, then click Simulation and select Historical Simulation.

, then click Simulation and select Historical Simulation.This module primarily aims to measure the risk of your portfolio and (or) trading desk and deliver the portfolio granularity metrics using NUMERIX and historical simulation. MRMM Historical Simulation enables you to compute VaR, Expected Shortfall for regulatory and non-regulatory requirements, IMA capital charges, and addresses the requirements of both regulatory reporting and internal risk management, as per FTRB guidelines.

FRTB has dependency on the risk factors, liquidity horizon information and reduced set. You must provide the required information in the following tables as a download at the portfolio level:

· Liquidity Horizon - FSI_MR_RF_LIQ_HOR_CATEGORY

· Reduced Set Identification - FSI_MR_PORT_RISK_RED_RSK_FACTR

See the Download Specification for more details.

NOTE:

Modellable and non-modellable risk factor identification is achieved through the RFET module.

You must provide the stress period information as part of the FRTB definition in the Portfolio User Interface.

The module provides the following computation:

· ES and VaR

· Stress calibrated ES

· Internally modelled capital charge (IMCC)

· Stressed capital add-on

· Aggregated Charge

Topics:

· Navigate to the Historical Simulation Summary Window

· Search for a Business Definition

· Create and Execute a Business Definition

· Export a Business Definition

· Approve or Reject a Business Definition

· Delete a Business Definition

From the MRMM Home page, select Market Risk Measurement and Management, click Navigation Menu  , then click Simulation and select Historical Simulation.

, then click Simulation and select Historical Simulation.

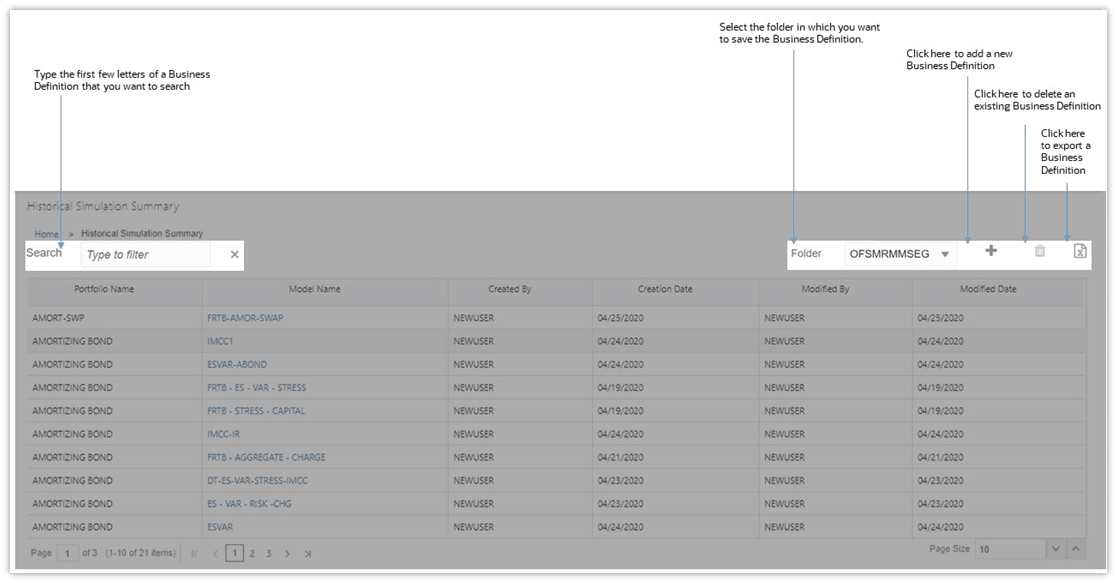

Figure 42: Historical Simulation Summary Window

In the Search field, type the first few letters of the business definition name that you want to search. The summaries whose names consist of your search string are displayed in a tabular format.

Figure 43: Historical Simulation Summary Window - Search Box

From the breadcrumb on top, click the Historical Simulation Summary link to return to the summary window after viewing details of the business definition.

See the Page View Options section for details.

