3 About SEPA Direct Debits

This chapter includes the following topics:

3.1 Single European Payments Area (SEPA)

The EPC (European Payments Council) is the governing body and coordination body of the European banking industry in relation to payments. The purpose of the EPC is to support and promote a Single European Payments Area (SEPA).

The SEPA initiative for European financial infrastructure involves a zone in which all payments and debits in euros are considered domestic. No distinction exists between the national and international payments. SEPA strives to improve the efficiency of international payments and developing common standards, procedures, and infrastructure to improve the economies of scale. As of March 2012, SEPA extends to the 27 EU (European Union) member states, plus Iceland, Liechtenstein, Norway, Switzerland, and Monaco.

The SEPA Core Direct Debit Scheme Rulebook defines the guidelines used by the EPC for customer to bank datasets.

3.2 SEPA Direct Debit Process

For SEPA direct debits, both the debtor and the creditor must hold an account with a participant bank located within SEPA. The debtor must authorize the creditor to initiate collection of payment from the debtor bank and also instruct the debtor bank to transfer the funds directly to the creditor bank. This authorization is based on an agreement between the debtor and the creditor and is referred to as a mandate. The mandate can be in paper or in electronic form and expires 36 months after the last initiated direct debit.

The debtor can give authorization for recurrent direct debits or a one-time direct debit. Recurrent direct debits are those for which the authorization by the debtor is used for regular direct debits initiated by the creditor. One-time direct debits are one-off direct debits for which the authorization is given once by the debtor to collect only one single direct debit. Authorizations for a single use cannot be used for any subsequent transactions.

You can generate the bank collection file for SEPA direct debits as part of the automatic debit process, or you can generate the bank file using a stand-alone process that you run after the direct debit process. When you run the Process Automatic Debits program (P03575) in final mode, the system populates the Automatic Debit Select and Build file (F0357) with records that include invoice information. You run the SEPA Direct Debit XML Generation program (P7403575) as the country-specific program for the P03575 program, or run it as a stand-alone program after you run the P03575 program in final mode.

The SEPA Direct Debit XML Generation program (P7403575) reads the F0357 records and validates them against the address book, bank, and mandate tables. If all required information is present in the files, the system generates the XML file for SEPA direct debits and includes the invoice information and the information from the mandates in the XML file.

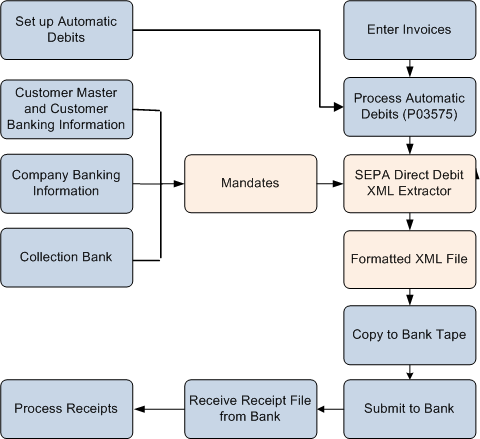

This image illustrates the process flow for generating the SEPA direct debit bank file using the automatic debit process:

Figure 3-1 Process Flow for SEPA Direct Debits

Description of "Figure 3-1 Process Flow for SEPA Direct Debits"

To process SEPA direct debits:

-

Set up address book records, customer master records, and company and customer bank account records with required information.

See Chapter 5, "Set Up Address Book, Customer Master, and Bank Records for SEPA Direct Debits"

-

Set up mandates.

-

Enter, review, and post invoices for customers.

See "Part II: Invoice Processing" in the JD Edwards World Accounts Receivable Guide.

-

Run the Process Automatic Debits program (P03575) in final mode.

You can specify in a processing option to use the SEPA Direct Debit XML Generation program (P7403575) as the country-specific format. Alternatively, you can run the SEPA Direct Debit XML Generation program separately from the Process Automatic Debits program.

See "Automatic Debits Processing Options" in the JD Edwards World Accounts Receivable Guide.

-

If you did not do so when you ran the Process Automatic Debits program, generate the SEPA direct debit XML file by running the SEPA Direct Debit XML Generation program (P7403575).

-

Send the XML file to the bank.

-

Load bank tapes to your system.

See "Load Bank Tapes" in the JD Edwards World Accounts Receivable Guide.

-

Process receipts.

See "Part III: Manual Receipts Processing" and "Part V: Automatic Receipts Processing" in the JD Edwards World Accounts Receivable Guide.