7 Amend Mandates

This chapter contains the following topics:

7.1 About Mandate Amendments

You can amend mandates if information about your company or your customer changes, or if other information, such as the effective date, changes for a mandate. The information that you need to change determines whether you make the change in the address book, bank account, or mandate record.

You can amend mandates only when:

-

No cancellation date exists for the record.

-

The mandate is active (status is Y).

If you need to amend a mandate that is not active, you must first change the status to Y to make the mandate active. After you save the status change, you can amend the mandate.

7.1.1 Changes in Address Book or Bank Records

When you set up a mandate, the system retrieves information from the Address Book Master file (F0101) and the Bank Account Transit Master file (F0030). The system saves this information from the F0101 and F0030 files to the Mandates - SEPA Direct Debits file (F740320) when you set up a mandate:

-

IBAN for both the creditor and debtor.

-

BIC for both the creditor and debtor.

-

Tax code for the debtor.

-

Mailing address for the creditor.

When you update in the address book or bank account record the field values that are also saved to the F740320 file, the system does not overwrite the original values in the F740320 file. Instead, the system creates or updates a record for the mandate in the History Amendment - SEPA Direct Debits (F740322) file. The F740322 record includes fields for the original values, and fields for the new values. You can view the original data for a mandate as well as information about updates to the mandate by viewing the mandate history.

The system also prints the original values in the XML file in the XML elements for that information.

See Section 7.4, "View Mandate History"

|

Note: The system updates the F740322 file with new address book or bank account information only when the mandate is active and has no value in the Last Collection Date field. |

7.1.2 Allowed Changes in Mandate Records

You can amend this information if the mandate is active and if the Last Collection Date field is blank:

-

Mandate Date

-

Sequence Type

-

Cancellation Date

-

Status

-

Mandate Active Date

-

Address Number - Name

The system updates these fields if you changed them:

-

Mandate Identification

-

Debtor Address Number

After you use a mandate by including the mandate information in a direct debit collection file, you cannot change the debtor address book number in the mandate.

7.1.3 Include Amendments in the XML Bank File

If the IBAN, BIC, tax codes, or mailing address change for a mandate, you must report the changes to the bank the next time that you use the mandate. The system determines whether to include updated information when it generates the bank XML file by using the last collection date of the mandate, and comparing that date to the mandate effective date in the F740322 table. The mandate effective date in the F740322 table is the date of the most recent change to the mandate.

If the effective date is greater than or equal to the last collection date, then the amendments to the mandate have already been reported to the bank and they are not selected to include in the bank file. If the effective date is a later date than the last collection date, then the system includes the changed information in the bank file.

7.2 Locate Existing Mandates

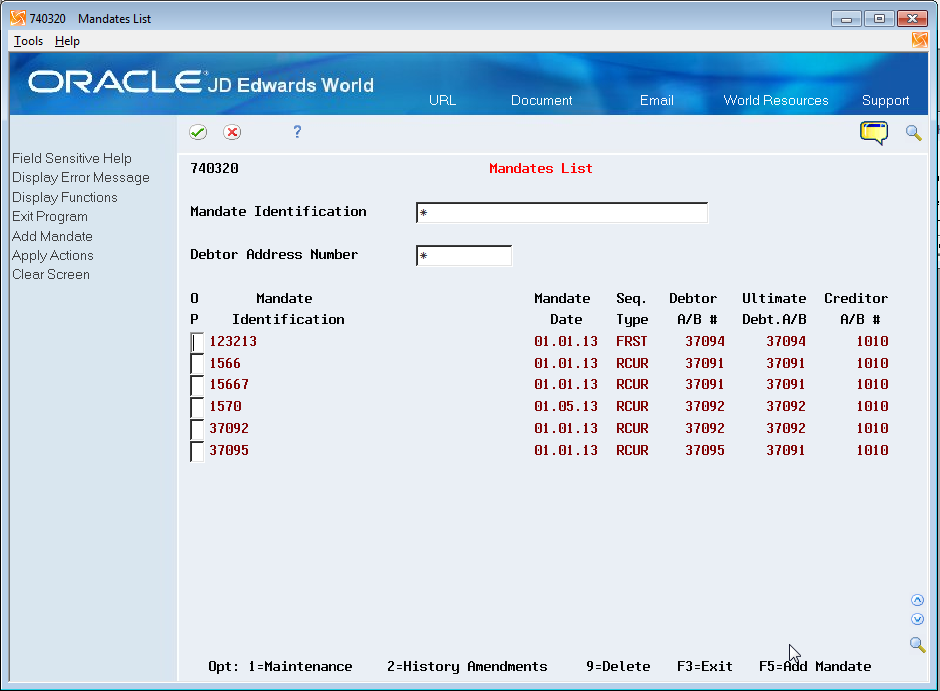

From SEPA Direct Debits (G740002), choose Mandates List.