To define a new Historical Simulation - business definition, follow these steps:

1. In the Historical Simulation Summary window, click Add  . The definition window is displayed.

. The definition window is displayed.

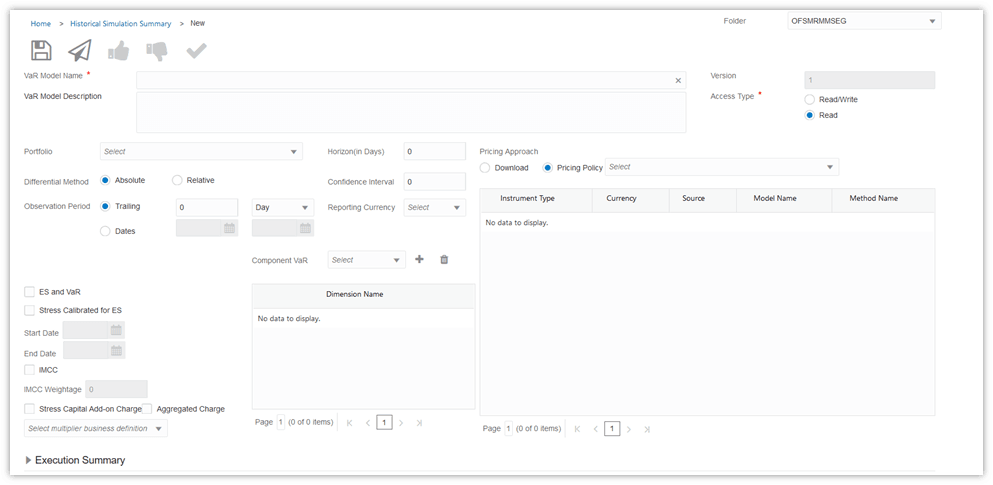

Figure 44: Historical Simulation Definition Window

2. Populate the details mentioned in the following table. Fields marked in red asterisk (*) are mandatory.

Fields |

Description |

|---|---|

VaR Model Name* |

Enter the name of the VaR model. |

VaR Model Description |

Provide a description of the VaR model. |

Version |

Displays the workflow version of the business definition. |

Access Type* |

Specify the access type. |

Folder |

Select the folder. |

Portfolio |

Select the Portfolio from the drop-down list. |

Differential Method |

Select the differential method whether Absolute or Relative. This is the interpolation method used for interpolating missing values in historical data. This parameter indicates how to construct the simulated market from the execution date’s market. You can select Absolute, or Relative. The following formula explains the computation of scenario values under each method.

Where, RF is the risk factor, and t is the number of execution days. |

Observation Period |

This is the current historical observation period to be considered for the computation of VaR. The current historical period starts from the execution date until the period specified in this column. The observation period is computed relative to the execution date. Specify the current observation period for computation of VaR, whether Trailing or Dates. · Trailing: Specify the number of Historical Days or Months or Years. · Dates: Specify the time period between which you want to compute the VaR. Select the From and To dates by using the Date-Time editor. |

Horizon (in Days) |

The time horizon over which you can compute the VaR number output. Specify the horizon in terms of days. |

Confidence Interval |

Confidence is the percentage value that you need to define the VaR numbers. Specify the confidence value required for calculating the output. |

Reporting Currency* |

The currency in which all the output for a given definition will be computed. Select the currency code from the drop-down list. |

Output Metrics |

Select the list of desired outputs. This section allows you to select the list of desired outputs mentioned below. The outputs are: · ES and VaR: Select this option to calculate the Expected Shortfall (ES) and Value at Risk (VaR) and Component VaR, using the current observation period. · Stress Calibrated for ES: Select this option to specify the stress window. If you choose to define the observation period, toggle the Identified Period button and provide the Observation Start Date and Observation End Date. · Internally Modelled Capital Charge: Select this option to specify the relative weight assigned to the firm’s internal model. This output is required to compute Internally Modelled Capital Charge (IMCC). · Stress Capital Add-on Charge: Select this option to set the computation of stress scenario capital charge (SES) with execution. · Aggregated Charge: Select this option to set the computation of Aggregated Charge with execution. Computation of aggregated charge requires a multiplier. A multiplier is the number that is associated with the number of exceptions arrived in Model Validation. Select the business definition defined in the Model Validation module from the drop-down list, to add a multiplier. If not selected, the system will take 1.5 as the default value of the multiplier. For details on the computations, see Historical Simulation - Output Metrics |

