Chapter 73: Processing Direct Bank Disbursements/Electronic Checks

Overview: Direct bank disbursement, also known as electronic checks, is a payment method in which a customer can pay for a purchase directly out of his or her bank account. To use a direct bank disbursement pay type on an order, the customer must provide the routing number and account number of the bank account. The service bureau uses the bank routing number and account number to withdraw funds directly from the customer’s bank account in order to pay for the order. The service bureau also uses the bank routing number and account number to refund the customer’s bank account for any returns.

The direct bank disbursement pay type is used in CWDirect for two different processes:

• Direct bank disbursement processing: During deposit processing, Commerzbank, using its COTEL software, withdraws funds directly from the customer’s bank account. Direct bank disbursement processing is also used by Bank of America to withdraw funds directly from the customer’s bank account. See Direct Bank Disbursement Processing.

• Electronic check processing: Allows a customer to use the funds in a checking or savings account to pay for an order. The system authorizes and deposits the amount of the order against the funds. See Electronic Check Processing.

In this chapter:

• Direct Bank Disbursement Processing

• Direct Bank Disbursement Setup

Direct Bank Disbursement Processing

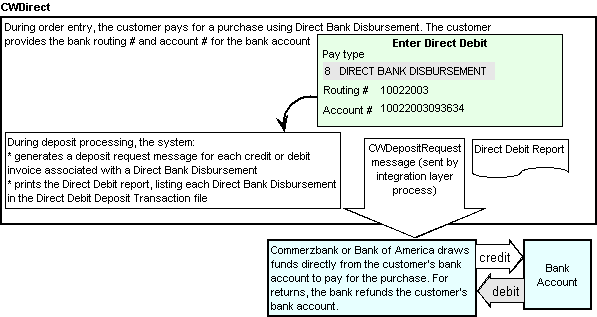

Direct bank disbursement processing illustration:

In Regular Order Entry: When you add a direct bank disbursement pay type to an order, the system displays the Enter Direct Debit For Window (Direct Bank Disbursement Payment Type), which requires the routing number and account number of the customer’s bank account.

A credit card number is not relevant for a direct bank disbursement pay type, so the system defaults the Description of the direct bank disbursement pay type to the Credit card number field.

Note: You cannot use deferred or installment billing with a direct debit disbursement pay type. See Working with Flexible Payment Options (WFPO) for more information on setting up payment plans for deferred and installment billing.

During Deposits: During deposits processing, the system calls the AAR003 user exit point and, if the user function AAR0258 is defined, the system processes direct bank disbursement. When you process deposits for an order containing a direct bank disbursement, the system:

• creates a record in the Direct Debit Deposit Transaction file for each order number/invoice number combination associated with a direct bank disbursement payment. This file contains the information a bank requires to draw funds directly from a customer’s bank account to pay for the purchase.

• prints the Print Direct Debit Report. This report lists each order number/invoice number combination that contains a direct bank disbursement payment and the amount, customer name, routing number, and account number associated with the payment.

Deposit request XML message: During deposit processing, if an integration layer process has been set up in Integration Layer Job Control (IJCT) to generate the deposit request messages for transmission to the per_bankofamerica site, the AUTO_DEP job starts this process and the message generation takes place. The AUTO_DEP job waits until it receives the deposit response message, and then updates each direct debit deposit to confirmed status.

Returns: If you process a return against the direct bank disbursement pay type, the system creates a credit invoice for the refund amount. When you process deposits for the credit invoice, the PERDEP process generates a deposit request for the amount the bank will refund the customer’s bank account.

Note: Returns are available for deposit processing after you use the Process Refunds menu option (MREF) to generate the credits.

General Ledger posting: During deposits processing, the system posts to the following general ledger accounts for direct bank disbursements.

Transaction Type |

Credit |

Debit |

Positive (deposits) |

Sales general ledger number for the Pay Type |

A/R cash G/L # for the bank defined in the Credit Card Deposit Bank # (C56) system control value |

Negative (refunds) |

Returns general ledger number for the Pay Type |

A/R cash G/L # for the bank defined in the Credit Card Deposit Bank # (C56) system control value |

Direct Bank Disbursement Setup

Setup required for direct bank disbursement includes:

• creating the deposit service USR

• creating a direct bank disbursement pay type

• setting up the user exit point AAR0003

• creating the integration layer process PERDEP

Each is described below.

Creating the USR deposit service: When creating the deposit service USR in Defining Authorization Services (WASV), set:

• At the first Create or Change Authorization Service screen:

• Service code = USR

• Application = DEP (deposit)

• Integration Layer Processes: Deposit = PERDEP

• Exclude from FPO = Y

• At the second Create or Change Authorization Service screen:

• Media type = C

• Batch/Online = C

• Installment billing = N

• Immediate response = Y

• Immediate deposit = Y

• Primary auth service = .IL

• Through the Defining Vendor Paytype Codes option: set up the direct debit pay type as described below.

• Through the Defining Authorization Service Currencies option: set up the currency codes that your customers can use with the direct debit pay type.

Creating a direct bank disbursement pay type: When creating a direct bank disbursement pay type in Working with Pay Types (WPAY), set:

• Pay category: enter 2 (credit card) as the pay category

• Card type: enter I (direct bank disbursement) as the card type

• Deposit service: enter USR as the deposit service

• Credit card length: enter the required length of the routing number of the customer’s bank account. If the routing number does not match the credit card length, the system does not accept the Direct Bank Disbursement pay type on the order. Leave this field blank if you do not want to validate the routing number length for a Direct Bank Disbursement pay type. Note: A routing number can be up to 9 positions in length.

