5 Set Up Address Book, Customer Master, and Bank Records for SEPA Direct Debits

This chapter contains the following topics:

5.1 About Address Book Records

To process SEPA (single euro payment area) direct debits, you must have valid address book records for these entities:

-

The creditor (company) that initiates the bank transaction.

-

The ultimate creditor, which can be different from the initiating company.

-

The customer (debtor) whose bank account you debit.

-

The ultimate debtor, which can be different from the debtor.

See "Enter Address Book Records" in the JD Edwards World Address Book and Electronic Mail Guide.

The system uses some of the information in the address book records in the mandates that you set up for SEPA direct debits. Mandates are the authorization that you send to banks to prove that the debtor has given you permission to debit their bank account. When you create mandates, the system retrieves the following information from address book records:

-

Mailing name

-

Mailing address

-

Tax ID

The system saves the original mandate information, including the information that it retrieves from the address book records, in the Mandates - SEPA Direct Debits file (F740320).

If you modify an address book record for a creditor or debtor for which a mandate exists, the system updates the History Amendment - SEPA Direct Debits file (F740322) with the updated information for the mailing name, mailing address, or tax ID when you generate the SEPA XML file. If no F740322 record exists because no previous amendments exist, then the system creates a F740322 record for the mandate and includes the changed information. The system tracks the changes by incrementing a counter by 1 for every change. You can use the History Amendments program (P740328) to view changes to mandates.

5.2 About Customer Master Records

Each customer with which you conduct business must have a customer master record in the JD Edwards World software system. When you set up customer master records for customers for whom you process SEPA direct debits, you must set up this information:

-

Assign payment instrument A to the invoices that you process for SEPA direct debits.

-

Enter Y (yes) in the Auto Receipt (Y/N) field.

-

Set up bank account information for the customer and assign the bank account the value D in the Bank Record Type field.

You set up codes in the Bank Type (00/BT) UDC for bank types.

See "Bank Type Code User Defined Table" in the JD Edwards World Accounts Receivable Guide.

5.3 About Bank Information

Banks require specific information about your company and your customer bank accounts when you process SEPA direct debits. You must:

-

Provide certain numbers and codes, such as the IBAN (international bank account number).

Optionally, you can also provide the BIC (bank identity code) number.

-

Set up both the company and customer bank accounts to use the euro as the currency.

You must use EUR as the currency code for the euro.

-

Enable SEPA processing for the accounts.

Mandates are the authorization that you send to banks to prove that the debtor has given you permission to debit their bank account. When you create mandates, the system retrieves this information from bank account records:

-

IBAN

The IBAN consists of a country code, check digits, and the basic bank account number. The JD Edwards World system validates that the IBAN number you enter is valid.

-

BIC

The BIC (SWFT field in F0030) consists of the bank, country, location, and branch codes. The JD Edwards World system validates only the country code. The country code must be a valid value in the 00/CN UDC table. Use care when entering the BIC code because the bank will reject the file if the code is not valid.

The system saves the original mandate information, including the information that it retrieves from the bank account records, in the Mandates - SEPA Direct Debits file (F740320).

If you modify a bank account record for your company or for a debtor for which a mandate exists, the system updates the History Amendment - SEPA Direct Debits file (F740322) with the updated information for the IBAN and BIC fields. If no F740322 record exists because no previous amendments exist, then the system creates a F740322 record for the mandate and includes the changed information. The system tracks the changes by incrementing a counter by 1 for every change. You can use the History Amendments program (P740328) to view changes to mandates.

See Section 7.4, "View Mandate History"

To use a customer or company bank account for SEPA direct debits, you must also enter 1 in the SEPA Flag field in the bank account record.

5.4 Set Up Company Bank Account Information

Set up bank account information, and then complete the bank cross-reference information for the internal bank account that you use to receive direct debits.

From Accounts Receivable Setup (G0341), choose Bank Account Information

On Bank Account Information, verify that these fields, required for SEPA processing, are completed with valid values:

-

SWIFT Co

Enter the BIC number for the account. The SWIFT number is interchangeable with the BIC (Bank Identifier Code).

-

IBAN #

Enter the IBAN for the company bank account.

-

SEPA Flag

Enter 1 to indicate that the bank account is for use in SEPA processing.

5.5 Set Up Customer Bank Account Information

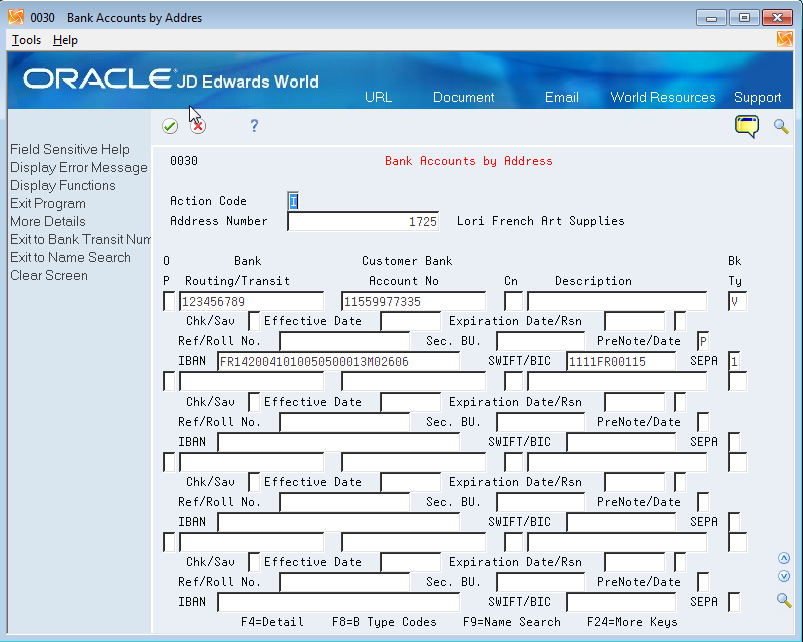

From Accounts Receivable Setup (G0341), choose Bank Account Cross-Reference

Figure 5-1 Bank Accounts by Address screen

Description of "Figure 5-1 Bank Accounts by Address screen"

Complete these fields that the system uses when you process SEPA direct debits:

-

Bk Ty (bank type)

The bank type code for a customer account used for SEPA must be D.

-

SWIFT Co

Enter the BIC number for the account. The SWIFT number is interchangeable with the BIC (Bank Identifier Code). This field is optional.

-

IBAN #

Enter the IBAN for the customer bank account.

-

SEPA Flag

Enter 1 to indicate that the bank account is for use in SEPA processing.