Analyze By |

You can select the dimensions for analyzing the VaR. Analyze by functionality enables you to view the VaR outputs at different granularity. For a selected dimension the application creates the tree structure of its nodes and provides the output. For Example, if you select Instrument Type in Analyze by at the time of Historical simulation run. If a portfolio has three instrument types such as Equity, Equity Forward, and Bonds. Then the application generates VaR numbers at following granularities: · VaR at Group level · VaR for underlying Account under the Node = “Bonds” · VaR for the underlying Equity Forward contracts under the node = ”Equity Forward” · VaR for Equity contracts under the node = ”Equity” To add dimensions, follow these steps: 1. 1. Select dimensions for analyzing the VaR and ES numbers from the drop-down list. 2. Click Add 3. Click Delete |

Pricing Approach |

Select the models and methods to be used for instrument pricing. You can Download or Select a Pricing Policy. Once you select the Pricing Policy from the drop-down list, the details such as Instrument Type, Currency, Source, Model Name, and Method Name are populated in the table. |

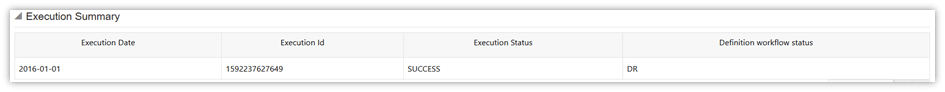

Execution Summary |

Displays the execution history of the business scenarios. It displays details such as Execution Date, Execution ID, Execution Status, Definition Workflow Status, EOD Execution. Select the execution to be marked as EOD execution. |

3. Click Submit  to save and submit the definition for approval. A confirmation dialog box is displayed.

to save and submit the definition for approval. A confirmation dialog box is displayed.

Or,

Click Save  to update the definition before submitting it for approval.

to update the definition before submitting it for approval.

4. If you want to execute the business definition, follow the steps in the Execute a Business Definition section.

5. Execution Summary displays the execution history of the business scenarios. Select the execution to be marked as EOD execution. You can view details of the execution, such as Execution Date, Execution ID, Execution Status, and Definition Workflow Status in the Execution Summary table.

6. The definition can be viewed in the summary window. They are further used for in the analytics to generate reports.

To execute a business definition, follow these steps:

1. Click the business definition name in the Summary page. The definition window is displayed.

2. Click Edit  .

.

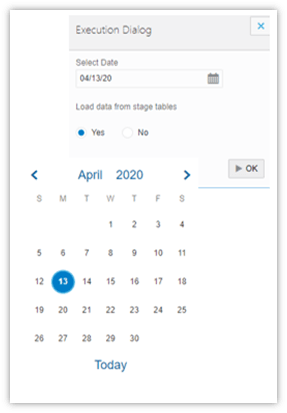

3. Click Execute  to trigger an Adhoc run. A pop-up message with a date-time editor is displayed.

to trigger an Adhoc run. A pop-up message with a date-time editor is displayed.

4. Specify the date on which the execution must be performed.

5. If you want to load trade and market data from stage tables, select Yes in the field Load Data From Stage Tables, else select No. Click OK  . The execution is triggered.

. The execution is triggered.

Figure 45: Historical Simulation Execution - Date-Time Editor

6. Click OK. A confirmation dialog box is displayed.

7. Click OK to confirm.

8. You can view details of the execution, such as Execution Date, Execution ID, Execution Status, and Definition Workflow Status in the Execution Summary table.

Figure 46: Historical Simulation-Execution Summary

See the Edit a Business Definition section for details.

See the Export a Business Definition section for details.

See the Approve or Reject a Business Definition section for details.

See the Delete a Business Definition section for details.