Manage Income Audit

Manage Income Audit allows a property to review and adjust eligible transactions after the business date is rolled via Manage End of Day. An income auditor can access a previous business date to review the charges and make adjustments, if necessary, for guests who are still in-house. The income auditor can then run final reports and close the business date. Once a guest is checked out, the charges cannot be changed by the income auditor.

|

|

|

|

Currently there are no videos for this topic. |

|

|

|

|

|

|

Understanding Income Audit

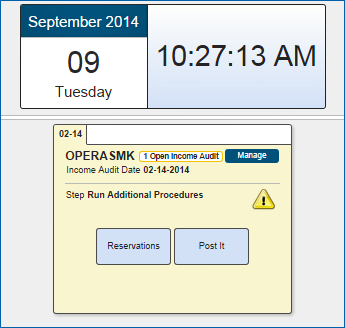

The Income Audit function displays the current date, time, and any open End of Day property tiles. Each property is represented by a property tile offering the following functions:

A maximum of five business dates per property can be left open for Income Audit.

Adjusting Reservation Charges

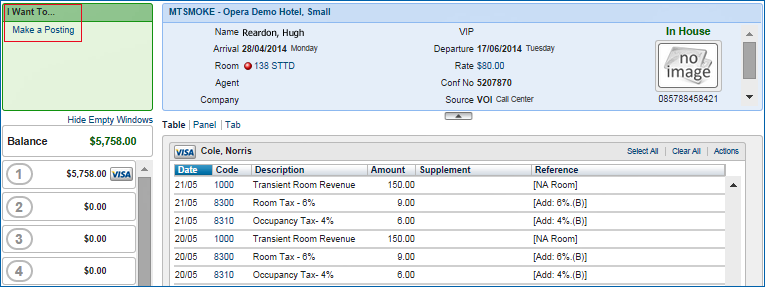

The Reservation link on an Income Audit property tile opens a list of current "In House" reservations. Each listed reservation provides a summary of stay details, rates, and any balances owed.

Use the Actions link to transfer charges, post adjustments, or split transactions. View Make a Posting

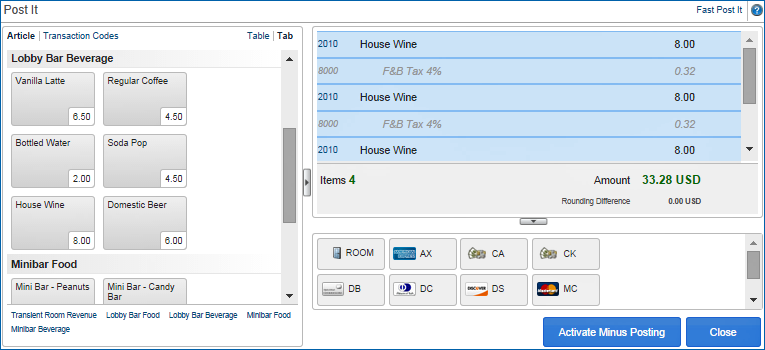

Using Post It

Select Post It to display food and beverage products that can be charged to appropriate rooms and/or other configured payment methods. This function allows the auditor to record charges that are incurred on the End of Day date but cannot be entered prior to running End of Day; for example, charges for additional beverages served at a late night event that ends after running the End of Day.

Running Manage Income Audit

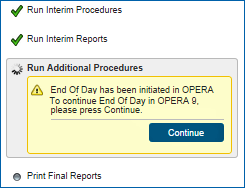

Manage Income Audit begins by selecting Manage on an Income Audit property tile. The Income Audit begins at the Run Additional Procedures step of End of Day.

The End of Day routine runs through additional procedures and generates Reports that you can print and review before completing the End of Day.