Note: You cannot assign a credit card number format to a direct bank disbursement pay type; instead, the description of the direct bank disbursement pay type displays in the Credit card number field.

Setting up the user exit point AUTODEPO: The user exit point AAR0003 is automatically called when you process deposits for the deposit service USR. When creating the user exit point in Working with User Exit Point (WUEP), set:

• Calling function = AAR0003

• User function = AAR0258

Setting up the integration layer process: Use the Integration Layer Process screen in Working with Integration Layer Processes (IJCT) to create a deposit process where:

• Process ID = PERDEP

• Inbound program = AAO0002

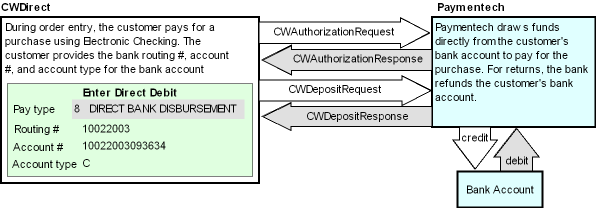

Electronic check processing illustration:

In Regular Order Entry: When you add a direct bank disbursement pay type to an order, the system displays the Enter Direct Debit For Window (Direct Bank Disbursement Payment Type), which requires the routing number and account number of the customer’s bank account.

In addition, if the Require account type field for the direct disbursement pay type is set to Y, the system requires you to define the type of bank account from which the funds are withdrawn. Valid bank account types are:

• C personal checking bank account

• S personal savings bank account

• X corporate checking bank account

A credit card number is not relevant for a direct bank disbursement pay type, so the system defaults the Description of the direct bank disbursement pay type to the Credit card number field.

During Authorizations: During authorization processing (online or batch), the system generates the Authorization Request XML Message (CWAuthorizationRequest) to send to Paymentech.

Paymentech authorizes the electronic check payment against the funds in the customer’s bank account.

During Deposits: During deposits processing, the system generates the Deposit Request XML Message (CWDepositRequest) to send to Paymentech.

When the CWDepositResponse is received from Paymentech and the deposit is confirmed, the system processes the electronic check. When you process deposits for an order containing a direct bank disbursement, the system:

• creates a record in the Direct Debit Deposit Transaction file for each order number/invoice number combination associated with a direct bank disbursement payment. This file contains the information a bank requires to draw funds directly from a customer’s bank account to pay for the purchase.

• prints the Print Direct Debit Report. This report lists each order number/invoice number combination that contains a direct bank disbursement payment and the amount, customer name, routing number, and account number associated with the payment.

Returns: If you process a return against the direct bank disbursement pay type, the system creates a credit invoice for the refund amount. When you process deposits for the credit invoice, the system generates a deposit request for the amount the bank will refund the customer’s bank account.

Note: Returns are available for deposit processing after you use the Process Refunds menu option (MREF) to generate the credits.

General Ledger posting: During deposits processing, the system posts to the following general ledger accounts for direct bank disbursements.

Transaction Type |

Credit |

Debit |

Positive (deposits) |

Sales general ledger number for the Pay Type |

A/R cash G/L # for the bank defined in the Credit Card Deposit Bank # (C56) system control value |

Negative (refunds) |

Returns general ledger number for the Pay Type |

A/R cash G/L # for the bank defined in the Credit Card Deposit Bank # (C56) system control value |

Setup required for electronic check processing includes:

• creating the Paymentech service bureau

• creating a direct bank disbursement pay type

Note: Electronic check processing with Paymentech is supported with the CWIntegrate version 3.0 Paymentech site. This site will be available in the Fall of 2007.

Creating the Paymentech service bureau: When creating the Paymentech service bureau in Defining Authorization Services (WASV), set:

• At the first Create or Change Authorization Service screen:

• Service code = PMT

• Application = ATDP (authorization and deposit)

• Integration Layer Processes: Online auth = the integration layer job used to process online authorizations

• Integration Layer Processes: Batch auth = the integration layer job used to process batch authorizations

• Integration Layer Processes: Deposit = the integration layer job used to process deposits

• Exclude from FPO = Y

• At the second Create or Change Authorization Service screen:

• Media type = C (Communications)

• Batch/Online = C (Online and Batch)

• Installment billing = N

• Immediate response = Y

• Immediate deposit = Y

• Primary auth service = .IL

• Through the Defining Vendor Paytype Codes option: set up the direct debit pay type as described below.

• Through the Defining Authorization Service Currencies option: set up the currency codes that your customers can use with the direct debit pay type.

Creating a direct bank disbursement pay type: When creating a direct bank disbursement pay type in Working with Pay Types (WPAY), set:

• Pay category: enter 2 (credit card) as the pay category

• Card type: enter I (direct bank disbursement) as the card type

• Authorization service: enter PMT (Paymentech) as the authorization service

• Deposit service: enter PMT (Paymentech) as the deposit service

• Credit card length: enter the required length of the routing number of the customer’s bank account. If the routing number does not match the credit card length, the system does not accept the Direct Bank Disbursement pay type on the order. Leave this field blank if you do not want to validate the routing number length for a Direct Bank Disbursement pay type. Note: A routing number can be up to 9 positions in length.

• Require account type: Enter Y in this field to indicate you must define the type of customer’s bank account the funds will be withdrawn from.

Note: You cannot assign a credit card number format to a direct bank disbursement pay type; instead, the description of the direct bank disbursement pay type displays in the Credit card number field.

| Pending Payment Plan Deposits Report | Contents | SCVs | Search | Glossary | Reports | XML | Index | Print Direct Debit Report |

SO07_06 CWDirect 18.0 August 2015 OTN