You use the Mandates List program (P740320) to locate and select existing mandates. You can search for a mandate by the mandate identification number or a debtor address number, or you can enter * (asterisk) in the search fields to enable the system to search for all mandates.

From the Mandates List screen, you can access screens to amend a mandate (Option 1: Maintenance), view mandate history (Option 2: History Amendments), or delete a mandate (Option 9: Delete).

See Section 7.3, "Amend Mandates", Section 7.4, "View Mandate History", and Chapter 8, "Delete a Mandate".

7.3 Amend Mandates

From SEPA Direct Debits (G740002), choose Mandate List.

To amend debtor information for a mandate

On Mandates List

-

Inquire on the mandate that you want to amend.

You must use the Inquiry action before you can use the Change action.

-

Enter 1 in the OP (Option) field.

-

On Mandate Debtor, modify the fields as necessary.

To amend creditor information for a mandate

On Mandates List

-

Inquire on the mandate that you want to amend.

You must use the Inquiry action before you can use the Change action.

-

Enter 1 in the OP (Option) field.

-

On Mandate Debtor, press F8 (Creditor).

-

On Mandate Creditor, modify fields as necessary.

To amend ultimate debtor information for a mandate

On Mandates List

-

Inquire on the mandate that you want to amend.

You must use the Inquiry action before you can use the Change action.

-

Enter 1 in the OP (Option) field.

-

On Mandate Debtor or Mandate Creditor, press F9 (Ultimate Debtor).

-

On Mandate Ultimate Debtor, modify fields as necessary.

7.4 View Mandate History

From SEPA Direct Debit (G740002), choose Mandate History Amendments

You can view the mandate history for both the creditor and debtor. You can also view original values for mandates with amendments. When you access mandate records using the History Amendment screen, you cannot make changes to the records; you can only view records.

When you access the History Amendments screen, you can enter the mandate identification number or the debtor address book record to search for the mandate history to view. Or, you can search for all mandates.

On History Amendments:

-

Locate the mandate to view.

Enter the Mandate Identification, Debtor Address Number, or enter * (asterisk) in the fields to search for all mandates.

-

Enter a value in the Option field and press Enter.

Enter 1 (debtor), 2 (creditor), or 3 (original values).

-

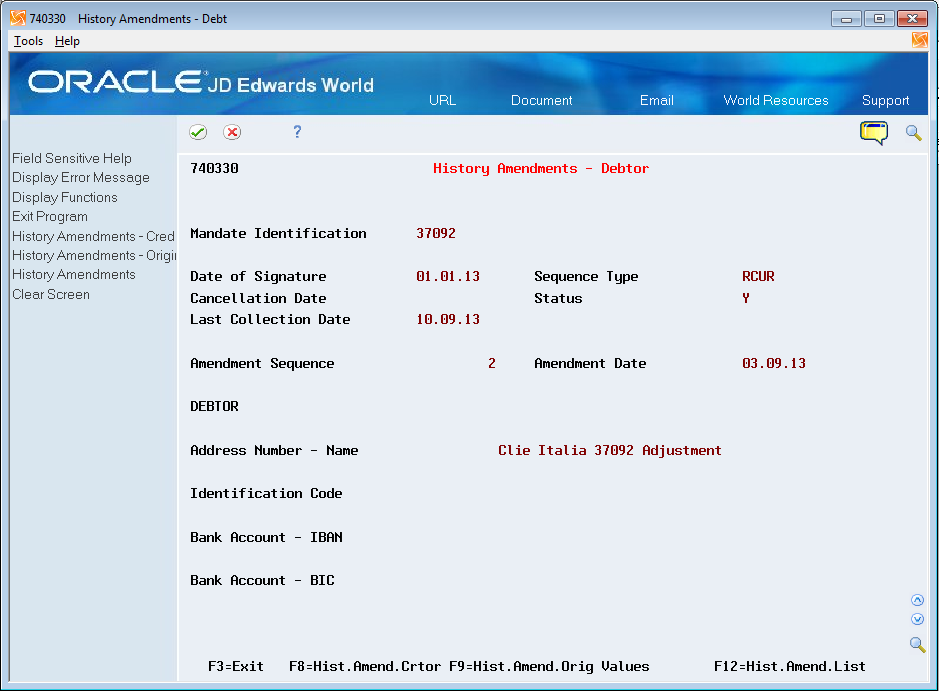

On History Amendments - Debtor, review the field values.

