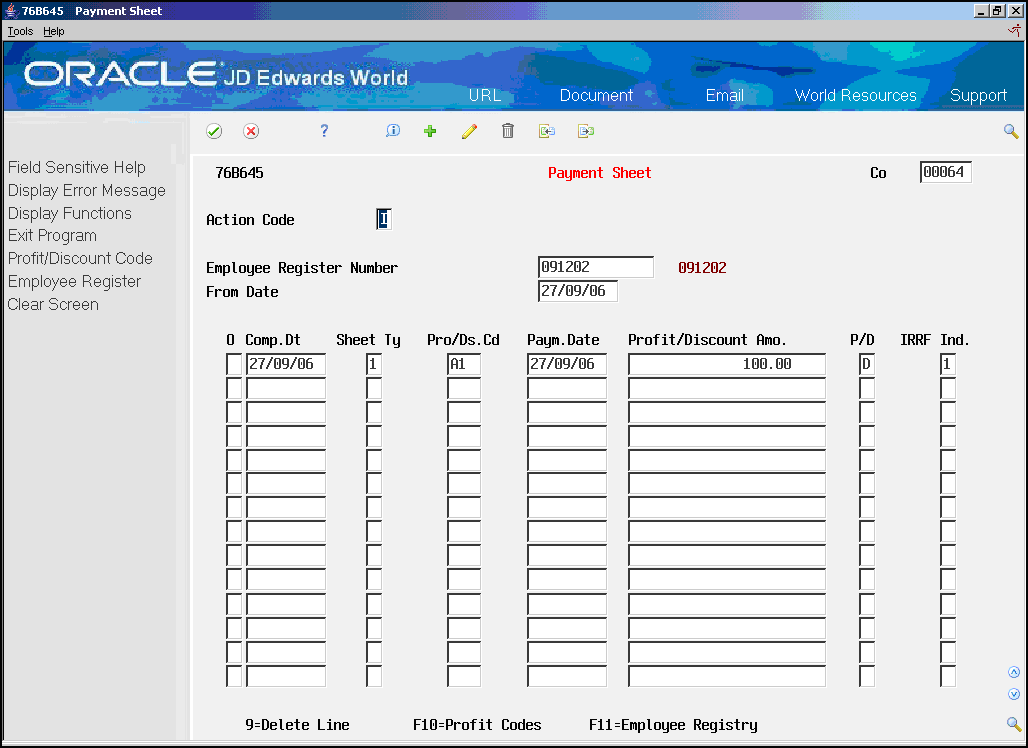

57.4.3 Payment Sheet

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 23 - Payment Sheet

Resolution IN86 establishes that the data related to Payment Sheet must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user to correct values or add new records. There is no batch process that automatically creates entries into this file as this information is not kept in JD Edwards base software.

Complete the following fields:

| Field | Explanation |

|---|---|

| Company | Code that identifies the organization inside the system. The system retrieves this value from processing option 1 to use as a default value. |

| Employee Register Number | Employee record number |

| From Date | Competition date |

| Comp. DT | Competition date |

| Sheet Ty | Payment date type. Allowed values are: '1' regular, '2' 13 salary, '3' vacation, '4' other. |

| Pro/Ds.Cd | Profit or discount code. |

| Payment Date | Payment date of the collection. |

| Profit/Discount Amount | Revenue or discount value. |

| P/D | Revenue or discount indicator. Allowed values are: 'P' revenue, 'D' discount. |

| IRRF Ind. | Incidence indicator or profit deductibility or discount to the effect or renta withholding. |

| Option | The only allowed value is '9' to delete a record. |

57.4.3.1 Processing Options for Maintenance of Payment Sheet (P76B645)

See Section 70.17, "Processing Options for Maintenance of Payment Sheet (P76B645)."

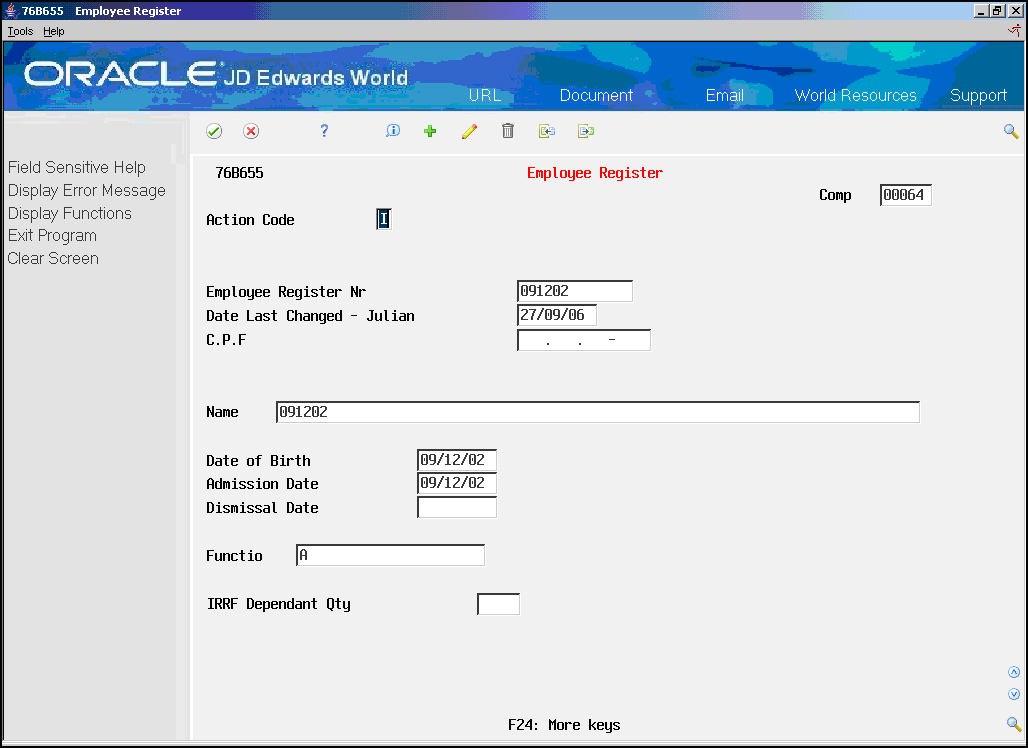

57.4.4 Employee Register

From Localization - Brazil (G76B), choose 20 - Fiscal Books

From Fiscal Books - Brazil (G76B00), choose 9 - Work files Maintenance and Inquiry

From Work files Maintenance and Inquiry - Brazil (G76B0065), choose 24 - Employee Register

Resolution IN86 establishes that the data related to Employee Register must be informed in a magnetic support, in agreement with a format specified by the corresponding Fiscal Authority.

This program executes the Workfile Maintenance and Inquiry step, allowing the user generated for the purpose of correcting values or adding new records from/to the workfile Employee Register (F76B65). There is no batch process that automatically creates entries into this file as this information is not kept in JD Edwards base software.

Complete the following fields:

| Field | Explanation |

|---|---|

| Company | Code that identifies the organization inside the system. The system retrieves this value of the processing option to use as a default value. |

| Employee Register Number | Employee record number |

| Date Last changed | Date that master or transaction record was last modified. |

| C.P.F. | Unique tax identification number that the federal tax authorities use to identify individuals. |

| Name | Employee full name. |

| Date of Birth | Employee date of birth. |

| Admission Date | |

| Dismissal Date | |

| Function | |

| IRRF Dependant Quantity | Quantity of dependant for Source Income Tax. |

57.4.4.1 Processing Options for Employee Register Maintenance (P76B655)

See Section 70.18, "Processing Options for Employee Register Maintenance (P76B655)."