Figure 7-2 History Amendment - Debtor screen

Description of "Figure 7-2 History Amendment - Debtor screen"

-

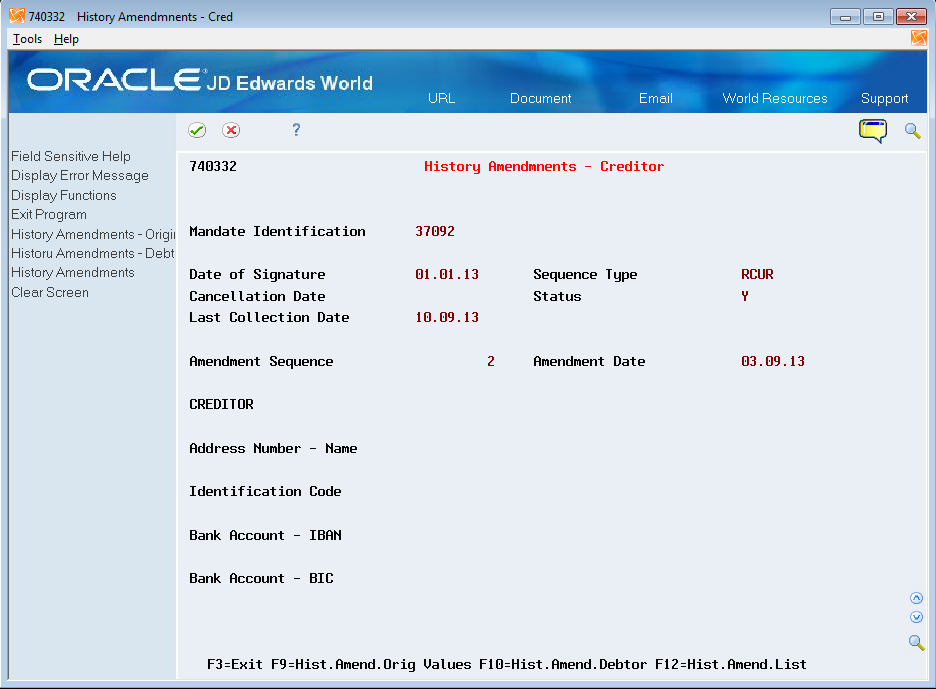

On History Amendments - Creditor, review the field values.

Figure 7-3 History Amendment - Creditor screen

Description of "Figure 7-3 History Amendment - Creditor screen"

-

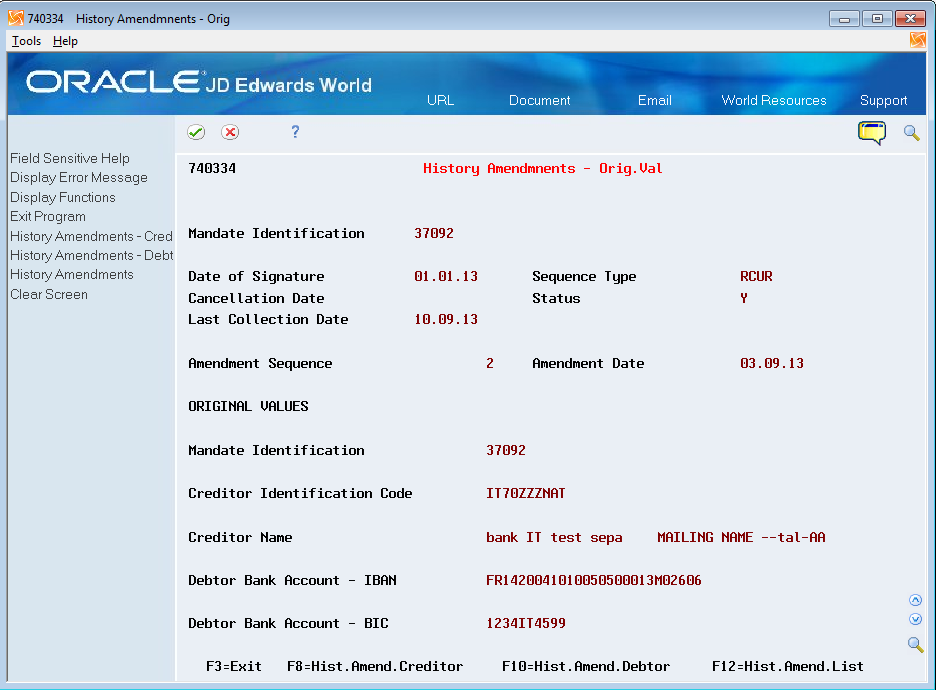

On History Amendments - Orig Val (History Amendments - Original Values), review the field values.

Figure 7-4 History Amendment s- Org. Val screen

Description of "Figure 7-4 History Amendment s- Org. Val screen"